THE WEEK THAT IT WAS...

As we moved into the second month of the third quarter, investors were again focused on the health of the US job market with the release of the July nonfarm payroll report. Earlier in the week, attention was on the US ISM Manufacturing Index, as well as the meetings of the Bank of Japan, the Bank of England, and the FED, along with the third quarter Treasury Quarterly Refunding Announcement as well as the second wave of earnings’ release from the Magnificent 7.

In China, the latest PMI data signal a poor start to the third quarter and a worrying development given the undershoot in Q2. The manufacturing sector contracted for a third consecutive month. The non-manufacturing gauge inched lower but remained in growth territory, largely due to construction activity supported by government measures. The service sector, which has a heavy concentration of private firms, stalled.

In Japan, in a move that will likely cause further anxiety among YOLO tech investors, the Bank of Japan unexpectedly raised its policy rate from 0.1% to 0.25%. It also announced plans to reduce its monthly pace of bond buying to around JPY 3.0 trillion (approximately $19.6 billion) by the first quarter of 2026. For comparison, the recent pace of purchases has been about double that amount.

In taking these ‘baby steps’, Governor Ueda demonstrates his commitment to normalization after years of ultra-easy policy, which included maintaining the world's last negative interest rate until March of this year.

As the BoJ undergoes a regime change, Japan is slowly but surely heading into a financial doom loop, which will be a significant headwind for investors seeking lower long-dated U.S. Treasury yields in the coming years.

In line with most analyst expectations, the Bank of England cut rates for the first time since March 2020, lowering the Bank Rate from 5.25% to 5.0% by a 5-4 vote. Dissenters Pill, Greene, Mann, and Haskel preferred to keep rates steady until there was clearer evidence that inflationary pressures would not persist. The guidance indicates that the Bank Rate will remain restrictive until inflation risks are further mitigated. Governor Bailey emphasized the need for caution in cutting rates too quickly or by too much. Bailey avoided commenting on future rate paths, and while initial reactions were dovish, lack of signals for further cuts led to a more hawkish outlook, with a 76% probability of no change in September and a 25bps cut not fully priced in until December.

In the US, the start of the third quarter saw a deterioration in business conditions among US manufacturers. The ISM Manufacturing PMI plunged to 46.8 (below the expected 48.8), the weakest since November 2023 and near post-COVID lockdown lows. Rubbing some salt in the ‘Goldilocks’ wounds’, Prices Paid rose while New Orders tumbled, and Employment fell to its lowest level since the COVID lockdowns. In a nutshell the ISM manufacturing provided more signs that the US is heading into an inflationary bust ahead of the most contested election I the history of the country.

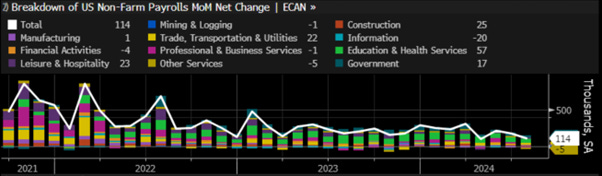

The July Non-Farm Payroll report suggests that the cooling in the labour market has become icier, even if some of the weakness can be attributed to disruptions related to Hurricane Beryl. In July, the US added only 114k jobs, well below the forecast of 175k. As usual, June's numbers were revised downward from 206k to 179k. This was the lowest NFP print since December 2020, at least before further revisions. Additionally, ahead of the presidential election, these politically influenced numbers include the creation of 17k uneconomical government-related jobs.

More worrying is the continued rise in the unemployment rate, which has increased from 4.1% in June to 4.3% in July as more people rejoin the workforce due to inflation-driven misery. Rather than following the ‘socialistically’ driven Sahm’s rule, investors should focus on the evolution of the unemployment rate versus its 24-month moving average. Historically, when the US unemployment rate has exceeded the 24-month moving average, as it has been the case since January, the US has been declared in a recession, a scenario the highly politicized Bureau of Labor Statistics is unlikely to announce before the November 5th election.

US Unemployment rate (blue line); US Unemployment rate 24-months moving average (green line) & US Recessions.

Adding to the inflation driven consumer’ misery, the increase in average hourly earnings was only 0.2%, below the expected 0.3% as more importantly the length of the work week fell to 34.2 hours. As a result, the average US worker saw a small decline in their weekly earnings as after accounting for the effect of hiring, aggregate personal income rose by just less than 0.1% in July.

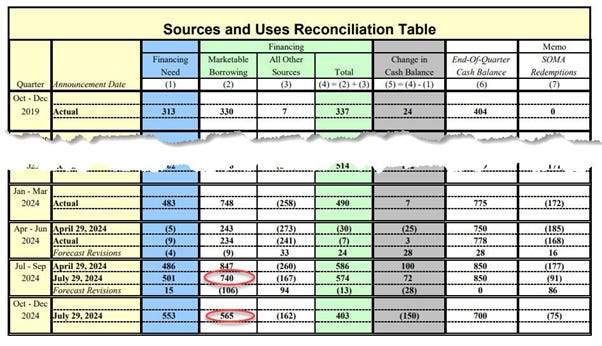

The Treasury Quarterly Refunding Announcement, which under Treasury Secretary Yellen has become little more than 'Stealth QE,' confirmed that the Q3 pre-election funding needs have been revised lower to $740 billion. According to the Treasury, the $106 billion reduction in financing needs is due to lower Federal Reserve System Open Market Account (SOMA) redemptions and a higher beginning-of-quarter cash balance. In other words, the QT taper is primarily responsible for the lower funding needs. Q4 funding needs, which will be required after the political circus has ended and were released for the first time, are estimated at $565 billion, $115 billion above the previous estimate of $450 billion. This increase is partly due to a higher Treasury General Account (TGA) estimate of $700 billion compared to our assumption of $650 billion.

In summary, the Treasury expects to borrow just over $1.3 trillion by year-end, though this figure is likely to rise significantly independent on who becomes the 47th president and whether the US ‘unexpectedly’ slips into recession early in the new presidency.

The Treasury’s cash balance at the end of June, approximately $778 billion, was above the $750 billion target set for the end of April. As of last Thursday, the holdings in the Treasury General Account stood at about $768 billion.

Keep a close eye on the $700 billion year-end cash balance, as it could impact the next debt-limit battle, post the November election. This cash reserve would be rapidly depleted after the debt ceiling law takes effect at the start of 2025, unless the new Congress increases or suspends the limit, which is unlikely if Congress remains divided. The law doesn’t specify a precise cash amount the Treasury must hold when the debt limit is reinstated. Looking at the details of the $125 billion quarterly refunding, which includes the issuance of $14 billion in new cash from private investors, it will be broken down as follows:

$58 billion in 3-year notes

$42 billion in 10-year notes

$25 billion in 30-year bonds

The refunding total is just shy of the record $126 billion first reached in February 2021. Auction sizes across the curve began rising in 2018 to finance tax cuts and surged in 2020 to support the federal pandemic response.

The Treasury confirmed expectations that the balance of its financing requirements for the quarter will be met through regular weekly bill auctions, cash management bills (CMBs), and monthly auctions of notes, bonds, Treasury Inflation-Protected Securities (TIPS), and 2-year Floating Rate Notes (FRNs).

The supply of bills has increased by around $2.2 trillion since the start of last year, facilitating the rapid drain of the FED's reverse repo facility. This has left their share of total debt above the 15%-to-20% range previously recommended by the Treasury Borrowing Advisory Committee (TBAC). With this latest new guidance suggesting that the uptrend will continue, this trend is expected to resume.

Behind the curtain and in a move towards a ‘QE-not-QE operation’ (i.e., treasury buybacks), starting this month, the US Treasury is removing the 20 CUSIP cap on eligible securities for each operation. It will now align operation sizes with its previous guidance, increasing to a maximum of $30 billion per quarter across various buckets for liquidity support, up from the previous $15 billion. While the FED's POMO schedule once served to boost the market on QE action days, the Treasury's bond buyback schedule will soon fill that role, at least until the FED resumes full-blown QE.

Bottom line: Contrary to its activist tactics aimed at boosting the market and front-loading debt needs, the Treasury’s reported numbers for Q3 were in line with expectations and slightly above blended estimates for Q4. However, the real question isn't about Treasury projections for Q3 and Q4, but rather for Q1 2025. This is when Biden will depart the White House, and either Trump, Kamala, or another candidate chosen by the deep state to enrich its plutocrats will take over. This transition will likely lead to increased government spending and reveal the true extent of financial challenges. While the highly politicized Treasury Borrowing Advisory Committee has previously indicated that higher shares of bills are not a problem, similar to the situation under the Clinton administration, the US Treasury is using this approach to artificially reduce interest rate expenditures. Ultimately, this will increase the debt burden for the generations to come.

At the latest FOMC meeting before heading to Jackson Hole later this month, Powell continued to entertain the phantasmagorical FED pivot for September by luring investors with another litany of ‘data-dependent’ comments, which will ultimately be used by the FED chairman to avoid cutting rates in September. In this context, investors are advised to beware the ides of September.

The second week of the Magnificent 7 earnings season continued on a lacklustre note, with unexciting earnings reports from Microsoft, Amazon, and Apple. Meanwhile, META, the second most meme-worthy stock among the Magnificent 7, provided more hope to those invested in the woke culture it promotes.

EPS Revisions for Alphabet (white line); Amazon (orange line); Apple (green line); META (blue line); Microsoft (red line); Nvidia (purple line); Tesla (yellow line) since July 1st 2024.

With 376 companies from the S&P 500 having reported their earnings so far, a quick look at the first three weeks of the Q2 2024 earnings season reveals that sales and earnings surprises have been the lowest since Q3 2023 and Q2 2022, respectively.

If the past two weeks of earnings releases have felt particularly volatile, that's because they are. This has been the most volatile earnings season since the financial crisis. While we are largely through the earnings reports, and some may hope for a quieter August, the political and geopolitical agenda is likely to once again drive financial markets as we head into the chaos leading up to the pivotal moment of the year of political hell on November 5th.

In this environment, the FED finds itself caught between a rock and a hard place, as whoever becomes the next tenant of the White House, Powell and his PhD colleagues know that interest rates ALWAYS RISE DURING A WAR. That’s why the unenlightened Wall Street banksters will once again be proven wrong by discounting almost 100 basis points in cuts before the end of the year.

At the end of the day, we all know that Wall Street and the plutocrats ruling in Washington need to continue luring naive investors and voters into the supposed Goldilocks nirvana, while the FED has become impotent to solve economic issues driven by communist Keynesian policies with the beating of the war drums threatening lower economic growth and rising inflation in other words, STAGFLATION.

As the US Treasury has just announced its Quarterly Refunding Program, it's interesting to put the US national debt into perspective for better understanding. The $35 trillion figure is truly staggering and difficult for most people to grasp. According to the National Debt Clock, each American citizen would need to write a check for $103,565 to pay off the national debt.

https://www.usdebtclock.org/

Of course, many people don't pay taxes, which means the burden on taxpayers is even higher. Each US taxpayer would need to write a check for $266,953 to eliminate the debt. And that's in addition to the taxes they already pay! To put it another way, $35 trillion is more than the combined total economies of China, Japan, Germany, and the UK.

For most of us, it is hard to wrap our heads around how big 1 trillion is, let alone 35 trillion. Here are a few factoids to help you visualize just how massive that number is:

There are 1 million seconds in 11.5 days. A trillion seconds is about 32,000 years.

If you could say one number every second, it would take about 11.5 million days to count to 1 trillion.

If you had spent $1 million every day since the birth of Christ, you still wouldn't have spent $1 trillion.

If you lined up dollar bills end-to-end, you could travel to the moon and back around 203 times with $1 trillion. You could also wrap them around the Earth about 3,893 times.

If you stacked up 1 trillion dollar bills, the tower would rise to 67,866 miles.

If a cup of coffee costs $3, you could buy 333 billion cups of coffee with $1 trillion or almost a billion per day during an entire year.

If you had $1 trillion, you could give every person on Earth approximately $125.

One trillion grains of rice would weigh about 20,000 metric tons.

Keep in mind that all these examples illustrate the size of $1 trillion alone. The US national debt is nearly 35 times that amount. Anyone with a degree of sanity knows that regardless of who occupies the White House in January, US government debt will only increase. It is highly probable that the US national debt will hit $100 trillion between 2027 and 2029, as politicians will continue to spend excessively to finance their bankers' wars. The faster these wars unfold the sooner the $100 trillion level will be reached.

To illustrate the debt burden created by Washington, America currently spends $2.4 billion in daily interest fees alone. To put this number into perspective, the US government is spending over a trillion dollars annually on interest payments, which is more than the entire market cap of Berkshire Hathaway, just to cover its interest expenditures.

James Madison, US president from 1809 to 1817, called a large national debt a ‘public curse,’ stating, ‘I go on the principle that a public debt is a public curse and, in a republic, a greater curse than in any other form of government.’ With the US national debt at $35 trillion, Madison's concerns are more relevant than ever. Thomas Jefferson also warned that public debt was a major danger. In his Farewell Address, George Washington advised using debt sparingly and paying it off quickly, emphasizing that public credit should be cherished and managed with caution to avoid greater costs in the future.

The FED, the government, and Wall Street have tried to assure investors of a smooth economic transition as the soft landing has been part of the ‘Forward Confusion’ narrative spread to investors. They also downplay the significance of government debt, despite Powell being the first FED chairman to label the current fiscal path as 'unsustainable.' However, consider the numbers: since January 2017, under UniParty rule, prices for essential items like services, food, energy, transportation, and shelter have surged by 32% to 36%. This translates to an annual inflation rate of around 4.0%, meaning prices could double every 18 years. Despite differing short-term trends, the cumulative inflation for these essentials over the past 7+ years has consistently hovered around this 4.0% annual rate. This highlights that cumulative inflation is more telling than short-term CPI movements and has impacted those unable to hedge their wealth against this structural inflation. This has been a major factor in the impoverishment of the middle class, not only in the US but in other parts of the world where Keynesians have been in power.

CPI Component Increases Per Annum Since January 2017:

Services less energy services: +3.8%.

Food: +3.9%.

Transportation: +3.9%.

Energy: +4.2%.

Shelter: +4.3%.

Index Of Major CPI Components Since January 2017

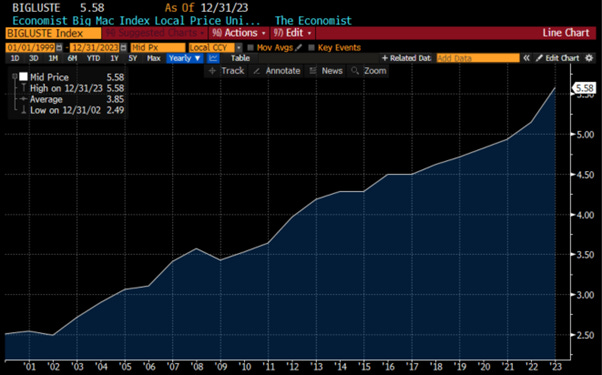

We must also remember that official inflation figures may not fully capture people's experiences. For instance, based on The economist data, the price of a McDonald's Big Mac has risen from $2.5 in december 2000 to $5.58 as of end of 2023, a 123% increase in 23 years or more than 5% a year on average.

US The Economist Big Mac Index (in USD).

In the past, central bankers focused on long-term price stability rather than manipulating short-term inflation rates. Their goal was a stable general price level, not the current fixation on various CPI or PCE components. Fast forward to the post GFC era, the FED has prioritized reflating the economy using its monetary tools, as in a rising debt environment what is the more dreadful for governments and Wall Street is DEFLATION not INFLATION, reminiscent of Japan's debt trap. In any event, investors should remember that Wall Street loves the FED’s pro-inflation policies and the portrayal of substantial price level increases as normal economic behaviour. Gary Cohn, a prominent figure moving between Wall Street and Washington, essentially exposed this reality in his comments on the June CPI report. ‘Chair Powell does not want to be late to cutting rates,’ former Goldman Sachs and Trump official Gary Cohn told CNBC after the release. ‘Especially after we all accused him of being late to raise rates.’

The concept of ‘early’ or ‘late’ adjustments to interest rates is absurd. The disconnect between interest rates on short-term funds and the broader economy is so vast that FED’s decisions are essentially meaningless for the real economy. With $99 trillion in combined private and public debt, even significant rate cuts won’t notably boost borrowing, spending, GDP, or jobs; instead, they will likely fuel inflation. Investors must understand that inflation is primarily supply-driven, as shortages related to uneconomic regulations from the climate change scam narrative and the diversity and equality propaganda have pushed prices structurally higher for everyone’s daily expenses.

US Economy Leverage Ratio, 1960 to 2024

During the heyday of Keynesian theory in the 1960s and 1970s, US public and private debt averaged about 150% of GDP, a stable figure during a century of industrial growth and rising living standards. Even though it never made sense that raising the economy’s leverage ratio could generate incremental GDP, jobs and wealth over the long-run, in the short-run cheap interest rates did tend to spur extra borrowing by households and businesses, thereby temporarily adding to GDP, albeit in a manner that actually amounted to stealing from the future. But today all bets are off. Post the Great Financial Crisis, debt has soared to 350% of GDP, with total debt at $99 trillion compared to $42 trillion at the old 150% ratio. Needless to say, that the FED's attempts to stimulate the economy with rate cuts in this high-debt environment are largely ineffective. Indeed, in a ‘debtentombed economy’ where the productive sectors are lugging an extra $57 trillion of debt, it is likely that interest rate-cutting has almost no macroeconomic potency at all. In this context, the goal of a 2.00% inflation rate through such measures is unrealistic and unattainable through the clumsy mechanism of adjusting the overnight funding rate, especially as the government continues to increase its fiscal deficit by providing cash stimulus that creates a dependency on more debt, much like a junkie’s addiction to fentanyl. In this environment, it is long overdue for Keynesian policies to be halted, and for the FED to return to its primary role of ensuring price stability and full employment, rather than serving as a political tool subject to unscrupulous government decisions.

FED Fund Rate (blue line); US CPI YoY change (red line); Correlations & US Recessions.

Further back in history, the Weimar Republic emerged from the 1918 German Communist Revolution, during which German communists sought to align with Russia’s Marxist vision. In December 1922, the Weimar Government confiscated 10% of bank assets to cover war reparations. Contrary to the common belief that hyperinflation was caused by money printing, it was the collapse of confidence in the Weimar Republic that led to this monetary policy. This distortion of history has tainted the German economy, contributing to Hitler's rise to power due to the oppressive reparations, which John Maynard Keynes had warned against. France’s desire for retribution in the 20th century was fuelled by prior reparations paid to Germany in the 19th century. Fast forward to 2024, the collapse in confidence in Western governments, plagued by irresponsible Marxist fiscal policies and degenerative moral values surrounding the Diversity, Equity, and Inclusion narrative, will inevitably prompt another wave of monetary policies which will ultimately contribute to the further depreciation of their fiat currencies against real assets.

For investors, it’s crucial to understand what FED rate cuts can and cannot achieve. The FED controls short-term rates with the FED Funds Rate, while long-term rates are influenced by supply and demand for government bonds. Since the 2008 GFC, the FED has used Quantitative Easing to impact long-term rates as well. However, what truly matters for homebuyers and businesses is the cost of long-term financing, such as the 30-year mortgage rate, determined by the long end of the Treasury curve.

FED Fund Rate (blue line); US 10-Year Yield – US 2-Year Yield (red histogram); Correlations & US Recessions.

The FED can adjust overnight lending rates but cannot control the entire yield curve unless it implements a Yield Curve Control policy as the Bank of Japan did to mitigate the impact of the fiscal exuberance of its government. A rate cut might steepen the yield curve, leaving long-term rates and mortgage rates unchanged or even higher as fiscal dominance trigger higher borrowing costs for everyone the government, corporates and households. It also doesn’t directly affect high-interest credit card debt, which remains between 20% and 23%. Despite higher rates typically discouraging borrowing and encouraging saving, credit card debt has increased, and delinquencies rose as household incomes are squeezed by the inflation driven misery which has spread over the past years.

There is an additional long-term risk if the FED starts cutting rates to avoid a statistical recession. This scenario echoes the 1970s when the FED’s rate cuts, after initially curbing inflation, led to renewed inflation and eventual hyperinflation. The FED mistakenly saw short-term trends as long-term successes.

As incredible as it seems, even though the job market is weak and output is generally moribund, there is probably no imminent threat to rising stock market over the foreseable future. It is typical in credit-soaked economic environments that equity markets perform well as meltup are usualy associated with rising government deficits. Indeed, no one can wish away the devastation that has been wrought by explosive government spending since the pandemic response began. As a percentage of Gross Domestic Product (GDP), it exceeds the Second World War. The resulting debt needs to find viable markets and the bond market is not the place where all this cash will flow given rising risks of sovereign defaults.

Investors can just have a look at countries like Argentina and Turkey which have been trough uncontroled government debt deficit which have sparked meltup in their respective stock markets as investors have not found other alternative to protect their wealth against rampant inflation pressures which have been induced by reckless government spendings. The US and other western countries will not be different from what happened in these emerging markets and that’s why at the end of the day whatever the economy is flaring stocks will continue to attract investors who understand the reality of stickier for much longer inflation on their wealth.

Performance of $100 invested in MSCI US Index (blue line); MSCI Turkey (red line); MSCI Argentina (green line) since December 31st 2019.

A quick look at the evolution of the US M2 money supply and the S&P 500 over the past 35 years shows that both are highly correlated. Equity performance mirrors changes in the money supply, as cash printed by the FED needs to be invested, regardless of the economic environment.

S&P 500 index (blue line); US Money Supply M2 (red line); Correlation and US Recessions.

Many people today are whispering about a potential great crash in financial markets. However, they might be looking in the wrong place. The real problem we face is grinding economic stagnation combined with ongoing inflation, which could intensify with another rate cut. This could be the real crisis. This doesn’t mean there won’t be significant bumps ahead for the economy or that the stock market will rise in a straight line. For instance, in Argentina, despite the market more than tripling in USD terms since the start of the COVID ‘plandemic’, there have been drawdowns of over 20% over several months along the way.

In this context, the narrative, part of the Forward Confusion intended to convince investors of the success of current Keynesian policies, is that Powell and the FOMC claim there will be no significant bumps ahead and that a ‘soft landing’ is achievable. Powell and the FED repeatedly assert that they can reduce inflation while maintaining economic growth and strong employment. However, there are two problems with this narrative:

The first issue is that the FED has never successfully achieved this outcome in the past 45 years. Historically, the FED has denied a recession until after it has started and only then has cut interest rates, often after unemployment has already begun to rise.

The second problem is that the FED's motivations extend beyond just employment and economic concerns. While it claims to be ‘data-driven,’ in reality, the FED is primarily focused on keeping interest rates as low as possible to allow the federal government to borrow vast amounts of money at low yields. As the federal debt increases, so does the pressure on the FED to maintain or further lower rates.

While it’s true that the FED fears price inflation because it causes political instability, when this fear prevails, the FED raises interest rates. However, the Treasury expects the FED to keep rates low to accommodate the federal government’s continuous deficit spending. When the ‘need’ for deficit spending takes precedence, the FED lowers interest rates. These two goals are directly opposed. Unfortunately, if the FED has to choose, it is likely to favor lower interest rates, which leads to rising inflation. This inflation exacerbates inequality between those who can own assets like physical gold and diversified blue-chip equities, proven to be the best way to preserve wealth against inflation, and those who cannot.

The latest FED's Summary of Economic Projections (SEP) claims there will be no recession and that economic growth will remain steady with stable employment. However, history shows that FED rate cuts often precede periods of significant job losses not the opposite. For instance, rate cuts in 1990 were followed by the 1991 recession, cuts in late 2000 led to rising unemployment, and similar patterns occurred in 2007.

FED Fund Rate (blue line); US Unemployment rate (red line) & US recessions.

In summary, the FED typically raises interest rates and tightens monetary policy when it fears inflation. Despite claims of no imminent recession and a ‘soft landing,’ it often becomes clear that the economy is weakening. At this point, the FED, fearing a recession, loosens monetary policy to spark a new economic boom through asset bubbles. This reality contrasts sharply with the FED's portrayal of a controlled and measured approach to monetary policy.

The second problem with Powell’s narrative is that the FED is not solely focused on employment and price stability. In reality, the FED is primarily concerned with keeping borrowing costs low so that politicians can continue deficit spending to support their agendas. With federal debt rising from $23 trillion to $35 trillion in four years, low interest rates have been crucial. As rates increase, so do interest payments, straining the federal budget and risking a sovereign debt crisis. Historically, high debt did not lead to significant interest costs due to low rates, but since 2022, rising rates have caused interest costs to surge.

FED Fund Rate (blue line); US Government Current Expenditure Interest Payments (red line) & US Recessions.

Interest costs have more than doubled since 2021. However, we have yet to see the full impact of mounting debt combined with rising interest rates. For now, interest costs have been somewhat contained because federal debt does not mature all at once. At the end of 2024, nearly $9 trillion in federal debt will have matured and will have to be replaced with new debt at higher interest rates (i.e., higher yields). Additionally, with around $2 trillion in new debt expected in 2024, the federal government will need to find buyers for over $10 trillion in debt. This immense debt will likely force the FED to intervene by again purchasing large amounts of government debt or to impose a yield curve control policy to keep interest rates from rising further and to keep yields in check. Ultimately, long term yields are unlikely to decrease significantly in this context.

United States of America Debt distribution by maturity.

In other words, political realities will mean the politically correct FED will have at some point once again come to the rescue of the US Treasury to control the ineluctable rise in yields in a structurally stickier inflation environment. Recently, Jay Powell has continued the routine of portraying the FED as skillfully managing the economy while expressing concern for those affected by inflation. However, this is often at odds with reality. The reality is that while the FED officially claims to be non-political, recent actions and statements, such as those from former Goldman Sachs economist and NY FED president Bill Dudley, reveal it as a political tool for the interests of plutocrats. Indeed, Dudley’s 2019 call for rate hikes to undermine Trump’s re-election bid underscores the FED’s political influence.

After sparking outrage with his op-ed before the last presidential election, exposing the FED’s true motives, even among establishment circles, Bill Dudley retreated into obscurity. There, he continued to publish occasional, often misguided op-eds. Most recently, on May 30, he wrote, ‘The Fed Thinks It’s Fighting Inflation. Think Again,’ claiming that even with a short-term interest rate above 5.25%, the FED’s target might still be insufficient to cool the economy.

A few weeks later and to boost ‘Kamalanomics’, in a Bloomberg video op-ed titled ‘I Changed My Mind,’ Bill Dudley flip-flops once again, now advocating for immediate rate cuts, despite having argued just two months ago for higher rates. Back then, he claimed that the FED's target range of 5.25% to 5.50% was insufficient to restrain growth and inflation. Dudley’s earlier op-ed suggested maintaining rates ‘higher indefinitely’ until inflation was under control. He even called for a rate cut at the July meeting, acknowledging a possible recession, a stark reversal from his previous stance that the economy and inflation were overheating. Dudley’s shift seems driven more by political motivations than consistent economic analysis, reflecting a clear bias towards supporting the current administration and its keynesian policies.

So what changed? As usual with Dudley, there are two layers: the superficial and the underlying. On the surface, Dudley’s flip-flop mirrors Goldman Sachs' recent recommendation for a July rate cut. Instead of examining the details, let’s focus on Dudley’s new stance. He now claims that after years of economic strength suggesting the FED wasn't doing enough, the situation has shifted. Although wealthy households continue to spend due to high asset prices and refinanced mortgages, most others have depleted their savings from government transfers and feel the pinch from higher credit card and auto loan rates. Housing construction is slowing due to high borrowing costs, and the momentum from Biden’s investment initiatives seems to be waning. Dudley, who previously emphasized the strength of the labor market, now cites slower job growth, using the household employment survey to justify his call for rate cuts. As a sudden, Dudley seems to have discovered how inflation has been spreading misery to the US middle class over the past 4 year of failed ‘Bidenomics’.

The real reason Powell still hesitates to cut rates is not only political but also because he knows that wars are stagflationary. Cutting rates before the election would be seen as a move to undermine Trump’s election chances and prop up a candidate the Democrats imposed on their voters. This highlights the need for a truly independent FED, free from political influence and which is really using an independent economic model to implement its monetary policy.

For those following US politics closely, ‘Project 2025’ offers a potential blueprint for a conservative administration to counteract the Keynesian policies introduced since the pandemic. The 922-page document can be summarized in four key points:

Restore the Family: Emphasize the family as the centerpiece of American life.

Dismantle the Administrative State: Place the entire federal bureaucracy, including independent agencies, under direct presidential control (unitary executive theory).

Defend National Sovereignty and Borders: Strengthen border security and national defense.

Secure God-Given Individual Rights: Promote individual freedoms and liberties.

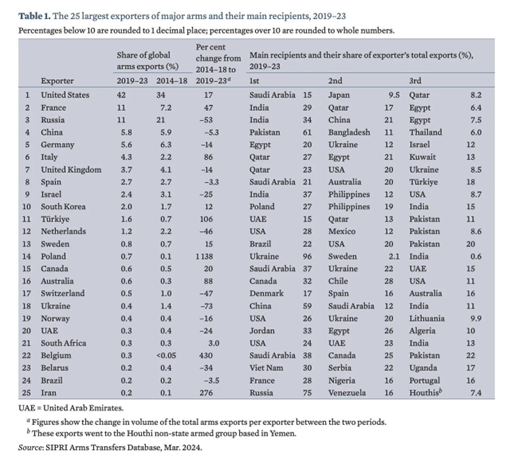

In a nutshell, Project 2025 aims to cut through the ‘byzantine bureaucracy’ that hinders economic growth but it is far from being a project which is preserve peace and prosperity in the next few years. For example, the Heritage Foundation critiques the current process where the State Department notifies Congress about arms sales, calling it an unnecessary “hindrance.” Contrary to promises of peace, Project 2025 also seeks to restore the US as the ‘Arsenal of Democracy’ by increasing arms sales outside the US, which they claim have dwindled under the Biden administration.

The release of Project 25 reflects declining trust in government, where power is increasingly controlled by a few plutocrats who manipulate rules to their benefit while leaving hardworking citizens struggling. This mirrors past political upheavals, like the collapse of monarchies, and aligns with Schumpeter’s idea of a ‘Wave of Creative Destruction’ in human history. The last collapse in government worldwide was all about monarchy. Nobody put it better than Thomas Paine in his publication Common Sense, which famously inspired action against tyranny, reflecting the cyclical nature of political change. This process mirrors Schumpeter’s concept of the ‘Wave of Creative Destruction’ in history.

The last time the world experienced such a deep distrust of public institutions was between 1882 and 1934. During that period, there were numerous financial panics, the beginning of the Progressive Era, the rise of socialism in 1912, and the onset of World War I in 1914, which was part of a plan by governments to default on their debt. Today is no different: Keynesian governments may push towards World War III, allowing them to default on their debts again and promote their climate change scam, which is ultimately linked to their aim of exploiting Russia’s natural resources. The previous 'private wave' peaked in 1929 with the start of the Great Depression, which led to socialism and Franklin D. Roosevelt’s gold confiscation. At that time, there was a global upheaval, marked by the rise of FDR, Hitler, and Mao, mirroring the current change in political power we are witnessing over the all year of political hell that 2024 has been so far.

Coming back to the Project 2025, chapter 24 of the document, authored by Paul Winfree, critiques the Federal Reserve and advocates for its abolition. Winfree suggests returning to a commodity-backed money system and lists other reforms like free banking and various monetary rules as less effective alternatives. He argues the FED exacerbates economic cycles, inflates the dollar, and facilitates excessive government spending. Winfree’s critique, influenced by monetarist ideas, acknowledges the FED's failure during the Great Depression but overlooks Rothbard's views on its role in the 1920s boom and subsequent bust. He proposes rules-based policies like the K-Percent Rule, which fixes money supply growth. This policy which has been developed by Milton Friedman states that money supply growth should not exceed 3% per year as this will keep the purchasing power of money stable over time. Friedman claimed that the best way to bring stability to the economy over the long term was to have central banking authorities automatically grow the money supply by a set percentage or amount (the "K" variable) each year, irrespective of economic conditions as Friedman understood that investors have to deal with the business cycle rather than trying to manipulate its course.

By following rules that could be amended, political pressures on monetary control could be removed from government hands, bolstering the perception that the FED is an impartial, scientific agency using sophisticated models and tools to manage the macroeconomy. Ultimately, investors should remember that the FED was established by bankers on Jekyll Island during a period of bank runs and that’s why it has kept its political bias over the years.

At the end of the day, the core problem with government control of monetary policy is its exposure to two unavoidable political pressures: the pressure to print money to subsidize government deficits and the pressure to print money to artificially boost the economy until the next election. Since these pressures will always exist with self-interested politicians, the only permanent remedy would be to remove monetary policy control from the Federal Reserve and to automate monetary policy using a computer-based rule that politicians cannot alter, as advocated by Milton Friedman and other monetarists. This approach would deal with the business cycle through a constant increase in the money supply, rather than attempting to influence it, as Keynesian and other central planning policies do. Karl Marx's ideology posited that the business cycle is an inherent feature of capitalism, driven by the tendency to create a reserve army of unemployed, leading to periodic crises of overproduction and underconsumption.

Ultimately, as in Physics, every action causes an equal and opposite reaction. Until we learn to live with the cycles and stop trying to manipulate society to create this fictional perfect world that cannot exist, as was the case with Communism, then perhaps, like a dog, we will one day shake off this political manipulation and just for once advance as a society. Communism was tried in ancient Sparta, Greece. This city-state never issued coins. Yet they waged war against Athens and defeated the land of freedom and democracy in 404 BC. Karl Marx drew much on this segment of history, including the writings of Aristotle.

On this matter, the Biblical story of Joseph and the Pharaoh can serve as a blueprint for understanding and adapting to cycles. At its core, the story illustrates that the world experiences periods of abundance followed by periods of scarcity, seven years of plenty and seven years of drought. This narrative suggests that the business cycle is inevitable, and we must prepare for it to mitigate its impact on society.

Both Keynes and Marx promoted the idea that governments could control the direction of the economy. Neither fully grasped the complexity of the global economy and its interconnectedness. Had it not been for World War I and II, capital might never have shifted from Europe to America, with New York replacing London as the Financial Capital of the World. Wars often arise from economic distress, much like the Barbarians who sensed weakness in Rome and struck. While some sought conquest, once an empire reaches its zenith, internal political corruption can erode it like a cancer. Thus, empires, nations, and city-states often meet a common fate because a collective society seems incapable of learning from past mistakes, ensuring that history repeats itself.

Ultimately, We The People should never forget what Thomas Jefferson once said:

Long story short, the world is still pinning hopes on a still phantasmagorical FED rate cut as the market saviour this year. However, even it would materialize, history suggests that rate cuts don't always lead to market gains, instead, they can signal the opposite. While the market anticipates rate cuts as a positive sign, they might actually be an alarm bell for a potential downturn.

Market bottoms typically follow FED rate cuts, which usually occur after previous rate hikes have fully impacted the economy (a process that generally takes 18 to 24 months).

But don’t rely solely on rate cuts as a signal that the market might be poised for a downturn. Behind the scenes, negative macroeconomic data is accumulating like a wreck on a highway. When the FED is in QE mode, bad news is often seen as good news. However, with the FED still focused on quantitative tightening as a way to curb inflation, bad news is just bad news. Evidence of this includes major cracks in regional banking and commercial real estate, consumers being squeezed as reflected in retail earnings, and unemployment rising to 4.1%, the highest since November 2021.

Here’s the coming cycle in a nutshell, even if the FED is tempted by the political serenades to cut rates:

Debt delinquencies indicate that borrowers are struggling to meet their obligations. Financial institutions that issued these debts may face liquidity constraints as their expected income flow is interrupted. In a rising delinquency environment, lenders tend to become more cautious, tightening lending criteria or increasing interest rates to offset the higher risk. This can inhibit entrepreneurship and decrease consumer spending, as both individuals and businesses find it harder to obtain credit.

When consumers spend less, businesses experience reduced revenue and profits, making them less attractive investments. Lower earnings can lead to a decline in stock prices, whether through reduced multiples or weakened fundamentals.

So yes, there will be a period between the FED’s decision to pause and cut rates. However, history suggests that stocks may tank initially, rather than rise. It’s often in the quarters or years following rate cuts that the market may find its bottom. Therefore, rate cuts should not be seen as an immediate buy signal for stocks. As they say in London, mind the gap between rate cuts and a market bottom if this rate cut finally become reality.

Indeed, looking at data since 1955, equities typically perform well only after the FED begins its interest rate cut cycle, unless growth is weak. Given that the recent inflation wave has sparked recession fears among consumers, investors should be cautious about what they wish for regarding the FED's next interest rate move.

Finally, investors should take note the steepening of the yield curve is ultimately recessionary as the US recession has historically started when the spread between the 10-year and the 2-year has become positive. For equity investors, they should also take note this has been associated with the outperformance of the Barbell equity portfolio made of Energy and IT stocks against the S&P 500 index.

Relative performance of the Barbell Equity Portfolio (50% S&P 500 Energy Index & 50% S&P 500 IT Index) to S&P 500 index (blue line); Spread between the US 10-Year Yield and the US 2-Year Yield (histogram); Correlation and US Recessions.

In conclusion, with the FED still willingly colluding with the government to fund its debts, the odds are small that any significant deficit reduction is possible whoever is the next tenant of the White House. While the path is unsustainable, it is likely much longer than most pundits appreciate. Investors should by now know that fiscal dominance comes with a significant cost. The FED fuels the widening wealth gap by manipulating interest rates and indirectly influencing the stock market. In this context, US Treasuries with a maturity of more than 12 months have become un-investable assets as they will only deliver negative inflation-adjusted returns with a rising risk of default. The alternative for fixed-income investors is to focus on a diversified portfolio of investment-grade bonds issued by companies with healthy balance sheets and bullet-proofed business models, which can navigate the uncertain economic, political, and geopolitical turmoil lying ahead. However, investors must remember that fiscal dominance and political uncertainties will inevitably push the US and the rest of the Western world into an inflationary bust (i.e., stagflation), an environment which is inauspicious for fixed-income investors in general. The same investors should now also know that only by owning physical gold and shares in US blue chips (i.e. the Dow Jones) they will be able to preserve their wealth from the misery spread by inflation. With the world facing significant economic, political, and geopolitical turmoil, investors must avoid having any kind of exposure to government risks, which are likely to be at the epicentre of the next debt crisis. In this context, prioritizing Return OF capital over Return ON capital becomes crucial. Investors should mitigate counterparty risks by allocating between 20% and 40% of their wealth to un-confiscatable assets like physical gold and silver. Regarding equity investments, sectors to avoid in this environment include financials and any sectors tied to consumer health or dependent on government interventions, given the current weaponization of the economy and rule of law by governments.

WHAT’S ON THE AGENDA NEXT WEEK?

The first full week of the second month of the third quarter will be much more relaxing for investors, as they will only need to focus on the US and China trade balances, along with another update on inflation in China and Germany. The week will feature bank holidays in Canada and Singapore, but the main focus will shift to earnings releases from Berkshire Hathaway, Palantir, Devon Energy, Mosaic, and Cheniere Energy, among others.

KEY TAKEWAYS.

As Mercury is once again in retrograde motion, here are the key takeaways:

The Chinese PMI data is another example that more time and effort will be needed to Make China Great Again.

The latest decision by the Bank of Japan is another sign that Japan is getting closer to its financial doom loop, which will be a major headwind for those still daydreaming about lower US long-term yields in the years to come.

The latest US ISM Manufacturing data added more salt to the wounds of those who believe the US is in a Goldilocks scenario rather than facing an inflationary bust.

The July US Nonfarm Payroll, while impacted by weather disruptions, added to the long list of factors that have pushed US consumers into misery.

The Q2 2024 earnings season has been the most volatile since the financial crisis, as high earnings expectations made earnings releases widely anticipated to be a headwind for equity markets.

Investors should beware the ides of September as data dependency will be used as the reason for NOT cutting rates at the next FOMC meeting.

Despite meeting Q3 expectations and exceeding Q4 estimates, the real concern for the Treasury funding is Q1 2025, when Biden exits and a new leader, chosen by the deep state, takes over, potentially increasing government spending and exposing deeper financial issues.

In a ‘debtentombed economy’, FED’s decisions are essentially meaningless for the real economy as bond vigilantes will not allow FED cuts to work.

As the FED controls short-term interest rates, its impact on long-term rates is minimal unless it implements Quantitative Easing or Yield Curve Control policies, which would drive asset inflation higher.

While appearing politically correct, the FED is increasingly political and partisan, serving as a tool for the interests of plutocrats who seek more government spending to further enrich themselves.

To counteract politically driven monetary policies, the solution is to implement a rule-based monetary policy that smooths the impact of the business cycle without attempting to manipulate it.

Marxism and Keynesianism aim to demonize the business cycle, which is a natural part of economic life, much like Joseph's interpretation of the Pharaoh's dreams.

Since an interest rate cut cycle is often followed by a severe drawdown in equity markets, investors should be cautious about what they wish for regarding the next FED rate move.

With communist Keynesian policies being implemented across the Western world, investors should be aware of the equity melt-up seen in countries like Argentina and Turkey, which have experienced a collapse of trust in government policies and structurally higher inflation as a result.

While equity markets in countries that have implemented Keynesian policies before have experienced "melt-up" moves, these gains have often been accompanied by substantial drawdowns along the way.

To preserve their wealth against central banking masquerades, government reckless spending, and uneconomic Keynesian regulations, investors should own a combination of physical gold and stocks of blue-chip companies.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscatable, like physical Gold and Silver.

Long dated US Treasuries are now an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

In such an environment, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

The first week of the second month of the third quarter revealed economic weakness that even the mainstream media could no longer ignore. While Powell entertained the prospect of a pivot, it was not enough to inspire confidence in equity markets. Stocks did not respond favourably to the dovish stance, as the 'soft landing' narrative shifted to a 'growth scare.' This led to small caps, the most sensitive to economic fluctuations, underperforming other US indices. The Russell 2000 had its worst week since March 2023 and the SVB collapse. The Nasdaq recorded its fourth consecutive weekly drop, and the S&P 500 found temporary support at its 100-day moving average, while the Nasdaq fell below it, officially entering correction territory.

In this context, with the Magnificent 7 erasing $2.3 trillion in market capitalization since their record high in mid-July, it was no surprise to see defensive and rate-sensitive sectors like Utilities and Real Estate outperforming, while IT and Consumer Discretionary declined by more than 4.0% over the past 5 days.

As the world prays that the FED will finally pivot in September, until then, GOOD NEWS is BAD NEWS, and BAD NEWS will also be BAD NEWS. Indeed, the question is not about to cut or not to cut as the drums of war are pushing the US economy into an inflationary bust. In this context, the FED is running out of power and time to implement its infamous pivot, which will prove ultimately ineffective as bond vigilantes will prevent monetary policy from having a significant impact on the real economy, which remains plagued by gargantuan and uneconomical regulations supported by irresponsible fiscal policies which are driving bankers' wars. As central banking masquerades prevail, investors should remember that this environment is inflationary and will lead to rising misery for those unprepared to face it, as inflation will erode their wealth. This will also lead investors to deal with much higher volatility than they have most of them have ever experienced in their career. Consequently, one asset class that is currently grossly undervalued is volatility. While it is difficult for most investors to buy volatility directly, they should consider continuing to hedge their portfolios against larger movements in equity markets until the political circus surrounding the White House concludes.

Longer term, investors seeking to maintain their wealth in inflation-adjusted terms must focus on assets that protect them against reckless Keynesian policies implemented by governments, which are always looking to raise taxes and spend more for their plutocrats. In this context, assets that are 'antifragile', which cannot be confiscated by governments once sovereign debt defaults become unavoidable, should be prioritized. Physical gold and silver, which should be stored outside the banking system in a secure location, should constitute a major portion of the portfolio (between 20% and 40%). In this same context, it should now be clear to everyone that owning government bonds with a maturity of more than six months is an irresponsible asset allocation decision, as it will only lead those holding these bonds to a miserable future once returns are adjusted from real inflation. Given the inflationary nature of fiscal dominance, investors should continue to avoid the 'duration risk' of any corporate bonds, as bonds with a maturity of more than 12 months will suffer from higher inflation and much higher Treasury yields. Investors must therefore look at a diversified portfolio of investment-grade bonds issued by US corporations with an average maturity of less than 12 months for the income part of their portfolio which should not exceed 20%.

Within equities, which should constitute between 40% and 60% of the portfolio depending on the risk tolerance of each investor, passive investors should consider investing in blue chip companies which can be portrayed by the Dow Jones index or in a diversified holding company like Berkshire Hathaway as well as an active ETF such the VanEck Morningstar Wide Moat ETF (MOAT US) which will manage the stock picking for them and will help them to alleviate the impact of stickier for longer inflation over the next couple of years.

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at info@themacrobutler.com.

Unlock Your Financial Success with the Macro Butler!

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

Hmmm

Miracle!!!!

Let's take a look at Donald Trump's Ear

Seemingly No Injury...

https://fasteddynz.substack.com/p/lets-take-a-look-at-donald-trumps