THE WEEK THAT IT WAS...

The first week of the final month of the year shifted investors' focus to key macroeconomic indicators, including manufacturing and non-manufacturing PMI data from China and the US. Additionally, investors reviewed the latest assessment of the US job market with the release of the November Non-Farm Payroll report, ahead of the year’s final FOMC meeting later in the month.

In November, the recovery of the Chinese manufacturing sector continued, with the official China PMI index rising to 50.3, above the 50 mark that separates expansion from contraction and exceeding Bloomberg’s consensus of 50.2. However, the non-manufacturing measure of activity in construction and services slipped to 50 in November, down from 50.2 in October and below Bloomberg’s consensus of 50.3. In summary, while there were some encouraging signs for the Chinese manufacturing sector in November, it is still far too early for investors to assume that the time to ‘Make China Great Again’ has arrived. The government is unlikely to implement additional stimulus measures ahead of a year that could bring significantly higher trade barriers in the US and Europe against Chinese goods.

Fuelled by hopes of deregulation and a ‘drill, baby, drill’ policy, the US ISM Manufacturing PMI rose from 46.5 to 48.4, beating expectations. New orders hit 50.4, the highest since March, while prices paid fell to 50.4, below forecasts.

Input price inflation eased to a one-year low, while output price inflation edged up, staying above pre-pandemic levels. Concerns over tariffs drove one in four manufacturers to boost input purchases in November, highlighting fears of inflationary pressure from protectionism.

Bottom line: While demand data outpaced regional FED surveys, the rise in new orders could simply signal that entrepreneurs are building inventories ahead of looming tariffs.

On the other hand, the US ISM Services PMI unexpectedly declined from 56.0 in October to 52.1 in November, marking the largest drop since last June and below consensus 55.7. The sharp decline in new orders was the main driver of this disappointment, while Prices Paid remained stubbornly high.

In November, according to the latest Bureau of Labor Statistics report, the U.S. economy added 227,000 jobs, surpassing estimates of 220,000. While the headline numbers appear non-recessionary, a closer look reveals that most job creation occurred in ‘unprofitable sectors’ such as Education & Health, Government, while Leisure & Hospitality, likely benefiting from a seasonal boost ahead of the holiday season.

The US unemployment rate unexpectedly rose from 4.1% to 4.2%, exceeding estimates of 4.1%, while average hourly earnings increased by 4.0% year-on-year, above the forecast of 3.9%. The unemployment rate has remained above its 2-year moving average since August of last year, a trend that has historically signalled a transition from an economic boom to an economic bust within 12 to 24 months. With tightening immigration policies likely driving up wages and tariffs on imported goods, it seems only a matter of time before the current inflationary boom turns into an inflationary bust.

Upper Panel: US Unemployment Rate (blue line); US Unemployment 24 months moving average (green line); Lower Panel: S&P 500 to WTI ratio (yellow line); US S&P 500 to WTI Ratio 84 months moving average (red line).

In a 30-minute interview at the New York Times Deal Book Summit 2024, the FED Chairman, still seemingly enjoying his role, perhaps unaware of his growing irrelevance to the economy and financial markets, candidly confirmed that the US economy remains in a boom, albeit an inflationary one.

In the same context, the latest Beige Book signals a shift from September and November’s sluggish ‘flat or declining’ trends, with economic activity ‘rising slightly in most Districts’ and modest growth in three regions offsetting declines in two others. Employment remained flat or edged up slightly, while prices rose modestly. Notably, optimism surged, with businesses expecting higher demand in the coming months. Mentions of ‘slow’ activity dropped sharply from 55 in October to 29, the lowest since the COVID surge, while ‘inflation’ held steady with 12 mentions, the highest since April.

Bottom line: If the September Beige Book prompted the FED's 50bps cut, the December report hints at a potential pause this month, unsurprising given Trump's presence in the White House and the growing recognition that tariffs, touted as a solution to all problems, will ultimately drive the US and, earlier, the global economy into an inflationary bust. Wall Street, which still assigns an 85% probability to a 25bps cut in December and anticipates over three rate cuts by the end of 2025, needs to accept that the FED has become increasingly irrelevant.

It is indeed bond vigilantes, not the FED, who dictate the direction of long-term yields, and by extension, mortgage rates and the cost of financing for Corporate America, who will drive how the economy evolves.

As the 47th US president elect prepares to take office, having selected the men and women likely to play leading roles in his administration, and with just about a month before inauguration day, it is time to consider how a younger, business-oriented Trump 2.0 team will impact investments.

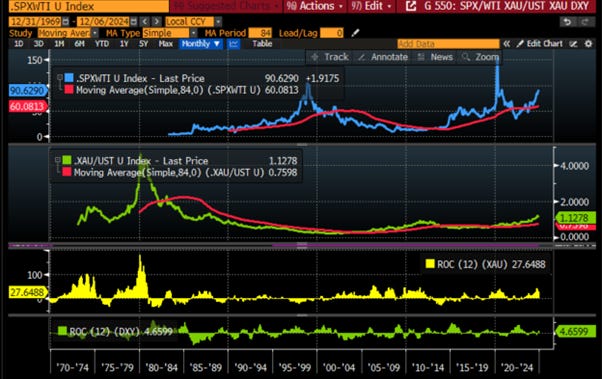

When Trump took office on January 20, 2017, he inherited a US economy in a deflationary boom. The S&P-to-Oil ratio was well above its 7-year moving average, while the Gold-to-Bond ratio was well below it. This robust environment stemmed from the Obama years, marked by a post-crisis economic rebound fuelled by low interest rates and global trade. This gave Trump fiscal flexibility to implement massive tax cuts early in his term, supporting strong economic growth until the COVID-19 pandemic struck in early 2020.

Fast forward to December 2024, Trump is set to inherit an ‘empty fridge’ from Biden, unlike the robust economy he inherited from Obama in 2017. As of today, the US economy is notably weaker as it is heading from an inflationary boom into an inflationary bust.

In 2017, when Trump took office, the US CPI Urban Consumers Index had risen at an annualized rate of less than 1.8% over the previous eight years of Obamanomics. Fast forward to December 2024, under Bidenomics, the same index has risen at an annualized rate of over 5.2%. This increase occurred even before the new administration implemented any tariffs.

While the latest FED Financial Stability Report highlights a shift in concerns from inflation to the dual threats of recession and fiscal debt sustainability, the reality is that the recent disinflationary illusion was largely driven by a decline in goods inflation, while services inflation remains stubbornly high. This is despite a loose immigration policy that should have eased service costs, which are primarily driven by the wages of unskilled workers. Even before taking office, the 47th US president-elect has already started discussing tariffs against countries that reject his vision of ‘Pax Americana.’ In this context, investors should prepare for a rebound in core CPI, which will likely be exacerbated by the mass deportation of illegal immigrants, tightening the job market, especially in the services sector, which remains highly manual and in need of automation.

US Core CPI YoY Change (blue line); US Core Services CPI YoY Change (red line); US Core Goods CPI YoY Change (green line).

On November 26th, President-elect Trump announced plans to impose a 25% tariff on all imports from Mexico and Canada, and an additional 10% tariff on imports from China. The tariffs on Mexico and Canada would remain until the flow of illegal drugs, especially fentanyl, and illegal immigration stops, while the China tariffs would remain until drug imports cease. He also stated he would sign the necessary documents to implement these tariffs as part of his first executive orders. This is not the first time Trump has proposed such tariffs. In May 2019, he threatened a 25% tariff on Mexico over immigration, but it was never enforced. In November 2024, he again pledged a 25% tariff on Mexico related to immigration. While he has previously discussed renegotiating the USMCA with Canada, this tariff threat is new. The 10% tariff on China is lower than the 60% he proposed during his campaign, and additional tariffs may follow. These tariffs, which would affect 43% of US goods imports from Mexico (15.4%), Canada (13.6%), and China (13.9%), could disrupt US trade, hurting GDP and pushing inflation higher. While, the announcement is likely more of a negotiating tactic, as seen in Trump’s first term, rather than a concrete policy plan, the tariff hikes would double existing Chinese tariffs and challenge the USMCA trade deal.

Trump’s tariffs could sharply reduce US imports, potentially cutting total goods imports by 40% if China responds with reciprocal duties. Retaliation from other trade partners would worsen this impact, as US exporters lose market share abroad and intensify competition domestically, displacing foreign producers. Retaliatory tariffs would also hurt the US economy by reducing production and demand, further impacting imports of goods. China would face the largest export losses to the US, while other countries' losses would depend on their trade structures. Countries with lower current tariffs would see bigger drops in exports, while those that can replace China in sectors like textiles would fare better. Economically tied countries like Canada and Mexico may see price adjustments that mitigate some export losses.

Contrary to Trump’s mercantilist view that tariffs boost GDP, evidence suggests they harm the economy, as seen with the 1930 Smoot-Hawley Tariff Act and its role in deepening the Great Depression. The GDP equation may seem to imply fewer imports (M) boost GDP, but reducing imports doesn't increase GDP, it merely shifts consumption. While money not spent on imports could be redirected to domestic goods, this results in lower utility, as consumers typically prefer cheaper imports. Tariffs thus lead to inflation and a worsened term of trade, not real GDP growth.

The problem with all the analysis around the causes of the Great Depression is the tendency to reduce the cause to a single event. In school, everyone had to read The Great Crash by Galbraith. Being a socialist, he blamed the corporations and never mentioned the Sovereign Defaults of 1931, as that would have implicated the government instead of the private sector. Additionally, the argument that tariffs ‘contributed’ to the Great Depression, if not the leading factor, also overlooks the role of Sovereign Debt defaults.

The Smoot-Hawley Tariff wasn’t signed into law until June 17, 1930, after stocks had already dropped from the September 1929 peak. By early 1930, politicians failed to realize that the stronger dollar made foreign imports cheaper. In 1927, the FED lowered US rates to encourage capital inflows to Europe, which backfired, revealing Europe's debt crisis. History always repeats itself, as capital flows to the US with war on the horizon, just like during World War I and World War 2. Those advising Trump on tariffs lack historical understanding and fail to grasp the interconnectedness of the global economy.

In a nutshell, those advising president elect Trump are idiots. They do not understand how the global economy functions. The US cannot experience a boom domestically while the rest of the world is contracting. The world economy and peace depend on ‘mercantilist free trade’.

Sanctions against Russia, including its exclusion from the SWIFT system, led to the rise of BRICS, as other nations rejected this authoritarian policy from American neocons and look to de-risk their sovereign assets from a weaponized USD by looking at assets such as gold which have no counterparty risks. That’s why emerging-market central banks have continuously reduced their allocation to US Treasuries and replaced them with physical gold, as they know that gold is for war, including trade wars.

While the US export drop is significant, most economies are expected to offset it by finding new markets, often by replacing US-made products that become less competitive due to higher input costs. However, Mexico and Canada, which heavily rely on US demand, will struggle to make up the shortfall. A tariff hike to 60% on Chinese goods and 20% on others would be a major shock, but the GDP impact in most regions would be limited as they shift trade elsewhere, with Mexico and Canada facing more severe effects than the US. By 2028, China’s GDP could be only 0.4% lower than a baseline with unchanged tariffs, and even less in the EU and Japan. While all regions would be impacted by Trump’s tariff plans, most would likely find alternative markets, especially for those countries integrating the mercantilist Global South among the BRICS. The challenge lies in how quickly these new trade relationships can be established, and the model's assumptions could understate the difficulty, leading to greater economic losses.

Outside the impact of tariffs on both the US economy and abroad, the new administration will face the difficult task of refinancing nearly $8.0 trillion of the US total debt, more than 20% of the total debt, in 2025. With higher inflation and lower economic growth resulting from the implementation of tariffs, it will inevitably mean that investors, likely increasingly fewer from outside the US, will have to absorb this great wall of debt.

This increase in refinancing debt and the need for new debt to finance more government spending will occur at a time when international investors from the Global South are increasingly reluctant to hold US Treasuries, with hedge funds located in Luxembourg, Ireland, and the Cayman Islands taking their place.

US Treasury Securities Foreign Holders from Japan (blue line); China (red line); Saudi Arabia (while line); Luxembourg (green line); Ireland (yellow line); Cayman Islands (purple line).

Anyone with a modicum of common sense understands that, with more weaponization of USD assets under Trump 2.0 than under Bidenomics, central banks from the Global South will continue reducing their allocation to US Treasuries. Meanwhile, hedge fund investors are in this market to make profitable trades, meaning they will demand higher term premiums. The implementation of tariffs will inevitably be inflationary, leading to higher, not lower, long-dated Treasury yields, unless the FED, which could also decide to weaponize liquidity for political reasons, adopts a yield curve control policy, further contributing to inflation, as seen in Japan over the past decade.

Trump's choice of Bessent, a long-time intellectual sparring partner and friend, led to the selection of a fund manager with an uncertain track record at Key Square Capital Management. While the hedge fund has $307 million in discretionary assets under management, its performance is unclear. Key Square's 2023 13F filing shows a $469.9 million portfolio, with 62% in Chinese stocks, including $170.7 million in iShares China Large Cap ETF call options. By March 2024, the portfolio had shifted dramatically, with $515 million (97%) in Nasdaq short positions via Invesco’s QQQ ETF puts. By Q3 2024, Key Square had sold its banking ETFs and held no assets.

https://whalewisdom.com/filer/key-square-capital-management-llc

Bessent, a key economic adviser to Trump, has unconventional yet pragmatic views on managing the US debt problem. As Treasury Secretary, Bessent would oversee the sale of US government bonds and advise on fiscal policy, tax collection, and sanctions enforcement. He advocates boosting growth to reduce debt, following a policy inspired by Japan’s Shinzo Abe. His ‘3-3-3’ plan aims to cut the deficit to 3% of GDP by 2028, spur 3% GDP growth, and produce 3 million additional barrels of oil daily. To control spending, he supports extending the 2017 tax cuts while offsetting their cost with spending cuts or revenue increases. Bessent has also become a strong advocate for tariffs, which he sees as both a tax revenue source and a national security tool. He has criticized US trade policy with China for benefiting Wall Street and weakening domestic industries, pushing for tariffs as a way to promote US economic interests. Both Trump and Bessent fail to understand that the real problem for the US is its global taxation, which makes US companies less competitive when seeking deals overseas. They also fail to recognize that tariffs will not solve this issue and could even make it worse, not better.

https://www.foxbusiness.com/politics/treasury-secretary-nominee-scott-bessents-3-3-3-plan-what-know

While some may hope that the Department of Government Efficiency (DOGE), created by the president-elect, will cut $2 trillion from the budget, its impact may be limited as it lacks congressional authorization. Tasked with shrinking the federal government, eliminating excess regulations, and cutting spending, the panel's recommendations are advisory, with Congress having the final say. While Elon Musk and Vivek Ramaswamy aim to cut $500 billion from federal spending through executive action, the panel's goals may not be achievable without legislation. Shrinking regulatory agencies and cutting funding to NGOs may face political resistance, and significant cost savings from discretionary accounts alone won't meet the target. With $900 billion of discretionary spending allocated to defence, Trump would need to deliver on his peace plan in Ukraine and the Middle East to have any chance of achieving reduced government spending. However, with the war taking a more dramatic turn in Syria and even the 'Taoist' Lavrov expressing doubts about Trump's sincerity in striking a 'fair deal' in the Ukraine-Russia conflict, it seems unlikely that any meaningful cuts to defence spending will materialize in the foreseeable future.

Time will tell if the chosen Treasury Secretary is a ‘Trumped gold card,’ but before everyone celebrates that Scott Bessent will be able to undo what Janet Yellen has done over the past four years, investors should remember that Trump will reserve the final decisions on key economic issues. Ultimately, it's important to note that under Trump 1.0, the US total public debt increased at an annualized rate of over 8.6%, much higher than during Obama, Bush, or even Biden.

Investors should also remember that before politics, Trump was a businessman known for leveraging debt. His career as a property and resort tycoon featured both successes and bankruptcies, particularly in the casino and hospitality sectors. Between 1991 and 2009, he filed for bankruptcy six times, using Chapter 11 to restructure debts on properties like Trump Taj Mahal and Trump Plaza. While these moves allowed his businesses to continue, creditors faced losses. Trump defended these decisions as strategic debt restructurings, highlighting his ability to negotiate rather than personal failure, underscoring the risks and reliance on debt in his business model. Here as well time will tell if Trump under his new term the US president will be who will push the country into a sovereign debt crisis which would be the last nail in the coffin of the USD as the world reserve currency.

https://www.thoughtco.com/donald-trump-business-bankruptcies-4152019

In this context, it seems that investors who sold gold following the red wave on November 5th, thinking that Trump would end all the wars in 24 hours and that his gold card, Scott Bessent, would bring fiscal discipline rather than fiscal dominance, have forgotten that the Trump 1.0 administration was the best for gold investors since Bush. It has delivered much better annualized returns for gold than the disastrous Bidenomics policies implemented since January 2021.

In a nutshell, while the US is still in an inflationary boom, increasing risks from the weaponization of liquidity, the escalation of the war cycle, and the implementation of tariffs could push the US into an inflationary bust within the next 6 to 9 months. Investors should be concerned that, despite expected deregulation under the 47th US president and his promises to end the wars started under the 46th president, he may be unable to deliver on his campaign promises, both economically and geopolitically, as the current inflationary boom could quickly turn into a bust. As the US remains in an inflationary boom, and with the growing political uncertainty, investors should own equities rather than bonds and gold rather than cash as history teaches that when legal and political orders collapse, currencies are often not far behind.

Investors who can connect the dots and look ahead should understand that Trump’s tariff strategy, aimed at reducing the trade deficit and funding the government by eliminating the income tax, is deeply flawed. US companies left the US not due to cheaper labour overseas but because of high taxes at home, fix the tax system, and they’ll return without tariffs. While appealing in theory, relying on tariffs to fund the government is impractical, promoting protectionism and retaliation against US businesses. Such policies would harm the global economy, intensify geopolitical tensions, and trigger what may be remembered as ‘Trump Stagflation.’

Everyone already understood that peace is not profitable and allows people to achieve financial freedom through private-sector investments, rather than reliance on Keynesian government spending. Those profiting from the forever bankers’ wars will keep fuelling conflicts to secure funding for their pensions. Unless we recognize the plans of Washington and Brussels warmongers, operating under the WEF agenda, governments will grow increasingly tyrannical, draining entrepreneurs' wealth to enrich their plutocrats.

In this context, gold, not government bonds, is the antifragile asset to hold. Among equities, investors will need to shift from energy-consuming sectors like IT to energy-producing sectors like oil and gas once the S&P 500-to-oil ratio dips below its 7-year average, and also add exposure to the Aerospace & Defence sector. This shift occurs in an environment where investors must increasingly prioritize the Return OF Capital over the Return ON Capital.

WHAT’S ON THE AGENDA NEXT WEEK?

As investors wrap up the year, the second week of December will be relatively light in terms of macroeconomic news, with the inflation reports from China and the US being the main points of focus. The politically driven ECB chairwoman will also have an opportunity to share her views on how the ECB plans to address the ongoing political and budget crisis in her home country as the European Central Bank meets for the final time this year. Investors will also be attentive to earnings releases from Adobe, Broadcom, and Costco Wholesale, among others.

KEY TAKEWAYS.

As the last month of the year unfolds, here are the key takeaways:

China's manufacturing showed signs of life in November, but rising global trade barriers on the horizon keep ‘Make China Great Again’ on shaky ground.

Likely boosted by deregulation hopes, the US ISM Manufacturing PMI rose, driven by booming new orders, possibly reflecting US entrepreneurs frontrunning for looming tariffs.

The US ISM Services index declined as new orders tumbled, while prices paid remained stubbornly high, signaling that inflation is far from over.

Job growth beats expectations but rising unemployment and inflationary pressures hint at an imminent shift from boom to bust.

When Trump moves into the White House in January, he will inherit an ‘empty fridge,’ and a country engaged into 2 proxy wars a stark contrast to 2017, as soaring inflation under Bidenomics sets the stage for a challenging economic environment.

Much like the Smoot-Hawley Tariff Act of 1930, implementing tariffs will first accelerate an economic bust outside the US before triggering one domestically, propelling the US economy from an inflationary boom to an inflationary bust.

Trump’s selection of Bessent, a fund manager with a questionable track record and potentially a ‘Trumped Gold Card,’ underscores their shared but misguided economic vision, including tariff-driven policies that will worsen rather than address the US’s competitiveness challenges.

The real issue for the US is its global taxation system, which makes American companies less competitive in securing deals abroad.

Trump’s track record of leveraging debt and his history of strategic bankruptcies raise questions about his ability to address US debt.

The ‘Trump Stagflation’ would not only drive gold prices higher but could also serve as the final nail in the coffin for the USD as the global reserve currency.

With the US still in an inflationary boom, the S&P 500/gold ratio sitting just above its 7-year average, a drop below this level has historically signalled poor outcomes for the economy and equity returns.

In today’s volatile market, investors should favour antifragile assets like gold over bonds, as gold offers low equity correlation, stability, and resilience against currency debasement.

In such environment, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold remains THE ONLY reliable hedge against reckless and untrustworthy governments and bankers.

Gold remains an insurance to hedge against 'collective stupidity' and government’ hegemony which are in great abundance everywhere in the world.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

With only 16 trading days left in the year, the Nasdaq outperformed other major U.S. equity indices, while the Dow closed the week lower. This marked the Nasdaq's largest outperformance over the Dow since early July, probably driven by year-end window dressing that pushed the Magnificent 7 to seven new all-time highs over the past seven days.

Despite bullish daily and weekly technical reversal patterns across all three indices, investors should note that Nvidia, the largest market cap globally and the best year-to-date performer among the Magnificent 7, has not reached a new all-time high since November 21st. In this environment, caution is warranted, as a potential yearly top and pullback could lead to a closure of the November 6th gap, with support likely at the 50-day moving averages in December.

In this context, it’s no surprise that Consumer Discretionary, Communication Services, and IT are outperforming, while Materials, Utilities, and Energy lag behind.

Nobody knows what will really happen when Donald Trump returns as the 47th US president on January 20th, but investors should remember that in The Art of the Deal, Trump mentions that he negotiates by throwing hand grenades into a room and then closing the door. This is probably the best way to explain one of his latest tweets, where he threatens any of the BRICS countries seeking further de-dollarization with additional tariffs.

https://x.com/realDonaldTrump/status/1863009545858998512

It should then be clear that Trump aims to revive the American System, emphasizing high tariffs and infrastructure investment to boost domestic manufacturing, contrasting sharply with post-1962 neoliberal policies. His focus on bringing foreign production back to the US would inevitably strengthen the USD against other fiat currencies, attract capital, and foster wage growth and social cohesion. Investors should therefore continue to buy dips in the USD, as US exceptionalism may prevail until at least the November 2026 mid-term elections. With Bessent as Treasury Secretary, there may be short-term confidence in managing the $7 trillion debt refinancing. However, tariffs will inevitably push the economy from inflationary boom to bust, raising the US 10-year treasury yield to 5% or higher as the yield curve steepens.

As tariffs bring the US from an inflationary boom into an inflationary bust sooner rather than later, like during previous inflationary bust from 2003 till 2013 or more recently from December 2021 till March 2023, investors should be ready to see the USD appreciating against other fiat currencies while at the same it depreciates against physical gold. In a nutshell, in an inflationary bust, investors will buy the dips in USD, Gold and sell the rips in bonds and equities.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (yellow line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Third Panel: Gold price in USD Terms 12-months rate of change; Lower Panel: US Dollar Index 12-months rate of change.

Upper Panel: S&P 500/Oil ratio (blue line); 84 months Moving Average of the S&P 500/Oil ratio (red line); Second Panel: Gold/Bond ratio (yellow line); 84 months Moving Average of the S&P Gold/Bond ratio (red line); Third Panel: S&P 500 index 12-months rate of change; Lower Panel: Bloomberg US Treasury Index 12-months rate of change.

As the Permanent Brown portfolio shows, in an inflationary bust, physical gold is the best asset, especially with Trump’s history of disregarding lenders, evidenced by his six bankruptcies and legal battles. Despite Wall Street’s optimism, Trump is unlikely to solve the $36 trillion US debt issue. Additionally, his foreign policies may escalate trade wars alongside kinetic conflicts. Even if Trump delivers on tax cuts, the rising deficit and difficulty refinancing debt will likely prompt foreign investors, like China and other global South nations, avoiding US Treasuries to gold.

As the trade war intensifies and inevitably leads to global capital controls, investors must follow key guidelines to preserve wealth in the face of stagflation and potential government defaults. Key DON'Ts includes avoiding fragile banks, sovereign bonds, and relying on inflation to reduce debt. Some important DOs for wealth preservation are holding physical gold and silver in secure jurisdictions outside the banking system, protecting assets from potential government confiscation, securing a second residency or passport, and prioritizing wealth preservation over aggressive wealth accumulation. Risk management is essential as authoritarian shifts may occur unexpectedly.

Given the high likelihood of fluctuating inflationary cycles, investors should focus on gold, not bonds, as the key antifragile asset. Gold offers better risk-adjusted returns, and with the US economy on the edge of moving from an inflationary boom into an inflationary bust, holding US equities without a significant gold hedge has become riskier. Allocating over 50% of equity holdings to energy and defence stocks, while avoiding long-term government bonds, will shield investors' wealth and deliver returns in excess of the 3% to 4% real annualized return of the Browne Portfolio. Investors should also minimize cash held in the banking system and government bonds, replacing them with gold and short-term, investment-grade corporate paper.

The coming years will be challenging for investors and their families, so it's crucial to focus on factual data rather than propaganda. While we can't alter cycles or control the future, we can learn from the past to prepare for what lies ahead, staying calm and proactive to protect ourselves and our loved ones. As the French and the song say: Ce Qui Sera Sera... Que Sera, Sera…Whatever Will Be, Will Be…

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.