THE WEEK THAT IT WAS...

While Hindus celebrated Guru Nanak Jayanti, investor focus shifted once again to inflation data from both the US and China, along with consumer health insights from October retail sales reports in both countries.

China's October inflation report showed encouraging signs, with the first uptick in core CPI since April, despite an overall weak price report. CPI inflation eased to 0.3% year-on-year from 0.4% in September, below the consensus estimate of 0.4%. The main drag was food prices, whose annual gain slowed to 2.9% from 3.3% the previous month. Core CPI edged up to 0.2% year-on-year from 0.1% in September, an improvement but still far from the pre-pandemic norm of 1.5% or higher. The PPI fell 2.9% year-on-year in October, more than September's 2.8% drop, marking the 25th consecutive month of PPI deflation. The consensus forecast was a 2.5% decline.

The spread between China’s core CPI and PPI shows some signs of stabilization, but this is unlikely to be sufficient to significantly boost corporate profits in China.

Spread between China Core CPI & PPI (blue line); MSCI China 12-month Forward P/E (red line).

China's retail sales and industrial production data for October's Golden Week showed a stimulus-driven uptick, with both indicators accelerating above a lacklustre September and exceeding market expectations. However, achieving a 'Make China Great Again' revival will require more Taoist patience, as consumption still lags pre-pandemic levels, and industrial output is likely to face challenges from escalating trade tensions between China and the U.S. under the new president-elect.

October US retail sales showed robust consumer spending heading into the holiday season, although most of the increase was driven by a jump in auto purchases, which could be a side effect of the hurricanes that devastated the East Coast in late September. While headline retail sales rose +0.4% MoM, beating expectations, core retail sales (excluding autos and gasoline) disappointed, rising just +0.1% MoM.

Investors should remember that published retail sales figures are nominal; when adjusted for inflation, retail sales remain in a downtrend since 2021. This reflects inflation-driven challenges that are unlikely to ease under the 47th US president, who is expected to implement costly tariffs on imported goods.

US Retail Sales adjusted to US CPI (blue line); US Misery Index (axis inverted; red histogram) & Correlations.

Even a 6-year-old can grasp the base effect, but politicians and Wall Street bankers still push the illusion that a 2% inflation target is just around the corner. Savvy investors know that reaching this target by year-end or mid-2025 is mathematically impossible without a miracle disinflation early in the 47th U.S. president's term which is never going to happen.

A return to 2.0% inflation in 2024 is mathematically impossible. Even if the CPI prints 0.0% month-over-month for the remainder of the year, the year-over-year change will still end above 2.9% as the disinflationary base effect fades as the year ends. Should month-over-month prices be 0.3% or higher, the CPI year-over-year figure would finish the year just below 4.0%.

For the CPI year-over-year change to return to 2% or lower by the end of the first half of 2025, the monthly inflation rate would need to remain consistently at 0.2% or below until end of June 2025.

If the month-over-month inflation rate reaches 0.2% or higher over the first half of 2025, the year-over-year CPI change will land between 3% and 4.6% by the end of June 2025. This would then force the FED to admit its partisan mistake of easing in the current inflationary boom of the US economy.

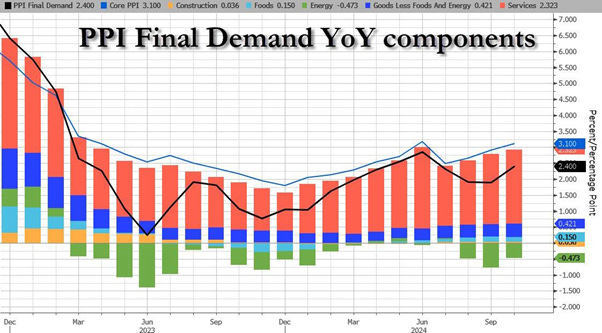

Following a CPI report suggesting a brief calm before the second inflation wave, headline PPI rose 0.2% MoM, meeting expectations, though September was revised upward from 0.0% to 0.1%. On a YoY basis, headline PPI rose 2.4%, slightly above the 2.3% forecast, with the prior month revised up from 1.8% to 1.9%. Unlike September, where a decline in energy prices significantly impacted the PPI, October saw energy subtract only 0.02% from the final print, the smallest detraction since July. Meanwhile, services added a substantial 0.179% to the overall figure.

Even more problematic for those who still believe inflation is a thing of the past is that core PPI rose to +3.1% YoY (higher than the expected 3.0%), with the previous month revised up to 2.9% from 2.8%. This marks the second-highest reading since March 2023, surpassed only by June's outlier surge, as persistent service costs continue to climb.

Savvy investors understand that what truly matters for equity markets is the spread between core CPI and PPI, as it reflects corporate America's ability to pass higher costs to consumers. Currently, it appears that corporations are finding it increasingly difficult to pass through these costs, which doesn’t bode well for equity valuations over the next 12 months.

S&P 500 index 12-month Forward P/E (blue line); Spread between US Core CPI & PPI index (red line) & Correlations.

Bottom line: there is still a long way to reach the FED’s mandated 2%, and inflation is already moving in the wrong direction, a fact not lost on the market which now only discount a 58% probability of a 25-bps rate cut in December and less than 3 rate cuts in 2025.

Investors should by now recognize the critical role of energy prices in the business cycle, as energy costs directly impact an economy's efficiency, the output generated from energy inputs reflects the private sector's value creation across different phases of the cycle. When stock prices rise faster than oil prices, energy is used productively, supporting economic growth. Conversely, if oil prices climb more rapidly, growth weakens, leading inevitably to a bust cycle. To gauge an economy's position in the cycle, investors by now know that they can compare any domestic stock market's ratio to oil prices in local currency against its 7-year moving average as a ratio above the average signals a booming economy, while a ratio below suggests a bust phase.

For those sceptical of the stock market-to-energy ratio's importance, it's worth noting the strong historical correlation between energy and GDP, as energy represents a form of manpower or ‘servants’ powering economic output. In a study published in 2017, Smil estimates an average man provides 100W of work, equal to 876 kWh annually, meaning readily available energy grants each OECD resident access to the equivalent of 60 full-time servants (and 14 in poorer regions). Since 1800, the energy available per person has increased 3.5 times and may nearly double by century’s end, expanding economic potential across all income levels.

In 1800, wood was nearly the sole energy source worldwide, later partially replaced by coal due to wood scarcity, though energy use per person only rose 18% by 1900. Even by 1945, energy per capita was up just 50% from 1800 levels. Post-WWII, energy availability doubled by 1980, slowed by oil crises, and has seen slight increases since. Mid-range forecasts predict an almost doubling of energy use by 2100, while sustainable models suggest only a 30% rise. Energy’s value has grown faster due to efficiency gains. In the 1800s, steam engines converted just 6% of energy, while modern turbines reach 60%. Technological advances allow for more output per kWh; for instance, lighting has improved 21,000 times, from dim candlelight to efficient LEDs. The global energy mix has shifted from wood to coal, oil, and gas over time, adding rather than replacing energy sources. Contrary to popular belief, renewables have yet to dominate; renewable energy accounted for 14% of global energy in 2018, mainly from biomass and hydro.

A quick look at the relationship between GDPs per capita and energy consumption per capita shows that there is no such thing as a low-energy, rich country, as there is a strong correlation between energy consumption and ultimately prosperity.

Over the past few years, energy prices have been impacted not only by geopolitical events and the rising war cycle but also by recurring tightening regulations implemented by those who promote the climate change scam, which ultimately serves as an additional means to weaponize the economy. On that note, it’s worth recalling that John McCain himself, one of the political leaders linked to the American deep state, introduced the concept of climate change to spread more false narratives aimed at targeting Global South countries like Russia, which economic strength relies on selling affordable fossil energy sources to the rest of the world.

Last week, the UN Climate Change Conference (COP29) was held in Baku, Azerbaijan—though few seemed to notice. While last year’s COP in the UAE drew 86,000 participants, this year’s turnout has been not more than half that, as government and corporate leaders find reasons to skip it. For a decade, green advocates have focused on reducing carbon emissions to counter alleged man-made climate change. While many countries embraced this trend, the US and Europe have pushed policies that raised energy costs and reduced efficiency. Meanwhile, China has leveraged the West’s coal reduction stance to fuel its own industries, maintaining a leading role in global carbon emissions. The irony hasn’t been lost on the US working class, who showed strong support for Trump in the recent presidential election.

Since Covid, investors have navigated an increasingly polarized world, also visible in countries' divergent net zero commitments. Finland leads major nations with a 2035 target, followed by Iceland (2040), Germany, and Sweden (2045). In contrast, several Asian countries, including China, Saudi Arabia, Indonesia, and Russia, aim for 2060, while India and Thailand targets 2070, meaning that the Global South by delaying the unnecessary phantasmagorical Net Zero illusion have acknowledged in a politically correct way that this goal is not on their priority as they have understand that to promote their mercantilist agenda they need to provide abundant and cheap energy to keep their economy in the boom phase of the business cycle.

electrification, but politicians often overlook that electricity costs vary widely depending on energy sources. These costs fall into three main categories:

wholesale costs, covering capital, operations, transmission, and decommissioning,

retail costs paid by consumers, and

societal costs, or externalities.

Wholesale costs, measured per megawatt hour, may be passed to consumers depending on regulations.

No one needs a PhD in energy management to understand that the higher the energy cost to sustain an economy, the lower its energy efficiency, ultimately increasing the risk that the economy spends much of the business cycle in a bust. The average global electricity price is USD 0.154 per kWh for residential users and USD 0.149 per kWh for businesses. Europe has the highest residential electricity prices at USD 0.228 per kWh, while Asia has the lowest at USD 0.082. Prices for Africa (0.119), Australia (0.236), North America (0.142), and South America (0.185) fall in between. For businesses, Europe also has the highest rates at USD 0.195 per kWh, with Africa (0.108) and Asia (0.082) having the lowest. Rates for Australia (0.205), North America (0.161), and South America (0.189) are intermediate. With no surprises as Europe has set the most ambitious goals in terms of sourcing its electricity from supposedly green sources like wind and solar, this is also where the price of electricity is the highest across the world.

https://www.globalpetrolprices.com/electricity_prices/

In many countries with unregulated electricity prices, power generators must raise prices to stay solvent when primary energy costs rise. In the US, natural gas is the leading source of electricity, accounting for about 43% of utility-scale generation in 2023, according to the EIA.

In countries that have spread the false narrative of miscalled ‘green energy,’ energy input costs will not only continue to rise but will also lead to unreliable energy supplies. This will drive further deindustrialization and push these economies toward a bust. As a result, it should not be a surprise that the entire climate-organized scheme to change the world is rapidly imploding because it has been based on misinformation and outright fraudulent data and theories. The energy agenda is switching from impractical wind generation, which has proven to be more of a scam and solar than a practical alternative agenda.

In recent years, natural gas has surpassed coal as the leading source of electricity generation in the United States. According to the Washington Post, natural gas powered 34% of the country’s electricity in 2014, overtaking coal and nuclear energy. EIA data shows that natural gas became the top source of electricity generation in 2016, replacing coal. This shift is due to a decline in coal use and an increase in natural gas production and infrastructure. In 2023, fossil fuels, including natural gas, accounted for 83% of total energy production and 61% of U.S. electricity generation. Although renewable sources like solar and wind are growing, they still make up a smaller share of electricity generation.

https://www.eia.gov/energyexplained/us-energy-facts/

Total energy consumption by the end-use sectors includes their primary energy use, purchased electricity, electrical system energy losses (such as energy conversion and other losses associated with the generation, transmission, and distribution of purchased electricity), and other energy losses. The sources of energy used by each sector vary widely. For example, in 2023, petroleum accounted for about 89% of the transportation sector's primary energy consumption but less than 1% of the electric power sector's primary energy consumption.

Probably because investors were too busy focusing on the distractions of garbage’s surrounding the US presidential campaign over the past few months, US natural gas production from shale and tight formations, which accounts for 79% of dry natural gas production, decreased slightly in the first nine months of 2024 compared to the same period in 2023. If this trend continues for the remainder of 2024, it will mark the first annual decrease in US shale gas production since we began collecting these data in 2000.

US shale gas production from January to September 2024 declined by 1%, to 81.2 Bcf/d, while other dry natural gas production increased by 6%, to 22.1 Bcf/d. Total dry natural gas production averaged 103.3 Bcf/d, unchanged from 2023. The drop in shale gas production was mainly due to declines in the Haynesville and Utica plays, down 12% and 10%, respectively. In contrast, production in the Permian grew by 10%, and the Marcellus remained flat.

The Haynesville play in Texas and Louisiana is a dry natural gas formation, while the Utica and Marcellus in the Appalachian Basin also produce lease condensate. Investors must remember that natural gas prices drive drilling in all three plays, but the US benchmark Henry Hub price has generally declined since August 2022, reaching record lows in 2024, making drilling less profitable. Several operators in the Haynesville and Appalachian Basin have shut in production and plan to continue curtailments in the second half of 2024. In contrast, the Permian play, primarily driven by oil prices, has seen increased natural gas production alongside rising oil output. In September 2024, Utica production was 5.6 Bcf/d, 33% below the 2019 peak, while Haynesville production was 13.0 Bcf/d, 14% lower than its May 2023 peak. The Haynesville, the third-largest shale gas play in the U.S., averaged 14.6 Bcf/d in 2023, accounting for 14% of total U.S. dry natural gas production.

The US Henry Hub natural gas price fell 79% from its August 2022 high of $9.39/MMBtu to $1.99/MMBtu in August 2024. This year, the price has averaged $2.10/MMBtu, down from $6.89/MMBtu in 2022 and $2.62/MMBtu in 2023. As prices declined, production economics worsened, leading producers to shut in production and reduce drilling rigs. The number of natural gas-directed rigs in the Haynesville, Utica, and Marcellus plays has steadily dropped since 2022. In September 2024, the Haynesville had 33 rigs, 53% fewer than in January 2023, marking the lowest rig count since July 2020.

Given this, while the financial mass media have spread the word that ‘Drill Baby Drill’ will have additional negative effects on prices, the real question everyone should ask is whether there will still be any players in the sector to drill if there is no additional support from the new administration to keep the sector profitable over the long term.

However, investors know that, more than other commodities, the natural gas market has a long history of boom-and-bust cycles, driven by oversupply from the shale oil industry, weather conditions like hurricanes, and regulations that limit the potential for additional exports via LNG terminals on the U.S. East Coast.

Outside of the ‘Drill Baby Drill’ policy, with Donald Trump expected to return as the next tenant of the White House, he will bring with him a platform that is largely pro-fossil fuel and anti-climate change. The broad implications of the election for the energy transition are already clear: oil and gas, especially those companies active in the oil and gas service segment, should fare well despite everyone expecting lower prices, while electric vehicles will not. Some climate-related sectors, such as nuclear, hydrogen, and carbon capture, lie in the middle and may even benefit from the incoming administration. Other questions remain. Will Trump push Congress to repeal the Inflation Reduction Act, outgoing President Joe Biden's signature piece of climate legislation? Will his promised tariffs strangle renewable power projects that rely on foreign-made parts?

Trump may have made Elon Musk his ally, but that won’t save electric vehicles (EVs) from his policies. With Republicans in control, several EV-related provisions are at risk of repeal. The clean car tax credit (30D), offering up to $7,500, and the credit for used EVs could face congressional pushback. However, Trump could act unilaterally to close the commercial EV leasing loophole, cutting $7,500 in incentives without congressional approval. Fuel economy and emissions targets will likely be relaxed, as they were during Trump’s first term, leading to potential legal battles with environmental groups and states like California.

While a full repeal of the IRA is unlikely due to its popularity and economic benefits in Republican-leaning states, Trump is set to reshape key clean energy regulations. He is expected to tighten requirements for IRA credits, making them harder to claim, and impose tariffs on wind, solar, and storage imports, which could hurt companies reliant on foreign supplies. These moves could slow renewable growth and favour fossil fuels, aligning with Trump’s push to relax coal and gas regulations.

At the end of the day, Trump aims to unleash US oil and gas production by easing regulations and lowering taxes. He has also proposed reducing corporate tax rates from 21% to 15%. If this goes through, the US oil patch could potentially see billions of dollars in tax savings. Oilfield service companies should benefit the most in this environment as more money becomes available across the industry. However, oil producers may still be reluctant to rapidly increase output, having been burned by overproduction and subsequent price crashes in the past. While the oil service sector appears to be the obvious winner of the US energy policy to be implemented by the 47th US president, the industry has not only underperformed the S&P 500 Energy Index but also the S&P 500 as a whole since the start of the year.

Relative performance of the US Listed Oil Services 25 Index to S&P 500 index (blue line); Relative performance of the US Listed Oil Services 25 Index to S&P 500 Energy index (red line) year-to-date.

While the 47th US president will inevitably impact the country’s energy mix and influence the climate change narrative that has been weaponized to shape the economy for over a decade, the world did not wait for Donald Trump's return to denounce the excesses of green policies. These policies have driven up energy costs and hindered companies' ability to generate profitable growth, ultimately weighing on the ability of the U.S. and Western economies to escape the bust phase of the business cycle.

Aswath Damodaran, a finance expert and professor, has discussed net zero emissions in various contexts. He suggests a global carbon price index to help reach net zero by 2050, with a proposed price of $100/tonne to incentivize emissions reductions. Damodaran also examines how the transition to low-carbon models impacts company valuations and investment decisions. In a 20-minute interaction with the Canadian parliament, he highlighted the contradictions of the net zero concept, criticizing its negative impact on businesses, consumers, and investors.

It is an undeniable fact that the climate change narrative has increased costs for businesses and burdened consumers, who are unfairly blamed for climate issues despite a lack of scientific evidence supporting human-caused climate change. Instead, some models suggest Earth is entering another ‘grand solar minimum,’ expected to last from 2020 through the 2050s. This phase could result in a global cooling period, with reduced sunspot activity, lower ultraviolet radiation, and diminished magnetism. This cooling could mirror the Maunder Minimum, which contributed to the Little Ice Age from the 1300s to the 1850s.

For investors, it doesn’t take a Wall Street guru to understand that climate change and ESG-related products were not created by Wall Street to benefit the planet or enhance investors' wealth. A look at the relative performance of the MSCI Energy sector, which includes the world’s largest fuel producers, and the S&P Global Clean Energy Index, which includes the world’s largest clean energy producers, shows that while the past 20 years have seen rallies and bear markets for fossil fuel energy suppliers, the same period has been far more painful for those following the supposedly ‘green precepts’ of Wall Street bankers.

Performance of $100 invested in MSCI World Energy Index (blue line); S&P Global Clean Energy index (red line).

In recent years, Wall Street has pushed investors to follow bureaucratic ESG principles, which prioritize environmental, social, and governance issues. ESG, a term first popularized in a 2004 UN-backed report, has grown from a corporate social responsibility initiative to a global movement managing over $30 trillion in assets by 2023. The reality is that if ESG has been profitable, it has only been for asset managers like BlackRock, which have been colluding with plutocratic governments to spread the climate change narrative over the past 20 years. For investors seeking the feel-good factor of investing responsibly, BlackRock charges an expense ratio of 0.15% on its MSCI US ESG Aware ETF (ESGU US).

https://www.ishares.com/us/products/286007/ishares-esg-msci-usa-etf-fund

This is more than 5 basis points higher than the expense ratio of the standard S&P 500 ETF (SPY US).

https://www.ssga.com/library-content/products/factsheets/etfs/us/factsheet-us-en-spy.pdf

Therefore, it should come as no surprise that, in order to comply with the misleading ESG narrative, investors not only pay higher costs to their asset managers but also receive lower returns compared to if they had invested in a standard passive S&P 500 ETF.

Relative performance of iShares ESG Aware MSCI US ETF to S&P 500 ETF since December 31st, 2020.

ESG as an investment style was already on life support, and with Trump’s return, it may get its final death certificate. It seems evident that one thing that the 47th US president will easily achieve is that he will ‘bury’ ESG for good. The U.S. has seen ESG investing sharply decline, as it’s become politicized and failed to meet its promises. Initially promoting sustainable business practices, ESG is now entangled in cultural debates and sidelined as US priorities shift towards nationalism and mercantilism. Even former advocates, like BlackRock CEO Larry Fink, have distanced themselves, with Fink calling ESG ‘weaponized.’

Heritage Foundation President Kevin Roberts has branded BlackRock ‘decadent,’ lumping it with the Boy Scouts. Many investors now view ESG as a gimmick, with firms like Invesco facing fines for ‘greenwashing.’ Unlike Europe, which has tightened ESG standards, the US is scaling back, as the SEC disbanded its ESG task force in September, a move that could accelerate as Trump returns to office. BlackRock’s clean energy ETF has significantly dropped since 2021, as funds shift back to traditional energy sectors. Investor and media interest in ESG is waning, with search activity, media coverage, and corporate mentions all in decline. BlackRock’s support for ESG proposals has plummeted, backing only 4% last year, signalling a retreat from reshaping capitalism through ethical investing. This shift raises questions about what will replace ESG’s influence. ESG fund managers, meanwhile, are also now advised to ‘keep lawyers close.’, as legal risks around antitrust and fiduciary duty are high, especially given that anti-ESG laws gain traction in various states.

As the US is still in an inflationary boom, the fact that the S&P 500 index to gold ratio is struggling above its seven-year moving average indicates that the economy is likely to transition into an inflationary bust sooner rather than later. This impending inflationary bust will most likely be triggered by inevitable escalating conflict in the Middle East, as anyone with a basic understanding of how Washington operates and who really holds power has a vested interest in perpetuating the forever bankers' wars.

Combining the business cycle with the Browne Permanent Portfolio, we see that in an inflationary boom, investors should overweight equities and underweight the asset classes which are represented by contracts (like Cash and government bonds) in the portfolio, while replacing these contracts by the ultimate property which has no counterparty risk, and which cannot be confiscated: Gold.

However, a look back at history shows that when the S&P 500 to gold ratio crosses below its 7-year moving average, this event is typically associated with the peak of the 12-month rate of change in the S&P 500 index for that cycle.

Upper Panel: S&P 500/Gold ratio (blue line); 84 months Moving Average of the S&P 500/Gold ratio (red line); Lower Panel: S&P 500 index 12-month rate of change (yellow histogram).

In conclusion, as the US economy is slowly but surely shifting from an inflationary boom to an inflationary bust, gold, not government bonds, is the antifragile asset to hold. Access to cheap, abundant energy is crucial for maintaining economic growth that benefits all citizens, not just the elite. Investors familiar with the business cycle and the Permanent Browne Portfolio understand that despite Wall Street's misleading advice to buy long-term bonds and sell gold, the opposite strategy is wise: sell rallies in fixed income and buy gold dips. As the US economy likely moves into a bust, investors should also, shift from energy consumer sectors like IT to energy producers like oil and gas once the S&P 500-to-oil ratio dips below its 7-year average. Unlike government bonds, which can be altered at the issuer's discretion, gold offers the unique advantage of no counterparty risk, making it a crucial asset as investors prioritize the Return OF Capital over Return ON Capital.

WHAT’S ON THE AGENDA NEXT WEEK?

The third full week of November will focus investors' attention on another estimate of US manufacturing and services PMI, as well as the first post-election update of the University of Michigan consumer sentiment and inflation expectations. With the macroeconomic agenda picking up, the main event of the week will undoubtedly be the release of quarterly earnings from Nvidia, along with other major U.S. retailers like Walmart, Lowe’s, and Target.

KEY TAKEWAYS.

As the Northern Hemisphere heads into winter, here are the key takeaways:

China's October inflation report showed a slight improvement in core CPI, but persistent PPI deflation suggest limited potential for a corporate profit rebound and Make China Great Again sooner rather than later.

China’s economy shows a stimulus-fuelled boost in October, but trade tensions and lagging consumption signal more Taoist patience is needed to ‘Make China Great Again’.

US retail sales may give investors the illusion of economic strength, but the reality is that tariffs will not only be inflationary but will also amplify consumer inflation driven misery.

The October CPI data in the US may offer a temporary sense of calm, but a second wave of inflation looms under the 47th president.

The October PPI, along with the CPI, signals that it’s not a matter of if but when the second wave of inflation will hit the American economy.

From Wood to coal, oil and now gas and nuclear power, the world energy mix has diversified into more sources of energy to accelerate economic growth at an increasing pace over centuries.

Over centuries, energy prices have been influenced by geopolitical events, and more recently climate regulations, aiming to to the weaponization of energy supply targeting fossil-fuel-reliant nations, which has not aligned with the American imperialist vision of the world economy.

There is no such thing as a low-energy, rich country, as energy consumption and GDP per capita are highly correlated.

The higher the energy costs required to sustain an economy, the lower its energy efficiency, ultimately increasing the risk that the economy spends much of the business cycle in an economic bust.

Natural gas now leads US electricity generation, with fossil fuels accounting for 83% of total energy production.

Given persistently low prices, the US natural gas production is expected to decline on a yearly basis in 2024, for the first time since 2000.

With a new energy policy to be implemented under the 47th US president, investors must keep in mind that to be successful ‘Drill Baby Drill’ must guarantee the sector a certain level of profitability.

Under the 46th US president, if ESG and green energy have been profitable, it has only been for asset managers which are charging higher fees to their clients to deliver lower return than traditional financial products.

In this context, oil services companies and pipeline companies are expected to be those companies which benefit the most from a reform of the US energy mix.

With the US still in an inflationary boom, the S&P 500/gold ratio sitting just above its 7-year average, a drop below this level has historically signalled poor outcomes for the economy and equity returns.

In today’s volatile market, investors should favour antifragile assets like gold over bonds, as gold offers low equity correlation, stability, and resilience against currency debasement.

In such environment, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold remains THE ONLY reliable hedge against reckless and untrustworthy governments and bankers.

Gold remains an insurance to hedge against 'collective stupidity' and government’ hegemony which are in great abundance everywhere in the world.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

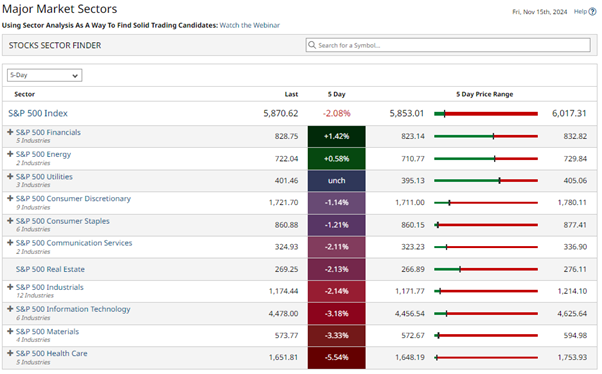

After markets initially celebrated the ‘Red Sweep’ and promises to ‘Make America Great Again,’ the post-election honeymoon has already begun to fade as investors are realizing that little is likely to change for consumers under the 47th US president and how he can influence the business cycle. In this context, all three major US indices ended the week on a negative note, with the Nasdaq underperforming both the S&P 500 and the Dow Jones. Over the past week, markets have retraced more than 50% of their post-election rally and are expected to close the November 6th gap, finding support at their respective 50-day moving averages before reassessing what the president-elect can realistically achieve to influence the business cycle and the implications for investors’ portfolios.

Financials and Energy were the only sectors to end the week green while IT; Materials and Healthcare unsurprisingly underperformed.

First and foremost, investors should understand that they can do good for society while delivering steady returns to their clients, without falling into the trap set by Wall Street bankers, who have made investing in green energy and ESG profitable only for themselves, without ensuring that their investors are actually benefiting society. In this context, all investors should use their respective capabilities to reduce energy costs for society as a way to deliver responsible ways to generate returns across the business cycle.

In this context, investors should also note that once the S&P 500/WTI ratio breaks below its 7-year moving average, historically occurring 3 to 9 months after the S&P 500 to gold ratio breaks its 7-year moving average, every equity rally should be sold.

Upper Panel: S&P 500/WTI ratio (blue line); 84 months Moving Average of the S&P 500/WTI ratio (red line); Lower Panel: S&P 500 index 12-month rate of change (yellow histogram).

Once the business cycle reaches this point, the IT sector, serving as a proxy for energy consumers, should stop outperforming the energy sector, which represents energy producers. This shift is likely to be accompanied by a significant drawdown in the IT sector, consistent with recent historical patterns. While we are not there yet, once the business cycle moves from a boom into a bust, investors will have to buy the dips in energy producers and sell the rips in energy consumers.

Upper Panel: S&P 500/WTI ratio (blue line); 84 months Moving Average of the S&P 500/WTI ratio (red line); Middle Panel: Relative Performance of S&P 500 IT sector to S&P 500 Energy sector (green histogram); Lower Panel: S&P 500 IT index 12-month rate of change (yellow histogram).

For High-Net-Worth Investors who are keen to risk part of their wealth in new technologies, they should allocate this portion of their portfolio to finance innovative technologies developed by companies aiming to generate reliable, lower-cost energy sources that can be implemented on a large scale across geographies. These innovations will help reduce the structural opportunity cost of energy and improve global energy efficiency.

For other investors focused on listed companies, the best way to shift from energy consumers to energy producers is to favour companies in the Oil Services sector, which not only have underperformed the S&P 500 and the S&P 500 Energy sector but are also trading at extremely attractive valuations in terms of Forward P/E compared to both indices.

Relative P/E of US Listed Oil Services 25 Index to S&P 500 index (blue line; upper panel); Relative P/E of US Listed Oil Services 25 Index to S&P 500 Energy index (red line; lower panel) rebased at 100 on December 31st, 2019.

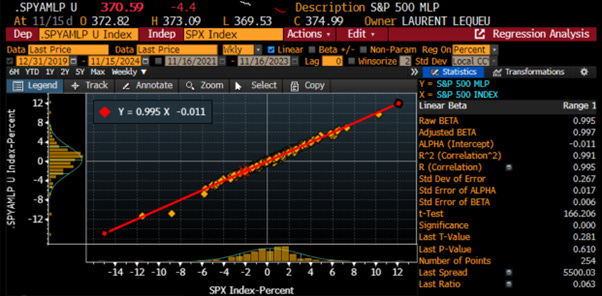

Outside of oil services, another sector poised to benefit from the ‘Drill, Baby, Drill’ policy is the pipeline sector and other energy infrastructure companies. Pipelines facilitate the transport of crude oil, natural gas liquids (NGLs), refined products, and natural gas, offering significant economic advantages to the US. Pipeline stocks typically generate stable cash flows as oil and gas flow through their infrastructure, enabling these companies to pay attractive dividends. A unique feature of this sector is the prevalence of master limited partnerships (MLPs), which are structured for tax efficiency and distribute a large portion of cash flows to investors, appealing particularly to income-focused portfolios. Given the reliable income growth of this sector, it offers a compelling alternative to allocations traditionally reserved for long-dated government bonds.

Notably, since the start of the decade, a portfolio composed of 60% S&P 500 ETF and 40% Alerian MLP ETF (AMLP US) has significantly outperformed the traditional 60/40 portfolio (60% S&P 500 ETF and 40% iShares 20+ Year Treasury Bond ETF [TLT US]). While it has underperformed the S&P 500 alone, it has done so with considerably lower drawdowns over the same period, enhancing its appeal for risk-averse investors.

Performance of $100 invested in the S&P 500 index (blue line); a portfolio made of 60% S&P 500 ETF & 40% Alerian MLP ETF (red line); 60% S&P 500 ETF & 40% iShares 20+Year Treasury Bond ETF (green line).

As the odds of the US and other major economies fluctuating between inflationary booms and busts are high, and in this environment, investors should by now understand that gold, not bonds, will be the antifragile asset to own alongside equities as gold will provide even better risk-adjusted returns for the foreseeable future.

Indeed, with the US economy in the upper right quadrant of the business cycle matrix and the S&P 500 to gold ratio just above its 7-year moving average, holding US equities without a substantial gold hedge, well above the 25% suggested by the Browne Portfolio, has become increasingly risky. Given that equity indexing inherently bets against rising fossil fuel prices, passive equity ETFs are likely a losing equity strategy. In this context, investors should allocate at least 50% of their equity holdings to energy-related stocks and avoid government bonds with maturities over six months while limiting cash to short-dated (maturities not longer than 12 months) Investment Grade corporate paper.

To navigate rising risks of monetary illusion and asset volatility, portfolios should be overweighted into scarce assets like physical gold, silver, and other commodities, which must be stored in a secured location outside the surveillance of the financial system which has been colluding with the reckless governments. Investors must always remember that physical gold and other precious metals have proven their ability to hedge against government risks. Equities of low-leverage companies with economic moats also provide inflation protection, though most gains in the current bull market may be behind us, suggesting caution. In any cases, investors should increasingly get ready to buy the dips in energy producers’ companies but also sell the rips in energy consumers companies. It should be clear to anyone with a modicum of common sense that cash and government bonds should be kept to a minimum (less than the 25% allocation recommended by the Browne Portfolio for these asset classes) and replaced by gold and short-dated US investment-grade paper with an average maturity of less than 12 months.

While we can always hope for the best and prepare for the worst, we must understand that the coming years will be particularly stressful for investors and their families. In this context, investors should focus on factual scientific data rather than propagandistic statements, which ultimately serve no purpose other than enriching those close to those in power, regardless of who they claim to represent.

Just as the business cycle cannot be altered, not even by someone who has survived an assassination attempt, neither can history be changed, nor the future controlled. However, we can each do our best to make an impact and prepare for what lies ahead. No cycle, whether political or economic, can be changed, but by studying the past to anticipate the future, we can protect ourselves and our loved ones by staying prepared and calm.

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

Just a reminder that there's not really any need to cut taxes for E&P companies. They lost so much money during the last drillbabydrill era that there are plenty of tax losses to cover the tab for awhile. Nat gas prices are way too low - it's why everyone wants to use it, which will be what drives prices up again.

Did you know that we are dismantling nuclear arsenals... cuz we need the uranium to operate the power plants? I just learned this

https://ourfiniteworld.com/2024/11/11/nuclear-electricity-generation-has-hidden-problems-dont-expect-advanced-modular-units-to-solve-them/