Powering AI

THE WEEK THAT IT WAS...

During the shortened holiday Memorial Day week in the US, the focus was on GDP, personal income and spending, core PCE, and another flood of treasury auctions.

What was until recently a ‘red-hot’ economy, with the US reportedly growing at an annual rate of 4.9% in Q3 and 3.4% in Q4 2024, has suddenly and dramatically downshifted. According to the latest GDP data released, Q1 GDP was revised downward from 1.6% to just 1.3% (1.250% to be specific), marking the lowest GDP since the mini recession of Q2 2022 when GDP declined for two consecutive quarters. The sharp downward revision primarily reflected a decrease in consumer spending, which rose 2.0% annualized, down from 2.5% in the first GDP report and below the 2.2% estimate.

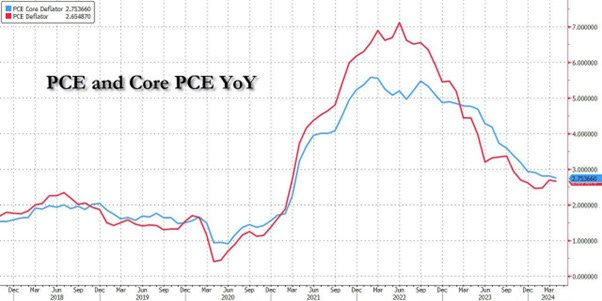

After a somewhat weaker-than-expected CPI print two weeks ago, all investors' eyes were on the core PCE, which dropped from 0.3% to 0.2%, the lowest monthly increase of 2024 but in line with market expectations. Extending the scientific notation a bit, investors found that the core PCE print was actually 0.249%, literally making the rounding to 0.2% by one thousandth of a point, down from 0.317% last month. Amusingly, this brings to mind something Governor Christopher Waller said last week: ‘I look forward to the day when I don’t have to go out two or three decimal places in the monthly inflation data to find the good news.’ Also, as previewed, the drop in the annual change in core PCE from just over 2.81% to 2.7537% means that the annual increase in core inflation is now the lowest since April 2021. This could possibly allow the FED to exhale and maintain Wall Street’s plans of an interest rate cut sometime in 2024. However, with commodity prices rebounding, the next few months could see a much different trend.

Meanwhile, household demand is also cooling. The BEA’s report showed real personal spending for services rose just 0.1%, the smallest gain since August, while spending on merchandise decreased by 0.4% last month. Overall, spending dropped by 0.1%, missing the estimate for a 0.1% increase. In nominal terms, income and spending both rose on a month-over-month basis. After March's 0.7% surge in spending (revised down from 0.8%), April spending rose just 0.2%, below the expected 0.3%, while income rose 0.3% as expected, down from a 0.5% increase in March.

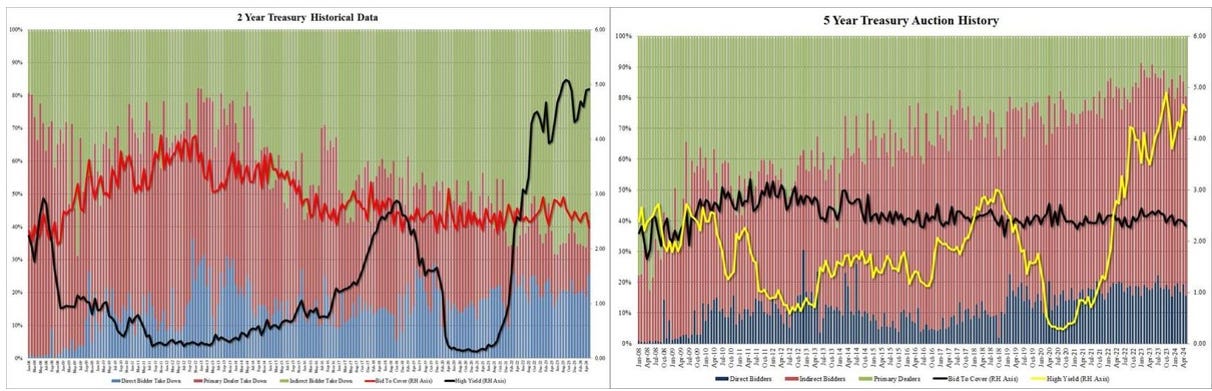

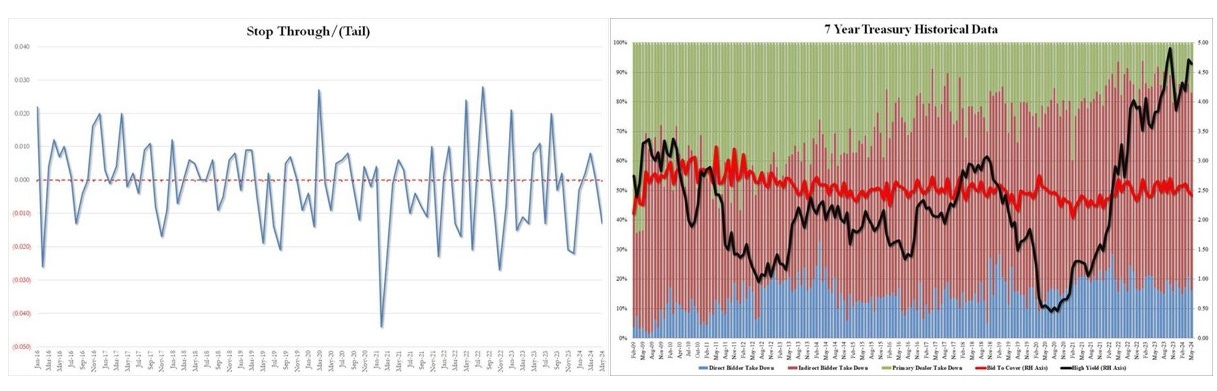

The holiday-shortened week was also heavy with bond auctions and will be remembered by bond investors as sour for the US Treasury, which saw its 2; 5-year bond auctions met with frigid demand. The $69 billion issuance in 2-year paper stopped at a high yield of 4.917%, the highest yield since last October's 5.055%, and tailed the When Issued yield of 4.907% by 1 basis point. This marked the third tail in the last four 2-year auctions. The bid-to-cover ratio slumped to 2.41 from 2.66, falling below the six-auction average of 2.59 and marking the lowest level since November 2021. The $70 billion issuance in 5-year paper was another subpar sale. The high yield of 4.553% was below last month's 4.659%, but it still tailed the When Issued yield of 4.540% by 1.3 basis points, the largest tail since January. As with the earlier 2-year auction, the bid-to-cover ratio slumped, dropping from 2.39 to 2.30, the lowest since September 2022 and well below the six-auction average of 2.41. The internals were not quite as bad, with Indirects taking down 65.0%, down from 65.7% and just below the recent average of 66.1%. Directs were awarded 15.4%, down from 19.2% in April, leaving Dealers holding 19.6%, up from 15.0% last month and the highest since January.

After two very ugly auctions on Tuesday, the US Treasury completed the week's final coupon auction by selling $44 billion in 7-year bonds, far from the record $62 billion during the COVID crisis. The high yield of 4.65% was below last month's 4.716%, but it tailed the When Issued yield of 4.637% by 1.3 basis points, marking the first tail since January and the largest tail of 2024. The bid-to-cover ratio was also disappointing, sliding from 2.481 to 2.427, the lowest since April 2023, and well below the six-auction average of 2.53. The internals were fractionally better, with Indirects taking down 66.9%, up from 65.1% last month and just above the recent average of 66.8%. Directs were awarded 16.1%, leaving Dealers holding 17.0%, the most since November.

Extending the sluggish US economic growth observed in last month's Beige Book, validated by a sharp drop in Q1 GDP growth, the FED published its latest Beige Book where investor found that while economic activity expanded from early April to mid-May, conditions varied across industries and Districts. Similar to last month, most Districts reported slight or modest growth, with two noting no change in activity. Additionally, the Beige Book warns of softening conditions in the commercial real estate sector due to supply concerns, tight credit conditions, and elevated borrowing costs. Overall outlooks grew somewhat more pessimistic amid rising uncertainty and greater downside risks.

https://www.federalreserve.gov/monetarypolicy/beigebook202405-summary.htm

In this context, it should be no surprises that the FED is still attempting to smooth over the data, entertaining the myopic Wall Street dreams of a FED pivot, with an 59% probability of a 25-bps cut by September, 7 weeks before the presidential election. In a nutshell, the FED remains caught between a rock and a paradox.

The most likely outcome for the bond market is still that the FED will be forced to fight the return of the inflation boomerang with an interest rate hike after the November election, leading to the un-inversion of the yield curve by the long end.

Over the past 18 months, the investment world has focused on how Artificial Intelligence is transforming and will continue to transform the way we work, live, and breathe. Everyone has heard about buying Microsoft, Nvidia, and various other ‘AI ecosystem’ stocks to get exposure to AI. However, what about gaining exposure to AI through various derivative trades, such as electrification, energy and everything related to what is needed for powering AI? As a matter of fact, the picks and shovels of this revolution will require a lot of power to become a reality. On that note, Wall Street and the mass media have underreported that the companies supplying uranium, the energy source likely to power AI in the future, have significantly outperformed the AI trade itself.

Relative performance of Invesco AI & Next Gen Software ETF to S&P 500 Index (blue line); Relative performance of Sprott Uranium ETF to S&P 500 Index (red line) rebased at 100 as of December 31st 2022.

As the Oracle of Omaha mentioned in his 2024 annual letter, to power the AI revolution, the world will need much more energy than it is currently generating. On that matter, the Berkshire Hathaway annual letter contained a rather insightful segment, one which may prove to be pivotal to US hopes of leading the AI revolution. Discussing the recent ‘earnings disappointment’ at Berkshire's energy subsidiary, BHE (Berkshire Hathaway Energy), which generates over 30 gigawatts of power and is one of the largest US energy distributors, Buffett lamented the regulatory chaos across various states, most notably California. He stated, ‘When the dust settles, America’s power needs and the consequent capital expenditure will be staggering. I did not anticipate or even consider the adverse developments in regulatory returns, and, along with Berkshire’s two partners at BHE, I made a costly mistake in not doing so.’

https://www.berkshirehathaway.com/2023ar/2023ar.pdf

It's not only Warren Buffet who is aware of the risk of power shortages the world faces. BlackRock Chairman and CEO Larry Fink, who has been one of the most vocal green zealot, has also recently highlighted the need for major nations to upgrade their power grids for the AI revolution to advance and become a source of widespread prosperity.

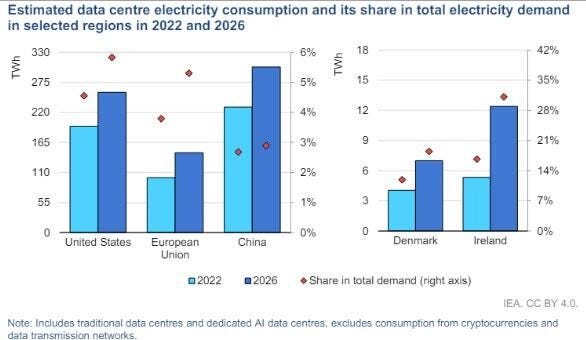

The IEA estimates that global electricity demand from AI, traditional data centers could nearly double in their base case scenario and increase by almost 150% in their high case scenario by 2026.

To dive deeper into the potential incoming energy crisis, let’s first look at some basics. Electricity peak demand and energy growth rates are increasing in North America after being flat for years. Load growth had already been driven by electrification trends and electric vehicles, but annual peak demand growth was still only up 0.9% in 2023. With the increased focus on data centers, industrial facilities, and other near-term investments, this is likely an underestimate. In just a year, the forecast of cumulative electricity growth over the next five years increased from 2.6% to 4.7%, driven by major utilities further revising their estimates upward.

To keep it simple, the need for the world to access cheap, large-scale energy can be summarized by the fact that a ChatGPT search requires 10 times as much power as a traditional Google search.

To be sure, the drivers of electricity demand growth extend beyond AI-related factors:

Onshoring trends: Tariffs, COVID-19, and other shocks to distributed production networks have prompted multinationals to re-evaluate their supply chain structures, leading to more manufacturing facilities in the US, which require more power.

Electrification of transportation and buildings: This includes the adoption of electric vehicles and electric heating and cooling systems.

Extreme weather: Increasing in frequency, extreme weather events are driving record peak electricity demands.

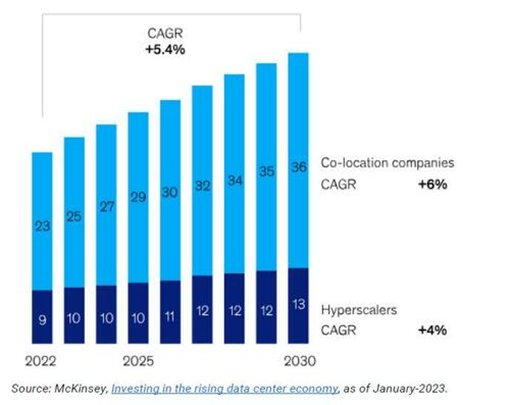

Data center demand: The biggest and most important variable, with demand forecasted to grow by an average of 10% per year until 2030.

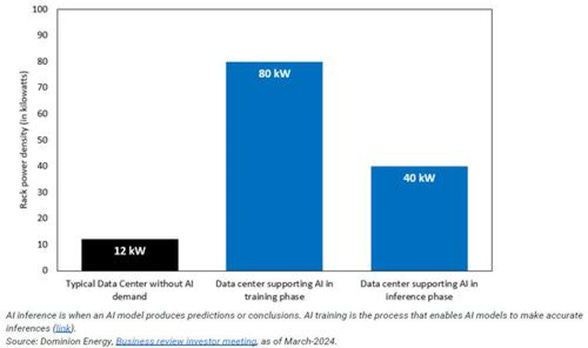

Turning solely to the AI aspect, data centers, crucial for facilitating the AI boom, are the fastest-growing consumers of power. Their power consumption varies widely: those supporting the AI training phase can consume up to 80 kW, while those supporting AI inference consume up to half of that, and those without AI demand consume up to 1/8th of that. Consequently, without more efficient training and inference processes, AI development will result in increased consumption from data centers and greater demand for power. It's noteworthy that data centers are altering their pricing models to include ‘power consumption’ rather than just ‘per space consumption.’

Boston Consulting Group believes that by 2030, AI and regular data center demand will grow to represent 7% of total electricity demand. To put this in context, this is equivalent to the electricity used for lighting in every home, business, and factory across the United States. It's a significant amount of energy. While traditional data centers built 10 years ago were typically 10 megawatts or less, today it's not uncommon to see 100-megawatt data centers.

The main problem lies in the need for an enormous amount of ‘compute’ and the inefficiency of current Large Language Models (LLMs). For instance, if Google were to fully incorporate AI into its main search feature, it could potentially see a 10-fold increase in its electricity demand. Western electricity grids already operate near full capacity, with the US grid reaching 94% capacity last year and Europe's even higher. This poses a risk of bottlenecks, especially as the demand for AI and traditional data centers, excluding cryptocurrency, is projected to rise worldwide. As an illustration, tech-focused Ireland is expected to have a third of its electricity demand coming from data centers by 2026.

One thing is certain: not only will tech giants devise elegant solutions to power their data centers, but the world is also on the verge of a historic spending boom to enable the AI industry. According to McKinsey, global spending on the construction of data centers is forecast to reach $49 billion by 2030, up from $37 billion this year.

Meanwhile, total capital expenditure (capex) across the utility sector is expected to take a significant step up in the next 5 years relative to the last 5.

According to an analysis from commercial real estate firm CBRE Group, electricity demand to power data centers is projected to increase by 13% to 15% compounded annually through 2030. However, a shortage of power is already delaying new data centers by two to six years. This shortage is also pushing Big Tech companies into the energy business. For instance, Amazon recently struck a $650 million deal to acquire a data center in Pennsylvania powered by an on-site 2.5-gigawatt nuclear plant. Despite potential opposition from Democrats and green zealots, the only practical solution to the imminent surge in electricity demand appears to be nuclear power.

As the colossal power needs of AI-driven data centers become apparent, so do the accompanying challenges, starting with an aging and deteriorating infrastructure. Approximately 20 gigawatts of fossil-fuel power are set to retire over the next two years. While some plants are naturally reaching the end of their lifespans, costly ESG related regulations play a significant role in constraining power supply. The impending Environmental Protection Agency rule would mandate expensive carbon capture technology for natural gas plants. Additionally, renewable subsidies in Biden's ‘Inflation Reduction Act’ further hinder fossil-fuel and nuclear plants from competing in wholesale power markets, despite their critical role in providing steady electricity for AI. Baseload plants, primarily nuclear and some coal steam, struggle to turn a profit, leading to closures and contributing to power outages like those experienced in Texas in February 2021 and the eastern US during Christmas 2022. Ultimately, investors have to understand that data centers, like manufacturing plants, require reliable, steady power around the clock year-round, which magical mirrors and windmills don’t provide. In this context, utilities will ultimately have to rely more on gas, coal and nuclear plants to support surging demand coming from AI.

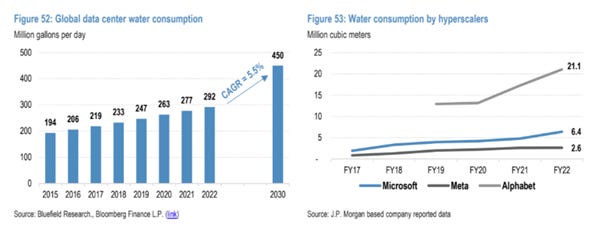

Beyond power generation and the necessary commodities like copper, gold, silver, and uranium, water is also a key element needed for a proper functioning of Data Centers and ultimately for the AI revolution to become a reality. While data centers have drawn attention for their heavy electricity use, their water-intensive operations have been relatively overlooked. Citing data from Bluefield Research, JP Morgan recently noted that total water consumption by global data centers (including on-site cooling and off-site power generation) has grown at a rate of 6% annually from 2017 to 2022. It is projected that by 2030, water consumption could soar to 450 million gallons per day. To put this into perspective, that's equivalent to 681 Olympic-sized pools of fresh water needed daily to cool global data centers in about 4.5 years.

By 2027, global AI demand could lead to 4.2 to 6.6 billion cubic meters of water withdrawal, exceeding the total annual water withdrawal of half of the United Kingdom when considering both scope 1 and scope 2 operational water withdrawal. The substantial water demand from data centers in regions with limited water resources could trigger increased competition and strain water availability, potentially leading to data center closures. Much of the water usage in data centers is due to the evaporation of millions of gallons of water daily in cooling systems designed to dissipate server heat. As AI data centers are poised to consume significant amounts of power and water, this raised the question of the viability of data centers in region which are expected to see structural deficit in water supply such as Texas and Arizona in the US.

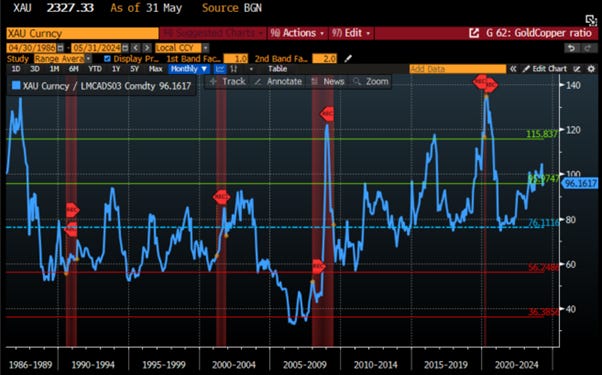

For those with a commodity bent, copper is also starting to show signs of ‘AI exposure,’ given its essential role in power production. As the narrative shifts and conventional wisdom starts equating copper with the ‘AI revolution,’ investors should be prepared to see copper turning into gold. Regular readers know that an incoming ‘Gold-Fever’ is about to spread, as gold remains exceedingly cheap in the current macroeconomic environment. On that matter, when considering the 50-year Gold-to-Copper ratio, the red metal itself is historically cheap compared to the barbaric relic.

Gold to Copper ratio.

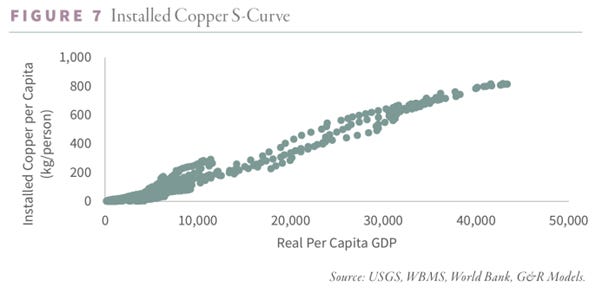

Countless analysts have warned for years that China is over-consuming copper, but this is taking into account that annual copper demand is based on real GDP, which is a mistake. Unlike oil, which is consumed, copper is ‘installed’ and lasts for decades like any capital good. Instead of focusing on annual copper consumption, investors should look at the economy’s total installed copper base, net of a depreciation allowance. By examining the relationship between China’s cumulative installed copper base and real GDP, China is exactly where it should be for an economy of its current size. With a real per capita GDP of $12,500, China has about 260 pounds of installed copper per person, aligning with other countries at similar economic development levels.

The copper supply is already extremely tight, and the structural growth in demand linked to powering AI will only tighten this market further in the coming years.

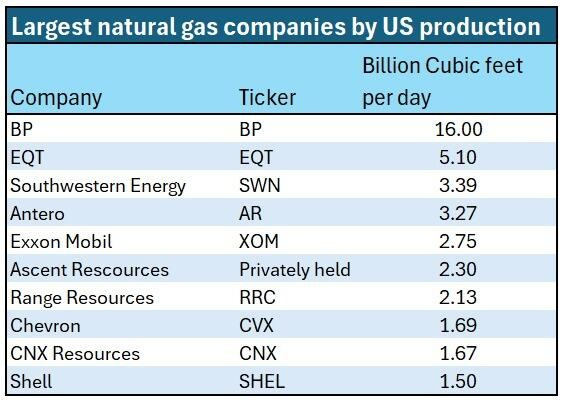

According to EIA data, natural gas made up 43.1% of US utility-scale electricity generation in 2023, earning it the moniker 'the fuel that keeps the lights on.' Abundant in the US, its price is near 30-year lows, making it an economical and cleaner alternative to coal or petroleum products to generate electricity. This surge in reserves is primarily due to shale oil fracking, with about three-quarters of the nation’s natural gas now coming from shale wells. Wells Fargo predicts that natural gas demand could rise by 10 billion cubic feet daily by 2030, nearly a 30% increase from current levels used for electricity generation in the US.

The natural gas industry can be divided into upstream and midstream sectors, with upstream participants involved in extraction and production, and midstream participants responsible for transporting natural gas downstream to homes, schools, and businesses.

The largest US natural gas producers, EQT, SWN, AR, and CNX, mainly drill for natural gas and have share prices closely tied to natural gas prices. Other companies in the sector have diverse fuel interests and less correlation with natural gas prices. If natural gas prices rise, EQT, SWN, AR, and CNX are poised to benefit the most. However, abundant US natural gas supply may keep prices stable, barring changes in supply estimates, resulting in continued benefits for these upstream companies due to increased natural gas use in the power grid.

Midstream natural gas distributors benefit proportionately from increased demand, transporting natural gas via pipelines from upstream wells to downstream end users. These companies function as toll-takers on the energy highway, generating revenue based on the volume of gas transported. Unlike producers, midstream stock prices are less correlated with natural gas prices and more so by transportation volume. Many midstream companies pay high dividends, which can fluctuate with profits, and some are structured as limited partnerships with unique tax reporting obligations. Given their reliance on transportation volume rather than natural gas prices, midstream companies should be favoured by investors looking to benefit from the AI revolution with an income bias in their investment profile.

Outside of oil and gas, which, along with coal, are the most ancestral ways to deliver reliable and stable power supply, uranium is unquestionably the energy source that could even appeal to green zealots who still argue that magical mirrors and windmills will save the planet from the ‘climate change scam’. Considering the basic supply and demand fundamentals of the uranium market, demand is set to explode, and there is nowhere near enough supply to meet this demand.

The uranium market is unbalanced due to a lack of investment in recent years, as prices were too low to incentivize miners to boost capital expenditures. Additionally, the recent decision by the US government to ban Russian imports will significantly increase the challenges for utilities to find reliable supply at reasonable prices in the foreseeable future.

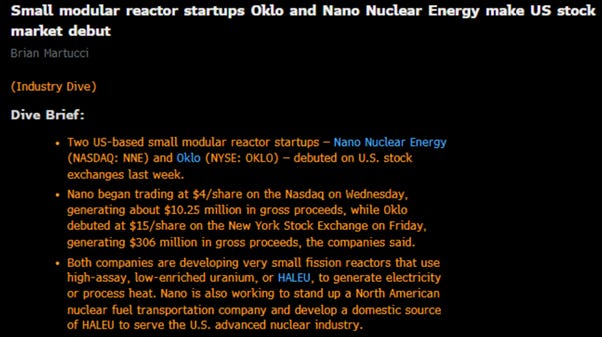

The considerable power demands of energy-intensive AI models are already driving tech firms to invest in their own energy infrastructure. While this may not be sufficient to prevent another wave of commodity-driven inflation, it creates a favourable backdrop for the energy and utility sectors while potentially posing challenges for high-duration tech stocks. This has been exemplified by the recent well-documented IPOs of Oklo Inc, backed by OpenAI founder Sam Altman, and Nano Nuclear Energy, supported by Asian entrepreneurs Jiang Yu and Prakitchaiwattana Mongkol.

Investors may find that an oblique approach to investing in AI stands to be more profitable. The energy-intensive nature of AI models, coupled with the risk of power and commodity capacity constraints and the resulting inflationary pressures, could pose, at some point, risks to expensively valued, high-duration technology stocks. In contrast, energy stocks remain inexpensive, under owned, and poised to benefit from rising commodity prices and power demand. They offer an oblique route to capitalizing on the initial stage of the AI progress explosion.

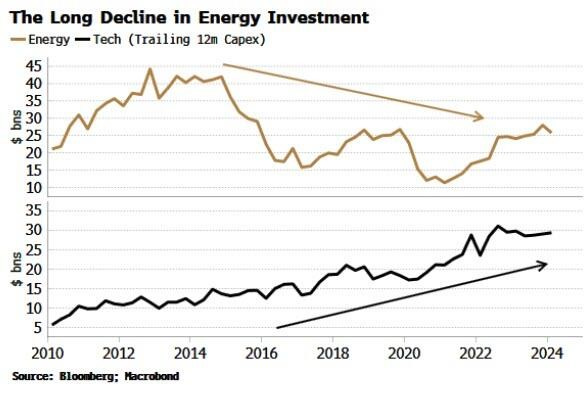

Capacity will be further constrained by almost a decade of underinvestment in upstream and downstream energy infrastructure. Following years of overinvestment during the commodities boom that ended around 2014, commodity companies slashed capital expenditure and returned more money to shareholders. It wasn't until 2021 that the capex of North American commodity producers began to pick up again. However, during the same period, they significantly increased dividend payouts and buybacks, to the extent that they equalled capex spending in 2022. This limited the amount that firms could allocate to new investment and maintenance capital expenditure.

The lags in bringing new energy sources online are lengthy, often up to four years, and even longer for transmission infrastructure. Delays in permissioning and construction, both upstream and downstream, contribute to these time lags, as well as waiting lists for key components in power stations such as transformers. Demand is expected to rise faster than supply can meet it, despite recent improvements in energy production and power usage efficiency. The sharp contrast between energy and tech firms is evident. While tech companies have been increasing their investment, signalling a rise in their demand for power, energy companies' capital expenditure has trended lower over most of the last decade.

Tech firms are not blind to the issues. They are diverting more of their capex to investing in energy infrastructure. Alphabet, Meta and other hyperscalers are directly investing in power plants. Tech companies are also entering into power purchase agreements (PPAs). These allow the buyers to purchase power directly from energy producers.

Despite these efforts, there remain bottleneck risks, particularly in the supply chain for raw materials like copper and silver used in energy technologies. As tech demand for power rises, higher inflation is likely, especially given the current inflationary environment. The current iteration of generative AIs with their fundamental limitations (reasoning, planning, understanding) are unlikely to lead to productivity enhancements as quickly as optimists believe. That means higher inflation is the most likely outcome from the expected rapid rise in tech demand for power. This comes at a time when the world is already in an inflationary regime, where inflation shocks have greater capacity to lead to a persistent rise in price growth. The 1970s were peppered with events such as the closing of the gold window, the Arab oil embargo, the Iranian Revolution, that on their own and outside of an inflationary regime may not have led to such persistent price issues.

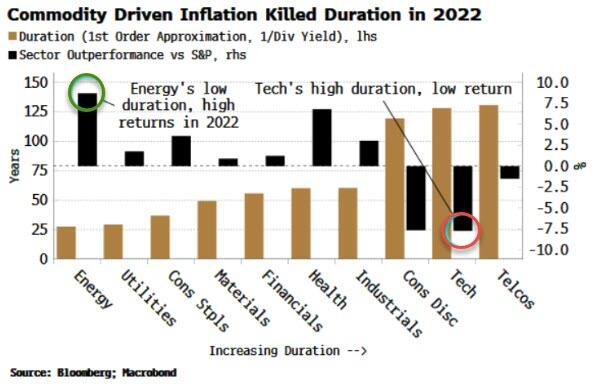

In a nutshell, there lies the rub for tech firms. While they are at the vanguard of AI, their stock prices are most exposed to higher inflation. The tech sector has high duration, with lumpy cash flows expected long in the future, and therefore is the most sensitive to the rising rates that would be likely to accompany another burst of commodity-driven price growth. Investors will remember that tech was the worst performing US sector versus the S&P in 2022 when inflation was rapidly accelerating, and the FED started to raise rates. On the other hand, inflationary environments, especially when they are commodity driven, are a sweet spot for low-duration energy stocks, which was the top outperforming sector in 2022. Utilities did relatively well too, but they stand in better stead this time as a low-duration sector benefiting from rising power demand.

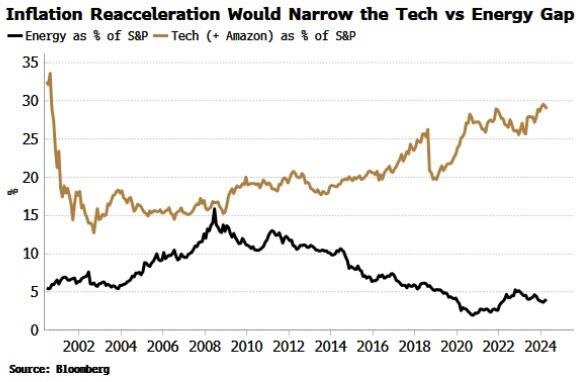

Currently, tech stocks are priced for near perfection with very high valuations, unlike energy stocks which are now very under owned and cheap on a historical and relative basis. A resurgence in commodity-led inflation could help narrow the extreme gap between tech and energy ownership. Energy represents only 4% of the S&P 500, while tech plus Amazon accounts for 29%.

The earnings revisions of the US energy sector have historically been well correlated with the price of oil and with supply constraints related to the escalation of geopolitical tensions in the Middle East, investors should anticipate structurally higher oil prices in the future. Additionally, additional ESG-related regulations tightening supply in the US and other so-called developed countries mean that higher demand will only be met with higher oil prices and ultimately higher profitability for the Oil and Gas sector.

12-monhts Fwd EPS of the US S&P 500 Energy index (blue line); WTI price (red line) & correlation.

This will also translate into the outperformance of the energy sector relative to the S&P 500 index in general.

Relative performance of the US S&P 500 Energy index to the S&P 500 index (blue line); WTI price (red line) & correlation.

In a nutshell, while tech stands to gain the most from AI in the long run, the path may not be straightforward. Just as ‘Obliquity’ offered the most profitable route to the Pacific Ocean, energy and other commodity related stocks could provide similar opportunities for investing in the AI revolution.

This brings us back to the Equity barbell portfolio made of technology and energy stocks which have proved to be the best way to invest in equities when inflation is on the rise and particularly when an inflationary bust unfolds.

US Stagflation proxy index (blue histogram); Relative performance of the Barbell Equity Portfolio to the S&P 500 index (red line) and correlation.

Considering that the biggest rises in CPI over the past 80 years occurred in the 1940s, the 1970s, and the 2020s, during times of wars and social unrests, the deflationary push of AI will be more than counterbalanced by the inflationary pressures of additional commodity demand, especially during times when supply shortages are driven by wars and ESG-related regulations. In a nutshell, the impact of the AI revolution is expected to be inflationary before being deflationary. In this context, the energy sector for the time being is not expensive at all; in fact, it is exceedingly cheap. Disregarding the positive impact on commodities by avoiding the energy sector and other sectors providing cheap energy sources for the electrification of the world denies the reality of the AI revolution. Therefore, the Barbell Equity Portfolio should remain the foundation of all equity allocations for the rest of this decade.

WHAT’S ON THE AGENDA NEXT WEEK?

The first week of the last month of the second quarter will once again focus investors' attention on PMI data in China and the US, as well as the health of the US job market. The focus will also be on the central bank meetings in Canada, Europe and India. The week will also feature the latest earnings reports from US retailers such as Lululemon and Dollar Tree, as well as cybersecurity software provider CrowdStrike.

KEY TAKEWAYS.

As the world prepares for the start of the third month of the second quarter, here are the key takeaways:

US Q1 GDP confirmed that a ‘consumer led recession’ is underway.

US core PCE continues to demonstrate that, apart from rounding errors, inflation is expected to remain stickier for much longer.

Last week's Treasury auctions were dismal, as more investors have begun to understand that an inevitable sovereign debt crisis will leave them owning nothing.

Tech is hungry for power and is poised to be Commodity’s best friend.

While Tech is deflationary, the need of power and the lack of investment in reliable access in commodity supply is inflationary.

With CPI already elevated and price-growth expectations rising, the AI revolution will take central banks’ inflation headache to develop into a migraine.

While tech companies have been increasing their investment, signalling a rise in their demand for power, energy companies' capital expenditure has trended lower over most of the last decade.

Outside oil, natural gas and coal; copper and uranium are set to turn into gold with the rising demand of fuel powering AI.

The Barbell equity portfolio build around Tech and Energy sector should be the foundation of all investors equity portfolio.

In addition to gold, which remains the ultimate hedge against government risks, energy-related commodities like oil, copper, and uranium can be added to a barbell portfolio for those able to stomach the higher volatility of these assets.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscatable, like physical gold.

For fixed income investors who are still chasing the long duration trade in US government bonds, more pain awaits as long-dated yields must reflect the new ‘stagflation reality’.

In a stagflation, the best way to protect wealth is still to own the equity barbell portfolio made of Tech and Energy and Physical Gold and avoid long dated bonds.

As stagflation rather than recession materializes as the economy is increasingly weaponized, investors should prepare their portfolios for HIGHER volatility.

In this context, investors should also remain prepared for dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

May ended on a strange note with weak hard data, soft high frequency macro data, poor micro data (ugly earnings hints for software and consumer sectors), and another noisy round of dovish and hawkish FED speeches. This added volatility to equity markets, which all ended the month in the green, with Nasdaq leading and the Dow lagging. That allowed the S&P 500 to find support on the 50 days MA which remains a key technical support to monitor in the coming weeks as volatility is expected to rise.

In this context, it's no surprise that last week’s rally was dominated by value and cyclical sectors like Utilities and Energy, while IT and Healthcare lagged behind.

There are various ways for investors to benefit from how to power the AI revolution, such as investing in commodities like oil, uranium, and copper. Unfortunately, unlike gold, owning these commodities physically is not accessible to most investors due to the cost of storage. Investors looking to invest in these commodities via ETFs must be aware of the shape of commodity curves, as contango and backwardation will impact the performance of these ETFs over time due to the need to roll their future exposure on a monthly basis.

Another way to benefit from higher uranium and copper prices is to invest in companies that mine these commodities. However, much like gold, a significant portion of uranium and copper mining occurs in regions where property rights can be 'flexible.' When prices rise, governments in countries like Kazakhstan or Peru may be tempted to expropriate or nationalize mines.

Finally, investors can consider the energy infrastructure sector as a way to benefit from the rising demand for power related to AI. This theme will attract income-seeking investors, with Master Limited Partnerships (MLPs) in the energy and power infrastructure sector being a prime option. For those unfamiliar, an MLP is a publicly traded company that combines the tax benefits of a private partnership with the liquidity of a stock. MLPs have two types of partners: general partners, who manage operations, and limited partners, who are investors. Investors receive tax-sheltered distributions and benefit from a low-risk, long-term investment that provides a steady income stream. However, like regulated utilities, MLPs can be subject to regulatory changes, which are likely to occur as power shortages increase and the government seeks to capitalize on the sector's rising profitability.

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.