THE WEEK THAT IT WAS...

The week of Columbus Day drew investors' focus to inflation data from China and Japan. Additionally, investors gained insights into the health of US and Chinese consumers with the release of September retail sales data. The week also included another ECB meeting, where the politically driven chairwoman spread more illusions about the economy of the old continent.

In China, CPI inflation slowed to a 3-month low of +0.4% YoY in September, down from +0.6% in August and below the consensus of +0.6% YoY. Without a bigger gain in food prices, the main contributor to CPI inflation, the reading would have been even weaker, as shown by the decline in Core CPI to +0.1% YoY from +0.3% in August. This brings the Q3 2024 CPI up from +0.3% in Q2 2024 to +0.5% YoY. On a monthly basis, CPI was unchanged in September, ending two months of gains. Meanwhile, PPI fell 2.8% YoY in September, more than the 1.8% YoY drop in August and below the consensus of a 2.6% YoY decline.

Looking at the evolution of the spread between the CPI and PPI, due to the heightened deflation in the wholesale price index, the spread has begun to widen again since June. This could ultimately help Corporate China expand margins and support the recent valuation expansion in Chinese equities, driven by various announced but mostly unquantified fiscal stimulus measures.

Spread between China CPI YoY Change and China PPI YoY change (blue line); MSCI China 12-monhts forward P/E (red line).

China's retail sales grew by 3.2% YoY in September, surpassing market expectations of 2.5%. While this may provide some optimism for investors, suggesting the domestic economy is on a path to improvement, the YoY change in retail sales remains well below last year's trend and is insufficient to offset the severe downturn in the property sector. This sector continues to weigh heavily on the Chinese economy and has contributed to a rebound in domestic misery since the beginning of the year.

China Retail sales adjusted to Chinese inflation (blue line); China Misery Index (axis inverted; red histogram) & Correlations.

In a nutshell, the Chinese data highlights the economy's urgent need for stimulus. While the pro-growth pivot has lifted market sentiment, the challenge now lies with policymakers to deliver meaningful support and lay the foundation for revitalizing the path to ‘Make China Great Again.’

In Japan, the September CPI can be summed up as a ‘nothing sushi,’ with the headline CPI slowing to 2.5% from 3.0%, in line with Bloomberg's consensus, thanks to the base effect. Core CPI, which excludes only fresh food, cooled to 2.4% YoY from 2.8% in August but exceeded expectations of 2.3%. Like other developed markets, Japan's disinflationary trend, aided by the base effect, obscures the reality of stickier for much longer services related inflation. With all metrics still above the BoJ's 2.0% target and the disinflationary base effect fading and core services CPI on the rise again, investors should prepare for another rate hike from the BoJ, especially if rising energy prices heat up due to the war cycle before year's end.

In Europe, as the ECB held its annual offsite meeting in Ljubljana, Slovenia, the partisan and politically driven ECB Chairwoman, along with her colleagues living in their ivory towers, unsurprisingly decided to cut the three key rates by 25 bps for the second consecutive meeting. Sticking to its uninspiring, data-dependent, meeting-by-meeting approach, the ECB based its decision on ‘incoming information on inflation shows that the disinflationary process is well on track’ and added that ‘the inflation outlook is also affected by recent downside surprises in indicators of economic activity. Meanwhile, financing conditions remain restrictive’.

Never shy about spreading ‘Forward Confusion’ and being an adept of dystopian narratives, the ECB tweaked its inflation language by acknowledging that ‘inflation is expected to rise in the coming months.’

In a nutshell, the politically driven, data-dependent ECB will sooner rather than later realize that Europe is on the brink of an inflationary bust, spreading further misery among its citizens. The inevitable stagflation will be happening concomitantly by a banking and sovereign debt crisis across the continent.

With less than 20 days until the US presidential election, in an attempt to project a rosy outlook for American consumers and voters, US headline retail sales grew by 0.4% month-over-month, surpassing August's +0.1% and the consensus estimate of +0.3%. Excluding autos and gasoline, retail sales increased by 0.7%, up from +0.3% in August and above the expected 0.3%. Notably, consumers reduced online shopping, focusing on clothing and miscellaneous items. More importantly, sales at food services and drinking places, a proxy for service sector spending, rose, suggesting a catch-up in discretionary spending after slower-than-usual growth earlier this year.

While the numbers depict a relatively healthy economy, they were driven by an unequivocally partisan, propagandistic seasonal adjustment. On a non-adjusted basis, retail sales actually fell by a shocking 7.5% month-over-month, making September 2024 the biggest positive September seasonal adjustment in the history of US economic data.

Not only is the supposedly healthy economic environment based on a nebulous Excel spreadsheet adjustment, but investors must also remember that retail sales are nominal (not adjusted for inflation). When adjusted for the 'CPLie' inflation data, US retail sales have been trending downward since April 2021, yet another sign of the undeniable, rising inflation-driven misery among US consumers as Bidenomics fades.

US Retail Sales adjusted to US CPI Index (blue line); US Misery Index (axis inverted; red histogram); Correlations and US recessions.

In this context, Wall Street still has to realize the FED's impotence in an economy driven solely by government spending, which will inevitably harm consumers and investors. Therefore, it is not a surprise that the Wall Street consensus still expect 2 additional FED rate cuts by the end of the year with 76% probability and 6 rate cuts in 2025. Seasoned investors must remember that inflation-driven misery stems not primarily from the FED, but from reckless regulations imposed by politicians pushing to ‘build back better’ for the kleptocrats and kakistocrats of the world. In this context, whether the FED cuts rates remains almost irrelevant; the real issue is stopping those who mismanage the economy under the pretence of climate change and DEI while fuelling forever bankers’ wars to enrich their plutocratic allies. Regardless of who occupies the White House next, Powell and his PhD colleagues know that interest rates always rise during wartime. The misguided Wall Street bankers will once again be wrong in thinking rate cuts will solve economic problems, which will only worsen under ‘Kamunism.’

While financial markets continued to enjoy a period of calm, it is an understatement to say that, over the past few weeks, the world has faced turbulent geopolitical and meteorological conditions. As we deal with the impact of wars on portfolio allocations, while consensus continues to daydream about immaculate disinflation, savvy investors know that outside wars, natural disasters are inflationary. They widen budget deficits, disrupt supply chains, and cause temporary surges in demand for certain goods. There is little reason to believe this time will be different, especially when natural disasters occur less than 30 days before the most contested election in US history. In this context, both Kamala Harris and Donald Trump have aimed to be seen as the candidate promising substantial federal aid to the affected regions. This will be particularly true for Harris, given the political backlash the Biden administration faced for its perceived modest response to the damage caused by Hurricane Helene in Georgia and the Carolinas.

https://www.newsweek.com/donald-trump-hurricane-milton-florida-ron-desantis-1967159

One lesson from past hurricanes is the heavy toll they take on cars. More often than not, a flooded car is a totaled car. This is especially true for electric vehicles. A flooded EV in the garage isn’t just a write-off, it’s a potential fire hazard that can spontaneously combust. In the aftermath of hurricanes Helene and Milton, the US may see strong demand for gasoline cars as replacements, while demand for EVs could diminish. Most automakers, however, have positioned themselves to meet the opposite trend.

For the US economy, this would mean that the deflation in new car prices reflected in the CPI since March 2023 could be over, and that cars, like other durable consumer goods, could add to external factors that will bring the return of the inflation boomerang sooner rather than later.

US CPI Index (blue line); US New Cars CPI (red line) (rebased at 100 as of December 31st, 2019).

A key lesson from past hurricanes is also that storm damage drives up home and auto insurance premiums, which is already a political issue in states where rising costs are affecting real estate values. In hurricane-prone areas like Florida, residents will face higher insurance premiums and potential local tax hikes. While some cleanup costs may be covered by the federal government, most of the burden for restoring infrastructure, roads, ports, etc., will fall on states and municipalities.

Given this economic backdrop, investors must account for the inflationary impact of the natural disasters, alongside the rebound in oil prices, which, after testing the mid-60s range, are now trending upward and adding to reflationary pressures. These pressures are also fuelled by China's recent stimulus measures and the impact of substantial pay increases secured by US longshoremen to keep East Coast ports open ahead of the ‘D-day’ of the year of political hell (November 5th).

WTI price (blue line); US CPI YoY change (histogram) & Correlations.

Put all this together, and no one needs a PhD in economics to wonder whether the coming quarters will see US inflation follow the path of the 1970s. What seems to still be missing from the conditions that led to a 1970s-style inflation firestorm is the spark of rising energy prices. Although Russia’s invasion of Ukraine initially triggered fears of natural gas shortages, energy rationing, and grandmothers dying in the cold European winter, none of these dire predictions came to pass. Instead, after a brief panic, energy prices settled into a $70-90/bbl range for Brent crude and a $40-90/bbl equivalent range for European natural gas, where they have remained for most of the past two years.

US CPI YoY Change between 1970 and 1979 (blue line); between 2017 and 2027 (red line).

Beyond being inflationary, rising oil prices have historically led to heightened equity market volatility within 3 to 6 months. If oil prices continue to surge amid escalating conflict, market volatility could quickly spike to crisis levels, with the VIX surpassing 40.

WTI price (blue line); Chicago Board Option Exchange Volatility Index (VIX Index) (red line).

Looking ahead, the volatility term structure is notably upward sloping into Election Day and the coinciding FOMC meeting, indicating that investors should prepare their portfolios for a potential ‘black swan event’ around that time and the period leading into January 6th and the certification of the election.

Investors must also remember that Wall Street has a long history of herd mentality, where it's safer to be wrong with the crowd than right alone. With less than 3 weeks until the D-Day of the year of political hell, asset managers haven't been this long on equities (i.e., S&P 500) since January 2020. This should be another reason for anyone with a minimum of common sense to avoid suffering from FOMO while the results of the election could only be announced on January 6th.

S&P 500 index (blue line); CFTC E-Mini S&P 500 Asset Manager Institutional total futures allocations (red line) & correlation.

In the current environment, everyone would agree that, like Christopher Columbus navigating through stormy waters to discover the Americas, investors today need a compass more than ever to navigate the turbulent markets ahead. The Schumpeter Business Cycle framework is one of the most reliable ways to map the economic landscape to help investors in their financial navigation journeys. Business cycles can be summarized into four quadrants, akin to the four seasons. The cycle begins in ‘spring’ after a ‘deflationary bust’, driven by rate cuts and fiscal support, leading to growth without immediate inflation. Financial markets thrive in this phase, characterized by a ‘deflationary boom’ and asset rallies, particularly in growth stocks. As the economy moves into ‘summer,’ inflation rises, entering an ‘inflationary boom’ phase where cyclicals, emerging markets, and commodities outperform. However, rising inflation triggers rate hikes, leading to a gloomy ‘inflationary bust’ characterized by stagflation, which negatively impacts most assets except gold. Eventually, inflation slows, and the economy falls into a recession, transitioning into a deflationary bust and the cycle continues.

Historically, researchers and investors have identified a 7-year pattern in economic cycles, potentially linked to the Hebrew tradition of debt forgiveness and land rest (Shemitah). This cycle has been observed in the stock market, with predictions of downturns every 7 years. Notable events often align with this timeframe, influenced by factors such as:

Debt forgiveness and land rest in the Hebrew tradition

Commodity price shocks and interest rate changes

Kondratiev waves (long-term technological cycles)

Juglar cycles (fixed-investment cycles of 7-11 years)

While the 7-year cycle has some empirical support and is neither rigid nor predictable, it remains the best-recognized pattern in the market and economy. Despite ongoing debates about its predictive power and reliability, the 7-year cycle remains the most universally accepted framework for understanding the evolution of the business cycle.

Having spent almost three decades in financial markets, like other strategists, we have been trying to find THE TOOL, or a series of tools, that would show precisely where an economy is in the four-quadrant matrix of the Schumpeter business cycle. After so many years of using official data measuring economic activity and prices, with humility we have to say that we have more or less failed to accurately estimate where the economy stands in this matrix.

In this context, rather than relying on government economic data, which can be easily manipulated for propaganda purposes related to elections and the egos of those in power, it should be clear that market data, rather than government data, are more appropriate for navigating the four quadrants of the business cycle.

A core principle in analysing a country's economy is that a modern economy can be thought of as energy transformed. Hence, energy is the core economic input, while the outputs are goods and services that should have a higher value than the input. While some are preaching the use of uneconomic ‘green energy’, about 80% of global energy consumption still comes from coal, oil, and natural gas, with prices typically converging around oil, the most easily transported source. Therefore, using the WTI crude contract price provides a reliable proxy for energy cost constraints.

Anyone who has a basic knowledge of economics knows that the output generated from energy input represents the value added by the private sector in the economy. In this context, fluctuations in the market value of this production can be approximated by stock market returns. As every good marginalist, one can assume that as long as stock prices rise faster than oil prices, energy is being transformed productively, leading to natural economic growth. The next obvious question is: what happens if the oil price rises faster than stock market returns? In this scenario, there is a high likelihood that the economy will stop growing, leaving equity investors in a challenging position.

The first proposal for revising the four quadrants is to replace ‘economic activity’ on the vertical axis with ‘energy efficiency.’ To maintain a long-term perspective and avoid noise that could distort analysis, investors should assess whether the an economy, in this case the US economy, is in a boom or a bust not by looking at whether the ratio between the S&P 500 and the oil price is positive or negative, but by comparing the current S&P 500-to-oil price ratio to its seven-year (84-month) moving average. Currently, since this ratio is above its seven-year moving average, it is clear that in the case of the US, the economy remains in a boom.

Ratio of S&P 500 to WTI price (blue line); 84 months Moving average of the S&P 500 to WTI price ratio (red line).

Moving to the old horizontal ‘inflation axis,’ everyone knows that the ‘CPLie’ is a poor indicator of the real inflation that citizens in an economy face. In this context, the key question for investors is not whether prices are going up or down, but whether the bond market is protecting them against rising prices. This leads to the question of whether the bond market is acting as a proper store of value.

To answer this question, gold is used as a standard of value or unit of account. By computing a ratio between the price of gold in fiat currency and the total return of the government bond index, we can assess fiat currency debasement. If the ratio is below its seven-year moving average, the bond market has been acting as a proper store of value, indicating that the economy must be experiencing a deflationary environment. Conversely, if the ratio is higher than its seven-year moving average, the currency is being debased, suggesting that the economy must be experiencing an inflationary environment.

As history shows for the US, there have been long periods when the US bond market acted as a proper store of value, followed by long periods when gold was a better store of value. Hence, since the start of the decade and the reckless government spending that has followed the onset of the COVID pandemic, the ratio of gold to the Bloomberg US Treasury Index (LUATTRUU index) has been above the 7-year moving average. This confirms, as anyone with a minimum of common sense can see, that despite the prevailing government propaganda, the US economy has been experiencing an inflationary environment.

Ratio of Gold price to US Treasury Index (blue line); 84 months Moving average of the Gold to US Treasury Index ratio (red line).

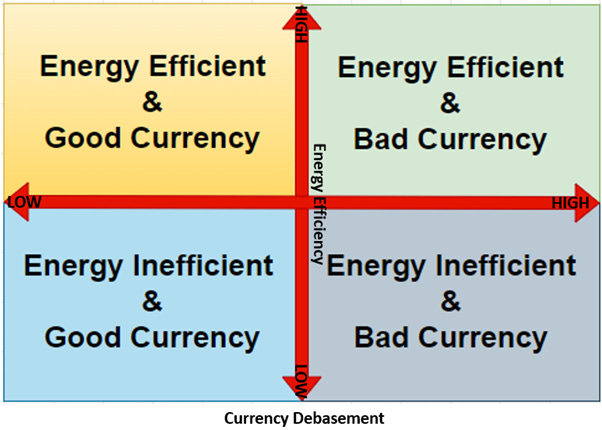

Hence, the two axes that form the backbone of the business cycle can be redrawn based on the energy efficiency of the economy (vertical axis) and the quality of the currency (horizontal axis). The vertical axis will now measure whether the economy is, at that time, energy efficient or energy inefficient. The horizontal axis shows whether the currency is acting as a store of value and is thus labelled as either a ‘good currency’ or a ‘bad currency.’

Therefore, any economy in question can be in one of the following four states:

Energy inefficient/good currency equates to a deflationary bust.

Energy efficient/good currency equates to a deflationary boom.

Energy efficient/bad currency equates to an inflationary boom.

Energy inefficient/bad currency equates to an inflationary bust.

Those familiar with the ‘Browne portfolio’ will remember that the best asset among the four components of the Permanent Portfolio to own in an energy-efficient economy with a bad currency is equities. Equities thrive in such an environment, as they benefit during periods of prosperity and economic expansion. This is probably why the US equity market have been making new all-time highs over the past quarters.

Like the Permanent Portfolio, the analysis of an economy based on its energy efficiency and the quality of its currency can be applied across geographies, making investments much more scalable for investors looking to invest outside their domestic markets.

Applying the same analysis to China, no one needs to understand Mandarin or have a Ph.D. in economics to see that with the CSI 300 to oil ratio denominated in CNY trading below its 84-month moving average, the Chinese economy has been in an environment of energy inefficiency since mid-2021.

Ratio of CSI 300 index to WTI price in CNY (blue line); 84 months Moving average of the CSI 300 index to WTI price ratio in CNY (red line).

Looking at the quality of the currency for China, the ratio of the gold price to Chinese bonds in CNY terms has traded above its seven-year moving average since mid-2019. It is clear that, like in the US; despite having outperformed their US peers, Chinese bonds have not been a better way to store value than their US counterparts for Chinese investors.

Ratio of Gold price to Bloomberg China Fixed Income Index in CNY (blue line); 84 months Moving average of Gold price to Bloomberg China Fixed Income Index ratio in CNY (red line).

In a nutshell, since mid-2021, the Chinese economy has been characterized by energy inefficiency and a bad currency, an environment previously referred to as an inflationary bust or stagflation. This is likely the reason why the Chinese government ultimately decided to intervene in the stock market to try to shift its economy from the current stagflation to an inflationary boom. However, for the time being, Physical Gold remains the best investment for Chinese investors.

Shifting gears to the country of the rising sun, the economy has fluctuated between energy efficiency and inefficiency over the past three years but has re-emerged into an energy-efficient mode since last November. However, Japan is one of the largest energy importers in the world, making it particularly vulnerable to rising oil prices linked to geopolitical tensions.

Ratio of Nikkei 225 index to WTI price in JPY (blue line); 84 months Moving average of the Nikkei 225 index to WTI price ratio in JPY (red line).

Like the US and China, there are no surprises that the Japanese bond market has not be a good store of value for its domestic investors over the past years. Indeed, the ratio of gold prices to Japanese bonds in JPY terms has been trading above its seven-year moving average since mid-2019.

Ratio of Gold price to FTSE Japanese Government bond Index in JPY (blue line); 84 months Moving average of Gold price to FTSE Japanese Government Bond Index ratio in JPY (red line).

In summary, like the US, Japan is currently in an inflationary boom. However, its high dependence on oil imports from the Middle East makes it highly vulnerable to a shift back into an inflationary bust, potentially sooner rather than later, similar to the period from mid-2021 until last November.

To conclude our analysis of the four major economic blocs, applying the same framework to the Eurozone reveals that, after nearly three years below its 7-year moving average, the ratio of EuroStoxx to WTI in EUR terms broke above this threshold in late June. This suggests that the European economy has transitioned from energy inefficiency back into a regime of energy efficiency. However, like for Japan, and as the recent dip in the ratio shows, this improvement might be short-lived. If current geopolitical tensions in the Middle East and Eastern Europe lead to further disruptions in energy supply chains, Europe could find itself back in an unenviable stagflation.

Ratio of Euro Stoxx 50 index to WTI price in EUR (blue line); 84 months Moving average of the Euro Stoxx 50 index to WTI price ratio in EUR (red line).

Examining the quality of the Eurozone's currency using German bonds as a proxy for the fixed income market, we find that the ratio of gold price to German bonds in EUR terms has been above its 7-year moving average since mid-2019. This indicates that, similar to the situation in the US; Japan and China, German bonds have not served as a store of value for their local investors.

Ratio of Gold price to Bloomberg Germany Fixed Income Index in EUR (blue line); 84 months Moving average of Ratio of Gold price to Bloomberg Germany Fixed Income Index in EUR (red line).

As Winston Churchill once said, ‘The farther backward you can look, the farther forward you are likely to see.’ The Eurozone's past struggles with energy disruptions remind us how quickly improvements can unravel when external shocks hit.

To summarize, the US, Eurozone, and Japan are currently in an environment characterized by energy efficiency and a bad currency, previously referred to as an inflationary boom. However, readers should note that both Japan and the Eurozone have recently exited an inflationary bust (energy inefficiency and bad currency) over the past 3 to 6 months. The recent rebound in oil prices could potentially push them back into an inflationary bust sooner rather than later. Conversely, China has been in an inflationary bust environment since mid-2021, requiring significant government efforts to stimulate the economy and stock market to transition back into an inflationary boom. The greater the impact of current geopolitical uncertainties on oil prices, the more stimulus will be needed in China. Based on these assumptions, American; Japanese and European investors should focus on a diversified portfolio of stocks within the four assets of the 'Permanent Portfolio,' while Chinese investors should continue holding physical gold until the effects of the recent stimulus measures by the Chinese government lead the economy from an inflationary bust into an inflationary boom.

Returning to the US, to tackle the effects of monetary illusion, which refers to the tendency of individuals to perceive their wealth and income in nominal terms rather than in real terms, ignoring the effects of inflation, investors should gauge the performance of the S&P 500 index in gold terms rather than in USD terms. While people may feel wealthier when their wages or asset values rise, even if the purchasing power of their money has not increased due to inflation, this illusion distorts financial reality. A quick comparison of the performance of the S&P 500 in nominal terms (USD) and in gold terms since the start of this decade shows that, while in USD terms the S&P 500 has grown by almost 80% since the start of the decade, when adjusted for gold performance, it is only up a mere 2.8% over the same period. In summary, it is fair to conclude that most of the stock market's performance since reckless government spending began has been attributed to the debasement of the USD and has benefited from a monetary illusion rather than strong efficiency.

Performance of $100 invested in the S&P 500 index (blue line) and the S&P 500 index valued in gold terms (red line) since December 31st, 2019.

The reality is that the US dollar has been declining against gold, and the gains in both assets are a monetary illusion. In light of this reality, the following conclusions can be drawn:

All true US bull markets, as defined by the S&P 500 rising in gold terms, have occurred when the economy was in the old deflationary boom quadrant.

All Ursus magnus dreadful bear markets, the big destroyers of capital, have taken place when the economy has been in the old inflationary bust.

When the economy is in an inflationary boom and deflationary bust, nothing too dramatic tends to happen.

In a true US bull market, setbacks in the S&P 500, such as those caused by a US economic slowdown, should be bought by smart investors.

When the economy is in the inflationary bust quadrant, any rally should be sold.

As of today, the US is still in the inflationary boom quadrant as it has been since end of 2020 despite the prevailing monetary illusion. In this environment the stock market is supposed to outperform gold. However, the S&P 500/Gold ratio has just broken below its 7-year moving average. Investors should note that every time the ratio has broken below its 7-year moving average, it has never been a good omen, as seen in the early 1970s, in the early 2000, and more recently again in January 2020.

S&P 500/Gold ratio (blue line); 84 months Moving Average of the S&P 500/Gold ratio (red line).

Such a breakdown in the S&P 500/Gold ratio has often preceded the breakdown of the S&P 500/WTI price ratio by a few months, which has also never been a good omen for financial markets and the economy.

Upper Panel: S&P 500/Gold ratio (blue line); 84 months Moving Average of the S&P 500/Gold ratio (red line); Lower Panel: S&P 500/WTI ratio (green line); 84 months Moving average of the S&P 500/ WTI ratio (red line).

One reason why European and Japanese investors should not get too excited about their economies escaping the inflationary bust recently is that this appears to be purely due to monetary illusion. Both countries have seen the ratios of their respective equity indices, the Euro Stoxx 50 and the Nikkei, to the price of gold in their respective currencies remain below the 7-year average since mid-2019 and the end of 2021, respectively.

Euro Stoxx 50/Gold ratio in EUR (blue line); 84 months Moving Average of the Euro Stoxx 50 /Gold ratio in EUR (red line)

Nikkei/Gold ratio in JPY (blue line); 84 months Moving Average of the Nikkei /Gold ratio in JPY(red line)

In a nutshell, while the US, Europe, and Japan are still in an inflationary boom, there are increasing signs that these three major developed economic blocs could quickly fall into an inflationary bust. This means investors in these regions will need to allocate even more to physical gold than they have over the past few quarters. In fact, it doesn't take a genius or a macro strategist to see that as the war cycle heats up and the world slides into an inflationary bust, gold is unlikely to get cheaper anytime soon. This is especially true given that, unlike stocks, which have been hitting new all-time highs day after day with institutional investors holding their longest equity positions since January 2020, gold has not only outperformed the S&P 500 year-to-date but, unlike stocks, remains under-owned and unloved by illiterate Wall Street bankers.

WHAT’S ON THE AGENDA NEXT WEEK?

The last full week of the first month of the final quarter will be relatively quiet in terms of macroeconomic data, with the BRICS Summit in Kazan Russia likely to be the most important event not only of the week but also a pivotal event for the decades to come. In the US, investors will focus on the flash estimates of the S&P US Manufacturing and Services PMI and another estimate of the University of Michigan Consumer Sentiment and inflation expectations. On the other hand, this week marks the ‘Super Bowl’ of the Q3 2024 earnings season, with 37% of the S&P 500's market capitalization reporting earnings, including three of the so-called Magnificent 7: Alphabet, Tesla, and Amazon. Beyond these, investors will focus on releases from RTX Corp, Lockheed Martin, Freeport-McMoRan, General Dynamics, Caterpillar, Coca Cola and Northrop Grumman, among others.

KEY TAKEWAYS.

As all eyes turn to Tatarstan’s capital to watch how the BRICS will reshape global finance, here are the key takeaways:

China's data shows the need for stimulus, and while the pro-growth shift has boosted market sentiment, policymakers must now deliver real support to ‘Make China Great Again’.

The ‘Nothing Sushi’ September Japanese CPI masked the reality of a stickier for longer inflation trend, which will require another interest rate hike from the BoJ sooner rather than later, especially if energy prices rebound further in the coming months.

The politically driven, data-dependent ECB will soon realize Europe is nearing an inflationary bust, alongside a banking and sovereign debt crisis across the continent.

The propagandistic and partisan seasonally adjusted nominal retail sales paint a picture that, for any investor who understands the impact of inflation on nominal data, highlights the rising inflation-driven misery for US consumers.

Amid geopolitical and meteorological turmoil, natural disasters are fuelling inflation as the US approaches a contentious election, with a shift in demand from electric vehicles to gasoline cars reversing deflation in new car prices.The current economic climate foreshadows a return to 1970s-style inflation, despite the absence of a significant energy price spike following Russia’s invasion of Ukraine.

Like Christopher Columbus navigating stormy waters, investors need a compass to traverse today’s turbulent markets by using the Schumpeter Business Cycle framework to chart the economic landscape.

The 7-year market cycle, rooted in the Hebrew tradition of debt forgiveness, has emerged as a compelling framework for understanding economic shifts, aligning with significant events and influencing market trends, even as its predictability sparks ongoing debate.

Savvy investors understand that to effectively navigate the Schumpeter business cycle, relying on market data rather than manipulated government statistics is the best strategy.

The business cycle can be redefined using a vertical axis for energy efficiency, indicating whether the economy is energy efficient or inefficient, and a horizontal axis for currency quality, which assesses whether the currency serves as a 'good' or 'bad' store of value.

Market data indicates that while the US, Eurozone, and Japan currently experience an inflationary boom driven by energy efficiency, rising oil prices may soon push them into an inflationary bust, while China’s current inflationary bust require additional stimulus.

In this context, US, Japanese, and European investors should primarily own a diversified portfolio of stock, while Chinese investors should primarily focus on gold until China moves back into an inflationary boom.

As the reality is that the US dollar has been declining against gold, the gains in US stocks, as well as in European and Japanese ones, have been driven by monetary illusion.

While the US remains in an inflationary boom, the S&P 500/gold ratio hovers precariously just above its 7-year moving average, and history warns that any drop below this level has never been a good omen for either the economy or future returns for equity investors.

Rather than focusing on passive investing, which over-weights energy consumers versus energy producers, US equity investors should position their portfolios in all sectors that are closely or indirectly linked to energy production.

In such environment, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold remains THE ONLY reliable hedge against reckless and untrustworthy governments and bankers.

Gold remains an insurance to hedge against 'collective stupidity' and government’ hegemony which are in great abundance everywhere in the world.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

An improvement in macroeconomic data over the past five days, likely more propagandistic than real as everything is good to create the illusion that everything is rosy and quiet ahead of the D-day of the year of political hell, has led the three major US equity indices to close the week on a positive note. This marks the sixth consecutive week of gains for all three indices, with the S&P 500 and Dow Jones reaching new all-time highs. The Dow emerged, once again, as the best-performing index over the past five days.

While the war cycle has shifted into ‘pause mode,’ giving investors a false sense of calm, the fact that institutional investors are fully positioned ahead of the political D-Day on November 5th should make more than a few investors nervous. The likelihood of a ‘buy the rumor, sell the news’ event looms post-election, with the potential surprise being not only the implementation of devastating economic policies under ‘Kamunism’ over the next four years but also the election results being postponed until January 6th instead of being announced on the evening of November 5th. In this context, investors should prepare for increased volatility, potentially pushing equity markets back to their August 5th lows, or even lower, as we approach the 'D-Day' of the year of political hell. Although the Nasdaq has broken the downtrend that began in mid-July 2 weeks ago, it remains unable to reach new all-time highs and has underperformed the Dow Jones over the past weeks. This suggests the current rally is being driven by non-American institutional investors moving capital into the US ahead of an inevitable acceleration in the war cycle, while US retail investors, who typically drive the Nasdaq, are showing signs of exhaustion.

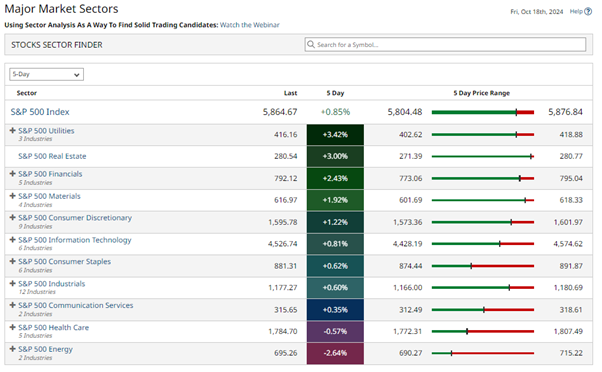

While any investor with common sense should prepare for reflation and an inevitable sector rotation in the coming months, last week's performance highlights the outperformance of interest rate-sensitive sectors such as Utilities, Real Estate, and Financials. Meanwhile, Energy remained unloved by myopic investors.

Given that the US economy is already situated in the upper right quadrant of the matrix and with the S&P 500 to gold ratio havig just closed below its 7-year moving average, it is becoming dangerous to hold US equities without a sizable gold hedge. By ‘sizable,’ investors must understand more than the 25% gold allocation recommended by the Brown Portfolio.

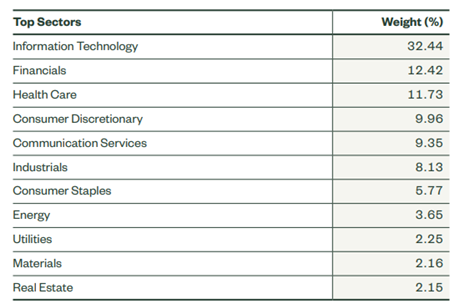

Moreover, the current favored method of owning equities indexing, means that investors are inherently betting against a pronounced rise in fossil fuel prices. On the surface, this suggests that everyone expects that the US economy should not, for the foreseeable future, face an inflationary bust. It goes without saying that, as the war cycle heats up and wars are historically good for gold and other commodities such as oil, anyone with a minimum of common sense and knowledge of financial history should consider this to be a bad bet.

As of today, fossil fuel-based energy producers represent less than 5% of the benchmark US and world equity market indices, compared to 30% in 1983. If investors are unable to buy gold as a hedge, they are advised to add a significant position based on the fossil fuel energy index. If they are unable to own physical gold in excess of the 25% recommended holding in the Browne Portfolio, they should own a majority of their equity allocation in a diversified portfolio of US blue chip companies active in the Oil & Gas sector and other energy related industries. In any cases they should NOT own any government bonds with a maturity of more than 6 monhts and keep their cash allocation minimum and invested in short dated (not more than 12 months maturities) Investment Grade paper of US corporates which can be designated as essential to the basic needs of the US economy.

Ultimately, if the world enters a new energy crisis driven by geopolitcally driven supply chain disruptions, fossil fuel producers are expected to perform well and at least partially protect a standard portfolio. Today’s indexation bias in the US or across the entire developed world amounts to having an equity portfolio made up of more than 95% energy consumers and 5% energy producers, which strikes anyone with a minimum of common sense as unreasonable.

S&P 500 index by sectors.

MSCI world Index by sectors.

In this context, investors are advised to allocate at least 50% of their equity holdings to energy-related equities, such as US oil major companies (proxied by the Energy Select Sector SPDR ETF, XLE US), US oil and gas exploration and production companies (proxied by the SPDR S&P Oil & Gas Exploration & Production ETF, XOP US), US oil service companies (proxied by the VanEck Oil Service ETF, OIH US), and other energy sources like uranium (proxied by the Sprott Uranium Miners ETF, URNM US) and even copper miners, benefiting from electrification demand, (proxied by the Global X Copper Miner ETF, COPX US). The remaining equity portfolio should be allocated to multinationals with low-leveraged balance sheets and a business model protected by a MOAT, making them more resilient as the world likely moves into an inflationary bust by early next year.

As the US and the other economic blocs are evolving between an inflationary boom and an inflation bust, in the ‘Browne Portfolio’, the allocation in government bonds and cash should be substituted with a higher exposure to physical gold (more than 25% of the portfolio) and other real assets expected to increase in value as wars lead to shortages and price increases. These real assets include physical silver and platinum, as well as commodities like oil and base metals such as copper and nickel, which are likely to see rising demand during wartime. Additionally, some exposure to agricultural commodities is recommended due to price increases from supply shortages. Cash allocation should be reduced to no more than 10% to 20%, managed with a diversified portfolio of short-dated (6 to 9 months) investment-grade USD bonds from low-leverage US corporations. T The equity allocation, rather than using a passive index fund replicating the S&P 500, should be primarily invested in companies active in the oil and gas sector and other sectors benefiting from the rising energy prices in general. This strategy will help preserve wealth amid rising stagflationary pressures, as recovery from the increasingly stagflationary environment is expected only after 2028.

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.