THE WEEK THAT IT WAS...

The first week of the third month of the Jubilee Year drew once again investors’ attention to PMI data in the U.S., alongside the first Non-Farm Payroll report since DOGE began implementing spending cuts, reductions also remembered as income for those who benefited from prior reckless government spending. The week also featured earnings from 52 S&P 500 companies, with Broadcom, Costco Wholesale, and CrowdStrike standing out as notable names concluding the final stretch of the Q4 2024 earnings season.

As widely expected from the increasingly politicized ECB, its plutocratic chairwoman Lagarde delivered, as expected, a sixth consecutive 25bps rate cut (Deposit: 2.5%, Refinancing: 2.65%, Marginal Lending: 2.60%). The ECB cited easing financial conditions and improving loan growth but flagged lingering headwinds from past hikes and weak lending. Growth projections were downgraded to 0.9% (2025), 1.2% (2026), and 1.3% (2027) due to export weakness and investment uncertainty. While rising real incomes and fading rate hikes may support demand, surging European bond yields cast doubt on fiscal policy's true restrictiveness. The ECB remains committed to its 2% inflation target, though domestic inflation stays high due to delayed wage and price adjustments, with wage growth moderating and profits absorbing some pressure. The bank revised forecasts, cutting 2025–2026 GDP, lowering 2025 core inflation, but raising 2025 headline inflation.

While the ECB continues to lure investors into believing the Eurozone is in good health, those who analyse the business cycle through market data rather than government propaganda know that the region is edging toward inevitable stagflation and a sovereign debt crisis. Wars will serve as a convenient scapegoat to obscure the grim reality of the European economy.

Even before they are implemented, tariffs have already spread their ‘stagflation vibes’ as ISM Manufacturing fell to 50.3 from 50.9, with new orders plunging and prices paid surging to a two-year high. Rising input costs are squeezing manufacturers, fuelling inflation fears, weakening sales prospects.

In a break from recent trends, the ISM Services Index rose in February from 52.8 to a better-than-expected 53.5. Orders, Employment, and Prices Paid all increased, with employment reaching its highest level since December 2021. Notably, February marked the third consecutive month where all four key subindexes: Business Activity, New Orders, Employment, and Supplier Deliveries—were in expansion, a first since May 2022.

As DOGE continues to track reckless government spending, the U.S. economy supposedly created 151K ‘Excel’ jobs in February, up from a downwardly revised 125K in January, just below the consensus estimate but well above the whisper number. Job growth remains concentrated in non-productive sectors like education and health services, while leisure, hospitality, and professional and business services continued to shed jobs in February.

The unemployment rate rose to 4.1% in February from 4.0% in January, slightly above the consensus estimate. The number of unemployed remained largely unchanged at 7.1 million. While the rate has hovered between 4.0% and 4.2% since May 2024, it has stayed above its two-year moving average since September 2023, historically a troubling signal for the U.S. economy over the next 12 to 24 months.

Upper Panel: US Unemployment Rate (blue line); US Unemployment 24 months moving average (green line); Lower Panel: S&P 500 to WTI ratio (yellow line); US S&P 500 to WTI Ratio 84 months moving average (red line).

In this context, Wall Street bankers and their parrots continue to delude themselves into believing that the increasingly impotent FED will keep cutting rates, even as the president enacts tariffs and tighter immigration policies that will fuel stagflation whatever the official propaganda of the White House spreads. Likely driven by the belief that FED rate cuts will once rescue Wall Street and Main Street as the US economy shifts into an inflationary bust, the market now prices in a 82% chance of three rate cuts this year, with the first fully expected in June, compared to October just two weeks ago. By that point, as the war cycle heat up, the U.S. economy will likely already be in an inflationary bust, potentially forcing the FED to raise rates if it remains committed to fighting inflation for the benefit of American citizens as it supposed to be.

Outside the business cycle and the war cycle, both of which cannot be beaten and for which investors can only prepare by analysing market data untainted by political propaganda, those who have dedicated enough time to studying how to adapt to and navigate the business cycle understand that the best way to benefit from it is not only by tracking the evolution of the three key ratios driving it (the stock market-to-oil ratio, the gold-to-bond ratio, and the stock market-to-gold ratio) but also by following the money, i.e., capital flows.

https://www.investopedia.com/terms/c/capital-flows.asp

Capital flows have long shaped economies and power dynamics, from ancient trade routes to modern financial markets. Cicero observed how events in Asia rattled Rome, while Aristotle’s critique of money-making foreshadowed Marx’s ideas. The colonial era saw wealth extraction, industrialization shifted capital to the West, and Bretton Woods formalized financial flows. In recent decades, globalization and digital finance accelerated cross-border investments, until the current decade, marked by the rise of a multipolar world.

The South Sea Bubble (1720) and the Mississippi Bubble (1719–1720) were early examples of speculative mania driven by international capital flows. Investors across Europe fuelled the South Sea Company’s surge, lured by exaggerated trade prospects in the Americas, while John Law’s Mississippi Company in France drew speculative capital with promises of Louisiana wealth. Both collapsed when profits failed to materialize, wiping out fortunes and exposing the risks of cross-border speculation, setting a precedent for the volatile, interconnected financial systems that define modern capital flows. A century and a half later, the Panic of 1896, triggered by a silver price collapse and over-speculation in railroads and real estate, led to U.S. bank failures and rising unemployment. Struggling to stabilize its gold-based system, the U.S. saw British investors inject capital to protect interests and seize distressed assets, highlighting the growing interdependence of global markets. This crisis foreshadowed modern international capital flows, demonstrating how financial distress in one nation could drive cross-border investment and reshape economic power dynamics.

https://www.britannica.com/video/William-Jennings-Bryan-speech-Cross-of-Gold-July-8-1896/-9087

Economists, preoccupied with theories of absolute control, failed to grasp the significance of net capital movement during the global rise of Marxism. In response, politicians introduced regulatory measures, beginning with the Interstate Commerce Act of 1887 and the Sherman Anti-Trust Act of 1890 to curb business consolidation. These were accompanied by the McKinley Tariff of 1890, crafted by William McKinley and John Sherman. The pivotal Sherman Silver Purchase Act of 1890, designed to appease Free Silver Democrats, mandated increased silver purchases, expanding the money supply but destabilizing U.S. Treasury gold reserves. This unsound policy contributed to the Panic of 1893, prompting President Grover Cleveland to push for its repeal.

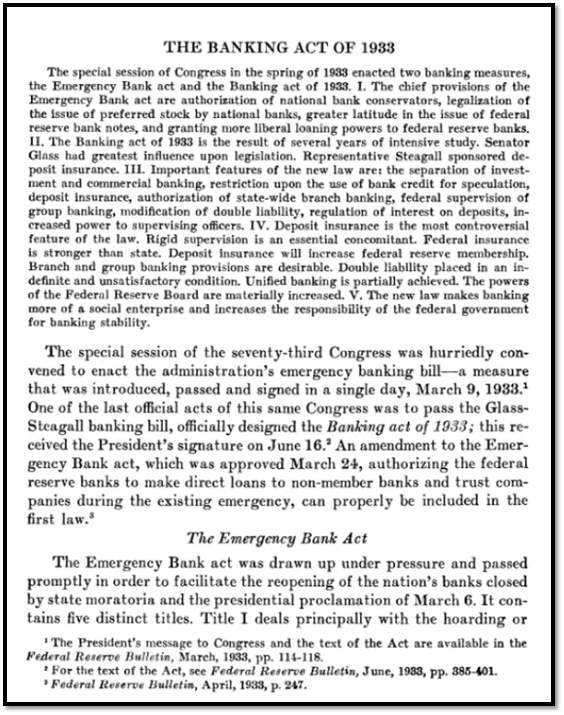

Governments often disrupt free capital movement through capital controls, measures like currency restrictions, investment limits, and transaction approvals, to stabilize economies, prevent capital flight, and manage volatility. Throughout history, capital controls have been employed by various nations to manage economic challenges, often during times of crisis or transition. One early example is the United States during the Great Depression, when the 1933 Banking Act and subsequent measures restricted gold outflows and foreign exchange transactions to stabilize the dollar and curb panic-driven capital flight.

https://corporatefinanceinstitute.com/resources/economics/emergency-banking-act-of-1933/

In post-World War II Britain, the government imposed strict controls under the Exchange Control Act of 1947, limiting the amount of sterling that could be converted into foreign currencies to protect dwindling reserves and finance reconstruction. During the 1997 Asian Financial Crisis, Malaysia and Thailand famously implemented capital controls, including fixing the exchange rates of the ringgit and baht and restricting offshore trading, to shield their economies from speculative attacks, measures that, while controversial, were credited with aiding recovery.

https://www.adb.org/sites/default/files/publication/28804/economics-wp251.pdf

More recently, Iceland imposed capital controls following its 2008 banking collapse, restricting foreign currency outflows to stabilize the krona. These measures were gradually lifted by 2017 as the economy recovered.

https://www.bbc.com/news/business-39248677

As of March 7, 2025, several countries maintain capital controls based on historical patterns and economic conditions, though specifics depend on evolving policies. China upholds long-standing restrictions to manage currency stability, while Argentina curbs dollar outflows to combat inflation. Russia enforces controls amid sanctions, requiring exporters to repatriate earnings, while Ukraine restricts transactions due to war-related pressures. India applies targeted measures to protect its economy, and Venezuela maintains tight controls amid its prolonged crises.

Capital flows have once again been at the epicentre of financial media discussions since the start of the year, following a late January Financial Times article highlighting the movement of gold from London and Zurich to Comex vaults in Manhattan, supposedly due to the threat of tariffs on imports from the UK and Europe.

https://www.ft.com/content/86a5fafd-603e-4ee1-9620-39b5f4465f53

Since the U.S. election in November, gold traders and financial institutions have moved around 18 million troy ounces (around 560 tons) into Comex vaults following the publication of the November 5th, 2024, election results. With around 39.7 million troy ounces now stored in Comex gold storage, this level is the highest in 35 years and above the levels seen in May 2020, when the global pandemic triggered a massive flow of physical gold into New York vaults.

Comex Gold Inventory data & Monthly Change.

This "transatlantic" movement of physical gold has raised many questions and triggered a spike in the spread between the Comex and LBMA gold prices over the past month, a spike which has just eased recently.

Spread between NY Comex Gold Price & LBMA London Price.

Gold flowing across geographies is nothing new, and it's not only New York's Comex vaults that have seen massive inflows in recent months. In fact, global flows of physical gold out of London are largely directed eastward, with most commercial gold eventually ending up in China via Switzerland. According to customs data, Switzerland imports about 1,000 tonnes of London gold annually, where it is refined in various Swiss mints and redirected to retail markets, primarily in China and, to a lesser extent, India. Indeed, China’s undisclosed purchases in the London OTC market reached an all-time high in late 2024 and continue to this day.

To be sure, it hasn't been just China: ever since the U.S. decided to make gold bugs around the world very rich by weaponizing the U.S. dollar in the aftermath of the Ukraine war, central bank gold demand has surged five-fold, leading to gold hitting a record high of $2,800 earlier today.

What stands out this time is that unlike in 2019 when Comex vaults were nearly empty of "registered" gold, sometimes dropping to zero with most of the vaults filled with "eligible" gold, there is now a notable amount of registered gold in the Comex system. "Eligible gold" refers to gold stored in approved Comex vaults that meets the requirements for delivery against gold futures contracts. This includes 100 oz and kilo bars, but not 400 oz bars. However, eligible gold doesn't necessarily mean it's for immediate trading; some may be stored for futures trading, while other gold could be deposited for reasons unrelated to futures contracts. "Registered gold," on the other hand, is eligible gold for which a warrant has been issued by an approved warehouse. These warrants, which are "documents of title," confirm ownership of a specified quantity of gold stored in the warehouse, meeting the requirements for delivery against a gold futures contract. A warrant details the number of gold bars, their serial numbers, and refiner brands. In terms of physical priority, registered gold ranks above eligible gold. Additionally, there is "pledged gold," which refers to vaulted gold used as collateral for margin obligations.

Comex Registered Gold Inventory (blue histogram); Comex Eligible Gold Inventory (red histogram).

Unlike "paper" gold, where physical delivery is not involved, COMEX gold futures are physically deliverable and can be settled in real gold. However, in 2018, only 1.6 million ounces (51 tonnes) of gold were actually delivered, meaning 99.98% of COMEX gold futures did not result in physical delivery. The majority of gold accumulation is happening in just three vaults: Brink's, HSBC, and JPMorgan, with JPMorgan holding the largest share. These three vaults alone account for 82% of all COMEX gold inventory, reflecting a significant rush to store physical gold, particularly at JPMorgan’s vault.

Some argue that the recent influx of gold into COMEX warehouses stems from speculation that the U.S. may revalue its gold reserves, currently priced at $42 an ounce, to the market rate of nearly $3,000. While this theory is hard to dismiss, especially under the ‘disruptor-in-chief’ Donald Trump, the real driver, beyond worsening geopolitics in Europe, is a physical gold shortage. Futures contracts represent ‘paper gold’ with no claim on physical metal, and the notional value of the paper market far exceeds actual supply, risking a crisis if widespread delivery is demanded. As gold prices rise, momentum traders and hedge funds push futures prices higher, tightening physical supply. Bullion banks, which typically short these futures, must deliver gold at expiration, leading to what appears to be an emerging squeeze.

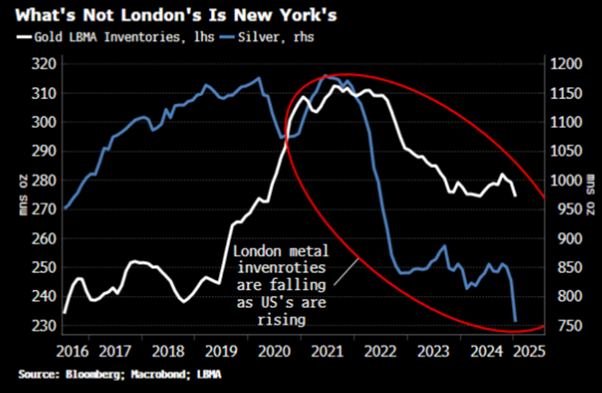

In this environment, speculators are unwinding their gold futures shorts leaving the bullion banks as those almost exclusively taking the other side of long positions. But where are they sourcing their gold? Trading volumes on the Shanghai Futures Exchange have surged, though it doesn't publish inventory data. Meanwhile, the LBMA, the gold market's hub, shows declining inventories in both gold and silver.

Everyone must remember that the bullion market is notoriously opaque, so it's likely that even more gold is leaking from London vaults than the data shows. Regardless, there’s almost certainly a shortage of physical gold for futures settlement in the West. Central banks have been buying heavily since the GFC, accelerating after the Russia-Ukraine war. The confiscation of Russia’s reserve assets has led to a drop in dollar reserves, mirrored by a rise in gold reserves, mainly from emerging-market central banks, while inventories in developed markets have remained stable. Gold is flowing from West to East.

Emerging-market (EM) central banks, once content to keep their gold in London, New York, and Switzerland, have reassessed risk following the Ukraine war. Notable buyers like India, Poland, Turkey, and even Hungary have repatriated some or all of their holdings. While that gold can still be lent out to banks for delivery obligations, central banks from the Global South are increasingly reluctant to lend. With developed-market (DM) banks increasingly relying on hypothecated gold in recent years, the leasing rate for gold has surged, driving up demand and amplifying the price squeeze.

In a nutshell, the smart money is moving gold from London and Zurich to New York in anticipation of potential capital controls, as investors prepare for the escalating war cycle in Europe. Those who study the history of wars and financial crises recognize the need to protect their wealth by shifting assets out of regions likely to be impacted by the ongoing conflict between Ukraine and Russia. With no doubts, Europe, facing tariffs and rising political instability, is particularly vulnerable to a sovereign debt crisis. With governments unable to implement necessary reforms, capital controls in the Eurozone could become a reality much sooner than anyone in Canary Wharf and Wall Street is keen to tell their clients. Historical precedents, such as the shift of capital from Europe to the U.S. during the World Wars, highlight how wars drive capital to safer environments, creating new investment opportunities.

Trump’s tariffs do not address the core issue: capital flows. America’s trade deficit is driven by capital inflows, not trade policy. Foreign nations invest in U.S. assets, resulting in a capital account surplus. By imposing tariffs, the U.S. government will contribute to reflation, increased costs for American businesses, and pushed non-US manufacturers to seek alternative supply chains rather than returning to the U.S. Economic power shifts not through tariffs but through capital investment and confidence. In a nutshell, China will simply redirect its exports elsewhere, while American consumers bear the burden of higher prices.

In this context, nobody needs a phd in finance to see that the outperformance of the US equity market to the rest of the world ex US has been highly correlated with the inflows (i.e. net holding) of US securities by foreign investors.

Net Foreign inflows to US equities (blue line in Trillion USD); Relative Performance of S&P 500 index to MSCI ex US Index (rebased at 100 as of December 31st, 2012, red line).

For financial markets, this also suggests a much stronger USD against other fiat currencies, along side the resurgence of U.S. exceptionalism (outperformance of the U.S. equity market compared to the rest of the world), and a significantly higher gold price in all currencies, as those who have studied these dynamics anticipate.

Net Foreign inflows to US equities (blue line in Trillion USD); USD Index (red line).

To end with a philosophical reflection from ancient Greece, if Socrates and Glaucon were still around today, they would most likely conclude as follows:

Socrates: Tell me, my friend, what is the nature of war? Is it not the pursuit of security or the desire for expansion?

Glaucon: Indeed, Socrates, men wage war to protect their own land or to seize that of another.

Socrates: And has it not always been so, that empires, intoxicated by ambition, cast their gaze upon distant lands, seeking dominion under the guise of necessity? Consider those who once sought to claim China as their prize—was their aim not conquest, cloaked in pretence?

Glaucon: It is as you say. And today, you suggest, the rulers of Europe look upon Russia with the same hunger?

Socrates: Precisely, for is it not written in the annals of history that those who govern often see war as a means of profit rather than principle? And yet, what follows such ambition? Do states not overreach, burden themselves with debt, and, in their folly, abandon the obligations they once swore to uphold?

Glaucon: That was the case in 1931, was it not? When Europe, drowning in its own excess, discarded its debts as one sheds a tattered cloak?

Socrates: Just as the Americans, in their infancy, turned from the currency of their revolution. And tell me, my friend, do men in power, having once broken faith, ever change their ways?

Glaucon: I fear they do not, Socrates. As history repeats, so too does the recklessness of those who rule.

Socrates: Then we must ask—if the past is our teacher and men have learned nothing, why should we expect this time to be any different?

Capital flows have always preceded financial crises and wars. In the context of the looming 'Trump-Re-Flation' morphing into 'Trump Stagflation,' holding real assets such as physical gold, the only antifragile asset with no counterparty risk, alongside a portfolio of short-dated, investment-grade (IG) USD bonds with maturities under 12 months and Treasury bills (T-bills) with maturities not exceeding 3 months, will provide stability. Investors will also need to hold other commodities to weather the storm brought by the 'Commodity Leviathan.' Among equities, investors should continue favouring low-leverage companies with strong EPS and FCF growth, prioritizing energy/commodity producers over consumers. By doing so, investors will emphasize the return OF capital over the return ON capital, securing both peace of mind and preserved wealth.

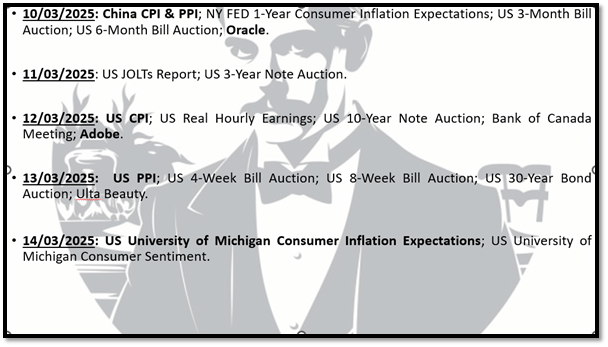

WHAT’S ON THE AGENDA NEXT WEEK?

The second week of the third month of the Jubilee Year will once again draw investors' focus to inflation data, first in China and then in the US, as both countries release their February CPI figures. Additionally, US consumer inflation expectations are expected to highlight growing concerns over ‘Trumped Tariffs Reflation’. The week will also feature earnings from 24 S&P 500 companies, with Oracle and Adobe standing out as notable names, marking the final stretch of the Q4 2024 earnings season.

KEY TAKEWAYS.

As spring is about to bloom in the Northern Hemisphere, the key takeaways are:

The ECB's sixth rate cut masks downgraded growth, rising bond yields, and an impending stagflation-driven debt crisis.

Even before their implementation, tariffs are already squeezing U.S. manufacturing, driving up costs, weakening demand, and accelerating the economy’s shift into an inflationary bust.

The ISM Services Index surprised positively, with all key subindexes in expansion for the third consecutive month.

Despite 151K new jobs in February, mostly in non-productive sectors, rising unemployment to 4.1% and a sustained breach of the two-year moving average signal economic trouble ahead.

Capital flows have shaped economies throughout history, with governments often using capital controls during times of crisis to stabilize markets and prevent financial instability, a trend likely to continue as the world transitions into a multi-polar era.

Capital flows in gold have surged since the election of the 47th US president, with massive physical gold movements from London to New York and increasing central bank demand, driving prices to record highs.

A surge in registered gold at Comex vaults signals a shift towards physical gold storage amid growing physical settlement of paper gold trades.

The influx of gold into COMEX and rising prices signal a physical gold shortage, fuelled by speculative demand and central banks shifting reserves East.

Smart money is moving gold to New York, anticipating capital controls and Europe's instability, with historical trends showing wars drive capital to safer havens.

This implies a stronger USD, U.S. equity market outperformance, and a higher gold price globally.

In such environment, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold remains THE ONLY reliable hedge against reckless and untrustworthy governments and bankers.

Gold remains an insurance to hedge against 'collective stupidity' and government’ hegemony which are in great abundance everywhere in the world.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

The final month of the first quarter started with a third consecutive risk-off week, as uncertainty over tariffs and renewed geopolitical tensions in Eastern Europe and the Middle East weighed on investors still trying to anticipate the 47th U.S. president’s next tariff move and its economic impact. Unsurprisingly, the trend from the first two months of the year persisted, with the Dow Jones continuing to outperform the S&P 500, Nasdaq 100, and the increasingly dubbed "Magnificent 7." On Friday, the S&P 500 rebounded off its 200-day moving average, while the Dow found support at the 61.8% Fibonacci retracement level of its one-year chart, also testing the lower end of its one-year uptrend. In contrast, the Nasdaq and the "Magnificent 7" closed below their respective 200-day moving averages and one-year 61.8% Fibonacci retracement levels, signalling severe technical damage from the past three weeks’ correction, which will take time to repair. As of March 7th, all major U.S. indices remain in a daily bearish reversal, though stochastics indicate early signs of a bottoming process. These trends reflect a broader market rotation from growth to value stocks, particularly in the Dow, highlighting a gradual but inevitable transition in the U.S. economy from an inflationary boom to an inflationary bust.

In this context, it unsurprising that Healthcare; Materials and Consumer Staples outperformed while Energy; Consumer Discretionary and Financials lagged.

As of March 7th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for more than a month, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

Capital flows have historically preceded financial crises and wars, triggering capital controls. With rising geopolitical tensions and the threat of tariffs, capital is increasingly fleeing Europe, with the US seen as a safe haven. Gold prices have surged, reflecting demand for a hedge against uncertainty, and the Bank of England is moving its gold reserves to New York. Similar to past world wars, capital is fleeing Europe, strengthening the dollar and boosting gold demand. As geopolitical instability grows, gold could rise further, driven by a loss of trust in institutions and heightened conflict in Europe.

In this context, investors should increasingly be aware of the risks related to where they custodian their assets geographically and with which counterparties (i.e., financial institutions) they deal. Anyone with a modicum of common sense will avoid custodizing assets in the old continent (i.e., the Eurozone, UK, and even Switzerland and Liechtenstein), which is expected to be at the center of the next phase of the heating up of the war cycle. Those living outside the US should consider diversifying the custody of their assets across Singapore, Hong Kong, and Mauritius. For those living inside the US, they should avoid owning assets in notorious blue states like California, New York, New Jersey, and Washington DC, and instead custodize their assets with financial institutions with steady balance sheets in 'red states' such as Florida and Texas, which will emerge as the new financial centers of the country once the DOGE (Department of Government Efficiency) has completed its tasks to clean 'the Augean stables' of the Deep State. For those unfamiliar with the greek’s mythology, the 'Augean Stables' refers to the stables of King Augeas from Greek mythology, which were notoriously filthy due to the vast number of cattle and the lack of cleaning for many years. Hercules was tasked with cleaning these stables as one of his Twelve Labors, a feat considered almost impossible. The phrase is often used metaphorically to describe a situation that is extremely messy or problematic and requires significant effort to resolve.

As capital continues flowing out of Europe, it should be clear to anyone that the US will keep recording inflows from regions like Europe, the Middle East, and even Asia, for the countries in the regions which are not part of the mercantilist globals south, as these countries are set to become the epicenter of the inevitable escalation of the war cycle.

For equity investors, the ongoing capital inflows into the US and the strengthening USD against other fiat currencies will likely lead to the Dow Jones outperforming the Nasdaq, as the former is historically driven by foreign flows, while the latter is fueled by US retail FOMO investors.In the context of the business cycle and the inevitable shift of the US economy from an inflationary boom to an inflationary bust, capital flows will contribute to a trend that Wall Street pundits failed to anticipate in their yearly outlooks: the outperformance of the Dow Jones versus the Nasdaq during the Jubilee year.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Lower Panel: Relative performance of Nasdaq index to Dow Jones index (purple line).

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

why do you think war will spread much wider in Europe and how far (geographically) do you think it could go?

"Bank of England is moving its gold reserves to New York. "

why would BOE move gold out of their own vaults? I thought clients of private banks/custodians are moving the gold....