The Inflation Boomerang Is Gradually Swinging Back...

What’s behind the numbers?

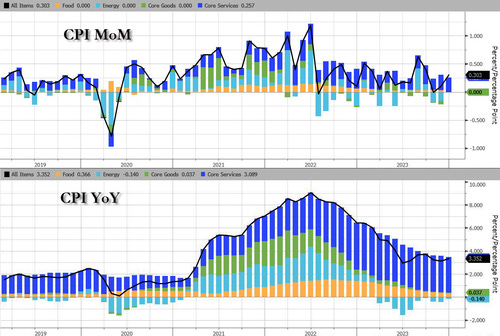

The headline December CPI came in at +0.3% MoM, hotter than +0.2% MoM expected and +0.1% prior. This pushed the YoY CPI change to +3.4% (hotter than +3.2% expected) from 3.1% YoY change in November.

On the brighter side, core CPI rose 0.3% MoM as expected, dropping the YoY change below 4.00% (3.93%) for the first time since May 2021.

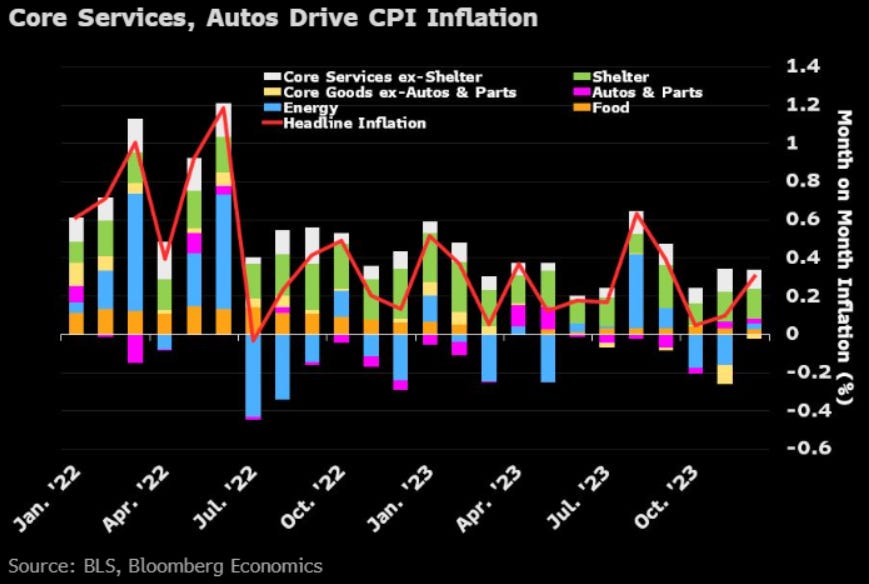

Goods deflation has stalled as the used cars and trucks index rose 0.5% over the month, after rising 1.6% in November. Services (Shelter mostly) costs re-accelerated and energy deflation stalled in December.

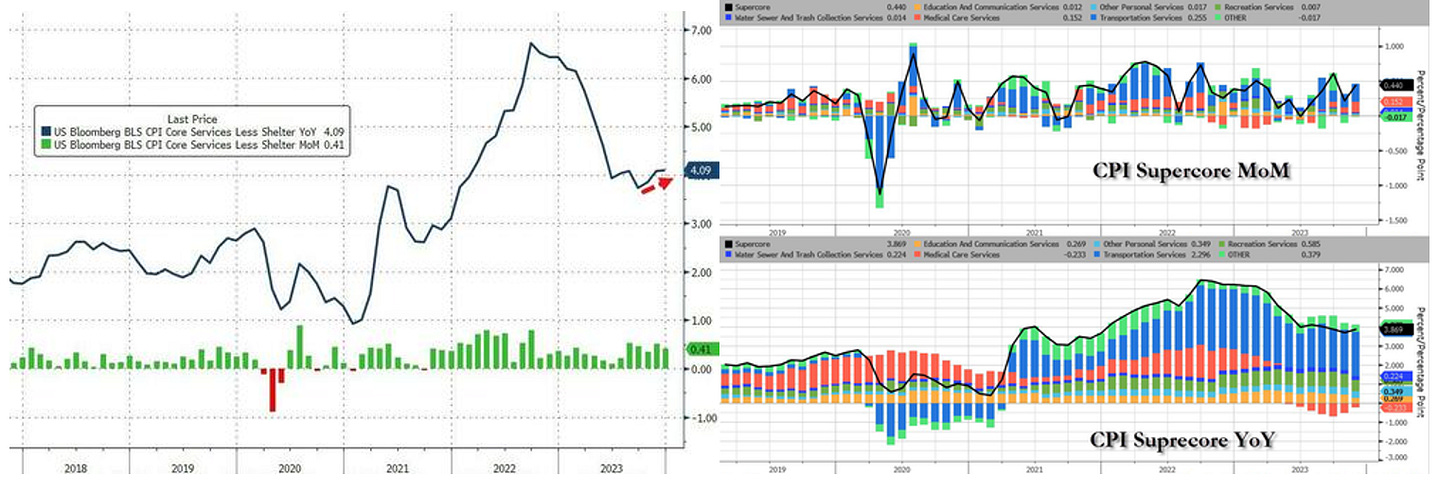

More problematically for the FED (and the rate-cut 'hypers'), is the fact that Core CPI Services Ex-Shelter (SuperCore) rose 0.4% MoM, upticking the YoY rise to +4.09%. All the subsectors of SuperCore rose MoM with the shelter index increased 6.2% over the last year, accounting for over two thirds of the total increase in the all items less food and energy index.

Looking at the details, energy prices added 3 basis points to headline inflation, with gasoline prices increasing by 0.2% (compared to -6% previously) and electricity costs rising by 1.3% (versus 1.4% prior). These gains more than offset the decline in natural gas prices. Core goods prices remained flat, reversing a six-month declining trend. The loss of disinflation momentum can be attributed to a 0.5% rise in used-car prices (versus +1.6% prior) and a 0.3% increase in new car prices (compared to -0.1% prior). However, prices for household furnishings, medical-care commodities, recreation commodities, and education commodities continued to decrease.

On a brighter side, real average hourly earnings rose 0.8% in December, confirming that the US consumers is regaining some pricing power as wages continue to be adjusted upward.

Market reactions.

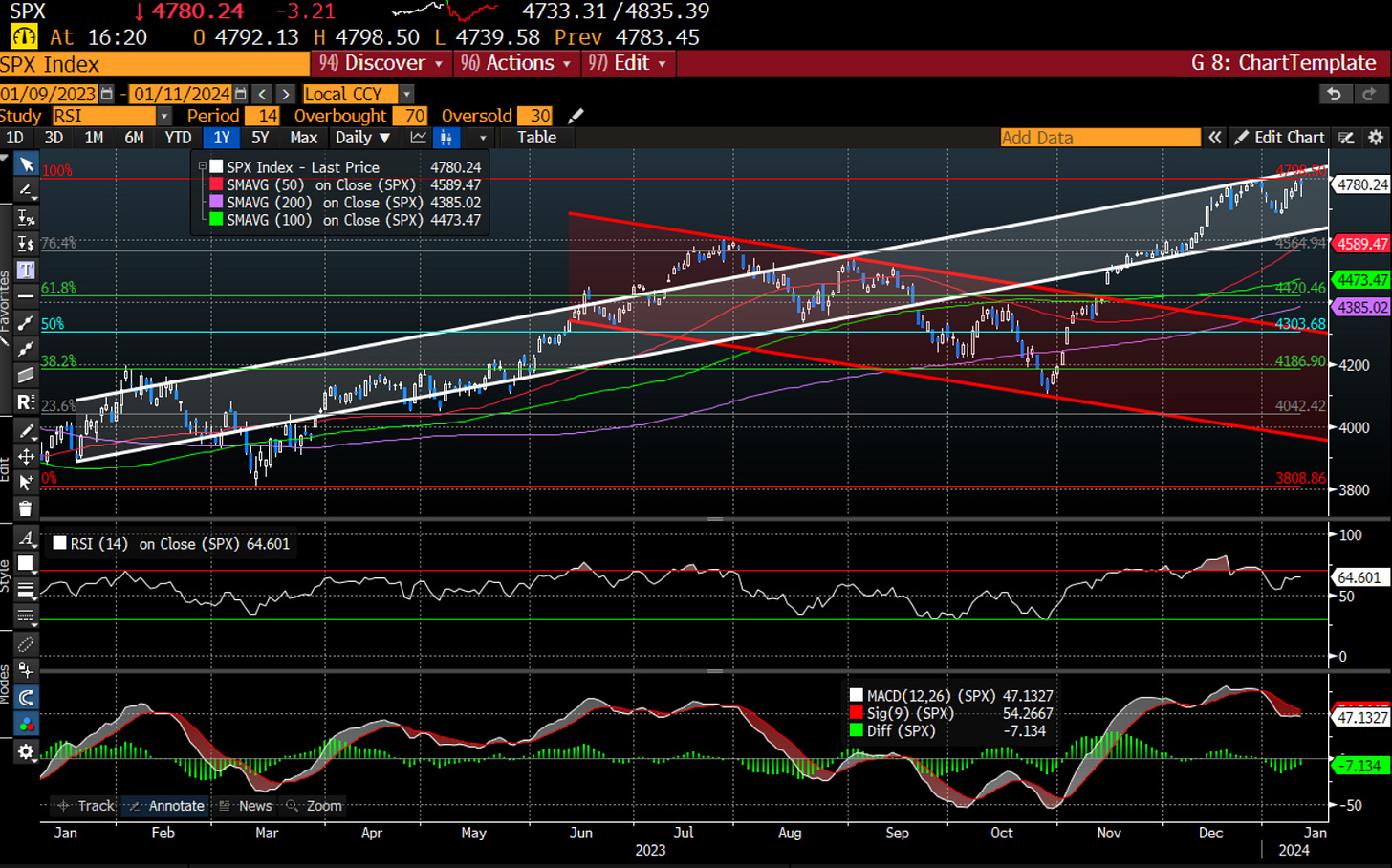

The hot CPI data, initially spark a typical hawkish reaction: Equity and T-note futures tumbled while the Dollar jumped. However, the moves gradually pared throughout the US session, with both Goolsbee (nv) and Barkin (v) noting that the data was in line with expectations. Although Mester (v, retiring) stressed that it shows the FED's job is not done yet, progress on inflation is not stalling. The S&P 500 ended almost unchanged, 18 point below the 52-week high.

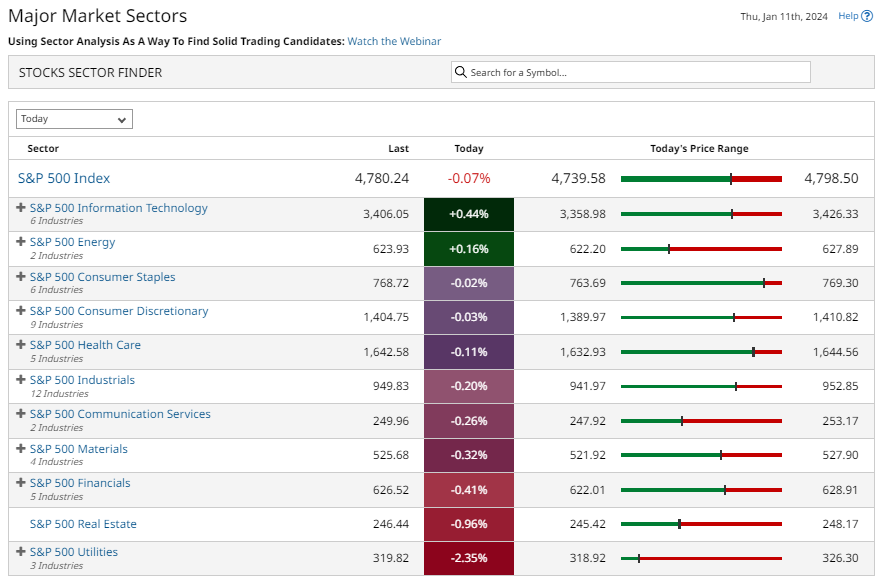

Technology and Energy outperformed while Utilities; Real Estate and Financials lagged behind.

FED pricing shifted dovishly post-CPI, with 154bps of cuts priced across 2024 vs 140bps just before the data. The implied probability of a March cut increased to 79% from 58%, while the first fully priced cut remains the May meeting. Treasury yields close a few bps lower on the session after losses post-CPI were pared into and after the strong 30 year bond auction.

The Dollar was ultimately flat on Thursday after hotter-than-expected US CPI data, which took DXY to highs of 102.76 although it gradually pared throughout the remainder of the session to unchanged levels.

The crude complex initially saw strong gains through the European morning amid heightened Middle East tensions, before paring a large part through the US afternoon.

Thoughts.

The December CPI report is surprisingly solid, but the PCE deflator might show firmer or softer core inflation. The financial-services category has a much larger weight in PCE than in the CPI report, and the significant loosening of financial conditions in December could boost that category. Pulling in the other direction, cars have a smaller weight in PCE, so the CPI increase in car prices won’t boost core PCE as much.

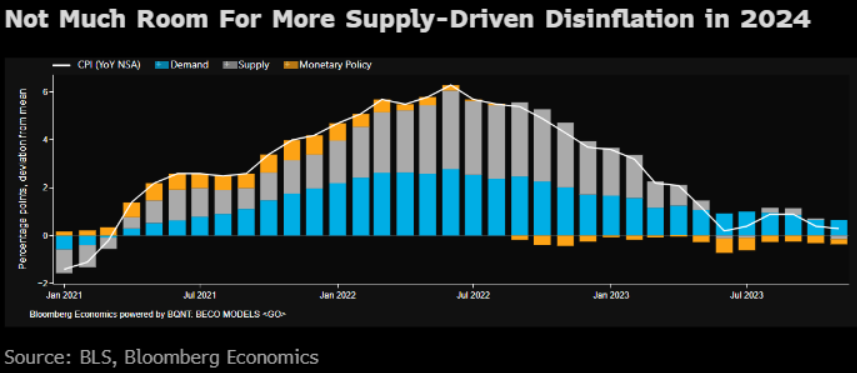

Headline CPI ended 2023 at 3.4% and core at 3.9%, higher than what most analysts forecast at the beginning of the year. With many already declaring victory in the battle against inflation, will the same lesson apply for 2024? We see some key differences between then and now — not all of which support the idea that inflation can return to the 2% target without some hard trade-offs for employment. Indeed, there was much more room in 2023 for supply-driven inflation to fall than there is in 2024. Bloomberg Economics’ inflation-decomposition model shows about two-thirds of the decline in inflation last year was due to supply factors, while excess inflation now is entirely due to demand.

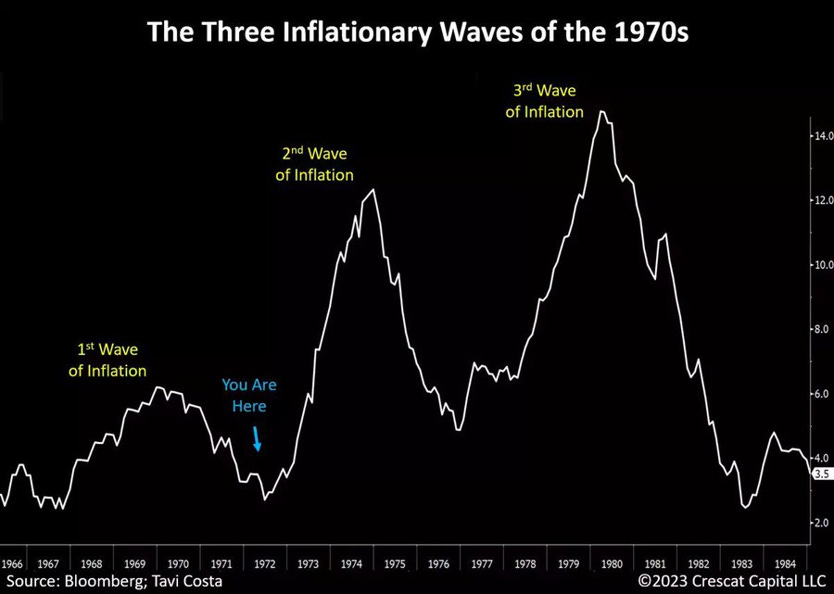

In 2020 and 2021, when supply chains were messed up by Covid disruptions, this pushed good inflation to skyrocket as goods were not available on time to meet consumers' demand. For now the 'Red Sea crisis' is expected to mostly impact Europe rather than the US. However, goods are fungible. They will be diverted from the US if they get higher prices in Europe. If these shipping problems persist, they will impact the US. This will likely disrupt the "last mile" to 2% inflation; reignite a second inflation wave and many Fed rate cuts in 2024.

One of the main hurdles for inflation to durably fall back to the 2% FED inflation target is the slow pace of disinflation in core services ex- shelter – or “supercore” — categories. Already, some businesses have planned sizable price hikes for 2024 — for example, the largest insurer in California is set to raise premiums for housing insurance by 20% and car insurance by 25%. Moreover, more than half of US states are set to hike the minimum wage, with Florida increasing it by as much as 18% this year and California raising fast-food workers’ minimum wages by 30%.

For the first half of 2024, headline CPI inflation is expected to fluctuate in the range between 3.0% and 3.5%, benefiting from further disinflationary effects.

FED futures markets are over-pricing the probability of rate cuts in 2024. The interest rate cuts expected in 2024 will not happen unless we see lower CPI data and a higher unemployment rate in the next 12 months which is unlikely given the latest economic data.

Bottom line: The December CPI report shows it’s premature to say the last mile of disinflation will be achieved as the economy could have to deal with the return of the inflation boomerang in the coming quarters. Similar to the 1970s, holding equities and hard assets, not long dated bonds, remains the most effective means to safeguard investors' purchasing power.

Key takeaways.

The December CPI underscores the choppy nature of getting inflation back in line, in particular in the service sector, which the FED has zoned in on as the last mile in its inflation fight.

Renewed supply chain disruptions, stemming from the geopolitical situation in the Red Sea, could trigger a reacceleration of goods inflation in the coming quarters.

More moderation in services is needed for the US economy to return to the 2.0% inflation target in the next 6-12 months. As the US economy continues to display resilience in the face of the ongoing interest rate hike cycle, the Federal Reserve is likely to maintain its hawkish tone in the foreseeable future to avoid a reacceleration of inflation in H1 2024.

Inflation consensus forecasts for 2024 look too optimistic as the consensus points to headline CPI falling to 2.4% at end of 2024.

While liquidity conditions could tighten in 2024 due to the accelerated refinancing of the corporate sector and the US government, current liquidity conditions remain loose, encouraging speculative behavior. This is contrary to efforts to temper animal spirits and increase risk premia for inflation containment.

Treasuries are set for a pullback after the recent rally which has been mostly driven by the expectations of significantly lower FED Fund Rates in the next 12 months.

A re-tightening of financial conditions is needed before a recession materializes.

Equity markets, influenced by the injection of shadow liquidity from the RRP and cheap energy prices, have completely factored in a soft landing for the next 12 months. At the same time, the bond market has been priced for a recession.

The barbell portfolio (a mix of IT and Energy stocks) with quality companies benefiting from the reshoring narrative should remain the core of the equity portfolio.

In a world of structurally higher inflation, gold, and hard assets in limited supply, NOT government bonds, are expected to be the new 'antifragile assets which are still under owned by the majority of investors.

As the stagflation narrative gains traction going into the US presidential election, investors should remain prepared for dull inflation-adjusted returns.

Bottom line, investors should continue to focus on laggards which include Energy; Materials; Industrials which are expected to outperform in another rebound of the trampoline landing.

At Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.