The Solar Health Effect

Solar storms expose the deadly formula of war, migration, and disease—while Washington’s new plutocrats plot their genomic Stargate agenda.

The Week That It Was…

The first week of Q3 in this Jubilee Year was more about fireworks than earnings, as markets from Hong Kong to Canada and the US hit snooze for their national holidays. While half the world hits the beach, the rest of us get treated to the thrilling combo of ISM data and a fresh batch of U.S. jobs numbers. As for earnings? Let’s just say Wall Street’s taking a summer nap—only two S&P 500 companies report, and unless you're deeply passionate about Constellation Brands, it’s probably safe to stay poolside with a margarita.

China’s June PMI was a bit like that glass of champagne at a frat party—it looks bubbly, but the room’s still a mess. Manufacturing production perked up and demand expanded for the first time in three months—cheers to that! But don’t get too carried away (or end up hugging the porcelain bowl), because employment is still shriveling and business confidence is down in the dumps—the weakest since Beijing’s big growth pep talk last September. With the U.S.–China tariff truce expiring in mid‑August, that glass of optimism might evaporate faster than a cold brew on a hot day. Sure, Beijing cranked up construction, signalling support for the economy, but any real stimulus is apparently being saved for late Q3—just in time to either calm nerves or go off-script entirely if trade tensions choke again.

The US ISM manufacturing PMI ticked up to 49.0—cue the applause for being less bad than expected. The bump came from a rebound in production and inventories, not from anything as exciting as actual demand. Firms aren’t betting on a recovery—they’re just hoarding ahead of looming tariffs. New orders dropped, backlogs shrank, and employment fell even faster. But hey, export orders rose—probably because everyone’s racing to beat the end of the “Liberation Day” tariffs truce. Supplier deliveries “improved,” which just means things are slowing more efficiently now. And prices? Still climbing. So, to recap: demand’s fading, workers are getting cut, inflation’s heating up—but sure, let’s celebrate that inventory bounce.

Services sprang back to life in June—just in time to dodge tariffs—though customers still seem to be holding onto their wallets like it’s 2008. Prices stayed annoyingly high, hiring slipped into reverse, and some savvy firms skipped the job ads and just poached laid-off talent from the big guys. In short: business is picking up, but it’s doing so with one eye on costs and the other on tariffs.

With the July 9 tariff ceasefire deadline looming like a piñata full of market chaos—the’ Manipulator In Chief’ decided to sprinkle in some good old-fashioned trade drama. Just in case investors were starting to relax (or nap), he proudly declared a new trade deal with Vietnam. Because nothing says "calm before the storm" like a last-minute handshake while the market sleepwalks into a déjà vu of Liberation Day.

Per the deal, Vietnam agreed to a 20% tariff on exports to the U.S. and a 40% hit on ‘transshipped goods’—aka a not-so-subtle jab at China’s backdoor trade tricks. Translation: Vietnam gets a deal, Xi gets a headache, and Washington gets to poke the dragon… again.

In return for the tariffs, Trump proudly declared that Vietnam would "OPEN THEIR MARKET TO THE UNITED STATES" with zero tariffs—an unprecedented move, apparently. Too bad it’s mostly symbolic, since the U.S. exports about as much to Vietnam as it does moon rocks. What may really matter is that a deal got inked—details be damned—even if it means poking the Chinese dragon. Trump, ever the salesman, may have mastered the art of the deal, but when it comes to the art of war—trade or otherwise—he’s still painting by numbers.

On the surface, the June Non-Farm Payrolls looked like a victory lap: job creation surged unexpectedly, unemployment ticked lower, hourly earnings cooled just enough to soothe inflation hawks, and full-time employment saw a healthy jump.

But scratch beneath the surface, and the celebratory headlines lose their lustre. The bulk of job creation came from Education and Health Services (+51K) and Government (+73K)—sectors either directly funded or heavily subsidized by taxpayer money. In other words, it wasn’t private sector dynamism but state-sponsored expansion doing the heavy lifting. Meanwhile, the federal workforce continued its slow bleed, and the drop in part-time roles hints at rising labour market rigidity.

Don’t pop the champagne yet. That jobless drop? It wasn’t more people getting hired—it was more people giving up and leaving the workforce. Even worse, the average workweek shrank—meaning Americans took home less money despite rising wages. Translation: the labor market isn’t booming, it’s quietly shrinking. But if the headlines sound good, who cares about the fine print?

At the end of the day, unemployment rate has remained above its two-year average since September 2023—a historically ominous signal that economic storm clouds may be gathering for the next 12 to 24 months.

Upper Panel: US Unemployment Rate (blue line); US Unemployment 24 months moving average (green line); Lower Panel: S&P 500 to WTI ratio (yellow line); US S&P 500 to WTI Ratio 84 months moving average (red line).

In the never-ending soap opera of rate-cut wish casting following a supposedly Goldilocks non-farm payrolls report, Wall Street’s eternal optimists—also known as traders—have once again dialed down their delusions, now assigning a 73% chance to a September cut after Jackson Hole. In this context, they’re pricing in two cuts by year-end, clinging to the soft-landing fantasy like a security blanket stitched by Jerome Powell himself.

Those who pierce the veil of political theatre and hollow promises grasp a darker, immutable truth: it is not presidents or parliaments that steer the course of history—it is the great, merciless cycles. And towering above them all, burning with ancient authority, stands the Sun. For centuries, it has been the silent orchestrator—an invisible hand that stirs the winds of commerce, fans the flames of war, and unleashes plagues upon empires. The solar cycle is no mere scientific curiosity; it is the hidden metronome of civilization’s rise and fall.

As the Sun descends once more toward a looming minimum—likely beginning as early as July 2025—the world begins to convulse. Revolutions spark like dry tinder. Streets swell with rage. Acts of terror tear through the fabric of civilized order. These are not random eruptions—they are ritual, recurring, rhythmic. A familiar drumbeat echoes through time, one that has haunted civilizations at every solar peak. We’ve seen this script before—empires faltering, economies shattering, societies turning in on themselves—all under the watchful eye of a restless star. History, it seems, is not only repeating—it’s being supercharged by the Sun.

But the Sun’s influence doesn’t stop at politics or markets. It reaches deeper—into flesh, into mind, into the shadowy corners of the human soul. Increasingly, science confirms what the ancients sensed: the Sun’s fury touches us on a cellular level. When solar storms rage across the cosmos, heart attacks spike, strokes multiply, and mortality climbs. It’s as if the body, wired to this celestial rhythm, cracks under its pressure. Even solar flares—those violent flashes of cosmic wrath—have now been linked to sudden heart failure. And the mind fares no better. Under geomagnetic assault, our darker instincts stir. Homicide rates rise. Tempers ignite. Impulses grow wild and erratic, as if the Sun were not merely a giver of life, but a provoker of death. This is not metaphor. This is not myth. This is the Sun, our star and sovereign, blazing not just in the sky—but in our blood.

https://absb.researchcommons.org/cgi/viewcontent.cgi?article=1621&context=journal

Long before labs, masks, and PCR tests, people already knew one thing: when the weather gets cold, so do your chances of catching something nasty. Flu season hits like clockwork every fall, and by summer, the germs go on vacation—just like everyone else. It’s not magic, just biology and a bit of bad luck. Cold air dries out your nose, everyone’s packed indoors breathing recycled air, and your immune system’s running low on vitamin D and sunshine. Add in the fact that winter lacks virus-zapping UV rays, and voilà—germ paradise.

History backs it up too. From Roman plagues to modern flu spikes, epidemics have followed the seasons like geese heading south. It’s not a conspiracy or divine punishment—it’s nature’s schedule. Ignoring it is like being surprised by snow in January. So next time sniffles start flying in winter, don’t panic—just pass the tissues and remember viruses have a calendar too.

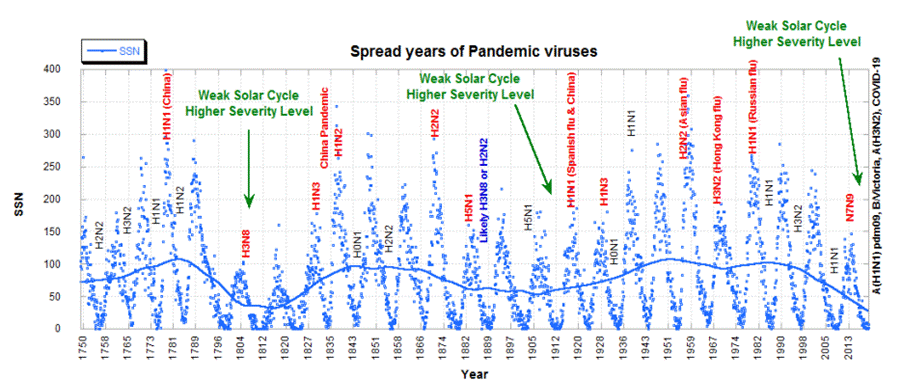

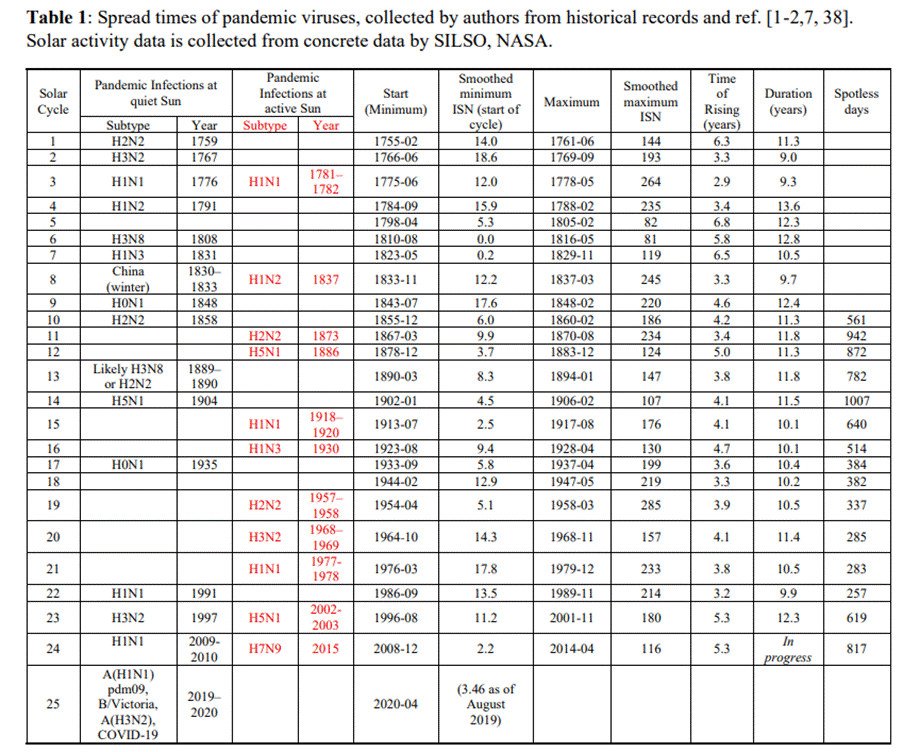

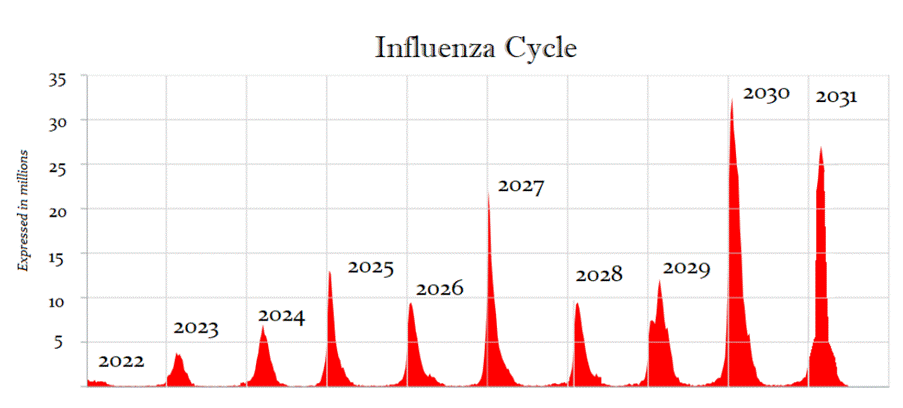

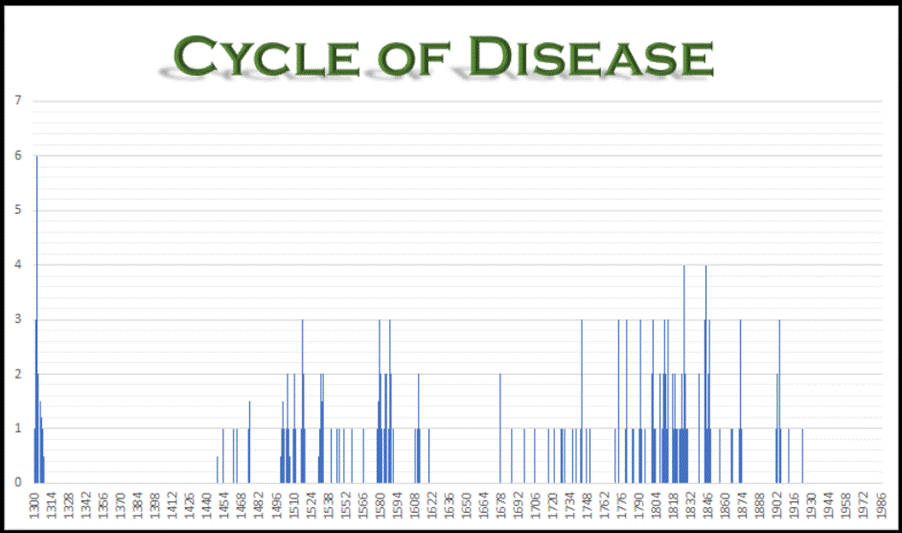

Based on these seasonal patterns, a not-so-shocking conclusion can be drawn, pandemic viruses are like bad fashion trends… they always come back. Looking at the greatest viral hits by subtype and their big debut years, it turns out, not all viruses follow the same tour schedule.

Some subtypes like H1N1, H2N2, and H3N2 are repeat performers, popping up so often we could practically write a formula for their encore. Others? Let’s just say they’re more “one-hit wonders,” which makes their comeback tour a bit harder to predict.

And then there are the newbies—H7N9, Victoria, and of course, COVID-19. They’ve only had one major showing so far, but don’t let that fool you. Genetically, they might just be the distant cousins of the original viral rockstar: the Spanish flu (possibly H3N8 or H2N2 with a disguise and new haircut). So yes, pandemics do have a rhythm… unfortunately, it’s not one we can dance to.

Most pandemic virus subtypes seem to follow a cosmic calendar—popping up every nine solar cycles, or roughly every 100 years. H3N2 is the exception, with an 18-cycle gap, but half of that is MIA in the data, so let’s just assume it got lost in space and call it nine too.

So, pandemic cycles fall into two camps:

· The Nine Solar Cycle Club: Includes H2N2, H5N1, H1N2, H1N3, H3N8, H7N9—and honorary members like Victoria and COVID-19, which may be Spanish flu reboots with a few genetic plot twists (especially COVID, thanks to its spike protein remix).

· The Twelve Solar Cycle Soloist: H1N1 stands alone here, though for safety, let’s assume it might show up after just six—consider it the early bird of pandemics.

Of course, all of this depends on the accuracy of the solar cycle, which has a few gaps. But with enough solar math, we can estimate the next viral surprise by mapping solar cycle start dates—just don’t expect the Sun to RSVP on time. Solar minimums are fashionably late, often stretching over two years. Still, we’ll pick a date and roll with it. Because when it comes to predicting pandemics, close enough is the new precise.

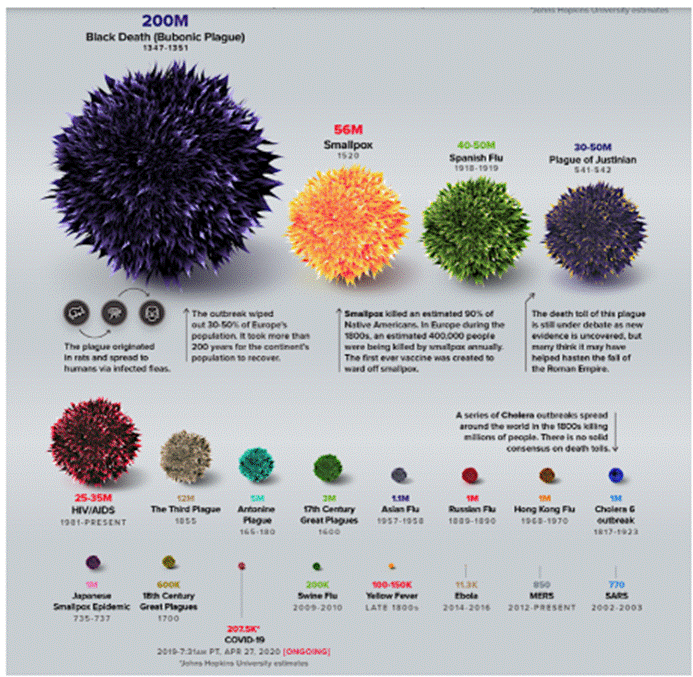

No matter how you frame it—solar cycles, war, unrest, or migration—the brutal truth remains: Migration + War = Disease on a deadly scale. History doesn’t just whisper this—it shouts it.

Take the Spanish Flu. We all learned it was a terrifying pandemic, but few realize it was turbocharged by World War I. The war didn’t just help spread the virus—it built the perfect delivery system. With millions of troops crisscrossing the globe, packed into trenches, trains, and troopships, with little food and no proper healthcare, the virus had a VIP pass to every continent. The result? Up to 100 million dead—eclipsing the 20 million lost to the war itself.

This isn’t just a one-time tragedy. It’s a recurring pattern. Wars have always been disease accelerants. In fact, before the 20th century, disease killed more soldiers than bullets. Fast-forward to modern conflicts—Syria, Yemen—and we see the same playbook: collapsing infrastructure, mass migration, and the resurgence of old killers like cholera, polio, and measles. The formula is tragically simple: War destabilizes, migration scatters, and disease follows. The Spanish Flu didn’t become the deadliest pandemic by accident. It was made deadly by the chaos of war—and we’d be foolish to think it won’t happen again.

Emperor Lucius Verus’s triumph over the Parthians may have earned him a shiny victory coin—but it also earned Rome one of the deadliest pandemics in history. His eastern campaign, especially the siege of Seleucia around 165–166 CE, is widely believed to have unleashed the Antonine Plague (aka the Plague of Galen) on the Roman world. Ancient historians like Cassius Dio and Ammianus Marcellinus didn’t mince words: the disease erupted in Mesopotamia, swept through the legions, and hitched a ride back to Rome with the “victorious” army.

The result? A full-blown empire-wide pandemic. The plague didn’t just linger—it scorched the Roman provinces for years, maybe even decades, killing millions and gutting the military. Even Emperor Marcus Aurelius wasn’t spared, dying in 180 CE, likely from the very disease that followed his co-emperor’s return from glory.

History doesn’t just rhyme—it coughs and spreads. Fast forward to the modern era, and we find ourselves staring down eerily similar patterns. COVID-19, whether the product of sloppy lab work or scientific overreach via gain-of-function research, has reminded the world just how fragile the global system can be when viruses go viral.

Now imagine lighting the fuse of World War III on top of that. According to current cycle projections, we may be heading into Phase I around 2029, with Phase II unfolding by 2032, and a final, far more destructive chapter not long after. The warning signs have been there for centuries. Girolamo Fracastoro wrote in 1546—well before germ theory existed— “There will come yet other new and unusual ailments in the course of time… And this disease will pass away, but later it will be born again and be seen by our descendants.” Well, here we are. Descendants. Witnesses. And maybe, just maybe, we’re repeating history with better tech and worse timing.

The year 2032 marks more than just the end of another economic cycle—it is the Sixth Wave in a powerful 51.6-year sequence, totalling 309.6 years. But there’s a deeper rhythm beneath it all: six such waves form a greater cycle—1,857.6 years long. And each ending, like a clock striking midnight, brings a reckoning. The last time this 309.6-year wave ended, the world was engulfed in chaos. The Great Plague of Marseille (1720–1722) ravaged France, becoming the deadliest epidemic of that century. At the same time, smallpox swept through the colonies, with Boston’s 1721 outbreak sparking bitter controversy over inoculation—eerily echoing today’s vaccine divisions. From 1700 to 1725, war was everywhere. The Great Northern War and the War of the Spanish Succession tore Europe apart, redrawing the global power map. Russia rose. Britain emerged. Sweden and France were left bleeding and spent. Disease followed war, as it always does. Typhus and camp fever—spread by lice, bred in filth—claimed thousands of soldiers and civilians alike, as borders shifted and empires clashed.

But the warning signs go back even further. The previous great wave, peaking in 1413, brought the Black Death—a plague that halved Europe’s population. It too followed war: the Mongol siege of Crimea, where diseased corpses were hurled into cities. Fleeing merchants carried the plague across Europe, sealing the fate of millions. Now, as we near the end of another grand cycle, the Sixth Wave, history’s rhythm grows louder. War, disease, collapse—the pattern is ancient, and unforgiving. A 50% population decline isn’t speculation. It’s precedent. We are not exempt. We are next.

The Black Death, which struck during Edward III’s reign (1327–1377), wiped out an estimated 30–50% of Europe’s population. But beyond the bodies it left behind, it exposed a darker constant: human nature never changes.

During COVID, dissenters were branded as dangerous—the unvaccinated, demonized, excluded, and silenced. In the 14th century, it was the Jews who were cast as the plague’s villains. Accused of poisoning wells and spreading disease, they were hunted down, forced to wear distinctive clothing, and burned alive—over 2,000 massacred across France and Germany between 1348 and 1350. The infamous badge of identification Hitler later imposed? History shows he simply revived what was first used during the plague.

The division didn’t fade. A century later, the same scapegoating would fuel the Spanish Inquisition, as the social fracture never healed. Even monarchs who saw the Jews' economic value couldn’t stop the tide of hatred that had been unleashed.

COVID was different only in detail, not in spirit. Society once again split into camps—compliant vs. defiant, vaccinated vs. unvaccinated. Travel was restricted, freedoms revoked, and anyone who refused the state-sanctioned narrative was cast as a threat.

Plagues don’t just kill bodies—they carve fault lines into society. The Black Death did it. COVID did too. And as the next crisis emerges, the same divide-and-rule playbook will return—this time with governments more empowered and less tolerant. We’re not just reliving history. We’re repeating its darkest chapters.

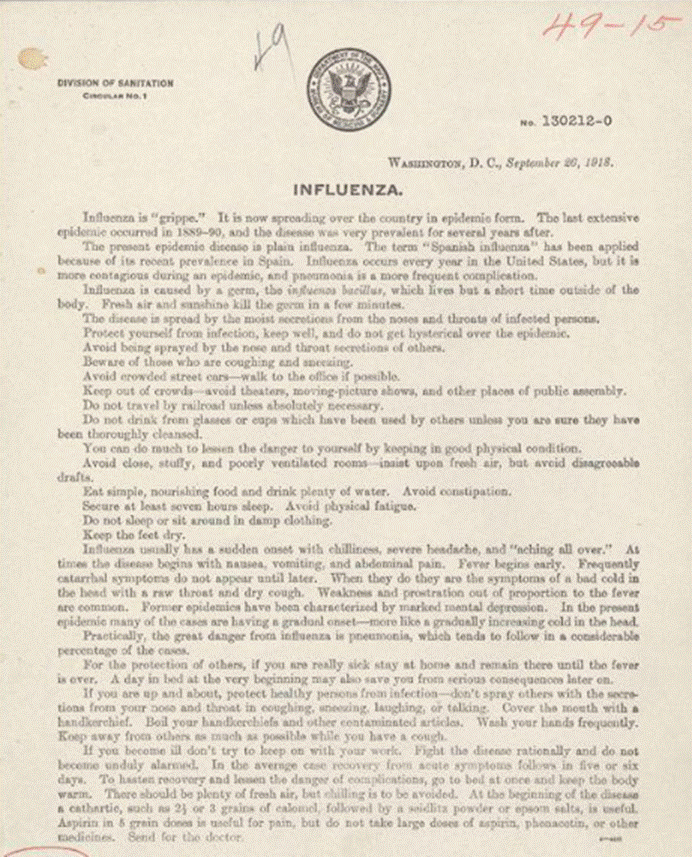

1918 is remembered as the year when officials actually believed people could handle a pandemic without losing their minds. Their advice? Simple and rational: avoid those sneezing on you, wash your hands, get rest, eat well, and enjoy some fresh air. And best of all, don’t get hysterical. How revolutionary.

Fast forward to COVID-19, and suddenly that sensible approach was tossed out the window. Instead of fresh air, we got lockdowns. Instead of calm, we had panic. Cash became a deadly weapon, and going outside was practically a crime. The message wasn’t “fight the disease rationally”—it was “submit to authoritarian control disguised as public health.” So yes, in 1918, governments said “stay calm and carry on.” In 2020, it was more like “stay scared and stay inside”—because who needs reason when you have lockdowns and digital surveillance?

COVID-19 stands as one of the defining pandemics of the modern era—a ruthless assault on the respiratory system that claimed countless lives before vaccines supposedly turned the tide. With a fatality rate hovering around 4% in its unmitigated early days, this virus emerged from the shadows of nature or most likely from an obscure lab in the Wuhan region. Yet, the origins remain shrouded in mystery. What sparked this viral inferno? Why did SARS-CoV-2 mutate with alarming speed, unleashing new variants that challenged human defences? Scientists have uncovered links between COVID-19’s spread and environmental factors—ultraviolet radiation can slow its advance, while pollutants fuel its fire, and rising temperatures may hold some measure of protection.

Still, crucial questions linger: What truly triggered the outbreak? Can we ever control these forces that drive viral evolution and explosive transmission? The answers may determine not only our survival but the future of humanity in a world forever shadowed by invisible enemies.

https://pmc.ncbi.nlm.nih.gov/articles/PMC8855047/?utm_source=chatgpt.com

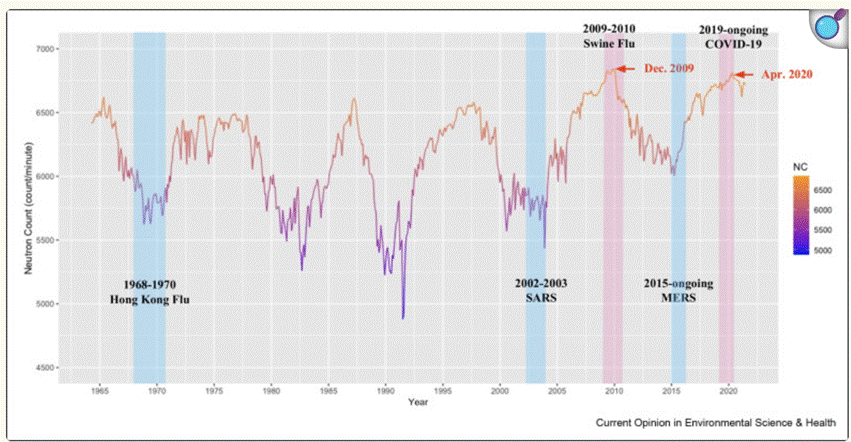

Cosmic rays, measured by neutron counts (NC) per minute, reached a peak of 6813 in April 2020, coinciding with the onset of the COVID-19 pandemic. Interestingly, an even higher peak occurred in December 2009 (NC = 6844), the highest since 1964. The 2008–2009 peak remained elevated (NC > 6800) for nine months (April to December 2009), while the 2019–2020 peak lasted only one month (April 2020). Despite this difference in duration, the cumulative neutron counts were remarkably similar: 161,606 for 2008–2009 and 161,832 for 2019–2020. Statistical analysis showed no significant difference between the two datasets (n = 24, p = 0.60), suggesting comparable cosmic ray activity during these solar minima.

So, some will find it a fun twist, but research shows that pandemic outbreaks might dance to the rhythm of sunspots. One theory says every 11 years (sunspot minima) and especially every 100 years (deep minima), the sun’s magnetic field weakens, letting cosmic rays—those sneaky mutagenic troublemakers—blast Earth like it’s an open target. On the flip side, solar maxima aren’t innocent either; stronger solar winds can pummel viruses with charged particles, sparking mutations in their RNA. So basically, whether the sun’s throwing a tantrum or taking a nap, pandemics might just tag along for the ride.

Meanwhile, on planet Earth, the ‘Manipulator In Chief’ is apparently increasingly being played like a fiddle by some shadowy Neocon puppeteers. The advice to the 47th US President? Let Europe sort itself out—watch the EU self-destruct while the rest of the world stays on the sidelines. If not, China and Russia will cozy up because, everyone knows that this isn’t really about Ukraine—it’s a proxy playground for NATO. History screams at us: war equals migration, and migration equals disease. Remember COVID-19? Think of it as the new Black Plague—with a twist. In reality, the vaccinated might be the most vulnerable.

Just crack open a history book: when Europeans landed in the Americas, disease wiped out 80-95% of Indigenous people—far more than war ever did. That’s one heck of a demographic disaster, brought to you by migration and germs the locals had never met before. So yeah, history doesn’t lie—and neither should we.

By 2025, the Cold War-era Stargate Project—once focused on psychic spying—has been reborn as a $500 billion AI mega-initiative to revolutionize biotech, especially mRNA medicine.

https://www.history.com/articles/cia-esp-espionage-soviet-union-cold-war

Launched days after Trump’s second inauguration, backed by OpenAI, Oracle, SoftBank, and others, it promises AI-driven breakthroughs from lightning-fast cancer vaccines to personalized treatments. Trump hailed it as America’s fight to reclaim tech supremacy from China, promising 100,000 new jobs and deregulation to smash “radical leftwing” barriers. OpenAI’s Sam Altman and Oracle’s Larry Ellison painted a future where AI sniffs out cancer early and churns out bespoke vaccines in 48 hours. SoftBank’s Masayoshi Son declared it the dawn of America’s “Golden Age.” Stargate is more than a project—it’s a bold gamble to turbocharge America’s tech dominance or a high-stakes gamble in a world racing toward artificial superintelligence.

So really, is anyone shocked that even the so-called “anti-vax in chief” from the last presidential circus is now peeling off the mask—revealing not some noble rebel, but just another career climber playing poker with the MAGA base to land a comfy government gig? Turns out the MAHA agenda was less about “health freedom” and more about quietly marching to the same old Malthusian drumbeat that’s been echoing through global halls of power for decades.

As the solar minimum sets the stage for another volcanic winter—bringing war, mass migration, regime change, and ultimately disease—smart investors should note that the S&P 500-to-gold ratio has remained stuck below its 7-year moving average since the very first day of the presidency of the 47th US president, flashing a clear warning that his MAGA project maybe another plan to enrich a new plutocracy build around the ‘PayPal Mafia’ and a new malthusian agenda. With the war and commodity cycles both accelerating, it’s time to shift focus from return ON capital to return OFcapital.

The solution? Real assets. Physical gold and silver—no counterparty, no surveillance—are the ultimate antifragile assets. Broader commodities offer protection as the global supply chain fractures. Manage cash actively: favor short-dated USD investment-grade bonds and T-bills for income and agility. In equities, seek lean, low-debt, high-cash-flow businesses poised to gain from reshoring, trade wars, and rising defense budgets—because the real enemy isn’t across the border; it’s the warmongers in charge.

Goldilocks is gone. Gold-in-lots is the new survival playbook.

What’s On The Agenda Next Week?

The first full week of Q3 looks like the calm before the earnings tsunami—just a light drizzle of drama with the July 9th tariff truce deadline and a side of Chinese inflation data to keep investors mildly entertained. As for earnings? Only two S&P 500 companies are stepping up early to break the silence—before following week’s corporate confessional turns into a full-blown flood. Enjoy the peace while it lasts!

KEY TAKEWAYS.

As solar minimums ripple through everything from crop yields to geopolitical tensions and diseases, the key takeaways are:

China’s June PMI brought a bubbly uptick in production and demand, but with jobs vanishing and confidence crashing, the fizz may flatline fast once the tariff truce pops in August.

US Manufacturing limped forward on inventory hoarding and renewed tariff fear, while demand sagged, jobs shrank, and prices kept climbing—call it a booming economy if you dare.

Services bounced back in June, dodging tariffs and trimming hiring, as businesses hustle, prices stay hot, and layoffs turn into talent shopping sprees.

June's jobs report looked like a boom, but behind the headlines, it’s just more government hiring, fewer work hours, and a shrinking labour force dressed up as a recovery.

History doesn’t follow presidents—it follows the Sun, whose silent cycle ignites wars, topples empires, stirs disease, and even sets the human heart ablaze.

Viruses have a calendar—and every winter, like clockwork, they RSVP with a vengeance.

Pandemic viruses, like bad fashion trends, follow a cosmic comeback tour—most return every nine solar cycles, and just when you think they're gone, they drop a remix.

When war marches and migrants flee, disease always follows—because history’s deadliest pandemics aren’t born in peace, they ride the chaos of conflict.

As the US economy shifts into an inflationary bust, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

Gold and silver are eternal hedge against "collective stupidity" and government hegemony, both of which are abundant worldwide.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

The week of U.S. Independence Day will be remembered as the week when the S&P 500 printed three new all-time highs over the four trading days of the holiday-shortened week. While both the S&P 500 and the Nasdaq 100 ended the week at new record highs, those paying attention to stochastics and momentum indicators can see through the propagandistic ‘hunky-dory’ narrative. In reality, daily RSI levels are now the most overbought since July 2024, and stochastics indicators are poised to roll over from similarly elevated levels.

In this context, U.S. equity indices appear priced for greed. With the end of the ‘Tariff Truce’ approaching and geopolitical tensions resurfacing in the Middle East and Eastern Europe, FOMO should be avoided. Instead, investors should focus on the charts—rather than hot takes from journalists who’ve never managed a dollar, even for themselves.

A potential correction in the coming weeks could bring the Nasdaq 100 and S&P 500 down to their respective 76.4% Fibonacci retracement levels (21,396 and 5,942), while the Dow Jones and Magnificent 7 may pull back to their 61.8% levels (41,841 and 24,199), signaling continued market headwinds.

With greed prevailing over fear and short-term indicators flashing overbought conditions, another wave of volatility could trigger a retest of the 50% Fibonacci retracement levels: Nasdaq 100 at 19,719; S&P 500 at 5,559; Magnificent 7 at 23,089; and the Dow at 40,842. If these supports hold, it may offer the last tactical buying opportunity of the year.

Since the April 21 “tariff tantrum” faded, all major U.S. indices have been forming higher lows, suggesting the 2025 bottom may already be in place. While geopolitical events—not economic data—are likely to drive volatility, long-term investors should stay focused and avoid getting swept up in either the doom-and-gloom or the "hunky-dory" narratives.

As of July 4th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for exactly 5 months, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

Oh, the irony. The self-proclaimed savior of the MAGA masses rode into office on a red wave—powered not by the common man, but by the very tech elites who helped script the pandemic panic playbook. Yes, the same "Paypal Mafia" that cheered on lockdowns, mask mandates, and Zoom-school dystopia suddenly became freedom’s biggest fans… just in time for the regime change. And let’s not forget how all that pandemic theater paved the way for an election so secure it needed an autopen president and a side of cognitive decline. Meanwhile, Oracle’s Larry Ellison—silent on masks but busy tinkering with mRNA wizardry—casually positioned himself at the center of the next round of biotech salvation. Because when it comes to saving the world, nothing says liberty like silicon, syringes, and surveillance.

With wars brewing and food shortages looming, Bill Gates’ pandemic warnings are starting to sound less like cautious foresight and more like a recurring sales pitch. In January 2025, he generously gave humanity a 10–15% chance of facing another pandemic within four years—because nothing says "comfort" like betting your life on coin-flip odds. His solution? GERM—a global rapid-response squad of health elites ready to spring into action (and maybe your bloodstream) at the first sign of viral trouble. Gates insists it’s cheaper to prepare than panic later, pointing to COVID's trillion-dollar tab. Fair point—except critics note his blueprint forgets one little thing: geopolitics. Like, say, relying on China to raise a red flag instead of burying the lab report. But sure, let’s build GERM and cross our fingers that global cooperation suddenly becomes contagious.

https://www.businessinsider.com/bill-gates-next-pandemic-covid-lessons-2025-1

In the next pandemic—which is a when, not an if—don’t expect common sense to lead the charge. While a healthy lifestyle, clean food, and strong immunity remain the best defense, Wall Street and its biotech allies will once again flood the airwaves with promises of salvation through mRNA shots and genomic wizardry. Beneath the buzzwords lies a darker truth: mass vaccination campaigns, like those seen with COVID-19 and avian flu, can accelerate viral mutations rather than stop them.

In China, poultry vaccinated against H5 flu evolved rapidly, mutating to evade immunity. With SARS-CoV-2, a similar pattern emerged—variants adapted, vaccine protection waned, and infections surged among the vaccinated, aided by antibody-dependent enhancement. CD8+ T cells kicked in, but so did asymptomatic spread, helping not just COVID, but RSV and flu ride the same wave. In short, the next "solution" may only deepen the problem—because sometimes, the cure sold on CNBC is just another way to cash in on the chaos.

The power behind mRNA vaccines lies in genomics—the decoding of life’s instruction manual. By mapping a virus’s genetic blueprint, scientists extract the precise sequence needed to program human cells to produce viral proteins like the infamous SARS-CoV-2 spike. This sparks an immune response without the pathogen ever setting foot inside the body.

But with such precision comes risk. Concerns over genomic instability—like the possibility of insertional mutagenesis, where vaccine RNA might integrate into human DNA—have been raised, though regulators claim no evidence supports such fears. Still, questions linger, especially as studies show that immunosuppressive drugs may blunt mRNA translation, leaving certain patients less protected.

At the frontier of this science is CRISPR—gene editing technology that can snip, rewrite, or erase DNA with surgical precision. Its promise spans medicine, agriculture, and industry, offering cures and climate-resistant crops—but also carries deep ethical shadows and experimental uncertainties. As genomics rewires biology and mRNA tech scales globally, we enter uncharted territory—where healing, mutation, and manipulation walk the same genetic tightrope.

https://blogs.cdc.gov/genomics/2021/03/05/mrna-covid-19-vaccines/

While wars serve the cold arithmetic of Malthusian planners, pandemics are their silent accomplice—and investors know it. Just as few want to profit from bloodshed, fewer still wish to see another engineered outbreak triggering mass vaccine mandates under the cloak of technological progress like the AI-fueled Stargate Program.

Yet reality bites: those positioning for the next "Plandemic"—accidental or not—are once again eyeing the usual suspects. Moderna and other mRNA giants, alongside key players in the rapidly evolving genomics biotech sector, stand ready to ride the wave of bioengineered urgency. Whether as part of a depopulation agenda or a digitally integrated future, the genomics revolution is no longer science fiction—it can also be a portfolio allocation.

For investors seeking exposure to this high-stakes frontier, genomic-focused ETFs offer the gateway. During the fever pitch of virus-driven biotech FOMO in late 2020 through early 2021, ARK Genomic Revolution ETF (ARKG US) dramatically outperformed its peers, driven by narrative momentum and speculative capital. Yet for longer-term resilience, the Invesco Biotechnology & Genome ETF (PBE US) has quietly held its ground since the dawn of COVID in December 2019.

In a world where viral mutations may be weaponized—or simply monetized—investing in genomics isn’t just a bet on innovation. It’s a wager on the future of humanity’s biological operating system.

Investors eyeing this high-risk, high-reward subindustry must confront an uncomfortable truth: participating in the genomics and mRNA revolution may also mean supporting technologies aligned—knowingly or not—with the broader Malthusian narrative of depopulation. Conscience, not just capital, is now part of the equation. Those willing to walk this ethical tightrope must carefully select the investment vehicle that aligns not only with their risk tolerance, but also with the moral weight they’re willing to carry.

Source: Bloomberg.

Bottom line? Forget Goldilocks—she’s been evicted. Now it’s all about Gold-in-lots, but only if you hold the key.

Nobody wants war or pandemic, yet it doesn’t matter. As long as the Malthusian neocons profit, regimes crumble, and the military-industrial-pharma complex cashes in, the blood keeps flowing. As Abraham Cowley, the 17th-century poet, put it: “Life is an incurable disease.”

In a world spiraling into chaos, preserving your wealth and health—whether you hold $100 or $100 million, and whether you’re 1 or 100 years old—is no longer a choice; it’s survival science. Step one: secure your gold and silver away from governments addicted to spending and seizures. Store it privately, far from bureaucratic reach.

As volcanic winters and war-driven shortages unleash waves of disease, don’t expect inflation to cool down. Tariffs, supply chain shocks, and currency debasement are the harsh new reality.

Bonds? A relic.

The savvy are turning to physical gold—immune to default, expiration, or social media hype about “transitory inflation.” In this era, canned food and bullion trump Bitcoin and blind faith. Stockpile 12–24 months of essential, healthy food. Acquire silver coins—not for sentiment, but for barter. Real assets need no internet, no government approval.

When the system collapses, gold won’t just gleam—it will endure as it has since 480 BC: outlasting emperors, empires, and mocking every fiat fantasy that preceded it.

Gold matters—yesterday, today, and crucially tomorrow.

Those who understand the looming storm of war, scarcity, and disease won’t merely survive—they will thrive, poised to seize a new era of opportunity as light returns by the next decade.

Finally, as Samuel Hahnemann (1755–1843), founder of homeopathy, declared: “Medicine is a science of experience; its object is to eradicate diseases by means of remedies. The knowledge of disease, the knowledge of remedies, and the knowledge of their employment constitute medicine.” In this uncertain age, wisdom, preparedness, and knowledge are the true cures.

Stay healthy, stay wealthy, and stand strong against those pushing the depopulation agenda!

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

I haven't studied solar cycle, butsolar minimum at first glance sounds like AG's could be the best or at least a very good investment....