THE WEEK THAT IT WAS...

The third week of Q2 in this Jubilee Year was shortened by Easter Monday in Europe. With few macro updates, markets turned to consumer sentiment and inflation expectations. Attention now shifts to earnings season, with 117 S&P 500 companies reporting—including Lockheed Martin, Tesla, Freeport-McMoRan, and Alphabet.

As the Tariff Tantrum trickles down from Wall Street to Main Street like a bad hangover, the US flash PMI for April decided to take a breather, slipping 2.3 points to a still-optimistic-sounding 51.2 (because hey, anything above 50 means we’re not technically panicking… yet). The future production index just booked a one-way ticket back to October 2022 levels. Manufacturing is basically standing still, like someone who just realized tariffs don’t magically create prosperity. On the services side, things are softening too, turns out people aren't rushing to book vacations in an economy built on rising uncertainty and falling exports. Oh, and prices? Up, up, and away! The composite price gauge hit a one-year high thanks to—you guessed it—tariffs, import markups, and wage pressures. Input costs for manufacturers are climbing like they’re training for Everest, with suppliers happily passing on the tab. But hey, if the plan was to create inflation and confusion, then mission accomplished.

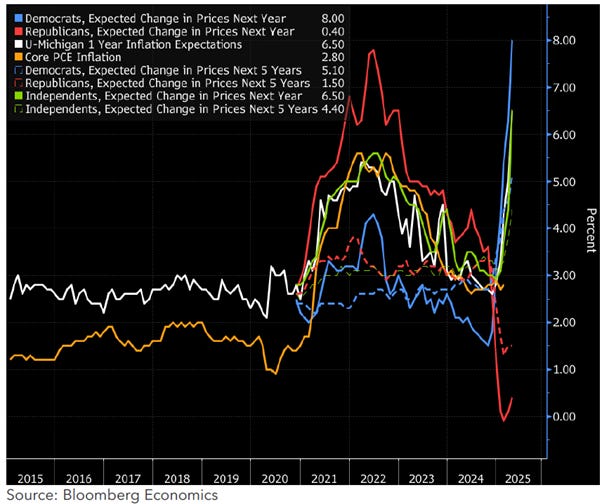

U.S. consumer sentiment edged up in the University of Michigan’s final April reading, with the headline index rising to 52.2 from 50.8 earlier in the month, though still below March’s 57.0 and the lowest final print since 2022. The improvement followed tariff-related news swings earlier in the month. The current conditions index rose to 59.8, while future expectations inched up to 47.3. Year-ahead inflation expectations dipped slightly to 6.5%, driven by more optimism among Republicans, though expectations among independents and Democrats worsened. Long-term inflation expectations held steady at a still elevated 4.4%. Labor market sentiment also improved slightly, with fewer consumers expecting higher unemployment.

While Wall Street and the ‘Manipulator In Chief’ begged for an emergency rate cut and media cheerleaders fan the fear, markets cling to the fantasy that the increasingly toothless FED will still be able to save the day, pricing in more than three cuts by year-end, starting in June with 69% odds. But in reality, no cut may come, and the FED might even have to hike to salvage what’s left of its credibility as inflation bites back.

In grammar class, ‘Maleficent’ is what happens when ‘Magnificent’ goes goth. Forget light and glory, this is power dressed in shadows, elegance dipped in venom, and vengeance with high cheekbones. While ‘Magnificent’ throws a parade, ‘Maleficent’ crashes it with a smirk and a dragon. Greatness doesn’t always sparkle; sometimes it broods. And speaking of dark turns , April 2nd’s so-called US ‘Liberation Day’ might make it into the history books, but don’t expect them to mention the embarrassing policy U-turns barely a week later. The Disruptor-in-Chief’s Trade War has now been gently placed on ‘pause’ , for 90 days or forever, depending on the way that he can strike deal as he is still try to impose his way of ‘The Art Of The Deal’ to the rest of the world in a ‘Trumperialistic’ way of course.

First, he said he’d do it—and surprise! He actually did. The 47th President, back in the Oval Office since January 20th, 2025, made good on campaign promises that many dismissed as just bluster. Cue the tariff extravaganza: a 10% blanket tax on all imports, and a jaw-dropping 145% tariff aimed straight at Chinese goods. That’s on top of the usual suspects—steel, aluminium, autos, and anything not hugged tightly by USMCA. The result? One way or the other, Americans corporates and consumers are now paying an extra 25% in tariff taxes, up 23 percentage points in just three months. Economists predict these tariffs might settle around 18%, which sounds almost reasonable until you realize it puts us in Smoot-Hawley territory. You know, that fun little policy move that helped deepen the Great Depression which started with a sovereign debt crisis in Europe.

So what happens next? GDP is set to shrink by 1% in 2025, while prices float up somewhere between 1.6% and 2.7%. Translation: stagflation with a side of economic heartburn. But the real killer isn’t the tariffs, it’s the whiplash-inducing uncertainty. In a world where trade rules are written by executive order and rewritten by tweet, businesses are hitting pause on investments faster than you can say ‘policy risk.’ The U.S. Economic Policy Uncertainty Trade Index is now screaming at historic highs, making the 2018–2019 ‘Tariff Tantrum’ of Trump 1.0 look like a kiddie pool splash.

US Categorical Economic Policy Uncertainty Trade Policy Index.

Those who assess the state of the business cycle through market data rather than government propaganda, and who understand that the economy is ultimately transformed energy, know that the evolution of the S&P 500-to-oil ratio relative to its 7-year moving average is the only reliable way to gauge the true health of the U.S. economy. A glance at how trade uncertainty affects the business cycle leads to an obvious conclusion for anyone with a shred of common sense: a rise in trade policy uncertainty almost always pushes the S&P 500-to-oil ratio below its 7-year moving average within 6 to 12 months. In layman’s terms, rising uncertainty has historically been a reliable precursor to an economic bust, and it’s hard to see why this time would be any different.

S&P 500 to Oil Ratio (blue line); 7-Year Moving Average of S&P 500 to Oil Ratio (red line); US Categorical Economic Policy Uncertainty Trade Policy Index (axis inverted; green line).

Naturally, it should come as no surprise that when the Economic Policy Uncertainty Index starts screaming, 12-month forward EPS for the S&P 500 soon follows with a whimper, typically within 6 to 9 months. After all, nothing says ‘future corporate profitability’ like total policy chaos. If there’s one thing Wall Street truly hates, it’s making billion-dollar investment decisions in an environment where the rules are made up on Monday and rewritten by tweet on Tuesday.

S&P 500 12-month forward EPS (red histogram); US Categorical Economic Policy Uncertainty Trade Policy Index (axis inverted; blue line).

Geopolitically, Trump’s tariff crusade zeroes in on China, now facing a whopping 135% effective tariff rate, because nothing says ‘national security’ like a trade war. The justification? Vague threats and political theatre that no one dares unwind after an election year. Talks to dial things down are supposedly on the way, but don't hold your breath. Both sides are stuck in maximalist mode, and China, unlike the others, has fully retaliated. Why? Because it can. While armchair China experts like Lutnick, Navarro, and Kyle Bass (none of whom have ever set foot in China) foam at the mouth on cable news, Beijing quietly shores up domestic demand and shrugs off pressure like a seasoned heavyweight. Meanwhile, Washington’s grand plan to isolate China via alliances is floundering, turns out ‘America First’ doesn’t inspire much loyalty. Since the original tariff tantrum of Trump 1.0 back in 2018, the whole thing has become a tit-for-tat routine, less about resolving real issues and more about flexing for the cameras. Call it economic theatre with no intermission.

US Average Tariffs on China Exports (blue line); China Tariffs on US Exports (red line) since 2018.

In the end, Trump’s trade policy isn’t so much about economics as it is about flexing, think less Adam Smith, more WWE. The goal? Tear down a global system that dares to limit American swagger and replace it with a tariff-powered joystick he controls at will. Forget predictability, uncertainty is the point. It makes trading partners sweat and MAGA crowds cheer but for how long…

Coherent economic rationale? Please. These tariffs are more about vibes than spreadsheets. Sure, the focus has been on punishing China to satisfy domestic chest-thumping, but here’s the twist: U.S. imports from China peaked way back in October 2018 and have been sliding ever since, now under $32 billion a month. Meanwhile, China’s exports to ASEAN—the neighbouring bloc whose name the U.S. Defence Secretary probably couldn’t spell, have soared past $42 billion monthly. So what's the genius outcome of this trade war? The U.S. buys less from China… and China just sells more to its neighbours. The ‘Disruptor-in-Chief’ might have dreamed of economic domination, but what he actually sparked was a regional trade boom, just not for America. Call it the Art of the Misfire.

US Imports from China in USD (red line); China Exports to ASEAN (blue line).

The reality is that China’s been quietly decoupling from the U.S. and the west in general for years, slashing its export dependence, rerouting goods through Vietnam with a “Made in Vietnam-ish” label, and expanding its Belt and Road club across Asia and Africa. Meanwhile, the U.S. gets tariffs, higher prices, and a boomerang effect that hits American wallets harder than Beijing’s. Add a collapsing Chinese property market to the mix, and guess who’ll get blamed? Yep, Trump, the all-purpose scapegoat. But here’s the kicker: China plays chess, the U.S. electorate plays TikTok. As Mao once quipped about the French Revolution, when asked, ‘What has been the impact of the French Revolution?’ he replied, ‘It is too early to say.’

Beyond trade, these so-called ‘reciprocal’ tariffs also double as Washington’s last-ditch attempt to keep its grip on a world that’s clearly moved on to multipolarity. Pure coincidence, of course, that ‘Liberation Day’ just happened to line up with a fresh round of U.S.-Iran tension—this time over nukes, again. Talks are dragging along in Muscat, but not much is moving. The U.S. is threatening airstrikes unless Iran shelves its nuclear program, while Iran insists it’s all peaceful and would love a reboot of the 2015 JCPOA in exchange for lifting sanctions. Military action is still on the table, though it would likely backfire, missing its goals, sending oil prices soaring, and making life even harder for a global economy already wheezing under tariffs.

Iran, embargoed and all, is still pumping out 3.3 million barrels a day (almost 12% of OPEC daily oil output), most of which end up in Asia, especially China.

Any disruption there would tighten supply, push oil prices up, and hit U.S. corporate margins right when they’re already struggling to digest Trump's tariff buffet. With pricing power fading, a Middle East blow-up would all but guarantee the S&P 500-to-oil ratio drops below its 7-year moving average, sealing the deal on what history might call “Trump Stagflation: The Sequel.”

Iran OPEC Crude Oil Production Output (blue line); WTI Prices (axis inverted; red line).

Anyone who lived through the COVID-era supply chain meltdown knows exactly how well this ends: badly. With Trump-era tariffs now reaching embargo-level intensity, both the U.S. and China have about zero political incentive to hammer out a grand bargain. Instead, it’s a game of economic whack-a-mole, corporations will scramble to dodge tariffs, but higher costs and supply hiccups are inevitable.

Much of the spotlight is on flashy imports like smartphones and laptops—products without easy alternatives. Cue the classic Trump flip-flop: after slapping 125% tariffs on Chinese electronics, the administration promptly carved out exemptions for smartphones and much of computer hardware. Apparently, making iPhones outrageously expensive isn’t a winning campaign strategy. These items are still subject to earlier 20% tariffs, though, and the threat of more (hello, semiconductors) looms large.

https://youtube.com/shorts/WL3aquzJKg4?si=GAdjHyUCv9P-S2UW

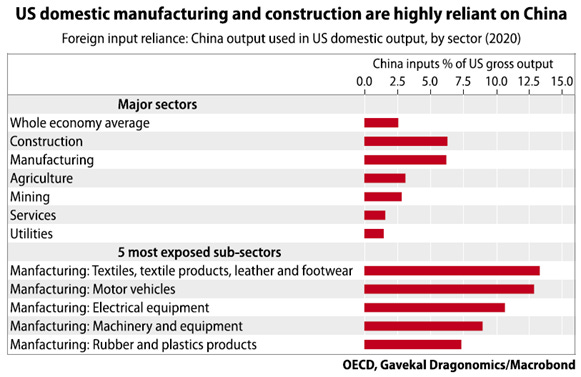

While consumer goods grab headlines, the real pain is in the invisible stuff, components buried deep in supply chains that keep U.S. factories and builders humming. Tariffs here will trigger shortages and price spikes without a “Made in China” label in sight. Sure, services dominate the U.S. economy and are mostly insulated from Chinese supply shocks. But construction and manufacturing? Not so lucky. According to OECD input-output data, they’re the most exposed to Chinese inputs. Think of all those “cheap” construction materials stacked at Home Depot, most of them trace their way back to China. Slap a 145% tariff on that, and contractors won’t just feel the pinch, they’ll be bleeding. Sticker shock will hit customers next, killing demand just when the economy could really use a bit of resilience. Welcome to tariff-induced stagflation, home-improvement edition. For U.S. manufacturing, the “Made in America” dream comes with a “Made in China” parts list. The industries meant to gain from Trump’s tariff wall. like textiles, autos, and machinery, are actually stuffed with Chinese components. So while the red, white, and blue rhetoric rages, factories are scrambling for bolts and circuit boards.

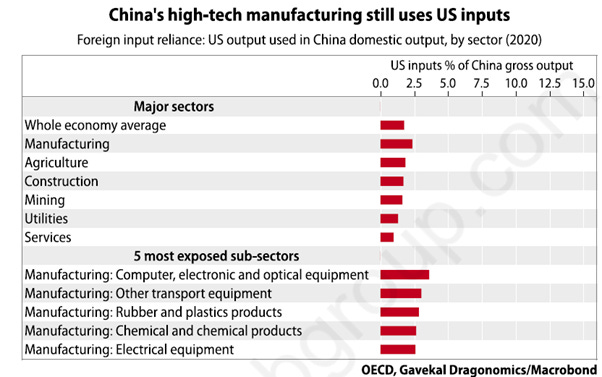

OECD data shows the U.S. is about three times more dependent on Chinese inputs than China is on American ones, fitting, since China’s manufacturing base is also three times larger. And in classic tit-for-tat style, Beijing’s 125% tariffs will sting U.S. exporters too, but with a bit more shrug than panic.

In China, the hit lands mostly in high-tech: semiconductors, electrical gear, and aircraft parts. U.S. chip giants like Intel and Micron might dodge some bullets thanks to export controls, but tariffs on actual made-in-America chips still burn. Aerospace? Another pain point, China may be building jets, but they're still flying with Western engines.

The irony? U.S. tariffs hurt sectors full of MAGA hat-wearing workers, cars, construction, textiles, who might start wondering why ‘America First’ made their job harder. Meanwhile, China gets a fresh excuse to double down on self-reliance, exactly where its industrial policy was already heading. So yes, the trade war’s a mess—but at least it’s a strategic mess… for someone.

Another maleficent impact of the trade war launched by the Manipulator-in-Chief will likely strike where it hurts most for U.S. investors, those holding 401(k)s, as the emergence of a multipolar world, accelerated by the ongoing trade conflict, inevitably undermines what were once hailed as ‘Platform Companies,’ and what YOLO investors still affectionately call the ‘Magnificent Seven’.

A ‘Platform Company’ business model traditionally relies on four key pillars:

Free trade – enabling companies to produce goods wherever costs are most attractive.

Technological progress, especially in communications – allowing decentralization of design, production, and sales.

Recurrent overcapacity in most industries, ensuring a constant supply of goods to sell.

Seamless logistics, the ability to move goods efficiently via ships, ports, roads, airports, etc.; without this, outsourcing becomes a logistical nightmare.

Platform companies aren’t just tech darlings, they’re capitalism’s spoiled brats. Built on free trade, tech wizardry, global overcapacity, and seamless logistics, they’ve surfed the globalization wave like pros.

The model? Easy: invent in the U.S., make in China, sell everywhere, and pay taxes (lol) in Ireland. Does it sound familiar to the business model of the Magnificent 7, which were supposedly antifragile?

The so-called "antifragile" business model of the Magnificent 7 is just a polished version of the platform model, built on free trade, tech, and global supply chains. But with rising deficits and tariffs making a comeback, their "antifragility" is cracking, like a house of cards that stays up... until someone sneezes. With governments hungry for revenue, tariffs are back, and globalization-on-autopilot is stalling. The platform model is starting to look more like a house of cards in a wind tunnel.

Apple Supply Chain Analysis.

Imagine a US company making a phone, with production in China for $100, selling it to US consumers for $1,000, and adding $50 in distribution and $50 in R&D costs. That leaves a neat $800 profit. In a perfect Ricardian world, a 30% tax rate means the US government pockets $240, and GDP grows by $900 minus $100 for production costs.

Now, throw in an Irish intermediary with a 4% tax rate. The US company sells its $100 phone to the Irish subsidiary for $900, which then resells it. The result? The US company pays no tax, and Ireland snags $32 for doing... well, nothing. The company makes $768 after tax, the stock price soars, and the CEO's grandkids will never have to work. Meanwhile, the value created for the economy? A total mystery. It's all a far cry from Ricardo’s theory of comparative advantage, and more like a corporate magic trick.

By the way, the beauty of international tax loopholes! It’s all perfectly legal, thanks to a little thing called the double taxation treaty between Ireland and the US, crafted long ago by a flood of Irish immigrants, some of whom now sit in the Senate and House (how convenient). This treaty is basically untouchable, a sacred relic of diplomacy, ensuring that the US government gets nothing, while Ireland, China, and the shareholders rake it in.

So, what's the US government can do? Enter tariffs, 25-30% on that imported phone to reclaim its ‘pound of flesh.’ This is a short-term fix, of course, because the real solution might involve convincing the US company to set up shop on home turf. But who needs that when you can slap a tariff and pretend it’s a solution?

Here’s the twist: If the company can’t pass on the tariff costs to consumers, it’ll eat into profits. That’s bad for earnings, worse for Ireland’s tax take, but the consumer? They’ll likely pay the same, if not less, and maybe even see lower taxes. Shareholders? They're in a pickle and should sell stock in these platform companies, buy real capitalist companies, and invest in land in the rust belt.

Meanwhile, Chinese manufacturers, who are no longer reliant on the US, will happily sell phones at a slightly higher price elsewhere. In the end, what began as a noble push for globalization turned into a tax optimization playground for the global elite (yes, the Davos crowd), siphoning wealth from the less fortunate to fatten their own pockets.

The result? The ‘Magnificent 7’ are no longer invincible. As trade wars heat up, their once-sweet margins are set to melt faster than snow in the Sahara.

Operating Margin of The Magnificent 7 Index (blue line); S&P 500 index (red line) since December 2019.

You don’t need a PhD in finance to see what’s coming: as tax hikes loom, the risk of the so-called Magnificent 7 turning into the Maleficent 7 is rising fast. Most investors don’t even realize their portfolios are stuffed with these names, courtesy of passive ETFs, 401ks, and auto-pilot investing. But here’s the twist: not only is looming stagflation bad news for these tech darlings, they’re also staring down a serious valuation reset. Meanwhile, forgotten sectors like U.S. energy are waiting in the wings. When the S&P 500-to-oil ratio breaks below its 7-year average, it could mark the start of a new regime, one where energy outperforms tech, just like it did from Jan 2022 to April 2023. In short: the next act might not feature flying Teslas but a comeback for good old oil rigs.

Upper Panel: S&P 500 to oil ratio (blue line); 7-Year Moving Average of S&P 500 to Oil Ratio (red line): Middle Panel: Gold to Bond ratio (green line); 7-Year Moving Average of Gold to Bond ratio (red line): Lower Panel: Relative performance of Magnificent 7 to S&P 500 Energy Index (yellow line).

Oh, of course, Trump and his MAGA China hawks clearly mastered the art of antagonizing their largest creditor. Because nothing screams ‘deal-making genius’ like poking the country that holds a massive stash of your debt. It’s almost laughably simple: if you antagonize China, they sell Treasuries, yields spike, and interest rates go up. If you ease tensions, maybe even nod politely at the One China Policy, they stop selling, and voilà, rates stabilize. But apparently, this bit of geopolitical common sense now qualifies as Nobel Prize-worthy economics. The irony? While some analysts scratch their heads in confusion, it’s usually because their worldview ends at their own borders. Global capital flows? Sovereign bond markets? Foreign policy? Too exotic, evidently. After all, why factor in the rest of the planet when you can just blame the FED or your enemy and call it a day?

https://www.whitehouse.gov/lab-leak-true-origins-of-covid-19/

Yes, both China and Japan have been dumping U.S. Treasuries, and surprise, it started before tariffs entered the chat. Their economies are slowing, and they need the cash back home. Japan was doing it while the Biden Administration was busy threatening China with sanctions for helping Russia. But sure, let's pretend it's all about Trump’s tariffs. Meanwhile, long-term yields are rising, and no, the FED can’t stop it, not with a magic wand. Trump’s fantasy that he can fire Powell and strong-arm rates lower for political brownie points has zero basis in history or reality. But hey, when you’ve got a hammer, every economic problem looks like the FED. And yes, this trade war won’t bring back manufacturing, it’ll just bring the US good old-fashioned STAGFLATION. Trump seems determined to repeat the worst parts of the 1970s, blaming China for everything short of bad weather.

Japan (blue line) and China (red line) US Treasury Holdings.

Let’s also kill the myth that companies offshore just for cheap labour. That’s socialist bedtime story stuff. The US multinationals moved outside the US because of insane regulation and tax regimes. But apparently, basic international logic now counts as some kind of elite secret. There will be shortages, prices will rise, and this tariff plan will blow back hard. But by all means, let’s keep pretending it’s all part of the master plan.

The world is interconnected, ignore that, and your economic forecast is little more than guesswork wrapped in ego. In today’s geoeconomic reality, defined by U.S. protectionism, tense China relations, and tiptoeing around Iran, the costs are mounting falling GDP, rising inflation, and lofty strategic goals that look more like wishful thinking. The era of the 'Goldilocks economy' is over. Welcome to the age of ‘Gold-in-lots’, where trade wars flip the playbook from boom to bust, and historians may one day call it the Trump Stagflation.

In myth, Maleficent, ever the cunning sorceress, sets her trap not for a noble, but for a nameless peasant. A simple ruse, laid with a flick of her staff and a whisper through the thorns, hidden in plain sight under a veil of insignificance. But fate, fond of irony, intervenes: Lo! , it is not a peasant, but a prince who stumbles into her web. Such is Maleficent’s brilliance, her traps need not be grand, only clever.

Unfortunately for the 'Vice MAGA In Chief,' had he made his grand pilgrimage to the Canton Trade Fair 2025 last week, the only ‘Chinese Peasants’ he'd have stumbled upon were humanoid robots—cheerfully posing for selfies with tech-hungry visitors from every corner of the globe. So much for the backward East narrative.

After all, those among the China Hawk MAGA crowd who still believe the fairy tale of the helpless Chinese peasant are in for a rude awakening. They’ve neither mastered the art of war nor of trade, and thus fail the first rule: know yourself, know your enemy. Without that, they must fear the outcome of a hundred deals, while the peasant simply waits by the river, watching the bodies of those who underestimated him float by.

As a reminder, savvy investors understand that to preserve and grow their wealth, they must adapt to the business cycle rather than attempt to change it. They should focus on Return OF Capital rather than Return ON Capial, by owning real assets like physical gold and silver, the only antifragile assets with no counterparty risk. They also must hold other commodities to weather the storm unleashed by the ‘Commodity Leviathan.’

Additionally, active cash management is key, using a portfolio of short-dated, investment-grade (IG) USD bonds with maturities under 12 months, and Treasury bills (T-bills) with maturities not exceeding 3 months. These income-generating assets provide much-needed stability. Among equities, investors should continue to favor low-leverage companies with strong EPS and FCF growth, and those that have paid their fair share of income tax, prioritizing energy and commodity producers over consumers.

By doing so, investors can ensure both peace of mind and wealth preservation as the world shifts from a magnificent ‘Goldilocks’ into a Maleficent ‘Gold In Lots.’

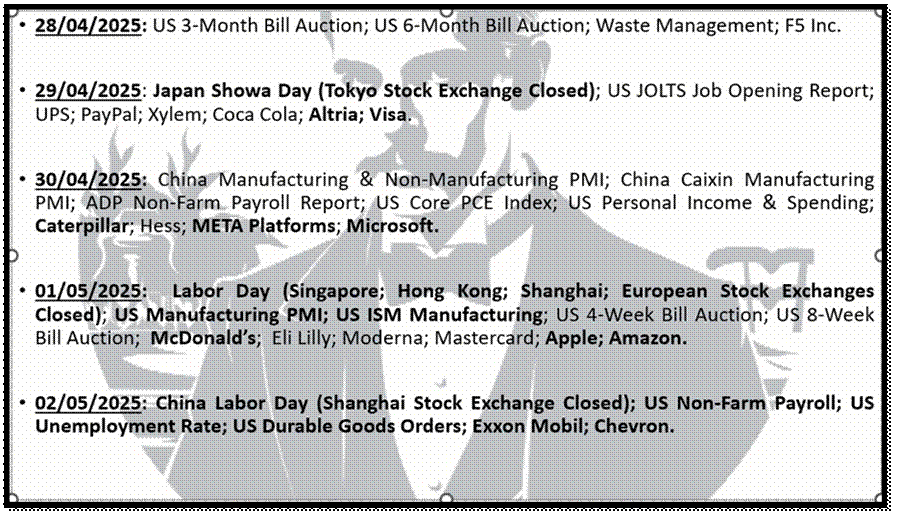

WHAT’S ON THE AGENDA NEXT WEEK?

The week of May Day holidays will see much of Asia and Europe kicking back, while Japan joins the party with Showa Day. But investors will still have plenty to chew on, with a fresh batch of Manufacturing PMI and ISM data out of China and the U.S., plus America’s latest job market check-up via April’s Non-Farm Payrolls, the first unemployment report since ‘Liberation Day’. Meanwhile, earnings season goes full blockbuster, with 175 S&P 500 companies stepping into the spotlight, including four members of the ‘Maleficent 7’ (META, Microsoft, Apple, and Amazon) along with Altria, Visa, Caterpillar, McDonald’s, Exxon, and Chevron. So yes, it’s a shortened holiday week... but not for your portfolio.

KEY TAKEWAYS.

As investors awaken from their tech-induced fairy tale, and the Magnificent 7 are morphing into something a little more… Maleficent.; the key takeaways are:

Tariffs are backfiring brilliantly, stalling growth, spiking prices, and proving once again that economic wizardry by decree is just inflation in disguise.

U.S. consumer sentiment ticked up in April, but stubbornly high long-term inflation fears and political divides keep optimism in check.

When Magnificent turns Maleficent, it wears tariffs like a crown, welcome to Trumperialism: where trade wars are rebranded as deals and recessions are patriotic.

When tariffs tango with tweets, uncertainty spikes, investments freeze, and the S&P 500-to-oil ratio quietly signals STAGFLATION ahead.

As the U.S. clings to tariffs and teeters on the edge of conflict with Iran, rising oil prices and trade chaos set the stage for ‘Trump Stagflation’.

The trade war’s escalating tariffs are a double-edged sword, sparking shortages, price hikes, and a "Made in America" nightmare where even the hardhat-wearing crowd feels the pinch.

The trade war is crumbling the once invincible ‘Magnificent Seven,’ revealing their reliance on free trade and global supply chains.

As tax hikes and stagflation loom, the Magnificent 7 are headed for a valuation reset, while U.S. energy waits in the wings for a comeback.

As the US economy shifts into an inflationary bust, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

Gold and silver are eternal hedge against "collective stupidity" and government hegemony, both of which are abundant worldwide.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

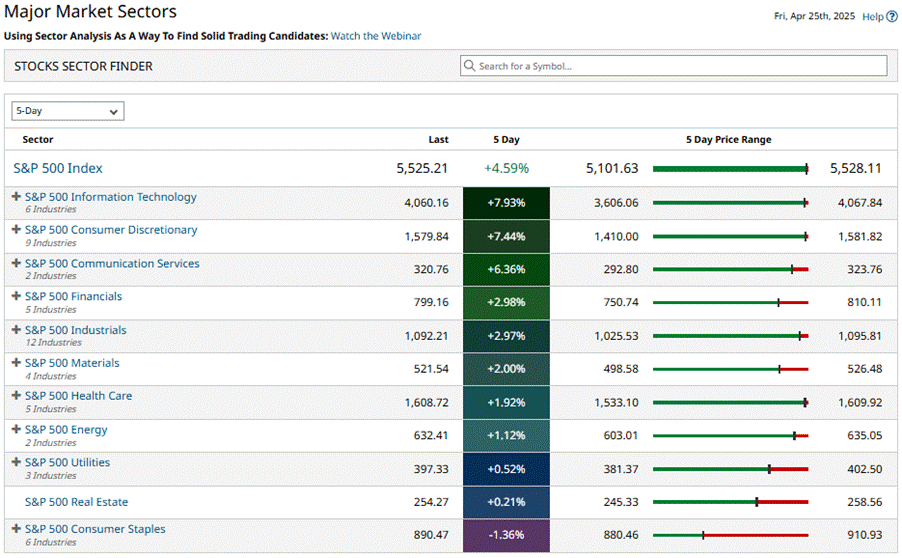

The third week of the first month of the second quarter of the Jubilee Year will most likely be remembered by investors as the week of the double bottom of the ‘Tariff Tantrum’, with U.S. equity indices starting off by retesting their early April lows before rebounding and closing above key technical resistance levels. The S&P 500 and Nasdaq ended the week above their respective 50% Fibonacci retracements (5,491, 19,382) on the one-year chart, while the Dow Jones and the Magnificent 7 rose above their respective 38.2% retracements (39,844; 21,079). With the second wave of the ‘Tariff Tantrum’ seemingly behind us, the April 8th closing prices (4,982 for the S&P, 17,090 for the Nasdaq, and 37,645 for the Dow) may mark the lows of the year as the Nasdaq 100 outperforms the S&P 500, the Magnificent 7 and the Dow Jones over the past 5 days. Momentum and stochastic indicators across all major indices have turned bullish again, suggesting that the bottom recorded on Monday may have been the double bottom investors were waiting for to regain upward momentum. As month-end approaches and the ‘Tariff Tantrum’ dust settles, a sustained close above the key daily technical resistance (5,491; 19,382, 39,844) could confirm that higher lows are in place and pave the way for new all-time highs in indices like the Dow in the second half of the year.

As of April 25, all major U.S. indices remain in daily and weekly bearish reversals, but stochastics now indicate that the intraday lows of April 7th were indeed the low of the year.

In this context, IT; Consumer Discretionary and Communication Services outperformed, while Utilities; Real Estate and Consumer Staples underperformed.

As of April 25th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for almost 3 months, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

After 100 days of the ‘Disruptor-In-Chief,’ in office, the world has become, well, decidedly more perplexing. In these delightfully confusing times, investors naturally turn to their favorite fallback: the old ‘keep it simple’ approach. After all, when the going gets tough, why not stick to the ‘known knowns’?

What we know for sure today is that globalization is so last season, and the world is rapidly splitting into three neat little economic zones.

First up, we have the ValeriePieris circle, a cozy 2,000-mile radius in Southeast Asia, home to more than half the world's population. How very convenient.

Second, Fortress America, a land where the borders are getting a little more, well, fortified, and trade policies are as unpredictable as the weather in March.

Third, Europe, that glorious continent where unity is always on the brink of collapse, but somehow, they keep it together, at least until the next Brexit-style drama unfolds.

Under Trump, the US has effectively withdrawn from its role as Europe's military protector, leaving its commitment to its Asian allies similarly questionable in the long run. As a result, Asian nations are increasingly turning their gaze toward China, especially as the US continues threatening any country that does not comply with its rules-based order by confiscating USD assets, as it did with Russia and Myanmar. Since the 2008 Global Financial Crisis, China has been quietly setting up its economic foundations for a new world order, focused on stabilizing the renminbi and creating an Asian-centric monetary system. With tools like bank swaps, alternatives to SWIFT, and emerging international institutions, China is ready to launch massive infrastructure projects to solidify its influence, backed by a region flush with excess savings and a tightly controlled currency exchange rate, an economic "snake" reminiscent of Europe's 1970s monetary arrangement. In this context, it would be absolutely shocking if a recession were to develop within the so-called ‘circle’ in the foreseeable future. After all, despite what the China hawks in Washington might claim, this is clearly where the world’s economic future is headed.

Equal weight index of SGD; THB; MYR, IDR versus Renmimbi since December 1994.

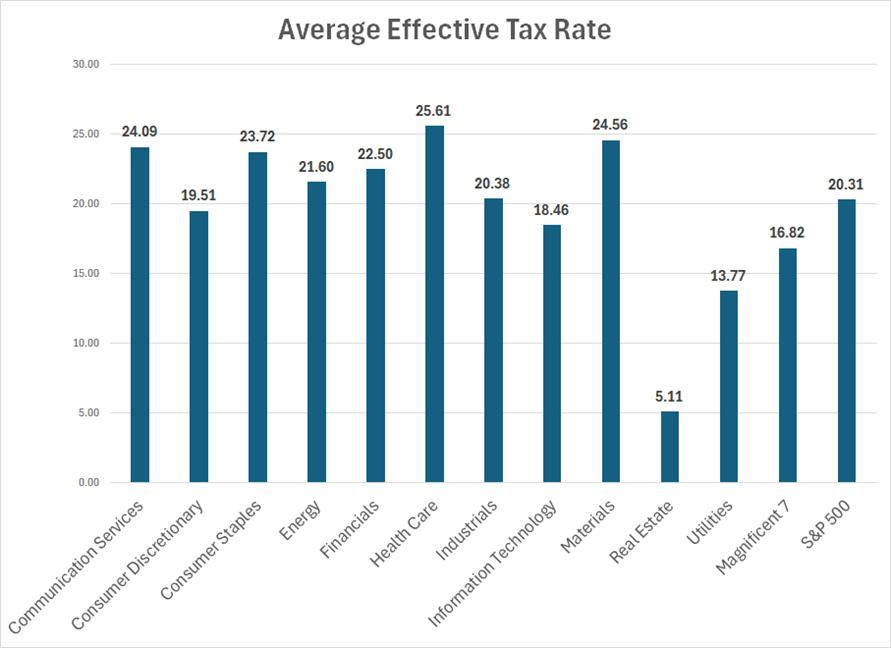

Moving on to Fortress America, we find that global and domestic equity portfolios are still overweight the ‘Magnificent 7’, you know, those companies that were supposedly the sole winners in the ever-unstoppable globalization process. But as most investors hold these stocks, now increasingly dubbed the ‘Maleficent 7,’ thanks to market-cap weighted passive investing, it's time to reconsider. Not only should investors steer clear of these tech giants heavy in US indices like the S&P 500 and Nasdaq, but they should also avoid those companies that have been reaping the rewards of globalization while conveniently dodging their fair share of taxes. In other words, investors, just stay away from the Maleficent 7 altogether, and if you happen to be holding any companies with tax rates in single digit while the the official US corporate tax rate is 21%, well, it’s time to sell fast. Why? Because the real "maleficent" impact of the trade war is that Uncle Sam, will be coming for taxes, no matter who and where you are.

Tax rate of the 20 largest market capitalization of the S&P 500 index.

Source: Bloomberg.

Ironically enough, when it comes to dodging taxes, it's not just the tech titans showing off their creativity. turns out Real Estate and Utilities are giving the Magnificent 7 a run for their money. Despite their reputation for being boring and predictable, they somehow manage to pull off tax rates well below the official 21% corporate rate… and even lower than those of Silicon Valley's finest. Meanwhile, the average S&P 500 company is playing it almost straight, hovering not too far from the official threshold. Who knew power plants and property moguls had such slick accountants?

Source: Bloomberg.

In a multipolar world where oil is now payable in whatever currency a country prefers, the vast USD reserves hoarded by central banks have suddenly become… well, rather pointless. In Asia, these surplus greenbacks could soon find new purpose: financing a massive capital boom, likely channeled through Hong Kong, where the HKMA conveniently pegs the USD to the HKD and allows free convertibility of both USD and CNY. Should these reserves be unleashed for investment, it would mean a falling dollar against Asian currencies, just as US yields rise, thanks to central banks quietly dumping their Treasury holdings to fund the Schumpeterian rise of the region.

Naturally, this would spell bad news for the newly elected Manipulator-in-Chief, who rode into office on the ‘It's the economy, stupid!’ narrative, using his predecessor incompetence for letting inflation and interest rates spiral to levels that crushed the daily lives of ordinary Americans, those who don't live off stock options but off honest labor.

And then there’s Europe. Companies relying on the health of its economies or the ability of its governments to ‘stimulate’ demand are likely to follow the same grim trajectory as those governments themselves, straight toward a cliff.

As for gold, everyone knows it’s the last truly antifragile asset, a timeless guardian of wealth through war, crisis, and political theatre. So, it’s no surprise that gold prices in USD have marched in lockstep with the US Economic Policy Uncertainty Trade Policy Index. After all, gold has always loved a bit of chaos.

Gold price in USD (blue line); US Categorical Economic Policy Uncertainty Trade Policy Index (log chart; red line).

By owning physical gold outside the tightening grip of centralized digital systems, the “old-fashioned” gold holders preserve true autonomy, not just from the USD, but from all fiat currencies racing toward centralization.

Gold in private vaults comes with no compliance protocols, no digital IDs, no counterparty risk, and no reliance on other politically exposed, centralized infrastructures. Unlike digital assets born in 2008, gold protects not just from currency collapse, but also from volatility and centralization. It’s been doing so since 480 BC. That matters. Gold matters—yesterday, today, and especially tomorrow.

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.