The Calm Before The Second Wave?

What’s behind the numbers?

After a hotter-than-expected headline CPI to close the third quarter, the final quarter of the year began with a headline CPI increase of +0.2% MoM, meeting expectations and unchanged from September's MoM change. As the yearly disinflationary base effect starts to fade, the YoY increase was +2.6%, aligning with expectations but higher than September's +2.4%. Energy and core goods remained deflationary YoY in October, while core services, comprising 58% of the headline CPI, grew by 2.86% YoY, up from September’s 2.83%. Food inflation slightly decelerated from 0.30% to 0.28%.

The core CPI rose by 0.3% MoM, meeting expectations and matching September's pace. On a YoY basis, with the disinflationary base effect having ended a few months prior, it increased by 3.3%, in line with expectations and matching September’s rate. Core services are still rising at 3.6% YoY, contradicting claims that inflation has been defeated. Core goods deflation remained unchanged from September. Notably, this marks the 53rd consecutive month of MoM core CPI increases.

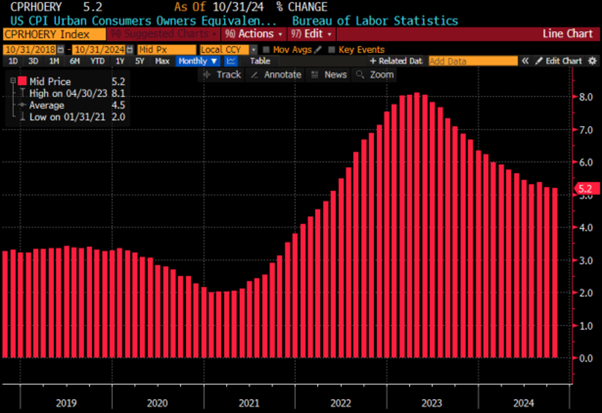

As an additional sign of persistent inflation, the Owners' Equivalent Rent (OER), a key indicator of inflation stickiness, grew by 5.2% YoY, similar to the pace in September and still well above the level that any central banker truly committed to fighting inflation would consider an indicator of easing inflation across the US economy. This suggests that property-related inflation remains a significant headwind for those hoping inflation is a thing of the past.

Finally, another data point that should concern the FED Chairman, if he is truly committed to fighting inflation for the good of the American people, is the SuperCore YoY change, which remained unchanged at +4.6%. This is still the highest level since January 2023 and remains far above the increasingly unrealistic 2% inflation target.

Market reactions.

Stocks closed mixed for the day, with slight gains in the Dow, which outperformed the S&P 500 and Nasdaq as they gave up earlier gains. After starting the week above 6,000, the S&P 500 began to lose momentum ahead of the CPI release, with stochastic indicators signaling a potential technical pullback, suggesting the post-election gap could close sooner rather than later.

The majority of sectors closed in the green with Consumer Discretionary and Energy outperforming, but Communication and Technology lagged, limiting the gains in the broader indices.

The US CPI data, which ultimately aligned with expectations, sparked a dovish reaction due to the lack of an upside surprise, with traders raising the probability of a 25-bps rate cut in December to 85%, up from around 60% pre-release.

The initial reaction was to sell the dollar. However, the dollar quickly reversed as focus shifted back to the ‘Trump Trade,’ pushing the DXY to fresh year-to-date highs.

Gold continued its post-election correction, closing below its first key technical support at $2,589. Although oversold, it is likely to pull back further to the May-August resistance, which could now act as new support at $2,466.

Long yields continue to move upward despite what appears to be the calm before the second wave of inflation, suggesting it’s a matter of when, not if, the US 10-year yield breaks above its April high of 4.73%, and even higher sooner rather than later.

Thoughts.

The October CPI, conveniently the first inflation data released after the U.S. presidential election, shows some signs of calm before the inevitable second wave of inflation, which is expected to hit the U.S. by the first quarter of next year at the latest.

However, even before macroeconomic policies favouring tariffs are announced and implemented, the October data shows that core and super-core CPI remain much stickier than what a central banker truly committed to fighting inflation would find acceptable. This signals that with higher import tariffs and tighter immigration policies expected to take effect in the new year, investors should brace for a second wave of headline inflation sooner rather than later. Indeed, higher tariffs on imported goods will inevitably drive-up goods inflation in the coming months, while tighter immigration policies will drive services inflation, which is still running at over 3% year-over-year, much higher for much longer.

Instead of perpetuating the political forward illusion that the 2% inflation target is within reach sooner rather than later and declaring 'mission accomplished,' investors, likely savvier than the thousands of PhDs, understand that hitting 2% by year-end or even by mid-2025 is mathematically impossible. This would require a miraculous disinflation to occur in the first six months under the 47th U.S. president. Indeed, anyone who understands the base effect can draw the following conclusions:

A return to 2.0% inflation in 2024 is mathematically impossible. Even if the CPI prints 0.0% month-over-month for the remainder of the year, the year-over-year change will still end above 2.9% as the disinflationary base effect fades as the year ends. Should month-over-month prices be 0.3% or higher, the CPI year-over-year figure would finish the year just below 4.0%.

For the CPI year-over-year change to return to 2% or lower by the end of the first half of 2025, the monthly inflation rate would need to remain consistently at 0.2% or below until end of June 2025.

If the month-over-month inflation rate reaches 0.2% or higher over the first half of 2025, the year-over-year CPI change will land between 3% and 4.6% by the end of June 2025. This would then force the FED to admit its partisan mistake of easing in the current inflationary boom of the US economy.

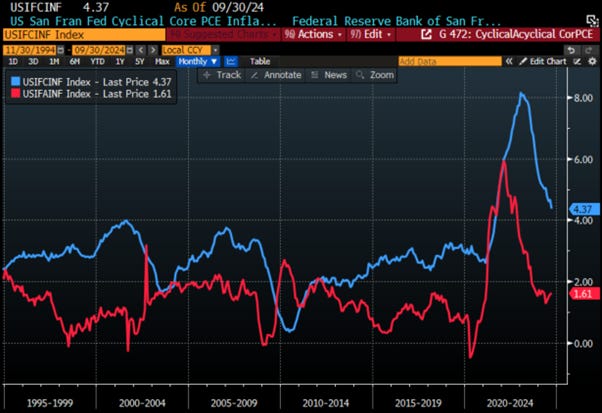

The reason a reflationary phase is ahead for the US is that, regardless of economic policies implemented by January, the acyclical components of the US Core PCE already bottomed out in May. With tariffs and an economic policy focused on tightening trade relationships with key partners, the decline in cyclical Core PCE observed since January 2023 is likely to end within the first months of the 47th U.S. president's term.

US San Francisco FED Cyclical Core PCE Inflation (blue line); US San Francisco FED Acyclical Core PCE Inflation (red line).

Savvy investors understand that, rather than relying on the CPI, manipulated by politicians to spread propaganda, to assess an inflationary environment, they should consider whether government bonds can effectively hedge their wealth against debasement relative to the only asset with no counterparty risk: gold. Indeed, everyone knows that gold serves as the ultimate hedge against reckless government policies that create inflation and currency debasement to default on obligations. With the gold-to-U.S. Treasury ratio above its 7-year moving average since July 2019, regardless of political or economic rhetoric, the US remains in an inflationary environment.

Gold to US Treasury ratio (blue line); 84-month Moving Average of Gold to US Treasury ratio (red line).

With other major economic blocs like Europe, Japan, and China also showing market data of being in an inflationary (i.e., currency debasement) environment, despite government-spread propaganda in these regions, the world, in general, is unequivocally in a high-inflation environment.

Gold to Chinese Bond ratio in CNY (blue line); 84-month Moving Average of Gold to Chinese Bond ratio in CNY ratio (red line).

Gold to Japanese Bond ratio in JPY (blue line); 84-month Moving Average of Gold to Japanese Bond ratio in JPY ratio (red line).

Gold to German Bond ratio in EUR (blue line); 84-month Moving Average of Gold to German Bond ratio in EUR ratio (red line).

Additionally, rising tariffs in the US threaten to squeeze both allies and adversaries alike, potentially fragmenting global trade and creating an ‘imperial preference zone’ similar to the 1930s British Empire trading system, aligning with America's allies. Paradoxically, this could lead to a world where both gold and the US dollar continue to rise, as they did in the 1970s.

Gold to US Treasury ratio (blue line); 84-month Moving Average of Gold to US Treasury ratio (red line); USD Gold price 12-month Rate of Change (middle panel; yellow histogram); DXY Index 12-month Rate of Change (lower panel; green histogram).

Inflation will be the central issue in 2025, echoing the 1970s as demand embeds cost pressures in consumer expectations. Following the 2024 election, inflation risks could intensify, with bond markets already reacting; rising yields may gradually erode the stock market, leaving equity investors at risk of a slow ‘sandpapering.’

At the same time, the FED under Powell has been, and remains, reluctant to tighten, as evidenced years ago by its use of the loaded term ‘transitory inflation.’ Additionally, US policymakers blur their inflation target by using too many different measures, such as CPI, core CPI, core services, PCE, and wage rates. Yet, despite missing nearly all of them, they still cut Fed funds rates. Moreover, they provide no information on their ‘reaction function’ (e.g., a revised Taylor Rule) to clarify how FED funds will adjust when these targets are missed.

Taylor Rule Model and Theoretical FED Fund Rate.

The latest November FOMC Statement reveals that Chair Powell believes (1) US inflation is declining, (2) the economy remains strong, (3) FED policy is restrictive, (4) the FED is still seeking a neutral rate, known only to the FED when they reach it, and (5) they aim to reduce the FED’s balance sheet while also cutting rates.

The FED’s gambit now centres on managing 10-year Treasury yields using a mix of tools Fed funds, Forward Guidance, and indirect QE measures, emphasizing the bond market’s stability over the real economy. However, with inflationary pressures persisting since 2019, US Treasuries have underperformed, suggesting that investors must stay away from the government bond asset class among the 4 asset classes of the permanent Browne portfolio and replace them by gold.

Gold to US Treasury ratio (blue line); 84-month Moving Average of Gold to US Treasury ratio (red line); USD Gold price 12-month Rate of Change (middle panel; yellow histogram); Bloomberg US Treasury Total Return Index 12-month Rate of Change (lower panel; green histogram).

Across World bond markets there are few unrelated events as international bond vigilantes have noticed universally weak policymakers. In this context, the 10-year bond yields reflect both a persistently high peak policy rate and a rising term premium, largely ignoring recent rate cuts by the FED, ECB, and Bank of England—suggesting a bleak outlook for fixed income markets.

Inflation matters because it drains global liquidity and shifts asset preferences, signalling the end of neo-Wicksellian policy, r-star, and Forward Guidance. The FED is unlikely to raise rates enough to curb inflation due to the enormous federal debt interest burden, especially with cost inflation rising from higher wages and tariffs. Inflation is crucial for asset valuations as stocks and bonds perform best under low, stable inflation but lose appeal in favour of real assets as inflation rises above 2-3% annually.

How embedded is inflation? The following chart shows an alternative way of understanding future inflation risks through the pass-thru’ parameter for US price changes. The chart shows the persistence, measured in months, of price shocks. It can be considered as a gauge of rising and falling inflation expectations. The data peaked at 31.5 months in 2021 and then fell rapidly. But worrying the chart has just flipped higher again.

The US Treasury currently pays over $1 trillion annually in interest on $36 trillion of debt, averaging 2.8% per dollar borrowed. With one-third of this debt set to roll over in the next year at an expected 4.3% rate, the effective interest cost could rise by 18%, highlighting the need for the Treasury and FED to cap bond yields as the liquidity tsunami hits the Great Wall of Debt. Recently, the Treasury has limited long-term debt issuance to pension and insurance funds, reducing long-dated yields. Treasury bills now make up over 22% of public debt, with issuance up by $1.9 trillion through October, creating an estimated 100bp gap, or $350 billion in potential interest savings. Unlike the 1980s bond vigilantes, today’s speculative hedge funds, focused on low volatility ‘basis trades’. In this context, they and all investors should closely watch the MOVE index of Treasury market volatility, which remains elevated despite a post-election dip.

Investors should know by now that the stronger the relative performance of gold to US Treasuries, the higher the relative volatility of bonds (i.e., the MOVE Index) to gold volatility (XAU/USD 3-month implied volatility index). A structurally debasement of the USD reinforces gold as the only antifragile asset to hold in a diversified portfolio for USD investors as well as for other investors in all major economies.

Upper Panel: Ratio between the ICE BofA MOVE Index and the XAU-USD 3-month ATM implied volatility rebased at 100 as of December 31st, 2004; Lower Panel Gold to US Treasury Ratio (green line); 84-month Moving Average of Gold to US Treasury Ratio (red line).

At the end of the day, before popping the champagne and declaring inflation a thing of the past, investors should never forget that historically, inflation moves in waves. As the 2020s resemble the 1970s lost decade, with geopolitical unrest (i.e., wars) and structural inflation driven by tighter regulations, tied to the climate change scam and the ludicrous Diversity, Equity, and Inclusion narrative, investors should hold their breath for the second wave of inflation.

US CPI YoY Change between 1970 and 1979 (blue line); between 2017 and 2027 (red line).

Therefore, the 2% target is now at best a floor rather than a ceiling or average. This means that in a 3%-4% inflation environment, a 5% interest rate is far from being restrictive.

FED Fund Rate (blue line); US CPI YoY change (red line); Spread between FED Fund Rate & US CPI YoY Change (green line) and correlation.

Those who believe that a partisan FED Chair and "Trumponomics 2.0" will solve the inflation problem and other problems of the world are in for a rude awakening, as tariffs, and continued uneconomic spending on forever bankers wars in the Middle East and elsewhere to fight against those which do not comply with the US imperialistic world order will only lead to more inflation-driven misery.

Finally, with the S&P 500-to-Gold ratio still struggling above its 7-year moving average, investors should remain aware that, while the US economy is currently in an inflationary boom, it may be only 6 to 9 months away from shifting into an inflationary bust (i.e., stagflation). STAGFLATION will be painful for investors who haven't prepared their portfolios for this scenario. In this environment, people will buy even less for even more, and it will be challenging for those still blindly following Wall Street's ‘Forward Confusion’ narrative of seeking refuge in long dated fixed income papers and government bonds. Physical GOLD remains the only asset likely to thrive during an inflationary bust.

Bottom line: Any savvy investor should know that, regardless of decisions by the 47th US president, the country is only months away from an inflationary bust that will be painful for both investors and consumers, much like the 1970s. Just as wars and turmoil drove inflation then, actively trading equities and holding a significant portion of a portfolio in hard assets like physical gold, rather than in long-dated bonds, will be the best strategy to preserve wealth amid rising taxes and structural inflation caused by war-driven shortages and other imperialistic economic rhetoric.

Key takeaways.

After hot CPI prints in Q1, cooler data in Q2, and a mixed Q3, Q4 started with another set of data showing that, for the time being, the calm preceding the second wave of inflation, expected to gain pace in early 2025, still prevails. However, there are also clear signs that inflation stickiness has not been defeated.

In this context, any investors with a minimum of common sense should get ready for the return of the inflation boomerang, which will accelerate even faster once the political circus surrounding the White House is over.

With services unlikely to moderate and good inflation rising, the path forward in the US leads to stagflation, marked by inflationary pressures and economic stagnation.

While the FED may believe that savvy investors fail to grasp the impact of base effects, the reality is that reaching 2% inflation by end of 2025 is a phantasmagorical illusion.

In a stagflationary environment, investors need to understand that protecting their wealth involves avoiding long-dated government bonds and focusing on a combination of equities from companies that can maintain pricing power with strong balance sheets and robust business models and physical gold as THE antifragile asset.

As stagflation rather than recession worsens in the next few months, investors should prepare their portfolios for HIGHER volatility.

In this context, investors should also remain prepared for dull inflation-adjusted returns in the foreseeable future.

Bottom line: While the Federal Reserve has cut interest rates by 75 basis points over the past two FOMC meetings, the reality is that the partisan, politically driven Fed chair has become impotent at managing the US economy in an environment primed for massive reflation. Investors should question the credibility of a central bank that aids the political establishment to address the illusion of corporate price gouging. In truth, structurally high inflation is being driven by reckless government spending aimed at maintaining power and perpetuating endless bankers' wars, adding further inflationary pressures.

With growing fears of civil unrest as the 47th US president takes office, uncertainty is set to increase, which could lower consumer spending while driving inflation higher. Ultimately, Powell and his PhD colleagues know that inflation rises during wartime. Wall Street bankers are once again misguided if they believe rate cuts alone will resolve these issues.

To navigate the upcoming volatility, investors should focus on low-leverage companies capable of sustaining EPS and FCF growth, focusing on sectors like energy and tech with quasi-monopolistic positions. In fixed income, avoid long-dated bonds, especially government bonds with maturities over six months. For managing their cash actively, investor must consider investment-grade corporate bonds with maturities under 12 months. Ultimately, they should replace long-dated fixed income investments with physical gold, silver, and other hard commodities, making up 20-40% of the portfolio depending on risk tolerance. These antifragile assets will benefit from scarcity premiums during times of war and the rising risk of a sovereign debt crisis, first in Japan and Europe and finally in the US before the end of the presidency of the 47th president which could be shorter lived than most political analysts expect. Investors can still keep partying, but they should dance near the exit door, as there are increasing signs that the music could stop much sooner than expected, given the false hopes surrounding the inauguration of the 47th US president.

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

Do holding miners count as commodities? Or do they get hit with increased costs/inflation along with the rising commodity revenue?