THE WEEK THAT IT WAS...

As the world celebrated the 80th anniversary of Victory Day with parades, the focus shifted to the FOMC meeting, non-manufacturing ISM data, and China’s inflation figures. With 94 S&P 500 companies reporting, the first-quarter earnings season concluded its last busiest week.

As expected—and in true “nothing to see here” fashion—China’s economy continues to flirt with deflation like it’s a long-term relationship. Despite the supposedly opening shots of a trade war with the U.S., consumer prices in April barely moved, with CPI YoY stuck at a romantic -0.1%. Meanwhile, factories have now been offering discount vibes for a record 31 straight months, with PPI falling 2.7%—a bit worse than March’s 2.5% and just shy of economists' thrilling guess of 2.8%.

Ultimately, equity investors know the real game is margin expansion—how well companies can dodge deflation’s punch while still charging customers’ full price. And on that front, China’s got a leg up: unlike the recent U.S. trend, the spread between Core CPI and PPI YoY remains positive and comfortably above 2.0%. That margin-friendly setup could fuel a long-overdue re-rating of Chinese equities—and who knows, maybe even be the spark that helps Make China Great Again.

Spread between China Core CPI & PPI (histogram); MSCI China 12-months Fwd P/E (blue line).

After May Day's weak manufacturing data, Cinco de Mayo brought a surprise: the ISM Services Index jumped to 51.6 — safely above the recession line and economists' low expectations. Prices paid surged to a 2022 high, with vendors hiking prices despite pushback, and tariff confusion making budgeting feel like guesswork. New orders ticked up, business activity cooled a bit, and hiring stayed stuck in reverse. Some rushed to buy cars before tariffs hit; others are eyeing a return to "Made in America." In short: services are still growing, but Trump's tariffs are already causing companies to panic-buy, rethink supply chains, and freeze hiring — so yes, the art of global chaos is working as planned.

As expected, the Federal Open Market Committee played it safe and left the federal funds rate sitting comfortably at 4.25%–4.5%, like a guest who refuses to leave the party. In their post-meeting press release, FED officials warned that risks are now popping up from every direction—basically, it's a choose-your-own-adventure between inflation and stagnation. And just to spice things up, they added a special shout-out to trade’s drag on GDP in Q1—because why not blame tariffs while you're at it? In his press conference, Powell opened with the usual nod to the FED’s dual mandate, but when pressed on whether inflation or unemployment would take priority, he gracefully admitted he has no idea—which, in central banker speak, is as close as you get to waving a white flag. He also added that the committee doesn’t need to rush into any rate changes—mainly because the FED still hasn’t quite figured out where the economy is going. Asked whether recent comments from the White House had influenced the committee’s thinking, Powell politely dodged any hint that outside pressure might affect monetary policy.

While Wall Street and the ‘Manipulator In Chief’ keep begging for rate cuts and media cheerleaders fan the fear, markets cling to the fantasy that the toothless FED will save the day, pricing in three cuts by year-end, starting in July with 68% odds. But in reality, no cut may come, and the FED might even have to hike to salvage what’s left of its credibility as inflation bites back.

The Truman Show’s roots trace back to screenwriter Andrew Niccol’s dark idea, The Malcolm Show—a dystopian thriller about a guy unknowingly trapped in a corporate-sponsored fishbowl. Enter director Peter Weir, who swapped the doom-and-gloom for satire and cast Jim Carrey in a rare "no rubber face" role. By the time it hit theatres in 1998, The Truman Show was serving up Orwell-lite with a side of media critique, long before reality TV and Instagram influencers made self-surveillance trendy. The film warned us: if someone controls the camera, they probably control the truth.

Fast-forward to today’s financial markets are a dystopian version of the Truman Show, where investors play Truman in suits. Central banks script the plot, financial media handles PR, and algos keep the extras moving. Gold, the quiet rebel of the story, is inevitably soaring in a world of debt, war, and inflation. But the reality is that derivatives and interventions keep its price on a leash. The smart money? It’s pulling a Truman—looking for the exit, ignoring the set, and realizing gold isn’t just another asset, it’s a crack in the façade.

Savvy investors know it's not just the economy that moves in cycles—wars do too. And behind both? Capital flows, quietly steering the ship of history. From ancient trade caravans to digital wire transfers, money has always chased opportunity (and occasionally, fantasy). Cicero warned that tremors in Asia could shake Rome. Aristotle grumbled about money-making long before Marx made it fashionable. Fast forward: colonial powers looted wealth, industrialization shifted capital Westward, and Bretton Woods turned money into a geopolitical chess piece.

Speculative bubbles? Nothing new. The South Sea and Mississippi Bubbles of the early 1700s were fueled by cross-border FOMO, as investors from across Europe piled into pipe dreams of gold, trade, and Louisiana swamps. Spoiler alert: it didn’t end well. Fortunes vanished faster than John Law’s credibility. Then came the Panic of 1896—silver crashed, railroads tanked, and American banks folded like cheap tents. British capital swooped in, buying up distressed assets and reminding everyone that when one market sneezes, another sees a buying opportunity.

Now? We’re seeing déjà vu with a twist. Despite mainstream spin, the biggest capital flow of 2025 isn’t tech stocks or politically driven crypto scams—it’s gold, which has been quietly fleeing London and Zurich vaults for Comex’s Manhattan fortress. The excuse? Tariffs. The reality? Those in the know suspect capital controls are coming to Europe. Why? Because the war cycle is heating up on the continent’s eastern flank, and history shows what happens next: controls, confiscations, and a rush for the exits. Gold, once again, is the canary in the vault.

https://www.ft.com/content/86a5fafd-603e-4ee1-9620-39b5f4465f53

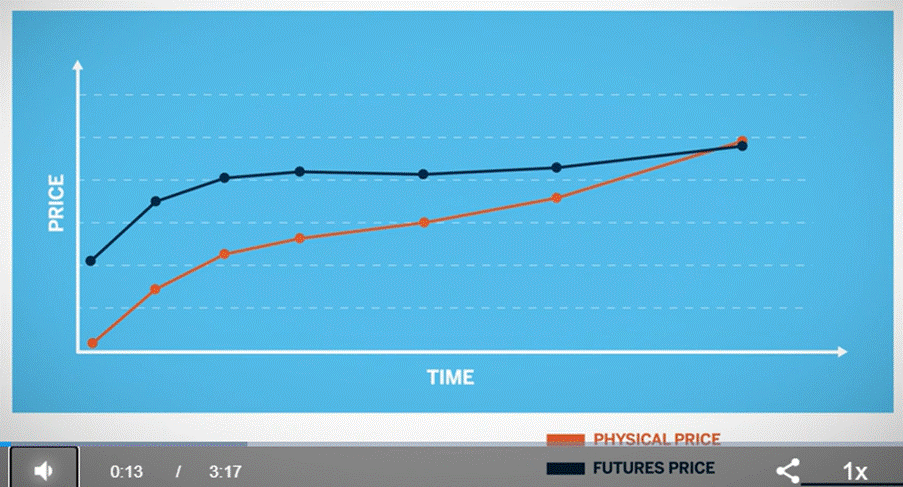

The COMEX (run by CME Group) is basically Wall Street’s version of a gold casino—where most of the shiny stuff is traded on paper, not in hand. It’s a place where two parties—one betting prices will rise (the long), the other betting they’ll fall (the short)—duel it out in the futures market, with the Comex acting as the referee.

Most traders never touch real metal; they just roll contracts from month to month like it's a game of financial hot potato. But if someone really wants delivery (read: prefers bars to spreadsheets), they have to pony up the full value before the “First Position Date.” That’s when the short has to cough up actual gold.

Futures come with leverage too—why buy $180K of gold when you can just throw down 15% as margin and pretend you own it? But if you post the full amount and don’t roll, you’re saying, “I want the bars.” Once delivered, those bars usually stay in the Comex vault, stamped as “Registered”—basically an “Eligible” bar with a backstage pass (a warrant) saying it’s good to go.

Bottom line: it’s all fun and leverage until someone asks for delivery. Then the real game begins.

Since the U.S. election on November 5th, gold traders and financial institutions have quietly shifted around 24 million troy ounces (roughly 746 tons) into Comex vaults—clearly, someone’s not feeling great about what’s ahead. With total gold stockpiles in Comex storage now hitting 39.15 million ounces, that’s almost the highest level in 35 years—beating even the pandemic panic of May 2020, when everyone suddenly remembered gold doesn’t default or need a bailout.

Comex Gold Inventory data & Monthly Change

Tracking delivery data is like peeking behind the curtain of the paper gold game. When investors actually take delivery, it’s not for fun—they’ve paid the full contract value and signed up for storage costs, so chances are they want the real deal. While there are many reasons to take delivery, a surge in these requests could signal a looming “bank run” on gold—only instead of dollar bills, it’s bars of metal.

Since 2019—and especially post-2020—more players have been saying, “I’ll take the bars, thanks.” If that trend keeps up (or picks up speed), things could get interesting fast. That’s because, eventually, someone has to cough up real metal—not just IOUs—putting serious pressure on supply and potentially sending gold and silver prices much higher.

Source: COMEX.

Since the U.S. election, the COMEX has been busier than a Black Friday sale—with gold deliveries hitting levels not seen before. This spike has been driven by a juicy arbitrage opportunity between spot and futures prices, which traders were more than happy to exploit. While things have cooled a bit, the market’s still behaving like it had one too many espressos. April stood out in particular—racking up 64,514 contracts delivered, the second-highest on record. That’s about $21.3 billion worth of gold handed over. So yes, someone out there really wants their metal.

Spread in $ between Futures & Spot Price.

Switching gears to Comex physical inventories…Comex stores gold in two main categories: Eligible and Registered. Eligible means the gold meets exchange standards and sits in a Comex-approved vault but can’t be delivered until it’s tagged with a warrant. Registered gold, on the other hand, has that warrant—it’s ready to go for anyone demanding physical delivery. Pledged gold is just Registered gold that's being used as collateral, so it is grouped under Registered for simplicity.

Interestingly, inventory levels have dropped since April—possibly because someone opted to skip the usual cash settlement and actually walked off with the metal. Unlike 2019, when Registered gold all but vanished and vaults were stuffed with “Eligible-but-hands-off” bars, we’re now seeing a solid stock of Registered gold. That’s a big deal—it means more gold is ready for delivery, but it also raises the question: who’s prepping for something and quietly calling in the shiny stuff?

Comex Registered Gold Inventory (blue histogram); Comex Eligible Gold Inventory (red histogram).

Unlike ‘paper’ gold—which is basically financial cosplay with no metal involved—COMEX gold futures can be settled in real, shiny bars. But here’s the kicker: in 2018, only 1.6 million ounces (a mere 51 tonnes) actually changed hands. That means 99.98% of traders said, “Nah, I’m good” when it came time to take delivery. As for where the real stuff is piling up? Just three vaults—Brink's, HSBC, and JPMorgan—are hoarding more than 80% of all COMEX gold. And JPMorgan? They’re not just in the lead—they’re basically the Fort Knox of Wall Street. Seems like when it comes to physical gold, the big players are making sure they’ve got their hands on the goods... just in case the music stops.

Interestingly, gold has been partying hard since February—but the usual crowd of COMEX speculators didn’t get the invite. Prices have surged without much action in speculative futures, meaning this rally has legs... but no cheerleaders.

Implied holdings actually peaked in early February and have dropped since, even as gold keeps printing higher highs and lows. With just 567 tons in non-commercial net holdings—the lowest since March 15, 2024, when gold was over $1,000 cheaper—this might just be the most hated gold rally in COMEX history. Spectators are sulking while gold’s doing a solo victory lap.

The same goes for U.S. retail investors—still too comfy (or lazy) to hold the real stuff and instead clinging to gold ETFs like they’re the real deal. Spoiler: they’re not. These paper proxies are about as anti-fragile as a sandcastle in a hurricane.

Gold ETFs only started seeing net inflows in late February 2025, and with 88.9 million ounces under management, they're just now crawling back to where they were in September 2023—when gold was still under $2,000 an ounce. For context, ETF holdings peaked back in Q3 2020, and we’re still 22 million ounces shy of that high. Translation? This gold party isn’t crowded yet. There’s plenty of room before we hit euphoria.

The Jubilee year isn’t even halfway through, and it’s been anything but boring—from trade wars to failed truces in Eastern Europe and the Middle East. Geopolitical risks are quickly becoming a major driver for gold prices in the years ahead. While these events are typically short-lived, if they start to rattle the financial markets, their impact can linger. The Geopolitical Risk (GPR) Index began climbing as the U.S. election approached, with candidates promising to raise tariffs, especially against China, threatening global growth. According to the World Gold Council, every 100-point rise in the GPR Index tends to boost gold by 2.5%. Experts like Dario Caldara and Matteo Iacoviello track these risks using automated searches across major newspapers covering global tensions.

Looking at gold’s price movements over the past 20 years, it’s clear: risk events might be temporary, but if they mess with financial markets, gold rallies. On average, these events lead to a 10% price jump over five weeks, and the rally often takes twice as long to subside. For instance, during the 2008 financial crisis, gold rose 26.5% in 12 weeks, and it took over a year for the price to settle. The same pattern followed in January 2016, and Russia’s invasion of Ukraine saw gold jump 11% in 11 weeks before normalizing.

So, it’s no surprise that as geopolitical risk rises, so does the price of gold. After all, anyone with a clue knows that when war is on the horizon, gold is the only truly anti-fragile asset with zero counterparty risk.

Gold Price in USD (blue line); Geopolitical Risk Index (GPR Index) (red line).

In short, smart money is moving gold from London and Zurich to New York, likely anticipating capital controls and Europe’s escalating war drama. Investors know the drill—history’s shown that in times of war and financial chaos, gold heads to safer spots (like the U.S.). Europe’s facing political instability and rising tariffs, making a sovereign debt crisis a real possibility. And let’s be honest, no one in Canary Wharf or Wall Street is telling their clients that capital controls in the Eurozone could happen sooner than we think. Just look at history: wars always make capital flee to safer places, opening up fresh opportunities.

While the West is still caught up in the COMEX Show, the real story is that China has become a far more significant player in the gold market. With property prices declining and the currency losing ground, the Chinese are getting smarter with their gold buys, pushing more strategic purchasing. This shift is evident in strong fund inflows from major ETF providers. March’s gold rally saw these inflows surge, mirroring a similar trend we’re likely to see in the US when retail and institutional investors start to realize that only gold will help them preserve their wealtth in the inevitable ‘Trump Stagflation’. The writing’s on the wall—China’s buying power is shifting the gold game.

If you ever doubted how seriously China takes gold, consider this: the People's Liberation Army (yes, the actual military) has had its own gold-hunting squad since 1979. Because clearly, tanks and camouflage are the natural tools for geology. This elite bling battalion has dug up over 1,800 tons of gold, helping China snag the title of world’s top gold producer—not by chance, but by military-grade commitment. And it’s not just about digging; the PLA also plays bodyguard, escorting gold convoys through treacherous terrain like they’re protecting a nuclear football. Nothing screams "strategic asset" like armored vehicles hauling gold through dust storms. Clearly, in China, gold isn’t just an anti fragile asset—it’s practically a matter of national defense.

https://www.bullionstar.com/blogs/koos-jansen/chinas-gold-army/

Like Truman Burbank trapped in a shiny illusion, millions of investors watch COMEX each day, thinking they're seeing the real story of gold prices. Spoiler alert: they're not. Behind the glittery paper façade lies a stage managed by algorithms and hype, with physical gold playing the understudy nobody mentions. But savvy investors are starting to walk off set—right into the arms of China, where the real bullion action is quietly stacking up. While Wall Street yells about chart patterns, Chinese buyers are hoarding bars like it's a national sport. April saw gold prices hit record highs (again), and despite some profit-taking, the message is clear: demand for physical is alive, well, and definitely not coming from your local ETF. So enjoy The COMEX Show—where the price is fake, the drama is real, and the truth is sealed in vaults. The only question left: got gold?

As the war cycle is about to accelerate again, savvy investors understand that to preserve and grow their wealth, they must adapt to the business cycle rather than attempt to change it. They should focus on Return OF Capital rather than Return ON Capital, by owning real assets like physical gold and silver, the only antifragile assets with no counterparty risk. They also must hold other commodities to weather the storm unleashed by the ‘Commodity Leviathan.’

Additionally, active cash management is key, using a portfolio of short-dated, investment-grade (IG) USD bonds with maturities under 12 months, and Treasury bills (T-bills) with maturities not exceeding 3 months. These income-generating assets provide much-needed stability. Among equities, investors should continue to favor low-leverage companies with strong EPS and FCF growth, and those that have paid their fair share of income tax, prioritizing energy and commodity producers over consumers.

By doing so, investors can ensure both peace of mind and wealth preservation as the world shifts from a magnificent ‘Goldilocks’ into a Maleficent ‘Gold In Lots.’

WHAT’S ON THE AGENDA NEXT WEEK?

Outside the potential volatility triggered by the visit of the 'Manipulator-in-Chief' to the Middle East, the week of Vesak Day in the Buddhist world will be relatively quiet for investors—aside from another U.S. inflation and retail sales report, as well as fresh consumer inflation expectations and sentiment data from the University of Michigan. The week also marks the start of the U.S. retail earnings season, with Walmart reporting results alongside 11 other companies from the S&P 500 index.

KEY TAKEWAYS.

As the attention turns to geopolitics once again, investors’ factual takeaways are:

· China’s deflation dance continues, but with a positive CPI-PPI spread giving companies room to grow margins, a stealthy equity market comeback might just be in the cards—Make China Great Again, anyone?

· ISM bounce shows services still growing, but Trump’s tariffs are already stirring price hikes, panic-buying, and hiring freezes.

· The ‘Independent’ FED is clueless where the U.S. economy is headed—an increasingly impotent bystander in a business cycle it has never controlled.

· Today’s markets are Truman Show 2.0—gold’s the unscripted rebel, COMEX is the casino, and smart money is already looking for the exit.

· Gold's piling into COMEX vaults like it's 2020 all over again—only this time, the smart money’s not hedging, it’s hoarding.

· COMEX gold may be a paper game for most, but with vaults shrinking and big players hoarding bars like it’s doomsday prep, someone’s clearly gearing up for more than just portfolio rebalancing.

· Gold’s been on a tear since February—rallying without the usual hype squad of speculators or ETF chasers, making this the quietest, most hated bull run since... ever.

· When geopolitics go haywire, gold doesn’t flinch—it rallies, reminding markets that in a world of rising war drums and tariff threats, real safety still glitters.

· While the West obsesses over the COMEX, China is quietly dominating the gold market, with its military-led gold hunts and strategic buys signaling that for China, gold isn't just an antifragile asset—it's a national security priority.

· As the US economy shifts into an inflationary bust, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

· Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

· Gold and silver are eternal hedge against "collective stupidity" and government hegemony, both of which are abundant worldwide.

· With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

· Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

· Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

· In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

The week marking the 80th anniversary of Victory Day will be remembered as about as exciting as a lukewarm cup of tea. As expected, neither the FOMC meeting nor the release of the last significant batch of earnings triggered any real volatility—setting the stage for what could be a far more interesting week from a geopolitical standpoint. While the Nasdaq 100 and the S&P 500 consolidated above their respective 61.8% Fibonacci retracements (5,646 and 20,052 on the one-year chart), the Dow Jones and the Magnificent 7 remain stuck in a tight trading range between their 50.0% retracement levels (40,842 and 22,776) and their 61.8% levels (41,841 and 22,776).

Despite declining volatility over the past five days, all major U.S. equity indices continue to trend in a higher-lows pattern since the second wave of the “tariff tantrum” on April 21. It is therefore fair to say that the lows for the year in U.S. equity markets are likely behind us. In this context, investors should once again adopt a “buy-the-dip” mentality—especially as short-term volatility driven by geopolitical events may emerge in the week ahead. However, momentum and stochastic indicators across all major indices remain overbought on a daily basis, suggesting a technical correction is overdue. For the higher-lows trend to stay intact, key supports to watch in the coming days include the 50% Fibonacci retracement levels on the one-year chart for the S&P 500 and Nasdaq (5,491 and 19,382), and the 38.2% retracements for the Dow Jones and the Magnificent 7 (39,844 and 21,592). Despite the inevitable doom-and-gloom headlines that will likely accompany the next pullback, investors should resist turning overly bearish. These higher lows are paving the way for potential new all-time highs—particularly for indices like the Dow in the second half of the year. As of April 25, all major U.S. indices are back in daily bullish reversals.

In short, the April 8th closing prices (4,982 for the S&P, 17,090 for the Nasdaq, and 37,645 for the Dow) may very well have marked the bottom for the year. Smart investors will now be watching for the next dip to increase equity exposure—regardless of the noise coming from illiterate journalists who have never managed a single dollar in their entire life.

In this context, Industrials; Consumer Discretionary and Utilities outperformed, while Consumer Staples; Communication Services and Healthcare underperformed.

As of May 9th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for more than 3 months, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

With geopolitical tensions rising, capital is fleeing Europe like it's the Titanic and the lifeboats are full, driving gold prices up and ultimately the dollar to a safe haven status. As the war cycle heats up, savvy investors should rethink custodianship—ditch Europe for places like Singapore and Hong Kong, and if you're in the US, move your assets to red states like Florida and Texas. After all, once the DOGE (Department of Government Efficiency) cleans up the Deep State’s Augean stables, these states will be the new financial hotspots.

No matter how much the fake news media tries to spin it, capital flows into the US and a strengthening USD are all but guaranteed to make the Dow Jones outperform the Nasdaq, since the Dow loves foreign inflows while the Nasdaq is just retail FOMO central. And just to keep the plot thickening, gold and the USD will rise in unison as the US economy smoothly slides from an inflationary boom to an inflationary bust. The best part? Wall Street pundits totally missed this obvious trend in their forecasts—because, of course, the Dow outperforming, along with gold and the USD soaring during the Jubilee year, was too much of a stretch for them to see coming.

Upper Panel: S&P 500/Oil ratio (blue line); 7-Year Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (green line); 7-Year Moving Average of the S&P Gold/Bond ratio (red line); Third Panel: 12-Month Return of Gold price in USD; Lower Panel: 12-Month Return of USD Index.

At the end of the day, despite what a self-proclaimed ‘seasoned’ hedge fund manager turned political preacher Treasury Secretary — who once operated under Soros’s seal of approval — might claim, anyone with a shred of financial sense knows that U.S. assets are ANYTHING BUT ANTIFRAGILE, be it bonds or stocks, especially in a world where dollar-denominated assets have been and remain weaponized against anyone unwilling to obey Washington’s ever-changing rulebook, whether it’s dictated by the deep state or full-blown Trumperialism.

By owning physical gold outside the tightening grip of centralized digital systems, the “old-fashioned” gold holders preserve true autonomy, not just from the USD, but from all fiat currencies racing toward centralization.

Gold in private vaults comes with no compliance protocols, no digital IDs, no counterparty risk, and no reliance on other politically exposed, centralized infrastructures. Unlike digital assets born in 2008, gold protects not just from currency collapse, but also from volatility and centralization. It’s been doing so since 480 BC. That matters. Gold matters—yesterday, today, and especially tomorrow.

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.