Watt-Flation!

‘Watt-flation’: How AI’s energy binge and America’s creaky grid are cranking up inflation—and powering the Trump stagflation storm.

What’s behind the numbers?

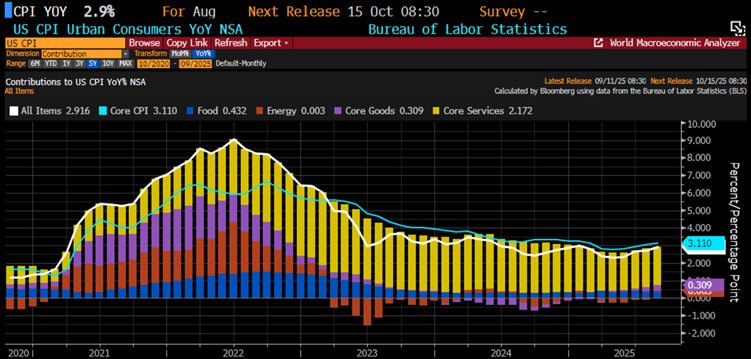

The eighth CPI print of this so-called Jubilee Year strutted onto the stage with a +0.4% MoM—slightly hotter than July’s +0.3% and the +0.3% economists had dutifully scribbled into their spreadsheets. Year-on-year inflation put on its best soap opera face at +2.9%, exactly on cue with forecasts, but still juicier than last month’s 2.7%. Energy, of course, played the diva role (thank you, oil) to keep the “deflation” fairytale breathing, while goods inflation came roaring back with its spiciest YoY act since May 2023. Food joined the fun too, delivering its biggest yearly surge since October 2023. And core services? They took a coffee break, slowing ever so slightly from +2.2% to +2.17%—a blink-and-you-miss-it deceleration worthy of May’s reruns.

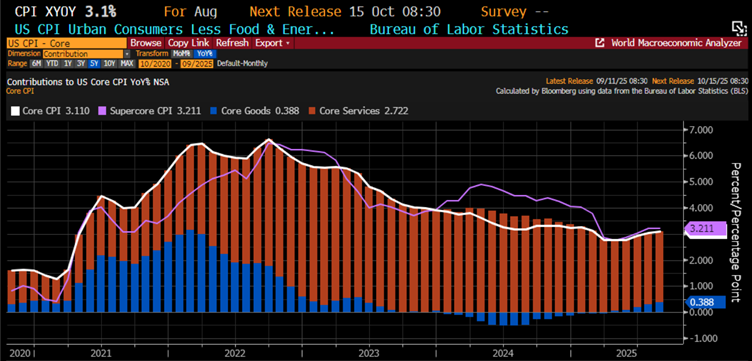

Core CPI in August arrived right on script at +0.3% MoM—steady as July, and exactly what forecasters ordered. On a YoY basis, it held at 3.1%, basically pressing pause after June’s little reacceleration. Core services—making up a whopping 76% of the inflation buffet—eased to 2.72% YoY, while core goods stayed stubbornly inflationary for the fifth straight month. And yes, we’re now on month 63 of uninterrupted core CPI gains. But relax—only economists, investors, central bankers, and anyone who eats, drives, or breathes need to care.

A crowd-pleaser for the “inflation is dead” fan club: Owners’ Equivalent Rent—the undead zombie of CPI—lurched in at +4.0% YoY in August, barely cooler than July’s +4.1% and proudly claiming its “coldest” reading since December 2021… which is like bragging your fever is only 102 instead of 103.

Even less comforting for the “inflation is six feet under” choir: SuperCore CPI—core services minus housing, the Fed’s beloved vanity metric—held firm at 3.21% YoY in August, putting its four-month reacceleration streak on pause. Translation: no victory lap, just a smoke break. But sure, inflation’s totally dead… if you squint, ignore rent, goods; food, and reality, and mainline a fresh dose of ‘hopium’.

Market reactions.

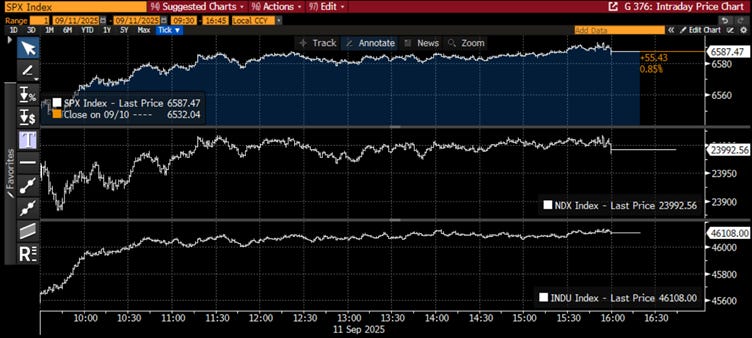

Wall Street threw itself a victory party over an “on-target” CPI, sending the Dow, S&P 500, and Nasdaq 100 dancing to fresh record highs—cupcakes, confetti, and all.

August’s CPI barely ruffled Wall Street’s rate-cut daydreams—traders are still betting on a 25 bps September trim and nearly three cuts by year-end, proving reality is just an optional extra.

The Dollar Index took more of a beating from limp US labour data and a hawkish Lagarde-boosted euro than from the CPI print itself.

Gold didn’t flinch, still glinting less than 1% below last Tuesday’s fresh all-time highs.

Despite Chapter 2 of the Great Reflation Saga looming, the 10-year yield is still stuck near 4.0%, as Wall Street’s finest cling to the fairy tale that the “risk-free” asset will stay risk-free when Trump Stagflation crash the party.

Thoughts.

August’s CPI confirmed what anyone with a shopping cart already knew: that first-quarter “deflation” was just a mirage, and the Trump Reflation Express is chugging along—tariff tolls included. While the “Manipulator in Chief” and his Fed sidekick pop champagne over their imaginary 2% target, real inflation is still jogging at 3.2% YoY. But sure, let’s call it a win—nothing screams success like shrinking margins and taxing consumers with a grin.

US Umbrella inflation Index (Average of CPI; Core CPI; PPI; Core PPI; Core PCE, 1-year consumer inflation expectations)

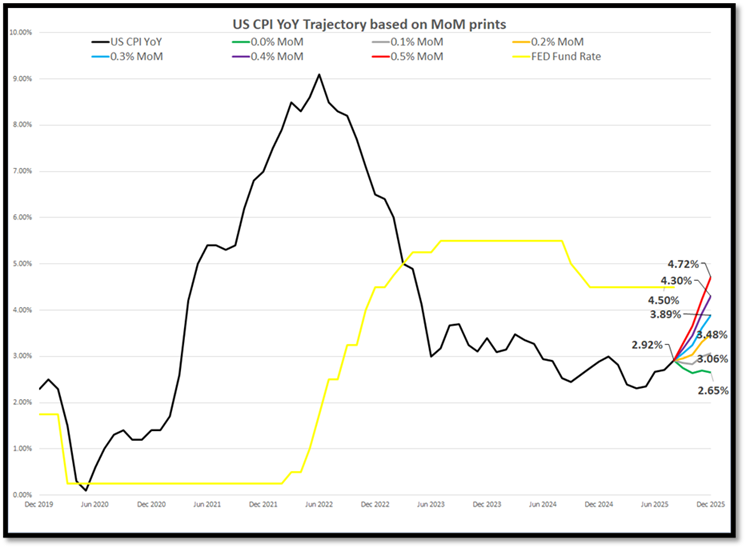

Instead of fantasizing about 2% inflation like it’s a Disney fairy tale, seasoned investors—unlike the caffeine-fuelled PhD circus at the Fed—can do the math.

For that miracle to happen, CPI would need to moonwalk below 0% each month—good luck with that in a tariff-choked, WW3-flirting world.

At 0.2%+ prints, we’re cruising toward 3.5%–4.8% CPI by year-end.

And when that reality check lands, not even Donald Copperfield sawing the “Central Banker in Chief” in half will disguise the fact that cutting rates into an inflationary boom might rank among the Fed’s dumber magic tricks.

For equity investors, the message couldn’t be clearer: when tariffs bite, someone has to pay, and Corporate America has no intention of letting it be shareholders. Just like in June, companies are passing higher input costs straight to consumers to keep margins intact and earnings safe. In August, the spread between core CPI and core PPI was once again positive, but slipped slightly from June, showing that firms are struggling to push through costs as efficiently amid regulatory chaos. Bottom line: consumers can rest easy knowing their patriotic duty is to pick up the tab—whether they like it or not.

Spread between US Core CPI & US Core PPI (Histogram); S&P 500 12-months Forward EPS (blue line); 12-month S&P 500 returns (lower panel; yellow histogram).

Of course, anyone who cracked open Econ 101 knows that government economic data are about as trustworthy as a used car salesman on April Fool’s Day. Take the CPI, for example—apparently, it’s designed to understate just how painfully inflation is hitting regular folks. According to a recent CBS News poll, Americans making under $50k magically “only” need $157k a year to live comfortably, while those earning six figures somehow require a modest $246k. Makes perfect sense, right?

https://www.cbsnews.com/news/salary-income-needed-to-live-comfortably-in-us-cities/

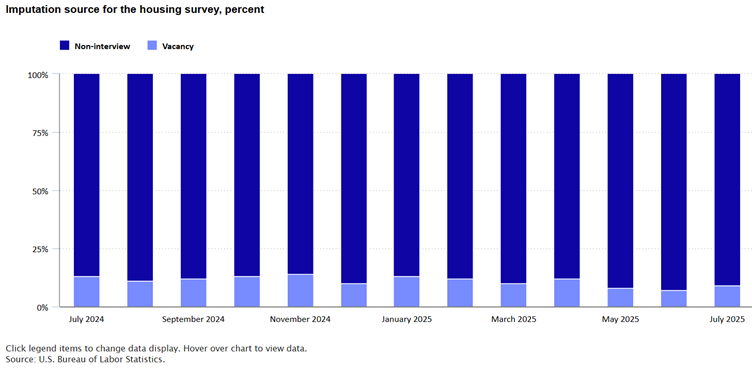

In British English, there’s a perfect term for it: “jobsworth”—someone who slavishly follows petty rules at the expense of sense. Enter the US CPI. Produced by an underfunded agency, it turns out about a third of the prices are just guesses, dressed up in statistical glitter. For housing, if a unit is vacant, they “impute” its rent from nearby units; if it’s long-term vacant, they copy the average of occupied ones. In other categories, missing prices are filled in from similar items—or if all else fails, carried forward with the assumption that nothing changed.

Today, more than half of the US CPI relies on these imaginative imputations, especially for shelter, which makes up over a third of the basket. Nearly a third of all CPI prices are guesses by any other name, raising the usual questions: if the data are mostly made up, can we really trust the headline number?

https://www.bls.gov/cpi/tables/imputation.htm

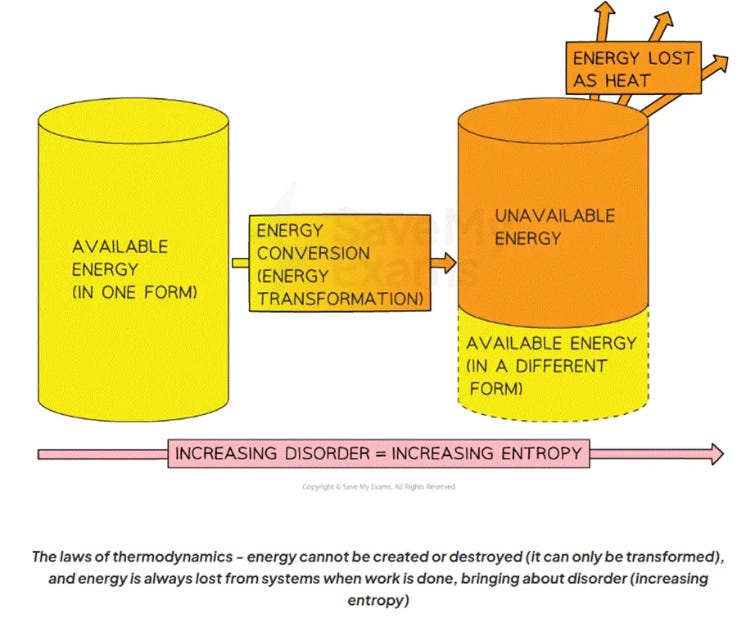

Forget the hype about AI deflation—brace yourself for the next blockbuster: “Watt-Flation.” Economics 101 101 students, pay attention: the economy is just energy in fancy disguise. Anyone who survived the electrifying lecture Energy and the Poverty of Nations knows the truth: Western prosperity wasn’t handed down by philosophers or politicians—it was mined, burned, and boiled into existence. High-quality energy is the real magic. Thermodynamics doesn’t lie: energy can’t be created or destroyed, but its quality inevitably decays. Civilization rises on energy, not on parliamentary speeches.

Wealth? Just organized energy doing your chores. For most of human history, all you had was wood, prayer, and guys in powdered wigs hoarding land. Then came coal—ancient sunlight squashed into black gold. Industrial Revolution: factories, railroads, mobility, literacy. Modern miracles.

And now? We’re trading it all for windmills and solar panels—the flaky, temperamental cousins of real energy. The result: higher costs, less power, shrinking freedoms, and a revival tour for the landlord class. Enjoy your “green” utopia.

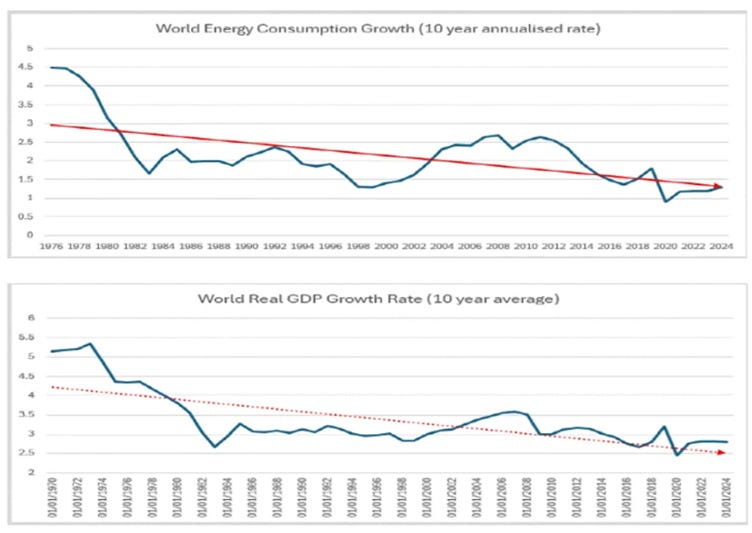

Energy—the boring little footnote in every GDP report that secretly runs the entire economy. But who cares about physics when Wall Street cheerleaders and Keynesian fairy tales insist the business cycle is just a vibe? Real investors—those not hypnotized by central bank pixie dust—already know that tracking a stock index to oil prices (local currency, naturally) tells you exactly where we are. Above the 7-year average? Party time. Below? Grab a helmet.

All that glorious GDP? It’s just energy—refined, transported, burned, and magically turned into spreadsheets and Teslas. And yes, it takes energy to get energy. Drill, transport, refine, deploy—it all costs power. If the output doesn’t earn its keep, congratulations, you’re burning capital. Even your MacBook isn’t exempt: if it doesn’t create more utility than it consumed to exist, it’s not a tech marvel—it’s a pricey paperweight. So, while pundits prattle on about “intangibles” and “soft power,” remember: everything from data centres to dinner plates exists because energy made it possible. And if that energy isn’t high-quality—aka “Transformity”—then civilization is just torching capital and calling it progress. But hey, let’s all bet the farm on wind and solar. What could possibly go wrong?

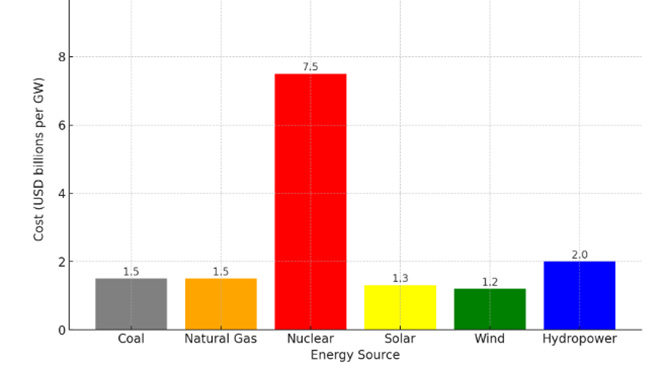

In an ‘electrified world’, if energy equals electricity, then cheap electricity equals prosperity simple as that. Generating a gigawatt of electricity isn’t cheap, and the price tag depends on how fancy you want to get. Coal and gas are the “cheap thrill” option—low upfront, but your wallet cries for fuel costs. Nuclear is the luxury condo: $6–$9 billion upfront, but cheap fuel for decades. Solar and wind are the trendy options, $1–$1.5 billion per gigawatt, but don’t forget your backup batteries for when the sun naps or the wind chills. Hydropower? Solid long-term value but finding the right waterfall isn’t exactly easy. Bottom line: every energy source makes you pick your poison—cost, reliability, or guilt.

Estimated cost to build the production of 1 GW of electricity

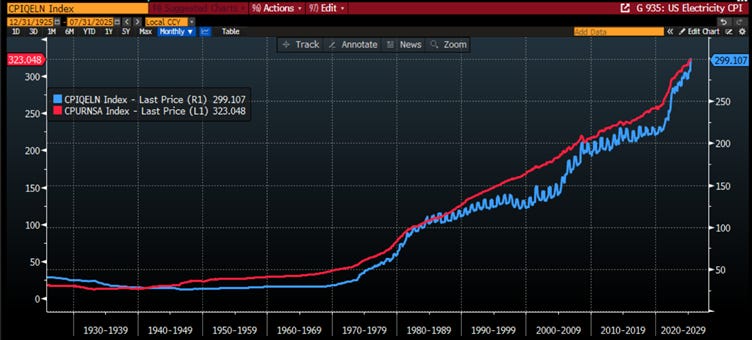

As the U.S. races to dominate AI, building ever more data centres, everyone is fixated on oil prices as the inflation culprit. The real threat to both Joe Sixpack’s wallet and corporate America’s profitability, however, is electricity inflation. From 2010 to 2019, electricity costs (CPI-measured) crept up by less than 12%. Since then, they’ve skyrocketed nearly 42%.

US CPI Electricity Index

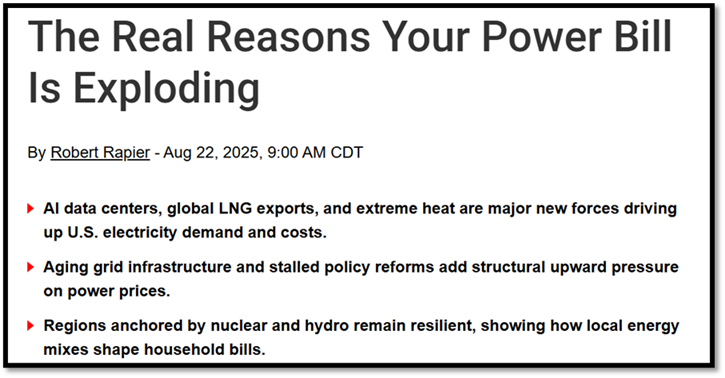

Electricity bills across much of the U.S. are soaring, creating what many call a power bill crisis. A key driver is the surge in demand from AI data centres, each consuming as much electricity as 80,000 homes, with projections suggesting they could require the equivalent of 30 new nuclear reactors by 2030.

https://oilprice.com/Energy/Energy-General/The-Real-Reasons-Your-Power-Bill-Is-Exploding.html

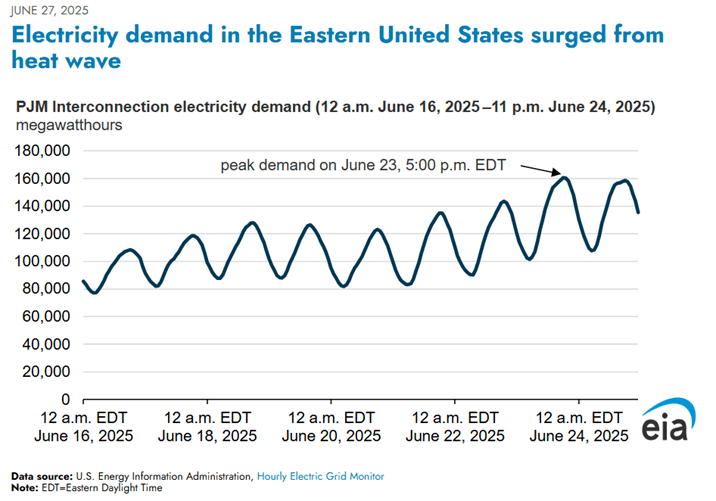

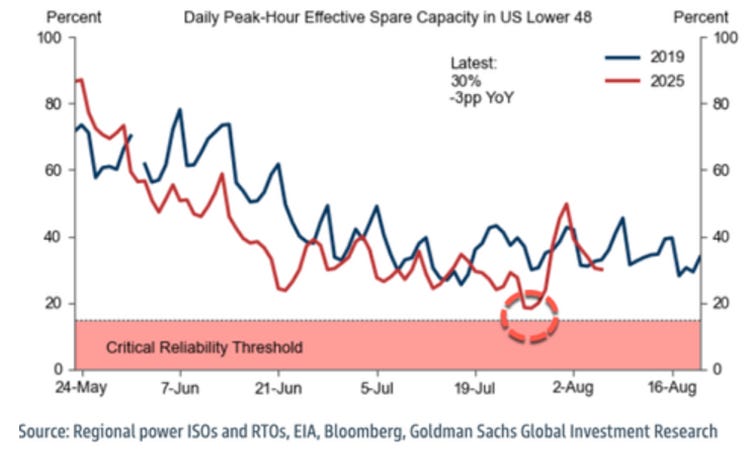

Extreme weather events, particularly the record-breaking July 2025 heat waves, have further strained U.S. electricity markets. A “heat dome” drove national peak demand to 758,149 MWh in a single hour, forcing utilities to purchase expensive spot-market power to meet air conditioning loads—costs passed on to consumers. The Southwest and Southeast were hardest hit, with households and businesses facing double-digit increases in monthly bills.

https://www.eia.gov/todayinenergy/detail.php?id=65604&utm_source=chatgpt.com

The aging U.S. electrical grid is another major driver of rising electricity prices. About 70% of transmission lines are over 25 years old, resulting in higher maintenance costs, energy losses, and inefficiencies. Frequent outages and capacity constraints during peak demand—especially in extreme weather—force utilities to buy expensive spot-market power, costs that are passed to consumers. Delays in infrastructure upgrades exacerbate these issues, with potential savings of up to $10.4 billion annually if modernization were accelerated. Increased demand from electric vehicles, AI data centres, and other technologies further strains the grid, making higher energy bills nearly unavoidable for households and businesses alike.

America’s Mid-Atlantic has been in the grip of a power bill apocalypse, and it’s only getting juicier. What started as a Baltimore shocker a year ago has now spread to New Jersey, where residents are staring at electricity bills like they just discovered a second mortgage.

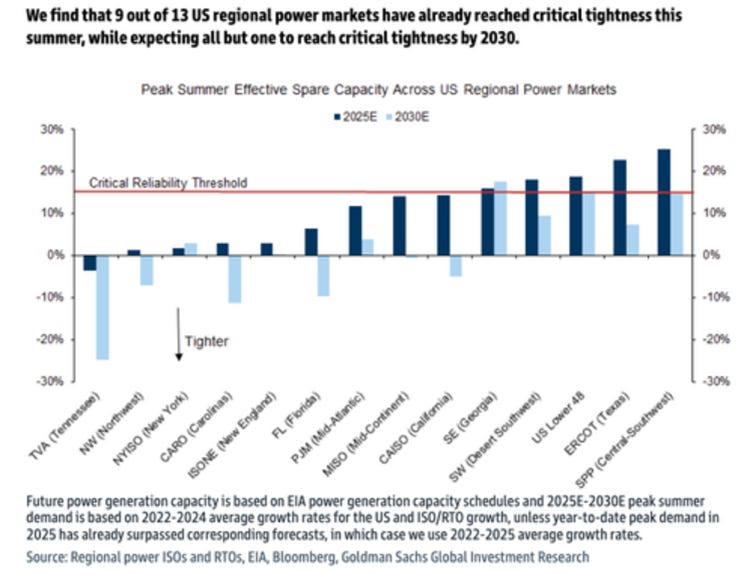

The culprit? Green energy gone wild. Radical leftist policies have shuttered reliable coal and nuclear plants in favour of temperamental solar panels and wind turbines. Meanwhile, demand keeps climbing—blame AI data centres slurping electricity like frat boys at a keg party, plus EVs and general electrification chaos. In June, New Jersey’s Board of Public Utilities decided it was time to shake things up with a 17–20% rate hike. One resident summed it up perfectly: “$200 more… this is killing us. My air conditioner was my only joy!” Green Zealots’ obsession with offshore wind and green projects didn’t help either. The Mid-Atlantic grid, PJM Interconnection, is now the epicentre of this electrified nightmare. Most U.S. grids are flirting with disaster—running on dangerously low spare capacity and flirting with blackouts and jaw-dropping price spikes. Nine out of 13 grids are already in the danger zone, with all but one expected to hit critical levels by 2030.

In short: if you thought your summer barbecues were expensive, just wait until your air conditioner bill arrives. The perfect storm of overambitious green policies and insatiable electricity demand has turned paying for power into a contact sport.

On the topic of grid fragility, it only took one little substation hiccup in Baltimore in August to put over a million Baltimore Gas and Electric customers on “maybe no AC for hours” alert. The problem got fixed in a few hours, but it was a perfect reminder of how delicate the local grid has become after years of ambitious green experiments… or, as some might call it, ‘epic mismanagement by green zealots’ leadership’. Unfortunately, most U.S. regional markets will remain critically tight through 2030. Heatwaves and growing power demand are only making things worse, especially in PJM (Mid-Atlantic), where both demand and prices are hitting record highs.

In short: it’s a mess, and the next power bill is going to remind you why.

And just like that, the green crusade—mostly a PR stunt by Malthusian Green Zealots to fundraise off a manufactured crisis—has left U.S. grids wobbling on the brink of Cuba-style rolling blackouts. Some silver lining: Donald Copperfield stepped in to delay coal retirements and boost nuclear investment. Translation: the power crisis is here, Mid-Atlantic voters are feeling it in their soaring utility bills, and the ‘Blue’ might be paying the political price once again.

We all notice gas prices—right there at the pump, glaring at us. Electricity? Not so much… until your monthly bill jumps like it’s on a trampoline, and suddenly everyone’s freaking out about energy inflation. High power costs mean pricier groceries, tighter business budgets, and an economic engine wheezing like it’s run a marathon.

US Electricity Price Index (blue line); US CPI Index (red line).

Sure, AI is gobbling up electricity like a teenager with free snacks, but let’s not forget the human touch in this chaos. Malthusian policymakers, obsessed with control, have let the U.S. lag in infrastructure investments—especially the electric grid, the backbone of a healthy economy and broad prosperity. Meanwhile, Wall Street keeps cashing in, regardless of whether the Oval Office occupant is rocking blue or red. So, no surprises here: U.S. Electricity CPI and the “Chaos Index”—a delightful cocktail of policy blunders and global tensions—are dancing in perfect sync. Translation? Expect to pay more for less, with a generous helping of political theatre on the side.

Chaos Index (US Economic Policy Uncertainty Index + Caldara Iacoviello Geopolitical Risk (GPR) Uncertainty Daily ) (blue line); US CPI Electricity YoY Change (red line).

Seasoned investors know inflation isn’t magic—it’s just scarcity, hot demand, and everyone losing faith in government. Throw in tariffs, trade wars, and Uncle Sam’s chest-thumping, and surprise: prices shoot up, confidence tanks. If ‘Donald Copperfield’ cooks up another inflation spiral or global mess, his political clout will vanish quicker than his campaign promises.

As if rising grocery bills weren’t enough, soaring electricity costs are now adding pressure on everyone’s wallet—a clear sign that inflation isn’t going anywhere. Wages? Barely keeping up. Toss in a slowing economy and AI snatching jobs faster than you can say “automation,” and voilà: the Great Inflation Squeeze is here. Buckle up — it’s about to get tight.

At the end of the day, as Maharishi Mahesh Yogi wisely put it:

Bottom line: The “Manipulator in Chief” has heroically decided that the best way to fix the economy is to slap on more tariffs and threaten to sue the “Central Banker in Chief” — because nothing says stability like a leader lobbing grenade at his own supply lines. And sure, let’s keep pretending trade barriers create jobs, while history sits in the corner rolling its eyes. America’s trade deficit? Obviously, China’s fault… if you ignore decades of American binge-buying and corporate offshoring.

What’s needed is deregulation, real tax reform, fiscal discipline and infrastructure spending —not tariff tantrums while politicians tend their portfolios.

Investors take heed: empires in decline collapse under the weight of war, debt, and delusion. Hard assets—gold, quality stocks—are your bunker. Long bonds? Only if you want to bankroll the Treasury’s spending spree.

In the end, the tariff warriors won’t be heroes—they’ll be the architects of America’s downfall.

Key takeaways.

August’s CPI delivered another inflation soap opera—energy hogging the spotlight, goods roaring back, food spiking, and core services barely budging—reminding everyone that the “deflation fairytale” is still very much fiction.

August CPI says inflation’s “death” is wildly exaggerated—OER still lurching, SuperCore refusing to budge, and the only thing cooling off is common sense.

Inflation isn’t dead — it’s lurking in the shadows, waiting to strike with a second wave.

While the ‘Trump-Re-Flation’ gains steam, fuelled by tariffs and tighter labour markets, the real question isn’t if inflation rises, but who picks up the tab: businesses trying to protect margins, or consumers bracing for sticker shock.

While the FED may downplay base effects, hitting 2% inflation by end of 2025 is quickly turning into another financial soap opera.

Inflation stems from shortages, demand, and declining confidence, all exacerbated by tariffs and trade barriers that stifle free mercantilism.

In an inflationary bust, investors need to understand that protecting their wealth involves avoiding long-dated government bonds and focusing on a combination of equities from companies that can maintain pricing power with strong balance sheets and robust business models and physical gold as THE antifragile asset.

As stagflation rather than recession worsens in the next few months, investors should prepare their portfolios for HIGHER volatility.

Gold and silver are eternal hedge against "collective stupidity" and government hegemony, both of which are abundant worldwide.

In this context, investors should also remain prepared for dull inflation-adjusted returns in the foreseeable future.

With the S&P 500-to-gold ratio below its 7-year moving average for more than 7 months, investors should remain aware that, while the US economy is currently in an inflationary boom, it may be only 3 to 6 months away from shifting into an inflationary bust (i.e., stagflation). STAGFLATION will be painful for investors who haven't prepared their portfolios for this scenario. In this environment, people will buy even less for even more, and it will be challenging for those still blindly following Wall Street's ‘Forward Confusion’ narrative of seeking refuge in long dated fixed income papers and government bonds. Physical GOLD remains the only antifragile asset to thrive during an inflationary bust.

Bottom line: As everyone knows, history shows that collapsing public confidence, fuelled by gangrening political corruptions and wars, leads to economic turmoil and this decade will be no different, as the ‘Trump-Re-Flation’, morphs into the 'Trump Stagflation,' which will force everyone, from billionaires to everyday citizens, to pay even more for even less.

Welcome to ‘Trump Stagflation’: favour low-leverage, cash-generating companies—energy over consumers, please—while long-dated bonds quietly roast in the sun. Keep cash nimble in short-term corporates, and stash 25%+ in gold, silver, and hard commodities for that “antifragile” vibe. Meanwhile, sovereign debt crises line up like dominoes—Japan, Europe, and ultimately the U.S.—as the 47th president dutifully repeats the same failed policies, expecting different results. Oh, and trade wars? Still just a global game of economic self-harm.

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

Hello Macro Butler,

You like Gold and Silver, what do you think of Platinum? And if you do, what funds would you recommend - PPLT?

Thanks

Super article.

Re nuclear https://fasteddynz.substack.com/p/why-dont-we-just-build-more-nuclear

Similar situation with coal

https://ourfiniteworld.com/2019/02/22/have-we-already-passed-world-peak-oil-and-world-peak-coal/

https://www.resilience.org/stories/2016-06-20/china-is-peak-coal-part-of-its-problem/

Let's assume the men who run the show are not stupid... so maybe solar panels etc... helped kick the can a little ... never meant to be a solution = there is no solution

Imminent https://fasteddynz.substack.com/p/collapse-and-cannibalism