Borrow, Bomb, Repeat…

Borrow, Bomb, Repeat—history’s oldest government playbook, and Europe is about to prove chaos still makes the perfect distraction.

The Week That It Was…

The first week of September limped in after Labor Day, giving U.S. investors a holiday-shortened schedule. They were treated to yet another batch of PMIs from the U.S. and China—because apparently, the world can’t function without endless surveys confirming what everyone already suspected. The U.S. jobs report showed up like a doctor’s appointment with no new prescription, while 25 S&P 500 companies reported earnings. Of course, only Salesforce and Broadcom managed to keep anyone from dozing off.

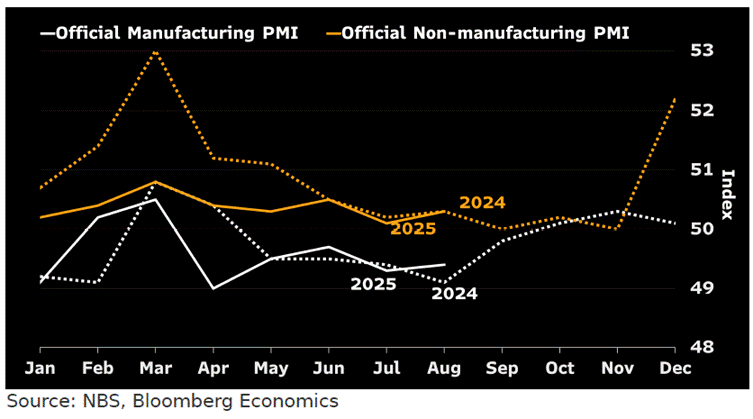

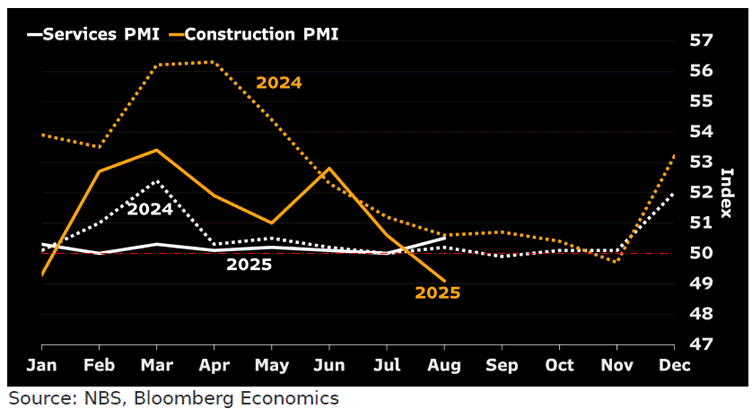

China’s August PMIs confirm the economy is still stuck in July’s rut — and no, you can’t just blame the rain. Manufacturing barely crawled up, construction face-planted to its worst level since Covid lockdowns, and demand looks like it’s on vacation. Services gave a little lift, but mostly thanks to tourists and a stock market sugar high — hardly the stuff of sustainable growth. Ironically, the hotter stocks run, the less likely the PBoC is to serve up another stimulus cocktail anytime soon.

China’s stock market is partying while the real economy is nursing a hangover. Weak PMIs argue for more PBOC easing, but with equities frothy, Beijing is in no rush to pour more drinks. Stimulus should now be expected to be later — and lighter — than hoped, with odds slipping on the year-end rate and RRR cuts. Fiscal room is also tight. With the 2024 budget already loaded, any slowdown would see spending pulled forward from 2025, not deficit expansion. Subsidies for kids and pre-school waivers show Beijing prefers targeted relief over broad stimulus.

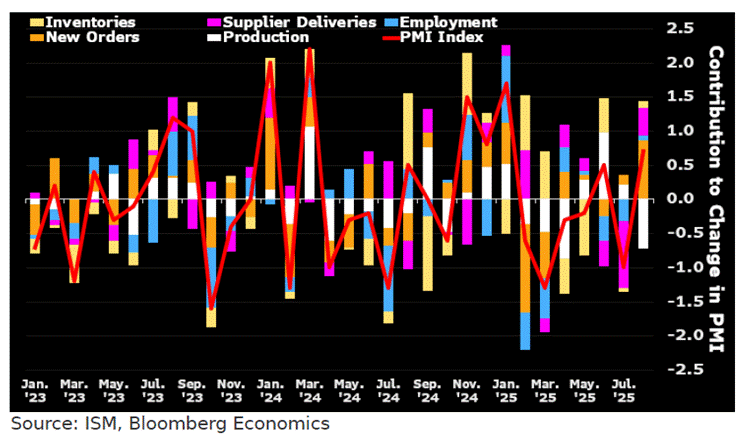

After a “Labour Day hibernation’, Donald Copperfield magically popped out of his golf course just in time to see ISM Manufacturing PMI tick up to 48.7 in August, a touch below expectations. New orders did the heavy lifting, inventories ran low, and suppliers slowed down — basically the same old song. Production lagged, jobs slipped (but not as badly), and prices cooled ever so slightly.

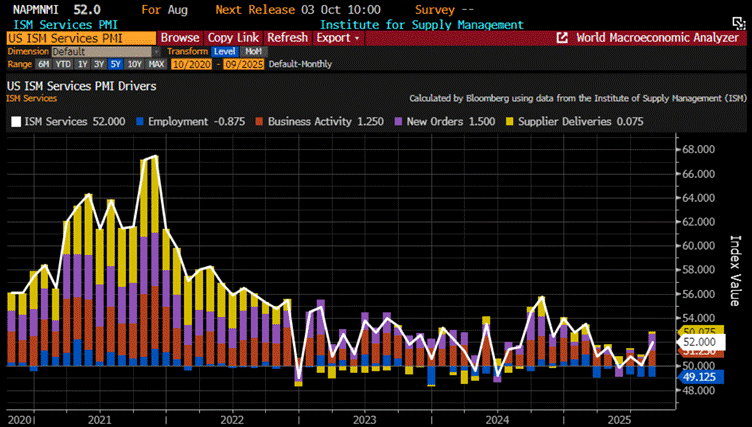

US Services activity perked up in August — thank you, data centres and the great sport of tariff front-running. The ISM Services PMI jumped to 52.0 from 50.1, with new orders at their fastest pace since October. Of course, backlogs shrank, prices stayed painfully high, and employment kept contracting. Translation: business looks “better,” but mostly because firms are rushing to beat tariffs while quietly admitting they can’t keep eating the costs. Call it growth with a side of inflation, served lukewarm or an inevitable stagflation ahead.

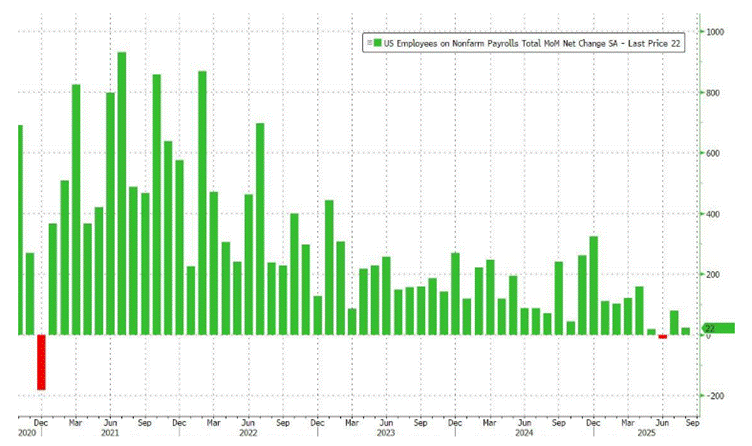

The “resilient” U.S. labour market that officials keep bragging about is looking more like a house of cards in a wind tunnel. August managed just 22K new jobs, while June was quietly revised into negative territory — the first red print since 2020 — and July wasn’t much better after downward revisions. Only teachers, bartenders, and amusement parks kept hiring, while business services and government trimmed payrolls.

.

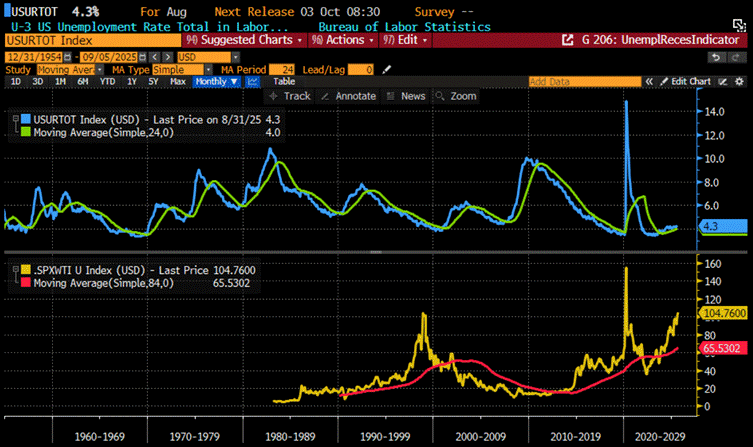

Unemployment rose to 4.3% in August, the highest since October 2021, while the participation rate held steady at 62.3% and average weekly hours worked slipped to 34.2. The combination points to a softening labour market. With joblessness now above its two-year average since September 2023, recession risks are clearly mounting.

Upper Panel: US Unemployment Rate (blue line); US Unemployment 24 months moving average (green line); Lower Panel: S&P 500 to WTI ratio (yellow line); US S&P 500 to WTI Ratio 84 months moving average (red line).

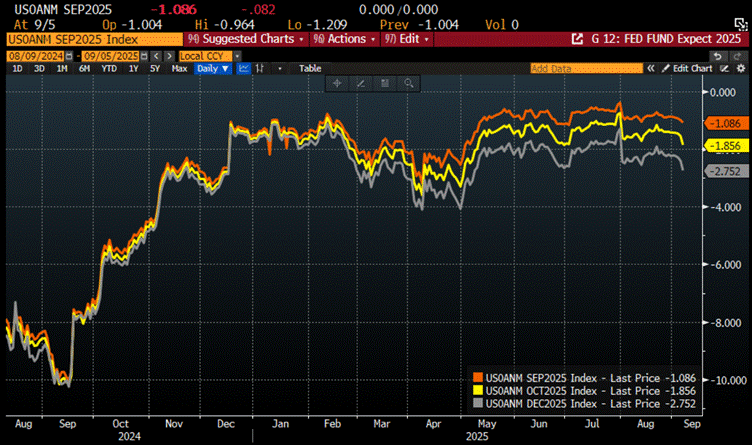

As Wall Street pundits lull themselves with bedtime stories of lower Fed Funds rates, the Street drifts off dreaming of Powell the Wizard—master of the business cycle, sprinkling not one, not two, but three sparkling rate cuts under the Christmas tree with “75% probability.” Too bad the spellbook doesn’t work : tinkering with the short end of the curve won’t stop the U.S. economy from stumbling straight into an inflationary bust.

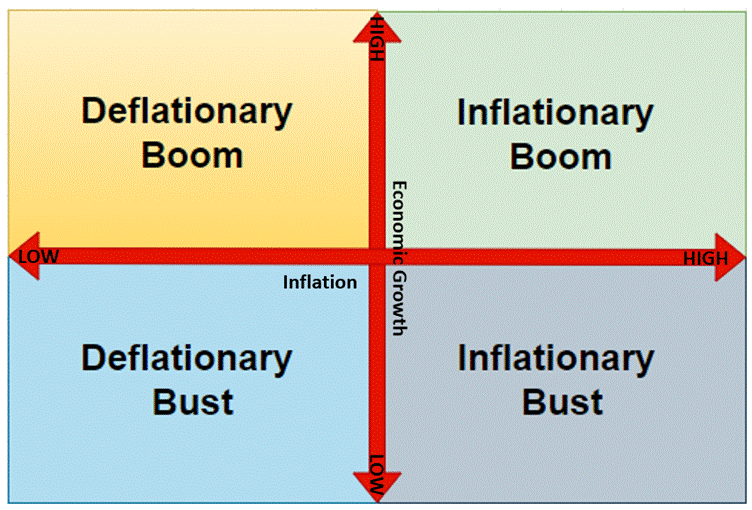

The business cycle is basically Mother Nature’s drama club. Spring is the feel-good comeback story: central bankers cut rates, politicians throw money around, and growth stocks pop up like daisies after a rainstorm. Then comes Summer, when inflation sweats through its shirt and commodities, cyclicals, and emerging markets hog the spotlight like sunburned tourists at a beach bar. By Autumn, the hangover sets in—stagflation arrives, everyone looks miserable, and the only ones still smiling are gold bugs hoarding bullions under their mattresses. Finally, Winter marches in: recession chills the air, inflation hibernates, and suddenly boring old cash get to play the hero, at least until the next act of this never-ending soap opera.

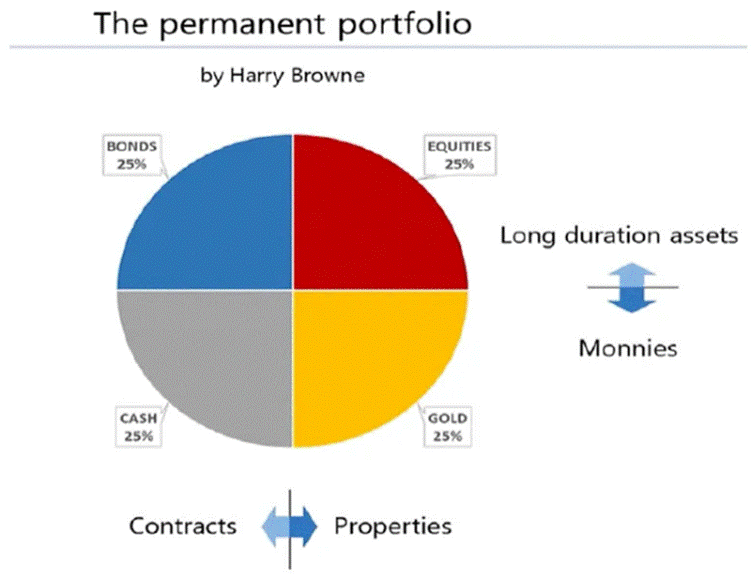

Harry Browne’s “Permanent Portfolio” is basically the financial crockpot—set it, forget it, and let it stew through any economic weather: sunny growth, stormy inflation, icy deflation, or gloomy recession. By mixing a bit of everything—stocks, bonds, cash, and gold—it aims for steady returns without the ulcer-inducing drama of day trading. Think of it as portfolio geometry: contracts vs. properties, short vs. long duration—like drawing a neat little Cartesian grid to keep your money from staging a rebellion.

Among the four assets in Harry Browne’s Permanent Portfolio, bonds are the simplest for laymen to grasp—they’re just debt. Debt is borrowed money, whether by an individual, company, or government, with the promise to repay—usually with interest—over time. It’s a way to pull tomorrow’s resources into today, financing everything from a family home to a national war chest. Used wisely, debt is fuel for growth; abused, it’s a ball and chain that drags balance sheets into crisis.

Debt is as old as civilization itself. Long before coins or paper money, early societies relied on credit and obligation. In Mesopotamia around 3000 BC, farmers borrowed grain or silver from temples, paying it back from future harvests. To prevent collapse when debts piled too high, rulers declared “debt jubilees,” wiping the slate clean. As economies grew, debt morphed into an empire-building tool: the Greeks and Romans borrowed to fund trade and wars, medieval Europe produced moneylenders and bonds, and Renaissance cities like Venice and Amsterdam pioneered sovereign debt markets. Fast forward to today, and debt underpins nearly everything—mortgages, corporate loans, government bonds—making it not just a financial instrument, but the very scaffolding of global capitalism.

https://unctad.org/publication/world-of-debt

As summer ended and the Keynesian-funded vacationers shuffle back from their ‘congés payés’, the European political circus resumes right on cue. Brussels’ clowns keep lecturing about “fighting for democracy” in Ukraine while their own citizens can’t stand them. In France, ‘MacroLeon’—the self-styled ‘Petit Napoléon’—looks on as his lame-duck sidekick, ‘Bay-Roue De Secours,’ staggers toward yet another inevitable government collapse.

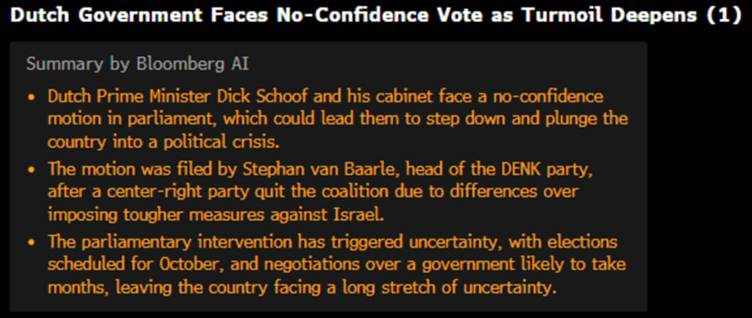

Further north, the Netherlands isn’t faring much better. After the ‘Gouda Warmonger’ traded The Hague for a cushy seat at the North Atlantic Terror Organization, the patchwork coalition he left behind is already unravelling—because even duct tape politics can’t hide a collapsing economy.

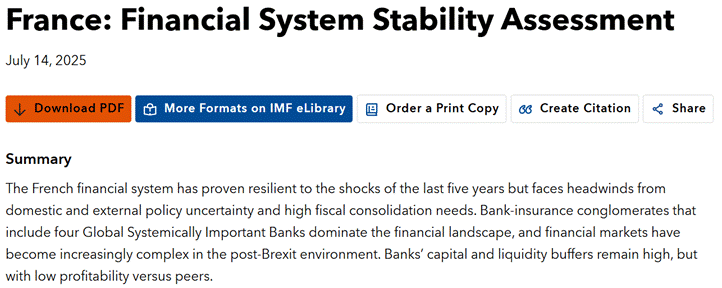

France is now batting its eyelashes at the unthinkable—an IMF bailout. Yes, the same “only for banana republics” safety net that the enlightened crowd of Wall Street geniuses swore Paris would never need. But here we are: the government wobbling toward its second implosion in under a year, the finance minister running around with his hair on fire, and bond yields climbing to their highest since 2011 as investors politely suggest they don’t believe in fairy tales about fixing a deficit that’s happily cruising toward 5.4% of GDP.

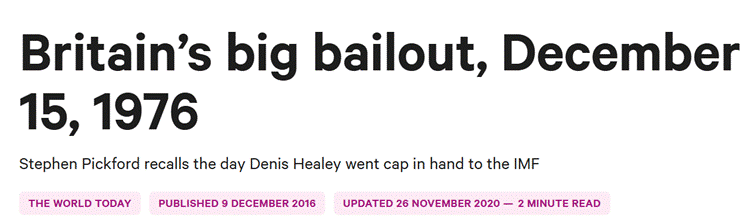

Across the Channel, the ‘Keith’ ’s Labour Keynesian ‘Prime Clown’ has managed to steer Britain straight toward an IMF begging bowl—again. With borrowing costs climbing, deficits ballooning, and debt piling up, even seasoned economists are whispering “1976 déjà vu. The ‘Keith’ ’s fiscal wizardry looks set to deliver the sequel nobody asked for: higher spending, higher taxes, and, if markets slam shut, a good old-fashioned IMF rescue. The UK economy—once mighty, now teetering like a drunk on the edge of the curb—may soon be reduced to pleading for bailouts just to keep the lights on.

So, speculation about IMF bailouts is back—but this time the whispers aren’t about Greece, they’re about Britain and France. London looks wobbly enough to need a foreign lifeline, while France’s own finance minister admits Paris might end up in the same queue. For Britain, of course, this would be a rerun: the once-mighty empire went cap in hand to the IMF in 1976, begging for what was then a record $4 billion loan. That humiliation came with strings attached—brutal austerity and a farewell to Keynesian fantasies—paving the way for Thatcher’s monetarist revolution. Nearly half a century later, it seems history is limbering up for an encore.

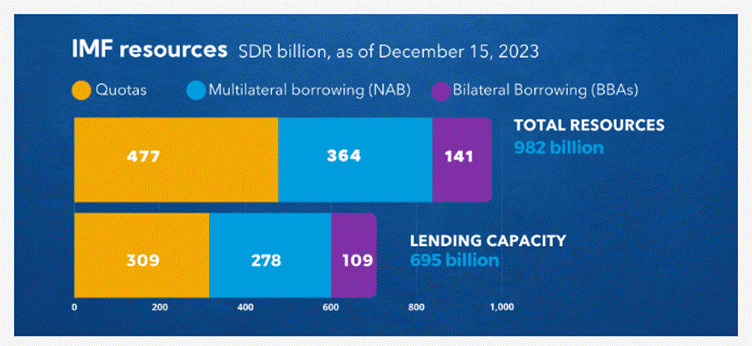

Before exploring the fallout of a European sovereign debt crisis, it’s worth remembering what the IMF actually is. Born at the 1944 Bretton Woods Conference alongside the World Bank, it was designed to prevent the kind of financial chaos that sparked the Great Depression and World War II. Officially launched in 1945, the IMF’s first job was keeping exchange rates “fixed” and lending to countries in temporary trouble. Over time, it morphed into the world’s crisis manager, handing out loans with conditions and keeping an eye on national budgets. It is funded mainly through quotas paid by its 190 members—membership fees scaled to the size of each economy, which also dictate voting power. Big players like the U.S., Japan, and Europe effectively call the shots, while the IMF quietly waits to rescue any country that trips over its own finances—and has implemented policies that serve the globalist agenda of its main contributors by helping extract resources from what the Western world has been calling Emerging Markets over the past 50 years. In short: a club of western globalists to run the global economy, with a polite promise to help everyone else.

https://www.imf.org/en/About/Factsheets/Where-the-IMF-Gets-Its-Money

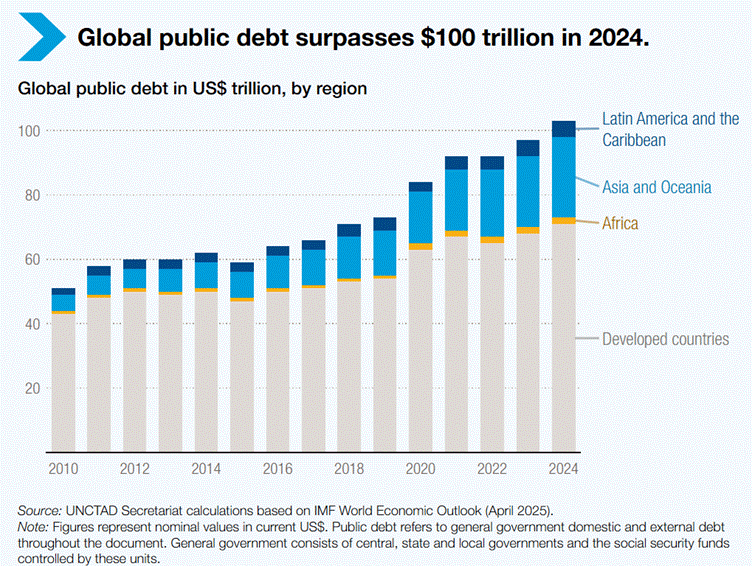

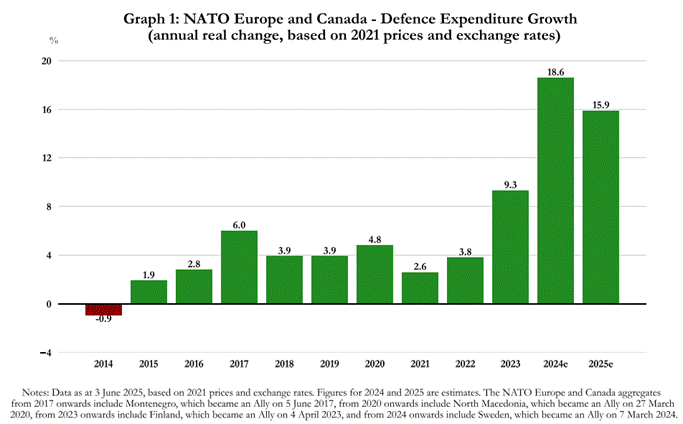

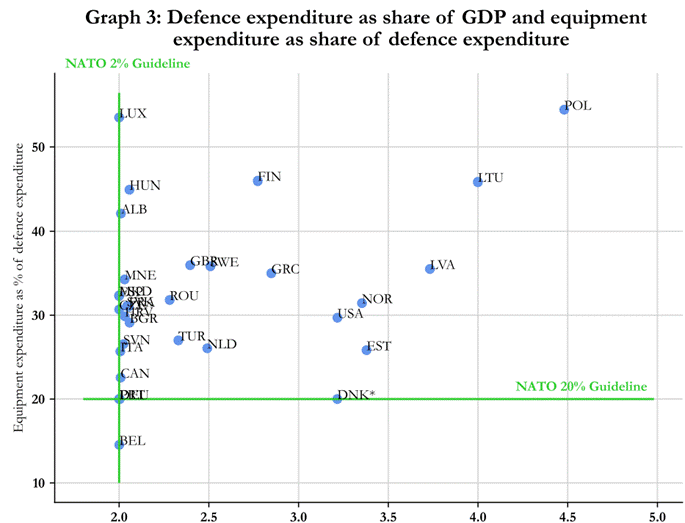

The grim truth is that Europe and the Western world are marching inexorably toward a sovereign debt crisis, a key chapter in the scenario of the world rule order. Western governments have borrowed relentlessly, year after year, with no intention of ever repaying a single penny. Warnings since 2025 have gone unheeded, and now France and the UK teeter on the edge of an IMF bailout. Yet these same governments demand NATO contributions of 5% of GDP, a spectacle of loyalty while their coffers bleed dry.

https://www.france24.com/en/live-news/20250714-macron-to-raise-defence-targets-citing-russia-threat

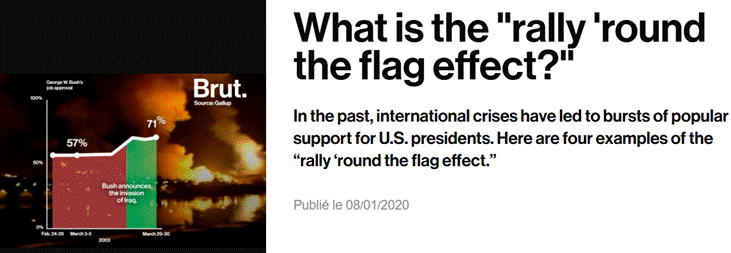

In this climate of economic collapse, Western governments seek a distraction. The ‘Russian Bear’, conveniently framed as a threat, becomes a tool for diversion and control. History and political science have long documented this tactic—the so-called “diversionary theory of war” or “scapegoat theory.” When domestic unrest rises, popularity falls, or the economy teeters, governments manufacture an external enemy. The goal is clear: unify the populace, deflect attention from internal decay, and tighten the grip of power. Western Keynesian opportunists, now masquerading as authoritarian overseers, are perfectly willing to stage—or at least exploit—a foreign attack to consolidate power. Psychologists call it the “Rally ’Round the Flag Effect”: a manufactured crisis sparks patriotism; silences dissent and unites a divided populace behind a lamed duck totalitarian leader. Class, race, and ideological divides vanish in the glow of a common enemy.

https://www.brut.media/us/videos/us/politics/what-is-the-rally-round-the-flag-effect

History is littered with examples of governments using external threats to mask domestic failures and consolidate power. After 9/11, the U.S. government invaded Iraq, passed the Patriot Act, imposed draconian financial controls, and turned airports into ritualized security theatres. Conflict became the excuse to expand state control, divert resources from social programs, and bend the population to obedience, all while citizens cheered, blinded by fear and loyalty.

Not every war is manufactured, and the strategy is risky miscalculation can destroy the regime it was meant to save. Argentina’s 1982 invasion of the Falklands, for instance, sought to unite the public amid economic crisis and social unrest. Initially successful, nationalist fervour collapsed after Britain’s decisive victory, toppling the junta and restoring democracy.

Germany provides a darker lesson: post–World War I humiliation, hyperinflation, and depression left the population desperate. Hitler and the Nazis scapegoated Jews, communists, Roma, and other minorities to create a unifying enemy. This manufactured hatred justified persecution, war, and the Holocaust.

The U.S. invasion of Iraq in 2003 followed a similar blueprint. The Neocons claimed Saddam Hussein had WMDs and ties to Al-Qaeda—a fiction used to redirect public attention and justify a broader Middle Eastern agenda.

Likewise, the Spanish-American War of 1898 capitalized on the USS Maine incident and sensationalist journalism to distract Americans from depression and labour unrest, while giving the U.S. an overseas empire.

Even in antiquity, rulers exploited this tactic. The Roman Senate and generals used foreign wars to suppress internal discord—'bellum externum civile discordiam’: “a foreign war ends civil strife.” The Gracchi brothers’ reforms in the 2nd century BC led to internal conflict, which the Senate deflected through military campaigns. Gaius Marius leveraged the threat of Germanic tribes to consolidate power and reform the army, promising land to soldiers to stabilize society. Augustus built the transition from Republic to Empire on similar principles, manipulating public perception of Cleopatra and Mark Antony. In Sparta, a constant state of militarized vigilance and the ideology of surrounding enemies kept the helot population submissive.

Across time, the pattern is unmistakable: rulers create or exploit external threats to unify populations, distract from economic crises, suppress dissent, and entrench authority. It is a recurring lesson in power—the external enemy is often less about reality than control.

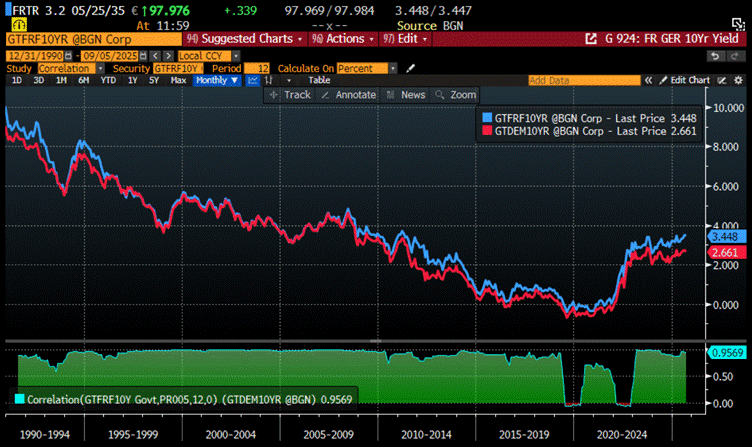

By September 2025, the European Union—run by reckless Keynesians pushing a Malthusian agenda of wars, scarcity, and control—is hurtling toward a major sovereign debt crisis. This collapse threatens to dismantle the EU itself, the very symbol of globalism, whose policies are drafted by unelected bureaucrats to serve a plutocratic elite entrenched in the Brussels swamp. Nobody needs to be a fixed income fund manager to notice that long-dated yields in major EU countries like Germany and France have been structurally rising since the start of the decade—a direct reflection of the acceleration of the globalist agenda, justified under the twin pretexts of the COVID ‘plandemic’ and the theatrics of “green” policies invented by politicians playing Dr. Jekyll and their Green Zealot doubles.

France 10-Year Yield (blue line); Germany 10-Year Yield (red line) & Correlation since 1990.

France teeters once again on the brink of political chaos. Lamed Duck Prime Minister ‘Bay-Roue de Secours’ gambled on a confidence vote, offering little hope for a swift solution to the nation’s crumbling public finances—whether through a new government or a snap parliamentary election. Amid the turmoil, fears are mounting that President ‘Macro-Leon’, cornered and desperate, may invoke Article 16 of the French Constitution. This clause grants extraordinary emergency powers in the event of a “grave and immediate threat” to the Republic’s institutions, national independence, or territorial integrity—effectively allowing him to rule as a dictator in a modern democracy, much like the ‘Cokehead Dancer on High Heels’ in Ukraine. One of the most potent executive powers in any contemporary state, Article 16 could transform France’s political crisis into a historic centralization of authority.

‘Macro-Leon’ better known as ‘Le Petit Napoleon’ may look powerful on paper—controlling foreign policy, defence, and EU affairs—but running France at home? That’s another story. Domestic governance depends on a prime minister who can survive Parliament’s mood swings. Lose ‘Bay-roue de Secour’ on September 8, and Macro-Leon’s centrist alliance faces yet another hung parliament headache, stalling budgets, reforms, and debt plans. Cue caretaker-mode president. Snap elections are an option, but good luck: they could hand the far-right or radical left even more leverage. Sure, Macro-Leon can’t be ousted easily—impeachment requires a two-thirds vote in both chambers for a “breach manifestly incompatible” with his duties—but practically speaking, repeated government collapses make him a glorified figurehead while the real chaos runs the show.

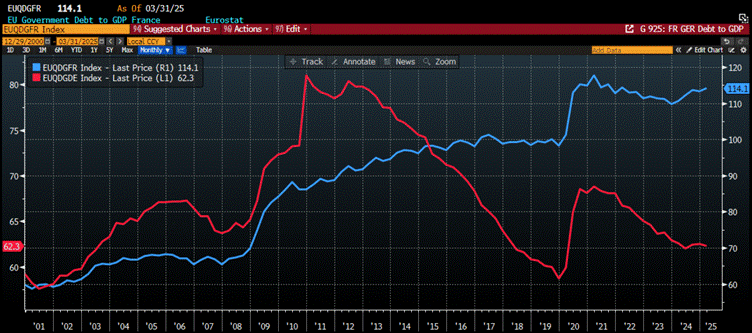

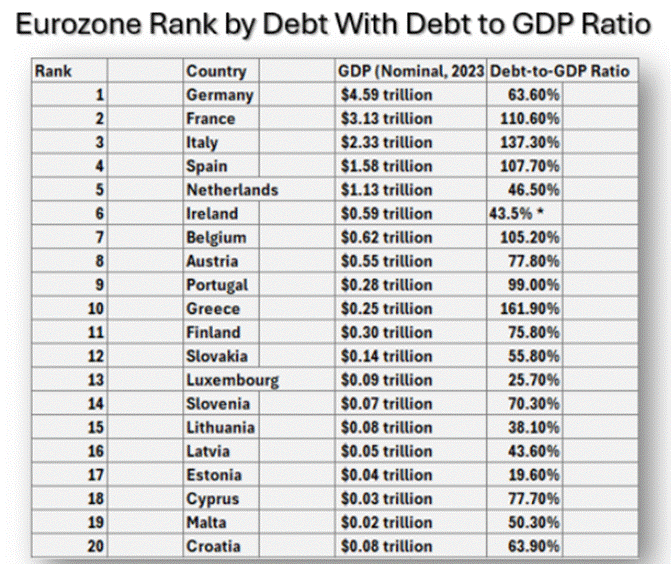

The truth is obvious to anyone with even a basic grasp of finance: France has been running a Keynesian Ponzi scheme for decades. As of March 2025, Eurostat reports—propaganda notwithstanding—show French debt at over 114% of GDP, compared with Germany’s 62.3%.

France Debt to GDP (blue line); Germany Debt to GDP (red line).

France faces a looming fiscal catastrophe. Public debt is projected to reach 120% of GDP in 2025, with the IMF forecasting a 6.1% deficit by 2030—the worst in the Eurozone. Political instability under President ‘Macro-Leon’ only worsens the situation. A projected debt explosion could push liabilities to EUR3.2 trillion, fuelled by unchecked spending and stalled reforms.

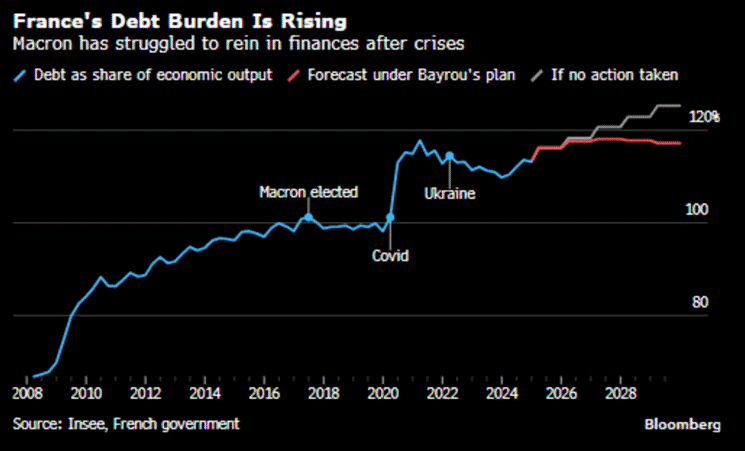

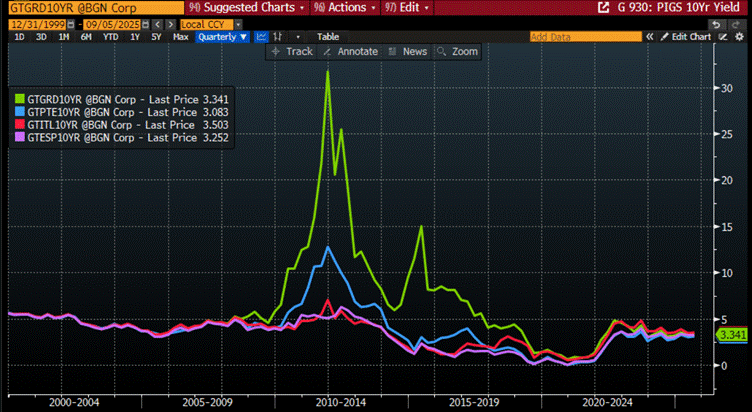

Borrowing costs are rising, leaving France as one of Europe’s weakest economic links despite its status as a cornerstone of the Union. With the European PIGS able to borrow at cheaper yields than France, markets have already anticipated the inevitable fall of the French Fifth Republic, which will shift toward greater financial repression and authoritarian measures within the Hexagon.

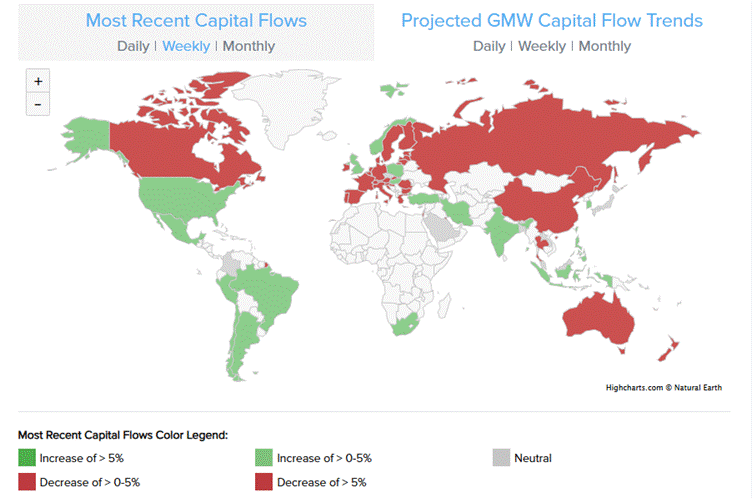

Spread of Portugal (blue line); Italy (red line); Greece (green line); Spain (purple line) 10-Year Yield to France 10-Year Yield.

Since the start of the jubilee year, Wall Street’s brain-dead pundits and their media parrots have tried to sell investors the myth of a heroic euro rescuing a decaying West. Propaganda claims that Donald Copperfield poses a greater threat than the Malthusian Keynesian globalists running European governments—puppets of the men of Davos—while investors are coaxed into believing their savings are safer in the Eurozone than in the United States. Anyone with a basic understanding of capital flows knows the supposed outperformance of the Euro Stoxx 50 versus the S&P 500 was a mirage, fuelled by retail YOLO investors chasing a fantasy “safe haven.” In reality, it was all about shifts in German bond yields relative to U.S. bonds. With the French crisis worsening and threatening the wider Eurozone, even Germany is no longer immune. The outperformance of German bonds versus U.S. Treasuries has already reversed, and equity investors are about to learn the hard way: when the dust settles, the United States remains the only place to hide capital from the chaos looming over Europe.

Relative performance of S&P 500 index to Euro Stoxx 50 Index (blue line); Relative performance of the Bloomberg US Treasury Index to the Bloomberg Germany Treasury Bond Index (red line).

At the end of the day, FX investing—like most investment—is essentially a beauty contest: the “less ugly” candidate outperforms the one that looks worse. What drives the relative performance of bond markets, and ultimately currencies, is how economic data appears at a given point in time. In this regard, the Citi US Economic Surprise Index versus the Citi Euro Economic Surprise Index has proven to be a reliable indicator of trends in both bond market performance and FX exchange rates.

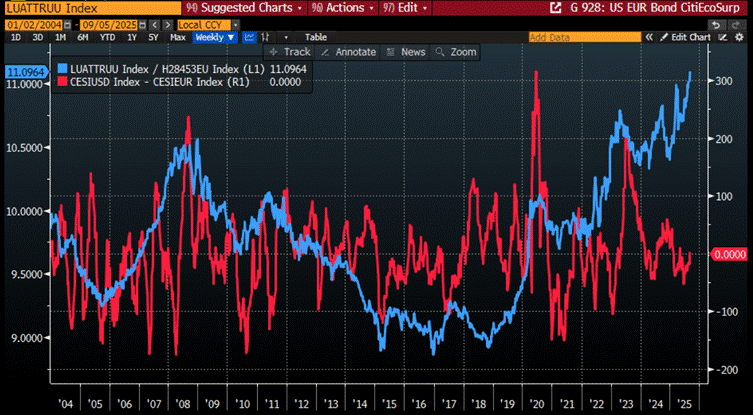

Relative performance of the Bloomberg US Treasury Index to the Bloomberg Germany Treasury Bond Index (blue line); Spread between Citi US Economic Surprise Index and Citi EUR Economic Surprise Index (red line).

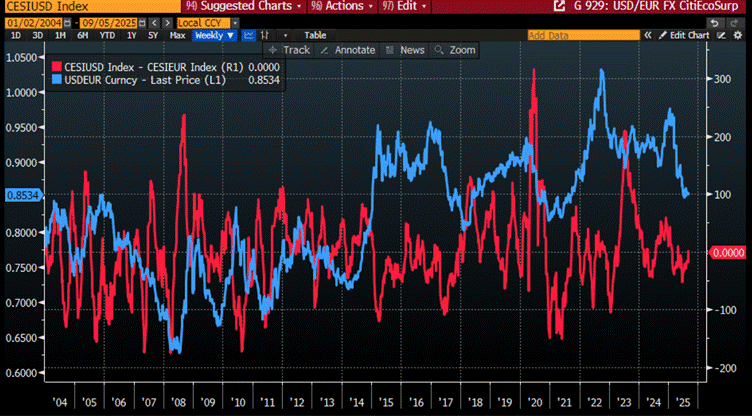

USD/EUR FX Rate (blue line); Spread between Citi US Economic Surprise Index and Citi EUR Economic Surprise Index (red line).

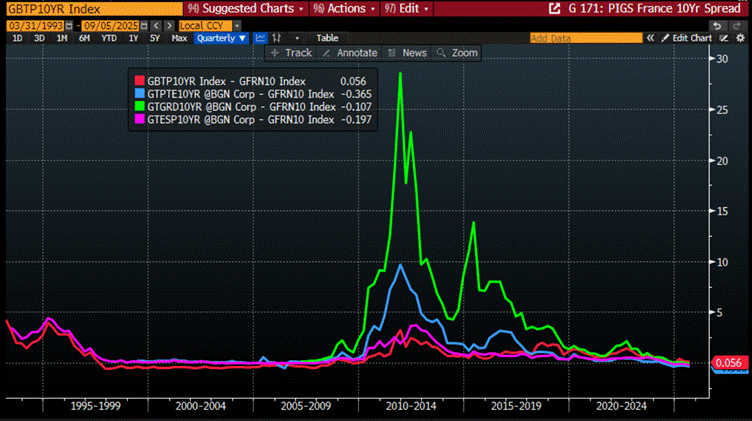

Savvy traders know how contagions spread. When the Euro was created, those behind the dream turned nightmare of the common currency failed to consolidate debt, and trouble in one member would infect the whole bloc. Enter Greece, April 2010. Borrowing costs soared, and Athens begged for a EUR45 billion EU–IMF bailout. Panic spread fast investors dumped not just Greek bonds, but Portugal, Ireland, Italy, and Spain too. Yields spiked, euro confidence wobbled, and the periphery caught a financial fever.

Portugal (blue line); Italy (red line); Greece (green line); Spain (purple line) 10-Year Yield.

In 2010, Greece’s IMF bailout lit the fuse for the full-blown Eurozone sovereign debt crisis, unleashing a contagion across the periphery. Markets didn’t just watch—they recalculated the risk of the entire union. The bailout proved that sovereign default in Europe was real: if Greece could fall, so could other heavily indebted nations, prompting investors to hunt for the next weak link.

European banks—especially in Germany and France—were sitting on mountains of Greek and southern European debt. Fear of losses sent bank shares tumbling and interbank lending spreads soaring. The euro plunged 20% against the dollar between late 2009 and mid-2010, as investors raced to “safe” havens. Global stock markets shivered, culminating in the May 6, 2010 “Flash Crash.” Greece didn’t just stumble—it set off a full-blown risk-off contagion, exposing how fragile confidence in sovereign debt and European banks really was.

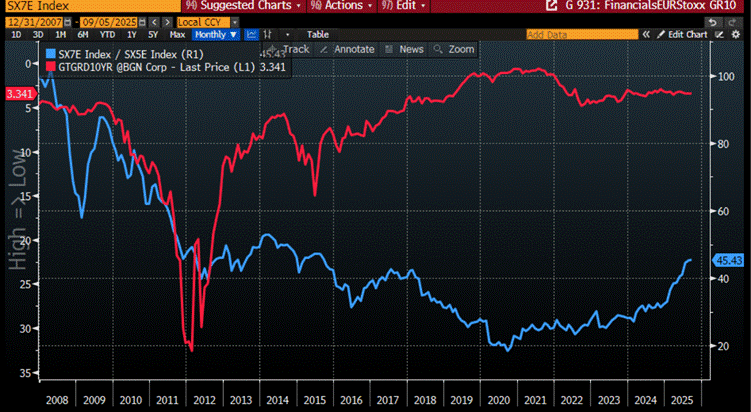

Relative Performance of Euro Stoxx Bank Index to Euro Stoxx 50 Index (blue line); Greece 10-Year Yield (Axis Inverted; red line).

Déjà vu: if France needs an IMF bailout, a Eurozone contagion is all but guaranteed. As one of the bloc’s largest economies, French distress would spike borrowing costs, panic investors, and destabilize other European states—replaying the 2010–2012 debt chaos. Amid the drumbeat for war as a distraction, fiscal mismanagement leaves the dollar looking like the only safe harbour.

The contagion risk across Europe will skyrocket. Germany won’t escape either, thanks to Merz. Investor panic will push bond yields higher in France, Italy, and Spain, while political gridlock worsens financial stress. France and Britain flirting with IMF assistance is a clear signal: buyers are fleeing, and these Keynesian Ponzi schemes collapse the moment old debt can’t be rolled over.

The true crisis emerges when governments can no longer sell their debt. In the Panic of 1935, what began as a national problem quickly metastasized into a global contagion. Italy, faced with circumstances eerily familiar to today’s Europe, did not default in the conventional sense—but it did something far more insidious: a coerced debt restructuring, a “forced loan.” The government, led by Prime Minister Francesco Crispi, passed a law that unilaterally converted short-term Treasury notes into perpetual bonds, stripping investors of their expected cash repayments. The new “Rendita Italiana 5%” carried a 5% coupon, issued below par, perpetual, and effectively a confiscation of wealth disguised as a financial instrument. Citizens and banks alike were left holding illiquid, uncertain paper, powerless to reclaim what they had lent.

This is the blueprint. Europe today is a vast Ponzi apparatus, a theatre of endless borrowing and illusion. When the continent can no longer issue new debt to pay the old, it will follow the same path: default or coerced “forced loans.” There is no other ending. The illusion of stability will crumble, and the people—like the investors of 1935—will awaken to the harsh reality that they were lending to a system designed to extract, control, and betray.

The intimate ties between banks and sovereign debt mean that French distress won’t stay in Paris. IMF studies confirm what anyone paying attention already knows: a bailout could spread contagion across borders. If Britain joins the fiscal fiasco, the IMF itself could be stretched to its limits. Without debt mutualization, the Eurozone teeters on a knife-edge. One country’s crisis undermines faith in the entire union, and simultaneous turmoil in France and Britain will send yields—and panic—soaring across the continent.

The bankrupt Western world is gearing up for war, and while the “North Atlantic Terror Organization” (NATO) isn’t officially at war yet, you wouldn’t know it from the balance sheet. Drowning in debt, its members somehow scraped together the cash to make Ukraine the costliest conflict in the alliance’s history. Spending will climb to $1.59 trillion in 2025—up from $1.5 trillion last year—with the U.S. shouldering the lion’s share at $980 billion. Canada and Europe will cough up $608 billion, averaging 2.76% of GDP, while Poland proudly takes the crown at 4.48%. Lithuania and Latvia aren’t far behind, and the Nordics are happily torching 3% or more of GDP on this so-called “defense.

https://www.nato.int/nato_static_fl2014/assets/pdf/2025/8/pdf/250827-def-exp-2025-en.pdf

Remember when NATO members were “struggling” to meet 2%? That was before Russia-Ukraine. Now they’ve shot up from 1.8% pre-war to 2.6% in 2024, and 2.76% today—already marching toward the 5% pledge made at the Hague Summit in June 2025. Apparently, when your economy is buckling under debt and inflation, the smartest thing to do is double military spending. Brilliant.

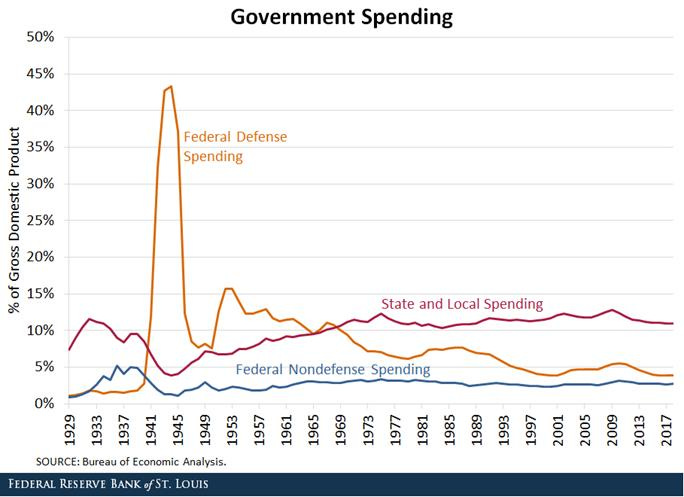

Of course, the sales pitch hasn’t changed in a century. Before World War I, it was “deterrence” as Europe poured money into armies and navies. In the 1930s, it was “job creation” as Germany, Italy, and Japan rearmed while their citizens starved under wage controls and shortages. Rome did the same in the third century: endless frontier wars devoured the treasury, coinage was debased, and the empire collapsed. Different actors, same playbook.

What NATO is doing today is no different—gutting social programs, diverting capital from productive enterprise, and pretending that war spending is “security.” In reality, it’s inflation, destruction, and debt-financed suicide. The latest NATO report isn’t just a budget—it’s a roadmap of nations stumbling into the War Cycle. The West has chosen militarization, and history is laughing—because we already know how this story ends.

https://www.stlouisfed.org/on-the-economy/2020/february/war-highest-defense-spending-measured

As of September 5, 2025, France hasn’t formally begged for a bailout—yet. But the frantic warnings from officials and jittery markets suggest the writing is on the wall. EU rules or domestic reforms might stop the dominoes, but if they fail, the contagion could spread like wildfire.

France’s republican theater is collapsing, and the march to war can no longer be denied. A leaked July 18, 2025 memo reveals the Ministry of Health has ordered hospitals to prepare for a “major military engagement,” expecting up to 50,000 wounded within months of deployment. ‘Macro-Leon’ has vowed to send troops to Ukraine, and the nation is being conditioned for the inevitable. Hospitals are instructed to train staff under wartime constraints, brace for psychological and physical trauma, and prepare emergency centers near airports and train stations for mass casualties. Europe is on the edge; the contagion of war will not remain contained.

Under the pretense of “peacekeeping,” Brussels’ warmongers are busy sketching out their next false flag. Anyone with a shred of historical sense knows their real aim: feeding more innocents into the Ukrainian meatgrinder. It’s the perfect excuse to tighten authoritarian grip at home, after having already Machiavellianly impoverished their citizens with the Covid “Plandemic” and the green scam that’s driven Europe into economic euthanasia.

Between war, a looming sovereign debt crisis, shifting capital flows, the threat of scrapped paper currencies, the world is staring at a profound upheaval—with wildcards raining in from every direction.

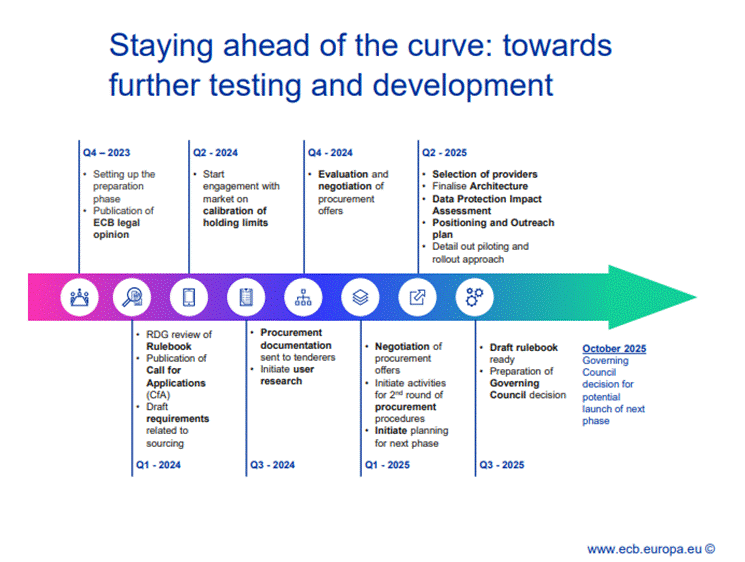

As the Euro sovereign debt crisis looms, Europe’s Malthusian leaders are primed not only to manufacture bogeymen to distract the masses from their reckless policies but also to tighten financial controls. Enter the Euro CBDC. The digital euro, the ECB’s central bank digital currency, is designed to mirror cash—while quietly setting the stage for unprecedented oversight. After a two-year investigation, the ECB moved into a preparation phase in November 2023, refining design, infrastructure, and rules. A key decision on issuance is expected by October 2025. Marketed as a tool for digital sovereignty and privacy, it also conveniently positions the ECB to monitor and control transactions like never before—a milestone that could redefine money in Europe, whether citizens like it or not.

Anyone familiar with CBDCs knows they are the ultimate tool of financial control—a digital cage for citizens. By rolling out a Euro CBDC, the Eurozone sets the stage for strict capital controls. Those who bought into Wall Street’s fairy tales will soon discover their savings trapped in a region hurtling toward conflict with the Global South, while domestic economies and governments teeter on the brink of collapse.

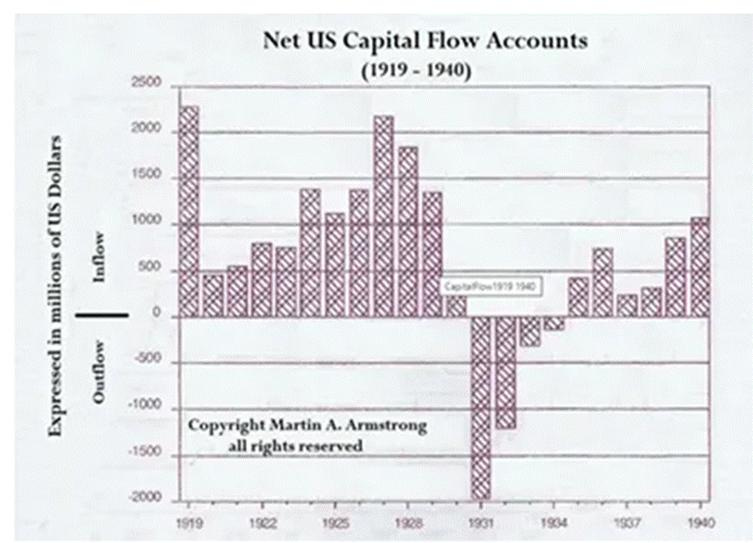

World War I and II catapulted the United States from a peripheral creditor to the world’s financial center. By 1918, Europe’s great powers were buried in war debt, while America supplied food, raw materials, and arms—paid in dollars and redeemed in gold. World War II intensified this transformation: U.S. industry became the “arsenal of democracy,” leaving Europe and Asia in ruins while America retained intact infrastructure, massive gold reserves, and the only fully functioning capital markets. The 1944 Bretton Woods system, pegging the dollar to gold and other currencies to the dollar, cemented the U.S.’s role as the global financial anchor—a position strengthened by Wall Street’s depth and the world’s hunger for dollar assets. The inevitable World War III is poised to shift the economic and financial center of gravity eastward, with China—and most likely Hong Kong—emerging as the new hub of global capitalism. This would mark the eclipse of the globalist Keynesian agenda and the rise of a multipolar world driven by mercantilist ambitions.

The inevitable World War III is poised to shift the economic and financial center of gravity eastward, with China—and most likely Hong Kong—emerging as the new hub of global capitalism. This would mark the eclipse of the globalist Keynesian agenda and the rise of a multipolar world driven by mercantilist ambitions.

In the meantime, as the global economy is heading into an inevitable inflationary bust, the path to real prosperity remains paved with tangible assets, not fragile IOUs not genius digital tokens, Physical gold and silver—free from counterparties, free from surveillance—stand as the ultimate antifragile shields. Beyond precious metals, broader commodities guard against a fracturing global supply chain.

Cash must be wielded with precision: favor short-dated USD investment-grade bonds and T-bills to maintain income and swift agility.

In equities, hunt for lean, low-debt, high-cash-flow champions—businesses ready to thrive amid reshoring, trade wars, and surging defense budgets. Because the real enemy isn’t next door; it’s the warmongers pulling the strings.

The Goldilocks era is dead. The age of Gold In Lots—is the new survival playbook.

At the end of the day, as Thomas Mann observed, “War is nothing but a cowardly escape from the problems of peace.”

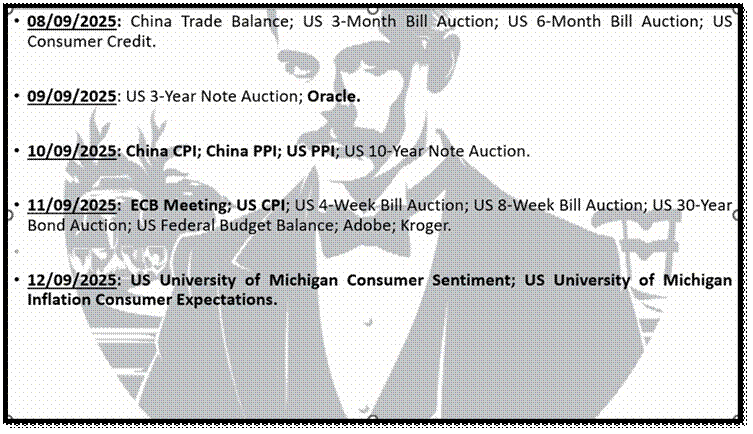

What’s On The Agenda Next Week?

Welcome to the second week of the last month of the third quarter of the Jubilee Year—otherwise known as “Wall Street calendar Sudoku.” This week, investors will obsess over inflation tea leaves, courtesy of CPI and PPI out of China and the US, plus the usual dose of crystal-ball psychology from the University of Michigan’s sentiment survey. Outside the US, investors will have to listen once again to the always politically and propagandistic ECB. Oh, and 14 S&P 500 companies are reporting—but let’s face it, only Oracle has a shot at keeping anyone from dozing off.

KEY TAKEWAYS.

As politicians once again repeat their Malthusian playbook—Borrow, Bomb, and Repeat—the key takeaways are:

It’s not yet time to “Make China Great Again,” and with the stock market partying, the PBoC is hesitant to spike the punch with fresh stimulus.

US Manufacturing’s still limping, but with new orders up and prices easing, it looks more like a stubborn jog than a collapse, at least for now.

August’s US services rebound looks less like real growth and more like tariff panic—demand up, costs rising, jobs shrinking: stagflation dressed as recovery.

The “resilient” U.S. labour market just cracked: weak hiring, negative revisions, rising unemployment, and shrinking hours now signal recession risks are no longer theory but reality.

Europe’s political clowns are back: France and Britain wobble toward IMF bailouts while deficits soar and bond yields spike, proving history loves a grim encore.

Facing a looming sovereign debt crisis, Western governments are primed to manufacture external threats—war, fear, and scapegoats—to distract populations, consolidate power, and mask decades of fiscal recklessness.

France teeters on the edge of fiscal and political collapse, with soaring debt, rising borrowing costs, and a desperate president potentially ready to seize dictatorial powers as the IMF looms on the horizon.

Amid Europe’s unravelling debt and market illusions, the Euro’s vaunted strength is a mirage—capital flows back to the U.S. as economic reality exposes the continent’s financial fragility.

As Greece did in 2010, France in 2025 will infect the Eurozone with a new fever—sending bank shares tumbling, yields soaring, and the euro crashing under the weight of its own debt contagion.

When governments can’t sell debt, they don’t default—they confiscate, as Italy’s 1935 “forced loan” turned short-term notes into perpetual bonds and stripped investors of their wealth.

Europe’s looming debt crisis is the perfect excuse for Brussels to roll out the Euro CBDC—marketed as “digital cash,” but in reality, a financial cage that locks citizens into capital controls and surveillance.

Just as World Wars I and II crowned the U.S. as the world’s financial hub, World War III is poised to shift that crown eastward—toward China and Hong Kong, heralding the fall of the Keynesian order and the rise of mercantilist multipolarity.

As the US economy shifts into an inflationary bust, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

Gold and silver are eternal hedge against "collective stupidity" and government hegemony, both of which are abundant worldwide.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

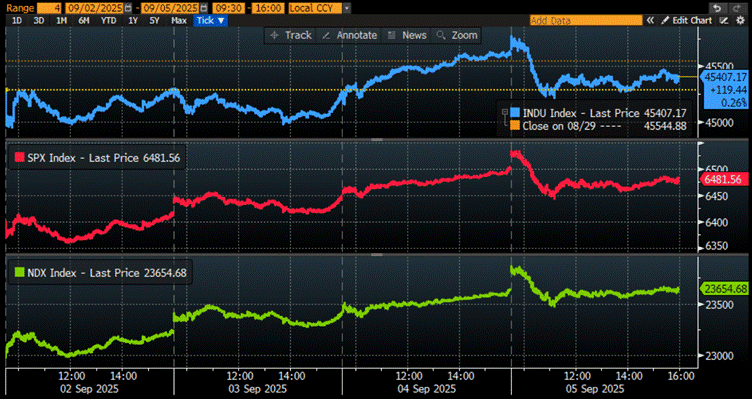

The first week of the third month of the third quarter of the Jubilee year was not only back-to-school week in the U.S. and Europe, but also the week that brought more signs the U.S. economy is heading into an inflationary bust. For investors, it will be remembered as the week when the S&P 500 temporarily broke above the 6,500 psychological level, printing yet another all-time high before pulling back. Despite its outperformance over the past five days, the Nasdaq posted a bearish daily reversal to start the month and remains in that pattern even after a rebound later in the week. The Dow Jones, meanwhile, ended the week in the red—another sign that despite prevailing bullish sentiment, rotation between the Nasdaq and the Dow continues to drive financial markets. Historically, such rotation has preceded a distribution phase, especially given that the Nasdaq has failed to make new all-time highs since mid-August.

In this context, investors should prepare for an inevitable distribution phase, which may already have begun. Stochastics remain overbought across all indices and have already turned bearish on a daily basis, pointing to further weakness ahead in line with seasonality.

While YOLO traders continue to ignore the historical fact that when the Fed cuts rates, the Dow outperforms the Nasdaq and energy producers beat energy consumers, daily stochastic indicators are flashing more consolidation—which could morph into a correction if the inevitable sovereign debt crisis in Europe pushes volatility higher in the next five days.

Near-term risks remain tilted to the downside, with markets still fueled by the greed of FOMO- and YOLO-driven investors. First support levels sit at the 76.4% Fibonacci retracement on the one-year chart: 43,608 for the Dow, 6,132 for the S&P 500, and 22,216 for the Nasdaq 100. If the geopolitical and financial backdrop deteriorates further—as expected—another wave of volatility could push markets down to retest the 61.8% retracement levels: 42,271 for the Dow, 5,884 for the S&P 500, and 21,132 for the Nasdaq 100. Should these levels hold, they may offer the final tactical buying opportunity of the year.

Since the “tariff tantrum” of April 2021 faded, all major U.S. indices have been forming higher lows, suggesting that the 2025 bottom may already be in place. While geopolitical events—rather than economic data—are likely to drive the next bout of volatility, long-term investors should stay focused and avoid being swayed by either doom-and-gloom or overly “hunky-dory” narratives.

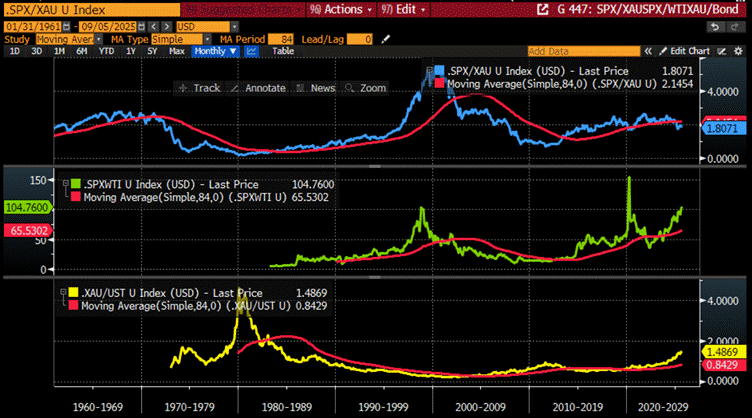

As of September 5th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for more than 7 months, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

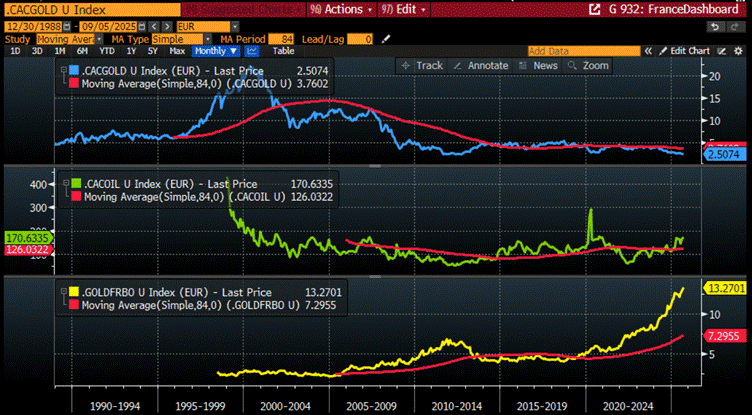

As of September 5th, 2025, the figures, unlike the ministries, cannot lie. France drifts in its engineered boom, the CAC-to-oil and gold-to-bond ratios paraded like banners of prosperity, yet the CAC-to-gold ratio has collapsed since October 2021—a silent record of Germany’s four-year dream inside a monetary hallucination. The ECB, Paris, and Brussels, guardians of the Ministry of Finance-Truth, tinker endlessly to preserve the illusion that debt is wealth and inflation is growth. But all illusions decay. Every boom is designed to end in bust, every pageantry of numbers conceals a reckoning. And should the war hawks succeed in their fabrication, the false flag will become the trigger: the inflationary masquerade will not fade tomorrow, it will collapse today.

For the citizen bound by the system’s financial cages—such as the PEA in France—there is but one sanctioned path: allegiance to multinationals that have severed ties with the decaying eurozone, producing beyond its borders and trading with the Global South and Oceania. All others will be sacrificed when the regional order collapses and the state defaults upon its promises. Survival now belongs only to those who escape the illusion.

Ignore the Ministry of Truth’s lies claiming Europe is a safe haven from the ‘Disruptor-in-Chief’ in the Oval Office. Beyond the borders of Japan, the Continent is poised to suffer under the twin hammers of American tariffs and internal political decay. France and Germany, their governments weakened and impotent, cannot enact the reforms demanded by survival. Citizens beware: European banks are tainted, and the eurozone’s rulers will tighten the chains of capital control in a futile attempt to stave off total financial collapse

While the Ministry of Truth extols the shining euro and laments the dying dollar, the inner circles—those whispering of war and regime change from the shadows—have quietly abandoned Europe’s sinking vessel for the U.S. Despite the theater of ‘Trump Derangement Syndrome’, America’s vast resources and twin oceans provide a sanctuary. Mismanagement festers, of course, but in this landscape of decay, it remains the least disastrous option.

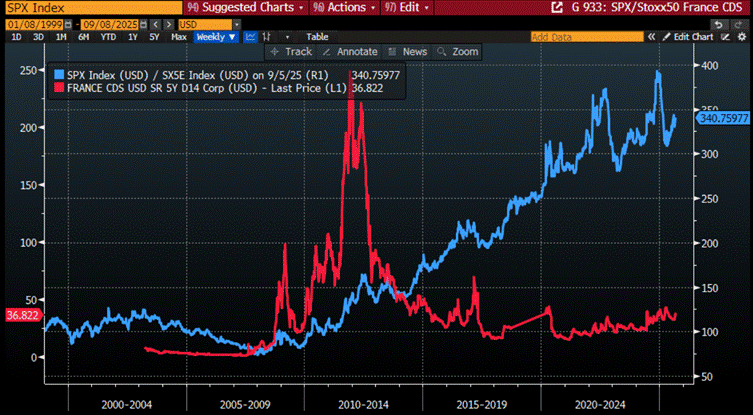

For those who can see past the siren song of supposed European returns, the lesson is clear: investing in a region teetering on sovereign debt collapse and war is a fast track to losing your savings. The smart—or at least the cautious—avoid European stocks. France’s rising CDS, a measure of government default risk, has long served as the canary in the coal mine, signaling when the S&P 500 will outperform the EuroStoxx 50—a stark reminder that danger in Europe always precedes opportunity in America.

Relative performance of S&P 500 index to Euro Stoxx 50 Index (blue line); France 5-Year CDS (red line).

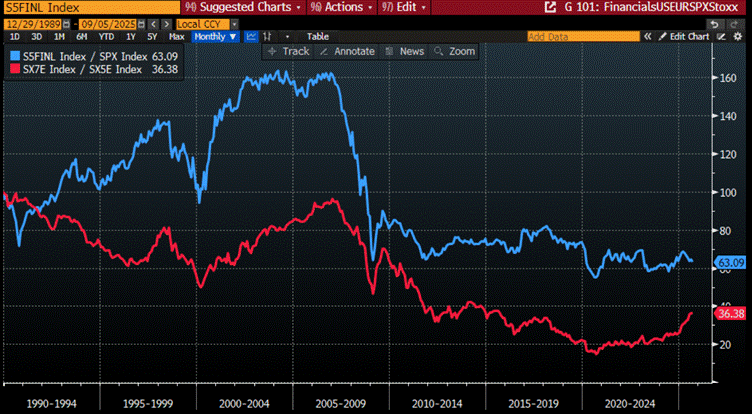

Beyond steering clear of the sinking Eurozone, investors must flee financials across all so-called ‘developed markets.’ History is clear: during the last sovereign debt crisis centered on the PIGS, banks and financials in both the U.S. and Europe massively underperformed their own equity indices—a stark reminder that the guardians of capital often become the first casualties.

Relative performance of S&P 500 Financials Index to S&P 500 Index (blue line); Euro Stoxx Bank Index to Euro Stoxx 50 index (red line).

As the American empire stumbles through its boom-bust death cycle and European unelected lamed ducks authoritarian leaders prepare their next ‘false flag’, investors have to follow the gold as history’s verdict is unchanged: tangible assets endure while paper promises burn. The future will not be won by those who innovate fastest, but by those who hold what cannot be printed, censored, or erased. Gold has outlasted empires; it will outlast this one.

In a nutshell, the playbook is simple: don’t get confiscated, don’t get frozen, and don’t get poor trying to get rich. In times like these, liberty and liquidity live in personal vaults—not in banks. And always remember: In Gold We Trust—Because Gold Is For War.

They whisper that Rothschild once said, “Control the money, and you control the laws,” meaning that the truth persists: whoever commands the currency commands the state, and the people remain powerless spectators to their own governance.

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

The PLAYBOOK for totalitarianism!!

What a classic, simple yet elegant writeup connecting the past with the future running through the course of the present. You have through this substantiative article established the playbook of freedom boasting, democratic leaders true modus operandi - Janus principle of duality!

This reading appears quite unbelievable to start with - reckless leadership riding on speculation over productivity, welfare over progress leading to debt explosion, external party bailouts, higher taxation, general confusion among the masses through propagandist media by outright gaslighting, manufacturing of an apparition as an enemy, bring on the war, war is a racket and establish totalitarian systems. The sad truth is, this seems to be the case, and you have boldly captured it and scintillatingly brought out the elephant in the room by painting it lucidly.

" WAR is a racket. It always has been. It is possibly the oldest, easily the most profitable, surely the most vicious. Only a small "inside" group knows what it is about. It is conducted for the benefit of the very few, at the expense of the very many." - General Smedley Butler

There are two brilliant future forecasts that you have captured in this writeup, and its sheer brilliance emanates from the fact to have expertly mind read the puppeteers (super government) of this illusory matrix and placed it for your audience - Digital currency and green initiative both leading to the totalitarian control. With green, EV has been fervently pushed, however logic defies wherein Lithium is a scarce metal in comparison to abundantly available Hydrogen. Is EV a programmable system which furthers the totalitarian control the wielders of modern finance are planting the seeds for? CBDC you have well established it with facts. CONTROL, CONTROL and more CONTROL seems to be the direction this article prognosticates and rightfully so.

"The inevitable World War III is poised to shift the economic and financial center of gravity eastward, with China—and most likely Hong Kong—emerging as the new hub of global capitalism. This would mark the eclipse of the globalist Keynesian agenda and the rise of a multipolar world driven by mercantilist ambitions." - This might be an altogether inadvertent consequence against the globalist's driven agenda to eliminate all class struggles and establish a Supreme master-lowly serf ecosystem, if it pans out the way this writeup predicts that will be a redemption to self-esteem of humanity !!

This article has faithfully followed the logic of the Greeks and their forewarning, the forerunners of most western systems, the inspiration of political and social of the modern western world carry with it the insignia of ancient Greeks.

"Dictatorship naturally arises out of democracy, and the most aggravated form of tyranny and slavery out of extreme liberty." - Plato

Thank you for laying out what seems to be truths, to an old man, who has seen this recurring theme!