What’s behind the numbers?

As widely expected by the consensus, the Federal Reserve held interest rates steady for an eighth consecutive meeting at 5.25-5.50%.

In its press release, while the FOMC’s July meeting contained minimal red lines, it sent a clear message to investors: Officials are not ready to cut rates in July and do not want to reassure investors that a 25-basis point cut is assured for September, let alone the 50-basis point cut that markets have recently contemplated.

In a hawkish move, the new statement retained language indicating that the committee ‘does not expect it will be appropriate to’ cut rates until it has ‘gained greater confidence’ about the disinflationary trajectory. Still, by acknowledging the recent rise in the unemployment rate and noting their equal attention to the full-employment aspect of their dual mandate, the FOMC kept hopes of a September rate cut alive.

The FED also tweaked its language to say that price pressures remain ‘somewhat’ elevated and acknowledged ‘some further progress’ toward its inflation goal, up from ‘modest further progress’ in the previous statement.

Regarding a rate cut in September, Powell stuck to his narrative that the FED remains ‘data dependent,’ with the balance of inflation and unemployment data potentially influencing a rate cut in September.

Powell emphasized that ‘it looks like an economy that is normalizing’ and that ‘the job is not done on inflation.’ Nonetheless, he noted that ‘we can afford to begin to dial back the restriction in the policy rate.

During his press conference, Powell mentioned that the committee needs to see more ‘good data’ like the last three CPI reports, which showed some progress. However, he emphasized that more data is needed to gain confidence that inflation is truly cooling down.

He added that the number of cuts, which will be updated in the September SEPs, will depend on the economic data released before then. He stated that the FOMC could consider anywhere from no cuts to several cuts in the next DOT plots released in September.

Powell acknowledged that the FOMC discussed the possibility of cutting rates at this meeting. The committee had a 'nice conversation' about it, and a 'strong majority' supported keeping rates steady this time.

Powell's opening remarks showed little change from June’s. This suggests that Powell was not meaningfully more dovish compared to his June comments, which were slightly more hawkish than his 'MayDay' remarks. Investors should 'beware the Ides of September,' as a cut later in 2024 (i.e., in September) remains 'highly data dependent.

Thoughts.

The FED's decision to keep interest rates unchanged was widely anticipated.

While some investors may be surprised by the relatively more hawkish stance, it should not be unexpected for those who understand that all roads ultimately lead to stagflation as the FED has become impotent in managing the real economy amidst gargantuan Keynesian-driven budget deficits and wars.

The real question investors should ask themselves is still whether the FED still matters to the real economy and investors' portfolios in the context of gargantuan fiscal stimulus and a FED that has lost its independence from political power, represented by its ‘de facto merger with the Treasury.’ Recent comments by former New York FED chairman Bill Dudley, who has a long track record of colluding to support the Keynesian policies of the lame-duck Democrat president, further highlight the need to ‘depoliticize’ the FED’s agenda sooner rather than later.

The truth is that the FED is, as always, behind the curve and has become highly political and increasingly partisan.

Ultimately, while rates are at generational highs, they remain close to the average over the past 40 years and correspond more with the 'Great Moderation' of Greenspan than with the punitive measures of Volcker. In fact, rates are not overly restrictive at these levels. However, they are disconcerting due to the distortions caused by ZIRP and QE over the past 17 years.

FED Fund Rate (blue line); FED Fund Rate 24-months moving average (red line).

Wall Street has been predicting rate cuts for more than two years and has been wrong every time. Economists were forecasting a June rate cut a few weeks ago, and with only three FOMC meetings left for the year, the market still expects a rate path more aggressive than the Fed's DOT plots for the next five months.

FOMC DOTS Median of current year end projections (blue line); Implied Overnight Rate for the US as of end December 2024.

Based on consensus, September remains THE meeting for the 'notorious pivot,' assuming that inflation pressures will ease further by then, which is unlikely given the numerous supply chain constraints affecting the economy. Additionally, September is only seven weeks before the presidential election. While the FED is a political apparatus, it may avoid appearing overtly partisan ahead of this highly contested election. By November or, more likely, December, if the geopolitical environment continues to deteriorate as it has over the past months, and the result of the November election leads to chaos and social unrest, the FED could ultimately consider a rate hike rather than a rate cut, even if Powell continues to dismiss that prospect for now due to his politically correct narrative.

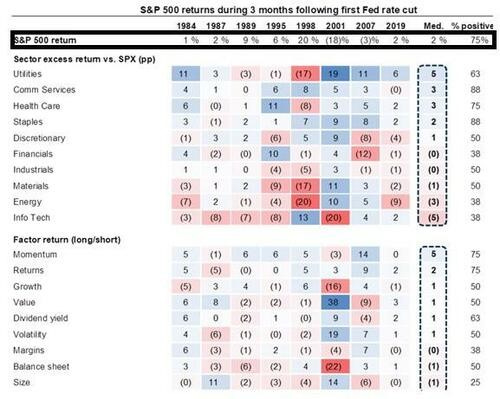

While the consensus still eagerly anticipates a soft landing for the US economy, investors should remain focused on what happens to financial markets once the FED ultimately starts cutting rates, which remains highly hypothetical. During the past eight FED cutting cycles since 1984, the S&P 500 typically rose by 2% in the first three months and by 11% in the 12 months following the first FED cut. More pertinent to the current situation, expectations of a FED cut have historically led to equity markets rising ahead of the first FED cut. However, the distribution of outcomes is wide, ranging from +21% (1995) to -24% (2007) in the subsequent 12 months.

Therefore, the key question is not about the rate cut itself but rather why the FED is cutting rates and whether this cut occurs as the FED expects a recession to be imminent. While readers and consumers already know that the US is in a consumer recession driven by persistent inflation, when a recession occurs shortly after the first FED rate cut, something that has happened in three of the eight past interest rate cycles, the market and sector performance has varied significantly.

If the US goes into a recession within 12 months (three out of eight total observations), the median return for the S&P 500 over one year is -15%.

If the US does not go into a recession within 12 months (five out of eight total observations), the median return for the S&P 500 over one year is +14% (note that, on a median basis, the S&P 500 has actually rallied into the cut, as indicated by the blue rectangle).

Market reactions.

Lured by another phantasmagorical Fed pivot and a somewhat more dovish comment from Powell, US stocks rebounded, with the S&P 500 notching its best FED-day performance in two years.

The rally was driven by strength in growth sectors like IT and Consumer Discretionary, while Consumer Staples; Real Estate and Healthcare underperformed.

In money markets, while July was ruled out for the FED to cut rates, the probability of a 25-basis-point rate cut in September, 7 weeks before the presidential election, rose to 114%. The consensus still anticipates three cuts before the end of the year, with September being the date when the FED's pivot, a scenario that Wall Street dreams about for 24 months, is expected to potentially happen.

The dollar pulled back on rising hopes of a rate cut in September, with the DXY falling below the 200-day moving average.

Thanks to a weak dollar and lower yields, gold regained momentum, rebounding above the $2,400 psychological level.

Treasuries rallied across the curve as investors remained lured by Powell’s comments that US Treasuries would act as a safe haven in a weaker economic environment if the FED finally cuts rates in September.

Key takeaways.

The FED remains data-dependent and inclined to begin cutting rates, but many variables beyond its control must align to bring inflation to the last mile of the 2% target and allow the FED to implement its plans before the end of the year.

In the meantime, it’s ‘HIGHER FOR LONGER’ as ‘Forward Confusion’ and inflation misery spread recession vibes.

Amid accelerated inflationary base effects due to renewed supply constraints and relaxed financial conditions, the FED is expected to hold interest rates steady until the end of the year.

After the election, with political chaos and geopolitical tensions both domestically and internationally, a rate hike rather than a cut might be needed, as the highly political FED will be free from political manipulation.

In the coming weeks, GOOD NEWS is likely to be BAD NEWS, and BAD NEWS will also be BAD NEWS as the US economy moves into an inflationary bust and the FED is running out of power and time to implement its infamous pivot.

Political and geopolitical uncertainties will ultimately lead to a stronger USD, higher Treasury yields, and increased oil and gold prices.

As governments seek to increase their control over their citizens, trust in public institutions (including the FED) will continue to decline, leading investors to move even more into assets with no counterparty risk and which are non-confiscatable, like physical gold and silver.

For fixed-income investors still chasing long-duration trades, more pain awaits, as long-dated yields must reflect the new stagflation reality.

In a stagflation, the best way to protect wealth is still to own the equity barbell portfolio made of Tech and Energy and Physical Gold and avoid long dated bonds.

As stagflation rather than recession materializes as the economy is increasingly weaponized, investors should prepare their portfolios for HIGHER volatility.

In this context, investors should also remain prepared for dull inflation-adjusted returns in the foreseeable future.

Bottom line: Like one swallow does not make a summer, the cooling set of CPI data recorded over the second quarter is not enough to provide the FED the needed confidence to start finally pivoting. This is particularly true in the context of a weaponized economy, with a rising risk of shortages not only related to supply chain disruptions but also to climate change and DEI-related, self-imposed, painful regulations and rising risk of wars, which are ultimately all inflationary over the long term, as much as a gargantuan fiscal deficit that is unlikely to end under whoever is the next tenant of the White House. In this context, investors should continue to prioritize investments in low-leverage companies capable of sustaining EPS and FCF growth amid economic weakness. This mostly includes sectors like Energy and Tech with quasi-monopolistic positions. In fixed income, investors should steer clear of long-dated bonds, particularly government bonds with a maturity of more than 6 months. If they truly want a fixed income allocation, they should consider investment-grade corporate issuers with maturities no longer than 12 months. Long-dated fixed income investments should be replaced by physical gold and silver as well as other hard and soft commodities, comprising at least 40% of the portfolio. These new antifragile assets will stand to benefit from a scarcity premium during times of war and the rising risks of an upcoming sovereign debt crisis, first in Europe and then in the US.

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

Excellent