The Big Beautiful Bullion

Big Beautiful Bill? More like a big fat joke. When chaos reigns, it’s the Big Beautiful Bullion that preserves wealth.

The Week That It Was…

The first full week of Q3 felt like the calm before the earnings tsunami—just a light drizzle of drama with the July 9th tariff truce deadline and a side of Chinese inflation data to keep investors mildly entertained. As for earnings? Only two S&P 500 companies stepped up early to break the silence—before corporate confessional turns into a full-blown flood in the coming weeks.

China’s CPI may have technically popped back into the black in June, but don’t break out the confetti just yet. Month-on-month, prices still slipped, and factory-gate deflation is throwing a 33-month-long pity party. The headline 0.1% year-on-year rise looks less like a recovery and more like a statistical hiccup. Meanwhile, the PPI’s 3.6% plunge is the biggest in nearly two years—because nothing screams “strong demand” like collapsing producer prices. In short: Beijing may need to grab the stimulus paddle again, because this economic canoe isn’t going anywhere fast.

For equity investors focused on what truly drives stock valuations—China Inc.'s ability to expand margins—the current spread between core CPI and PPI is flashing a familiar signal. It's now back at its widest since April 2023, a time when equity valuations were strikingly similar to today. In other words, margin tailwinds are forming again… if corporate China can catch the breeze.

12-Month Fwd P/E of MSCI China (blue line); Spread between Core China CPI & PPI (Histogram).

With the 90-day tariff truce having gasped its final breaths, the Manipulator-in-Chief—still busy exporting his signature brand of ‘Trumperialism’, declared that any country daring to flirt with the “anti-American policies of BRICS” will get slapped with a bonus 10% tariff. Because nothing says free trade like punishing sovereign nations for not playing cheerleader to Washington's economic agenda.

Before that, BRICS just had dropped a diplomatic love letter from Copacabana, slamming U.S. and Israeli strikes on Iran—a fellow BRICS member—and demanding ‘the Malthusian In Chief from Tel Aviv’ pack up and leave Gaza. They called for peace, a ceasefire, and humanitarian aid, while Israel, of course, denies any wrongdoing. Meanwhile, China’s Premier says BRICS should lead global reform and solve conflicts... because clearly, the UN wasn’t doing enough group therapy.

After turning the almighty dollar into a cursed relic of control, Donald Copperfield now casts his infernal eye upon copper—because why merely curse currencies when you can drag metals into the abyss of trade wars too? With a hissed “50% tariff,” copper futures ignited like brimstone, exploding 17% last Tuesday in a blaze not seen since 1988. Cloaked in the incantation of “national security,” Section 232 is summoned like a demonic rite—because clearly, true defence begins with electrified sedans and copper plumbing. U.S. stockpiles bloat like a glutton’s purse, while China’s drain away like lifeblood. And still, the copper cult chants, waiting for new American mines that won’t rise until the next fiscal resurrection. This isn’t trade policy—it’s black magic on Capitol Hill.

The latest FOMC Minutes read like a script from Eyes Wide Shut: Central Bank Edition—a foggy mix of confusion and cautious optimism. The FED’s not quite sure how tariffs will shake out, but one thing they do agree on is this: growth’s going to hit the brakes. As for the balance sheet? Apparently, shrinking it is going great... if you ignore that it’s still hovering near pandemic-era highs and $6.2 trillion in size. Most of the runoff has quietly drained from the Reverse Repo facility—because why upset reserves when you can slowly bleed the plumbing instead? Survey respondents now expect the runoff game to end in February 2025, conveniently after the election circus wraps. Until then, the Fed continues its magic trick: pretending $2.9 trillion in reserves and a still-bloated balance sheet mean "mission accomplished."

https://www.scribd.com/document/886400464/Fomc-Minutes-20250618#download&from_embed

In the enchanted tale of rate-cut wishcasting, Wall Street’s spellbound optimists—those tireless traders—remain bewitched by the shimmering illusion of a Goldilocks economy. As the mirage glows ever fainter, they now conjure a 70% chance of a September cut post-Jackson Hole, still weaving dreams of a soft landing like a security blanket hand-stitched by Jerome Powell, high priest of monetary alchemy.

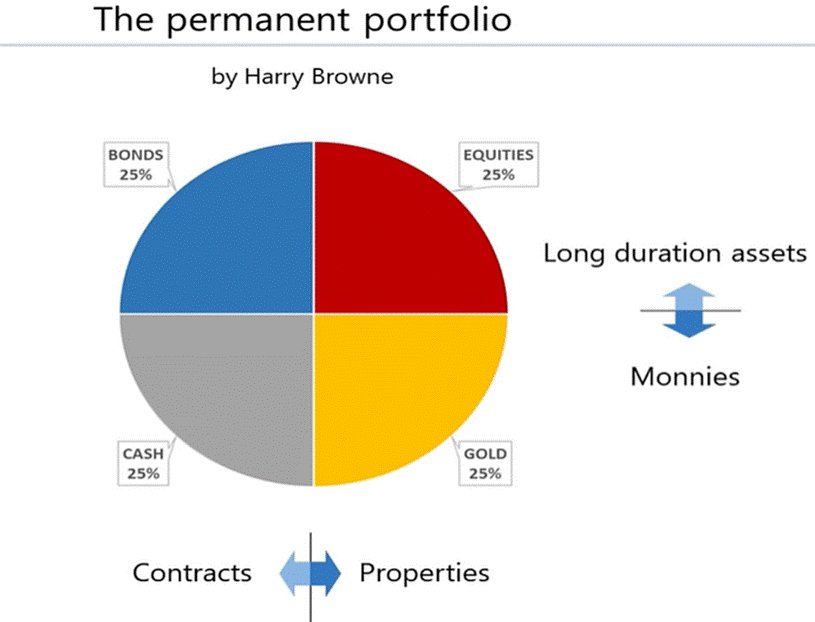

Investors who have done more investing homework than just bingeing Wall Street pundits or tuning into finance soap operas hosted by clueless journalists, will know they basically have two flavours to choose from: contracts and properties.

Harry Browne, an economist with a knack for common sense, cooked up the Permanent Portfolio—a no-nonsense, all-weather mix of four uncorrelated assets: stocks, bonds, gold, and cash, each at 25%. Simple, balanced, and built to survive just about any economic circus.

On one side we have contracts made of Cash and Bonds which can be seen as IOUs with fancy suits.

Cash (or short-term Treasuries) is investors’ financial mattress—comfy during recessions and ready to pounce when deals appear. Fiat, yes, but not a hostage to long-term drama.

Bonds are polite loans to governments or companies, paying you interest while you wait for your money back. They shine when rates fall but melt in default or inflation tantrums.

On the other side, properties are made of Gold and Stocks These are the “real” stuff—no promises, just ownership. Gold doesn’t care about central banks or election cycles. It’s your shiny insurance policy against global chaos and government meltdowns.

Stocks let you own a slice of capitalism. Great in growth spurts, but they do throw the occasional tantrum when the economy catches a cold.

In short: Contracts say, “Trust me,” while properties say, “Own me.”

By mixing contracts (which can go poof via default or inflation) with properties (which stubbornly hold their value), Harry Browne built a portfolio that’s basically a financial Swiss Army knife—ready for inflation, deflation, booms, busts, and everything in between. The magic? Balancing risk and resilience across totally different asset personalities.

Now enter the old-school 60/40 portfolio—60% stocks, 40% bonds—the beloved brainchild of post-WWII finance and the go-to playbook for wealth managers. It rode high through decades of falling interest rates and rising markets, delivering growth with a side of stability. For years, it was the financial equivalent of a Volvo: safe, steady, and mildly exciting.

But today? That same portfolio looks like it’s stuck in the wrong era—kind of like showing up to a tech startup in a pinstripe suit. With inflation throwing punches, rates climbing, and geopolitics on edge, the once-golden 60/40 is now getting side-eyed as investors ask: Is this thing still built for the road ahead?

Performance of $100 invested in the US 60/40 Portfolio (blue line); US Browne Portfolio (red line) since December 31st, 1999.

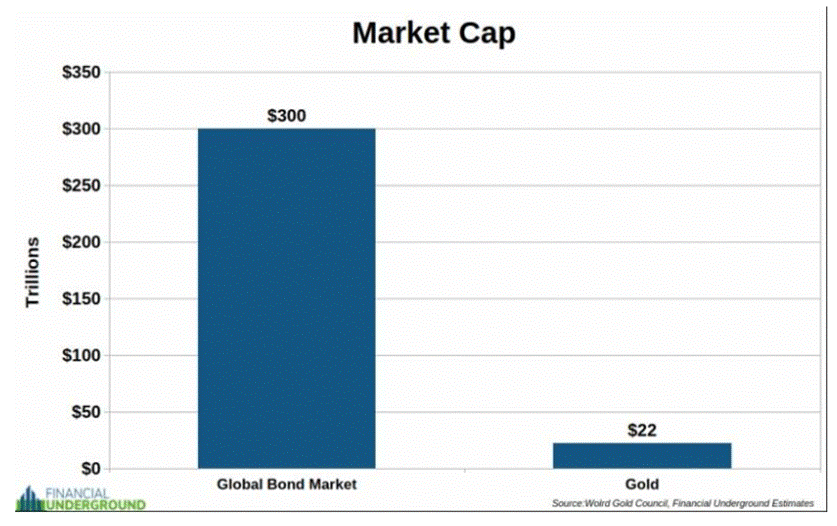

Thanks to decades of Wall Street brainwashing—and their loyal media parrots—there’s a laughably persistent myth in finance: that U.S. Treasuries are “risk-free.” It’s repeated like a sacred chant. Banks build entire portfolios on it. Advisors treat it as gospel. And most investors never question it. Since Nixon unshackled the dollar from gold in 1971, bonds—especially Treasuries—have become the default adult piggy bank. Safe, steady, and oh-so-respectable. The result? The global bond market has ballooned into a $300 trillion beast, all because everyone was told, “This is the smart move.”

Now, compare that to all the gold ever mined in human history—about $22 trillion. That’s barely 7% of the bond market. So much for “barbarous relics.” Apparently, what’s really smart is still trusting politicians with your savings.

Even before the Big, Beautiful Bill that promises to Make America Great Again hits the ground running, anyone who’s paid attention to the business cycle—or the impact of trade wars, capital wars, and actual wars—could tell you this: long-term yields aren't going anywhere but sideways or up, unless a miracle bring peace and lower government spending in the foreseeable future.

Inflation’s still sticky, fiscal risks are ballooning, and foreign buyers (like BRIC’s pension managers) are repeatedly threatening to dump Treasuries if Uncle Sam keeps spending like a drunken sailor while spreading ‘Turmperialism’ to rest of the world.

US 10-Year Yield (blue line); US CPI YoY Change (red line) & Spread between US 10-Year Yield & US CPI YoY Change (histogram).

The self-declared “Treasurer-in-Chief”—a former hedge fund manager with a less-than-stellar track record and a loyal graduate of the George Soros school of speculation and regime change—once mocked the gospel of “Yellenomics” from outside the Washington swamp. But the moment he got a taste of political power? He dropped the critique and grabbed Yellen’s playbook with both hands—the very one he used to scoff at. Turns out, nothing turns a critic into a copycat faster than a seat at the table.

On July 1, 3 days before it was signed by the ‘Manipulator In Chief’, the Congressional Budget Office gave the Senate’s “Big Beautiful Bill” a glowing review—claiming it would slash deficits by $0.4 trillion. Sounds great, right? Well, hold your applause. This magic trick relies on a baseline cooked up by Senate Budget Chief Lindsay Graham, the ‘Regime Changer In Chief’.

The real cost disappears like Houdini’s best trick. Graham even bragged, “I’m the king of the numbers, I’m Zeus, the budget king.” Meanwhile, the bipartisan CBO quietly notes the bill actually increases deficits by $3.4 trillion over the next decade. But wait, there’s more: the bill front-loads tax cuts and delays spending cuts, setting up a fiscal cliff in 2028—right before crucial elections. This cliff almost guarantees another round of tax-cut extensions and likely undoing of deficit reductions, potentially pushing the deficit impact from $3.4 trillion to $4.8 trillion, according to the Committee for a Responsible Federal Budget. In other words, like the 2017 TCJA, these “temporary” sunset provisions are just a fancy way of making permanent promises that blow up the deficit down the line. Welcome to the ultimate political accounting magic show.

Despite the soaring budget deficit, the impact on U.S. economic growth will likely be minimal. Most of the so-called “tax cuts” in the One Big Beautiful Bill are just extensions of the TCJA’s income tax provisions—basically removing the fiscal cliff Republicans feared would tank their election chances. So, no surprise here, growth projections stay put. The actual new stimulus? Much smaller. Fiscal discipline? Out the window on Capitol Hill. The few hawks left can only slow the debt’s upward march. That leaves bond vigilantes as enforcers—. As they diversify away, expect demands for higher yields. Eventually, either rising interest rates or tax hikes will force lawmakers to get serious—or slow growth will do it for them. For now, enjoy the extended low taxes and fresh cuts—just don’t bet on tomorrow.

US 10-Year Yield since 1961.

Despite all the hype around Trump’s “grand strategy,” defence spending in the One Big Beautiful Bill doesn’t exactly scream “military dominance.” With tax cuts extended and Social Security and Medicare untouchable, there’s barely any wiggle room to boost defence budgets. Translation: America’s foreign policy ambitions are about to hit the brakes. So, while the recent US strike on Iran might be a quick win for the globalist, the One Big Beautiful Bill hands the long-term advantage to the isolationists.

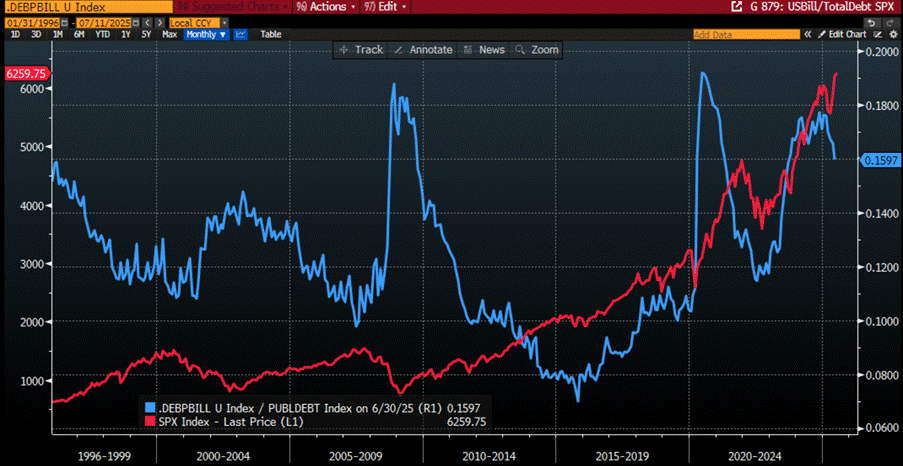

Before the “Big Beautiful Bill” took effect, the self-styled “Treasurer-in-Chief” made it clear: his team isn’t too fond of locking in debt at longer maturities. Instead, they’re leaning into short-term bill issuance—a move ‘The Manipulator In Chief’ himself echoed with his fantasy of issuing only sub-nine-month debt, something that isn’t happening even in the most honky-dory MAGA dreams.

Issuing more bills and less long-term debt juices reserve velocity and gives a sugar high to risk assets.

Ratio of US Total Debt Outstanding Bills to US Total Government Debt (blue line); S&P 500 Index (red line).

Financing America’s abyssal deficit with short-term Bills instead of longer-term coupons is basically the fiscal equivalent of buying groceries with a credit card—and yes, tragically, that’s the real-life budget strategy of millions of Americans still clinging to the hope that their vote for a better life wasn’t hijacked by the PayPal Mafia and their Wall Street pals. And while Washington juggles debt like it’s running a late-night infomercial (“Why lock in rates when you can just roll it over forever?”), gold quietly benefits. Every time Uncle Sam chooses Bills over bonds, it’s just one more tailwind pushing the shiny metal higher.

Ratio of US Total Debt Outstanding Bills to US Total Government Debt (blue line); Gold price in USD Terms (red line).

Cranking up bill issuance isn’t technically quantitative easing—after all, the FED’s balance sheet doesn’t balloon automatically. But let’s not kid ourselves: by shortening the average maturity of U.S. debt, Treasury makes it feel a whole lot more like cash. More “money-ness” means investors chasing yield elsewhere, inflating risk assets in a fiscal-led version of QE—just without the FED doing the printing.

With the debt ceiling being raised (surprise!), the Treasury is also looking to refill its FED checking account (Treasury General Account) from $360 billion back up to a more comfy $750–800 billion. But let’s be honest—this smells like the start of a bigger plan: shift more debt into bills, prop up markets, and pretend inflation isn’t being hardwired into the system. Because what could possibly go wrong when you fund a fiscal black hole with IOUs that mature faster than American’s attention span on TikTok?

While retail investors—and even many HNWIs—still cling to the bedtime story that U.S. Treasuries are “risk-free,” central bankers, particularly those in the American-imperialism-free world of the Global South, have long known the truth: physical gold—not government IOUs printed on a whim—is the real antifragile asset: zero counterparty risk, no political drama.

So, it shouldn’t shock anyone not fully hypnotized by Wall Street’s honky-dory narrative that gold has now overtaken the euro as the second-largest reserve asset in the world, according to the ECB’s review of 2024 holdings. As the curtain fell on the year, reserves broke down like this: 46% USD, 20% gold, 16% euro, and the rest just rounding errors.

That 20% gold share might even be lowballing it—central banks don’t exactly advertise their gold shopping sprees. But here’s what we do know: they’ve been scooping up over 1,000 tons annually since 2022, bringing official holdings to the highest weight since the 1970s and near the all-time high from 1965. That’s a quarter of global mined production vanishing into vaults.

Why? Well, the ECB, ever the diplomat, blames it on Russia’s invasion of Ukraine and the ensuing sanctions. Translation: once the U.S. started using the dollar like a geopolitical sledgehammer, central banks took the hint—grab gold before your reserves end up in a financial freezer.

In fact, in five of the ten biggest annual gold-buying binges since 1999, the buyers were either under sanctions or getting their “you're next” warning. Of course, the ECB tiptoes around the more awkward truth: Western governments printing trillions to fund their latest political pet projects. But sure—this gold rush is definitely all about peace of mind and stability for those who are looking to remain independent from the agenda spread by those following the elites of Davos.

So, while Wall Street and the White House cheer for digital dollars and deficit spending, the central banks mostly in the Global South are quietly stuffing their vaults with shiny yellow “barbarous relics.” Who’s the reckless one now?

Meanwhile, the dollar’s share of global reserves keeps shrinking, now down to a modest 43%—still the big kid on the playground, but looking a bit less invincible these days. Who’s driving this shift? Emerging-market central banks, especially in Asia, who’ve seen enough dollar diplomacy to know they don’t want to be the next financial hostage. They’re quietly stacking gold like it’s going out of style. As for developed-market central banks? They’re still lounging in their post-GFC comfort zone, barely lifting a finger to add gold. Apparently, they missed the memo that “full faith and credit” sounds a lot scarier when it’s backed by a printing press and foreign policy mood swings.

That might be about to change. The current U.S. administration has made one thing crystal clear: if you don’t play ball—whether it’s trade, defense, or regulatory karaoke—you’re fair game. So if developed-market central banks suddenly rediscover their inner gold bug, don’t be surprised when the metal rips even higher.

Retail investors? Late to the party especially in the West, as usual. They mostly snoozed through the central-bank-led gold rally that kicked off in 2022. Only recently have U.S.-based gold ETFs started showing signs of life. Meanwhile, retail buyers in Asia—particularly China and India—were already sprinting ahead, clearly paying more attention to their central banks than CNBC. Sure, the total gold in Asian ETFs is still smaller than in the West, but the growth since mid-2024 has been so steep it’s nearly matched the combined rise in U.S. and European ETFs. Not bad for the so-called “barbarous relic.”

Gold may be consolidating now, thanks to a (temporary) breather in tariff drama and Middle East chaos, while equities break new highs. But make no mistake: with the global financial system mutating and geopolitical stress bubbling under the surface, gold remains the ultimate "break-glass-in-case-of-crisis" asset—except this time, everyone’s eyeing the hammer.

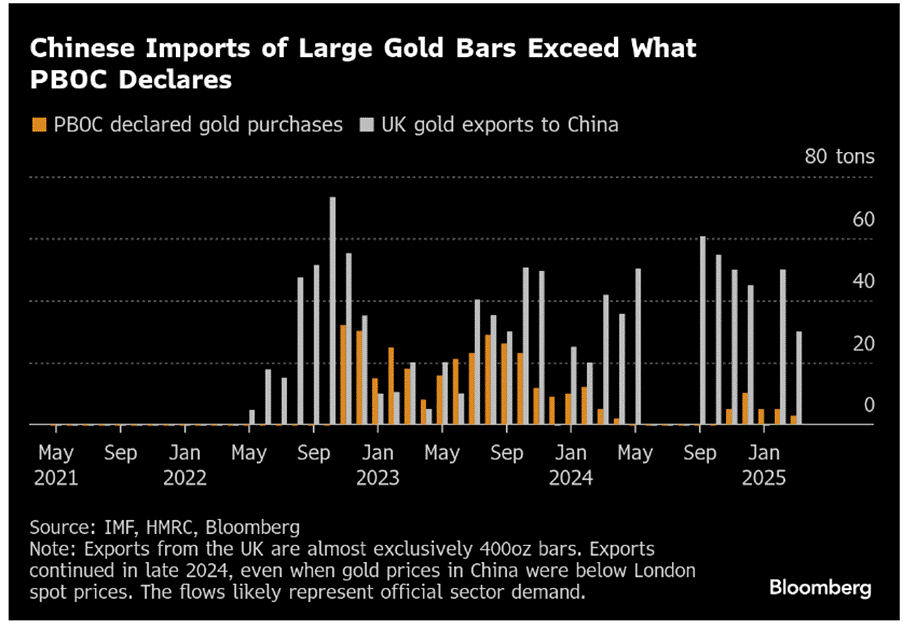

There’s plenty of chatter about central banks and sovereign wealth funds underreporting gold reserves—but of course, there’s no proof. Just years of mysteriously large imports, silent accumulation, and the occasional "oops, forgot to mention we bought 600 tons" moment, like China pulled in 2015 after six years of radio silence. Naturally, markets speculate—because who would ever expect full transparency from the People’s Bank of China? In a nutshell, the real numbers are probably much higher than what’s officially reported.

Gold flows into China are tightly controlled and funnelled through the Shanghai Gold Exchange (SGE), yet in recent years, supply has consistently outpaced withdrawals. Where’s the excess going? Don’t ask SAFE, the PBOC’s reserve manager—they’re not picking up the phone.

Meanwhile, big 400-ounce bars (favoured by central banks, not retail investors) keep leaving London for China—even when gold in Shanghai trades cheaper than London. Makes perfect sense… if you're not running a for-profit operation, but rather quietly swapping dollar reserves for hard money offshore. So yes, no “concrete evidence”—just market footprints, statistical oddities, and a whole lot of conveniently timed opacity. But sure, let’s all pretend it’s just a rounding error.

For those who need a reminder, central banks can’t quit their gold habit—net buyers scooped up 20 tons in May, just shy of their 12-month average, as Middle East tensions kept geopolitical nerves tingling.

Poland stayed top hoarder (67t YTD), while Kazakhstan, Turkey, and China added to their stashes too. Meanwhile, Singapore led the “gold detox” club, offloading 5t. Moral of the story? Central banks still trust gold more than their own currencies.

In Asia, it’s not just central banks hoarding gold—affluent investors are joining the rush. Hong Kong’s wealthy have nearly tripled their gold allocation in a year, jumping from 4% to 11%, while their mainland counterparts doubled theirs to 15%. With tariffs flying, markets wobbling, it’s no surprise that confidence in cash and bonds is fading. The new safe-haven starter pack? Bullion, Bullion, and Bullion—because in times like these, shiny assets speak louder than promises.

For central bankers paying attention, Russia’s frozen reserves were a wake-up call—a not-so-subtle reminder that the dollar isn’t just a currency, it’s a weapon. Most of those frozen funds sit at Euroclear in Belgium, and now some Western leaders want to go full pirate and use them to fund their Malthusian agenda in Ukraine. Gold, on the other hand? Store it at home and it is untouchable.

Since 2022, the risk calculus has changed. Sanctions are one thing, but fears of a Fed losing independence—or a Trump encore featuring a deliberately weaker dollar—have rattled reserve managers. So yes, the dollar’s share of global reserves is falling, and it might slip even faster as central banks tiptoe toward alternatives... or sprint, if headlines get any spicier. Sure, options are limited—there’s only so much high-grade debt in other currencies to go around—but gold doesn’t need much to move. According to JP Morgan, by shifting just 0.5% of foreign U.S. assets into gold could send it to $6,000 by 2029. As everyone knows, the gold market’s big—but the dollar market is massive. A tiny leak from one can flood the other.

And speaking of floods, 2025—the so-called Jubilee Year—has already been a gold blockbuster: trade wars, hot wars, ceasefires, and whispers of currency accords. Gold’s shrugged off the noise and kept marching. Long-term investors aren’t fazed by daily price flickers—they see the 1970s déjà vu: inflation, geopolitical chaos, and a FED slowly losing its grip. Back then, gold skyrocketed. This time? It might just make the '70s look like a warm-up act.

While the “Treasurer-in-Chief” is busy hawking the ‘Big Beautiful Bill’ as America’s golden ticket to prosperity, anyone with more than a few brain cells knows better. In the real world of sticky, longer-lasting inflation—something we’ve all been living through since the start of the decade and can expect to continue—shortages and crumbling trust in public institutions run like banana republics are the real story, not the MAGA propaganda which has been created by some tech billionaires to repopulate the Washington swamp.

In that mess, the ‘Big Beautiful Bullion’ will quietly rise as the only true store of value for investors who want to keep their financial freedom and prosperity intact. Because when everything else fails, shiny metal still speaks louder than empty promises.

If you’ve got enough brain cells to see past the political smoke show—red, blue, or whatever flavor of the month—one thing’s obvious: bonds, once the “safe” harbor, are now capital graveyards. With fiat currencies on a fast track to debasement thanks to endless government debt, those long-dated promises? They’re basically guarantees of real losses.

Remember that the global bond market clocks in at a staggering $300 trillion, and when the shift hits, it could trigger the biggest wealth transfer in history. Investors, nations, and institutions will have no choice but to ditch Treasuries and chase real value—hello, gold.

Remember the 1970s? Gold went up 24x after Bretton Woods collapsed. The next reset? Buckle up—it could be even crazier, as the world rediscovers gold and abandons so-called “safe” assets that turned out to be anything but.

In a world dazzled by the fanfare of the “Big Beautiful Bill” signed on Independence Day’s, savvy investors see through the illusion. They know the true refuge lies not in hollow promises, but in the Big Beautiful Bullion—the timeless bastion of wealth when the focus shifts from chasing returns on capital to preserving the return of capital.

The path to real prosperity is paved with tangible assets, not fragile IOUs. Physical gold and silver—free from counterparties, free from surveillance—stand as the ultimate antifragile shields. Beyond precious metals, broader commodities guard against a fracturing global supply chain.

Cash must be wielded with precision: favor short-dated USD investment-grade bonds and T-bills to maintain income and swift agility.

In equities, hunt for lean, low-debt, high-cash-flow champions—businesses ready to thrive amid reshoring, trade wars, and surging defense budgets. Because the real enemy isn’t next door; it’s the warmongers pulling the strings.

The Goldilocks era is dead. The age of Gold In Lots—is the new survival playbook.

What’s On The Agenda Next Week?

The week of Bastille Day won’t just see fireworks in France—investors are in for their own economic guillotine test. All eyes will be on U.S. inflation as June CPI and PPI numbers march in, followed by a retail sales check-up to see if U.S. and Chinese consumers are still alive and kicking—or just swiping on fumes. Meanwhile, earnings season ramps up with 39 S&P 500 companies spilling the Q2 beans. Expect Wall Street’s finest—JP Morgan, BofA, Goldman, Wells Fargo—to either boast or beg, joined by PepsiCo, Netflix, and Schlumberger for a full menu of soda, streaming, and shale.

KEY TAKEWAYS.

As investors trade the Big Beautiful Bill for the Big Beautiful Bullion, the key takeaways are:

China’s inflation just barely blinked positive, but with factory-gate prices in freefall and demand still limping, it’s less a comeback and more a cry for stimulus—yet margin tailwinds may quietly be building for brave equity investors.

The Fed may not agree on tariffs, but they all see a slowdown coming—while quietly juggling a $6.2 trillion balance sheet like it's business as usual.

Investors with a clue know the choice: trust the shaky promises of contracts like cash and bonds, or own real, resilient assets like gold and stocks

Wall Street and its media hype have convinced everyone that U.S. Treasuries are “risk-free,” fuelling a $300 trillion bond bubble—while all the gold ever mined is just a tiny $22 trillion afterthought, proving that trusting politicians with your savings might be the real gamble.

By betting on short-term bills—America’s credit card debt—Washington is fuelling risk assets and gold prices amid its drunken sailor’s never-ending spending.

While retail investors cling to the myth that U.S. Treasuries are “risk-free,” savvy central banks—especially in the Global South—are quietly ditching dollars for gold, the true antifragile asset, as geopolitical tensions and reckless fiat printing expose the dollar’s fading dominance.

Bonds are dying, fiat is melting, and as the $300 trillion bond bubble bursts, savvy investors are racing to the true safe haven—the Big Beautiful Bullion—ready for a gold rush that could make the ’70s look tame.

As the US economy shifts into an inflationary bust, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

Gold and silver are eternal hedge against "collective stupidity" and government hegemony, both of which are abundant worldwide.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

The first full week of the third quarter of the Jubilee Year was all about the return of a "tariffied world." While financial markets played "TACO" for most of the week, they suddenly woke up on the last day to register their first negative weekly performance since the end of the 12-day war in the Middle East.

Although the S&P 500 managed to print a new all-time high over the past five days, the Nasdaq 100 did not follow suit. Those who have paid attention to stochastics and momentum indicators in recent weeks could have easily identified that, despite the prevailing greed among investors—especially YOLO retail crowds—equity markets had already lost momentum since Independence Day, with the S&P 500 printing a negative reversal on its stochastics on July 7th. With daily RSI levels still hovering near the most overbought readings since July 2024 and stochastics rolling over from similarly elevated levels, investors should brace for further correction. For now, U.S. equity indices remain priced for greed—another reason why FOMO should be avoided. Instead, investors should focus on charts, not on hot takes from journalists who've never managed a dollar, even for themselves.

A potential correction in the coming weeks could bring the Nasdaq 100, S&P 500, Dow Jones, and Magnificent 7 down to their respective 76.4% Fibonacci retracement levels (21,411; 5,946; 43,076; 25,573).

With greed still trumping fear and short-term indicators flashing bearish reversals, another wave of volatility could trigger a retest of the 50% Fibonacci retracement levels: Nasdaq 100 at 19,719; S&P 500 at 5,559; Magnificent 7 at 23,089; and the Dow at 40,842. If these supports hold, it may present the last tactical buying opportunity of the year.

Since the April 21 "tariff tantrum" faded, all major U.S. indices have been forming higher lows, suggesting the 2025 bottom may already be in place. While geopolitical events—not economic data—are likely to drive volatility, long-term investors should stay focused and avoid getting caught up in either doom-and-gloom or "hunky-dory" narratives.

As of July 11th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for more than 5 months, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

Government overspending, monetary manipulation, and systemic fragility aren’t new—they’re relentless, worsening with every passing year. The same tragic cycle repeats: every four years, the U.S. piles on debt faster, spends more than it has quicker, and promises to fix it—only to punt once in power. This so-called Big Beautiful Bill is just another chapter in the same old story. There’s a dangerous fantasy that America—and other Western nations—will magically grow their way out of this debt nightmare. Meanwhile, actual government spending fuels absurdities: endless subsidies, regime-change wars, and bankers’ battles paid for with borrowed money.

Yet, amid this chaos, one spark of hope flickers—people finally feel the sting of inflation. A few years ago, warnings about the government stealing your money through inflation were dismissed as fringe theory. Now, the pain hits home at the grocery store. Shoppers ask themselves, Why am I paying twice as much for half the cereal? That gut punch is awakening a hunger for truth.

The bond market is the battlefield where the real fight plays out—forget the stock market’s smoke and mirrors, bonds tell the brutal truth. Anyone with eyes wide open has noticed yields climbing even as the FED pretends to ease. It’s not normal. Stocks and bonds selling off together? That’s an emerging market move—not the behavior of the world’s reserve currency.

Behind the curtain lurks an even darker secret: who’s really buying this mountain of debt? Don’t be fooled—the FED and Treasury might be fighting in front of the camera but behind the curtain they are spinning an illusion of demand, propped up by shadowy offshore players and Cayman Island tricks. It’s sketchy, it’s opaque, and it’s terrifying.

The cold, hard truth? When you adjust for the so-called CP-Lie, the U.S. government has already defaulted—not with a bang, but a silent, inflationary whimper that’s stealing value from every American’s pocket since the decade began.

Performance of $100 invested in Gold (blue line); S&P 500 index (red line); Bloomberg US Treasury Index (green line); Bloomberg US Treasury Bill: 1-3 Months Index (purple line) adjusted to US CPI Index since December 31st, 2019.

As uncertainty tightens its grip—from turbulent markets to volatile geopolitics—volatility is no longer the exception; it’s the new normal. Policymakers stumble from one crisis to the next, debt piles higher like dry kindling ready to ignite, and trust in institutions crumbles by the hour. In this fractured world, it won’t be digital fantasies or hollow promises that protect wealth—it will be The Big Beautiful Bullion, timeless and unyielding.

Welcome to the Chaos Cycle. Pack your gold and food—leave behind Bitcoin and paper hopes tethered to worthless contracts. The future belongs to what endures.

Clutching physical gold—the “old-school” stuff—gives investors something the “future-forward” Bitcoin bros and Stablecoin fan club will never have: real autonomy. Not just from the almighty USD, but from all those fiat currencies sprinting headlong into full-on centralization.

In short: as the U.S. economy stumbles through its classic inflationary boom-to-bust routine, history’s spoiler alerts ring loud—the Dow will keep outpacing bonds, energy producers will leave consumers in the dust, and gold? Gold will keep stealing the spotlight like a diva at karaoke night.

Gold locked away in private vaults means no compliance checkboxes, no digital IDs, no sketchy counterparty risks, and zero need for Ripple, Tether, or any other politically exposed, centralized circus act. Unlike those flashy digital toys born from the chaos of 2008, gold isn’t just a hedge against currency collapse—it’s the original protector against volatility and centralization. Rocking since 480 BC—no big deal.

So yeah, gold matters—yesterday, today, and tomorrow.

As the US marks its 250th anniversary—blessed with vast natural resources and shielded by two mighty oceans yet plagued by structural mismanagement—one truth rings louder than ever for investors:

‘Gold is a treasure, and he who possesses it does all he wishes to in this world.’

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.