THE WEEK THAT IT WAS...

The first full week of the second month of the third quarter was supposed to be more relaxing for investors, as they only needed to focus on the US and China trade balances, along with another update on inflation in China. The week also saw the release of the US ISM services data; the FED latest Senior Loan Officer Opinion Survey (SLOOS) and another round of earnings from US corporations which was dominated by subliminal message sent to investors by the oracle of Omaha.

In China, the CPI rose to 0.5% YoY from 0.2% in June, surpassing expectations of a 0.3% YoY gain, primarily due to a rebound in pork prices. Core CPI decreased to 0.4% YoY from +0.6% YoY in May and June, marking the weakest reading since January. Meanwhile, the PPI fell 0.8% YoY, matching the previous month's decline and coming in less than the expected 0.9% YoY drop.

For equity investors, the slight uptick in the spread between the CPI and PPI could mean that Chinese corporates are starting to see some pricing power which should translate sooner or later into a re-rating of Chinese equities, but it is still too early to call the time that Xi can claim victory in ‘Making China Great Again’.

Spread between China CPI & PPI (blue line); 12-month forward P/E of China MSCI Index (red line).

In the US, despite the deterioration in business conditions among manufacturers, the ISM Services PMI indicated a much brighter outlook for the services sector. The index rebounded from 48.8 to 51.4, surpassing the expected 51.0. While hard data on payrolls and orders has been disappointing, soft-survey data shows rising orders and employment. Prices paid continued to rise to 57.0, exceeding expectations of 55.1 and July's 56.3, reaching the highest level since February. In summary, while manufacturing may already be experiencing stagflation, the services sector continues to enjoy relatively better environment. However, with prices paid on an uptrend, the question is for sure not whether the FED should cut rates in September.

The latest FED Senior Loan Officer Opinion Survey (SLOOS) shows that the share of banks actively raising standards for commercial borrowers remains positive, largely due to economic uncertainty. Banks are also continuing to tighten standards and conditions for unsecured consumer loans, as anticipated given the rise in charge-off rates over the past year and the ‘inflation-driven’ recessionary pressures among consumers. However, they are starting to lower credit standards for loans secured by residential real estate and autos, giving consumers a bit more leeway in the near term. Commercial and industrial lending has continued to stall, as the commercial real estate crisis is far from over. While the declining share of banks reporting tightening standards would typically bode well for loan growth in the coming year, current high rates and expectations for phantasmagorical FED rate cuts and uncertainty about the economic policy of the next tenant of the White House may lead potential borrowers to delay investment plans and credit demand in the near term. In summary, the SLOOS suggests that some may think that most of the credit tightening may be behind us, although those who understand what’s ahead know that the banking sector will likely continue to tighten its belt in a consumer-driven stagflation. Therefore, those still calling for rate cuts should beware of the Ides of September.

With 455 companies from the S&P 500 having reported their earnings so far, a wrap of the Q2 2024 earnings season reveals that sales and earnings surprises have been the lowest since Q3 2023 and Q2 2022, respectively.

Probably the most relevant release of this earnings season came once again from Omaha, where Berkshire Hathaway engaged in an unprecedented selling spree that sent its cash pile soaring by a record $88 billion to an all-time high of $277 billion at the end of the quarter. Including short-term investments, the cash pile rose to $608 billion.

Berkshire sold a net $75.5 billion worth of stock, most of which, as we now know, came from Buffett's liquidation of half his Apple shares.

While there was no 13F filed yet to accompany Berkshire's 10-Q, the company did provide a snapshot of its top holdings, revealing that as of June 30 it held only $84.2 billion in Apple stock, down sharply from $135.4 billion as of March 31 and $174.3 billion as of December 31, 2023. This translates to just 400 million shares of AAPL held as of June 30, down almost 50% from 789.4 million as of March 31 and 905.6 million at the end of 2023.

The rest of Berkshire's top 5 holdings (Bank of America, American Express, Coca-Cola, and Chevron) were left untouched in Q2. However, since mid-July (i.e., the start of the third quarter), Berkshire has unloaded 90 million Bank of America shares.

While Buffett's Berkshire remained Bank of America's largest shareholder, owning approximately 942.4 million shares, the size of Berkshire's BofA stake has been reduced to levels last seen in early 2020.

The decision to increase cash reserves is likely the best indicator for seasoned investors that the coming weeks, and possibly until the world knows the name of the next tenant of the White House, will be marked by rising volatility. This environment may bring the Buffett Indicator (US Equity Market Cap/US GDP) back to a one in a lifetime buying opportunity.

The Buffett Indicator (S&P 500 Market Cap/US GDP) & US Recessions.

Ultimately, investors should take note that Buffett is now FEARFUL.

To show how fearful Warren Buffet is today, a quick calculation shows that dividing $277 billion by the current market cap of $923 billion means that around 30% of Berkshire Hathaway’s market cap is allocated to cash. To put this into perspective, this brings the cash-to-market ratio to levels seen in early 2020 during the COVID lockdowns and late 2005 when the world was dealing with the early signs of the 2007-2008 global financial crisis. Overall, it suggests that Buffett is preparing for a major financial shock in the coming months or quarters.

Ratio of Berkshire Hathaway of Cash Equivalent to Market Cap.

While Warren Buffett has an outstanding track record of outperforming the S&P 500, a higher cash pile at Berkshire Hathaway has not always been synonymous with a peak in equity markets. However, investors should also note that the correlation between cash equivalents levels and the S&P 500 index has been particularly high during times of crisis, such as in 2008, 2015, and 2018. This correlation has also been a fairly good indicator of a US recession.

Berkshire Hathaway Cash Equivalent (blue histogram); S&P 500 Index (red line); Correlations and US Recessions.

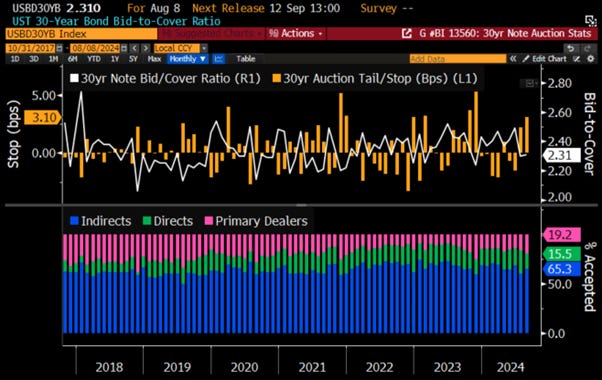

Amid the chaos from the unwind of the JPY carry trade, Wall Street investors started to find that a stronger yen is adding to the headwinds for US Treasuries. The latest $42 billion 10-year auction stopped at 3.96%, tailing by over 3 basis points, the highest since November 2022. Indirect bidders increased slightly to 66.2% but remain below the three-refunding average of 68.7%. Direct bidders took 16% of the issue, down from 18.7% in May. This reduced demand pushed the bid-to-cover ratio to 2.32x, the lowest since November 2022, reflecting a pullback in demand at lower yields.

After an ugly 10-year auction, where only reckless investors would accept yields below 4%, the Treasury sold $25 billion in 30-year bonds. The auction yield of 4.314% was the lowest since January and down sharply from July. The auction tailed significantly, with the When Issued trading at 4.283%, the largest tail since November. The bid-to-cover ratio was 2.308, slightly above last month but below the six-auction average. Indirect bidders took 65.3%, up from 60.8% last month but still below the average, while Direct bidders were awarded 15.5%, leaving Dealers with 19.2%, the highest since last November.

Not helping matters and adding to the risks of higher yields in the coming weeks were comments from JPMorgan Chairman and CEO Jamie Dimon, who told CNBC that he was ‘skeptical that inflation will get back to 2%,’ and added that a 50-basis point cut by the Fed "doesn't matter as much as people think.’

Needless to say, this revulsion for paper below 4% is not bullish and raises the question of whether bond traders will be willing to absorb longer-dated Treasury auctions in the future. This also suggests that volatility and tightening liquidity in US government bonds are the next indicators to monitor to expect the next leg down in this market chaos. Indeed, seasoned investors would have noticed that while the Wall Street consensus still believe that US Treasuries will provide the safe haven they have been over the past decades, when markets entered the JPY unwinding carry trouble last week, both the VIX and the MOVE spiked. Historically, such moves have been associated with much tighter liquidity in the US government bond market, which ultimately leads to adverse economic and financial consequences.

US Government Securities Liquidity Index (blue line); ICE BofA MOVE Index (red line); Correlations & US Recessions.

In that context, Wall Street parrots who spend their time on cable TV spreading confusion and nonsense by repeating theories that have never worked and will never work should be banned from advising investors. Following the ‘Yen carry trade tantrum’ of the past few days, some have been calling for the FED to announce an ‘emergency cut’ to keep the party going around Wall Street desks, similar to what happened during the Covid ‘plandemic’ in 2020.

The latest ‘emergency cut’ occurred on March 4, 2020, during the Covid crash. Investors will recall that the market continued to fall after the emergency cut, reaching new lows until March 23rd. Rather than spreading nonsense, Wall Street bankers should review past actions and ask, ‘Did that work before?’

S&P 500 index (white line); FED Fund Rate (blue line) between December 31st, 2019 and December 31st, 2020.

Investors must understand that inflation-driven misery stems not from the FED but from the reckless regulations imposed by politicians to ‘build back better’ for their own interests. These policies have caused shortages and allowed illegal immigration, all for the sake of extending their plutocratic power. In this context, whether to cut rates or not is irrelevant. The real issue is stopping those who mismanage the economy under the guise of climate change scam and DEI, while restricting the freedoms of contributors to economic growth and promoting bureaucracy to enrich their plutocrats ‘friends. In this environment, the FED finds itself even more caught between a rock and a hard place, as whoever becomes the next tenant of the White House, Powell and his PhD colleagues know that interest rates ALWAYS RISE DURING A WAR. That’s why the unenlightened Wall Street banksters will once again be proven wrong by discounting more than 100 basis points in cuts before the end of the year.

At the end of the day, we all know that Wall Street and the plutocrats ruling in Washington need to continue luring naive investors and voters into the supposed Goldilocks nirvana, while the FED has become impotent to solve economic issues driven by communist Keynesian policies with the beating of the war drums threatening lower economic growth and rising inflation in other words, STAGFLATION.

While Wall Street bankers and the financial mass media like to denigrate gold as a barbaric relic and a shiny piece of rock, seasoned investors know that, contrary to a banker, numbers never lie. As a matter of fact, gold has delivered better returns, not only since the start of the COVID pandemic but also year-to-date, compared to US equities (S&P 500), international equities (MSCI World Index), and long-dated government bonds (iShares 20+ Year Treasury Bond ETF (TLT US)).

Performance of $100 invested in physical gold (blue line); S&P 500 index (red line); MSCI World (green line); iShares 20+ Year Treasury Bond ETF (TLT US) (purple line) since the start of 2024.

In this context, investors should consider what’s driving the current gold rush and In Gold, Who Trusts? Before diving into the recent surge in gold prices, which has been fuelled by the weaponization of the USD and Keynesian policies and soaring government debt, it’s important to understand gold's cultural significance across the world.

In China, gold is traditionally given as gifts for special occasions, such as newborns receiving tiny gold necklaces or bracelets, and ornate 24-carat jewellery is bought during the Chinese New Year. Gold has been valued in China since the Han Dynasty, but its demand surged during the Six Dynasties with the advent of Buddhism. Today, China is the world’s largest gold market, driven by increasing affluence and a belief that gold signifies financial wisdom and good fortune.

In India, gold holds a central cultural role as a store of value, symbol of wealth, and essential element in rituals. It is highly valued for its portability and security as an investment, especially among the rural population. Gold is considered auspicious in Hindu and Jain cultures, with ancient traditions prescribing its use in important ceremonies. Major festivals like Diwali and regional celebrations, Akshaya Tritiya, Pongal, Onam, Ugadi, Durga Puja, Gudi Pavda, Baisakhi, and Karva Chauth, are marked by gold. Additionally, gifting gold is a key part of marriage rituals, with weddings accounting for about 50% of India’s annual gold demand.

In the Western world, while wedding rings have been part of Western European culture for centuries, the modern American tradition of gold wedding bands gained prominence during World War II, when soldiers wore them as tokens of their loved ones back home. Gold appeals to consumers seeking a piece associated with tradition or a memorable moment in their lives. Its key strengths are its enduring emotional and financial value, which can be passed down through generations.

https://owninggold.com/gold-culture/

Recent trends in gold demand show that the rally has been driven primarily by central banks, especially those in the so-called emerging markets. This isn’t surprising given the current geopolitical turbulence, with active conflicts in Ukraine and the Middle East that could escalate into wider international issues. Additionally, significant elections have been happening this year: in India, the UK, and the EU, where incumbents have lost influence; even Mexico has a new leader with a leftist agenda; and the unpredictable US presidential election in November is approaching. In this context, sociopolitical tensions, deep ideological divides, and dangerous polarization are becoming global norms.

Gold’s recent gains are therefore unsurprising given the current environment of doubt and uncertainty, where investors seek a real safe haven. As record highs in gold prices have been largely driven by central bank purchases, historical scepticism toward the metal from private bankers, mostly in the west, prevails, as they have little interest in promoting gold as a major holding in investors' portfolios.

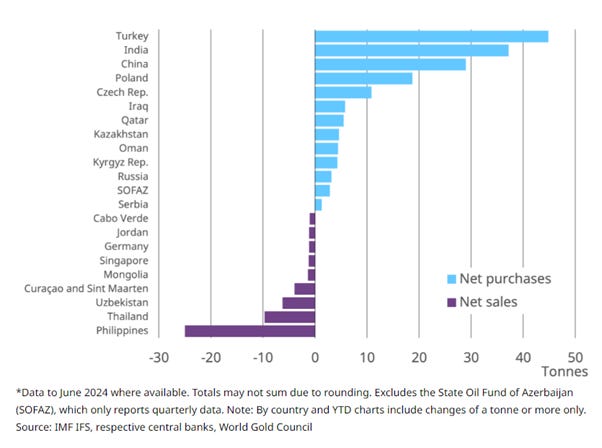

So, central banks have been gobbling up gold and based on responses to the World Gold Council's 2024 Central Bank Gold Reserves Survey, their appetite for the yellow metal isn’t going to be satisfied anytime soon. Last year, central banks added a net 1,037 tons of gold to their reserves, just slightly below the record of 1,082 tons from the previous year. This pace of buying is likely to continue. According to a World Gold Council survey of 70 respondents, 29% of central banks plan to add more gold to their reserves in the next 12 months. The WGC noted that this is the highest level since the survey began in 2018.

Why do central banks hold gold in their reserves?

Central banks hold gold for several reasons. The primary reason is that gold serves as a long-term store of value and provides a hedge against inflation. Other key reasons for holding gold include its performance during times of crisis, its role as a portfolio diversifier, and the fact that it carries no default risk. Emerging and developing market central banks view risks differently from those in developed markets. A higher proportion of EM central banks consider the following factors more relevant to their decision to hold gold:

Concerns about systemic financial risks

Lack of political risk

Concerns about sanctions

Anticipation of changes in the international monetary system

JP Morgan's phrase ‘gold is money and everything else is credit’ highlights gold's enduring value. Until recent past, central banks hold treasury bonds from reserve currency countries to stabilize their currencies. However, with government bond prices falling 7% from 2019 to 2024, central banks are facing latent asset losses. To strengthen their balance sheets and reduce fiat currency exposure, many are turning to gold. The recent surge in central bank gold purchases, especially by China and India, underscores this shift, though it doesn’t indicate full de-dollarization. The weaponization of USD holdings since the start of the war between Ukraine and Russia and reckless government spending in the western world have been others catalyst motivating central banks to reduce their holdings in US Treasuries and other government bonds while increasing their gold reserves.

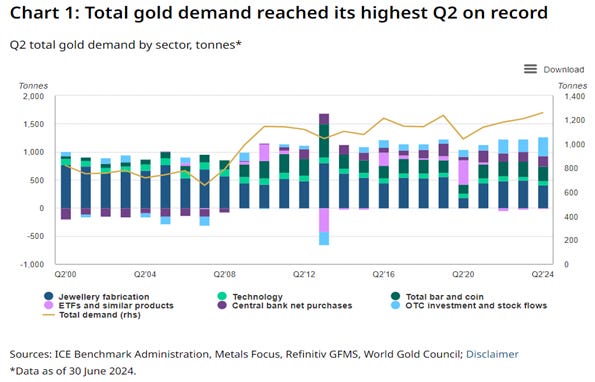

According to the World Gold Council, central banks accelerated their gold purchases to over 1,000 tonnes per year in 2022 and 2023. This means that monetary authorities account for almost a quarter of annual gold demand during a period when supply and production have not grown significantly. The ratio of output to demand stood at 0.9 in June 2024, according to Morgan Stanley. Global official gold reserves increased by 290 net tonnes in the first quarter of 2024, the highest since 2000, and 69% higher than the five-year quarterly average of 171 metric tonnes. This trend continued into the second quarter of the year, with gold purchases reaching 31 tonnes in June 2024.

The People’s Bank of China and the Reserve Bank of India have been the largest buyers of gold, aiming to balance their reserves and reduce exposure to government securities. China has increased its gold reserves by 16% since 2022, reflecting rising global polarization and trade tensions. Despite this, gold still only makes up 4.6% of China's total reserves, with US Treasury bonds representing around 50%. China aims to boost its gold reserves to at least 14%, requiring significant annual purchases. India's central bank added 19 metric tonnes of gold in the first quarter. Other central banks diversifying their gold holdings include Kazakhstan, Singapore, Qatar, Turkey, and Oman. In Europe, the Czech National Bank and the National Bank of Poland have also increased their gold reserves to balance their portfolios and reduce reliance on eurozone government bonds.

This trend is not about full de-dollarization but about mitigating the volatility of government bond prices and geopolitical risks. Central banks are returning to gold after years of reducing their holdings and suffering losses from government bonds. This shift suggests that central banks are anticipating erosion in the purchasing power of reserve currencies due to excessive fiscal and monetary policies, hence their increased gold purchases.

Even countries like Nigeria, Uganda, Zimbabwe, and Madagascar are also boosting their gold reserves and backing their currencies with gold. For instance, Uganda's central bank announced a gold-buying program from local miners to mitigate international financial risks. Tanzania plans to invest $400 million in gold and reduce reliance on the US dollar. Zimbabwe has introduced a gold-backed currency, the ZiG, to replace the Zimbabwean dollar, backed by gold and other foreign reserves.

To put things into context, as of the end of 2023, gold makes up around 18% of central bank reserves, while the share of the US dollar in total global reserves has declined from 71% in 2000 to 56% (according to the IMF Official Foreign Exchange Reserves (COFER)). This reflects the push among public asset managers to diversify their foreign reserves, as achieving safety and capital preservation through traditional assets and currencies has become more challenging due to historical real yields and the rising risk of USD reserve weaponization.

The weaponization of the USD against Russia has clearly signalled to both Moscow and the world that US dollar assets are not safe for countries that do not align with Western agendas centred around climate change and other woke policies. When BRICS admitted four new members, Egypt, Ethiopia, Iran, and the UAE, early this year, with Saudi Arabia expected to join soon, it became evident that these BRICS+ countries could face sanctions, similar to Russia, for not adhering to the globalist narrative promoted in the US and Western countries. This development coincides with the World Bank's recent ‘Gold Investing Handbook for Asset Managers,’ which recommends up to 22% gold holdings for central banks, highlighting its role as a diversifier during periods of volatility.

The emerging bipolar global order, highlighted by Zoltan Pozsar’s ‘Bretton Woods III’ article from March 2022, suggests a shift towards a new global monetary framework. Pozsar predicted a transition from the gold-backed Bretton Woods era to Bretton Woods II, supported by Treasuries, and now to Bretton Woods III, backed by gold and other commodities. While the future path remains uncertain, it is clear that we are moving towards a new global monetary system, with gold increasingly becoming a key asset for central banks and sovereign wealth funds on the geo-economic chessboard.

This can be illustrated by the trend in physical gold and US Treasuries held by the Chinese central bank. Over the past 10 years, its official gold reserves have increased from around 33 million troy ounces to about 73 million troy ounces. Meanwhile, its U.S. Treasury holdings have declined from approximately $1.3 trillion to less than $770 billion as of the end of May 2024.

China Gold Reserves (blue line); China US Treasury holding in billion USD (red line).

Ultimately, investors need to recognize that China is not only aware of the impending US sovereign debt crisis but also that the weaponization of USD assets has made it untenable to hold US Treasuries. This is compounded by rising pressure from Washington to initiate another proxy war in Asia, likely around the Korean Peninsula and the Taiwan Strait.

Another question is how central banks add to their gold reserves. Most central banks have been increasing their gold reserves through purchases in over the counter (OTC) markets or local procurement programs. Some central banks possess inherited gold that may not meet current market standards, leading them to engage in gold upgrading programs.

Investors should also remember that most of the largest gold producers in the world are in what the Western world still pompously calls Emerging Markets, such as China, Russia, Kazakhstan, and Indonesia. This gives these countries direct access to the primary source of gold for their reserves and their citizens.

In a nutshell, after years of printing money without limits, monetary authorities are now seeking to increase their gold reserves. Contrary to expectations that the US-China trade war and global polarization would ease under Biden, these issues have intensified. Central banks are responding to latent losses in sovereign bond portfolios by buying more gold to guard against inflation. Many emerging market central bankers are concerned about shifts in global economic power and the potential for the dollar to be used as a foreign policy tool. In fact, 32% of surveyed central bankers cited de-dollarization as a reason for increasing their gold holdings.

Outside central banks, gold demand has been primarily driven by retail investments, particularly in Asia, while Western, especially US, investors have been sceptical of gold. This is evident from Q2 2024 data, where bar and coin demand in China surged 62% year-over-year to 80 tons, marking the strongest Q2 since 2013. Despite a 28% seasonal decline from Q1, the first half of the year saw a 65% increase to 190 tons. During this period, gold investment demand closely tracked gold prices, with investors buying more bars and coins as prices rose from March to May and pausing in June as prices stabilized.

Similar trends have been observed in India and the Middle East. Despite year-over-year declines, gold bar and coin demand in the Middle East remained robust, with Q2 investment falling 13% year-over-year to 28 tons and H1 demand also down to 53 tons. In contrast, demand in the US and Europe for gold bars and coins has been weak, despite the impact of irresponsible Keynesian fiscal policies that devalue fiat currencies and could lead to a sovereign debt crisis.

Some might believe that Western investors have a less established tradition of owning physical gold and prefer ETF investments in the metal. In this context, the flows of the most popular physical gold ETFs in the US and Europe indicate regular quarterly outflows since Q4 2020. This trend reflects how Western, particularly American, investors have increasingly adopted a YOLO investment style, which tends to undervalue the benefits of holding physical gold in a diversified portfolio and their misunderstanding of the fact that an ETF will not provide the de-centralized attribute of holding the physical bars in their own storage.

Despite a rise in gold prices of over $700 from 2019 and 2012 levels, total known ETF holdings are at the same level as they were in November 2019 and December 2012. Meanwhile, managed gold futures net long positions have also barely changed compared to these periods. This shows, if still needed, that retail and institutional investors in the west have completely missed the recent gold bull market.

Total Managed Gold Future Speculative positions (blue line); Total Known Gold ETF Holdings (red line); Gold price in USD (yellow line).

Indeed, despite gold's recent steady performance, one might have expected ETFs to register record inflows. However, the reality has been different and contrary to expectations: from April 2022 to June 2024, there was a net outflow of almost 780 tons, or 20%, from gold ETFs. According to the old gold playbook, gold should be around USD 1,700 given the decline in ETF holdings.

It is evident that, despite its impressive returns, gold continues to be viewed sceptically by many in the West, including both professional investors and the general public. Investments in gold are often dismissed as shady, unsustainable, too risky, or too speculative. Political implications are increasingly being drawn as well. But why does a safe haven that has proven reliable for centuries face such a negative reputation? Why is gold despised rather than eagerly sought after? In a geopolitically divided world, with the US government weaponizing the global reserve currency, the US dollar, against its adversaries, who then turn to gold and other assets to bypass the dollar, a crackdown on gold owners no longer seems far-fetched. Doomberg recently envisioned a propaganda campaign with such dynamics as follows:

Another factor negatively impacting demand for physical gold in the West is the increasing legal requirements for buying physical precious metals, particularly restrictions on cash transactions. In the US, cash transactions exceeding $10,000 must be reported to the IRS via Form 8300, including US dollar coins, bills, and equivalents. The IRS and Treasury have proposed lowering the reporting threshold for third-party payment platforms to $600 under the American Rescue Plan Act, affecting all transactions of this amount over a year. This change, though delayed for clarity, aims to improve tax compliance and fairness according to the IRS but the real goal is to impede retail investors to own physical gold as the government knows that gold and silver are the only tool that retail investors have to preserve their wealth against reckless government spending and more tyrannic government regulations.

On the other side of the pond, in early 2024, the EU set a cash transaction limit of EUR 10,000 supposedly to combat terrorism, money laundering, and sanctions evasion. This rule is part of the AML/CFT package and introduces the Anti-Money-Laundering Authority (AMLA) in Frankfurt to oversee and coordinate financial supervision. Countries with stricter limits can keep them; for instance, France and Portugal have limits of EUR 1,000, Greece EUR 500, and Italy raised its limit from EUR 2,000 to EUR 5,000. The real value of these limits decreases due to monetary devaluation. In Germany, the EUR 2,000 limit makes anonymous gold purchases impossible, though higher limits in Austria and Switzerland still allow for some anonymous transactions.

Given the spread of YOLO culture and its DEI ramifications in Western society, many American and European investors, both institutional and individual, believe that Bitcoin, not gold, is the decentralized asset that will protect them from increasingly authoritarian governments using sovereign debt and Keynesian fiscal policies to consolidate power. These investors should be aware that first Bitcoin's true origins are still in question, with a high degree of speculation than Bitcoin might be a government creation designed to attract these investors to a form of digital currency that could ultimately be replaced by a central bank digital currency (CBDC). Additionally, Bitcoin's outperformance relative to gold has been closely correlated with the Nasdaq index's performance over the past decade, showing that Bitcoin is not an antifragile asset. In this context, owning gold can be seen as an insurance to hedge against the 'collective stupidity' that is in great abundance, in particular in the Western world.

Relative performance of Bitcoin to Physical Gold (blue line); Nasdaq 100 index (red line) & Correlation.

For those who still doubt the need to own physical gold, recent events highlight the importance of physical over electronic assets. When a private company like CrowdStrike can cause a global cyber outage due to an 'inappropriate' software update, it underscores that cyberattacks can paralyze computer, electronic, and electrical systems, as well as entire economies. In today’s world, virtually nothing functions without these systems, financial markets, banks, travel, shipping, supply chains, telecommunications, and the internet. As our reliance on electrical and electronic systems has grown, their failure could thrust us back into the Stone Age. In such an environment, a gold coin will always be accepted by a farmer to feed anyone anywhere on earth, while an unreliable cryptocurrency may prove worthless in a digital world controlled by tyrannic governments.

Interestingly, while US and European investors remain cautious, Japanese investors are increasingly turning to gold as a store of value amid a structurally depreciating yen and low interest rates and the prospective financial doom loop for the country. The MUFG Gold ETF has seen a surge in demand since its launch, driven by a rise in gold prices in yen, which have increased by nearly 30% this year and over 150% since 2019. Investor demand in Japan surged by 228% in 2023 compared to 2022.This shift suggests that Japanese investors understand their country will be among the first, along with Europe, to experience the severe effects of government defaults and currency devaluation on their standard of living.

Physical Gold price in JPY (blue line); Bank of Japan Balance (in trillion JPY).

This likely explains why the price of gold in Japanese yen has increased more than fivefold since 1985, while the Nikkei index, expressed in yen, has less than tripled and experienced drawdowns of over 60% during various periods.

Value of ¥100 as of 31st December 1985 invested in physical gold (blue line) and Nikkei 225 index (red line).

Most importantly, understanding the slump of the Japanese yen should serve as a warning to the US and the rest of the western world. As the world’s most indebted nation with a debt-to-GDP ratio of 400%, the yen had no choice but to fall sharply. Its impact on gold prices in yen terms is already historic. Remember, the yen was once considered a safe-haven currency! So, why are investors expecting better outcomes for the US dollar?

Gold price in USD (blue line); US Government Debt (red line).

While Western investors remain largely uninterested in physical gold, the global currency system has been unravelling since Nixon ended the gold standard in 1971. With high debt-to-GDP ratios and soaring deficits, many Western nations face a crisis of rising debt, failing banks, and currency devaluation. This will inevitably lead to debt defaults, increased money printing, higher interest rates, and further deficits. Although the dollar may temporarily strengthen due to demand, all currencies will lose significantly in real terms against gold. Since 1971, currencies have lost 97-99% of their value in real terms, with gold being the true measure of worth.

The final 1-3% decline (100% from now) will occur over the next 3-8 years, signalling the end of yet another currency system. This one, which has lasted since 1913, just over a century, was doomed from its inception. As always in history, the impact will extend beyond the collapse of money. Debt and currency failures go hand in hand, resulting from sustained government deficit spending. After a period of unchecked currency printing, the financial system will either partially or fully collapse. This will likely lead to political and social unrest, potentially even civil war. Under this kind of economic pressure, governments historically start or escalate conflicts to distract from domestic issues, using war as a pretext for printing even more money.

With the vital element of the new gold playbook being that Western financial investors are no longer the marginal buyers or sellers of gold, and with the most significant demand now coming from central banks and private Asian investors, the old correlation between gold prices and US real yields no longer holds. This is why, to the surprise of uninformed Wall Street bankers, the price of gold has thrived even in an environment of rising real interest rates.

Gold price in USD (blue line); US 10-Year Real Yield (axis inverted; red line); and correlations.

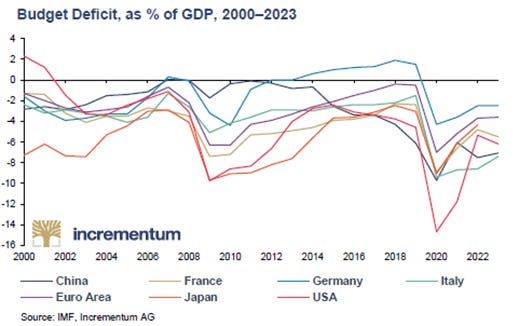

As the West faces a growing debt crisis, this should prompt investors to add gold to their portfolios. Debt directly impacts inflation and the value of sovereign currencies. The looming debt shadow now affects the entire Western world, not just the US.'s $35 trillion debt. For instance, Italy’s 250% debt-to-GDP ratio seems minor compared to France’s 330%, making France the second-most bankrupt nation globally. France’s worsening debt situation, now exacerbated by a far-left candidate promising to tackle inequality through currency debasement, raises concerns about the Eurozone’s stability.

As the collapse of Western financial and political systems unfolds, wealth preservation takes on new significance. Geopolitics has driven the rise in gold prices in recent years, but the ultimate catalyst for Western investors returning to gold may be the fall of their own governments, signalling the end of a major era. Deficit spending, debt expansion, currency debasement, and inflation are leading to political and economic turmoil. In the UK, France, and the US, political instability is exacerbating the debt crisis. In the UK, Prime Minister Keir Starmer won with just 33% of the vote, and 80% of eligible voters did not support him. This reflects the growing dissatisfaction and uncertainty in Western politics. The US faces a similar problem after the November election. If Trump wins, he may have a narrow majority, leading to significant opposition. Conversely, if a Democrat wins whoever he or she is, Trump supporters might reject the outcome. In France, Macron suffered a major defeat in the recent parliamentary election and is now a lame duck president. Despite this, he continues to act with undue confidence. Macron might manage to join a new coalition government, but his political position remains weak, with Le Pen’s National Rally being the largest party but having been denied a legislative majority because of political games, social tensions in the country will keep rising once the Olympic flame has been switched off, ultimately leading to a civil war as currently experienced in the UK.

Finally, seasoned investors know that physical gold is the best hedge against rising government risks and inflation. To avoid financial hardship from inflation, investors should hold substantial amounts of physical gold. Historically, gold preserves purchasing power better than cash. For example, in 1963, the average US house cost about 542 ounces of gold. By 2024, despite house prices soaring to $500,000, the cost in gold has dropped to only 215 ounces. This shows that gold effectively maintains its value over time, preserving wealth against inflation.

US New One Family House Average Price in Gold ounces.

The same applies to stocks for mitigating inflation's impact on financial health. In 1963, the average US house could be bought with about 21 units of the Dow Jones Industrial Average. By 2024, the same house can be purchased with approximately 13 units of the Dow Jones.

US New One Family House Average Price in Dow Jones Industrial Average.

Although long-term data on fixed income is limited, the available data over the past 24 years shows that the price of a New One Family House, when measured against the Bloomberg Global Agg Treasury Total Return Index, has increased by over 30%. This indicates that even with the bull market in fixed income until the start of the COVID pandemic, these investments have not effectively protected investors from the inflation caused by irresponsible fiscal stimulus.

US New One Family House Average Price in Bloomberg Global Agg Treasuries Total Return Index.

As the investment environment for gold has fundamentally shifted, the reorganization of the global economy, the influence of emerging markets, and rising debt and inflation are driving gold's value up. Consequently, the traditional 60/40 portfolio should be adjusted to 60% equities and 40% antifragile assets like physical gold and silver. This change reflects current market conditions and will evolve as currency stability returns. In the meantime, a higher allocation to hard assets is advisable until a stable currency system, whether sovereign or a gold/silver standard, is established.

Performance of the Barbell 60/40 Portfolio (30% S&P 500 IT sector; 30% S&P 500 Energy Sector; 40% Physical Gold) (blue line); the old 60/40 Portfolio (60% S&P 500 index; 40% Bloomberg US Agg Total Return Index) (red line); the 60/40 Silver Portfolio (30% S&P 500 IT sector; 30% S&P 500 Energy Sector; 20% Physical Gold; 20% Physical Silver) (green line) rebased at 100 as of December 31st, 2019.

To conclude, investors must understand that the real move in gold and silver prices has not yet started. The shift away from the US dollar as the global trading currency is expected to accelerate, with BRICS countries increasingly using local currencies and gold for settlements. This transition will likely speed up as trading through intermediary currencies becomes redundant. Additionally, the US confiscation of Russian assets is prompting central banks to shift reserves from dollars to gold, setting the stage for a major gold price increase in the coming years. Given the fixed global gold supply of around 3,000 tonnes per year, rising demand will drive prices higher, not production.

Looking at history, over the past 55-year there has been 2 major bull markets in Gold.

The first one was from 1971 to 1980 with gold up 20X from $35 to $700.

The second one started in 2001 at $250 and has only started a move which will reach multiples of the current price.

But these past 55 years have been just over 1% of the long-term gold bull market. Since the emergence of the fiat money system, the gold bull market has largely reflected government mismanagement of the economy, resulting in ever-growing deficits and debts. In this system, the price of gold primarily reflects the chronic debasement of paper money.

Gold price in USD since 1960.

At the end of the day, governments and central banks are gold's best friends. They have consistently destroyed the value of fiat money through currency debasement, deficit spending, and debt creation. For example, during the Roman Empire from around 180 to 280 AD, the Denarius Silver coin's silver content dropped from nearly 100% to 0%, with silver replaced by cheaper metals. This raises the question: why hold fiat or paper money? In a sound economy with no deficits, minimal inflation, and a balanced budget, holding interest-bearing cash is fine. However, such conditions have not existed since 1971, when Nixon closed the gold window. Even today, gold remains as undervalued relative to the money supply as it was in 1970 when it was $35 or in 2000 when it was $300.

USD price of an ounce of Gold adjusted to the US Federal Reserve Money Supply M2 (rebased at 100 as of 31st December 1959.

As the world is witnessing a fundamental shift, with old certainties fading and traditional strategies failing, embracing the new gold playbook, which advocates increasing allocation to real antifragile assets like physical gold and silver, requires courage but offers potential for growth and stability. While Asia and other members of the mercantilist Global South have embraced the ‘In Gold We Trust’ narrative, the Western narrative disparages it, driven by those who benefit from maintaining the fiat system. This negative image, perpetuated by the media and powerful interests in the west, reflects Ron Paul's observation that ‘gold is honest money, disliked by dishonest men.’ With dishonest leaders in the West, only astute investors will emerge from the upcoming regime crisis with improved purchasing power.

To summarize the current environment, gold has remained strong despite China’s economic weakness, the hawkish stance of the FED, and the strength of the US dollar. If any or all of these factors reverse, gold could surge even higher, especially if Western investors begin to understand that ‘In Gold, They Must Trust’.

To conclude, avoiding exposure to government risks is crucial wherever you live on this planet and as the focus should be on RETURN OF CAPITAL rather than RETURN ON CAPITAL, investors should like their Asian peers trust in gold rather than in fiat currency assets. Indeed, while the world is engulfed in conflict as a direct result of the global economic downturn, evident in countries like Bangladesh, Ghana, Uganda, Kenya, and Nigeria, it's clear that peace often prevails when everyone is fat and happy. However, this is no longer the case for the majority of the world, given the cost-of-living crisis. Some regions are hit harder than others, but all countries governed by reckless Keynesians who support the WEF's Great Reset agenda are likely to face proliferation of these challenges. That’s why in the course of time, this is NOT a time to get pessimistic; it is a time to observe, study, and understand what lies ahead for us as investors and citizens. We, The People, need to be prepared for the future to come as the challenges we endured in the past become our tools to reshape the future!

As Soren Kierkegaard famously said: ‘Life Can Only Be Understood Backwards, But It Must Be Lived FORWARD.’

WHAT’S ON THE AGENDA NEXT WEEK?

The week of Assumption Day in the Christian world will feature a busier macroeconomic agenda, focusing on the health of Chinese and American consumers and entrepreneurs. Key releases include monthly retail sales and industrial production data in China and US. In the US, attention will also be on inflation with the PPI released on Tuesday and the CPI on Wednesday. The final leg of the Q2 2024 earnings season will include results from Home Depot, Walmart, Deere, Tencent, and Alibaba, among others.

KEY TAKEWAYS.

As Mercury remains in retrograde motion, here are the key takeaways:

Latest inflation data in China while showing some signs of improvement in consumer demand are still not yet enough to declare that Xi has reached his goal to ‘Make China Great Again’.

After a stagflationary manufacturing ISM, the services part of the survey confirmed that the risk of higher inflation remains in the coming months.

Wall Street parrots shouting for emergency rate cut should learn from history books that this kind of interventions have never been effective before.

The latest results from Berkshire Hathaway indicate that Warren Buffett is particularly fearful now. Given his track record, investors should take note and consider maintaining a substantial tactical cash allocation in their portfolios.

To know, In Gold Who Trusts? Investors should look East for an answer.

In a 'debt-entombed economy,' where the FED’s decisions are essentially meaningless, gold prices are no longer driven by marginal Western investors.

Gold has been and is linked to the rise of the Global South as a new economic powerhouse, as the de-dollarization of reserves has only just begun.

While EM retail investors have participated in the recent gold rush, YOLO-driven Western investors still need to realize that physical gold, not Bitcoin, will preserve their wealth during the upcoming sovereign debt crisis, which will spread across developed markets sooner rather than later.

Physical gold remains THE ONLY reliable hedge against reckless and untrustworthy governments.

Investors should keep in mind that wars spur shortages, and shortages during a stagflationary crisis are particularly problematic.

Gold may not make investors rich, but it will help them stay rich.

Gold is an insurance to hedge against 'collective stupidity' that is in great abundance, in particular in the Western world.

As governments and central banks are gold's best friends, the nominal price of gold fails to reflect that its value has barely increased when adjusted for the quantity of fiat money created over the past 50 years.

Investors should keep in mind that wars spurs shortages, and shortages in the middle of a stagflationary crisis are a very bad thing.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscatable, like physical Gold and Silver.

Long dated US Treasuries are now an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

In such an environment, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

As the country of the rising sun prepares to celebrate Mountain Day and the Yen carry trade tantrum eases, the last five trading days have been highly volatile. After starting with a woke version of ‘Black Monday,’ stocks recovered over the next four trading sessions, leaving the S&P 500 index almost unchanged. The Nasdaq even managed to end the week in the green, while the Dow Jones underperformed. While YOLO investors bought the dip on Monday and are still entertained by Powell’s ‘Forward illusion,’ that the FED will cut rates to save the world, rational investors recognize that the real issue lies with reckless Keynesian fiscal policies and the implementation of regulations related to the climate change scam and DEI phantasms, for those outside the Washington plutocracy. In this context, while the S&P is holding above its 100-day moving average, investors should stay alert, as more volatility is expected. This may come with the next earthquake shaking the Yen carry trade, a bomb going off in the Middle East or any events related to the last 90 days of the year of political hell.

In this context, despite the Wall Street parrots squawking and rising fears about the economy, cyclical sectors such as Industrials and Energy outperformed, while Consumer Discretionary and Materials lagged.

In the current context of wars and stagflation, to preserve wealth for financial survival, there are first some obvious DON’T’S that investor should look at first. These include:

Don’t keep most of your wealth in a fragile banking system, whether in cash or securities. With many banks likely to default, it could take a long time before your assets are released, if they are released at all. Bail-ins or forced investments in government securities at low real (i.e. inflation adjusted) interest rates and for extended periods, such as 10 years or more, are also likely.

Don’t hold sovereign bonds as many if not all governments will default.

Don’t bet on inflation reducing your debt. High interest rates or the indexation of loans might make it impossible to repay your borrowings.

This list of DON’TS is far from exhaustive, as the largest global debt and asset bubble in history is likely to surprise even those investors who believe they are well-prepared for a doomsday scenario for governments.

On the other hand, some DOs could be more useful such as:

Do hold substantial amounts of physical gold and physical silver in secure jurisdictions such Singapore and Liechtenstein or any other countries which have taken some independence from the Malthusian agenda spread by the WEF. This physical gold must be stored outside the banking systems anywhere in the World. Precious metals should be stored in very safe non-bank vaults, in your name, with direct access to the metals. To minimize the risk of confiscation or freezing, it is best to keep some of them outside your country of residence.

Focus on wealth preservation. Avoid trying to get rich at all costs and focus on staying rich. Risk management and avoiding severe drawdowns should be the top priority for everyone, whether high-net-worth individuals or retail investors. Everyone should now prioritize wealth preservation, with more than 20% of their investment assets in physical gold and silver.

With the dominoes falling as outlined above, most people will face significantly more hardship than they do now. For anyone with savings, whether it’s $100 or $100 million, wealth preservation should be a top priority. Safely storing physical gold and silver outside the banking system is crucial. During difficult times, helping family and friends becomes paramount. This support will be essential to navigate the challenges we all face. Additionally, don’t forget that some of the best things in life are free, such as nature, books, music, and hobbies. In the meantime, never forget: In Gold, We ALL Trust….

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.