Chilling April Won't Quell the Inflation Boomerang's Return

What’s behind the numbers?

Following the unexpected return of the inflation boomerang seen over the first quarter of the year, April's headline CPI surprised slightly on the cooler side, increasing by 0.3% MoM, below the expected +0.4% MoM, aligning with January's pace and below February and March's pace. Year-over-year, the headline CPI rose by 3.4%, in line with the consensus and one notch lower than the +3.5% YoY change in March. Under the hood, services cooled modestly MoM while energy-related costs are reaccelerating the most on a 3- and 6-month annualized basis.

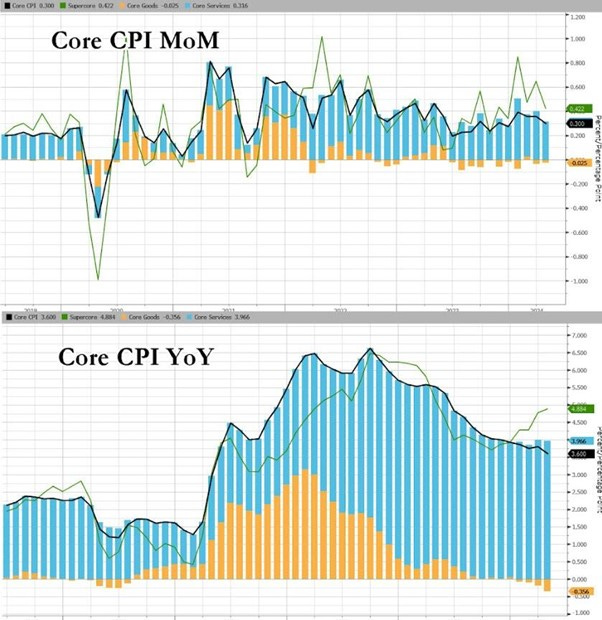

The core CPI rose by +0.3% MoM, meeting expectations, and also slowing the YoY change from +3.8% to 3.6% as expected. This April cooling was mostly related to core goods deflation while core services continued to rise.

Slamming even more the FED chairman's narrative that he still cannot see ‘the -flation’ in the US economy, the so-called Super Core index (Core CPI Services Ex-Shelter) surged by 0.5% MoM to reach 5.05% YoY, marking the highest level since April 2023.

Under the hood of Super Core CPI, education costs rose (to pay for cleaning up all those protests?), and transportation services dominated on a YoY basis.

Market reactions.

Lured by a phantasmagorical new disinflation trend, US stocks notched their 23rd record-high close.

It was a broad-based rally across sectors, with IT, Real Estate, and Healthcare leading the trend, while Consumer Discretionary underperformed after weaker-than-expected retail sales confirmed that the US consumer is leading the country into an inflationary bust.

In money markets, while June was already ruled out for the FED to cut rates, the probability of a 25-basis-point rate cut in July, in between the Republican and Democrat conventions, rose to 38%. The consensus now anticipates two cuts before the end of the year, with September being the date when the FED's pivot, a scenario that Wall Street dreams about for 18 months, is expected to potentially happen.

The Dollar sold off after the soft inflation data, with the DXY breaking below the 105 level.

Benefiting from a weak dollar and lower yields, gold rebounded but failed to reach new all-time highs.

Treasuries rallied across the curve after the soft US CPI and retail sales, as the bear steepener was hit by a wave of optimism that US Treasuries will act again as a safe haven in a weaker economic environment.

Thoughts.

After three strong core CPI prints for 2024 highlighting the ongoing challenges in achieving a sustained return to 2% inflation, the slightly cooler-than-expected April data mask the reality that while goods prices are deflating at the fastest pace since April 2004, services prices are stuck around +5.3% YoY.

Despite Wall Street's optimism about reaching the notorious 2% goal, this narrative is expected to fade further by summer, as supply constraints drive up goods inflation.

Instead of heeding the 'Forward Confusion' spread by Wall Street, examining the numbers for the rest of the year leads to three simple conclusions:

A return to 2.0% is almost impossible in 2024. Even if the CPI prints a 0.0% MoM for the rest of the year, the YoY change will end at 2.22%.

If a 0.3% MoM change becomes the new normal for the rest of the year, the CPI YoY change will end 2024 at 4.70%, just 80 bps below the current FED Fund Rate, leaving the FED with no margin to maneuver to implement even one interest rate cut this year.

If the MoM change sees a 0.4% or higher change, which could be the case if the rebound in oil and commodity prices continues, the YoY change will end the year at 5.53% or above 6.0%, meaning that the FED will have to raise rates, even maybe before the November election.

This once again confirmed that the magical immaculate 2023 disinflation owed more to luck (Chinese deflation; easing of supply chains) and base effects rather than to the FED's skills.

With the "Red Sea crisis" still yet to substantially affect the CPI data, given that there has been historically a six-month lag between the trend in the supply chain index and the year-over-year change in CPI, the risk for the rest of the year at both the headline and core levels is more tilted to the upside rather than the downside, regardless of the trend in shelter costs.

FED of New York Global Supply Chain Index (blue line); US CPI YoY change (red line).

Investors must remember that historically inflation moves in waves, and the 2020s resemble the 1940s and 1970s with geopolitical unrest (i.e., wars) and structural inflation related to tighter (related to the climate change scam) regulations which are constraining supply.

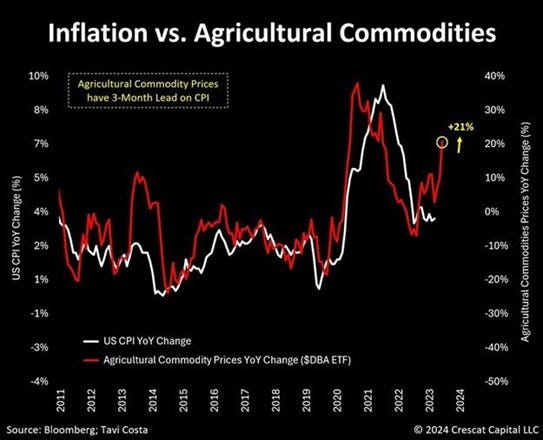

What the market still overlooked is that the second wave of inflation is typically driven by scarcity, resulting in higher energy and commodity prices. For instance, agriculture commodity prices have historically led to higher headline CPI in the following 6 months.

Indeed, higher energy prices ultimately feed into higher food production costs and likely increase prices across the economy. This means that investors should be ready to see a sharp rebound in headline CPI in the months to come.

WTI price (blue line); YoY CPI Change (red line); UN Food YoY Price Change (green line).

This second wave will push the US into the 'inflationary bust' phase of the business cycle (i.e. stagflation), which will be painful for those who are still blindly following the 'Forward Confusion' narrative of Wall Street.

In that context, the most probable scenario is that hopes of any rate cuts are once again disappointed in 2024. While the FED may need to raise rates in the current environment, it will likely stay on the sidelines to avoid being perceived as taking any political side, especially considering Powell and his colleagues' preference regarding the Oval office occupant after the November 5th election.

Bottom line: It is far too early to declare that the disinflationary trend has resumed. The April CPI report may give some hope to Wall Street bankers that the worst is behind us for this inflation cycle, but the last mile to the 2% target will remain as phantasmagorical as the FED pivot has been over the past 18 months. With geopolitical and social unrest both domestically and abroad, stagflation is anticipated to emerge by the end of the second quarter. Similar to the 1940s and the 1970s, characterized by geopolitical turmoil and wars, holding equities and hard assets in limited supply, rather than long-dated bonds, seems to be the most effective strategy for safeguarding investors' purchasing power.

Key takeaways.

After 3 CPI prints in 2024 which underscored the erratic process of reining in the inflation genie, a cooler April data is unlikely to be sufficient to ease the pressure of an upcoming second inflation wave.

The ongoing supply chain disruptions triggered by the geopolitical tensions in the Middle East are poised to start to fuel additional upward pressure on goods inflation in the forthcoming months.

As moderation in services is unlikely to occur, and uncertainties associated with the upcoming election will impact growth, the US economy is poised to enter a stagflation, characterized by inflationary pressures and economic stagnation.

Given the current circumstances, consensus forecasts for inflation in 2024 are still overly optimistic.

Easy financial conditions persist, offering significant support for the return of inflation, as evidenced by the resurgence of the ‘meme stocks’ trade over the past few days. Consequently, the FED is not done combating inflation if it remains serious about doing so.

After its latest ‘MayDay’ signal, even with the FED chairman unable to see ‘the stag and the flation’, despite its ‘Forward Confusion’ narrative, investors should get ready for an interest rate hike rather than a cut in 2024.

Amid rising deficits and persistent inflation, the US economy is moving in an inflationary bust (i.e. stagflation).

In a stagflation, investors have to understand that the way to protect their wealth is to avoid long dated government bonds and focus on a combination of the equity barbell portfolio made of Tech and Energy and Physical Gold as an antifragile asset.

As stagflation rather than recession materializes in the next few months, investors should prepare their portfolios for HIGHER volatility.

In this context, investors should also remain prepared for dull inflation-adjusted returns in the foreseeable future.

Bottom line: Investors should continue to prioritize investments in low-leverage companies capable of sustaining EPS and FCF growth amid economic weakness. This mostly includes sectors like Energy and Tech with quasi-monopolistic positions. In fixed income, investors should stay away from long dated bonds (in particular governments bonds with a maturity of more than 6 months) and If they really want to have a fixed income allocation, they should consider investment-grade corporate issuers with maturities no longer than 12 months. Long dated fixed income investments should be replaced by physical gold and other hard commodities for at least 50% of the portfolio. These new antifragile assets will stand to benefit from a scarcity premium during times of war and the rising possibility of an upcoming sovereign debt crisis in Europe first and in the US next.

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.