The Price Of Chaos…

Policy blunders, global flare-ups, and fading trust in government are fueling the runaway train to Trump Stagflation—where prices stick and chaos comes at a cost.

What’s behind the numbers?

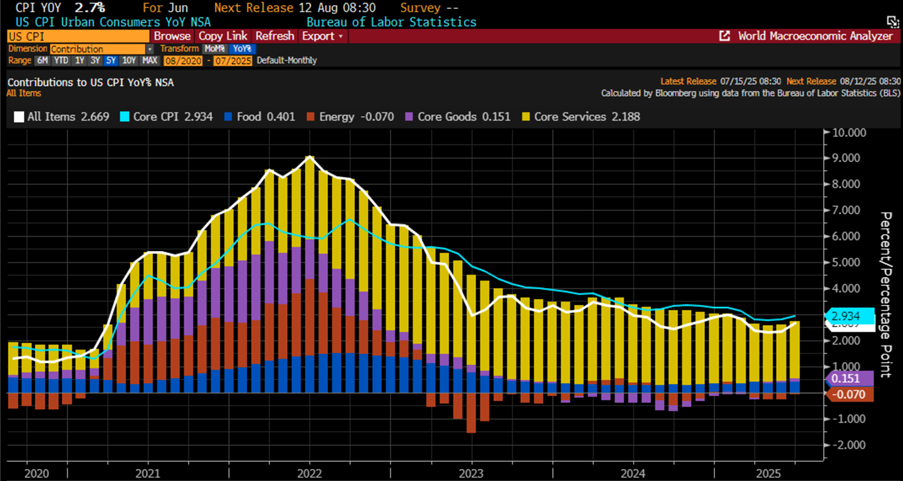

The sixth CPI print of this grand Jubilee Year strutted onto the stage with a +0.3% MoM rise—exactly as forecast, but still a jump from May’s sleepy +0.1%. Year-on-year reflation made a dramatic entrance at +2.7%, beating the +2.6% estimate and marking its flashiest performance since last February—back when tariffs and wars were just PowerPoint slides in the ‘Disruptor In Chief’s’ inbox. Energy once again threw on its superhero cape and saved the deflation narrative (thanks, oil), while goods inflation made its biggest comeback since July 2023. Meanwhile, food prices kept climbing like egg prices on roller skates, and core services quietly kept grinding higher at an annualized 2.2% pace.

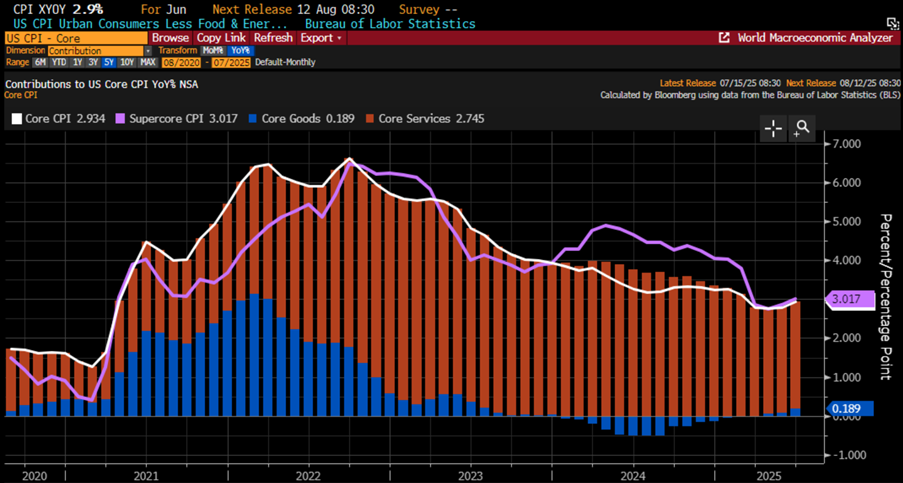

Core CPI rose +0.2% in June—not as hot as the expected +0.3%, but still warmer than May’s tame +0.1%. Year-on-year, it ticked up to 2.9%, right in line with forecasts but slightly up from May’s 2.8%, signalling a not-so-subtle reacceleration. Core services (76% of the index, aka the main course on the inflation buffet) picked up to 2.74% YoY, while core goods turned inflationary again for the first time since December 2023. Oh, and for those keeping score at home—this is month 61 of consecutive core CPI gains. But hey, who’s counting? Just economists, investors, central bankers… and anyone buying groceries.

A favourite stat for the “inflation is over” crowd: Owners' Equivalent Rent—the undead of CPI—held steady at a 4.2% YoY rise in June, its "coolest" print since Jan 2022. So yes, inflation is totally tamed... if you squint hard, ignore rent, food, and reality, and maybe take a deep breath of ‘hopium’.

Even less comforting for the “inflation is dead” cheerleaders: SuperCore CPI—core services ex-housing, a.k.a. the Fed’s favorite excuse to stay “data dependent”—jumped to 3.02% YoY in June, up from 2.86% in May and hitting its highest level since last February. So much for that victory lap—seems the only thing cooling is common sense.

Market reactions.

U.S. stocks threw a mini party after the CPI came in as expected—cue balloons, confetti, and maybe a victory cupcake—before realizing, oops, June’s goods reflation is just the appetizer. The main course? A buffet of tariffs about to hit American companies and wallets alike. Cue the market hangover: the Dow stumbled, the S&P 500 limped, and only the ever-optimistic Nasdaq managed to stay in the green—probably too hyped on cupcake frosting to notice the storm ahead.

The June U.S. CPI print, paired with FED Governor Collins' call for “active patience,” poured some cold water on rate-cut fever—markets now see fewer than two cuts by year-end, with just a 57% chance of a September 25bps trim.

The dollar surged Tuesday, with the Dollar Index hitting 98.699 as markets digested a CPI report that screamed "reflation." With capital flows boomeranging back to the U.S., the greenback looks set to flex its muscles against its fiat peers—higher highs, higher lows, and maybe even a smug victory lap or two in the months ahead.

Gold remains still stuck in that glamorous consolidation party it’s been attending since its all-time high on April 22nd—still printing lower highs like it’s on a discount sale and flirting with lower lows just to keep things interesting.

With Chapter 1 of the Great Reflation Saga now hot off the press, the U.S. 10-year yield finally broke out of its nap just below 4.5%, stretched its legs, and strolled right out of that weeks-long consolidation like it remembered it's supposed to be dramatic.

Thoughts.

June’s CPI confirmed what anyone buying groceries already knew: the deflation blip was a fluke, and the Trump Reflation train has left the station—tariff tax and all. While the “Manipulator in Chief” and his central bank sidekick toast their imaginary 2% victory, aggregate inflation still jogged around 3.15% YoY. But hey, nothing says “success” like reducing corporate margins and taxing consumers with a smile.

US Umbrella inflation Index (Average of CPI; Core CPI; PPI; Core PPI; Core PCE, 1-year consumer inflation expectations)

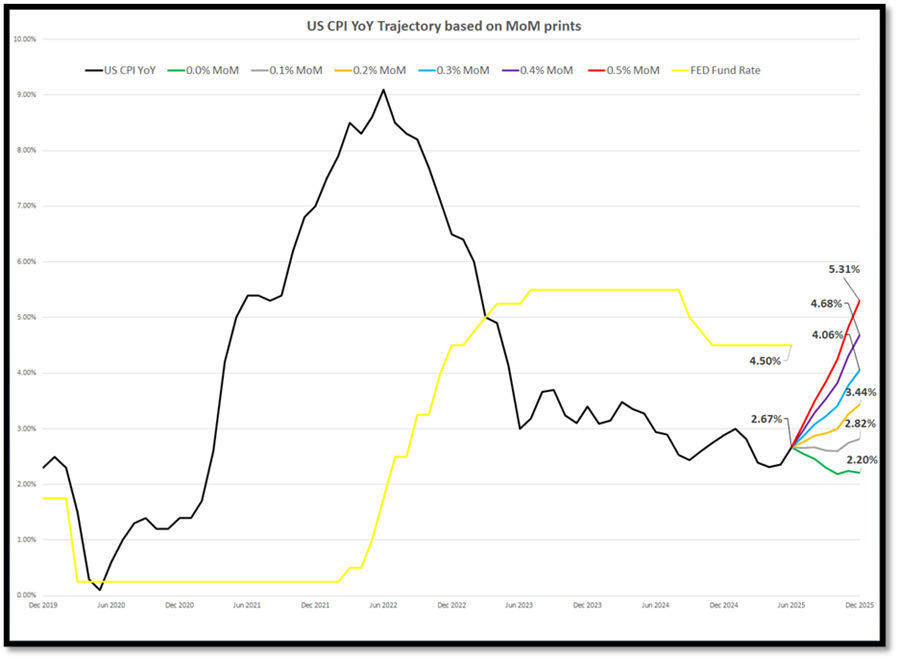

Instead of fantasizing about 2% inflation magically arriving before the end of the Jubilee Year (cue harp music and sparkles), seasoned investors—unlike the caffeine-fuelled PhD army at the FED—know better. In a world stuffed with tariffs and trillion-dollar tabs, math is still a thing.

To hit that 2% dream. CPI would need to moonwalk below 0% monthly—basically, a unicorn riding a flying spreadsheet.

But if those prints inch up to just 0.2% or higher? Get ready for CPI to land somewhere between 3.4% and 5.3% by year’s end.

And in that case, not even Donald Copperfield threatening to saw the “Central Banker in Chief” in half will stop the FED from awkwardly admitting that cutting rates during an inflationary boom might not have been their brightest moment. Rate hike for the autumn, anyone?

Tariffs aren’t inflationary, says the “Treasurer in Chief.” True—it’s not inflation, it’s just a massive tax someone pays. Like Conagra and Helen of Troy, now choking on 7% cost inflation and a cool $200 million tariff hit. But who cares if margins collapse and hiring freezes, as long as elites can chant “Making America Great Again” into the void. Meanwhile, Washington is quietly raising corporate taxes through the back door—because nothing screams pro-business like a tariff bomb.

Investors who’ve truly studied the rhythms of history and the brutal logic of business cycles understand inflation isn’t some mysterious force—it’s born of scarcity, surging demand, and the slow death of trust in public institutions. When tariffs tighten the noose, trade wars ignite, and U.S. imperial bravado fans the flames, the outcome is inevitable: prices rise, confidence crumbles. And if ‘Donald Copperfield’s policies unleash another inflationary spiral or plunge the world into conflict, his political capital will evaporate faster than the promises he made to earn it.

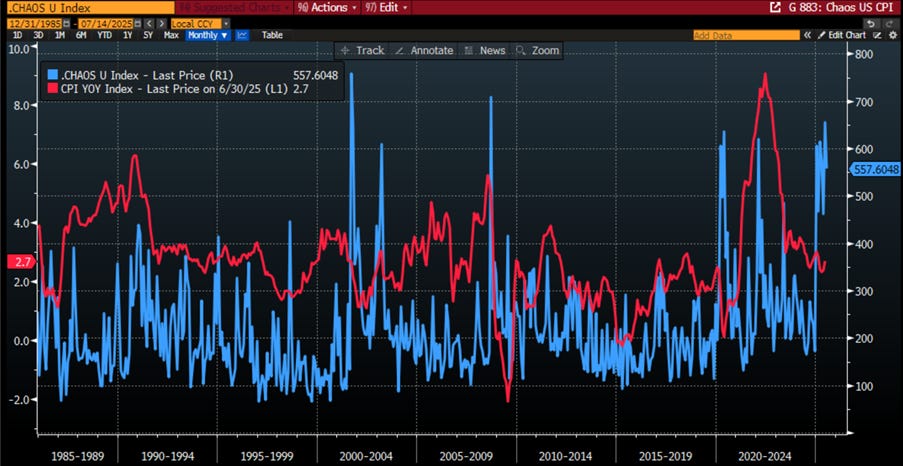

At the end of the day, nobody needs a PhD in economics—or even a full attention span—to see the obvious: when governments spew mixed signals and geopolitics turns into a dramatic soap opera, investors and consumers are left scratching their heads. Confidence erodes faster than a campaign promise, and guess what comes next? Inflation. Rising policy chaos—whether at home or abroad—inevitably fuels rising CPI. It’s not rocket science; it’s just economic gravity… with a side of unhinged social media posts.

Chaos Index (US Economic Policy Uncertainty Index + Caldara Iacoviello Geopolitical Risk (GPR) Uncertainty Daily ) (blue line); US CPI YoY Change (red line).

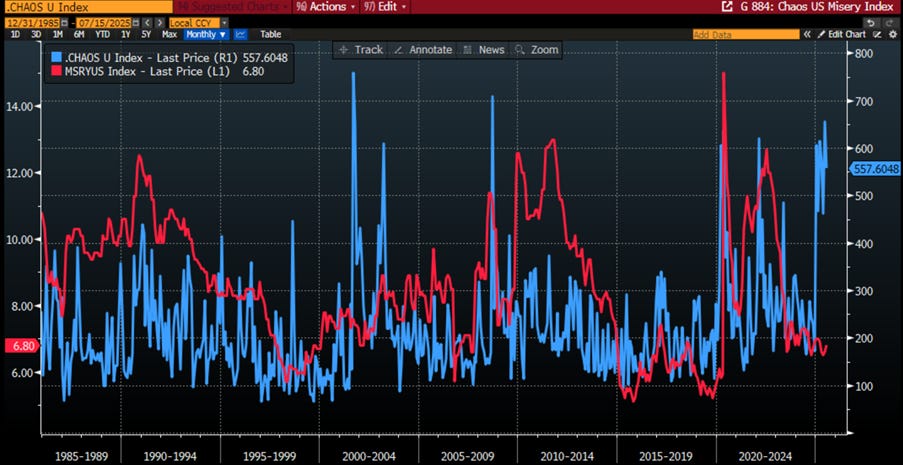

In this kind of policy circus, where uncertainty reigns supreme, it doesn’t take an MBA to figure out that business owners will slam the brakes on hiring and capex. And when spending stalls and layoffs creep in, guess what follows? A nice spike in the misery index. So yes, rising chaos doesn’t just dent confidence—it eventually lands everyone in a full-blown economic hangover.

Chaos Index (US Economic Policy Uncertainty Index + Caldara Iacoviello Geopolitical Risk (GPR) Uncertainty Daily ) (blue line); US Misery Index (red line).

While Keynesians still cling to the fantasy that central bankers and bureaucrats can tame inflation like it’s a house pet, those who’ve studied a chart or two know better. Inflation isn’t summoned by interest rates or buried under mountains of freshly minted toilet-paper dollars—it’s driven by the business cycle and, more specifically, three classic culprits: shortages, strong demand, and eroding trust.

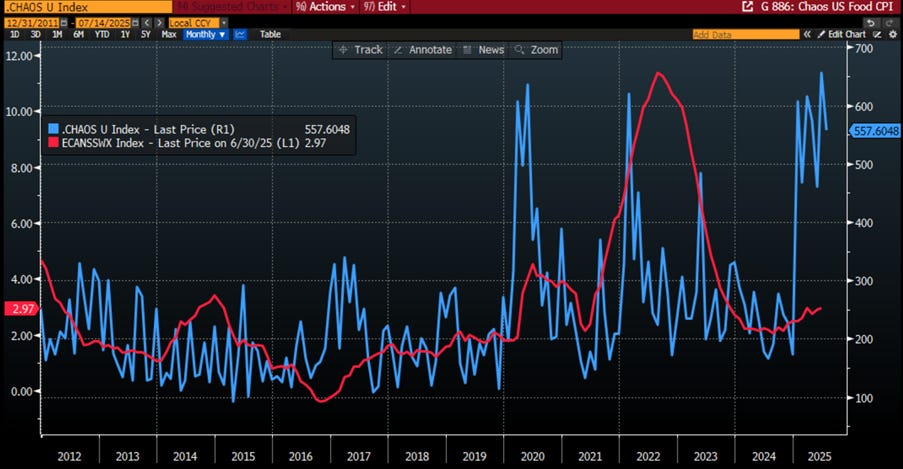

Need proof? Just look at the tight dance between food inflation and the global chaos index. Raising or lowering the Fed funds rate won’t magically grow more wheat. When wars break out or some genius regulators decide to save the world by wrecking supply chains, food gets scarce—and prices soar. And yes, the sun’s solar cycle still beats Jerome Powell’s Excel spreadsheet when it comes to crops.

Chaos Index (US Economic Policy Uncertainty Index + Caldara Iacoviello Geopolitical Risk (GPR) Uncertainty Daily ) (blue line); US CPI Food YoY Change (red line).

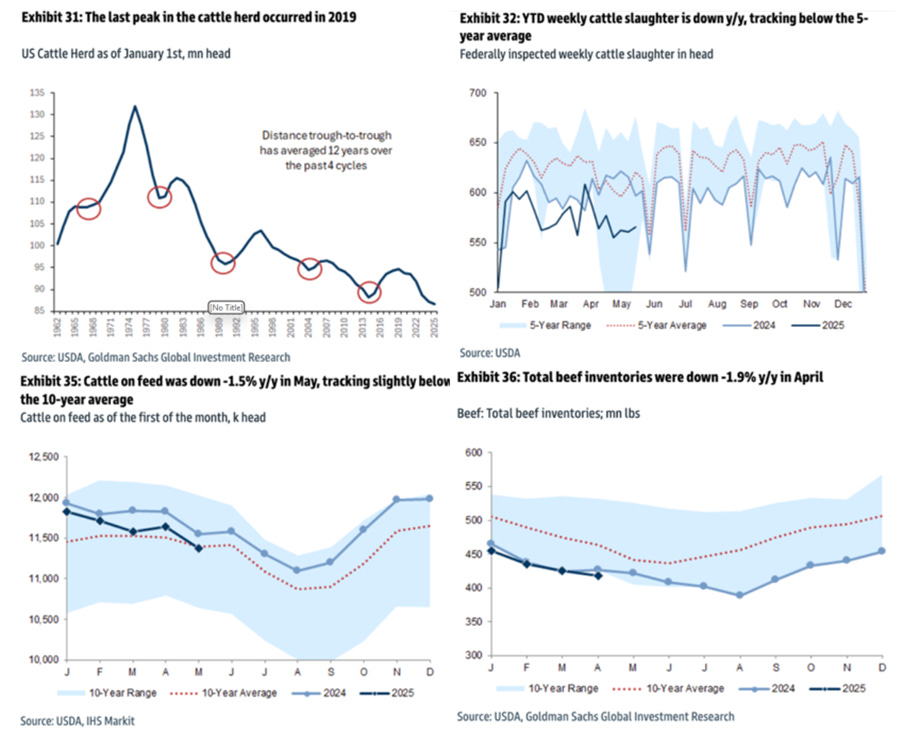

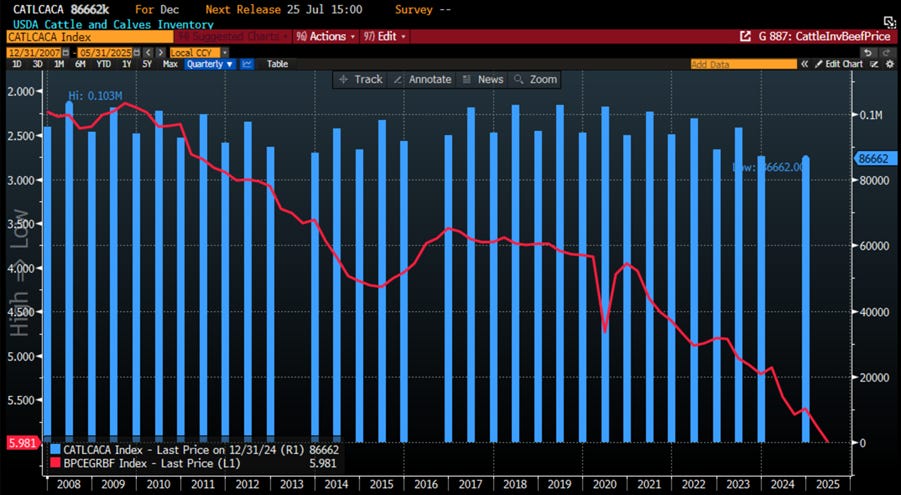

Want to understand how food cycles work? Just follow the cows. The U.S. beef industry runs on a 12-year herd cycle, and after years of liquidation since 2019, the cattle count is now at its lowest since the 1950s—hello, 86.7 million. Rebuilding may be near (thanks to pricey calves and cheap feed), but don’t expect juicy margins anytime soon: tight herds = fewer steaks = squeezed packers.

During Tyson Foods’ May earnings call, Brady Stewart, head of beef and pork operations, signalled the U.S. cattle herd may be bottoming out, with inventory at a 73-year low of 86.7 million head. Record animal weights are easing the supply crunch, but year-over-year volumes remain down. USDA data showed ground beef hitting a new high of nearly $6 per pound in May, but tight supplies and high prices could persist for years. With the MAHA movement gaining traction, more Americans are turning to clean, locally raised beef and distancing themselves from global food giants—perhaps it's time to shake hands with your neighbourhood rancher if you want to survive the next volcanic winter, which could make eating protein daily a luxury akin to owning a Porsche Cayenne for a hedge fund manager on the eve of a bear market.

USDA Cattle & Calves Inventory (histogram); USDA Ground Beef Retail Price Index (axis inverted; red line).

While Wall Street and its well-coiffed pundits have made a full-time job out of demonizing inflation—treating it like Voldemort with a CPI chart—it turns out this so-called villain might just be corporate America’s favourite sidekick. Sure, inflation is a sneaky tax government love to impose while pretending they’re doing you a favour. And yes, they’re desperately trying to inflate their way out of a debt hole deeper than a Netflix true crime plot. But here’s the twist: for Corporate America, inflation means fatter margins, rising prices, and happier shareholders.

S&P 500 Index Operating Margin 12-month forward (Histogram); US CPI YoY index (red line).

Savvy investors know the drill: when inflation sticks around and chaos takes the wheel, bonds flop while stocks and gold put on a show.

US CPI YoY Change (histogram); Relative Performance of S&P 500 Index to Bloomberg US Treasury Total Return Index (blue line); Relative Performance of Gold Price to Bloomberg US Treasury Total Return Index (green line).

Among stocks, savvy investors know that when chaos-driven inflation spreads, it’s time to ditch the YOLO sirens of the Nasdaq and sail back to the sturdy shores of the Dow—especially into old-school energy producers like oil and gas, not energy-hungry tech darlings.

US CPI YoY Change (histogram); Relative Performance of Dow Jones Index to Nasdaq 100 Index (blue line); Relative Performance of S&P 500 Energy Index to S&P 500 IT Index (green line).

Those who see through the Disruptor-in-Chief’s smoke and mirrors—amplified by his social media circus—already know the MAGA narrative was just a Silicon Valley power grab. Turns out, draining the swamp meant flooding it with PayPal Mafia operatives. And no, you don’t need a tinfoil hat to notice that every White House tenant somehow ends up serving the Israeli agenda under the convenient disguise of American imperialism.

https://rumble.com/v6vwuwc-the-final-act-of-jeffrey-epstein.html?e9s=src_v1_clr%2Csrc_v1_upp_a

Oh, Pam Bondi, you’ve royally screwed the pooch. Epstein’s gig wasn’t just pedo nonsense—it was a slick blackmail op, looking more like the good old days ‘women honeypots. Her “no client list” excuse has Dems and MAGA foaming at the mouth, and she’s too busy playing dumb to admit it was an intelligence scheme. CIA? Mossad? Who was Epstein’s boss? MAGA wants Trump to fire her sorry butt before she tanks 2026. Maxwell’s in jail for conspiracy—enticing minors, trafficking, the works. No client list needed; just prove an agreement, and bam, guilty. Bondi’s two-page memo? “No blackmail, no evidence.” Sure, Pam, and the Easter Bunny will appear from Donald’s Copperfield’s hat.

Just before Election Day on November 3rd, 2024, Wikileaks reported that Michael Wolff, author of a Trump White House book, has 100 hours of Jeffrey Epstein discussing Trump but released only a one-minute clip, with outlets like The Daily Beast highlighting claims about Trump’s personal conduct. Recently, it emerged that former Secretary of State Antony Blinken’s stepfather, Samuel Pisar, was a lawyer and confidant to both Robert Maxwell, a media mogul and alleged Mossad operative, and Epstein. Evidence suggests Epstein’s network gathered blackmail material on political figures from both parties, often using the abuse of girls as a means, though mainstream reports, like the Daily Beast’s, avoid mentioning “blackmail.”

Obviously, it’s just common knowledge that nearly every U.S. government rep is swimming in buckets of cash from AIPAC, the American Israel Public Affairs Committee— the shiny, above-board tip of the Israel influence iceberg in American politics. Meanwhile, Epstein and Ghislaine Maxwell are the oh-so-charming underbelly, working the same grand scheme to puppeteer the U.S. government and shove that Zionist agenda down everyone’s throats, whether it’s through good old’ U.S. imperialism or the dazzling spectacle of Trumperialism.

https://www.trackaipac.com/shame

In a sinister web of deceit, the Trump administration's lies about Jeffrey Epstein unravel, exposing a vile alliance with the billionaire paedophile, once his "closest friend." Epstein, a demonic orchestrator of a vast honeypot scheme, lured elites with depravity and blackmail, his "Lolita Express" and secret surveillance rooms ensnaring figures like Presidents; Princes and Businessmen, listed in his cryptic black books. His ties to Israeli intelligence, are also linked through figures like Robert Maxwell’s father-in-law Yehuda Koppel. Despite Trump’s denials, evidence of Epstein’s blackmail—hard drives, lewd photos, and boasts of elite misdeeds—piles up, yet only Ghislaine Maxwell, sentenced for trafficking to no one, faces justice. The FBI and CIA hoard this damning evidence, while the government teases transparency with Epstein’s files, only to bury them in shadows, as AG Pam Bondi’s contradictory promises of disclosure fade into silence.

In a diabolical twist, Donald Copperfield’s abrupt shift on the Epstein case aligns with Netanyahu’s visit, a dark omen of hidden truths. Epstein, a Mossad puppet, wove a web of blackmail, his island’s secrets now clutched by both the US and Israeli overlords. The ties bind tightly, yet the US government, a den of vipers, will never let the Epstein trial surface. Branded a conspiracy to shield the deep state, this scandal erodes trust, fuelling chaos and inflation as citizens, like those in banana republics, learn their leaders—puppets of plutocrats—serve only themselves and their shadowy masters.

Bottom line: Behold the infernal truth, with eyes to see: the 47th president's cabal does not purge the fetid swamp—they merely anoint it with perfumed vipers, clad in finer robes. Their lips drip with populist venom, yet their steps tread the gilded path of plutocracy, crushing the common soul beneath their cloven hooves while embracing the eternal coven of oligarchs, those tech-shrouded demons who never once served the meek but eternally advance the shadowed will of those seeking to stretch their profane dominion from the cursed biblical sands to the accursed Land of Canaan.

Freedom? A cruel jest, granted only to those who kneel before the grimoire scribed by Silicon Valley’s billionaire fiends and the sinister machinations of the alphabet agencies, those veiled puppets of the star of David’s unholy realm.

Meanwhile, not only the ‘Manipulator In Chief’ doubled down on tariffs as if economic isolationism ever ended well but he also contributes every day to spread distrust in public institutions which have already lost the confidence of those who can see through the dark curtains of the White House. The fantasy that trade barriers will “bring jobs back” ignores basic history: America’s trade deficit isn’t because of China—it’s because the U.S. chose to become a consumption-addicted debtor state after WWII. Multinationals offshored for profit. Imports just filled the vacuum.

What the US needs isn’t a tariff tantrum—it’s deregulation, real tax reform, and fiscal restraint. But that won’t happen while the political class is too busy managing its personal portfolios. For investors, the message is blunt: empires in decline tend to self-implode under the weight of war, debt, and delusion. In times like these, hard assets—physical gold, select equities—remain the go-to shelters. Long bonds? Only if you're feeling generous toward the Treasury's spending addiction.

In the end, the tariff crusaders won’t be remembered as patriots. They’ll be the ones who helped script the final chapter of American economic supremacy.

Key takeaways.

CPI’s June’s act: inflation’s back in the spotlight, food’s still climbing, services won’t cool—and the “Jubilee Year” deflation fantasy just took another hit.

Core CPI rose for the 61st straight month—services are simmering, goods are heating up, and the inflation cooldown? Still lost in the FED’s transitory translation.

Inflation’s not dead—it’s just hiding behind stubborn rent hikes and a FED-favourite metric that keeps heating up.

While the ‘Trump-Re-Flation’ gains steam, fuelled by tariffs and tighter labour markets, the real question isn’t if inflation rises, but who picks up the tab: businesses trying to protect margins, or consumers bracing for sticker shock.

With the American economy still reliant on government handouts, the rollout of tariffs is bound to ignite the ‘Trump Stagflation.’

While the FED may downplay base effects, hitting 2% inflation by end of 2025 is quickly turning into another financial circus.

Inflation stems from shortages, demand, and declining confidence, all exacerbated by tariffs and trade barriers that stifle free mercantilism.

In an inflationary bust, investors need to understand that protecting their wealth involves avoiding long-dated government bonds and focusing on a combination of equities from companies that can maintain pricing power with strong balance sheets and robust business models and physical gold as THE antifragile asset.

As stagflation rather than recession worsens in the next few months, investors should prepare their portfolios for HIGHER volatility.

Gold and silver are eternal hedge against "collective stupidity" and government hegemony, both of which are abundant worldwide.

In this context, investors should also remain prepared for dull inflation-adjusted returns in the foreseeable future.

With the S&P 500-to-gold ratio below around its 7-year moving average for almost 6 months, investors should remain aware that, while the US economy is currently in an inflationary boom, it may be only 6 to 9 months away from shifting into an inflationary bust (i.e., stagflation). STAGFLATION will be painful for investors who haven't prepared their portfolios for this scenario. In this environment, people will buy even less for even more, and it will be challenging for those still blindly following Wall Street's ‘Forward Confusion’ narrative of seeking refuge in long dated fixed income papers and government bonds. Physical GOLD remains the only antifragile asset to thrive during an inflationary bust.

Bottom line: As everyone knows, history shows that collapsing public confidence, fuelled by gangrening political corruptions and wars, leads to economic turmoil and this decade will be no different, as the ‘Trump-Re-Flation’, morphs into the 'Trump Stagflation,' which will force everyone, from billionaires to everyday citizens, to pay even more for even less.

As the world sails in tariff shock, investors should favour low-leverage companies with strong EPS and FCF growth, prioritizing energy producers over consumers as the U.S. joins the global inflationary bust, soon known as 'Trump Stagflation.' In fixed income, avoid long-dated bonds, especially government debt beyond six months, and actively manage cash through sub-12-month investment-grade corporate bonds. Ultimately, replacing long-term bonds with more than 25% allocation to physical gold, silver, and hard commodities will provide antifragile protection, as scarcity premiums rise amid a looming sovereign debt crisis, first in Japan and Europe, then inevitably in the U.S., where the 47th president, like his predecessors, repeats failed policies while expecting different results. Indeed, everyone should by now know that consumers and businesses always lose amid trade wars. The tariff game has become tit-for-tat, with nations continually “retaliating” despite the reality that these measures are hurting their own economies.

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

Check out the bitcoin etf with the ticker BITO. It pays out a big dividend monthly. Use the proceeds to buy metals. Win win win