THE WEEK THAT IT WAS...

The second week of the last month of the third quarter was once again focused on inflation and consumer confidence data, with China, and the US reporting their CPI and PPI figures for the final month of summer. The week included US consumer inflation expectations and confidence indicators. Outside inflation, investors turned their attention to the ECB, which came back from its summer break and stayed unsurprisingly ‘data dependent’.

In China, the undershooting CPI and the sharp drop in the August PPI indicate that recent policy measures, such as cash-for-clunkers programs and rate cuts, have been insufficient to offset the drag from the slumping housing market and low consumer confidence. In August, CPI rose by just +0.6% YoY, marking the 18th consecutive month under 1% and falling short of the +0.7% expectation, highlighting weak demand and supply conditions. The PPI declined 1.8% YoY, a sharper drop than July’s 0.8% and worse than the forecasted 1.5% decline.

The silver lining is that despite a sluggish domestic economy, falling producer prices coupled with a still positive CPI allow Chinese corporations to expand their profit margins. While this may help sustain current valuations for Chinese equities, it is not sufficient to ‘Make China Great Again’ anytime soon.

Spread between China CPI and PPI (blue line); MSCI China 12-month Fwd P/E (red line).

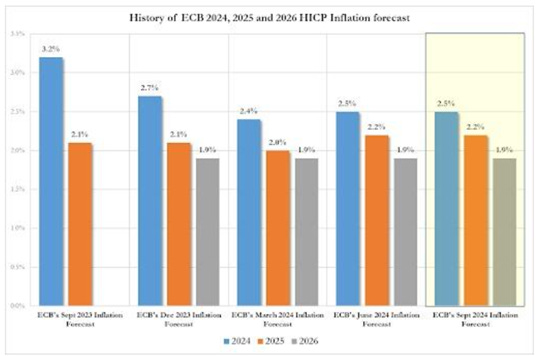

After its summer break, as widely expected, the politically driven ECB cut rates by 25 bps to 3.5%. As night follows day, the ECB and its sun-tanned president, Lagarde, confirmed in a statement that the central bank will continue to follow a data-dependent path, cut its PEPP by EUR7.5 billion a month, while raising inflation expectations and lowering growth forecasts. In a nutshell, while taking a victory lap around Frankfurt, the ECB president acknowledged that stagflation will continue to plague the Eurozone's future, even before the Ukraine-Russia war reaches a new stage in the coming weeks and governments take difficult decisions for the upcoming fiscal year, worsening the life of European consumers already constrained by tight energy supplies.

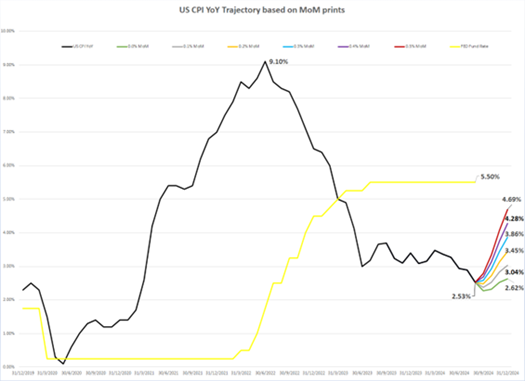

In the US, the rebound in shelter and core CPI added to the long list of indicators showing that, while politicians and central bankers have declared 'mission accomplished' in their fight against inflation, the 2% inflation target has become an unreachable floor rather than a ceiling in a world dominated by reckless fiscal spending and central bank masquerades which will inevitably lead to painful inflationary busts.

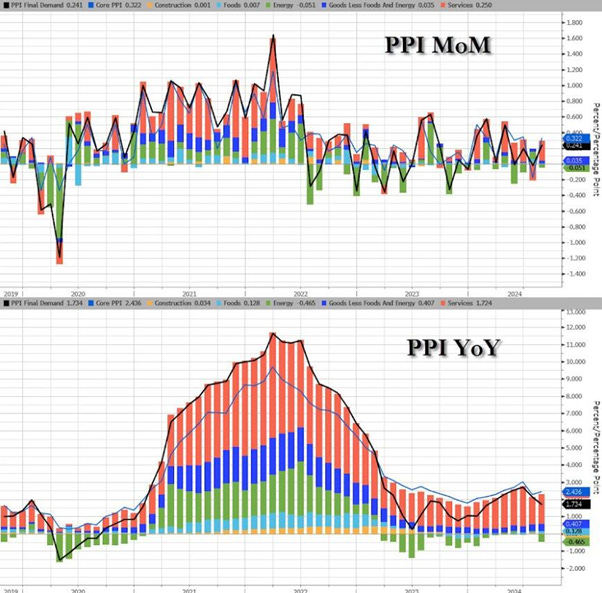

Adding to the hotter-than-expected core CPI, the August PPI also surprised to the upside, with headline PPI rising 0.2% MoM, above the expected +0.1% MoM, which pushed the YoY PPI down to +1.7% due to a favourable base effect. Core PPI rose 0.3% MoM, also hotter than expected and reaccelerating from the previous month. Looking behind the curtain, service costs rebounded significantly, offset by deflating energy costs.

Ultimately, equity investors understand that what matters for corporate profitability is the evolution of the spread between core CPI and PPI. On that front, the decline in this spread presents an additional headwind for equity markets to sustain the recent P/E expansion which have been driving equity returns.

12-month Fwd S&P 500 P/E (blue line); Spread between US Core CPI and PPI (red line) & correlations.

After a series of hotter-than-expected inflation data for August, the University of Michigan consumer inflation expectations further highlighted the long-term threat of inflation, as medium-term expectations rose, while short-term expectations, largely driven by oil prices, fell to their lowest level since December 2020.

For bond investors, this should be another sign that the summer bond rally is over. Regardless of what the FED decides on September 18th, long-dated U.S. Treasury yields (such as the 10-year yield) are poised to rise much HIGHER, as consumers and investors increasingly recognize the ongoing inflationary bust, despite central bank masquerades and desperate politicians spreading ‘Forward Confusion’ to maintain power.

University of Michigan 5-10 Year Inflation expectations (blue line); US 10-Year Yield (red line); Correlations & US Recessions.

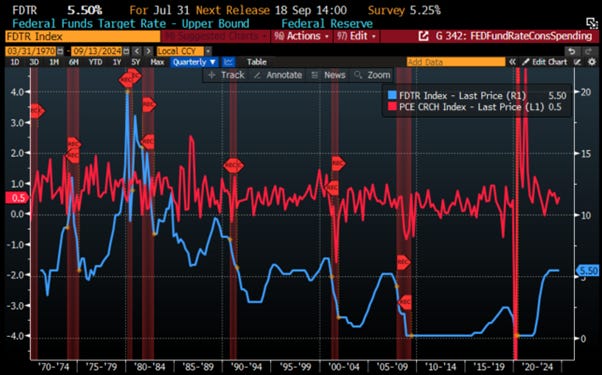

In this context, the Federal Reserve will most likely lower interest rates on September 18th, primarily as a face-saving move for the FED Chairman, who has become impotent at managing the US economy as he decided to declare ‘mission accomplished’ but unlikely ‘completed’.

While Jerome Powell made it crystal clear in the mountains of Wyoming that ‘The time has come’ for a shift in US monetary policy, with rising hourly earnings, even amid a lower August Non-Farm Payroll, and core CPI still well above 3.0% YoY and rising again, market expectations that the FED will cut its federal funds target range by a full percentage point or more by year-end are completely phantasmagorical.

By making a symbolic and politically partisan driven 25-basis-point cut to the FED funds rate, Jerome Powell could save face, support the current administration, and avoid alienating the opposition, which has vowed to reform the FED if elected. Investors should understand that this small cut won’t alter the broader economic outlook. With growing fears of war and civil unrests and a highly contentious election ahead, uncertainty will rise, leading to a decline in consumer spending whoever is declared winner of the political circus around the White House.

FED Fund Rate (blue line); US Personal Consumption Expenditures Nominal Dollars MoM SA (red line) & US Recessions.

Ultimately, what’s reflected in the 10-year long-term rates is clearly the winds of war. From 1981 until 2020, the US government benefited from a 39-year decline in the 10-year yield. Then came the reckless Keynesian spending and regulations tied to the climate change agenda and diversity and equality initiatives, which mainly served to expand uneconomical bureaucracy and create more obstacles for entrepreneurs. This has already led to shortages and supply-driven inflation which will worsen as more bankers’ wars spread across the world.

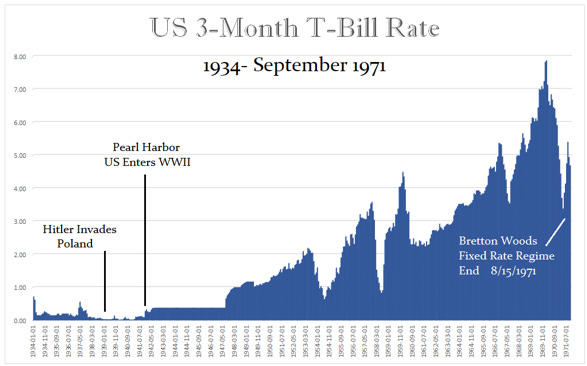

The high short-dated yields (i.e. 3-month T-Bill rate) signals the looming threat of war. Looking back at history in a scenario which sounds again familiar, when Hitler invaded Poland, Franklin Delano Roosevelt repeatedly sought to bring the US into World War II, but Congress resisted. FDR took several steps to provoke Japan into attacking Pearl Harbor. Once the attack occurred, US interest rates began to rise as the nation entered the war. The flatline in rates that followed reflected the Federal Reserve's agreement to cap rates during the war.

The yield curve that truly matters is the spread between the 10-year yield and the 3-month rate. With the 3-month rate at 4.75% and the 10-year yield at 3.65%, the curve remains heavily inverted, reflecting the Federal Reserve's ongoing effort to combat inflation, which was triggered by (1) COVID lockdowns and (2) sanctions on Russian energy sales. However, no level of rising interest rates can resolve this type of inflation. The US will likely face a sovereign crisis once it officially enters in conflict with the Global South. Meanwhile, Japan and Europe, particularly France, which is heading for a collapse under the leadership of ‘Petit Roi’ Macron, will face their own sovereign debt crises first, as they are at the epicentre of the forever bankers’ wars driven by Washington's warmongers.

US 10-Year Yield-US 3 Months Yield (Histogram); US GDP Annualized QoQ Growth (blue line) & US Recessions.

Regardless of who occupies the White House next, Powell and his PhD colleagues know that interest rates always rise during war. The misguided Wall Street bankers will once again be wrong in thinking rate cuts will solve problems, which will only worsen under 'Kamunism.', as ‘kleptocrats’ and ‘kakistocrats’ keep ruling the western world.

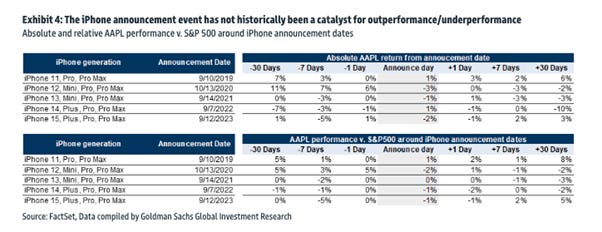

Apart from showcasing how deeply the LGBTQ and DEI culture is embedded in its DNA, Apple Glow Time 2024 will only be remembered by investors as the biggest dud the company has delivered in many years.

Indeed, the design changes in the iPhone 16 don’t seem compelling enough to drive a major refresh cycle, especially since the Apple Intelligence features will be released on a staggered basis in 2025. Meanwhile, the new, thinner Apple Watch with a larger screen has the potential to slow the product's sales decline. In fact, new iPhone debuts historically haven't been a strong catalyst for either outperformance or underperformance of the stock.

Looking at the expected EPS impact, it is likely to be negligible, as the ongoing quarter's expected $1.59 is only slightly better than the previous two quarters and well below the Q1 fiscal 2024 EPS of $2.10 which encompassed last Christmas season.

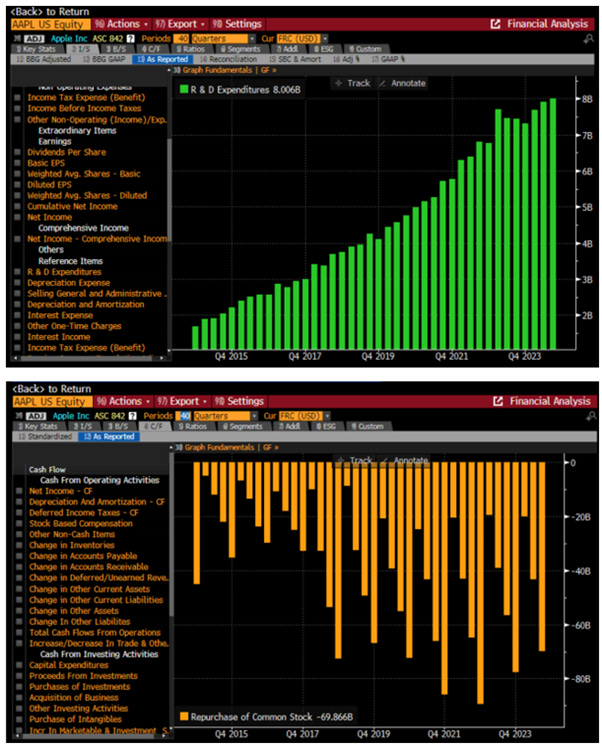

In a nutshell, as in the past, Apple is lacking innovation and remains driven by artificially financially engineered growth through buybacks. R&D expenses have not only been structurally lower than its share buybacks over the years but have also failed to deliver any significant innovation. This will impact consumers, many of whom are already suffering from inflation-driven misery and hold traditional family values that are out of sync with the LGBTQ culture, which has harmed other US corporations in the past. In a nutshell it is undeniable that Apple remains the largest hedge fund on earth pumping its share price with increasingly elusive share buybacks.

Since the Oracle of Omaha started selling its Apple shares in Q2, Apple has massively underperformed Berkshire Hathaway and has delivered no alpha against the S&P 500. All in all, it is pointless for investors to hold the stock, even giving it the benefit of the doubt of its LGBTQ DEI orientation.

Relative performance of Apple Vs S&P 500 index (blue line) & Versus Berkshire Hathaway (red line) Year-To-Date.

As Apple is busy pleasing its DEI and LGBTQ shareholders and essentially acts as the largest hedge fund on the planet by buying back more than $70 billion of its own stock per year, real innovation is coming from a company that arrogant Western investors once described as a dog. Huawei has unveiled its first tri-fold smartphone, the Mate XT, featuring a unique Z-shaped design that folds with a dual-hinge mechanism.

In fact, anyone with a sense of humour will agree that Apple is not far behind the competition in that regard.

More seriously, after selling half of its stake in LGBTQ Apple and methodically reducing its position in Bank of America, one of Berkshire’s longtime insiders has now sold more than half of his remaining shares, signalling what appears to be a major event looming for the stock market in the weeks ahead.

https://www.cnbc.com/2024/09/12/ajit-jain-dumps-more-than-half-of-his-berkshire-hathaway-stake.html

In his 40 years with Berkshire, Ajit Jain has only sold shares twice before this week—on March 6th, 2019, and July 6th, 2020, selling just 1 share each time. However, this time he sold 200 shares, worth approximately $139 million. The disposal means the long-term executive is left with control of 166 such shares, 61 of which he directly owns. The Oracle of Omaha and his colleagues appear to be preparing for the spread of "Kamunism" and the inevitable social unrest which will follow, as no one with a minimum of common sense will accept price controls, taxes on unrealized gains, or the creation of a ‘United Socialist America,’ which could lead to a crash landing on US.

While investors should by now be accustomed to the role of precious metals in their portfolios and the historical significance of physical gold and silver as money and a store of wealth, there is another side to precious metals that is less well known: the Platinum Group Metals (PGMs).

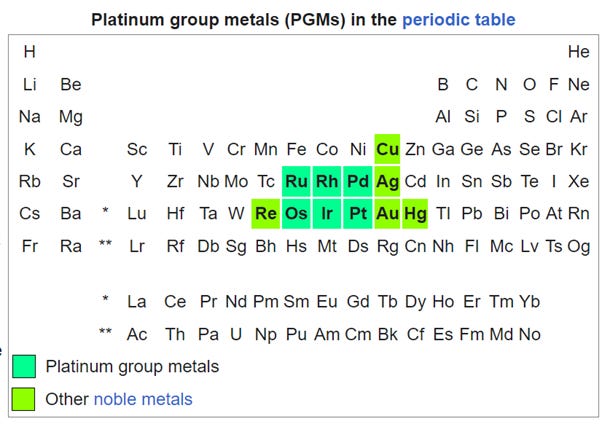

The platinum-group metals (PGMs), also known as platinoids, platinides, platinum metals, or platinum-group elements (PGEs), consist of six noble, precious metallic elements clustered in the periodic table. These elements are all transition metals located in the d-block (groups 8, 9, and 10, periods 5 and 6). The six PGMs are ruthenium, rhodium, palladium, osmium, iridium, and platinum. They share similar physical and chemical properties and are often found together in mineral deposits. However, they can be subdivided into two groups based on their geological behaviour: the iridium-group PGMs (IPGEs: Os, Ir, Ru) and the palladium-group PGMs (PPGEs: Rh, Pt, Pd).

Platinum was valued by ancient civilizations in South America, notably the La Tolita Culture, and in Egypt. It was used in ceremonial jewellery and mixed with gold, as seen in the 700 BC Egyptian Casket of Thebes. Indigenous cultures, like the Muisca Indians of Colombia, likely extracted and shaped platinum from ores through hammering, sintering, and annealing.

Platinum and platinum-rich alloys were known to pre-Columbian Americans, but the first European reference to platinum came in 1557 from Italian humanist Julius Caesar Scaliger, who described a metal found in Central American mines that couldn't be melted with Spanish techniques. The name "platinum" comes from the Spanish word platina ("little silver"), as Spanish settlers in Colombia saw it as an impurity in their silver mining. By 1815, rhodium, palladium, iridium, and osmium had been discovered. Industrial PGM mining began in the 19th century, especially in South Africa’s Bushveld Complex, one of the largest known PGM deposits. Over the years, it was discovered that the Platinum metals have unique catalytic properties and are highly resistant to wear and tarnish, making them ideal for fine jewellery. They also exhibit resistance to chemical attack, excellent high-temperature performance, high strength, good ductility, and stable electrical properties.

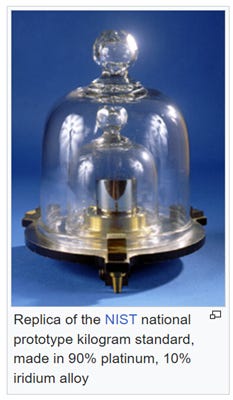

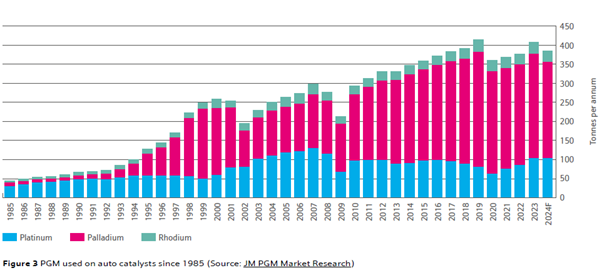

The global Platinum Group Metals (PGM) market has been established for over 50 years, driven by industrial use in various applications. Known for their irreplaceable properties, PGMs are widely used in jewellery as well, but the biggest demand comes from automotive catalytic converters that reduce vehicle emissions. PGMs are used in numerous industrial processes, including petroleum refining, pharmaceutical synthesis, and in products like computer hard drives, pacemakers, and airplane engines. They are also sought for investment purposes, primarily in ETFs backed by physical metal or in the form of bars and coins.

With the projected decline in internal combustion engine (ICE) vehicle production, there’s growing availability of platinum, palladium, and rhodium, along with more favourable prices for palladium and rhodium. This creates a rare opportunity compared to other critical materials, like those used in lithium-ion batteries, where supply is tightening. PGMs benefit from well-established supply chains and infrastructure, ongoing investments in efficiency and sustainability, and high recycling rates. Their use is often driven by necessity, offering superior efficiency, low energy consumption, and minimal waste. Key advantages include:

Strong availability and stable supply.

A normalizing price environment.

Mature circularity with high recycling.

Low-intensity usage in various applications.

Platinum group metals (PGMs) are often classified as ‘critical metals,’ but their supply-demand dynamics are less constrained compared to other critical materials. Demand for PGMs is shifting to new technologies, often replacing older uses. For example, platinum’s role in internal combustion engine (ICE) vehicles is transitioning to fuel cell electric vehicles (FCEVs). PGM supply chains are well-established, with South Africa playing a dominant role. In 2023, PGM mining contributed 1.6% to South Africa’s GDP and nearly 10% of its merchandise export value. South Africa’s Bushveld Igneous Complex (BIC) remains a vast and rich source of PGMs, making alternative sources, like seabed or asteroid mining, unnecessary and unlikely to compete. Recycled PGMs, particularly from catalytic converters in ICE vehicles, will remain a significant supply source for decades. Even after ICE vehicle sales cease, as projected for Europe by 2035, PGM recycling from auto catalysts will continue to supply platinum, palladium, and rhodium well into the future.

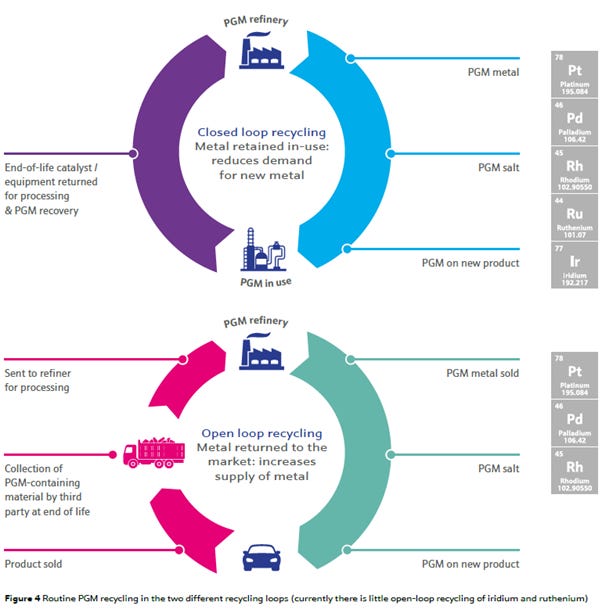

In addition to catalytic converters, other above-ground sources of PGMs exist, many of which are part of closed-loop recycling systems, returning the metals to their original owners. Although not included in official recycling figures, this practice is common for all PGMs, including iridium and ruthenium. Effective recovery from newer materials, such as catalyst-coated membranes (CCMs) in PEM electrolysers and fuel cells, is already integrated into existing recycling processes. PGM refiners continuously innovate to enhance recycling for specific materials, such as recent advancements in recovering not only PGMs but also valuable membrane material (ionomer) from CCMs. For new PGM users, circularity is built-in, provided they ensure end-of-life materials reach appropriate secondary refiners.

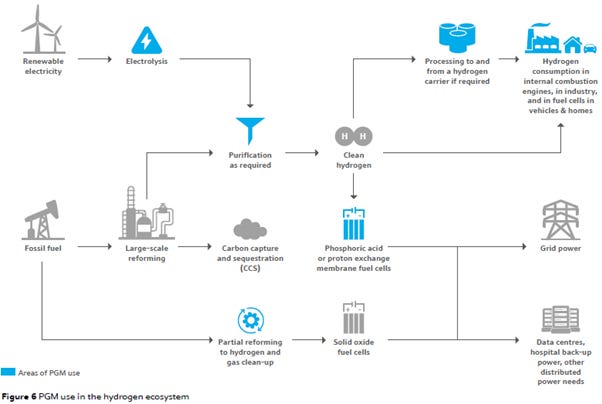

While still in its early stages, demand for PGMs has been increasingly linked to the energy transition process. One key area is clean hydrogen production, achieved through either electrolysis or converting methane from fossil fuels with carbon capture. Hydrogen has numerous applications in transportation, industry, and power generation, and can also be converted to ammonia or other fuels. Proton exchange membrane (PEM) technology heavily relies on PGM catalysts—platinum in PEM fuel cells, and platinum, iridium, and ruthenium in PEM electrolysers. Platinum also acts as an anti-corrosion plating for electrolyser components. Additionally, PGMs are used in other fuel cell and electrolyser technologies, such as anion exchange membrane (AEM) electrolysers and phosphoric acid fuel cells, a mature technology used in South Korea. Solid oxide fuel cells (SOFCs), while not requiring PGMs directly, depend on PGM catalysts (rhodium, palladium, and platinum) for natural gas processing. These fuel cells are gaining traction for distributed power generation. The handling and transport of hydrogen, using ‘hydrogen carriers,’ also create PGM demand, with platinum and ruthenium often catalysing the processes for hydrogen storage and retrieval.

In hydrogen purification, platinum catalysts and palladium membranes are essential, with palladium also playing a role in hydrogen sensing. Altogether, PGMs are crucial in enabling the hydrogen economy and driving the transition to net zero.

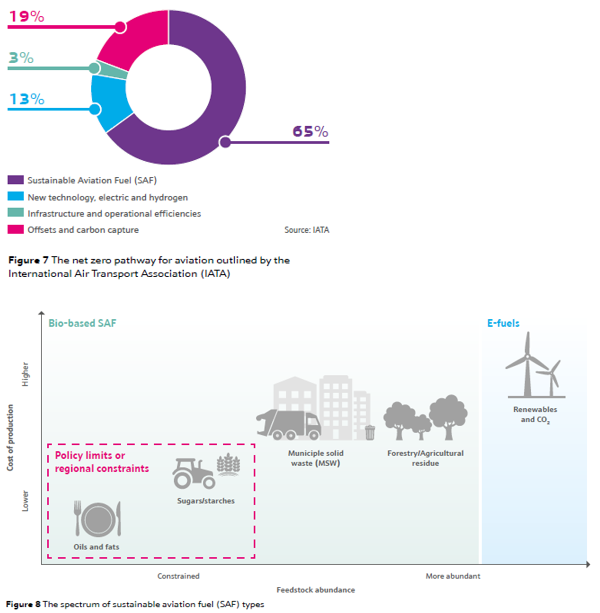

Aviation, which currently accounts for 3% of global energy consumption, is another sector driving new demand for PGMs. As the industry pursues net zero, various technologies will rely on PGMs. Hydrogen-powered aviation, through either jet engines or fuel cells, is being tested for shorter-haul flights, while long-range flights require alternative fuels. While like uneconomical over the long term, the industry is focusing on sustainable aviation fuel (SAF), which can replace fossil jet fuel but is made from biomass or by combining clean hydrogen with captured CO2. Platinum catalysts are crucial in producing SAF from vegetable oils (HEFA or HVO), though this supply is limited. PGMs are also used in other processes to convert biomass and waste into SAF. Additionally, Fischer-Tropsch synthesis, which combines captured CO2 with clean hydrogen to create SAF, requires PGMs in electrolysis and purification processes. Thus, PGMs play a key role across the SAF production spectrum.

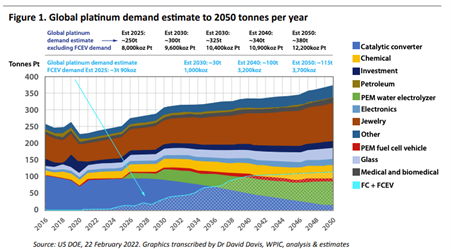

In a nutshell, there will still be strong demand for PGMs even if the internal combustion engine ceased to exist. Indeed, despite the gloomy outlook for internal combustion engines (ICE), platinum demand is projected to grow. Fuel cells, chemicals, and PEM electrolyser demand will replace the demand for catalytic converters. Over the past few months, ICE has made a comeback while the electric vehicle (EV) craze has cooled. The need for catalytic converters, and therefore for platinum and PGMs, has returned. Achieving zero carbon targets requires more than just catalysts. Fuel cells powering vehicles are becoming increasingly relevant, with platinum serving as a catalyst to accelerate chemical processes. So far, no alternative metal can replace platinum in fuel cells. By 2030, fuel cells are expected to account for 10% of platinum demand, and 28% by 2040.

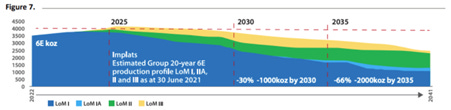

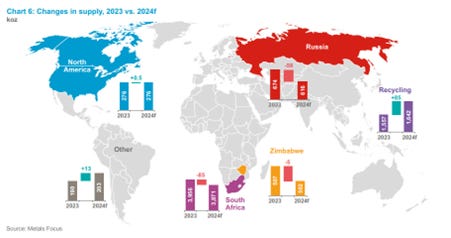

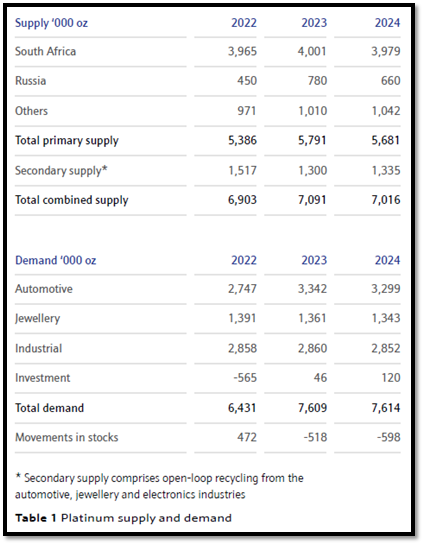

On the supply side, PGMs come from primary and secondary source of supply. Mined supply is heavily concentrated in South Africa; Zimbabwe and Russia. PGMs are mainly extracted from dedicated PGM mines although some are mined as byproducts in nickel and copper mines. Mine production has structurally declined over the years due to geopolitical and environmental constraints that have impacted the profitability of mining PGMs in various countries. For example, global platinum mine production decreased from 6,073 thousand troy ounces in 2019 to an estimated 5,468.3 thousand troy ounces in 2024. This decline is primarily driven by reduced supply from South Africa, the largest platinum producer, as well as from Russia and countries like the US and Canada, where mining costs are significantly higher than elsewhere.

Like all other metal mining industries, the Platinum sector follows the CAPEX cycle. Over the past decade, the lack of investments has had noticeable consequences. Supply is steadily declining, and the need for new deposits to replenish dwindling reserves is putting pressure on companies. Investments to renew depleted reserves are essential for every miner. The basic heuristic in the mining industry is: The reserves growth rate must exceed the reserve depletion rate. In this context there has been a steady decline in reserves among major platinum mining companies. The reserves (blue) are part of the resource base (yellow and green). Converting resources into reserves requires time and capital, and little investment has been made in recent years. This is not the exception but the rule for mines producing PGMs.

The location of these deposits also explains why mining supply has been structurally declining over the years, in addition to the time required to discover, develop, and build a new mine. Of every 100 ounces of platinum reserves, 90 are in South Africa, 6 in Russia, and 2 in Zimbabwe. The remaining 2 ounces are in North and Latin America. South Africa is in an acute energy crisis which has impacted its mining industry, and Russia is partially isolated politically and economically. These factors make discovering new deposits and building mines even more challenging.

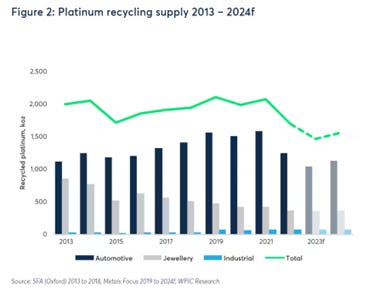

Supply PGM recycling set up in open and closed loops is essential to meeting global demand for PGMs. Out of every four ounces of platinum, one is obtained through recycling. However, this cannot compensate for the dominance of one country in the platinum supply. The statistics are clear:

South Africa holds 90% of the world's reserves of platinum, palladium, and rhodium.

South Africa produces 73% of the world's platinum and 42% of its palladium.

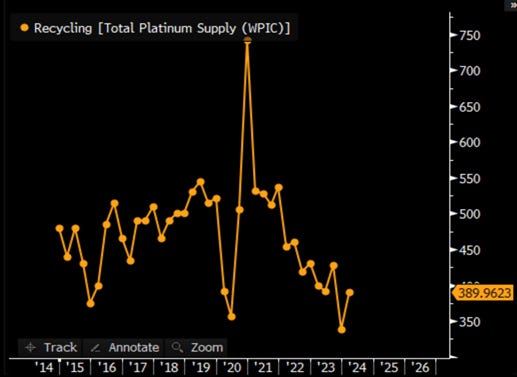

While one-quarter of the platinum supply comes from recycling, recycling faces two main headwinds:

Higher interest rates result in higher car payments, leading to extended vehicle ownership and fewer catalytic converters recycled.

Lifestyle changes, such as increased home office use and reduced mileage, also reduce catalytic converter recycling as people’s mobility has been structurally reduced.

The combination of more expensive vehicles and reduced mileage results in decreased recycling output. As 80% of recycling supply comes from catalytic converters removed from end-of-life vehicles, the trend in recycling supply is expected to structurally decline, especially if economic growth is lacklustre in the coming years.

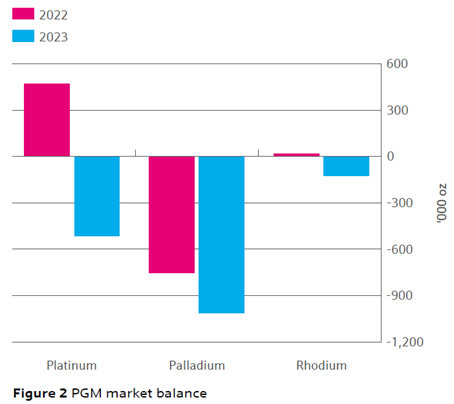

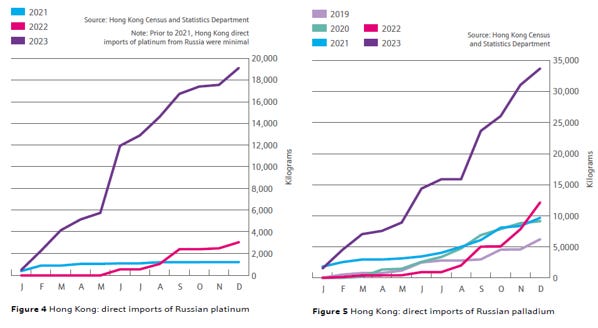

In 2023, expected improvements in primary and secondary PGM production fell short. Plant maintenance and electricity shortages hindered progress at South African smelters and refineries, and a decline in end-of-life vehicles reduced PGM recovery from automotive scrap by about 14%. Despite significant Russian PGM sales to China, overall supply of platinum and palladium only slightly increased, while rhodium supply declined. Platinum, palladium, and rhodium faced notable deficits, but palladium and rhodium prices dropped sharply due to market liquidity and negative sentiment, with Russian sales to Hong Kong and mainland China supporting overall PGM supplies.

Despite significant deficits in palladium and rhodium, prices did not reflect this imbalance. Elevated prices in 2020-2022 led long-term holders to sell excess stocks, while industrial consumers also over-purchased to hedge against future price risks. As prices fell and concerns about supply risks eased, excess inventories were reduced, leading to a temporary drop in PGM purchases and some metal being sold back to the market. This trend was exacerbated by demand shifts, such as reduced palladium use in gasoline catalysts and lower rhodium content in glassmaking alloys. For palladium and rhodium, investor sentiment and increased liquidity further pressured prices. Both metals are still heavily tied to the automotive sector, which accounts for over 80% of their demand. With the rise of battery electric vehicles (BEVs) expected to create surpluses and no clear alternative uses, prices fell sharply. Primary PGM supplies increased in 2023, mainly due to a surge in Russian exports to Hong Kong and China. Russian palladium exports rose by 17% to 2.7 million ounces, and platinum exports more than doubled to 780,000 ounces. Following the Ukraine invasion and subsequent sanctions, Russian PGMs faced reduced trade with Western and some Asian partners, leading to unsold inventory from 2022. Starting in mid-2022, Russian PGMs were increasingly shipped directly to China, with significant discounts allowing them to partly displace imports from other regions and domestic Chinese refineries. However, declining Chinese palladium consumption limited the impact of these sales, while US imports of Russian PGMs were significantly affected by new import tariffs imposed in April 2023.

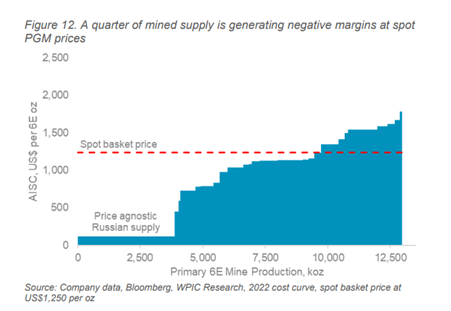

Releasing Russian above-ground inventories have pressured platinum and palladium prices. However, above-ground stocks, particularly in the West, are now at their lowest level since 1980. Given the significant deficit, above-ground stocks have declined to their lowest levels in records dating back to 1980, with further deficits expected in 2024 and 2025. On top of that, given the depressed prices, major miners have cut output because spot prices have fallen below their all-in sustaining costs (AISC). Currently, about 25% of miners' AISC is above the spot price, resulting in negative margins.

It should be clear by now that over the past 4 years, Platinum and Palladium prices have grossly underperformed those of the most popular precious metals like gold and silver.

Performance of $100 invested in Platinum (blue line); Palladium (red line); Gold (yellow line); Silver (green line) since 31st December 2019.

The acute underperformance of platinum and palladium compared to gold and silver is due to the fact that, although they are precious metals, their prices are more influenced by industrial demand than by investor demand. In this context, the prices of platinum and palladium are more closely correlated with economic growth than those of gold and silver.

USD Price of 1 ounce of Platinum (blue line); Palladium (red line); Gold (green line) and US GDP Nominal Dollars YoY SA (white line) & US Recessions.

With platinum currently priced below $1,000 an ounce and having significantly underperformed gold and silver over the past four years, some investors might begin to view this price weakness as a buying opportunity. Historically, platinum reached an all-time high of $2,213 an ounce in March 2008, surpassing gold's 2011 peak, driven by severe supply issues in South Africa at the time. Until 2015, platinum was more expensive than gold, but this trend reversed. As gold prices have been primarily driven by demand from central banks, institutional and retail investors in the Global South, and primarily Asia, the underperformance of platinum relative to gold has been more pronounced since 2020. This is because platinum lacks the same store of value significance for these investors as gold does.

Gold to Platinum Ratio since December 31st, 1987 & US Recession.

However, this could change as investment demand for platinum is rising, driven by increased coin and bar purchases in China. WPIC forecasts double-digit growth in China’s retail platinum investment this year, fuelled by perceptions of undervaluation compared to gold. In July 2024, China launched platinum futures contracts, allowing delivery of platinum in forms used by industrial consumers, potentially boosting investment demand. These new contracts may enhance platinum’s appeal by reducing premiums and buyback discounts. While it remains uncertain if platinum will regain its pre-2010s price parity with gold, current supply and demand dynamics suggest it could be a promising buying opportunity.

All three auto catalyst PGMs are expected to remain in deficit in 2024, despite a projected 5% decline in light-duty ICE vehicle production, slight improvements in autocatalyst recoveries, and continued sales from Russian stockpiles. The palladium shortfall is anticipated to decrease to around 360,000 oz, with demand falling 6% to 9.7 million oz, the lowest since 2016. Automotive use is forecasted to drop to 8.1 million oz, an eight-year low, due to a 4% contraction in gasoline car production and reduced output by Chinese automakers. On the supply side, a 4% increase in secondary palladium recoveries should balance out a slight decline in primary metal sales. ETF holdings of palladium are relatively low, under 600,000 oz, compared to nearly 3 million oz in 2014–2015. Heavy ETF redemptions could theoretically balance the market, but this would require selling more than half of the remaining holdings. The palladium market's balance also depends on vehicle output, which may improve if gasoline car production stabilizes at 2023 levels, potentially adding around 200,000 oz to the demand forecast. Despite challenges like a slowdown in new orders and component shortages, recent industry forecasts suggest that ICE vehicle production may hold up better than anticipated in 2024. Auto recycling is another major source of uncertainty. The backlog of older vehicles still in use, which would typically have been retired by now, complicates predictions. It's unclear how quickly vehicle scrappage rates will return to normal. While recycling might rebound more strongly than expected, there's also a risk of disappointment due to a slowdown in new vehicle sales, continued tightness in the used car market, and cost-of-living pressures that encourage car owners to keep their vehicles longer.

Number of shares outstanding in ABRDN Physical Platinum ETF (white Histogram); ABRDN Physical Palladium (red Histogram).

The deficit in the platinum market is forecast to exceed half a million ounces again in 2024. Demand is expected to stabilise at around 7.6 million oz, with small decreases in automotive and jewellery balanced by an uptick in investment. Industrial consumption will be virtually unchanged. On the supply side, a fall in Russian shipments (following unusually large producer stock sales in 2023) should be offset by modestly higher recoveries from auto recycling, and slightly increased primary supplies from Zimbabwe and North America. South African platinum supply is forecast to be virtually flat, with releases of work-in-progress from producers’ refining pipelines largely compensating for a small decline in underlying mine output. These demand estimates allow for positive platinum investment of 120,000 oz in 2024, much of this in the form of coins and small bars, including new platinum products celebrating the Chinese Year of the Dragon issued by the Perth Mint in Australia and the People’s Bank of China. Net investment in the form of retail bar sales in Japan, and via exchange traded funds in other regions, was minimal during the first quarter of 2024. Platinum ETF holdings totalled nearly 3 million oz as of the end of March 2024, while Japanese retail investors also hold large quantities of metal purchased in previous years, so it is theoretically possible for disinvestment to balance the market, as happened in 2022 (when rising interest rates reduced the attractiveness of non-yielding assets, and dollar strength provided some profit-taking opportunities for platinum investors in other currencies). Historically, liquidation of large bar holdings in Japan has been favoured by sharp upward movements in the yen-denominated platinum price, but it is harder to anticipate the reaction of ETF investors.

Before investors consider adding platinum to their portfolios, they should understand that, over the past 20 years, platinum’s implied volatility has been nearly double that of gold and comparable to that of silver. Palladium is even more volatile than Platinum given the smaller size of its market. In layman's terms, this means that adding platinum and or palladium to the antifragile part of a portfolio will increase its volatility.

3-Month At The Money Implied Volatility of Platinum (blue line); Palladium (red line); Gold (yellow line); Silver (green line).

Although platinum appears increasingly attractively valued compared to gold, its price drivers will likely remain influenced by geopolitics and government regulations related to climate change agenda, which will impact recycling supply. Indeed, Russia is the big unknown in this equation. Further sanctions on PGM exports to the EU imposed by the EU could act as a catalyst. Russia might also impose sanctions on PGM exports to the EU, leading to a potential parabolic price move in PGMs. Prices may reach levels seen in March/April 2022. At that time, the EV craze was strong, and PGMs were undervalued. Now, with the PGM deficit deepening, restricting 45% of palladium and 10% of platinum exports could trigger an exponential market response.

While the PGM deficit suggests higher spot prices for platinum and palladium in the near future, investors should consider the market's challenges. On the positive side, slowing PGM production and low spot prices are pressuring South African miners, leading to the closure of high-cost operations, a trend exacerbated by power shortages. On the negative side, the green energy transition while it is uneconomical and unjustified has impacted and will continue to impact the pricing of PGMs. Ultimately, investors should keep in mind that unlike gold, which is primarily a monetary metal, PGMs and silver are mainly industrial metals. Thus, their price dynamics differ from those of gold and are more impacted by economic growth than by the search of an antifragile asset in the context of the weaponization of USD assets for those in the world who are not complying with the unipolar world view of those ruling the so-called western democracies.

In brief, PGMs are probably the least popular precious metals among investors. Given the uncertain future of supply and their reliance on industrial demand, only those with a high-risk appetite should consider adding platinum and palladium to their portfolios. While platinum and palladium are undeniably currently undervalued compared to gold, investors must be prepared to endure greater volatility than with gold and silver. In this context, they will need a ‘Taoist Patience’ to Make Platinum Great Money Again.

WHAT’S ON THE AGENDA NEXT WEEK?

The third week of the last month of the third quarter will be a shortened holiday week in Asia, as China celebrates the Mid-Autumn Festival and Japan observes Respect for the Aged Day. Aside from cutting traditional mooncakes, investors will once again focus on central bank masquerades, first in the US with probably the most anticipated FOMC meeting of the year on Wednesday, and then the Bank of Japan closing out the week. Stock pickers will keep an eye on FedEx, Lennar, and Darden Restaurants for more clues about the inflation-driven misery impacting US consumers.

KEY TAKEWAYS.

As everyone prepares to cut the mooncake under the autumn full moon, here are the key takeaways:

In China, the latest inflation data show that more ‘Taoist Patience’ will be required for those looking to Make China Great Again by boosting domestic consumption.

The politically driven ECB embraced rate cuts despite increasing stagflationary signs, as a sovereign debt crisis looms in the Eurozone, with France being in pole position to fall into the debt trap.

The rebound in shelter and core CPI, alongside reckless fiscal spending and central bank masquerades, shows that the 2% inflation target is now an unreachable floor, and will result in painful inflationary busts.

The US PPI added further evidence that the return of the inflation boomerang is inevitable once the political circus surrounding the White House subsides.

The University of Michigan long-term inflation expectations added to the growing list of indicators pointing to HIGHER long-dated yields, regardless of what the Fed decides on September 18th.

Even in the phantasmagorical scenario of 200 basis points rate cuts over the next 18 months, as expected by the illiterate Wall Street consensus, reckless Keynesian government spending will still lead to a higher interest burden, pushing toward yield curve control and financial repression. This will harm investors who continue to chase the ‘duration trade’ and believe that the ‘once upon a time risk-free’ U.S. Treasury remains free of risk.

The PGM market, established for over 50 years, is driven by the unique properties of these metals and high demand in automotive catalysts, industrial processes, and investment products.

Despite slowing economic growth, platinum demand is expected to rise, driven by its essential role in fuel cells and other applications, which will sustain significant demand over the next decade.

PGM supply can be divided into primary sources from mining activities, mainly in South Africa, Zimbabwe, and Russia, and secondary sources from recycling industrial and automotive materials through open and closed-loop recycling processes.

Out of every four ounces of Platinum, one is obtained through recycling

Over the past four years, platinum and palladium have underperformed compared to gold and silver because their prices are more influenced by industrial demand and economic growth than by investor demand.

Platinum priced below $1,000 an ounce and well below its historical ratio to Gold may attract deep value bargain hunters in ‘decentralized real assets’ in particular investors from the Global South who are looking to diversify their wealth outside USD assets.

Before adding platinum to their portfolios, investors should note that its implied volatility has been nearly double that of gold and is comparable to silver.

Adding platinum or palladium to a portfolio will inevitably increase its long-term volatility, but given their current relative valuation against gold and silver, it could be worth taking the risk.

To surf ‘Kamunism’, investors should focus even more on companies with low-leveraged balance sheets and strong business moats.

Physical gold remains THE ONLY reliable hedge against reckless and untrustworthy governments and bankers.

Gold is an insurance to hedge against 'collective stupidity' and government’ hegemony which are in great abundance everywhere in the world.

Silver, platinum, and palladium can be added to diversify the "antifragile" portion of a portfolio for investors seeking enhanced performance and willing to manage higher volatility.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

In such an environment, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

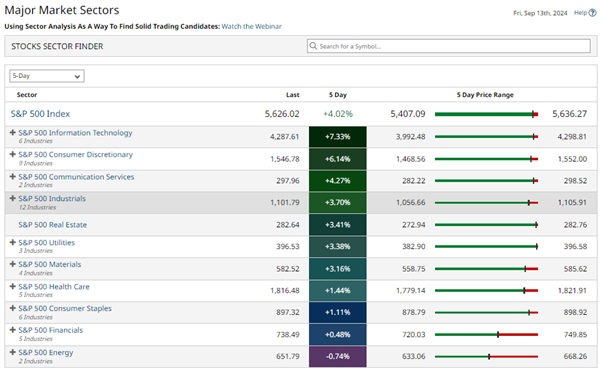

After an eventful week revealing that inflation has bottomed out and the US is already in an inflationary bust (i.e., stagflation), with central banks showing their impotence, particularly the ECB, which has already conceded its inability to fight inflation, equity indices surged, with the Nasdaq recording its best week since the ‘Powell Pivot’ in early November 2023. The S&P 500 closed just 43 points below its all-time high and is on track to form a triple top ahead of the September 18th FOMC meeting. Notably, despite its sharp rebound over the past five trading days, the Nasdaq remains in a downtrend, while the S&P 500 and Dow Jones have been trading sideways within a tight 10% range for the past two months.

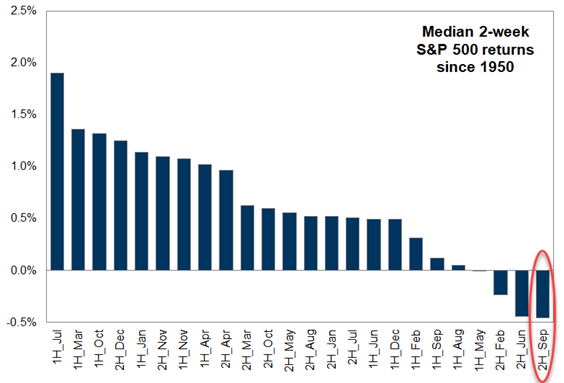

Ahead of another eventful week, technical indicators are clearly showing a triple top for the S&P 500, signalling that investors should brace for the ‘Ides of September,’ which could push markets back to their January lows as we approach the D-Day of the political hell year (November 5th). Investors should keep this in mind given that the next two weeks have historically been the worst period of the calendar year for markets.

In this context, it should come as no surprise that high beta growth sectors like IT, Consumer Discretionary, and Communication Services outperformed, while Energy was the only sector to end the week in the red.

Like physical gold and silver, the best way for those with the risk appetite to own platinum and palladium in a diversified portfolio is to hold the metal outright and store it in a private, secure vault outside the banking system. This approach is simple, clean, liquid, and less likely to bring negative surprises. However, investors must accept that trading and monetizing platinum and palladium bars is more difficult than with gold and silver, as these metals are less familiar to most laypeople and therefore will be more reluctantly accepted as decentralized, non-confiscable assets without counterparty risks. An alternative is to trade physical platinum and palladium ETFs, but this sacrifices the decentralized nature of physical ownership, as these ETFs are subject to stock exchange rules and the counterparty risk of the ETF issuer. For even more adventurous investors, PGM mining companies are an option. However, like gold and silver miners, while many of these stocks are attractively valued and under-owned, they exclusively operate in exotic jurisdictions like South Africa, Zimbabwe, and Russia, with only a few operating in Canada, which is ruled by WEF-affiliated green zealots. In these countries, including Canada, property rights can be ‘flexible,’ especially when metal prices rise, and the economic environment becomes more challenging for governments to satisfy their voters. Canadian-domiciled PGM mining companies also have the highest production costs in the industry, which, during times of depressed prices, could threaten the viability of their operations.

On September 12th, Russian President Vladimir Putin instructed the government to consider restricting exports of strategic raw materials such as nickel, titanium, and uranium in retaliation for Western sanctions. While platinum is not yet included in the preliminary list, this could change over time. Investors should be aware that if the conflict between Russia and NATO countries escalates, Russia's platinum mined-supply could be impacted. As the world's third-largest platinum miner, any potential export ban could remove more than 11% of the global mined platinum supply, inevitably driving prices higher, regardless of broader macroeconomic conditions.

As it is already evident that the 2020s are and will be a transformative period in world history, investors must stay focused on what ultimately matters for themselves and their loved ones. In this context, as Epictetus stated centuries ago, ‘everyone should remain attached to what is spiritually superior, regardless of what others may think or do.’

Understanding this concept will not only help individuals and communities prepare for the challenges and opportunities ahead, but also avoid falling into traps set by those who are looking to compromise their thinking by spreading unnecessary 'noise' that diverts attention from the essentials. While complacency has once again spread across financial markets, seasoned investors like Warren Buffett and others have demonstrated through their recent decisions that they are preparing for what the media will likely call 'black swan events,' which are however being widely expected and will have a significant impact in the state we live and invest in the coming years. As the Western world heads into a global inflationary bust, investors must stick to a disciplined approach and remember that it's time to hold substantial cash (between 20% to 40% of their portfolio), preferably in USD IG short-dated papers (maturities not exceeding 12 months) or 1-month T-bills, rather than in bank accounts, as the risk of a banking crisis is rising daily. Another strategy is to stay hedged against rising volatility, which will increase significantly after November 5th, as last week's debate revealed that neither side contesting the White House will ever accept the election results. In this context, those who followed the recommendation to buy a 507 Put on the S&P 500 ETF (SPY Index) expiring on November 29th can continue to hold this position and may even use this week's market rebound to add to the trade, as the premium for protecting against such a downside remains highly attractive.

To survive more regulation and the rising risks of social unrest and chaos domestically and abroad, investors are reminded to own a sizeable portion of your wealth in assets which have no counterparty risks and will preserve your wealth from reckless action taken by even more tyrannic governments. In this context, everyone should own between 20% to 40%, depending on their risk appetite in physical gold, silver and eventually platinum, stored outside the financial system and in jurisdictions which are less likely to succumb to the WEF narrative which is targeting to destroy those who are not complying with their ‘stakeholder capitalism’ narrative aimed to promote the climate change scam and other ‘Stalinist’ policies such price controls and tax on unrealised gains. Ultimately, nobody should ever forget that the real problem is the government with its reckless spending and that taxes are only there to allow the plutocrats in power to spend more to enrich the kleptocracy (a government ruled by thieves) and the kakistocracy (a government run by unprincipled career politicians, corporations, and thieves that panders to the worst vices in human nature and has little regard for the rights of the citizens) prevailing in those countries who have been rallying to the WEF narrative.

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.