THE WEEK THAT IT WAS...

The last 2 weeks of the year featured very limited macroeconomic data releases, with the only significant events being the US durable goods orders and US ISM Manufacturing Index. Outside the US, the focus was on the China PMI Manufacturing and non-Manufacturing PMI and the Tokyo CPI.

Inflation in Tokyo rose for a second consecutive month in December, with consumer prices excluding fresh food up 2.4%, up from 2.2% in November. This, along with a tight labour market and stronger-than-expected retail sales, supports expectations for a Bank of Japan rate hike sooner rather than later as Tokyo's data is a key indicator for national trends.

China's December PMI data showed an unexpected rise in the non-manufacturing reading, indicating a pickup in service and construction activity. The non-manufacturing PMI rose to 52.2 from 50.0 in November, driven by a surge in construction, which reached a seven-month high of 53.2. However, more data is needed to confirm that the time to Make China Great Again has come as the manufacturing PMI fell slightly to 50.1 from 50.3, below consensus, signalling that the economy remains in an inflationary bust for the time being.

November’s US durable goods orders dropped 1.1%, below expectations, mainly due to volatile transportation trends, including a decline in Boeing orders. However, core orders, excluding transportation, were stronger, rising 0.7%, signalling potential capex growth. With business sentiment improving after the November election, expectations for economic improvement under the incoming Trump administration, including deregulation and tax cuts, suggest capital spending will likely pick up as companies proceed with delayed investment plans.

The US ISM Manufacturing PMI rose to 49.3 in December, beating expectations, driven by stronger new orders and improved factory output. However, the sector remains in contraction, with employment falling sharply to 45.3, signalling that producers anticipate weaker demand ahead. Prices paid climbed to 52.5, above the estimated 51.8, reflecting growing cost pressures. In this context, the widely hoped disinflation process remains elusive, especially with the implementation of tariffs, making the FED’s 2% inflation target seem increasingly unattainable.

In this context, Wall Street bankers and their parrots have not yet assimilated that tariffs and tighter immigration policies will not only be inflationary but stagflationary, and while the consensus still expects 2 FED rate cuts by the end of 2025 with June and December expected the time when the FED cut rates further while by then the US economy will already be in an inflationary bust and the FED will need to raise rates if it remains serious about fighting inflation for the good of the American citizens.

It is that time of the year when all investors look back at the past 12 months and try to anticipate what is in store for the next 12. At this time last year, investors were navigating through the fog of the year of political hell, which did not disappoint in terms of political and economic events. Ultimately, these events led to the notorious partisan-driven FED pivot on September 18, 2024, while the U.S. economy remained in an inflationary boom throughout the year. This environment prompted gold and stocks to significantly outperform cash and bonds, as is typically the case during an inflationary boom.

CPI adjusted return in USD of Gold (blue line); S&P 500 index (red line); Bloomberg US Ag Total Return Index (green line); Bloomberg US Treasury Bills 1-3 months Index (purple) in 2024.

As 2024 is in the books, it is time to look ahead and anticipate what Wall Street bankers and their parrots are not telling their clients. To be fair, most of these investment outlooks written by Wall Street bankers are not designed to make their clients wealthier but to promote Wall Street own interests.

Even though forecasting is a difficult task, and portfolio management is not solely about forecasting but also about risk management and adapting to the environment to deliver the appropriate risk adjusted return. In this context, there are 10 bold predictions investors should not ignore as they look ahead to the next 12 months.

The FED will resume rate hikes before December 31, 2025.

In 2024, the FOMC delivered irrelevant rate cuts that culminated in a predictably hawkish tone at its final meeting of the year, as the FED began to factor in the impact of tariffs on the U.S. business cycle. Investors should remember that this is not the first time the FED has embarked on an interest rate cut cycle while the U.S. economy was in an inflationary boom. Indeed, a similar scenario occurred during the 2007–2009 interest rate cut cycle. As tariff threats are likely to initially create monetary illusions and push the S&P 500-to-gold ratio below its 7-year moving average, investors should recall that when the S&P 500-to-gold ratio fell below its 7-year moving average—followed by the S&P 500-to-WTI ratio—rate hikes soon followed to combat monetary illusion, ultimately triggering economic busts. If Powell and the FED truly aim to preserve the USD's status as the reliable reserve currency and curb inflation for the supposed interest of the American citizens, a policy reversal with rate hikes in 2025 seems inevitable.

Upper Panel: S&P 500 to Gold ratio (yellow line); 84-months Moving average of S&P 500 to Gold ratio (red line); FED Fund Rate (axis inverted; green line); Lower Panel: S&P 500 to WTI ratio (blue line); 84-months moving average of S&P 500 to WTI ratio (red line); FED Fund Rate (axis inverted; green line).

The Dow will outperform the Nasdaq.

Savvy investors know that two market ratios determine the stage of the business cycle: the S&P 500-to-Oil ratio and its position relative to its 7-year moving average, and the Gold-to-U.S. Treasury ratio and its position relative to its 7-year moving average. Equity investors will note that when the US economy is in an inflationary boom, as it has been since October 2023, the Nasdaq outperforms the Dow Jones. However, with rising risks of the U.S. transitioning from an inflationary boom to an inflationary bust with the implementation of tighter trade and immigration policies under the 47th U.S. president, investors should take note that in such an environment, as observed between January 2022 and October 2023, the Dow outperforms the Nasdaq.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Third Panel: Dow Jones 12-months Rate of Change (yellow histogram); Fourth Panel: Nasdaq 100 12-months Rate of Change (purple histogram); Lower Panel: Relative performance of Dow Jones to Nasdaq index (orange line).

The US energy sector will outperform the Magnificent 7.

Savvy investors also know that when the US economy is in an inflationary boom, as it has been since October 2023, energy-consuming sectors—proxied by the IT sector and more narrowly by the "Magnificent 7"—outperform energy-producing sectors, which can be proxied by the energy sector. However, as tariffs are implemented and the so-called ‘Trump rally’ morphs into ‘Trump Stagflation,’ and as the US economy transitions from an inflationary boom to an inflationary bust, energy-producing sectors will outperform energy-consuming sectors. While Wall Street bankers continue to spread the mistaken belief that the over-owned and idolized ’Magnificent 7’ will remain the leaders of equity market trends, savvy investors who understand that 2025 will see the US fall into an inflationary bust will look to sell the rips in the Magnificent 7 and buy the dips in the unloved and under-owned energy sector.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Third Panel: Bloomberg Mag 7 Index 12-months Rate of Change (yellow histogram); Fourth Panel: S&P 500 Energy Index 12-months Rate of Change (purple histogram); Lower Panel: Relative performance of Bloomberg Mag7 index to S&P 500 Energy index (orange line).

The US 30-Year Yield rise above 6.0%.

With the US government facing more than $10.0 trillion in debt to refinance in 2025 alone, and with tariffs and tighter immigration policies set to be implemented once the 47th US president is eventually inaugurated on January 20th, the FED may be tempted, or even forced, at some point to implement yield curve control to preserve the health of the US banking system and maintain a semblance of importance and credibility. It should be clear to any savvy investor with a modicum of common sense that the US economy's shift from an inflationary boom to an inflationary bust will push the US 30-year yield significantly higher, exceeding 6% before December 31, 2025. Everyone with a modicum of knowledge know that not only the FED doesn’t control the long end of the curve but the 30-year yield is what impact interest cost for entrepreneurs and consumers who are contracting loan to grow their business of engage into a mortgage to buy a car or a house, meaning that a much higher US 30-year yield will make the stagflationary vibes to spread among key sectors such discretionary spending and real estate. In this environment, investors will want to avoid any exposure to the US financial sector, which has historically underperformed in periods of structurally higher US 30-year yields.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Third Panel: US 30-Year Yield (purple line); Lower Panel: Relative performance of S&P 500 index to S&P 500 Financial index (orange line).

The USD Index (DXY) will reach new century highs, (i.e. exceeding 121).

Savvy investors understand that the implementation of tariffs will not only spread stagflationary vibes worldwide, since all economies are interconnected, but will ultimately trigger a ‘Trump Stagflation.’ They also recognize that this environment will attract more foreign investment into the US, driving higher U.S. yields. Additionally, rising geopolitical uncertainties in Europe, the Middle East., and Asia will contribute to the strengthening of the USD against all fiat currencies. However, while the USD strengthens against fiat currencies, it will continue to weaken against the one asset with no counterparty risk and that serves as the ultimate hedge against government and war risks: physical gold. In this context, savvy investors should not be surprised to see the USD index reach its 21st-century high (above 121) before the end of 2025.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Lower Panel: USD Index (DXY Index) (purple line).

The Yen will trade above 200 against the USD.

Nobody needs to be an expert in economics to recognize that governments in the misleadingly called developed countries have been living on borrowed time, a trend that has only worsened since the start of the decade. This suggests that governments, not the private sector, are likely to be at the epicentre of the next financial crisis in these nations. Among these so-called developed countries, Japan is likely to be the first to face a sovereign debt crisis, followed by Europe, and ultimately the United States by the end of this decade. In this context, while the Bank of Japan may attempt to signal its commitment to combating the return of inflation, the reality is that US-Japan interest rate differentials may not narrow as widely expected. With U.S. 10-year yields rising and Japan heading into an inflationary bust—followed closely by the US—the Japanese yen is poised to become an inevitable collateral casualty of these trends, exacerbated by the looming prospect of a Japanese financial doom loop.

JPY/USD FX rate (blue line); Spread between US 10-Year Yield and Japan 10-Year Yield (red line).

Physical gold will outperform Bitcoin.

Investors who have studied the business cycle throughout history understand that there is only one asset class that has preserved wealth during inflationary times, particularly during inflationary busts, and that provides a hedge against government actions and the rising risks of wars: PHYSICAL GOLD. While Wall Street and even politicians, who will do whatever it takes to be elected, have sold the idea to uneducated YOLO investors that Bitcoin is an antifragile asset, the reality is that Bitcoin, like other cryptocurrencies, is the biggest scam ever created by authoritarian governments. Ben Franklin once said, ‘Our new Constitution is now established; everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes.’ Part of the problem has been the uneducated propaganda against the Federal Reserve's money printing, with blame directed at the bankers as if it should be in the hands of politicians. This has distorted the very definition of money. They blame the FED for inflation instead of the politicians who claim they can spend as much as they want and that it's the FED’s job to make it non-inflationary. Throughout centuries, money has taken many forms, from seashells and gold to things of value such as bronze, grain, and sheepskins. When it comes to durable money, it typically has practical use, utilitarian value. The reality is that Bitcoin is nothing more than an investment tool created as a leveraged, energy-consuming asset that will underperform gold, just as energy-consuming sectors tend to underperform energy-producing sectors once the US economy shifts from an inflationary boom to an inflationary bust, as occurred between January 2022 and October 2023.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Lower Panel: 12-months Rate of Change of the Gold to Bitcoin ratio (blue histogram).

The Eurozone will implement capital controls.

Outside of Japan, which is expected to experience the first significant crisis among the wrongly called developed markets, Europe will not only be the region most impacted by the implementation of tariffs by the 47th U.S. president but will also have to deal with rising political instability. Recent events in France and Germany have shown that lame-duck governments are impotent in implementing the necessary reforms to avoid an inevitable sovereign debt crisis. In this context, investors should not only avoid the European banking sector but also be aware of the rising risk in the Eurozone of implementing capital controls to prevent a complete meltdown of its financial sector. Wars drive capital out of conflict zones into safer environments, creating investment opportunities elsewhere. For example, without World Wars I and II, capital might never have shifted from Europe to America, making New York the global financial capital instead of London. In addition to geopolitical tensions that may intensify inflationary pressures, investors should also be wary of the looming great wall of debt in countries like France. The need to refinance existing debt by issuing new debt in a tightening liquidity environment would ultimately trigger a sovereign debt crisis. Capital controls in economic zones directly affected by wars, such as Europe and the Middle East, seem inevitable in this context.

A ‘Volcanic Climate Lockdown’ will be enforced.

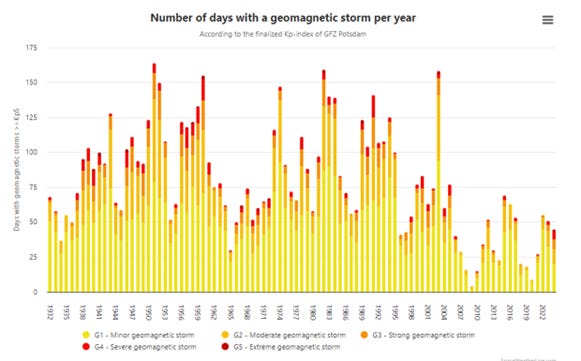

Anyone with a basic understanding of the business cycle knows that economic prosperity depends on access to cheap, abundant energy. The climate change narrative, particularly in Europe and blue states like California, has hindered this access. Instead of global warming, the Earth is entering a Solar Minimum, a period of quiet solar activity with fewer sunspots and less intense solar events. Solar Cycle 25, which began in December 2019, marks the 25th cycle since 1755. It is expected to continue until around 2030. Predictions for Cycle 25 range from weak, potentially leading to a Maunder Minimum-like state, to stronger cycles. The cycle began with reversed magnetic polarity sunspots, signalling the start of Solar Cycle 25. The risk of catastrophic volcanic eruptions increases during grand solar minima and maxima, cooling the Earth and triggering centennial-scale glacier growth and famine. Data from the past 8,000 years show an inverse correlation (R = -0.72, P = 0.002) between 500-year sunspot averages and large volcanic eruptions, with eruptions increasing as solar activity declines. The strongest correlation appears during the last 2,500 years, coinciding with the lowest 500-year sunspot averages in 7,500 years. While the incoming US president recognizes the need for energy independence and dismisses the climate change scam, the reality is that the solar cycle could trigger a climate-driven lockdown, similar to a volcanic eruption cycle, as a new source of supply disruption for food and basic necessities.

https://www.spaceweatherlive.com/en/solar-activity/solar-cycle.html

A new proxy war between NATO and the Global South will erupt on the Korean peninsula.

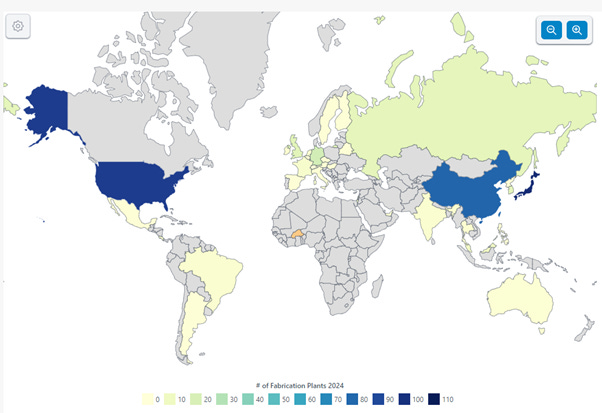

While the 47th U.S. president-elect has boasted on the campaign trail about his ability to end the forever bankers’ wars in Eastern Europe and the Middle East in less than 24 hours through his ‘art of the deal,’ the reality is that, once elected, he and his team have shown increasing interest in striking Iran and have proposed continuing military aid to Ukraine, contingent upon other European NATO members increasing their contributions to NATO to 5% of their GDP. Meanwhile, while all eyes were on Mar-a-Lago, the political environment in Europe dramatically deteriorated, with the French and German governments collapsing within weeks of the election of the 47th U.S. president. Looking east, the lame-duck South Korean president went so far as to declare martial law to maintain power, citing a ‘false flagged’ interference from the North in domestic politics. While the two Koreas are already engaged in a proxy war in Ukraine, anyone with a modicum of common sense knows that desperate men will do desperate things to stay in power. As South Korea's politicians join the ranks of desperate, lame-duck politicians among NATO which seeks to expand its influence on the Asian shores, aiming to find more reasons to supply US weapons to countries bordering the expanding mercantilist Global South, the next escalation in the global conflict cycle will inevitably occur on the Korean Peninsula. This conflict will not only spark a new proxy war between the Malthusian NATO countries and the mercantilist Global South, but it will also exacerbate shortages, particularly in semiconductors. South Korea is the second-largest semiconductor manufacturer in the world after Taiwan. Samsung Electronics, South Korea's multinational tech giant, is one of the largest companies globally in terms of revenue and semiconductor production. Samsung acts both as an Integrated Device Manufacturer (IDM), making semiconductors for its own products, and as a foundry, producing semiconductors for other companies. Semiconductors from Samsung and other companies like SK Hynix are South Korea's largest exports, comprising 15% of the country's total exports in 2023.

https://worldpopulationreview.com/country-rankings/semiconductor-manufacturing-by-country

In this context, while the future is uncertain and unpredictable, investors should always prepare for the worst and hope for the best. Investors should also never forget that, in the worst-case scenario of an inflationary bust, gold, not government bonds, remains the antifragile asset to hold. Among equities, investors will need to shift from energy-consuming sectors like IT to energy-producing sectors like oil and gas. This shift will occur in an environment where investors must increasingly prioritize the Return OF Capital over the Return ON Capital.

WHAT’S ON THE AGENDA NEXT WEEK?

The first full week of 2025 will be shortened in the US, as the New York Stock Exchange will close on January 9th to mourn the death of the 39th U.S. President, Jimmy Carter. The week will once again focus on the health of the job market with the release of December Non-Farm Payrolls, while the political agenda will feature the Counting and Certification of Electoral Votes on January 6th. The FOMC meeting minutes are expected to shed light on Jerome Powell's recent hawkish comments, and companies like Cal-Maine, Constellation Brands, and Walgreens Boots will kick off the Q4 2024 earnings season.

KEY TAKEWAYS.

As a new year of living dangerously starts, here are the key takeaways:

China's December PMI data shows a surprising boost in services and construction, but a slight dip in manufacturing suggests that Make China Great Again may take longer than most investors can expect.

The US ISM Manufacturing PMI rose above estimates, signalling slower contraction, but falling employment and rising cost pressures highlight persistent challenges ahead.

As investors reflect on the past year, they recognize that the political turmoil and inflationary boom of 2024 led to the FED's partisan pivot in September, with gold and stocks outpacing cash and bonds.

After the FED's irrelevant rate cuts in 2024, tariffs will push the U.S. economy into an inflationary bust, which will force the FED to raise rates in 2025 to preserve the USD's reserve status and give a sentiment of curbing inflation.

With rising risks of the US economy transitioning from inflationary boom to inflationary bust, the Dow will outperform the Nasdaq in 2025.

While energy-consuming sectors like the IT sector outperform during the inflationary boom, the transition to an inflationary bust in 2025 will shift the advantage to energy-producing sectors, prompting a strategic shift from the ‘Magnificent 7’ to the under-owned energy sector.

With over $10.0 trillion in debt to refinance and new policies under the 47th president, unless the FED resort to yield curve control, investors should brace for rising long dated yields and avoid the underperforming US financial sector.

Tariffs will inevitably trigger global stagflation, boost foreign investment into the US, and strengthen the USD against fiat currencies, but it will weaken against physical gold.

Governments in misleadingly called developed countries, particularly Japan, face a looming sovereign debt crisis, with Japan’s currency weakening further as Japan enters an inflationary bust.

As physical gold preserves wealth during inflationary busts, Bitcoin, a leveraged, energy-consuming asset with no track record or credible source, will underperform gold as the US economy shifts from inflationary boom to bust.

Europe, facing the impact of US tariffs and rising political instability, will be forced to implement capital controls to avoid an inevitable sovereign debt crisis, creating risks for investors, particularly in the banking sector.

Economic prosperity depends on abundant energy, but the climate change scam has hindered access, while Solar Cycle 25, marked by quiet solar activity, could lead to climate-driven disruptions such as lockdown and food shortages.

Rather than ending the forever bankers' wars in 24 hours, geopolitical tensions will spread to another proxy war on the Korean Peninsula, worsening semiconductor shortages as desperate politicians act desperately to stay in power.

As the year to come is expected to be much more volatile, investors should favour antifragile assets like gold over bonds, as gold offers low equity correlation, stability, and resilience against currency debasement.

In such environment, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold remains THE ONLY reliable hedge against reckless and untrustworthy governments and bankers.

Gold remains an insurance to hedge against 'collective stupidity' and government’ hegemony which are in great abundance everywhere in the world.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

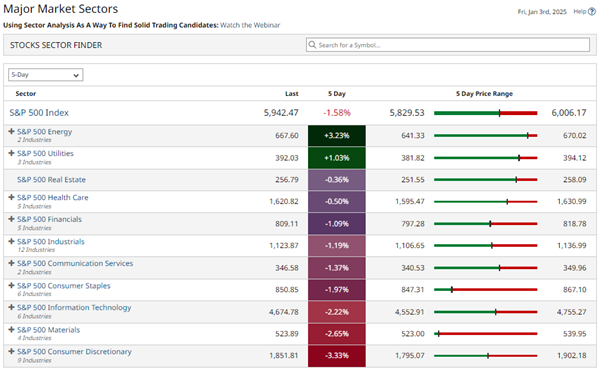

After a year of 'gifts' in 2024, Santa left stock investors with a lump of coal as the 'Santa Claus Rally' ended down, and the first week of the new year began on a negative note. The S&P 500 outperformed the Dow and Nasdaq, but all three major indices closed the week in the red. The S&P 500 declined for the third time in four weeks, though it bounced on Friday after a five-day losing streak. Key technical supports were tested, with the Nasdaq closing above its 50-day moving average, while the S&P 500 fell below it and retraced much of the post-November 5th 'Trump Rally.' The Magnificent 7 underperformed all three indices, led by declines in Apple and Tesla which reported poor sales in the last quarter of the year. The Dow triggered another bearish daily reversal on Thursday, maintaining the pattern through week’s end, as bearish pressure loomed across the markets.

Energy stocks were the week's biggest gainers while Materials and Consumer Discretionary were the biggest losers on the week.

The future is a known unknown for everyone, including investors and wealth managers. The best quality of any manager is not only to prepare for the worst while hoping for the best, but also to adapt to any circumstances, as everyone knows that ‘Hard times create strong men. Strong men create good times. Good times create weak men. Weak men create hard times. ’

In this context, rather than listening to Wall Street and its parrots, investors should stay calm, disciplined, and methodically use market data tools to monitor the state of the business cycle and anticipate its changes. As of the end of December 2024, the US economy is the only major economy in an inflationary boom, while Japan; Europe and China are already in an inflationary bust.

Those who understand the business cycle know that in the current inflationary environment across all major economies, government bonds, considered once upon a time ‘risk-free’, are no longer ‘free of risks,’ especially in the misleadingly called developed markets, which are living on borrowed time.

As the US economy faces increasing risks of shifting from an inflationary boom to an inflationary bust, investors should avoid all types of bonds (government and corporate) with maturities over 12 months globally. They should also avoid exposure to all fiat currencies outside the USD, which remains the ‘’least dirty shirt in the laundry basket’ and, due to its status as the reserve currency, will continue to appreciate against other fiat currencies while depreciating against gold. Gold, the only asset that has preserved wealth across centuries and provides a hedge against government and war risks due to its lack of counterparty risk, will continue to be a safe haven.

Therefore, in the contract side of the Browne portfolio, which savvy investors know should be underweight (less than 50% of the total portfolio holding), those seeking a regular income stream should focus on a diversified portfolio of USD short-dated (less than 12 months maturity), investment-grade bonds from US companies with strong balance sheets and low leverage. This strategy offers minimal credit and duration risk and have delivered a 3.3% return over the past 7 months translating into an expected annualized return of at least 5+%.

On the property side of the Browne Portfolio (Equities and Gold), investors should avoid holding stocks in regions that are or are in an inflationary bust, such as China, Europe, and Japan. In the US, as long as the S&P 500 to gold ratio remains above its 7-year moving average, as it does on January 3rd, 2025, investors can allocate their portfolio equally between stocks and gold. Among stocks, the best approach over the past 24 years has been an equal-weighted allocation between IT, Energy, and Aerospace/Defence stocks, or the Smart Defence Equity portfolio, which has consistently outperformed the S&P 500.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Lower Panel: Relative Performance of the Smart Defence Equity Portfolio to S&P 500 index (yellow line).

Once the S&P to Gold and S&P to Oil ratios break below their respective 7-year moving averages, investors will need to reduce their equity allocation and shift it to physical gold, while also decreasing exposure to energy-consuming sectors (e.g., IT) and increasing exposure to energy-producing sectors (e.g., Oil & Gas).

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Third Panel: Relative Performance of S&P 500 to Gold (Yellow line); Lower Panel: Relative Performance of the S&P 500 IT Index to S&P 500 Energy Index (Orange line).

In a nutshell, in both inflationary environments, bonds no longer provide the risk-free hedge they do in deflationary environments. This is particularly true with higher tariffs and significant debt refinancing ahead. For now, investors can still buy the dips in equities and gold while selling the rips in bonds, as the US economy remains in an inflationary boom. When the economy shifts into an inflationary bust, these investors should sell the rips in equities and bonds and buy the dips only in gold and other physical assets in limited supply. Among equities, as the US economy moves from an inflationary boom to an inflationary bust, investors should allocate over 50% of their equity portfolio to energy producing stocks, minimize cash in banks and government bonds, and use a diversified portfolio of short-term, investment-grade corporate paper to generate income and navigate the upcoming Skyfall.

Many mistakenly view the stock market as a sign of economic health, but the true danger lies in the debt market. While stock market declines of 30-40% might not cause a recession, a disruption in government debt can lead to severe economic downturns, wiping out the banking system, as investors in times of crisis will have to accept that there is no bid for what has been depicted by Wall Street and its parrots as the ‘risk-free asset.’

As the coming year will be challenging for investors and their families, it's crucial to focus on factual data rather than propaganda. While we can't alter cycles or control the future, we can learn from the past to prepare for what lies ahead, staying calm and proactive to protect ourselves and our loved ones. As the adage says, ‘Prepare for the worst and hope for the best.’ Savvy and disciplined investors know that they should not ‘bet their life, every night while they're chasing the morning light’ and that ‘Until the world falls away, until you say there'll be no more goodbyes, I see it in your eyes, tomorrow never dies.’

In this context, investors should ‘let the sky fall, and they will stand tall’ through the post-‘Trump stagflation’ by using a disciplined investment approach based on market data and a proven asset allocation to navigate the stormy waters of the business cycle.

If this report has inspired you to invest in gold, consider Hard Assets Alliance to buy your physical gold:

https://www.hardassetsalliance.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.