MayDay @The FED?

What’s behind the numbers?

The Federal Reserve held interest rates steady for a sixth consecutive meeting at 5.25-5.50%, in line with expectations and market pricing.

In its press release, the FOMC added the following 2 sentences: ‘In recent months, there has been a lack of further progress toward the Committee's 2 percent inflation objective.’ ‘The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year.’

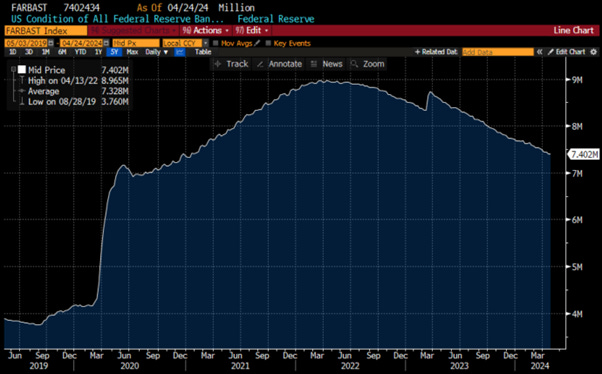

The most important announcement was related to the QT taper, which was bigger than expected. Beginning in June, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion. The Committee will maintain the monthly redemption cap on agency debt and agency mortgage-backed securities at $35 billion and will reinvest any principal payments in excess of this cap into Treasury securities.

FED Balance sheet.

In his prepared comments, Powell reiterated that ‘inflation is still too high,’ while labor demand still exceeds the supply of available labor despite immigration as a factor in helping to boost the labor supply. He added that the committee has gained little confidence needed to lower interest rates, and this will take longer than previously expected.

During his press conference, Powell mentioned that ‘it is unlikely that the next policy move will be a rate hike’. To raise rates, the FED would need 'persuasive evidence' that policy is not tight enough.’ Asked about the rising risks of stagflation, in Powell’s opinion, ‘I don’t see the stag or the flation.’

Powell's opening remarks were mostly neutral; however, his comments over the press conference were relatively dovish as usual as he remains convinced that he will be able to bring back inflation to 2% before the Presidential election. However, this suggests that a pivot in June remains unlikely and that a cut later in 2024 remains ‘highly data-dependent’.

Market reactions.

Stocks initially surged on the announcement of the QT tapering, but the rebound was short-lived as they saw a large reversal into the close, lacking a fresh catalyst. The Dow managed to end the day in the green, helped by Amazon, while the S&P and Nasdaq pulled back as investors remained uncertain about the persistent "Forward Confusion" narrative from the FED on how to bring back inflation to the last 2% mile. With the S&P 500 still in its post-March CPI downtrend, further consolidation to the 100-day MA (4,974) and the 61.8% Fibonacci Retracement (4,800) should be expected in the weeks to come.

Defensive and rate-sensitive sectors like Utilities and Healthcare outperformed, while Energy and IT sold off due to lackluster convictions from investors about the next move of the FED and weaker oil prices.

Treasuries saw a bull steepening following a more dovish than expected FED statement, mixed economic data, and an uneventful Quarterly Reporting Announcement. T-Notes initially dipped after the FOMC statement but rebounded to new highs during Powell's press conference, driven by the QT taper announcement and continued focus on hypothetical rate cuts.

Powell's statement initially weakened the USD index, but with the FED unlikely to cut rates before other central banks like the ECB, investors bought the dip, keeping the Dollar Index above the 76.4% Fibonacci Retracement at 105.51.

Oil prices ignored all the fuss around the FED and fell for the third day in a row (its biggest daily drop since early January) with WTI back below $80 at six-week lows as investors are speculating on a hypothetical cease fire in the Middle East.

Finally, rate-cut expectations rose hawkishly on the day, with the likelihood of one or two cuts in 2024 now at 50-50, and investors are still looking for the infamous pivot to start in September.

Thoughts.

The FED's decision to keep interest rates unchanged was widely anticipated.

The surprise is related to the size of the QT tapering, which, in plain English, means $105 billion gross issuance less needed in Q3, just ahead of the election, with the FED implicitly helping the US Treasury to finance its gargantuan fiscal policy, and indicating that long dated yields are too high ahead of the election.

The real question investors should start asking themselves is if the FED really matters to the real economy and investors' portfolios in the context of a gargantuan fiscal stimulus and a FED that has lost its independence from the political power represented by its ‘de-facto merger with Treasury’. The truth is, indeed, that the FED is as always behind the curve and has become highly political but not yet openly partisan.

Wall Street has been predicting rate cuts for almost two years and has been wrong every time. Economists were predicting a June rate cut a few weeks ago, and now investors are looking for September. September remains an 'open meeting,' but this assumes that the return of the inflation boomerang has eased by then, which is unlikely given the long list of supply chain constraints impacting the economy. Additionally, September is only 7 weeks before the Presidential election, and while the FED is a political apparatus, it may not want to appear clearly partisan ahead of this highly contested election. By November, if the geopolitical environment continues to deteriorate as it has been over the past months, the FED will likely look to a rate hike rather than a rate cut, even if Powell has dismissed that prospect for now.

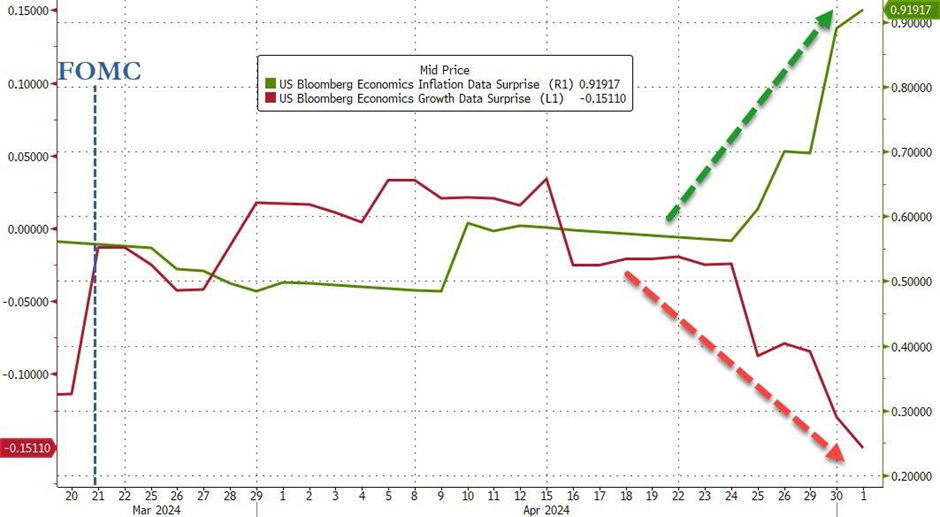

The market still eagerly anticipates a soft landing for the US economy, but over the past few weeks, signs have increasingly pointed towards the worst economic outcome Recession + Inflation = Stagflation. Indeed, even though Powell lectured investors that he 'doesn't see the stag or the 'flation' in markets, he should focus on how growth and inflation surprises have evolved since the March FOMC.

Anyone under the age of 60 has no real acquaintance with stagflation as the last time the US experienced such an economic scenario was between 1977 and 1981. This was a time of high volatility for equities and poor inflation adjusted returns.

And those who ignored hard assets like gold and were stuck in government bonds would have lost the attractiveness of the real antifragile asset in a period where investors lost confidence in government.

Performance of Bloomberg US Agg Index (blue line); Gold (red line) between 1977 and 1981.

Key Takeaways

The FED remains data-dependent and remains inclined to begin cutting rates, but there are many variables beyond its control that must align to bring inflation back to the last mile of the 2% target and allow the FED to implement its wishes.

In the meantime, it is HIGHER FOR LONGER as ‘Forward Confusion’ spreads.

Amid accelerated inflationary base effects due to renewed supply constraints and relaxed financial conditions, the FED is expected to hold interest rates steady until the November election.

By then, a hike could be more likely as the highly political FED will have achieve its goal to contribute to the Forward Confusion spread by the current administration.

In the coming weeks, GOOD NEWS is likely to be BAD NEWS, and BAD NEWS will also be BAD NEWS as the US economy moves into an inflationary bust and the FED is running out of time to implement its infamous pivot.

The recent strengthening of the USD and the rebound in long-dated government bond yields are most likely to continue to be used by the FED as a way to fight the inflationary bust until November 5th.

As governments seek to increase their control over their citizens, trust in public institutions (including the FED) will continue to decline, leading investors to move even more into assets with no counterparty risk and which are non-confiscatable, like physical gold.

For fixed income investors who are still chasing the long duration trade, more pain awaits as long-dated yields must still reflect the new stagflation reality.

In a stagflation, the best way to protect wealth is still to own the equity barbell portfolio made of Tech and Energy and Physical Gold and avoid long dated bonds.

As stagflation rather than recession materializes as the economy is increasingly weaponized, investors should prepare their portfolios for HIGHER volatility.

In this context, investors should also remain prepared for dull inflation-adjusted returns in the foreseeable future.

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.