THE WEEK THAT IT WAS...

The week of Vesak Day in the Buddhist world was relatively quiet for investors—aside from a fresh U.S. inflation and retail sales report, as well as new consumer inflation expectations and sentiment data from the University of Michigan. It also marked the start of the U.S. retail earnings season, with Walmart reporting results alongside 11 other S&P 500 companies.

April’s US CPI—the first since the grand “Liberation Day”—gently reminded us that March’s deflationary dip was just a statistical mirage. Inflation’s alive and well, fuelled by the magical return of tariffs in the U.S.-China trade soap opera. Welcome to the Trump-Re-Flation era, where someone’s always picking up the tab—be it consumers or producers. While the "Manipulator in Chief" and "Central Banker in Chief" will pat themselves on the back, the umbrella inflation index is up 3.38% YoY and that mythical 2% target? Still hiding with unicorns. Savvy investors, unlike the Fed’s PhD army, know better. With tariffs looming like a punchline waiting to land, even a 0.1% monthly CPI print (aka a fantasy) won’t get us to 2% by end-2025. At 0.2% or more, we’re staring at 2.5% to 5.8%. But hey, who needs monetary credibility when you’re playing partisan limbo with inflation?

Following the cooler-than-expected but still rising CPI, US Producer Prices absolutely face-planted in April—down 0.5% MoM vs. the expected +0.2% (the biggest drop since April 2020). Sure, last month’s decline got revised away, but let’s not ruin the drama. The headline YoY print slid to +2.4%, the lowest since September 2024. Meanwhile, core PPI didn’t just dip—it set a record plunge (data back to 2010). Final demand services prices sank 0.7%, the biggest drop since the index began in 2009, mostly thanks to trade service margins collapsing 1.6%. Even transportation and warehousing joined the party, with modest drops of 0.3% and 0.4%.

When it comes to what actually drives corporate America's profits—namely, the magical ability to pass rising costs onto consumers and still brag about "margin expansion"—things aren’t exactly going to plan. The gap between Core CPI and Core PPI (a handy little indicator of pricing power) is now sitting at -0.27% year-over-year. That’s seven straight months in the red. Historically, this kind of trend has been about as bullish for equity valuations as a skunk at a garden party.

Upper Panel: S&P 500 Index 12-month Fwd P/E (blue line); Spread between US Core CPI YoY Change and Core PPI YoY Change (Histogram); Lower Panel: 12-Month Rate of Return of S&P 500 Index (Yellow Histogram).

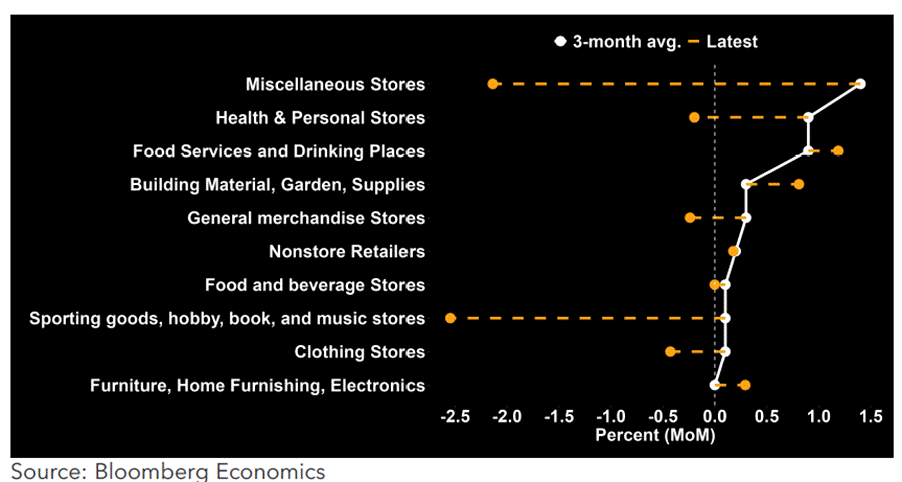

Cue the confetti—April retail sales beat expectations! But behind the fanfare, sporting goods crashed, building materials, and all other China exposed spending, declined, and the previous month’s tariff-fuelled car-buying frenzy? Gone. In a nutshell, consumers are pulling back where tariffs hit hardest, though they're still shelling out for food and fun—for now.

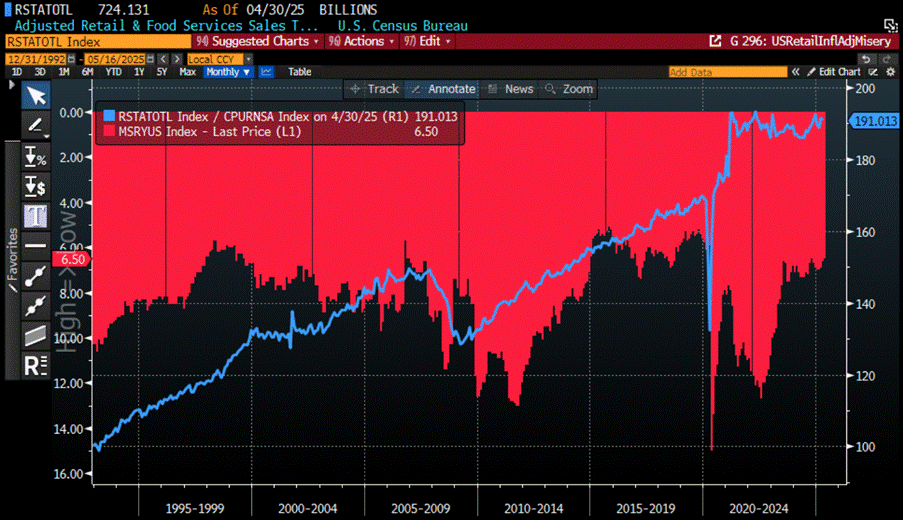

As everyone who’s skimmed an econ textbook (or just nods along at dinner parties) should know, retail sales are nominal meaning they ignore that pesky thing called inflation. Adjust for it, even roughly, and sales are still below their April 2022 peak. Historically, that’s been a flashing warning light: inflation-adjusted retail sales peaks tend to line up with peaks in the S&P 500 to Oil ratio and foreshadow the ratio dipping below its 7-year moving average—a not-so-subtle hint that a real U.S. recession may be lurking around the corner.

US Retail Sales Adjusted to inflation (i.e. CPI) (blue line); S&P 500 to WTI ratio (green line); 84-months Moving Average of the S&P 500 to WTI ratio (red line).

Trade war "ceasefire" in the Swiss Alps? Lovely photo op. Meanwhile, back on Earth, US consumer sentiment just plunged to a record low of 50.8, with nearly 75% of Americans ranting about tariffs—Republicans included. Inflation expectations? Try 7.3% next year, the worst since 1981. Long-term? Highest since 1991. Expectations index? Lowest in 45 years. Personal finances? Not this bad since 2009. But sure, everything’s fine for those still believing in the smoke and mirrors spread by the ‘Manipulator In Chief’.

In the circus of rate-cut dreams, Wall Street’s hype squad and the “Manipulator-in-Chief” keep chanting for FED magic —ever the optimists—are now barely pricing in two cuts by year-end. The FED’s big comeback has been delayed from July to September (maybe), but let’s be honest: no cut might come at all. In fact, with inflation creeping back in like an unwanted sequel, the FED may need to hike just to remind everyone it still has a spine.

It’s been a mere 135 days since the grand Jubilee year kicked off and just 115 days since the ‘Disruptor In Chief’ waltzed back into the Oval Office for round two — and wow, what a yawn fest, right? Regardless of your political flavour or where you call home on this spinning rock, one thing’s clear: this Jubilee year has been so far anything but uneventful. And sure, Lenin once said, "There are decades where nothing happens and weeks where decades happen," but honestly, *who knew he was talking about this year?

In an environment like this, investors might want to channel their inner John Maynard Keynes — you know, the guy who, when called out for changing his stance, coolly replied, "When the facts change, I change my mind. What do you do, Sir?" A refreshing reminder that clinging to old narratives in a world flipping upside down every other week might not be the sharpest strategy.

In theory, Keynes’ advice sounds like pure gold — “When the facts change, I change my mind. What do you do, Sir?” Elegant, logical, wise. But in practice? Well, good luck figuring out which “facts” actually matter, and which are just social media chum tossed into the market aquarium by the ‘Manipulator In Chief’ — whose tweets do more for confusion than a magician with a fog machine at a Wall Street conference.

And let’s be honest — today's “new facts” often point in opposite directions. One says buy, the other says sell, and a third says panic quietly into your oat milk latte. So, what’s an investor to do? First, remember the golden rule: KISS ME — Keep It Simple, Stupid; Minimize Entrapment. Yes, in a world spinning faster than a leveraged ETF on FED Day, simplicity is a radical act of rebellion.

Instead of obsessively refreshing Twitter—or whatever we’re calling it this week—or chasing every clickbait headline from financial pundits who haven’t managed a dollar in their lives, focus on the mega-trends reshaping the world like tectonic plates at a disco.

1. Fortress America 2.0: The U.S. has clearly decided it’s time for a glow-up... in bunker form. “Territorial expansion” is back in fashion: booting Denmark out of Greenland, China out of Panama, and whispering sweet nothings about the glory of two oceans and a dream. From the ‘Vice MAGA in Chief’ charming crowds in Munich to Oval Office showdowns with Ukraine’s increasingly unwanted guest star, the signs are clear — America’s done playing world cop and is now binge-building its own gated community.

2. The US Consumer? Not Your Atlas Anymore: The US consumer has been the mighty consumer of last resort since WW2, but he is likely to look increasingly just a tired shopper dodging tariffs like potholes in the next few years. The so-called ‘Liberation Day’ tariffs? More like Liberation-from-your-wallet Day. And our ‘Manipulator In Chief’ seems to believe trade wars are a masterstroke of negotiation — when in reality, it’s more like trying to fix a watch with a hammer and has not year that trade wars are wars of attrition and that the time is in China’s favour not the American who will soon have to focus on their next mid-term election.

US Retail Sales Adjusted to US CPI Index (blue line); US Misery Index (red histogram; axis inverted).

3. AI: The Not-So-Golden Goose: Remember when Artificial Intelligence was supposed to unlock unlimited profits and possibly eternal youth? Well, China just cannonballed into the AI pool with DeepSeek, and let’s be real — when China shows up, profits quietly grab their coats and leave the party. Monopoly-style gains like the post-dot-com boom? Probably not happening when the ‘Maleficent 7’ are up against an industrial juggernaut with no interest in playing by Silicon Valley rules.

Relative Performance of Magnificent 7 to S&P 493 (blue line); US CPI YoY Change (red histogram).

4. Beijing Stimulus Bonanza: While the West debates soft landings and FED next action, China’s out there actually doing stuff — like cranking up fiscal and monetary stimulus to turbocharge domestic consumption. Welcome to the Valeriepieris Circle: where Russia supplies cheap commodities, China builds everything with terrifying efficiency, and India shows up with a booming population ready to spend. It’s basically the Avengers of global economic power — only this time, Captain America will not get an invite.

China Retail Sales Index (blue line); Bloomberg China Credit Impulse 12-Month Change (red line).

5. De-Dollarization and the Great Asset Exodus: For decades, global excess cash parked itself safely in U.S. Treasuries and more recently in the beloved Magnificent 7 stocks which were mistakenly promoted as ‘antifragile’. But now? The great escape is underway. De-dollarization is no longer a conspiracy theory whispered in gold bug forums — it’s happening in the Global South. And as history reminds us, trade wars don’t end in handshakes; they graduate to capital wars, and eventually to the kind with tanks and awkward UN meetings.

USD Index (DXY Index) (blue line); Gold Price in USD Terms (red line).

In short: Forget the noise. Zoom out. Simplify. And maybe mute the ‘Manipulator In Chief’ while you're at it.

These five trends combine into a heady cocktail — the kind that’s bound to leave financial markets with a long-term hangover (or maybe a total personality shift). Let’s start with the once-mighty USD assets — and specifically, the crown jewel: U.S. Treasuries.

Now, you’d think that after the ‘Liberation Day’ fireworks and the ensuing ‘Tariff Tantrum’, investors would be stampeding into Treasuries for safety like it’s 2008 all over again. But nope — the rally never showed up. It's the bond market equivalent of calling 911 and getting voicemail. In fact, U.S. Treasuries have been dragging their feet ever since Russia kicked off its "Special Operation" — an event that didn’t just redraw geopolitical lines but also highlighted just how weaponized dollar-based assets have become. Add to that the reality of sticky inflation that just won’t quit and whispers of the return of everyone's favourite '70s throwback — Trump Stagflation — and you’ve got a recipe for bond market disinterest at best, desertion at worst.

The bottom line? Global investors (and yes, even Americans) seem increasingly uninterested in clinging to the fairytale of Treasuries as “risk-free.” Instead, they’re pivoting to the one asset that doesn’t care who’s tweeting, sanctioning, or printing: physical gold. No counterparty risk, no algorithmic volatility, no empty promises — just 5,000 years of antifragile credibility.

Inflation adjusted performance of Gold (blue line); S&P 500 index (red line); Bloomberg US Treasury Total Return Index (green line); Bloomberg US T-Bills 1-3 months Total Return Index (purple line) since February 24th, 2022.

Or, more simply — and far less glamorously — it might just be that Uncle Sam’s tab has gotten so absurdly large that the market can’t stomach it anymore. The issuance and rollover of U.S. debt are no longer routine exercises in fiscal housekeeping; they’re more like trying to sell a truckload of hot dogs outside a vegan festival. There's just too much supply, not enough appetite — and investors are starting to realize that endless debt auctions aren’t exactly the hallmark of a safe haven.

It’s not just the U.S. government staring down a mountain of maturing debt — the corporate world is right there too, nervously eyeing the same Everest. One of the major stories for the second half of this not-so-boring Jubilee year will be the record rollovers in U.S. corporate debt. And no, this isn’t some unexpected twist — it’s the boomerang effect of the 2020 debt binge, when companies gorged on cheap money… and then promptly spent it on share buybacks instead of, you know, building stuff or investing in actual growth. Now, with spreads widening and yields rising like bad headlines on a Monday morning, the U.S. economy finds itself tiptoeing around its very own Achilles’ heel. If refinancing becomes painful — and it will — expect balance sheets to buckle, margins to compress, and markets to start asking some very uncomfortable questions.

Like it or not — and let’s be honest, Wall Street really doesn’t like it — almost all the trends barrelling down the track are flashing green for gold. The retreat of the U.S. security umbrella, combined with the increasingly creative use of the dollar as a geopolitical battering ram, is nudging (or rather shoving) foreign central banks toward reallocating reserves. Instead of plowing excess savings into U.S. Treasuries or bidding up the already over-hyped Magnificent 7, they’re turning to the one asset that doesn’t come with sanctions, counterparty risks, or political strings: GOLD. And let’s not forget China — which, in its own stimulus-fuelled way, is quietly becoming gold’s best friend. As Beijing dusts off the fiscal and monetary playbook, both institutional giants and retail investors are loading up on gold like it’s 2023 all over again. And if recent history is any guide, they’re not just stacking — they’re setting the price.

The only catch for gold? Joe Six-Pack is getting priced out. As the U.S. economy sleepwalks into a classic case of Trump Stagflation — think high prices, low growth, and plenty of political theatre — gold may be shining, but it's also slipping further out of reach for the average American trying to build a personal safety net that doesn’t evaporate with every Fed pivot.

Back in the good old days (i.e., the start of this decade), the average U.S. worker only had to put in a little over 5 hours of labour to afford a gram of gold. Today? Try more than 11 hours. So while gold might be the obvious choice for central banks, billionaires, and macro-conscious capital allocators, the working class — the ones most in need of antifragile assets — are being left behind by the very risks they’re trying to hedge against.

Price of a Gram of Gold divided by US average hourly earnings.

Most of the trends we've touched on — from rising geopolitical instability to China's return to stimulus mode — aren’t just gold-positive; they’re flat-out bullish for commodities across the board. But the real game-changer? The slow-motion collapse of the U.S. security umbrella.

In a world where Pax Americana is more of a historical reference than a functioning reality, countries and corporations alike will be forced to stockpile strategic commodities the way doomsday preppers hoard canned beans — not because it’s trendy, but because uncertainty is the new normal. Supply chains will get bulkier, just-in-time will give way to just-in-case, and the age of abundance will quietly exit stage left. And as the commodity leviathan stirs from its long slumber, inflation won’t just be “sticky” — it’ll be Velcro. That’s a problem for politicians who live on two- to four-year timeframes and central bankers who still pretend CPI is a science. Unfortunately for them, commodity cycles don’t care about re-election calendars.

Bloomberg Commodity Index adjusted to US CPI (rebased at 100 as of December 30th, 1960).

When it comes to China, the Western media chorus and Wall Street talking heads — many of whom wouldn’t know Guangzhou from a dim sum menu — have been preaching the doom of the Middle Kingdom for a decade now. Yet, on the ground, Chinese companies remain as globally competitive as ever. The real issue isn’t collapse — it’s confidence. Both consumers and businesses are still stuck in a post-Covid funk, and despite massive trade surpluses, that money isn’t being recycled into domestic assets. But if — or rather, when — sentiment turns, the recent outperformance of Chinese equities won’t just continue… it’ll go into turbo mode.

Performance of MSCI World (blue line) and MSCI China (red line) in USD since December 31st, 1999.

China’s corporate debt market may look like a graveyard — most issuers are priced to fail, and many probably will. But some won’t. And with Beijing now stomping on the fiscal and monetary gas pedal, the space offers sharp asymmetric upside for those willing to dig through the rubble. At the very least, the renewed stimulus should act as a powerful tailwind for equities. After all, when China’s credit impulse turns up, history says equity bulls aren’t far behind.

MSCI China Index (blue line); China Credit Impulse 12-Month Change (red line) & Correlation.

At the very least, investors should start thinking about how to position for the inevitable “brrrr” of China’s money printer — because when Beijing decides to flood the system, it doesn’t trickle, it pours.

Needless to say, when China’s credit impulse is fully unleashed, shareholders of Chinese banks stand to benefit handsomely. These lenders, backed by the state and stuffed with juicy dividends, are being paid to wait as Beijing prepares to steer the next economic revolution. And with China set to extend its manufacturing dominance across the ValeriePieris circle during the coming deflationary boom, the big state-owned banks look like front-row seats to the show.

Relative performance of GS China Bank Index to MSCI China Index (blue line); China Credit Impulse 12-Month Change (red line).

Anyone with a shred of common sense—and who glanced at The Economist's 2025 outlook—could see it coming: the Jubilee Year was always going to be a turning point. Political chaos, geopolitical realignments, and economic regime shifts are already in full swing, and we’re barely past day 135. This kind of upheaval opens up compelling risk-reward setups across the four core asset classes of the Browne Portfolio. In this environment, smart investors won’t just be judged on their forecasts—but on how fast they can adapt when the ground shifts beneath them.

KISS ME — Keep It Simple, Stupid; Minimize Entrapment — shouldn’t be confused with the ‘Manipulator In Chief’s’ latest attempt to shove his Art of the Deal down the world's throat in true Trumperialistic fashion.

Because what really matters now isn’t ego-driven dealmaking — it’s to understand the Art of the Trade and the Art of War. And investors are left to navigate the fallout from trade wars that promise nothing but the export of chaos on a global scale.

In this context—and sticking to what really matters (Keep It Simple, Stupid)—investors should stay laser-focused on the three ratios that cut through the noise and actually guide smart asset and sector allocation:

S&P 500 to Oil Ratio vs. its 7-year moving average – a tell on the balance between growth optimism and real-world cost pressures.

Gold to Bond Ratio vs. its 7-year moving average – a signal of whether safety lies in hard assets or paper promises.

S&P 500 to Gold Ratio vs. its 7-year moving average – the ultimate reality check of how monetary illusion lure investors in which asset they should overweight.

Everything else is just background noise—or worse, clickbait.

As the S&P 500 to gold ratio has now been below its 7-year moving average since the first day in office of the ‘Manipulator In Chief’, and as the war cycle is on the verge of a new upcycle, investors will have to adapt to the business cycle rather than attempt to change it. They should focus on Return OF Capital rather than Return ON Capial, by owning real assets like physical gold and silver, the only antifragile assets with no counterparty risk. They also must hold other commodities to weather the storm unleashed by the ‘Commodity Leviathan.’

Additionally, active cash management is key, using a portfolio of short-dated, investment-grade (IG) USD bonds with maturities under 12 months, and Treasury bills (T-bills) with maturities not exceeding 3 months. These income-generating assets provide much-needed stability. Among equities, investors should continue to favor low-leverage companies with strong EPS and FCF growth, and those that have paid their fair share of income tax, prioritizing energy and commodity producers over consumers.

By doing so, investors can ensure both peace of mind and wealth preservation as the world shifts from a magnificent ‘Goldilocks’ into a Maleficent ‘Gold In Lots.’

WHAT’S ON THE AGENDA NEXT WEEK?

The week of Canada’s beloved Victoria Day is shaping up to be a snoozefest for investors. With only China’s Retail Sales and Industrial Production and the US Flash PMI data daring to show up on the macro calendar. Meanwhile, the second week of U.S. retailer earnings will roll on with all the excitement of a clearance sale—Home Depot headlines, joined by 14 other S&P 500 names, though let’s be honest, Palo Alto Networks is the only one anyone might stay awake for.

KEY TAKEWAYS.

As investors should Keep It Simple, Stupid, the key takeaways are refreshingly straightforward:

Inflation’s back, tariffs are the punchline, and the FED’s 2% dream is still chasing unicorns.

Producer prices just staged their worst faceplant since 2020, margins keeps evaporating, and corporate pricing power looks about as sturdy as a wet paper bag—bullish, right?

Retail sales may have topped forecasts, but inflation-adjusted weakness, collapsing tariff-hit categories, and a fading car-buying sugar high all scream: the consumer’s cracking—and recession warning lights are blinking red.

Despite the Alpine handshake, consumer sentiment just hit rock bottom, with inflation fears and tariff fatigue dragging confidence to 45-year lows.

In a chaotic Jubilee year, investors should KISS—Keep It Simple, Stupid—and focus on the big trends, not the social media noise.

As U.S. Treasuries lose their appeal, investors are turning to gold—an antifragile asset amid mounting debt and market chaos.

As U.S. corporations face record debt rollovers, investors are shifting towards gold, driven by China's strategic accumulation while the average American worker is increasingly priced out.

The unravelling of the U.S. security umbrella is compelling nations and corporations to stockpile strategic commodities, transforming supply chains from just-in-time to just-in-case models, thereby making inflation more persistent.

China's strategic stimulus and credit expansion are poised to catalyse a market re-rating, especially in equities and banks, as the credit impulse turns positive and Beijing's fiscal support gains traction.

As the US economy shifts into an inflationary bust, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

Gold and silver are eternal hedge against "collective stupidity" and government hegemony, both of which are abundant worldwide.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

The week of Vesak Day in the Buddhist world will likely be remembered in financial history books as the week when the first 90-day ceasefire in the U.S.–China trade war was declared, sparking a new wave of optimism among equity investors. This optimism fuelled belief in the fairy tale of the "Magnificent 7," which significantly outperformed the Nasdaq 100, S&P 500, and Dow Jones over the past five days. Year-to-date, both the S&P 500 and the Dow have returned to positive territory. This rally pushed the Nasdaq 100 and S&P 500 above their respective 76.4% Fibonacci retracement levels (20,882 and 5,837 on the one-year chart), while the Dow and the Magnificent 7 remain stuck below this key technical resistance for now (43,076; 25,447). With greed replacing fear, all major U.S. equity indices have continued to follow a higher-lows pattern since the “tariff tantrum” subsided on April 21. It’s therefore fair to say that the lows for the year are likely behind us. In this context, investors should adopt a “buy-the-dip” mindset again—especially as short-term volatility driven by geopolitical events may resurface in the coming week. That said, momentum and stochastic indicators across major indices are increasingly overbought on a daily basis, indicating a technical correction may be imminent.

To maintain the higher-lows trend, key support levels to watch in the days ahead include the 50% Fibonacci retracement levels on the one-year chart for the S&P 500 and Nasdaq (5,491 and 19,382), and the 38.2% retracement levels for the Dow and the Magnificent 7 (39,844 and 21,592). Despite the inevitable doom-and-gloom headlines that will accompany the next pullback, investors should resist turning overly bearish. These higher lows are paving the way for potential new all-time highs, particularly for indices like the Dow in the second half of the year. Since April 25, all major U.S. indices have returned to daily bullish reversals. In short, the April 8 closing prices (4,982 for the S&P, 17,090 for the Nasdaq, and 37,645 for the Dow) may well have marked the bottom for the year. Smart investors will now be watching for the next dip to increase equity exposure—regardless of the noise coming from illiterate journalists who’ve never managed a single dollar in their entire lives.

In this context, IT; Consumer Discretionary and Communication Services outperformed, while Consumer Staples; Real Estate and Healthcare underperformed.

As of May 16th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for amost 4 months, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

“Keeping It Simple, Stupid’, investors should remember that as the US economy tumbles from inflationary boom to bust, history’s lessons come into play: the Dow will keep beating the Nasdaq, energy stocks (that’s right, oil and gas) will crush the tech nerds, and the once-Magnificent 7 will now have to deal with their new Maleficent makeover. But here’s the kicker—while everything else goes haywire, the one thing that’s always been a rock-solid wealth-preserver is physical gold. As for the USD? It’s still going to flex its muscles over other fiat currencies, at least until the economic trifecta of cheap Russian commodities, Chinese manufacturing might, and India’s growing consumer base (courtesy of their ever-expanding population) sets up shop and claims the throne of global finance.

Upper Panel: S&P 500/Oil ratio (blue line); 7-Year Moving Average of the S&P 500/Oil ratio (red line); Middle Panel: Gold/Bond ratio (green line); 7-Year Moving Average of the S&P Gold/Bond ratio (red line); Lower Panel: Relative Performance of S&P 500 IT to S&P 500 Energy Index.

Upper Panel: S&P 500/Oil ratio (blue line); 7-Year Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 7-Year Moving Average of the S&P Gold/Bond ratio (red line); Third Panel: 12-Month Return of Gold price in USD; Lower Panel: 12-Month Return of USD Index.

In a nushel by owning physical gold outside the tightening grip of centralized digital systems, the “old-fashioned” gold holders preserve true autonomy, not just from the USD, but from all fiat currencies racing toward centralization.

Gold in private vaults comes with no compliance protocols, no digital IDs, no counterparty risk, and no reliance on other politically exposed, centralized infrastructures. Unlike digital assets born in 2008, gold protects not just from currency collapse, but also from volatility and centralization. It’s been doing so since 480 BC. That matters. Gold matters—yesterday, today, and especially tomorrow.

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.