Gold Is For War

THE WEEK THAT IT WAS...

As the Chinese returned from their Golden Week, the week of Chung Yeung Day in Hong Kong shifted investors' focus once again to inflation, with the release of the last US CPI and PPI reports before the 'D-Day' of the year of political hell. The week also featured several speeches from FOMC governors, the minutes of the September 18th FOMC meeting, and the first estimate of the University of Michigan’s consumer inflation expectations. It also marked the kick-off of the Q3 2024 earnings season.

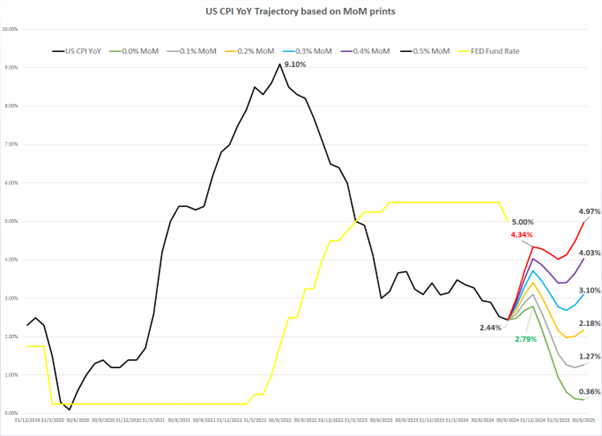

After the release of the September CPI, instead of perpetuating the political forward illusion that the 2% inflation target is within reach sooner rather than later and declaring 'mission accomplished,' investors, likely savvier than the thousands of PhDs at the partisan FED, understand that hitting 2% by year-end is mathematically impossible. Even achieving this target by mid-2025 would require a miraculous disinflation to occur in the first six months under the 47th U.S. president, whoever that may be. Indeed, anyone who understands the base effect can draw the following conclusions:

A return to 2.0% inflation in 2024 is mathematically impossible. Even if the CPI prints 0.0% month-over-month for the remainder of the year, the year-over-year change will still end above 2.5% as the disinflationary base effect fades by the last quarter. Should month-over-month prices reaccelerate, as it should under with the recent rebound in oil prices, the CPI year-over-year figure would finish above 3% or even higher.

For the CPI year-over-year change to return to 2% or lower by the end of the first half of 2025, the monthly inflation rate would need to remain consistently at 0.2% or below for the next 9 months.

If the month-over-month inflation rate reaches 0.2% or higher over the next 9 months, the year-over-year CPI change will land between 3% and 5% by the end of June next year. This would then force the FED to raise rates in an economy already suffering from war-related shortages and increasingly resembling the war-driven economy of the 1940s.

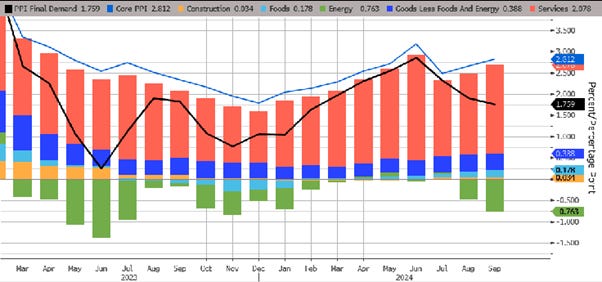

After a hotter-than-expected CPI, the September PPI was unchanged MoM, cooler than the expected +0.1%, but up 1.8% YoY, hotter than the expected +1.6% and slightly below the previous month’s +1.9%, which was revised downward. Energy prices weighed the PPI down (though everyone knows that won’t last), as Food and Services surged. More concerning for those still ignoring the looming return of the inflation boomerang, core PPI jumped to +2.8% YoY, hotter than the expected 2.6%, with PPI ex-food-and-energy rising 0.2% MoM, as expected.

Wise investors understand that what truly matters for equity markets is the trend in the spread between core CPI and PPI, as it serves as the best indicator of corporate America's ability to expand margins, a key driver of stock market valuations. With this spread having narrowed since July, it signals a particularly challenging earnings season ahead for companies lacking a competitive moat or those tied directly or indirectly to US consumers, who continue to struggle with inflation-driven misery.

S&P 500 forward P/E ratio (blue line); Spread between US Core CPI YoY change and US Core PPI YoY change (red line); Correlations.

As a final indicator of inflation anxiety among consumers ahead of the holiday season, medium-term inflation expectations rose in the preliminary University of Michigan sentiment data for October, with the 5–10-year outlook now at 3.0% and 1-year inflation expectation at 2.9%, the highest level since July. This should especially concern investors still holding long-dated treasuries, given the strong correlation between 5–10-year consumer inflation expectations and the US 10-year yield.

University of Michigan 5-10Year Consumer Inflation Expectations (blue line); US 10-Year Yield (red line); Correlation & US Recessions.

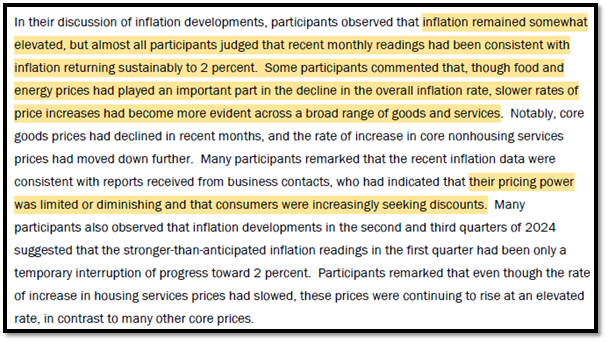

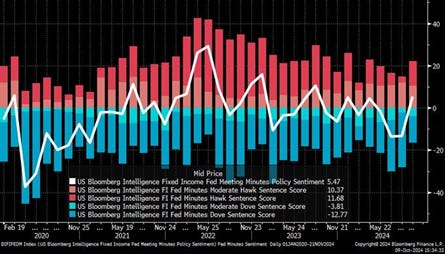

The minutes of what will be remembered in history books as the most partisan FOMC meeting in US history reveal a deeper division among members than headlines suggested. While a substantial majority supported a 50bps rate cut to 4.75-5%, citing alignment with inflation and labour market data, some preferred a smaller 25bps cut, arguing it would better reflect gradual policy normalization and allow more time to assess economic conditions. A few participants believed a 25bps move would signal a more predictable policy path. Despite progress on inflation, concerns remained about elevated prices, solid economic growth, and low unemployment, with participants emphasizing the importance of continuing the FED's balance sheet reduction.

In a nutshell, the minutes reveal a much more divided FED and the most hawkish stance since last April, while the politically driven and partisan Chairman continues to spread the ‘Forward Illusion’ that the Fed is fully in control of the future of the US economy.

With politically driven economic data misleading investors and voters into thinking that everything is fine in the United Socialist America, Wall Street still has to realize the FED's impotence in an economy driven solely by government spending, which will inevitably harm consumers and investors. Therefore, it is not a surprise that the Wall Street consensus still expect 2 additional FED rate cuts by the end of the year with 81% probability and almost 6 rate cuts in 2025. Seasoned investors remember that inflation-driven misery stems not primarily from the FED, but from reckless regulations imposed by politicians pushing to ‘build back better’ for the kleptocrats and kakistocrats of the world. In this context, whether the FED cuts rates remains almost irrelevant; the real issue is stopping those who mismanage the economy under the pretence of climate change and DEI while fuelling forever bankers’ wars to enrich their plutocratic allies. Regardless of who occupies the White House next, Powell and his PhD colleagues know that interest rates always rise during wartime. The misguided Wall Street bankers will once again be wrong in thinking rate cuts will solve economic problems, which will only worsen under ‘Kamunism.’

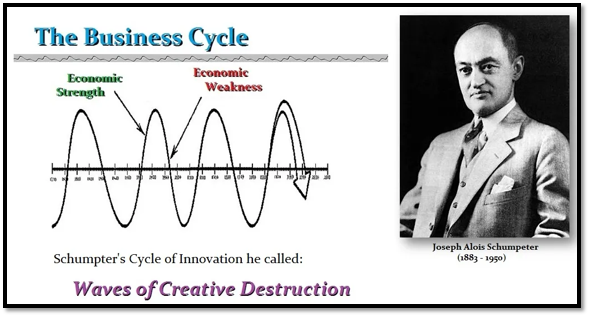

Investors who have studied Economics 101 have surely come across the idea of 'creative destruction,' developed by Joseph Schumpeter. Around this concept, Schumpeter established that the economy evolves in a business cycle, where economic growth and innovation are driven by cycles of disruption and renewal. Schumpeter believed that the business cycle is inherently tied to entrepreneurial innovation, which introduces new products, processes, or technologies that disrupt existing markets. These innovations lead to periods of rapid economic growth as new industries emerge, but they also result in the obsolescence of older industries, which can trigger recessions. Over time, the economy moves through phases of expansion and contraction, with each cycle being fuelled by the continuous process of creative destruction. Schumpeter’s theory highlights the dynamic, ever-changing nature of capitalism, where innovation is both the engine of growth and the cause of periodic economic downturns.

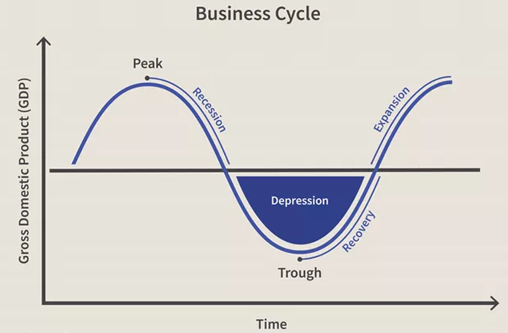

In essence, business cycles are marked by the alternation of phases of expansion and contraction in aggregate economic activity, and the co-movement among economic variables in each phase of the cycle. Aggregate economic activity is represented not only by real (i.e., inflation-adjusted) GDP, a measure of aggregate output, but also by aggregate measures of industrial production, employment, income, and sales, which are the key coincident economic indicators used for the official determination of business cycle peak and trough dates.

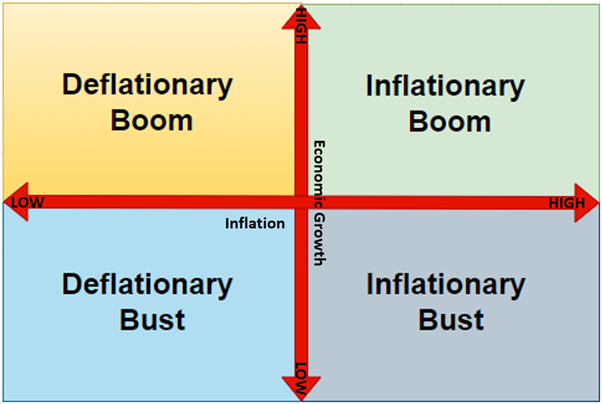

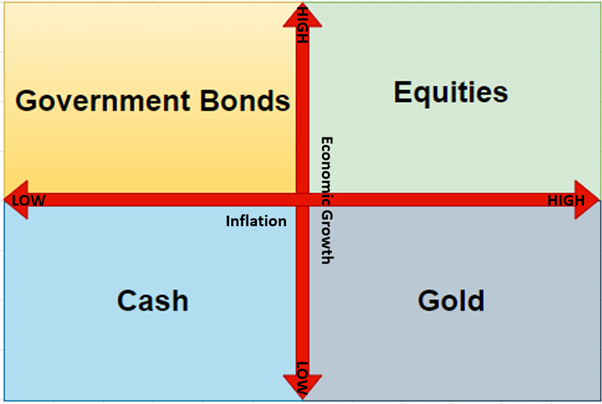

To simplify, business cycles can be summarized into four quadrants, which can be compared to the four seasons of the year. The economic cycle begins its ‘spring’ after a deflationary bust, spurred by rate cuts and fiscal support, leading to growth upticks without immediate inflation. Financial markets thrive in this environment, marked by deflationary boom and asset rallies, particularly in growth stocks. As the economy heats up into the ‘economic summer,’ inflation rises, transitioning into an ‘inflationary boom’ phase. During this period, cyclicals, emerging markets, and commodities outperform. However, accelerating inflation prompts rate hikes, impacting growth and leading to a gloomy ‘inflationary bust’. Periods of stagflation are the worst for most assets, except for gold. Inflation eventually slows as the economy falls into recession, paving the way for a deflationary winter bust.

The business cycle is closely linked to technological development, as advancements often drive both periods of economic expansion and contraction. During times of innovation, new technologies can boost productivity, create new industries, and enhance economic growth, leading to an expansion phase in the cycle. For example, the rise of the internet and digital technologies in the 1990s spurred significant economic growth and job creation. However, as these technologies mature, they can also disrupt traditional industries, causing job losses, structural changes, and sometimes triggering economic downturns as markets adjust to new realities. Additionally, as businesses adopt new technologies, the benefits may not be evenly distributed, contributing to cycles of economic inequality and volatility. Thus, technology acts as both a catalyst for growth and a disruptor within the business cycle.

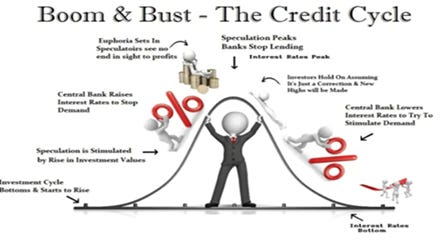

In a nutshell, it's important to understand that the business cycle, which is also a credit cycle is inevitable, and everyone must prepare for it to mitigate its impact on society. Despite technological advances like AI, the business cycle, rooted in scarcity and abundance, remains a fundamental part of economic systems.

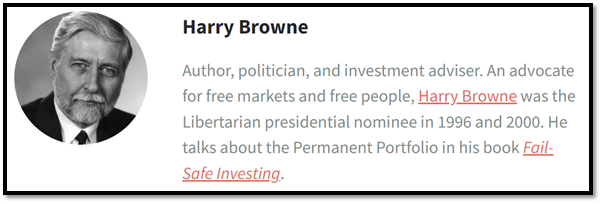

Just as farmers adapt their behaviour to the seasons and weather to plan their harvest and ensure the fruit of their labour over time, investors must first understand the business cycle to adjust the asset allocation of their portfolio and benefit from all four seasons of the cycle. In the 1980s, Harry Browne, a politician, investment adviser, and advocate for free markets and individual freedom, developed the Browne Portfolio, also known as the 'Permanent Portfolio.' The 'Permanent Portfolio' was introduced by Browne as a simple, all-weather investment strategy designed to perform well across any economic environment. Browne, a libertarian and financial author, created the portfolio in response to the unpredictability of business cycles and market conditions.

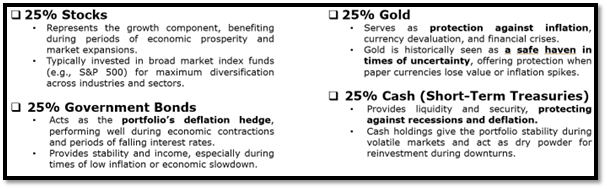

Browne’s aim was to design a portfolio that could safeguard wealth in times of prosperity, inflation, deflation, and recession without requiring constant adjustments. The original allocation called for equal portions (25%) in stocks, long-term bonds, gold, and cash. Each asset class was chosen for its ability to perform in different economic conditions—stocks during growth, bonds during deflation, gold during inflationary bust, and cash during recessions. Over the decades, the Permanent Portfolio gained popularity for its simplicity and risk-averse nature, offering a balanced approach to long-term investing that remains relevant today.

Source: https://harrybrowne.org/

Anyone with a basic understanding of finance knows that financial assets can be divided into two categories: contracts and properties. In the context of financial assets, a contract refers to a legally binding agreement that establishes a claim to future payments. For example, a bond's contract outlines its interest rate (coupon), maturity date, and repayment terms. Properties, on the other hand, represent ownership in a corporation and provide a claim on a portion of the company’s assets and profits. The most common form of property is stocks, which are issued by companies to raise capital for various business purposes, such as expanding operations, financing new projects, or even repaying debt. As investors should already know, gold is the only property that carries no counterparty risk, having been accepted for centuries as the ultimate form of money. As John Pierpont Morgan famously said: 'Gold is money, everything else is credit,' meaning that all properties and contracts involve counterparty risks, but physical gold is the only asset that does not. This is why physical gold serves as the only true hedge against government risk, especially relevant today, as governments worldwide have implemented reckless policies to advance their Keynesian agendas, which are part of a broader Malthusian agenda tied to the forever bankers’ wars.

Some contracts and properties have long maturities, such as government bonds and equities, while others have short maturities, like cash and gold. To summarize, the 'forever portfolio' can be subdivided into four quadrants as well based on two dimensions: properties and contracts on one axis, and long and short duration on the other.

By aligning the Schumpeter business cycle with the Browne Portfolio, investors can understand that, just as their wardrobe evolves over the four seasons of the year, there is a preferred asset class for each phase of the business cycle. The Browne Portfolio is designed to perform well across all phases of the business cycle by allocating assets to four key areas: stocks, bonds, gold, and cash. Each asset is intended to thrive under different economic conditions. Stocks benefit during periods of prosperity and economic expansion, bonds perform well during deflation or recessions when interest rates fall, gold provides protection during inflationary busts, and cash serves as a safeguard during deflationary busts. By balancing these assets, the Browne Portfolio aims to mitigate risk and volatility, providing stable returns regardless of fluctuations in the business cycle. This approach reflects Browne's belief in preparing for a variety of economic outcomes, from inflation and deflation to booms and busts, without attempting to predict them. If we match the four seasons of the business cycle with the four assets of the Permanent Portfolio, investors can easily determine which asset is best to own in each season. Therefore, the primary task of a portfolio manager is to assess which season of the business cycle the economy is currently in and adapt their investment portfolio accordingly.

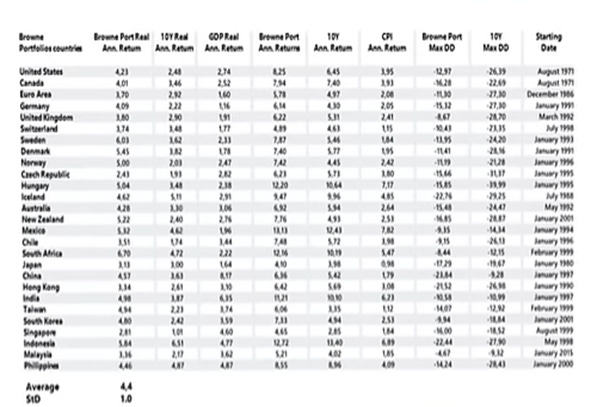

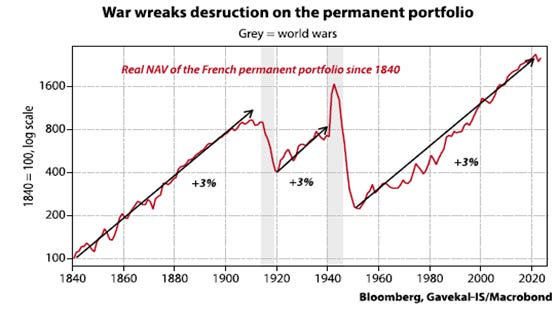

Back testing the permanent portfolio across countries show the incredible results of a portfolio growing by between 3% and 4% per year in real currency terms with very low volatility and almost complete absence of double-digit drawdowns for most of the country from developed markets to emerging markets.

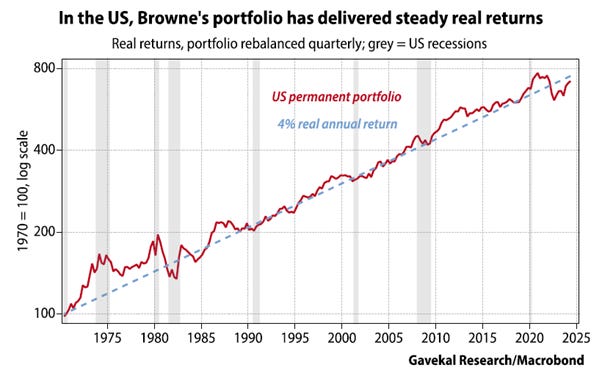

For those who are not convinced by these results, let’s examine the cases of 2 different economy systems like the United States and China as case studies of how the Browne Portfolio has delivered such steady performance by simply rebalancing the portfolio on a quarterly basis among the four asset classes. Since 1970, in the US, the Browne’s Portfolio has not outperformed the stock market index, but it has outperformed cash, bonds, and gold. Moreover, it has achieved a very similar absolute return to a classic balanced portfolio maintained at 50% in the S&P 500 and 50% in long-dated US Treasuries and delivered just below 4% real returns. However, its returns are much more stable, with lower volatility and significantly smaller drawdowns.

Even in the past decade, when the returns on cash and bonds in the US were dismal both in nominal and real terms, the Permanent Portfolio performed reasonably well, thanks to surging equity values and, more recently, soaring gold prices. Since the beginning of 2014, the US Permanent Portfolio has returned 3% in real terms. This is slightly less than the returns from 1970 to today but falls within the 3-4% range seen across other countries. What is interesting is that the property asset components of the portfolio (equities and gold) have performed well, while the contract assets (cash and bonds) have each lost 17% in purchasing power. Clearly, US policy over the last 10 years has pursued the ‘euthanasia of the rentier,’ with value transferred from savers who own contract assets to holders of gold and shares. In short, US policy has favoured the transfer of wealth from the poor to the rich, regardless of political consequences. Returns available to savers holding contracts were artificially depressed by abnormally low interest rates, which led to accelerating inflation and spectacular returns for stocks and gold.

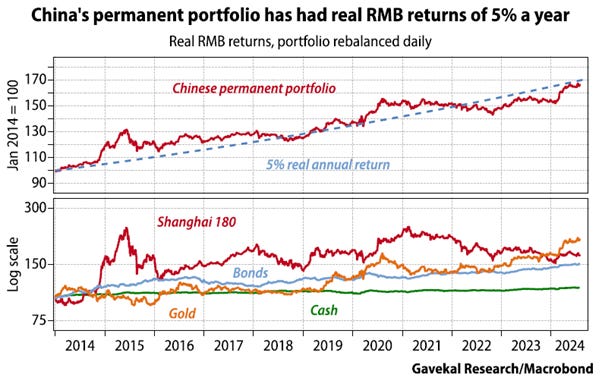

Looking at China, the situation has been quite different. Looking at the performance of the Chinese Permanent Portfolio over the past 10 years, despite all the talk about how China has been a dismal place for investors, the Chinese Permanent Portfolio has generated real local currency returns of 5% per year over this period. This compares to 3% for the US Over the past decade, each component of the Chinese Permanent Portfolio has generated a positive real return, meaning that no owner of any of the four assets has suffered a decline in purchasing power.

A significant portion of the divergence in real returns between the US and China is due to the different paths of inflation over the past few years. This highlights how inflation is detrimental to at least half of the Permanent Portfolio and emphasizes that policymakers who do not want to disadvantage one part of their population for the benefit of another should always aim to keep inflation in check.

US CPI Index (blue line); China CPI Index (red line) rebased at 100 as of December 31st 1994 (in local currency).

This last observation shows how important the actions of the government are in the way investors build their portfolios, as reckless government spending and uneconomic regulations can impact the creation of wealth for owners of contracts and properties. This highlights the important philosophical point regarding the role of government between monetarists like Milton Friedman and Keynesians like John Maynard Keynes.

In the case of monetarists, governments are a necessary evil whose primary goal is to ensure the game is played as fairly as possible, according to established rules. The obvious analogy here is the referee in soccer or rugby, who stoically does the best job he can while suffering abuse from players, pundits, and the public, knowing that without him, the game could not proceed.

In the case of Keynesians, governments are active participants in the game, tipping the scales for one team against the other.

A quick look at the recent history of the US and China shows that the more governments participate in the game like it has been the case in the western world and the US over the past few years, the greater the inequality they create, and the more inequality is spread between those who own and do not own properties. If we accept that governments should tip the scales for one set of participants against another, isn’t it unavoidable that the rich and powerful will capture the government and tilt the scales in their favour? And isn’t this what has happened in the US? As PJ O’Rourke once wrote, ‘Giving money and power to government is like giving whiskey and car keys to teenage boys.’

This may seem harsh, but history shows that when pillaging is accepted, we create moral and religious justifications for it. In recent years, some have argued that:

Low interest rates promote long-term growth. This belief is misguided, especially since the US cut rates to zero and has destroyed the ability for those who do not have the resources to own properties to create wealth.

Economic growth stems from consumption; therefore, governments should stimulate it when growth falters. This view is also flawed, true growth occurs when returns on invested capital exceed the cost of capital, as evidenced by Switzerland’s long-standing prosperity.

Discouraging saving leads to higher economic growth. This idea is not only incorrect but also counterproductive.

Despite this, many believe US authorities excel in managing the economy, while their Chinese counterparts do poorly, largely due to US stock market performance. Yet, the real returns of the Browne portfolios over the past decade tell a different story: 5% annually for China versus 3% for the US in local currency terms. Moreover, all components of the Chinese portfolio have seen real gains, fostering a sense of fairness among the population and promoting political stability.

Returning to asset allocations, investors may ask themselves why they should bother with asset allocation if the Browne Portfolio can deliver a 3% to 4% real return over time with minimal drawdowns. The answer is that the success of the Permanent Portfolio is based on mirroring real wealth creation in times of peace. Indeed, in wartime, the situation is different, and the ‘Permanent Portfolio’ is no longer so permanent. During wartime, centralized assets such as government bonds and cash lose value as government defaults and inflation erode the ‘fixed income’ portion of the portfolio. For example, debt securities lost 97% of their real value in France between 1914 and 1950!

A contemporary example of the inefficacy of the Permanent Portfolio during wartime is Russia. Consider an extreme scenario: a country at war with an invader. None of the countries in the study of the permanent portfolio faced this issue during the 50-year sample period. In a wartime economy, the state often seizes private savings and redirects production for military purposes, prioritizing national defence over the economic well-being of the population. While building bombs generates economic activity, it does not create lasting wealth. In this context, the Permanent Portfolio would suffer from the loss of benefits associated with healthy economic activity. It is not a secret for anyone that Ukraine’s economy has been devastated, with much of its fixed capital—factories, roads, homes—destroyed by the war. However, the Russian economy hasn’t escaped damage either. The Russian Permanent Portfolio, composed of the MOEX stock index, long-term and short-term local currency bonds, and gold, lost around 35% of its value early in the conflict. Although Russia has not experienced significant domestic fixed capital destruction, the risk of long-term decline is evident. Looking at France’s history over the last 200 years, we find that while the Permanent Portfolio can withstand many challenges, it struggles during wartime.

However, in times of financial disaster inflicted by war, the permanent portfolio never falls to zero. Thanks to the 25% allocation to gold, it should always retain a significant percentage of its value. This is compounded by the false belief that government bonds and cash are risk-free assets. While Western investors have become accustomed to living in countries where governments have been relatively stable, emerging market investors know that reckless policies, like those implemented by current governments in the Western world, can lead to government changes and defaults. For example, in July, Ukraine avoided defaulting on $20 billion in loans by reaching a preliminary agreement with private creditors. Given the financial burden of war, the country suspended interest payments on international debt over the last two years, which was set to expire on August 1, 2024. Without this new debt restructuring, this default would have ranked among the ten largest in recent history. The last time Ukraine defaulted on its debt was in 2015, after Russia’s invasion of Crimea. As the world is slowly but surely entering a period of rising war cycles, investors should look back at history to see how the war cycle has impacted confidence in public institutions and how it has influenced asset allocations.

Despite widely spread misconceptions, a country does not need to be the epicentre of a war to default. For example, Greece’s $264.2 billion default in 2012 stands as the largest overall, occurring when the country was mired in recession for the fifth consecutive year. The country defaulted again just nine months later, making it the fourth-largest default ever. Leading up to the crash, Greece ran significant deficits despite being one of the fastest-growing countries in Europe. Furthermore, in 2009, the newly elected prime minister revealed that the country was $410 billion in debt, substantially more than previous estimates. Following closely is Argentina, which recorded the second-highest default when it failed to repay interest on $82.3 billion in foreign debt in 2001. Like Greece, Argentina is a repeat offender, having defaulted numerous times since gaining independence in 1816. Today, it is the largest debtor to the International Monetary Fund, despite being Latin America’s third-largest economy. Next in line is Russia, which defaulted on $72.7 billion in loans in 1998, coinciding with a currency crisis that erased more than two-thirds of the rubble’s value in a matter of weeks. That year, several other countries, including Venezuela, Pakistan, and Ukraine, also defaulted on their debts after the Asian Financial Crisis of 1997 spurred instability in global financial markets. Just as 1998 saw a wave of defaults, 2020 was marked by major debt upheavals. Due to the pandemic and collapsing oil prices, it became a record year for sovereign defaults, reaching a total of seven. Among these, Lebanon, Ecuador, and Argentina experienced the largest defaults amid deepening fiscal pressures.

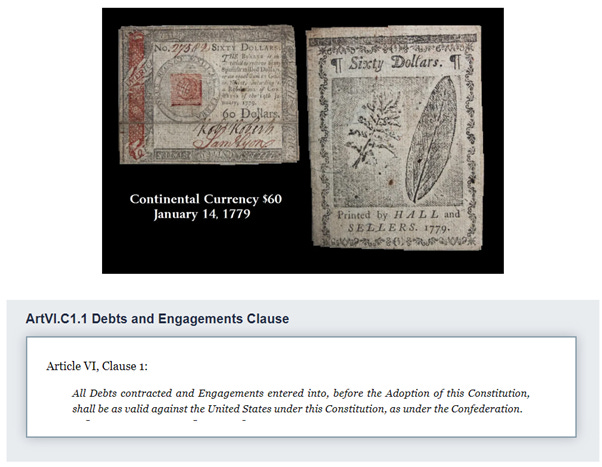

Contemporary Americans may not recall that the United States defaulted on all debts incurred by the previous Continental Congress, despite Article VI of the Constitution stating that those debts would be honoured. When George Washington became the first US president in 1789, New York was the capital. By 1792, during his second term, the capital had moved to Philadelphia. While it’s often taught that Philadelphia served as the capital for ten years, it had previously been the home of Congress and the site where the Declaration of Independence was signed.

In more recent history, in his memoirs, Herbert Hoover commented on the 1931 sovereign debt crisis reflected his concerns over the destabilizing effects of global financial turmoil. As the Great Depression deepened, Hoover believed that the collapse of European economies, exacerbated by sovereign debt defaults, was a significant threat to global stability and US recovery. He saw the excessive borrowing by European countries during and after World War I as a root cause of the crisis. Hoover argued for a temporary moratorium on war debts and reparations to alleviate the pressure on struggling nations, hoping that this would stabilize international finances and prevent further defaults. His proposal, the Hoover Moratorium of 1931, aimed to give countries breathing room to reorganize their debts, although it was met with mixed reactions. Ultimately, Hoover's efforts underscored his belief that the global financial system was interconnected, and that sovereign debt crises abroad could severely impact US economic recovery.

As the 2020s progress, it's evident to anyone with common sense that the war cycle is steadily, and unfortunately, on the rise. In this context, investors must reassess their strategies for navigating such a challenging environment, recognizing that gold is an essential asset to hold during times of conflict.

https://www.cnbc.com/2024/09/24/jpmorgan-ceo-jamie-dimon-warns-geopolitics-is-getting-worse.html

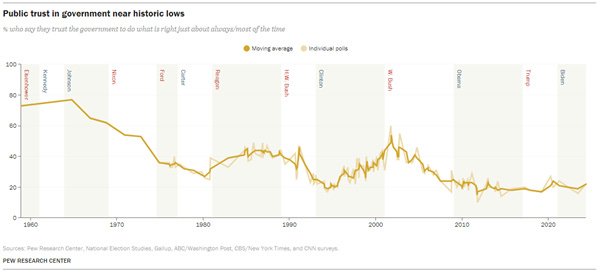

This rise in the war cycle coincides with increasing distrust in public institutions, which have been mismanaged to benefit a minority. Regulations favouring the plutocracy surrounding governments are harming those outside this elite group, with rules designed to advantage the top 1% at the expense of the 99% who have not.

https://www.pewresearch.org/politics/2024/06/24/public-trust-in-government-1958-2024/

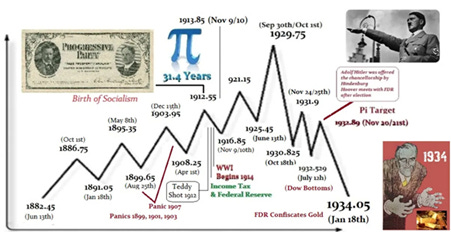

The last time the world experienced such a deep distrust of public institutions was between 1882 and 1934. During that period, there were numerous financial panics, the beginning of the Progressive Era, the rise of socialism in 1912, and the onset of World War I in 1914, which was part of a plan by governments to default on their debt. Today is no different: Keynesian governments may push towards World War III, allowing them to default on their debts again by promoting climate change, which is ultimately linked to their aim of exploiting ‘Global South’ natural resources.

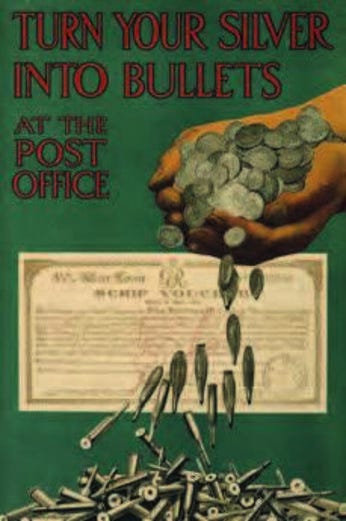

Gold and war have long been intertwined. Spain's wealth from New World conquests financed its military but led to domestic inflation rather than economic development. The influx of silver devalued metals in Europe and widened the gold-silver ratio, benefiting England and the Netherlands, who supplied goods to Spain. This weakened Spain in future conflicts. During the French and Napoleonic Wars, Britain abandoned the gold standard in 1797 due to rising debt but leveraged its strong financial reputation to borrow heavily, despite higher inflation. In contrast, France retained its bimetallic standard, limiting its borrowing capacity and forcing reliance on taxation. This difference gave Britain an advantage in sustaining a prolonged war, as France's history of defaults restricted its financial flexibility. On the eve of WWI, Imperial Russia held vast gold reserves, which were heavily depleted during the war. By 1918, both the Bolsheviks and counter-revolutionary Whites accessed this gold. The Bolsheviks used seized Imperial gold, circumventing Allied blockades to fund crucial imports. The Whites controlled a portion known as "Kolchak’s gold," from Kazan’s Imperial vaults, though it ultimately fell into Bolshevik hands. By 1921, Bolshevik reserves were drained, leading Trotsky to seize private gold, which helped sustain the revolution and secure their victory.

During WWI, the Allies’ access to substantial gold reserves, notably from the British Empire, gave them an edge over the Central Powers. South Africa’s gold production was critical for Britain, which blocked shipments to Germany, limiting its ability to import necessary war supplies. Britain abandoned the gold standard in 1914, increasing its money supply, while France and Russia sent gold to the UK to finance war efforts. Germany’s gold reserves were smaller, but it preserved them through war loan subscriptions and lent gold to allies like the Ottoman Empire. These dynamics re-emerged in WWII, with Nazi Germany seizing gold from occupied territories to fund its war efforts.

Gold and silver have long been essential for financing wars, acting not just as spoils but as strategic resources to sustain conflict. The side that manages its bullion most effectively often gains a significant advantage. For instance, Britain, despite abandoning the gold standard during the Napoleonic Wars, leveraged gold to fund coalitions. In both world wars, the Allies' access to gold and credit greatly bolstered their war efforts, while depleted gold reserves signalled economic strain for the losing side. Gold provides confidence to creditors, stabilizes currencies, and often indicates shifts in power.

Outside wars, the 2020s have also been marked by reckless government spending aimed at implementing Keynesian policies designed to control citizens in every aspect of their lives. Western governments have adopted the belief that increased public spending will create prosperity. However, from an ethical perspective, incidents like the government’s incompetent response to Hurricane Helene illustrate two key issues: (1) government employees have a myopic vision, lacking long-term perspective, and (2) they tend to see only what is directly in front of them, which is not an admirable quality for those in power.

This was perfectly highlighted by the last US president who truly understood how excessive government can harm the economy and its citizens. As Ronald Reagan famously stated, the nine most terrifying words in the English language are, ‘I’m from the government, and I’m here to help.’

From an economic perspective, gargantuan government spending has resulted in the US government achieving the highest debt-to-GDP ratio outside of wartime and recession. One doesn't need a PhD in economics to recognize that this rising debt-to-GDP ratio has been and will remain a significant tailwind for gold prices. In short, the more reckless governments are in managing their finances, the higher gold prices will climb when priced in the respective fiat currencies of these governments.

Gold prices in USD terms (blue line); US Government Debt to GDP ratio (red line) & US Recessions.

For those still unconvinced that the recklessness of politicians in managing public funds is closely tied to gold prices, a look at the correlation between gold prices and US CDS (the cost of insuring against a US government default) should serve as a wake-up call. It is widely understood that gold remains the only effective hedge against government risk, including a sovereign default.

Gold price in USD terms (blue line); US 5-year CDS Rate (red line) & Correlations.

The broader implications of rising government default risks (indicated by higher CDS) include increased volatility in equity markets as such periods of potential default are typically associated with a risk-off sentiment, which negatively impacts equity returns negatively.

US 5-year CDS Rate (blue line); CBOE Volatility Index (VIX index) (red line) & Correlations.

For asset allocators, wartime conditions present a unique challenge few have encountered in their careers. In this environment, gold may be poised for a breakout against beta, especially as volatility increases. Gold typically gains traction when stock market risk metrics rise, prompting an uptick in the gold-to-S&P 500 ratio and driving its outperformance relative to equities. This dynamic is particularly relevant as US assets become increasingly weaponized by Western governments and as the ‘unlimited friendship’ between China and Russia boosts gold demand among investors in the Global South.

Relative Performance of Physical Gold to S&P 500 index (blue line); CBOE Volatility Index 200 day moving average (red line).

Despite Wall Street's phantasmagorical disinflationary narrative, in an environment of continuous reckless government spending, supply shortages driven by armed conflicts across the globe, and uneconomical regulations imposed by Keynesian policies, and with the next US president, whoever that may be, expected to pursue more fiscal stimulus, the economy seems poised for a reflationary wave. When coupled with the European Central Bank cutting rates and China implementing new monetary and fiscal measures, it seems clear that the world is heading toward either an ‘inflationary boom’ or, at worst, an ‘inflationary bust’ (i.e Stagflation) if wars exacerbate inflation-driven misery for consumers, as has historically been the case. Indeed, one major risk to the inflationary boom is an energy shock. Historical precedents from 1973, 1979, and 2008 show how rapidly rising energy prices can turn an inflationary boom into a bust. For example, the 2008 Sichuan earthquake disrupted coal transport, causing oil prices to spike. While we haven’t reached that point yet, the risk is increasing. Investors will recall that during an inflationary bust, gold typically rises in value, as it has consistently since the 1970s.

US Stagflation proxy index (blue histogram); USD Gold price (red line); Correlation & US Recessions.

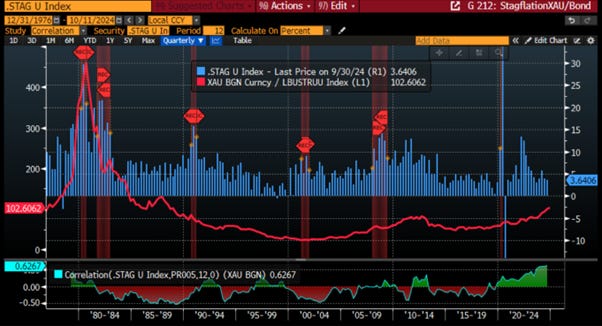

Not only did gold rise in value relative to fiat currencies during an inflationary bust, but it has also historically outperformed bonds as the inflationary environment erodes the returns of those holding fixed income assets.

US Stagflation proxy index (blue histogram); Relative performance of USD Gold price to Bloomberg US Agg Total Return Bond index (red line); Correlation & US Recessions.

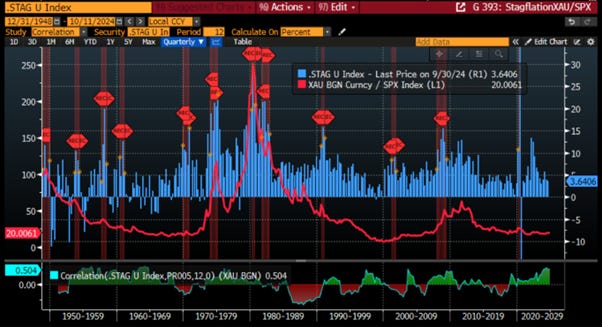

In the meantime, low economic growth during an inflationary bust impacts corporate profitability, leading to the outperformance of gold against equities during this time period of the business cycle.

US Stagflation proxy index (blue histogram); Relative performance of USD Gold Price to S&P 500 Index (red line); Correlation & US Recessions.

To summarize the path that has brought the world to the brink of World War 3, it is clear to those who can analyse history with an open mind that Washington's warmongers have waged endless wars since Vietnam that they have been unable to win. They lied to the American public to justify these wars, as Robert McNamara admitted before he died when he said, ‘WE WERE WRONG' about Vietnam, acknowledging that the Russians were not involved, and it was merely a civil war. The cost of the War on Terror has been estimated at $8 trillion by a Brown University study, yet there has been no victory. There were no weapons of mass destruction in Iraq, and no one was ever held accountable.

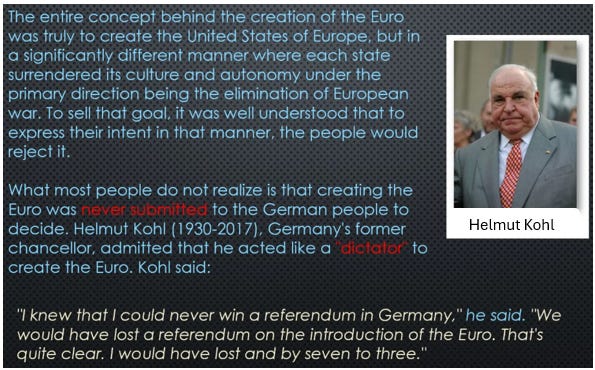

Fast forward to today, EU leaders are pushing for conflict with Russia to distract from the economic failures of the European Union, a vision of a unified Europe that has repeatedly faltered throughout history, from Charlemagne to Hitler and Napoleon. It was Chancellor Kohl who blocked the debt consolidation. He admitted he acted like a dictator and took Germany into the euro, denying the German people any right to vote because he knew he would have lost the vote seven to three. As a result of that decision, the euro could never replace the dollar, and institutional investors still had to compare one member state against another.

Originally, the EU was intended to prevent wars through centralized governance, but now it seeks conflict to mask its mismanagement and flawed euro design. Historically, centralized control has failed, leading to civil unrest, as seen in the US before its independence and under Communism in Russia and China. The EU's centralized government is becoming increasingly ungovernable, and the only way for European leaders to save face is to push their countries into war, which would allow them to default on their sovereign debt. This is particularly true as organizations like NATO and all the lobbyists enriching themselves have no reason to exist if the forever bankers’ wars end.

As tensions escalate in the Middle East, the critical question is whether the conflict between Iran and Israel will intensify to the point of disrupting Iran's oil production. Such a scenario could lead to widespread instability in the region, which is a major oil supply source, especially considering the U.S. shale industry and Russia are currently under embargo. The potential for a broader conflict raises concerns about global oil supply, prices, and overall market stability.

After spreading their deadly war agenda from the borders of Russia to the Middle East, the Washington and Brussels warmongers of the North Atlantic Terror Organization are now threatening to extend conflicts into Asia by provoking North Korea. NATO recently issued a statement condemning North Korea and Iran for 'fuelling' Russia's war of aggression against Ukraine through direct military support to Moscow. This hypocrisy highlights NATO’s and the West's arrogance, as they can fund Ukraine but threaten those who support Russia. In response, North Korea warned NATO that if it infringes upon the dignity, sovereignty, or security of the country, NATO will be held wholly responsible for the tragic consequences that follow. It should be clear to anyone with common sense and an open mind that NATO and the American neocons prefer to threaten the world rather than seek peace. This is a war they desire, and the population in Europe and America needs to wake up, as the people have no say in this matter of war.

https://youtube.com/shorts/cNBGpV1qkbs?si=K2QrErC9hDmDpo4x

In this context, North Korea is removing all references to reconciliation with the South from its constitution. The 11th session of the 14th Supreme People’s Assembly (SPA) is expected to address these revisions, nine months after North Korean leader Kim Jong-un redefined inter-Korean relations as being between 'two hostile states' and vowed to no longer consider South Korea a partner for reconciliation and unification. That says it all. This signals a third proxy war emerging in Asia this time as the Washington and Brussels warmongers once again expand their Malthusian agenda to a new continent, threatening countries that do not follow their narrative. The US and its Malthusian allies seek to impose their fake vision of prosperity on the mercantilist Global South, which is building alliances around Russia and China. As 2025 approaches, investors will have another hot spot in North Asia to watch closely.

https://www.koreaherald.com/view.php?ud=20241009050029

Over the past century, numerous conflicts have spread chaos and death, bringing the world to the brink of Armageddon many times. Focusing on two major wars in the past 70 years, the Vietnam War (1955-1975) and the Second Gulf War (2003-2011), gold outperformed stocks (i.e., Dow Jones) by more than threefold when adjusted for inflation over these bellicose periods. This outperformance also came with much lower drawdown than for stocks.

Evolution of $100 invested in physical gold adjusted to inflation (blue line); the Dow Jones adjusted to inflation between 1955 and 1975. (Vietnam War).

Evolution of $100 invested in gold adjusted to inflation (blue line); the Dow Jones adjusted to inflation between 2003 and 2011 (Second Gulf War).

Fast forward to the 2020s, for those who want a better understanding of how the four pillars of the Browne Portfolio have performed since the start of the Russian special operation in Ukraine, it’s helpful to look at how gold (XAU currency), equities (e.g., the S&P 500 index), government bonds (e.g., Bloomberg US Agg Total Return Index), and cash (e.g., Bloomberg S T-bills 1-3 months Index) have performed since then. While the US and its NATO allies have consistently denied being directly at war with Russia, anyone with common sense can see that the current conflict in Eastern Europe is nothing else than a war between the US and Russia. One doesn’t need a PhD in finance to contemplate that over the past 30+ months, gold and equities (S&P 500 index) have significantly outperformed cash and bonds

Performance of $100 invested in Gold (blue line); S&P 500 index (red line); Bloomberg US Agg Total Return Index (green line); Bloomberg S T-bills 1-3 months Index (purple line) since 24th February 2022.

Looking at the inflation-adjusted return of the same assets over this same period, it becomes clear that the inflationary impact of wars has been even more detrimental for investors holding contracts such as bonds and cash. The inflation, fuelled by the economic disruptions and war-related misery over the past 32 months, has indeed eroded the nominal returns on cash entirely.

Inflation adjusted performance of $100 invested in Gold (blue line); S&P 500 index (red line); Bloomberg US Agg Total Return Index (green line); Bloomberg S T-bills 1-3 months Index (purple line) since 24th February 2022.

Savvy investors understand that wars create shortages of critical resources such as energy, metals, and food, all of which are essential to sustaining a war economy. When looking at the performance of other commodities, such as oil (WTI), metals (Bloomberg Industrial Metals Index), and agricultural commodities (Bloomberg Agriculture Index), it's clear that, despite these shortages, only gold has consistently preserved investors' wealth during wartime. This was even the case during the second Gulf War between 2003 and 2011, despite the fact that the war occurred in a major oil-producing region.

Performance of $100 invested in Gold (blue line); Crude oil (WTI) (red line); Bloomberg Industrial metal Index (green line); Bloomberg Agriculture Index (purple line) between 2003 and 2011 (Second Gulf War).

As everyone knows, if history doesn’t repeat itself, it sure does rhyme! So, it’s no shocker that despite once again involving a big oil producer like Russia, gold has totally outshone oil, metals, and agricultural commodities ever since the special operation in Ukraine kicked off.

Performance of $100 invested in Gold (blue line); Crude oil (WTI) (red line); Bloomberg Industrial metal Index (green line); Bloomberg Agriculture Index (purple line) since 24th February 2022.

In a nutshell, gold is the asset to own during wartime. In such times, paper currency is discounted and practically worthless in countries ravaged by war-related destruction. Governments have historically used war as an excuse to renege on their contract promises (i.e. bonds), either by failing to pay out, restructuring debts, or inflating their value away. In war, gold becomes the currency of choice. Like all tangible commodities, it rises in value with inflation linked to supply shortages during the war cycle. As the war cycle continue to escalate, gold won’t become cheaper anytime soon, and inflation will worsen as long as wars prevail.

WHAT’S ON THE AGENDA NEXT WEEK?

The week of Canadian Thanksgiving will draw investors' focus to inflation data from China, the Eurozone, and Japan. Additionally, investors will gain insights into the health of US and Chinese consumers with the release of September retail sales data. The week will also see another ECB meeting where the politically driven chairwoman will have to spread more illusions that the old continent economy is a healthy shape. This week marks the real start of the third-quarter earnings season, with over 60 S&P 500 companies releasing their quarterly earnings, including Bank of America, Steel Dynamics, Netflix, Procter & Gamble, and Schlumberger among others.

KEY TAKEWAYS.

As the world waits for the next strikes in the forever wars, here are the key takeaways:

After hot CPI prints in Q1 and cooler data in Q2, Q3 ended with an additional sign that the Q2 disinflation was purely an illusion, which will definitively end after Americans cast their votes on November 5th.

The US PPI added further evidence that the return of the inflation boomerang will come much sooner than most Wall Street bankers still expect

The University of Michigan inflation expectations should frustrate the Wall Street consensus, which continues to push investors into long-duration trades, ultimately a major asset allocation mistake, with an inflationary bust looming ahead.

The FOMC minutes expose a divided FED and its most hawkish stance since April, while the partisan Chairman maintains the ‘Forward illusion’ that the ‘now impotent’ FED controls the future of the US economy.

Investors familiar with Economics 101 understand Joseph Schumpeter's concept of 'creative destruction,' which illustrates how entrepreneurial innovation fuels business cycles, likened to four seasons: a spring of recovery, an inflationary summer, an inflationary bust, and a recessionary winter.

Just as farmers adapt to seasonal changes for successful harvests, investors must grasp the business cycle to adjust their asset allocation.

Harry Browne's 'Permanent Portfolio' provides a timeless, all-weather strategy with equal 25% allocations in stocks, long-term bonds, gold, and cash, preserving wealth across different economic conditions without constant adjustments.

The Browne Permanent Portfolio consists of contracts, which are legally binding agreements for future payments (like bonds), and properties, representing ownership in corporations (like stocks).

Gold is unique as the only property free of counterparty risk, making it the ultimate hedge against government risk in today's environment of reckless fiscal policies.

Aligning the Schumpeter business cycle with the Browne Portfolio allows investors to identify the optimal asset class for each phase: stocks for inflationary boom, bonds for deflationary boom, gold for inflationary bust, and cash for deflationary bust, thus mitigating risk and volatility across the 4 seasons of the business cycle.

While the Browne Portfolio can provide steady real returns in peacetime, its effectiveness wanes during wartime, as centralized assets like government bonds and cash lose value due to defaults and inflation. Historical examples, such as France's during WW2 and recently Russia during the Special Operation in Ukraine, illustrate how the portfolio's resilience is compromised in wartime environments.

Wars have historically been used by governments as a means to default on their sovereign debt, as wars destroy the economic capital that forms the basis of an economy.

As wars trigger inflationary busts rather than inflationary booms, gold is the asset to own during wartime.

Over the past 70 years, during major armed conflicts like the Vietnam War and the Second Gulf War, gold has outperformed stocks by three times when adjusted for inflation.

While wars lead to shortages of essential resources, oil, metals, and agricultural commodities falter, whereas gold consistently preserves wealth during conflicts, as seen in the second Gulf War from 2003 to 2011 and the current war in Eastern Europe and the Middle East.

After initiating two proxy wars with the mercantilist Global South, one in Europe in 2022 and another in the Middle East in 2023, Washington warmongers are now eyeing a third proxy war in Asia in 2025, which could further spread inflation-driven misery worldwide.

As 'Kamunism' rather ‘Trumponomics 2.0’ is taking shape, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

To surf the inflationary bust, among equities, investors should focus even more on companies with low-leveraged balance sheets and strong business moats and avoid direct exposure to the financial sector.

Physical gold remains THE ONLY reliable hedge against reckless and untrustworthy governments and bankers.

Gold remains an insurance to hedge against 'collective stupidity' and government’ hegemony which are in great abundance everywhere in the world.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

In such an environment, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

Despite hotter-than-expected inflation data, it was another week of all-time highs for the S&P 500 and Dow Jones, with the Dow emerging as the best-performing index among the three major indices over the past five days. While the war cycle paused, giving investors a false sense of calm, the 45th all-time high of the year for the S&P 500 occurred alongside rising volatility. This week marked the first time all year that the VIX closed above 20 every day, signalling that elevated risk is expected as we move deeper into October and approach the political D-day of November 5th.

As here is October, investors should prepare for increased volatility, potentially pushing equity markets back to their August 5th lows, or even lower, as we approach the 'D-Day' of the year of political hell. Although the Nasdaq has broken the downtrend that began in mid-July 2 weeks ago, it remains unable to reach new all-time highs and has underperformed the Dow Jones over the past week. This suggests the current rally is being driven by non-American institutional investors moving capital into the US ahead of an inevitable acceleration in the war cycle, while US retail investors, who typically drive the Nasdaq, are showing signs of exhaustion.

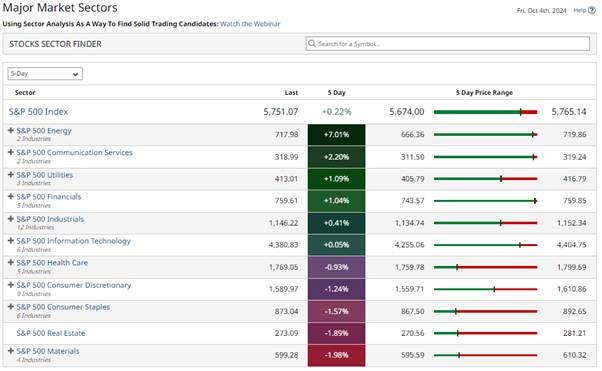

While any investor with common sense should get ready for reflation and an inevitable rotation in the coming months, IT still emerged as the best-performing sector of the week, alongside Industrials and Financials. On the flip side, Consumer Discretionary, Communication Services, and Utilities underperformed.

As war becomes a primary concern for everyone, those seeking victory, both economically and on the battlefield, must understand their enemy and themselves first. Those who do not know their enemy will suffer defeat for every victory gained, while those who know neither the enemy nor themselves will fail in every battle, whether in economics or on the battlefield itself.

In the current context of wars and stagflation, investors are reminded that to preserve wealth for financial survival, there are some obvious DON’T’S that investor should look at first. These include:

Don’t keep your wealth in the fragile banking system, whether in cash or securities. With many banks likely to default, it could take a long time before your assets are released, if they are released at all. Bail-ins or forced investments in government securities at low real (i.e. inflation adjusted) interest rates and for extended periods, such as 10 years or more, are also likely.

Don’t hold sovereign bonds as many if not all governments will default.

Don’t bet on inflation reducing your debt. High interest rates or the indexation of loans might make it impossible to repay your borrowings.

This list of DON’TS is far from exhaustive, as the largest global debt and asset bubble in history is likely to surprise even those investors who believe they are well-prepared for a doomsday scenario for governments imposing marshal laws.

On the other hand, some DOs could be more useful such as:

Do hold substantial amounts of physical gold and physical silver in secure jurisdictions such any countries which have taken some independence from the Malthusian agenda spread by the World Economic Forum. This physical gold must be stored outside the banking systems anywhere in the World. Precious metals should preferably be stored in a private vault, with direct access to the metals. As governments set the rules and increasingly disregard constitutional limits, investors should be aware that even storing gold in safety deposit boxes outside the traditional banking system may be risky. Governments around the world will grow more tyrannical, blaming citizens for rising deficits. History shows examples like FDR’s Executive Order 6102 in 1933, which prohibited private gold ownership. In the future, with digital currencies on the rise, asset seizures could become more common. Always remember that the government has the ability to accuse anyone of committing a crime and use that as a means to seize assets. We have seen it happen time and time again with debanking practices. This is a worldwide issue, not confined to the US. In 2016, UK-based HSBC targeted safe deposit boxes in Hong Kong to assist the government in seeking citizens' cash. Similarly, in 2015, during Greece’s financial crisis, Deputy Finance Minister Olga Valavani announced restrictions on safe deposit boxes. Numerous examples exist of governments around the world confiscating assets, with banks compelled to comply.

To minimize the risk of confiscation or freezing, it is best to keep some of some of your wealth outside your country of residence. Given the rapid evolution of the war cycle, both on the kinetic front and in terms of financial and free speech constraints, those who have the means should secure a second country of residence or even a second passport. As of this writing, it is clear that many countries, particularly those openly aligned with the World Economic Forum agenda, should be avoided. This includes most European countries and the US if 'Kamunism' prevails in the November elections. These places are no longer be safe to live in or to hold financial assets. For citizens who wish to remain free and for investors aiming to preserve their financial independence from reckless governments, it is essential to have a second, or even third, contingency plan, as countries that seem safe today can shift toward authoritarian Keynesianism faster than anyone might expect.

Focus on wealth preservation. Avoid trying to get rich at all costs and focus on staying rich. Risk management and avoiding severe drawdowns should be the top priority for everyone, whether high-net-worth individuals or retail investors. Everyone should now prioritize wealth preservation.

Referring to the ‘perpetual portfolio,’ the allocation in government bonds and cash should be substituted with a higher exposure to physical gold (more than 25% of the portfolio) and other real assets expected to increase in value as wars lead to shortages and price increases. These real assets include physical silver and platinum, as well as commodities like oil and base metals such as copper and nickel, which are likely to see rising demand during wartime. Additionally, some exposure to agricultural commodities is recommended due to price increases from supply shortages. Cash allocation should be reduced to no more than 10% to 20%, managed with a diversified portfolio of short-dated (6 to 9 months) investment-grade USD bonds from low-leverage US corporations. This strategy will help preserve wealth amid rising stagflationary pressures, as recovery from the current stagflationary environment is expected only after 2028.

With the dominoes falling as outlined above, most people will face significantly more hardship than they do now. For anyone with savings, whether it’s $100 or $100 million, wealth preservation should be a top priority. Safely storing physical gold and silver in a private vault inaccessible to reckless governments is crucial. In challenging times, supporting family and friends becomes essential for navigating shared difficulties. It's also important to remember that some of life's best offerings,nature, books, music, and hobbies, are free. Amidst all, never forget: In Gold, We ALL Trust as GOLD IS FOR WAR.

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.