THE WEEK THAT IT WAS...

The second week of the second month of the second quarter of the year was much quieter than the previous week for investors, with the focus on China's Trade Balance and inflation data. In the US, attention was on the Senior Loan Officer Opinion Survey (SLOOS), the 3-Year; 10-Year and 30-Year bond auctions, along with the University of Michigan's inflation expectations.

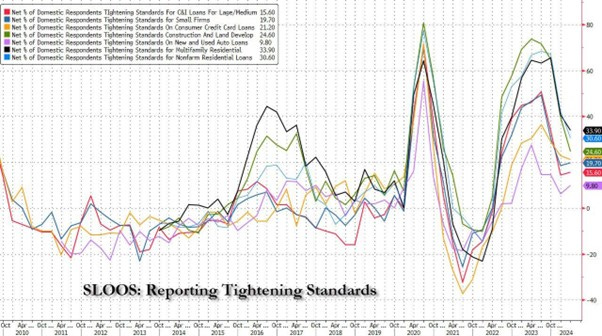

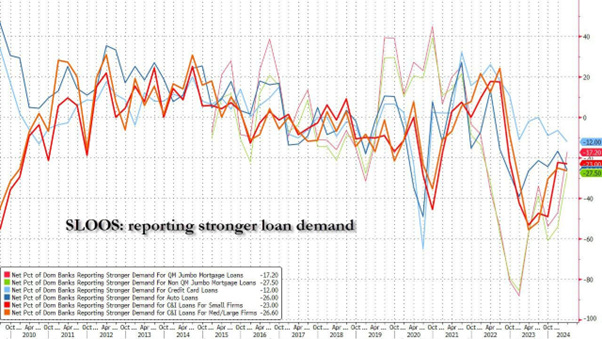

In the US, a close examination of the FED Senior Loan Officer Opinion Survey (SLOOS), conducted between March 25th and April 8th, reveals that the net share of US banks tightening standards on the crucial C&I (commercial and industrial) loans for mid-sized and large businesses increased to 15.6% in the first three months of the year, up from 14.5% in the fourth quarter. Other loan types experiencing tightened lending standards include New and Used Auto Loans (with standards tightening to 9.8% from 6.3%) and small firm credit (rising to 19.7% from 18.6%). Simultaneously, credit conditions eased modestly, though still tighter compared to the baseline, for Consumer Credit Card loans, Construction loans, Multifamily residential loans, and nonfarm residential loans.

On the demand side, the picture was rather mixed: while demand decreased across the board relative to the baseline, it experienced a modest decline for C&I loans. Credit card loan demand, auto loan demand decreased sequentially, while there was a notable increase in demand for jumbo loans (both qualifying and non-qualifying).

In a nutshell, in a higher-for-even-longer interest rate environment, it should not be a surprise that the US economy remains severely credit-constrained on both the supply side (due to fears of renewed bank walk) and the demand side (owing to a lack of visibility into the economic future and concerns about how Bidenomics will further impact the economy by implementing additional ‘uneconomical regulations’. Given Wall Street's claims that the economy has rarely been in such good shape, it could be that the latest craze in the financial market (i.e., private credit) is fueling economic growth, or that data are ‘seasonally adjusted’ manipulated to sow ‘Forward Confusion’ ahead of the presidential election.

After the release of the QRA and the FED issuing a 'MayDay' signal, the US Treasury resumed its auctions which started with an expected solid 3-year auction. The 10-year auction was soggy which has become standard for 10-year auctions, given that there have been 13 tails in the past 15.

The $25 billion 30-year bond auction was surprisingly good as it stopped through the When Issued rate by 0.7 basis points, marking the 5th such instance in the past 6 auctions. The bid-to-cover ratio rose to 2.409%, surpassing the six-auction average of 2.38%. Indirects were awarded 64.9%, up from 64.4%, while Directs received 19.8%. Dealers were left with 15.4% of the final auction.

The University of Michigan consumer survey revealed a decline in consumer confidence due to the resurgence of inflation, coupled with a bleak labor market outlook and higher interest rates for even longer. The headline consumer sentiment index dropped to 67.4 in May from 77.2 in April, falling below expectations. Both the expectations index and the assessment of present conditions also declined. Concerns about inflation grew, with year-ahead inflation expectations rising to 3.5% and long-run expectations inching up to 3.1%. This data suggests the FED pivot could remain a phantasmagory for longer.

In this context, and post the Powell’s ‘MayDay emergency call,’ rational investors will acknowledge that the FED will NOT be able to cut rates in the foreseeable future, and that rate HIKES will be the new narrative once the election calendar is behind us. However, the myopic Wall Street consensus remains addicted to the hope of rate cuts in 2024, with a probability of a rate cut in September now at 76% and a 61% probability of two cuts for the entire year.

With more data pointing to an inflationary bust, it is surprising that the bear steepener lost some momentum over the past weeks. Mesmerized by the latest magic tricks from Janet Yellen and Jerome Powell, investors should stay aware that the inevitable is the un-inversion of the yield curve by the long end.

In this context, investors should remember that the FED's next set of policy decisions will have a massive impact not only on customers and investors but also on the federal government's interest expenses.

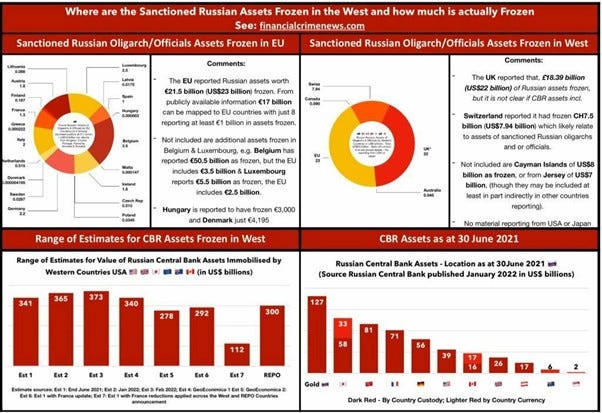

As part of the illegal confiscation of Russian sovereign assets, which is part of the USD weaponization process, the US administration is now looking at onboarding the G7 countries into this robbery. The package would be funded from interest accrued via investments utilizing the approximately $300 billion in Russian assets currently frozen in Western banks. European banks, holding the bulk of frozen funds, face potential backlash as global distrust spreads throughout the banking system. These frozen assets within the European Union currently generate about EUR5 billion ($5.3 billion) in windfall profits annually. According to Euroclear’s first-quarter financial results, EUR159 billion of frozen Russian assets have generated a net profit of EUR557 million ($601 million) since February 15. Since last year, these assets have generated about EUR3.9 billion in net profit. Russian sovereign assets held by the company could grow to as much as EUR190 billion by 2028 as they mature into cash. Most of these assets are located in the UK, Switzerland, Belgium, Luxembourg, Italy, and France.

If this measure were implemented, it could serve as the final trigger needed to initiate a banking and sovereign debt crisis in the region, preceding the inevitable descent of European countries into the debt trap.

In China, the latest trade data for April revealed better-than-expected imports and exports, signaling a continued overall recovery in the economy.

China's inflation data continues to suggest sluggish demand weighing on the economy despite a pickup in consumer prices. Indeed, factory gate prices (PPI) extended their decline for 19 months. With the continued widening of the CPI and PPI since the start of the year, the valuation expansion should continue to gather further momentum which could be a tailwind for Chinese equities.

Spread between China CPI & PPI Index (blue line); MSCI China 12-months Fwd P/E (red line).

With Xi Jinping visiting Europe for the first time since the Covid pandemic and the end of the May Golden Week, the question investors should ask is: what if China becomes once again one of the main catalysts in macro investment? Since the start of the Covid pandemic, equity investors will argue that for them, it was Anything But China but this could be already changing.

Indeed, looking at the year-to-date performance in USD terms, the HSCEI index has outperformed the S&P 500 index, and the Shanghai Composite is on par with the Dow Jones. This performance, achieved in less than five months, has surely surprised most Wall Street analysts, many of whom were claiming at the end of last year that China was un-investable.

For government bond investors, it was the opposite, as China fixed income in USD terms have widely outperformed US Treasuries and German bunds, which in the past were seen as the risk-free assets of choice.

Bloomberg US Agg Bond Index (blue line); Bloomberg China Agg Bond Index (red line) Bloomberg Germany Agg Bond Index (green line); (rebased at 100 as of 31st December 2019).

The mass media and Wall Street have been speculating on a devaluation of the Chinese Yuan over the past 12 months. However, investors have to understand that the CCP will sacrifice everything to keep the chart above going. This is the path to de-dollarization and thus to financial freedom. Getting out from under the USD’s dominance will finally mark the end of the “century of humiliation” in which foreign powers dictated their way to China. Foreigners must understand Xi’s desire to be a “great power” once again. China will likely be the first great civilization that collapsed, dusted itself off, and came back. Rome didn’t do it. Neither did the Ottomans. Nor the Egyptians. Nor the Persians.

Chinese Yuan/USD FX rate (blue line); China Manufacturing PMI (red line).

A country can't be a great power with a weak currency. And you definitely cannot be a great power if you settle your trade in your rival power’s currency. Western investors have to understand that the Chinese people have a greater ability to endure suffering for their future prestige than Westerners can comprehend. In that context, Xi will impose all the pain in the world on the Chinese economy before devaluing meaningfully. Not that a devaluation solves anything anyway. China already has a massive trade surplus, and other countries are putting up trade barriers because it is so competitive. The way Xi can address the current domestic crisis is to turn the PBoC into the new Bundesbank of the Global South. Western investors have complained over the years that the PBOC doesn’t ride to the rescue of their stock market. But that’s not the game Xi is playing. Xi wants the Yuan to be the Deutsche Mark of emerging markets. You don’t get to be that by bailing out the stonk monkeys. You get to be that by having a strong bond market and a strong currency. People have had China wrong for ten years and continue to do so because they can’t imagine a world in which the central bank doesn’t bail out corrupted bankers.

CNY/IDR FX rate (blue line); CNY/RUB FX Rate (red line); CNYBRL FX Rate (green line); CNYTHB (purple line) rebased at 100 as of December 31st 2019.

In this context, while the Wall Street consensus has been that the next move in the CNY is a devaluation against the USD, investors should ask themselves what if we will see the CNY/USD at 5 first rather than 9 in the near future. The case for a devaluation is that the crazy weakness in the Japanese yen has been a major catalyst for China poor economic growth since Covid. This supposed that a clear goal of Chinese policymaking over recent years has been to move away from a growth model based on real estate towards one based on an industry. In reality, the focus is on developing domestic consumption and increasing trade relationship with countries which share the same mercantilist objective and have no problem with China dominating the world once again. Indeed, growing through industry is pretty challenging when one of the world’s largest, and more efficient, industrial powers (Japan) maintains an exchange rate that is undervalued by up to 40% on a purchasing power parity basis.

CNY/JPY FX rate since December 31st 2019.

In fact, China is using same playbook as US post 1945:

Marshall Plan = Silk Road fund/OBOR

Asia infrastructure investment bank = World Bank

WTO = BRICS

First, you lend the people the CNY they need to buy your capital goods (in 1945, it was Caterpillar; today it is LongHe machinery). Then you tell them that they can earn the CNY they need by either selling you cheap assets (i.e., JP Morgan buying its headquarters on the Place Vendôme for a song in 1958) or by selling you cheap goods. When the latter happens, you start to move into a trade deficit. But that’s still way down the line for China in its trade with the Global South.

With US imports from China declining structurally in a more bipolarized world, it would not make any sense for the PBOC to devalue the Yuan against the USD, as China is increasingly focused on becoming a reliable trading partner of the global South in general and ASEAN in particular.

China export to ASEAN (blue line); US Import from China (red line).

A yuan suddenly at 9 against USD would indeed signify that the US has won its Cold War with China, and that Xi is conceding his hopes of making the CNY a credible trade and financing currency for emerging markets. It's uncertain whether Xi would survive this politically. Such a scenario would essentially negate all his programs of OBOR, Silk Road, Asia Infrastructure Investment Bank. This outcome is not impossible, but it would represent a profound reversal in the current political rhetoric. Moreover, it would have to be a political decision since foreigners own no Chinese debt and foreigners own practically no Chinese equity. Wall Street probably would cheer of a weaker Yuan which would help the ‘disinflationistas’ to push the FED to cut rates while the opposite would add headaches to those in power in Washington.

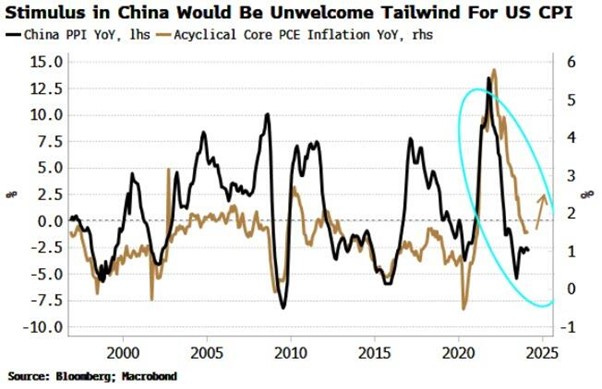

Indeed, over the past quarters, China has been exporting deflation to the western world. A more forthright response from China to its deflationary predicament would further support US inflation, which is already proving sticky, adding to longer-term upward pressure on term premiums and thus yields. The stickier-for-longer US inflation has indeed already been proven to be the case, even without China so far managing to engineer a robust recovery. The San Francisco Fed separates out core PCE into a cyclical and an acyclical component, with the former being those inputs to PCE most correlated to FED policy and the latter being anything left over. Most of the fall in core inflation over 2023 has been driven by the acyclical component, while the cyclical has only fallen marginally, implying that much of the disinflation was not directly due to FED policy. The acyclical component, however, is highly correlated to China's PPI, indicating that China is a significant driver of global inflation pressures. If the country had experienced a stronger recovery since its Covid reopening, it is likely that the US (and other countries) would be contending with a larger inflation problem than they currently have.

That’s why China’s next fiscal move is so important for the World. Falling bond yields in China, in contrast to rising ones in the US and the Western World, signal the economy is still convalescent after the Covid lockdowns. Typically, China has responded with much broader stimulus, reflected in rising M1 growth, when yields have seen such a fall. If China responds similarly again, inflation pressures in the US will receive an unwelcome boost, even as it is already dealing with price growth that is becoming embedded.

Ahead of the golden week, China's Politburo signaled policymakers will increase fiscal and monetary stimulus to support the economy and highlighted new plans to deal with long-term structural impediments to growth. The commitment is largely positive but China, contrary to the west is unlikely to adopt any policies which will support its plutocrats as the CCP and the PBOC now understand that over the long-term, a sustainable economic growth relies on LESS not MORE government supports. The third plenum, one of China’s most important meetings focusing on long-term economic policies and reforms, which will take place in July, will be key for the economic development over the next few years.

Over the past few months, China’s crude oil inventories increased by a whopping 26.5 million barrels to 937.83 million barrels. This increase came at a time when a decrease was expected given high oil prices. It's worth noting that about 5 million barrels of the additions went to China’s Strategic Petroleum Reserves. This sudden increase in inventories was mostly caused by the opportunistic purchase of Russian Sokol crude at a large discount. About a dozen tankers laden with Sokol crude got stuck at sea for weeks after India refused to accept them over a price dispute. If this is the case and, then this increase in inventories does not constitute any change in the market nor in Chinese policy. It is just a one-time opportunistic purchase. The fact that all the increase was reported in one week gives credence to our point. This gives China more pricing power as it might continue its policy of using its inventories to influence prices.

Outside of oil, there has also been a sharp rise in China’s copper inventories.

While some see this stockpiling as a precursor to a CNY devaluation, which is highly unlikely in the current circumstances, it could be a sign that China, contrary to the US, is trying to buy commodities at low prices ahead of possible shortages. Bidenomics, on the other hand, has been all about manipulating prices to deter supply growth. It could also be that, contrary to the Western world, China is getting ready for a significant deterioration of the geopolitical environment and potentially tighter trade sanctions. This could occur as the warmongers in Washington and Brussels try to push China into a global conflict, which, at the end of the day, has no other goal than to elude the reality that Europe and the US are on the verge of falling into a government debt trap. Investors must remember that the number one threat facing America is its rising government debt burden. Indeed, the US is still relying on China to buy its government debt to fund weapons aimed at countering China. This strategy is broken and will fail from a national security perspective. It would ultimately lead to the collapse of the plutocratic regimes in place in the Western world, either from internal civil unrest or external global conflicts.

This is also to be put in the context of the weaponization of the USD, which has been the major trigger for China to structurally reduce its holdings in US Treasuries and increase its physical gold holdings.

China Gold Reserve (blue line); China holding in US Treasuries (red line).

Indeed, while Western investors have been piling into the YOLO-driven cryptocurrency trade, Chinese investors have been accumulating physical gold, likely due to their longstanding tradition of viewing gold as a crucial asset to own for rainy days and as a legacy to pass on to heirs. Purchases of gold bars and coins, which largely reflect investment and hedging demand, surged by 26.8% year on year to 106.3 tonnes. Meanwhile, gold jewellery sales declined by 3% from a year earlier to 183.9 tonnes. With minimal evidence in exchange data, buying activity must be over the counter. Price action also indicates that the buying program is price insensitive, as deep-pocketed investors have begun to increase their exposure to the antifragile asset.

Not only Chinese investors, including the PBOC, have been hoarding physical gold, but investors must also keep in mind that China remains the top producer of physical gold in 2023, responsible for over 12% of total global production, followed by Australia and Russia.

Last week also marked this time of the year when the world of finance converged on Omaha to heed the wisdom of its oracle, gaining insights into financial markets and navigating investments without succumbing to FOMO. Apart from learning that Berkshire’s cash pile continues to climb, reaching a new quarterly record of $188.9 billion, or roughly equivalent to McDonald's market capitalization, investors also learned that Berkshire still holds an 8% in Chinese EV manufacturer BYD while it has no interest in looking into Tesla.

At quarter-end, Berkshire revealed that approximately 75% of its aggregate fair value was concentrated in just five companies and that, while keeping it as its largest holdings in its portfolio, Berkshire decided to reduce its holding by 22% over the past year.

The fact that Berkshire holds its stake in BYD tight, never considered buying into Tesla, and reduced its exposure to Apple is perhaps a sign that the Oracle of Omaha, who is always ahead of the Wall Street crowd, has started to understand that China could be doing to US ‘tech champions’ what it did to US Rust Belt ‘industrial champions,’ US unions, and the US working class from 2001 to 2010. At that time, US Rust Belt ‘industrial champions’ initially found it inconceivable too that China could produce better products than it did.

An industry where China has already taken over the global lead is the car industry. China has spent the past three decades being the world’s main deflationary force in this industry. This begs the question of whether its deflationary impact amplifies from here as wall street consensus thinks. A second view is that the Western world’s relationship with China has changed dramatically in recent years, making it less open to Chinese imports or China’s control of supply chains. Typically, more protectionism means higher, not lower, prices. Thirdly, China’s move up the value chain could prove less deflationary than many investors expect, since China’s recent trade growth has mostly been with emerging economies.

Looking at China’s surging car exports, China has emerged from nowhere to become the world’s largest car exporter by producing and selling cars more cheaply than anyone else. However, these cars are not being sold on the streets of New York, London, or Toronto, but rather on the streets of Jakarta, Bangkok, and Jeddah. In other words, China’s cheap exports are helping open new markets and create new demand. As a result, there will continue to be ever more cars on the road, not just in Western countries, but worldwide. This entails more demand for copper, steel, rubber, glass, which are things the world has broadly under-invested in over the past decade.

China’s dominance has also extended across clean-tech supply chains, which are now promoted by the green zealots in the Western world. Therefore, while the US and the Western world try to become much more independent from China, as a matter of fact, their green policy has increased their dependency on the Middle Kingdom. In a nutshell, Western governments are increasing budget deficits in their own countries to subsidize Chinese green tech manufacturers, while investors with common sense know that these green technologies would have been rejected due to their uneconomical nature without government support.

It's not just the car and renewable energy industries in which China already excels. Last August, in a testimony to the US Congress, Josh Wolfe, the Co-Founder and Managing Partner of Lux Capital, testified that China can produce nuclear power plants for $2 billion per GW, while it costs the US $12 billion. Since a GW in China equals a GW in the US, if the USD cost of a GW is 6 times the CNY cost of a GW, that implies the USD is 6x overvalued versus the CNY and therefore a devaluation of the CNY doesn’t make any sense.

Similar to Russia, US administration has tried to stop China’s economic growth by imposing sanction on transfer of technology as part of its trade war with China. These decisions have proven highly ineffective in curbing the technological advancement of the country so far. China's technological progress is grossly underestimated by Western powers which tend to still think they will dominate the World forever. Indeed, despite the US undertaking its largest postwar policy endeavor by relocating semiconductor manufacturing capabilities domestically and imposing sanctions on China to hinder its domestic manufacturing efforts, these measures have thus far been unsuccessful. Chinese imports of chipmaking equipment have reached record highs since the US began imposing sanctions on this industry.

The revocation of licenses allowing Huawei Technologies to buy semiconductors from Qualcomm and Intel should not change the inevitable rise of Chinese tech companies on a global scale with sale to the Global South as one of their key focuses.

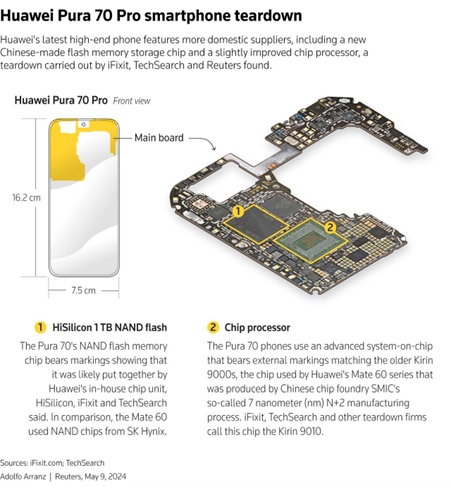

Indeed, a recent teardown analysis of the latest Huawei phone, the Pura 70, revealed that it operates on a Huawei-made advanced processing chipset called the Kirin 9010. The new chip is likely an improved version of the advanced chip used in Huawei's Mate 60 series, which was launched last year to compete with Apple's iPhone 15 lineup. The Pura 70's 7-nanometer chip is an improved version of the South Korean SK Hynix DRAM chip, which was used in the Mate 60, Huawei's previous best seller Despite the worsening tech war between Beijing and Washington, Huawei has been able to source more handset components from the domestic market. This has prompted Huawei to pursue a mission of entirely sourcing components from local suppliers.

In a nutshell, a devaluation, which has been discussed on Wall Street as eagerly as the notorious FED pivot, would indeed have to be a political decision, indicating a significant change of direction by the Chinese leadership. Why would they do that? Why would they bail out the US through a big deflationary wave at precisely the moment it feels like the US may be starting to crack? The only reason would be a power shift at the top of the CCP. Xi either dies or steps down and is replaced by someone more ‘US compatible’. But the CIA already made their colour revolution play in 2019, and it failed. Of course, they could try again. But China is now way more paranoid about such manoeuvres. The days when the US consular staff could just meet with the leaders of the students who tried to storm the HK parliament in the restaurant of the JW Marriott are well behind us now (American can imagine if the Chinese ambassador had met with the January 6 buffalo head guy and the lectern guy… that’s what the US did in HK!). Anyway, all this to say that if the CNY is at 9, then the USA wins, and China loses.

For investors this would mean:

A lower oil price: to the extent that a US win means the return to the unilateral world, with fewer risks of conflicts, a greater Pax Americana. Then there is a lower need for oil inventories all around. Also, if the CNY is at 9, China can no longer just load up on inventories as it has been doing in recent years. It likely means a lower gold price. If CNY is at 9, why bother owning anything else than the USD. Initially, gold may go up for a month or two as Chinese retail panic buy more. But longer term, why bother with gold?

Lower UST yields: CNY at 9 is a massive deflationary shock for the world.

Higher S&P 500: Strong dollar and lower yields are the stuff US growth bull markets are made of. In this scenario, maybe US becomes 80% of global market cap!

All in all, it is unlikely that a country like China, whose trade surplus at US$70bn+ per month is now bigger than the combined trade surpluses of Japan + Germany AT THEIR PEAK, will devalue meaningfully. Against that lies China’s efforts in the last decade to reduce its dependency on the US dollar, which has compelled China to offer investors better returns on renminbi bonds than those offered by US treasuries. This objective has been met in spades since the start of the Covid pandemic. The problem for China today is that while five years ago, its bond yields were more than twice the level that prevailed on US treasuries, the reverse is true today. Such a yield differential begs the question of how Chinese government bonds can continue to outperform treasuries. There seem to be three possible answers to this question:

Option 1: Given the yield differential, the period of CGB outperformance is ending, and China’s effort to dedollarize will falter. This outcome is unfortunate for Xi Jinping’s grand geopolitical designs and his hopes of ‘Making China Great Again’. This is the scenario envisaged by the Wall Street consensus, which has been historically wrong in the past and is still likely to be wrong.

Option 2: As long as US yields continue to rise, China can largely ignore the value of the yuan. If China’s currency remains broadly stable, this should be enough to guarantee continued outperformance of CGBs against face-planting US treasuries. This is the scenario that is currently unfolding.

Option 3: Given low yields, it will be hard for CGBs to generate big capital gains from here. Thus, if Chinese policymakers wish to continue internationalizing the yuan and convince foreign central banks to hold more reserves in the currency, they will need to engineer an exchange rate gain. This should not be too hard. After all, China is running trade surpluses of US$70bn a month, and foreign investors have spent the past three years divesting assets away from China. Possible catalysts for a stronger yuan would include a stronger yen, a rally in Chinese equities that would draw underweighted foreign investors back in, a rollover in gold, an improvement in US-China relations, and the signing of oil-for-renminbi deals with Middle Eastern countries. In any event, no one in the market envisages this scenario as a possibility, even though reducing China’s dependency on the US dollar remains a key policy goal of the Chinese leadership.

Once again, investors should beware of recency bias influencing their decisions. Many Wall Street investors persist in the belief that China will devalue its currency, but what would really be painful for the US and its allies would be if the PBOC decided to revalue the CNY. This would make the return of inflation boomerang quicker and harder than it has been over the past few months.

In this context, America’s consumer economy will continue to decline while places like China see their middle class grow and the consumer economy rise. Additionally, China is not creating worthless spending packages on climate change but is using western government subsidies to develop its own technologies. In a few words, ‘Make China Great Again’ is likely to happen before ‘Make America Great Again’ is a reality.

WHAT’S ON THE AGENDA NEXT WEEK?

As the fifth month of the year progresses, investors will once again turn their focus to inflation in the US with the release of April's PPI on Tuesday and CPI on Wednesday. The April US Retail sales will serve as a barometer of consumer health, while major US retailers like Home Depot, Macy's, and Walmart will announce their quarterly results. Among the long list of FOMC speakers scheduled for the week, another speech from FED Chairman Jerome Powell on Tuesday will be the most significant, providing insight into the follow-up of the 'FED MayDay's distress call'. In China, attention will be on retail sales and industrial production, while domestic tech giants like Alibaba, Baidu, JD.com and Tencent will release their quarterly results.

KEY TAKEWAYS.

As the world is getting ready to celebrate buddha’s birthday, here are the key takeaways:

The SLOOS confirmed that the US economy remains severely credit-constrained on both the demand and supply side.

The latest bond auctions continue to be driven by investors' phantasmagorical hope for a FED pivot, which has been leading Wall Street in the wrong direction for more than 18 months now.

The latest consumer sentiment survey shows that even consumers are starting to become aware of the upcoming inflationary bust, which is still denied by the FED and politically correct Wall Street bankers.

China's latest macroeconomic data confirms that the rebound initiated since the Lunar New Year is gathering further momentum despite significant fiscal stimulus having been implemented.

Over the past quarters, US disinflation has been mostly driven by China exporting its deflation.

While it has been ‘Everything But China’ for equity investors, it has been ‘China But Anything’ for fixed income investors since the start of the Covid pandemic.

While Wall Street and its ‘Forward Confusion’ narrative focus on a CNY devaluation, what would be really painful for the US is if China revalued its currency in an effort to further please its bondholders.

‘Make China Great Again’ will likely happen before ‘Make America Great Again’ is a reality.

In this context, trust in western public institutions will continue to decline, leading investors to move even more into assets with no counterparty risk and which are non-confiscatable, like physical gold.

For fixed income investors who are still chasing the long duration trade in US government bonds, more pain awaits as long-dated yields must reflect the new stagflation reality.

In a stagflation, the best way to protect wealth is still to own the equity barbell portfolio made of Tech and Energy and Physical Gold and avoid long dated bonds.

As stagflation rather than recession materializes as the economy is increasingly weaponized, investors should prepare their portfolios for HIGHER volatility.

In this context, investors should also remain prepared for dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

As investors prepare to celebrate Buddha's birthday and despite the illusionary 'Forward Confusion' spread by the Wall Street consensus, equities rebounded further, closing the week above their respective 50-day moving averages for the first time since mid-April. In this context, investors should remain 'Strategically Patient' as rising volatility could push equity indices back to key supports in the coming weeks.

Despite the optimistic atmosphere, utilities continued to outperform the usual suspects of rebounding sectors such as consumer discretionary and information technology, which have been lagging behind over the past two weeks.

Investors who are looking to take part of ‘Make China Great Again’ and are keen to tiptoe into the Chinese equity market can consider the Global X High Dividend Yield ETF (3110 HK), which invests in the Hang Seng High Dividend Yield Index. The ETF has a dividend yield of 8.24% as of the last dividend payment date.

The ETF is diversified across sectors with higher exposure to companies in the Financial, Energy, and Industrials sectors.

It has delivered outstanding outperformance against the HSCEI index, thanks to its selection of dividend-paying stocks with steady fundamentals. These stocks have been cherished by local and foreign investors in a much more challenging macroeconomic environment.

Investors can look at a retracement to the 50% Fibonacci Retracement (HKD21.23) to enter this trade which will be a key holding of their exposure to Chinese equities.

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

The Babylonians came back a thousand years after their fall, under the leadership of Nebuchadnezzar.