The Week That It Was…

The first week of the last month of Q2 promised to be a festive juggling act. In Asia, China kicked things off with the Dragon Boat Festival—because nothing says market volatility like racing boats and sticky rice—while the Muslim world closed out the week with Eid al-Adha celebrations. Meanwhile, investors performed their own ritual dance around economic indicators, eyeing ISM Manufacturing, Non-Manufacturing, and the ever-suspenseful May Non-Farm Payrolls report (a.k.a. Wall Street’s monthly mood swing trigger). And yes, 27 S&P 500 companies still reported earnings, though let’s be honest—unless you’re obsessed with CrowdStrike, Dollar Tree, or Broadcom, it was safe to hit snooze.

While the China–U.S. trade war “truce” might not even last as long as a TikTok trend, May’s China PMI landed exactly where expected. The official manufacturing PMI edged up from 49.0 to 49.5—still stuck in contraction, but hey, progress! (Blame the five-day holiday for the meh reading.) On the flip side, the non-manufacturing PMI dipped to 50.3 from 50.4, barely expanding and missing the mark of 50.5.

Looking ahead, China’s economy might catch a tailwind. With exports to the U.S. resuming and American importers likely to panic-buy like it’s Black Friday, both manufacturing and services could get a lift. Add in a quicker fiscal stimulus rollout in Q1, and the growth engine might finally start humming—at least until the next trade tantrum. In the near term, Beijing seems content to watch and wait, focusing on rolling out the March expansionary budget rather than dropping fresh policy bombs. But things could heat up by late July: Q2 GDP lands mid-month, the Politburo meets soon after, and the 90-day tariff pause ends in early August. If tensions flare again, expect policymakers to reach into their stimulus toolkit—think a 10-bp rate cut and a 25-bp RRR trim in Q3. Should tariffs return with a vengeance, a hefty supplementary budget may not be far behind.

As expected by the perfectly choreographed Stalinist choir of 52 out of 52 economists, the ECB delivered its 8th straight rate cut—trimming deposit rates by 25bps to 2.00%—in yet another politically convenient move that won't do much to cheer up the ‘Disruptor In Chief’ on the other side of the pond. In a masterclass of repetition, the ECB reassured investors (twice) that inflation is basically hovering near their sacred 2% target, while wage growth is "moderating" and profits are politely soaking up the rest. April’s trade drama? No big deal—markets calmed down, so carry on. CPI forecasts were nudged down for 2025 and 2026 (thanks, energy prices), while core CPI and GDP projections were left untouched. In short: nothing to see here, folks—just another central bank cutting rates into stagflation and calling it a plan.

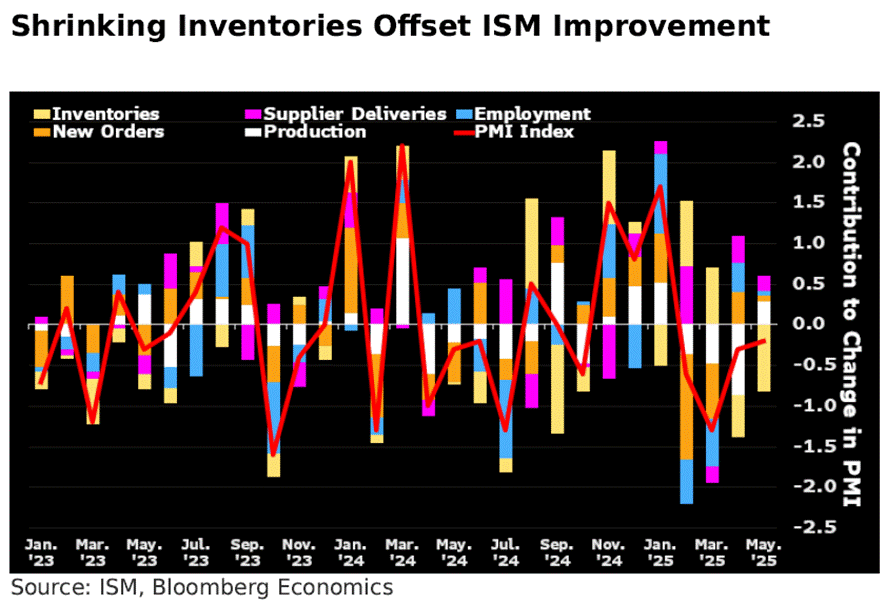

In the US, the ISM Manufacturing PMI may have dropped to 48.5 in May, disappointing headline watchers, but let’s not pop the recession champagne just yet. Beneath the doom-and-gloom exterior, there’s a mildly less depressing story: new orders and employment nudged higher, customer inventories are running low, and order backlogs are improving—all signs that activity could rebound soon, especially if the tariffs’ ceasefire lasts after the Summer. Sure, supply chains are still wheezing, and imports fell off a cliff, but even the prices-paid index cooled a bit. So, while the headline screams contraction, the internals whisper, “Hold the panic—for now.”

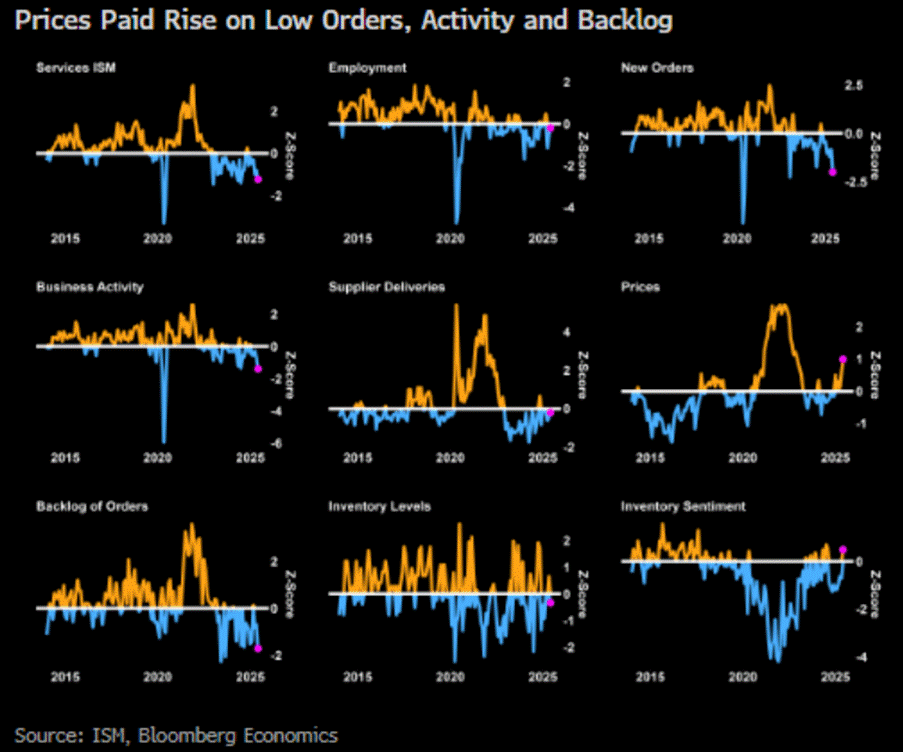

May’s ISM Services Index dipped into contraction at 49.9, and the culprit was classic: businesses hit the brakes on new orders thanks to tariff chaos, while suppliers gleefully jacked up prices. So now service providers are stuck playing hot potato with rising costs—trying to pass them to consumers but likely eating them through squeezed margins. New orders plunged to 46.4, business activity flatlined at 50, and prices-paid hit their highest since 2022. On the bright side, employment ticked up to 50.7—probably thanks to last-minute seasonal hires squeezing in before tariffs kick back in.

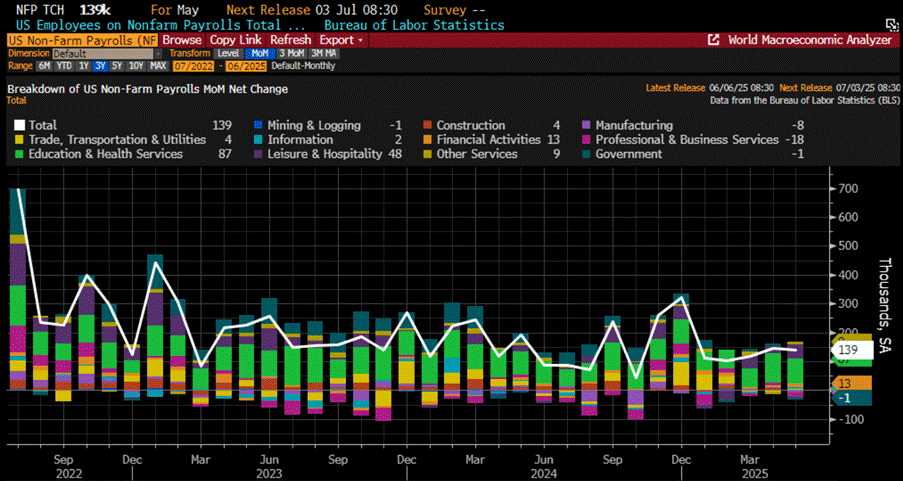

May’s jobs report came in hotter than expected—headline payrolls rose, and leisure, hospitality, and trade didn’t flop as badly as feared. Under the hood, things look shakier. Household employment fell, labour force shrank, and past months got revised down (because of course they did). Also, those payroll gains? Probably overstated by 60–90k a month thanks to the BLS’s magic math on business “births and deaths.” When you strip that out, real job growth looks more like 50–70k—aka "meh." Welcome to the job market recovery that looks solid… until you read past the first paragraph.

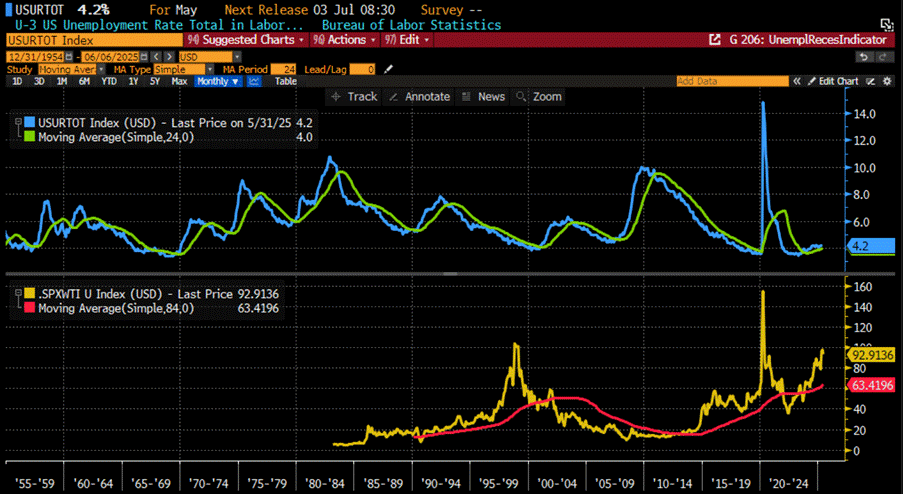

The unemployment rate? Steady… but for all the wrong reasons. Turns out, it's not that people are finding jobs—it’s that they’re disappearing from the labour force, possibly out of fear of deportation. Charming. On top of that it has stayed above its two-year average since September 2023. Historically, this suggests that economic clouds could gather over the next 12–24 months.

Upper Panel: US Unemployment Rate (blue line); US Unemployment 24 months moving average (green line); Lower Panel: S&P 500 to WTI ratio (yellow line); US S&P 500 to WTI Ratio 84 months moving average (red line).

The Fed’s likely reading this as a slow-motion labour market cool-down, but with firms ready to pass on tariff costs soon, don’t expect any rate cuts before September—if we’re lucky..

In the never-ending circus of rate-cut fantasies, Wall Street’s cheerleaders—and the “Manipulator-in-Chief”—are still out here waving pom-poms for some magical FED rate cuts. Once dreaming of six cuts, they’re now clinging to the hope of just two by year-end (bless their hearts). September is the latest date pinned on the FED’s comeback tour—if the economic gods allow it of course. But let’s be real: there might be no cut at all. With inflation creeping back like the bad sequel nobody asked for, the FED might even hike—just to prove it’s still got a pulse.

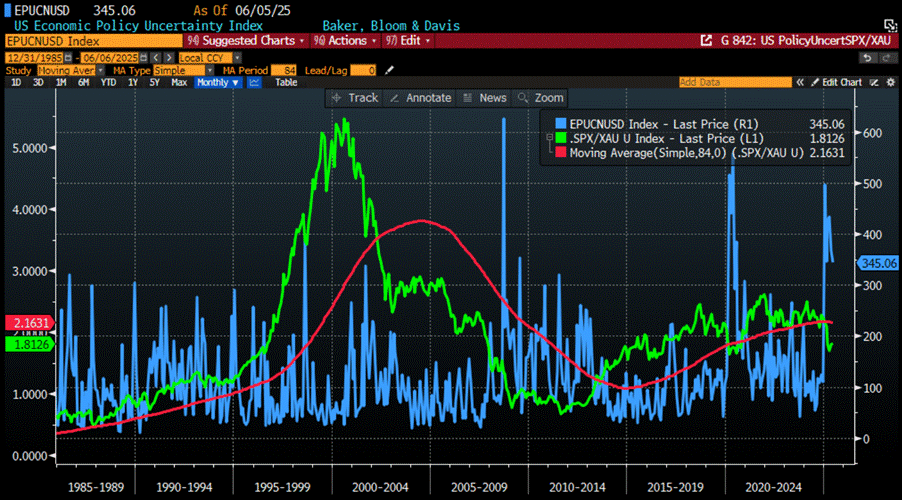

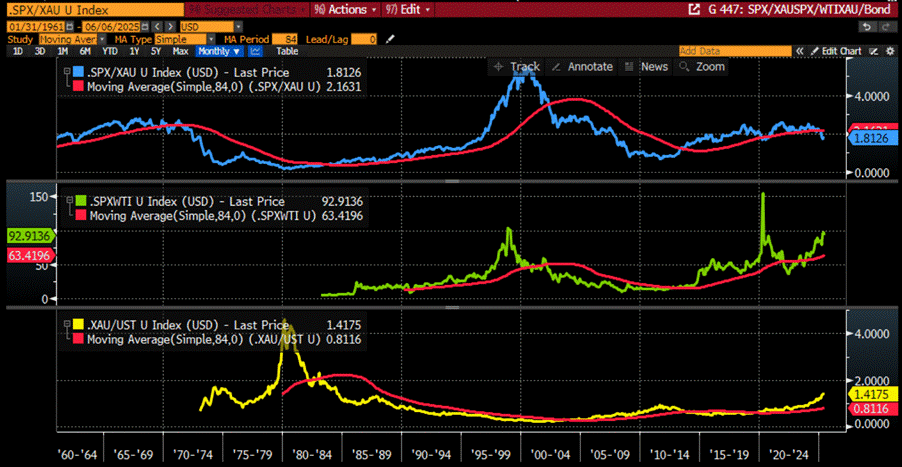

When future investors and historians look back at the “Jubilee Year” of 2025, they’ll likely note two things happened on January 20: the 'Disruptor in Chief' was sworn in as the 47th U.S. president, and the S&P 500-to-gold ratio broke below its 7-year moving average—for the first time since May 2020. Quite a cosmic alignment. The self-styled Mr. Nice Guy, also known as the Manipulator-in-Chief, seems to think he's some kind of messianic problem-solver like his ‘Tech Bros’ who have now filled the Washington Swamp but with a bigger ego and worse timing.

June 1st will go down in history much like Archduke Ferdinand’s joyride or Hitler’s casual saunter into Poland—brilliantly reckless. This NATO-approved strike on Russian nuclear bomber bases—yes, the ones not even involved in Ukraine’s so-called "Special Operation"—is exactly the kind of masterstroke historians will pinpoint as the opening scene of World War III.

Anyone who's spent more time reading actual finance books than doomscrolling Truth Social knows this kind of move rarely bodes well for the U.S. economy—or markets, for that matter. With the ‘Disruptor in Chief’ back behind the Resolute Desk, 2025 was always destined to be a chaos year. As a matter of fact, the world is deep in the chaos cycle now—where disruption, geopolitical drama, and policy U-turns are the norm. Risk isn’t priced in straight lines anymore; it’s priced in plot twists. Fundamentals have taken a backseat to narratives, and volatility isn’t a bug—it’s the main feature. In this new reality, the winners aren’t the optimists—they’re the ones who can zig when everyone else zags.

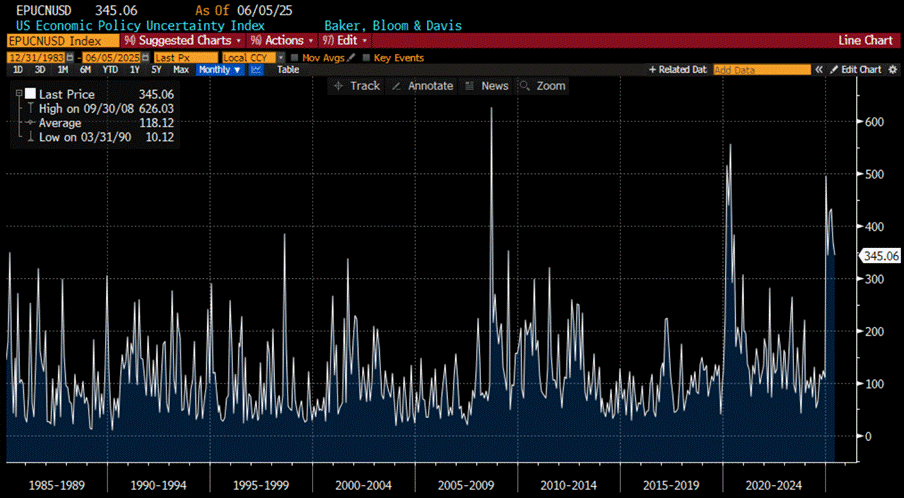

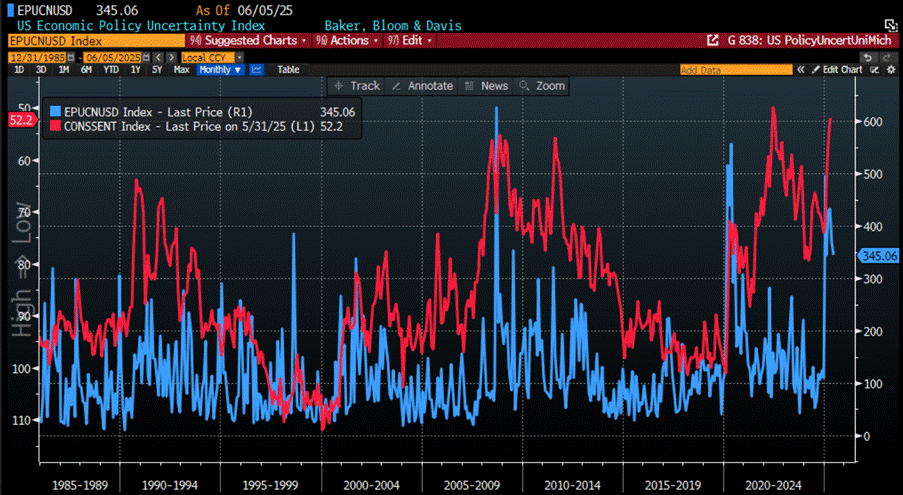

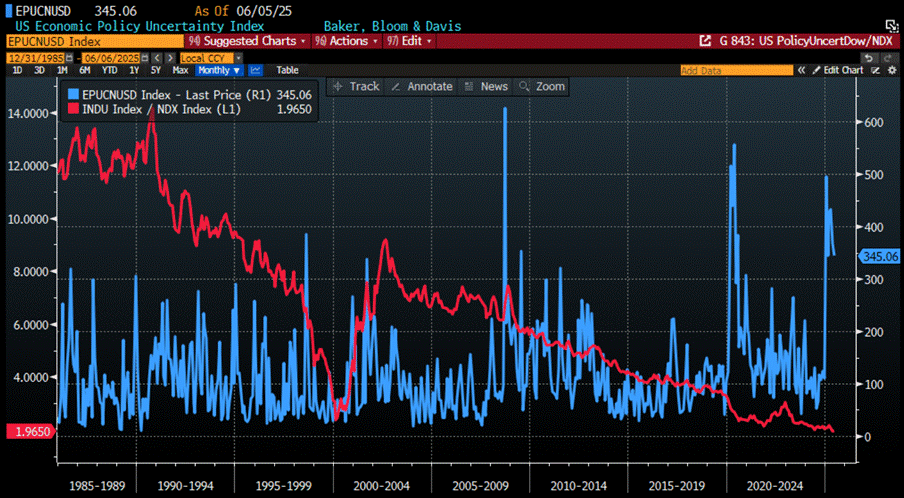

Policy uncertainty has now blown past levels seen during Trump’s first term—and yes, it could get even messier. The latest surge in anxiety stems from the “reciprocal” tariff plan, which, despite being unveiled, still leaves plenty of room for plot twists, retaliation from trading partners, and yet more tariffs. The Economic Policy Uncertainty Index (courtesy of Baker, Bloom, and Davis) confirms the mood. It's built by scanning U.S. newspapers for the usual suspects: “economy,” “uncertainty,” and government buzzwords like “legislation,” “deficit,” or “White House.” Without doubts, the headlines aren’t exactly soothing.

US Economic Policy Uncertainty Index since 1984.

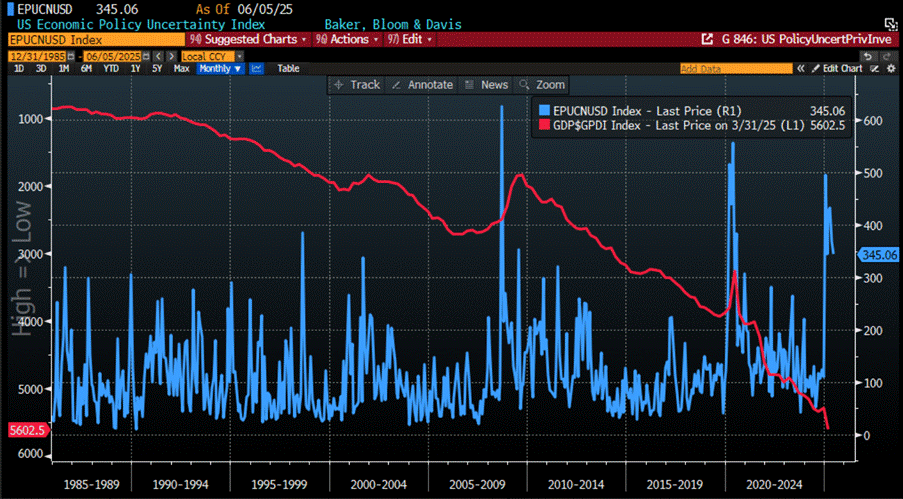

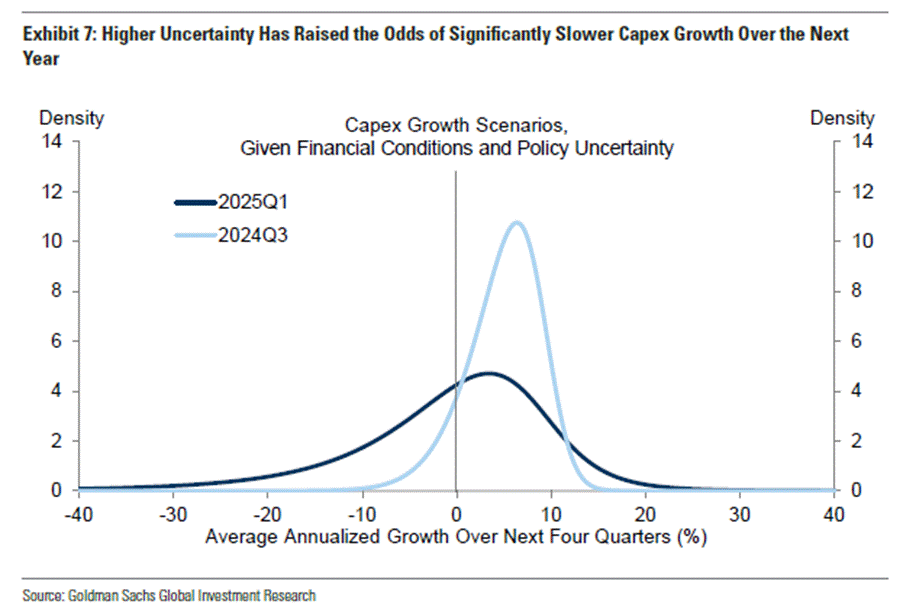

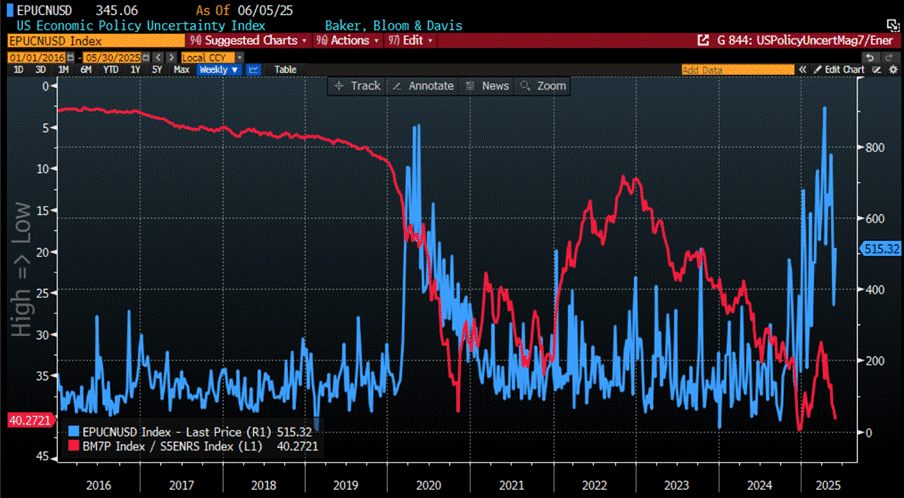

Using previous studies (and a dash of economic dread), this uncertainty is dragging business investment down by about 5 percentage points. In plain English: capex are expected to flatline, and there’s a 45% chance it actually shrinks over the next year. Why worse than round one? Because this time, way more U.S. companies are in the blast zone—not just from tariffs, but from fiscal and immigration policy fog as well.

US Economic Policy Uncertainty Index (blue line); US GDP Private Domestic Investment Index (axis inverted; red line).

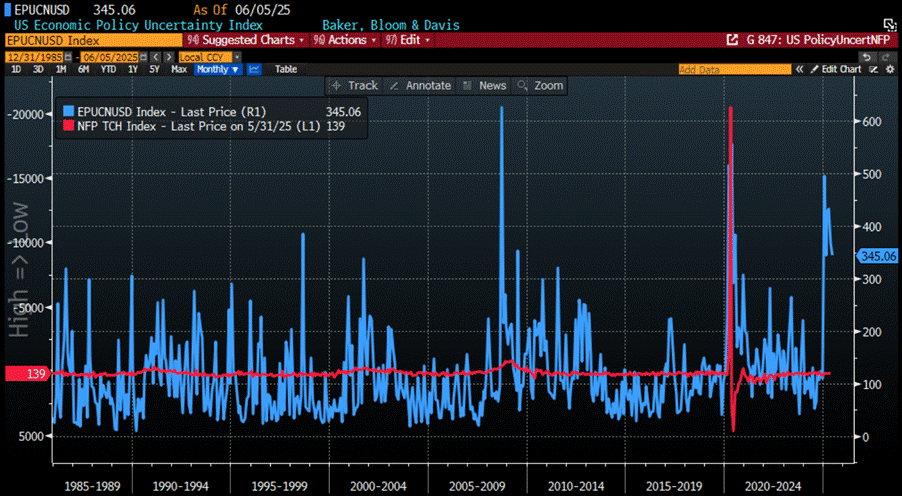

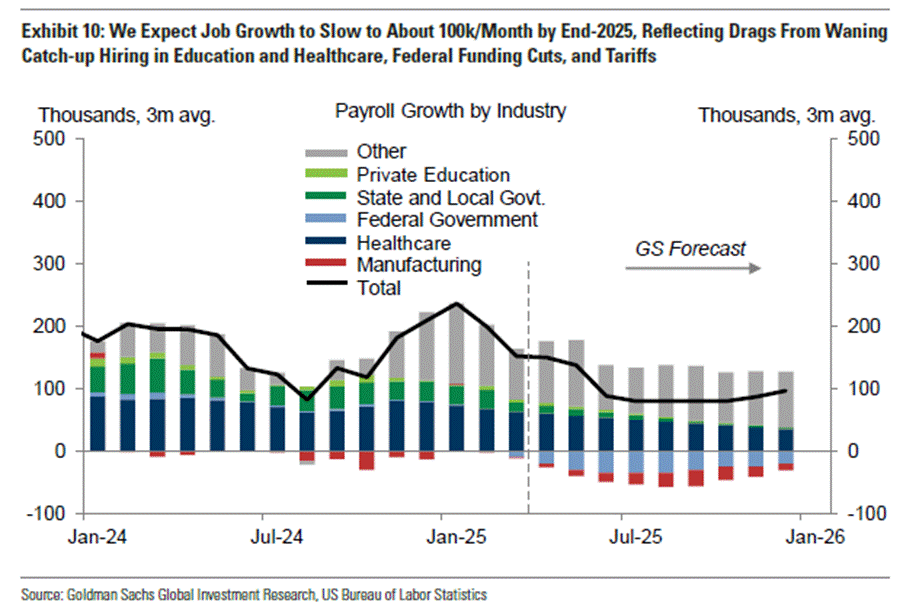

On the hiring front, trade war déjà vu could slash 20,000 jobs a month, while cosmetic federal spending cuts may chip away another 25–30k in government roles. Add in funding jitters in sectors like education and healthcare, and you’ve got another 35,000 jobs hanging in the balance. So far, the data hasn’t caught up—but don’t get too comfortable.

US Economic Policy Uncertainty Index (blue line); US Change in Non-Farm Payrolls (axis inverted; red line).

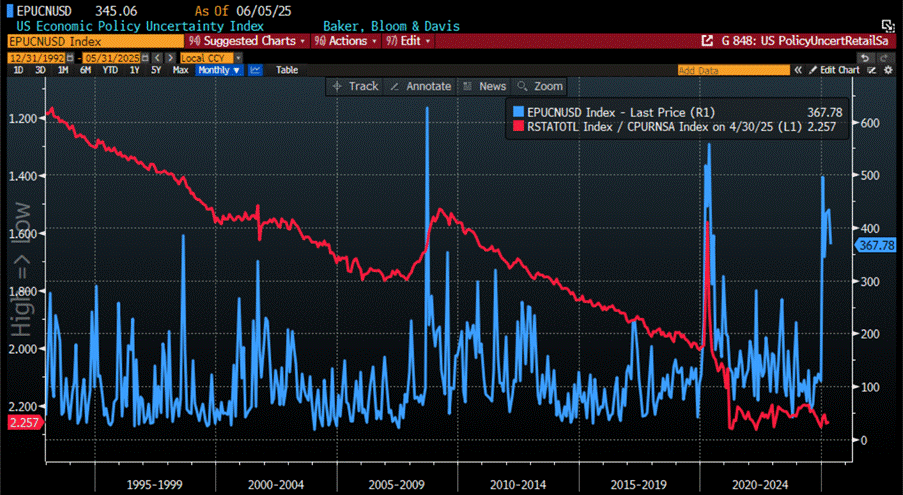

As for consumer spending, the slowdown is already baked in: slower job growth, real income hit by tariffs, and stock market woes turning last year’s feel-good wealth effect into a drag. If fear keeps climbing, savings rates might spike too—though let’s be honest, survey-based predictions and even government data are often as reliable as campaign promises.

US Economic Policy Uncertainty Index (blue line); US Retail Sales Index adjusted to US CPI Index (axis inverted; red line).

Since Inauguration Day, policy uncertainty—especially on trade—has spiked faster than a meme stock on Reddit. The US has recently hit levels above the chaos levels of Trump’s first term, with more turbulence ahead as new policies drop and global trade partners plot their revenge.

What’s fuelling this mess? The return of the ‘Disruptor in Chief’ and his beloved “reciprocal” tariffs of course—basically a trade war with everyone at once. But let’s be honest: U.S. manufacturing wasn’t destroyed by foreign villains—it was gutted by platform giants (hello, Maleficent 7) who offshored production, exploited tax havens like Ireland, and funnelled their monopoly profits not into innovation but into boardroom bonuses and massive share buybacks. Real economic patriotism, Silicon Valley style.

US Economic Policy Uncertainty Index (blue line); US Trade Policy Uncertainty Index (red line).

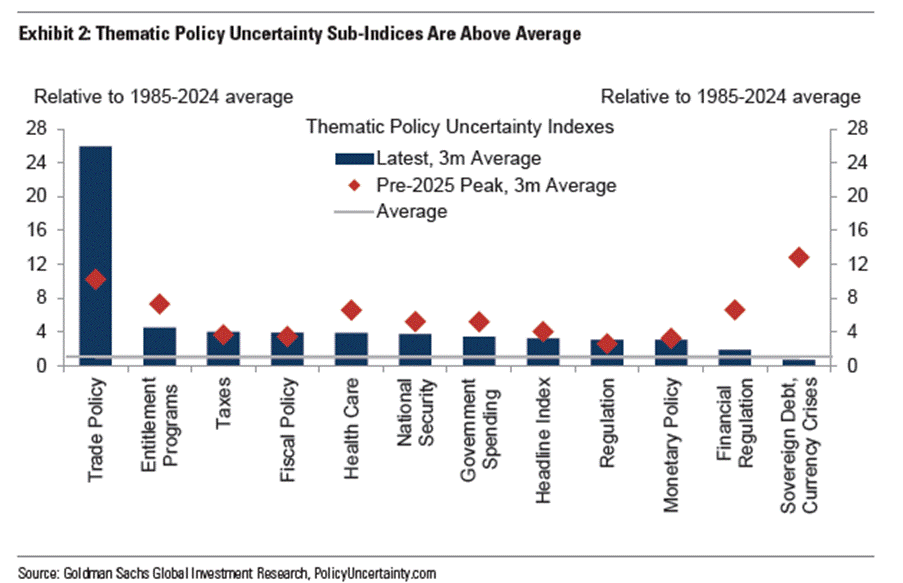

Interestingly, while trade policy uncertainty is off the charts, most other policy-related uncertainty indices are also running hot. Translation: even businesses that don’t import a single widget are in for a wild ride. Uncertainty isn’t just global—it’s gone domestic.

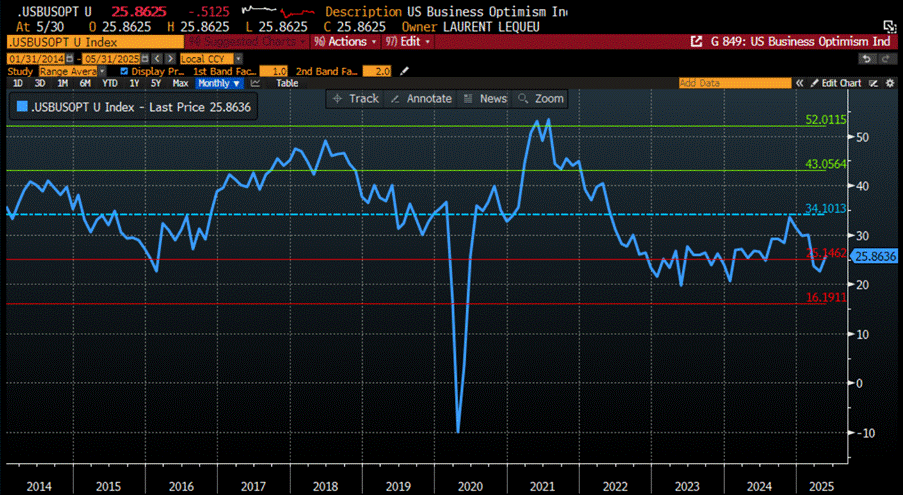

Indeed, policy chaos and looming tariffs are already souring the mood. The US Business Optimism index, a mix of 8 surveys from US ISM Manufacturing and Services sectors and regional FED business survey tanked below 1 standard deviation below the 10-year mean in March. And that was before the “reciprocal” tariff bombshell even dropped. Confidence, it seems, packed up early.

US Business Optimism Index since 2014.

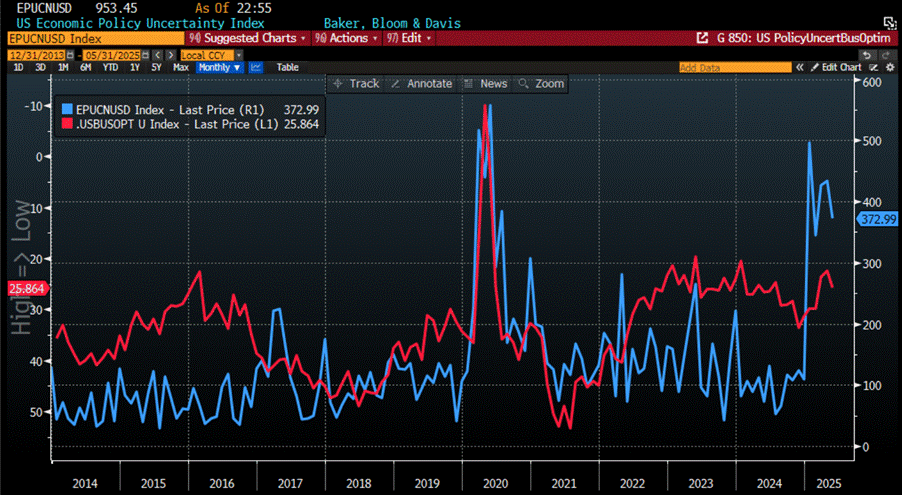

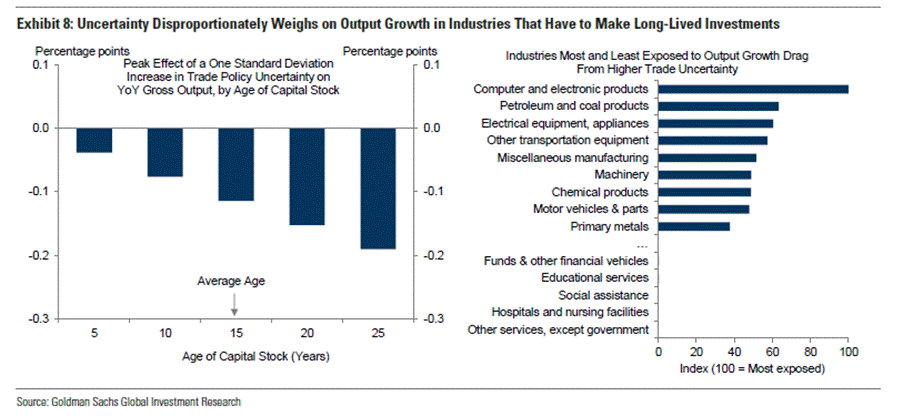

Elevated uncertainty tends to freeze decision-making—firms and households alike delay big, irreversible investments. Academic research back this up: when policy signals get murky, capital spending pulls back. During the last trade war, policy uncertainty chipped away albeit modestly.

US Economic Policy Uncertainty Index (blue line); US Business Optimism Index (axis inverted red line).

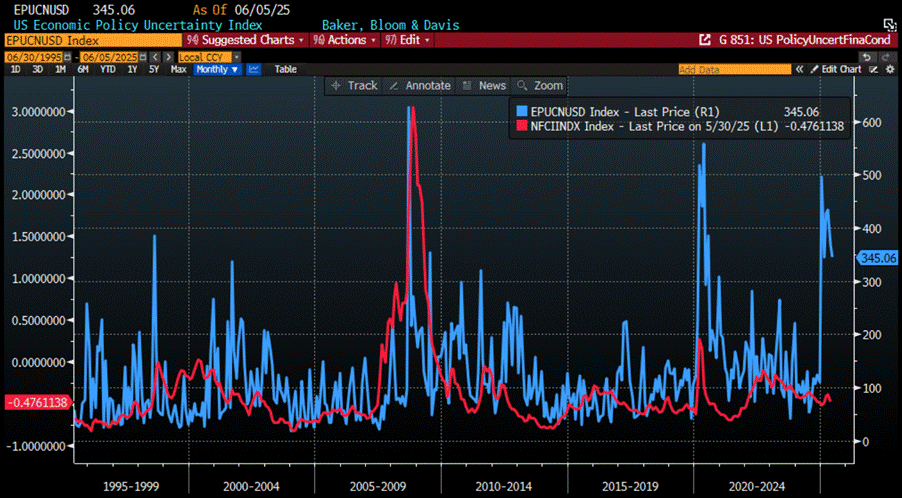

Now it’s not just policy uncertainty giving everyone migraines—financial conditions are tightening too. And with more tariffs likely (because why stop now?), investors should brace for further stress. U.S. financial conditions have long been the canary in the coal mine for banking trouble—so if that bird starts gasping, don’t act surprised.

US Economic Policy Uncertainty Index (blue line); Chicago FED Financial Conditions Index (red line).

Anyone with even a shred of financial literacy knows that tighter financial conditions mean slower economic growth—and a fatter tail of downside risk. The same logic applies to policy uncertainty: it doesn't just drag the baseline down; it makes bad outcomes more likely. To put numbers to it, computing quantile regressions of capex growth one year out, using inputs like financial conditions, policy uncertainty, unemployment, and past capex. The results show that not only has the average outlook for business investment nosedived, but the odds of negative growth have tripled—from 15% in Q3 2024 to 45% today. In other words, the floor just got a lot closer.

Turns out, uncertainty hits hardest where it hurts most—industries that rely on long-term investments and global trade. Shocking, right? Regression analysis confirms the obvious: the older and more capital-heavy the gear, the bigger the growth drag. On the bright side, if you're in manufacturing—especially in computers, electronics, appliances, or chemicals—you get to lead the race... to the bottom.

The job market is also in for a reality check. Trade policy uncertainty alone is expected to drag down manufacturing jobs by 20k a month—call it the tariff tax on employment. Add in federal spending cuts, and Uncle Sam’s trimming another 25–30k jobs from his own payroll. And that's before you count the 35k monthly hiring freeze hitting healthcare, education, and local governments—the sectors that were doing the heavy lifting post-pandemic. Basically, sectors that bulked up on jobs after COVID are running out of gas, just as D.C. decides to play budget surgeon. Combine all this, and by end-2025, payroll growth could limp along at just 100k a month. Best-case scenario? Labor supply slows enough to cushion the blow. Worst-case? An abrupt hiring freeze and the unemployment rate gets a rude wake-up call.

When it comes to consumer spending, the slowdown is basically baked in. Slower labour supply growth plus rising uncertainty = weaker job and income growth. Tariffs add insult to injury by acting like a stealth tax, eroding real disposable income. But wait, there’s more. Uncertainty’s hitting portfolios too). On top of that, consumer mood is souring. Fear of layoffs is spiking, with the Michigan survey flashing post-GFC levels of anxiety. While these gloomy vibes haven’t had a huge statistical impact historically, common sense says people who think they might lose their job tend to spend less. So, yeah—between job jitters, tariff hits, and shrinking 401(k)s, don’t expect a consumer-led rally anytime soon.

US Economic Policy Uncertainty Index (blue line); University of Michigan Consumer Sentiment Index (axis inverted; red line).

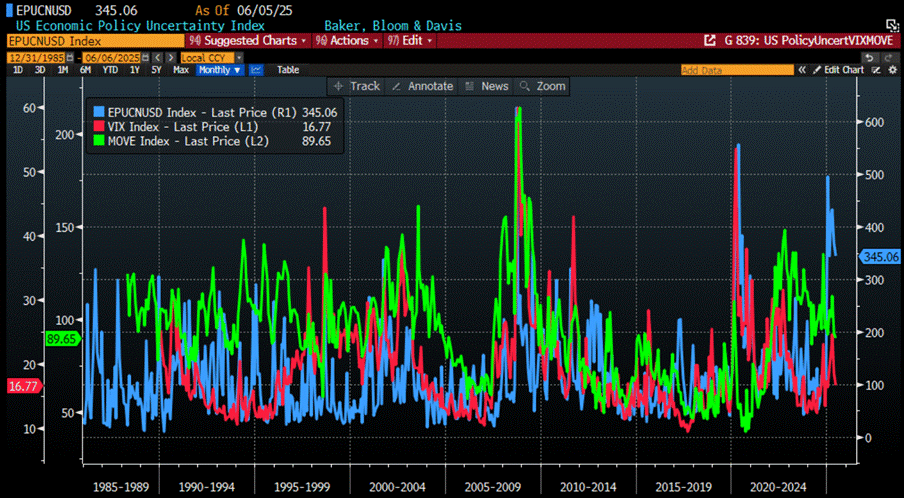

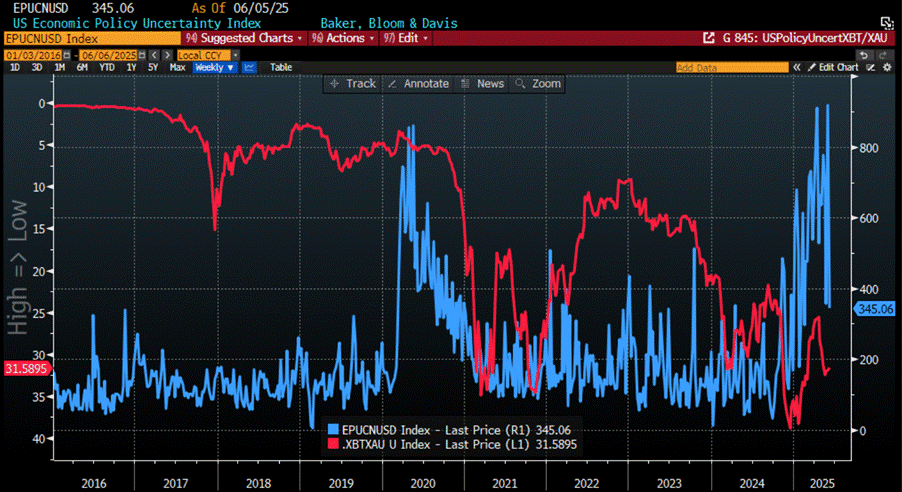

No PhD in economics, finance, or psychology needed here: higher policy uncertainty means one thing for investors—more volatility. And it’s not just stocks getting jittery; bonds take a hit too. When trust in public institutions and the rule of law starts to wobble, the very contracts governments issue—like those trusty Treasuries—start looking a lot less “trustworthy.”

US Economic Policy Uncertainty Index (blue line); CBOE Volatility Index (VIX Index) ( red line); ICE BofA Move Index (green line).

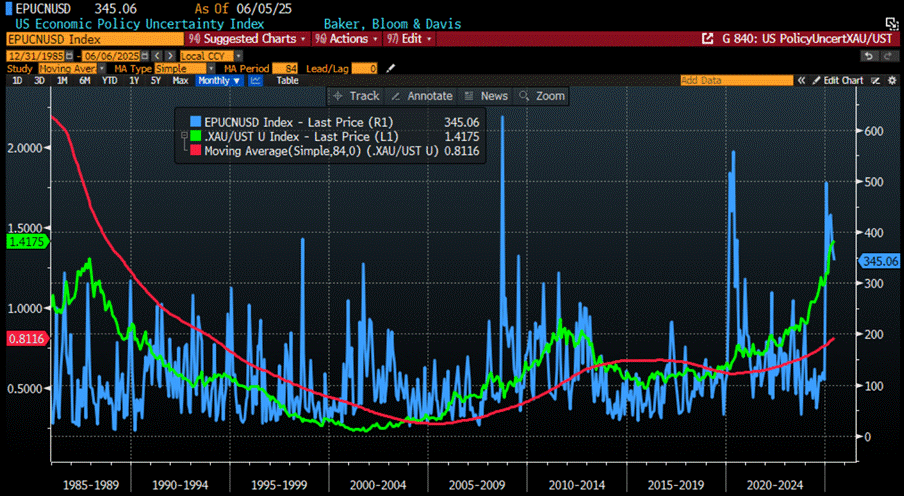

When it comes to the business cycle, rising policy uncertainty is like adding fuel to the inflation fire. Anyone who’s studied cycles knows inflation thrives on shortages—whether it’s demand outstripping supply or plain old distrust in public institutions. So yeah, uncertainty isn’t just noise; it’s pushing the economy deeper into inflation mode.

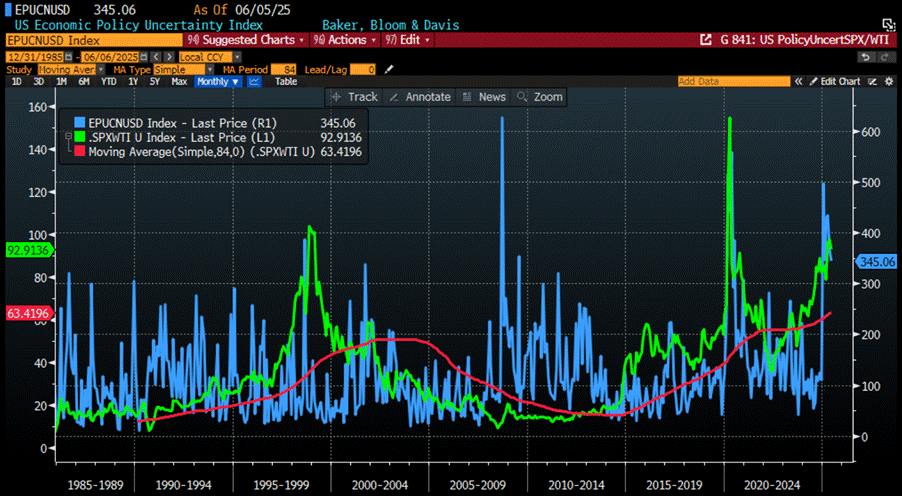

US Economic Policy Uncertainty Index (blue line); Gold to US Treasury Index ratio (green line); 7-Year Moving Average of Gold to US Treasury Index ratio (red line).

Behind all the political smoke and propaganda-fed “economic data,” savvy investors know better than to trust those politically doctored GDP numbers. The real crystal ball? The S&P 500 to Oil ratio and how it stacks up against its 7-year moving average—that’s the only honest signal showing if the US economy’s booming or busting. Every time policy uncertainty spikes, the economy usually crashes from boom to bust within 12 to 24 months. No matter what Wall Street spin doctors and politicians’ tweet, this time won’t be any different.

US Economic Policy Uncertainty Index (blue line); S&P 500 Index to Oil ratio (green line); 7-Year Moving Average of S&P 500 Index to Oil ratio (red line).

The same investors who’d rather crack open a book than tune into the ego-fests in the Oval Office know this: the S&P 500 to Gold ratio, especially how it sits against its 7-year moving average, is the only reliable gauge of the monetary illusion driving the US economy from boom to bust. So it’s no shock that rising policy uncertainty has pushed this ratio down, crashing below that moving average — historically the canary in the economic coal mine and a red flag for markets. And with the US heading into what will go down in the history books as the ‘Trump Stagflation,’ this ominous signal couldn’t be clearer.

US Economic Policy Uncertainty Index (blue line); S&P 500 Index to Gold ratio (green line); 7-Year Moving Average of S&P 500 Index to Gold ratio (red line).

While policy uncertainty climbs in the land blessed by two gorgeous oceans on its borders, across the pond Europe’s elite—still preaching their Malthusian WEF gospel—are practically begging for World War III to break out. Why? Because nothing says “unity” like rallying around a hot mess of a war to distract citizens from the grim economic reality crushing powerhouses like Germany and France, both speeding toward an unavoidable sovereign debt disaster. Remember when Merkel casually admitted that Germany and France never had any intention of honoring the Minsk Agreement—the very deal that might’ve stopped this whole mess?. And of course, the number one rule in the NEOCON playbook is: don’t talk to the enemy. So no European leader dares pick up the phone to Putin. Meanwhile, it took Trump—love him or hate him—to actually open a line of communication, and now the establishment is doing everything they can to shove him into this conflict. Because who needs peace when you have politics?

Fast forward to June 2025, and there’s le Petit Napoléon—self-lamed duck ruler of France’s fate—off to Asia giving lectures on the utterly phantasmagorical Russian threat. Not stopping there, he’s also busy threatening China and North Korea with an expansion of the ‘North Atlantic Terror Organisation’ (a.k.a. NATO), all to spread its warmongering gospel across Asia. Because nothing screams diplomacy like waving big sticks and stirring the pot halfway around the world.

https://www.politico.eu/article/macron-china-keep-north-korea-out-ukraine-nato-to-asia/

Sun Tzu’s Art of War says sowing doubt and fear inside the enemy camp is key—funny how fake news and European politics seem to be doing that to their own people instead. They preach this is just Ukraine vs. Russia, yet push NATO troops into Ukraine and stir up drafts across Europe. Even a blind man can see the “fake news” narrative is, well, fake—governments do the exact opposite. Putin got played once with the Minsk Agreement; he won’t fall for another peace deal while the West keeps arming Ukraine.

Sun Tzu favored spying and deception over chatting it out—winning by tricking the enemy into self-destruction, not by hugging it out. NATO/EU strategy? Use Eastern Europeans as cannon fodder to weaken Russia, so they can stroll in later without lifting a finger. Just look at the meddling in Romanian elections—more pawns in the game. Trump? He won’t get peace unless he wakes up from the NEOCONs’ puppet show. Meanwhile, neutral Switzerland and Sweden got roped in, risking their people for someone else’s war game. Classic.

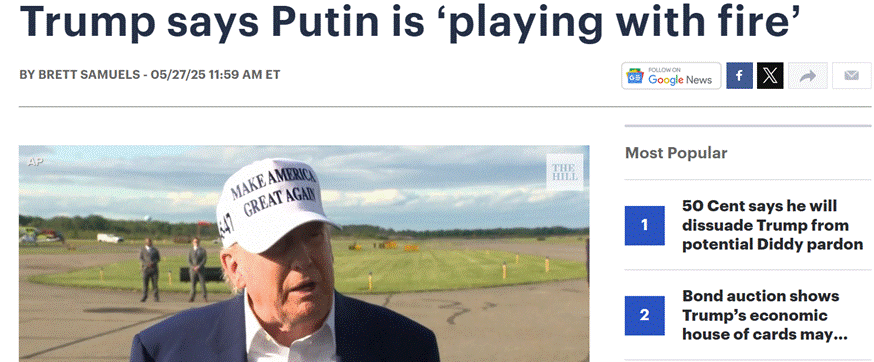

Trump started out against the war, but it looks like he’s taken a sharp wrong turn—probably listening to those NEOCONS still lurking in the shadows. His tough talk on Putin isn’t just tough; it’s downright provocative. This isn’t some business deal to negotiate over a boardroom table. If he can’t see that it’s really the EU and NATO sabotaging any peace deal—because they crave war and couldn’t care less about their own people—then buckle up for World War 3.

https://thehill.com/homenews/administration/5319856-trump-criticizes-putin-russian-attacks/

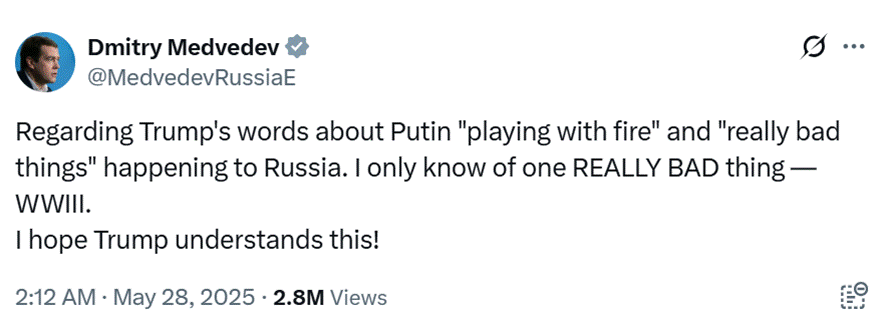

Former Russian President Dmitry Medvedev fired a not-so-subtle warning shot at Trump on May 28th, as tensions between nuclear powers escalate. Posting on X, Medvedev called out Trump’s “playing with fire” remarks about Putin, saying, “I only know of one REALLY BAD thing — WWIII.” And, just to make sure the message landed, he added, “I hope Trump understands this.”

https://x.com/MedvedevRussiaE/status/1927427723028238477

In a nutshell, since the Manipulator in Chief took office, the S&P 500-to-gold ratio has lived below its 7-year moving average—a quiet alarm for those paying attention. As the war cycle heats up, investors should stop pretending they can bend the business cycle and instead adapt. That means shifting the focus from Return ON Capital to Return OF Capital.

The antidote? Real assets. Physical gold and silver remain the only truly antifragile stores of value—no counterparty, no nonsense, no digital surveillance. Broader commodity exposure is also essential to survive the storm stirred by the Commodity Leviathan.

Active cash management is equally vital: stick to short-dated, IG USD bonds (<12 months) and T-bills (<3 months) to generate income and preserve flexibility. In equities, favor lean, low-leverage businesses with strong EPS and free cash flow—especially those that actually pay taxes and are set to benefit from the trade war and the reindustrialization of America. Prioritize energy and commodity producers to consumers. In short: farewell, Goldilocks. Say hello to Gold-In-Lots.

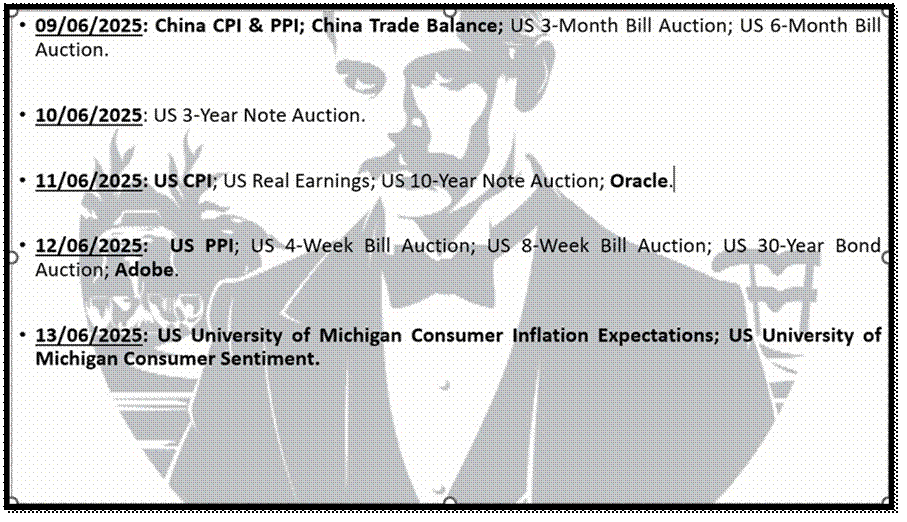

What’s On The Agenda Next Week?

As the Catholic world marks Pentecost, investors will be celebrating their own sacred ritual: obsessing over inflation data from China and the U.S., while consulting the gospel according to the University of Michigan on consumer sentiment and inflation expectations. Meanwhile, 14 S&P 500 companies will report earnings—but let’s be honest, only Oracle and Adobe are worth more than a passing glance unless you're a fan of financial fan fiction.

KEY TAKEWAYS.

As the power of uncertainty spreads like wildfire through chaos and business cycles, the key takeaways are:

China’s economy is treading water for now, but with exports rebounding, stimulus in motion, and another trade war cliffhanger looming in August, the real action may just be warming up.

The ECB cut rates for the 8th time, declared victory over inflation (again), and called it a strategy—while growth flatlines and the Fed watches with popcorn.

May's ISM headline says "contraction," but under the hood, it's more "not dead yet" than full-blown recession.

As demand is stalling, costs are soaring, services are stuck in the middle of a very unfunny squeeze play.

May’s job report looks solid on the surface, but dig deeper and it’s more smoke, mirrors, and vanishing workers than real labour market strength.

With Trump back in the Oval Office, 2025 is shaping up as a chaos-fueled rollercoaster where soaring policy uncertainty, endless tariff twists, and nonstop volatility make zigging when others zag the only way to survive.

Business investment is in the fetal position as uncertainty spreads beyond tariffs to fiscal and immigration chaos, leaving capex shrinking and the economy bracing for impact.

Consumer spending is stuck in slowdown mode—tariffs, job jitters, and market dips have killed the vibe, and if fear keeps rising, expect a savings spike and spending slump.

It’s not just policy chaos anymore—tightening financial conditions are piling on, and with more tariffs looming, don’t be shocked if the canary in the banking coal mine keels over.

Rising Policy Uncertainty = Rising Volatility, and when trust in institutions cracks, even Treasuries start looking more like IOUs from a shaky hand.

When policy uncertainty surges, inflation catches fire, market signals crack, and with the S&P 500 to gold ratio plunging, the canary’s not just singing—it’s screaming: welcome to the Trump Stagflation.

As U.S. Treasuries lose their appeal, investors are turning to gold—THE antifragile asset amid mounting debt and market chaos.

As the US economy shifts into an inflationary bust, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

Gold and silver are eternal hedge against "collective stupidity" and government hegemony, both of which are abundant worldwide.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

The first week of the third month of the second quarter—aside from the Rasputin-esque feud between the Manipulator-in-Chief and his former Plutocrat-in-Chief—will be remembered by investors as the second consecutive week of a market rebound, something we hadn’t seen since early January. That was when the Manipulator-in-Chief was sworn in and both consumers and investors were still mesmerized that he had been elected to "Make America Great Again"—for the citizens, not his plutocratic backers.

However, momentum indicators on a daily basis, such as RSI and stochastics, are increasingly toppish and have failed to make new weekly highs. While the S&P 500, Nasdaq 100, and Dow Jones have broken above the upper bounds of the downtrend that had formed since February, momentum is now overbought and pointing to an imminent rollover. This could bring the Nasdaq 100 and S&P 500 down to their respective 76.4% Fibonacci retracement levels (20,882 and 5,837), and the Dow Jones and Magnificent 7 to their 61.8% retracement levels (41,841 and 24,199), suggesting broader market headwinds remain.

With retail FOMO still driving market enthusiasm and short-term indicators starting to roll over, investors should brace for a pullback in the coming month. A potential retest of the 50% Fibonacci retracement levels (Nasdaq 100: 19,382; S&P 500: 5,491; Magnificent 7: 23,089; Dow: 40,842) could trigger another round of bearish panic. However, if those supports hold, it may offer the last tactical buying opportunity of the year.

Since the “tariff tantrum” faded on April 21, all major U.S. equity indices have been forming higher lows—suggesting the year’s bottom may already be in. While geopolitical shocks, not economic data, may drive the next dip, long-term investors should remain focused and not be swayed by doom-and-gloom headlines. These higher lows could be setting the stage for new all-time highs—especially for the Dow in the second half of the year. With all major indices showing daily bullish reversals since April 25, the April 8 lows (S&P 500: 4,982; Nasdaq 100: 17,090; Dow Jones: 37,645) may well have marked the 2025 bottom. Smart money will be buying the next dip—regardless of the noise from the Wall Street pundits.

As of June 6th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for more than 4 months, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

While the ‘Disruptor-in-Chief’ and his ‘Treasurer-in-Chief’ are busy “tariffying” America into greatness, their Truth Social-style policymaking—equal parts improv comedy and economic roulette—has brewed a storm of uncertainty for investors, business owners, and consumers alike. With Executive Orders flipping faster than pancakes on a campaign trail, it’s no surprise the business cycle is heading from an inflationary boom straight into an inflationary bust. In this chaos circus, the smart money hides in boring-but-beautiful companies with real profits and rock-solid balance sheets. And yes, once again, the Dow Jones—home of grown-ups—looks set to school the Nasdaq 100’s tech tantrums for the rest of the Jubilee Year and beyond.

US Economic Policy Uncertainty Index (blue line); Relative Performance of Dow Jones Index to Nasdaq 100 Index (red line)

In a world sliding deeper into chaos and polarization, investors who actually understand the business cycle are waking up to the reality: the so-called Maleficent 7—those flashy, energy-guzzling platform giants—are losing their shine, while the real stars of the next phase of the equity bull market will be the energy producers powering the shift.

US Economic Policy Uncertainty Index (blue line); Relative Performance of Magnificent 7 Index to S&P 500 Energy Index (axis inverted; red line)

When stagflation crashes the party and chaos is the main course, seasoned investors know there’s only one guest worth trusting—good old PHYSICAL GOLD. In a world run by the ‘Disruptor-in-Chief’ turned ‘Crypto Manipulator-in-Chief,’ whose hidden agenda seems more about enriching tech bros than stabilizing the economy, it’s no surprise that gold—war-tested, chaos-hardened—keeps shining while Bitcoin will scramble for relevance.

US Economic Policy Uncertainty Index (blue line); Bitcoin to Gold ratio (axis inverted; red line)

As uncertainty tightens its grip on everything from markets to geopolitics, volatility has become the default setting, not the exception. Policy makers lurch from one crisis to the next, debt is piling up like kindling, and trust in institutions is eroding by the hour. Real assets—not digital dreams—are proving to be the only reliable hedge. In this new era, narratives collapse faster than crypto exchanges. Welcome to the chaos cycle. Pack gold and food, not Bitcoin and hope.

By clutching physical gold—yes, the “old-fashioned” stuff—investors hold onto something the “future-forward” Bitcoin bros and stablecoin fan club will never get: actual autonomy. Not just from the almighty USD, but from all those fiat currencies desperately sprinting toward full-on centralization.

In a nutshell (because we all love those), as the US economy does its classic tumble from inflationary boom to bust, guess what? History isn’t shy about its spoilers: the Dow will keep beating bonds, energy consumers will keep dragging behind energy producers, and gold? Gold will keep outshining bonds like a diva at a karaoke night.

Gold stashed away in private vaults? No compliance checkboxes, no digital IDs, no sketchy counterparty risks, and absolutely no need to rely on Ripple, Tetther , or any other politically exposed, centralized circus. Unlike those shiny digital toys born in the chaos of 2008, gold isn’t just a hedge against currency collapse—it’s the OG protector against volatility and centralization. Been doing its thing since 480 BC, no big deal.

So yeah, gold matters—yesterday, today, and especially tomorrow.

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.