The Week That It Was…

The final full week of Q2 in this Jubilee Year wasn’t exactly a thriller if it was not for the geopolitical drama in the Middle East and unless you find joy in flash PMIs, Core PCE data, and the ever-optimistic guesses of the University of Michigan’s sentiment and inflation surveys. Meanwhile, the Fed’s very own Eyes Wide Shut chairman appeared before Congress for a testimony that was just as enlightening as his last press conference—meaning, not at all. On the earnings front, 14 S&P 500 companies reported, but only FedEx, Micron, and Nike offered enough caffeine to keep investors from dozing off before we close the first half of the year with a shrug.

While diplomacy is now apparently conducted via social media posts and hashtags, the US Flash PMI did its own version of humblebragging: Manufacturing was totally flat—but hey, it beat expectations (52.0 vs 51.0), so that’s a win in Fed-speak. Services also edged down a touch but still managed to outshine forecasts (53.1 vs 52.9). So yes, the economy is slowing, but it’s beating expectations while doing it—kind of like bragging about jogging slower than last year but still faster than your neighbour. Meanwhile, service sector prices jumped again—because tariffs, wages, fuel, and financing costs apparently missed the memo about disinflation.

In a congressional appearance with all the energy of a damp teabag in monsoon season, Fed Chair Powell assured everyone there’s no rush to cut rates—because apparently staring in the rearview mirror is still the preferred policy tool. Inflation might rise, tariffs might bite, but hey, let’s wait and see. Meanwhile, Trump—never one to whisper—labelled him “Too Late Jerome” and called for Congress to “work him over” for keeping rates high. The punchline? Powell admits tariffs will likely hike prices and slow growth… but don’t expect any urgency. The Fed’s motto? Delay and pray.

While anyone with a pulse in finance knows that bonds are the ultimate scam in the incoming “Trump Stagflation” era, the Fed just gave them a fresh coat of lipstick. In a move sold as “strengthening liquidity” but better described as bailing out the usual suspects, the Fed voted to loosen a post-2008 capital rule, making it easier for mega-banks to gorge on Treasuries. The idea? If you call them “safe assets” often enough, maybe people will forget the U.S. like most other government in the world is broke.

Powell and friends claim it’s all about “market resilience,” but the plan effectively cuts required capital for the big boys while hoping no one notices the increased systemic risk. Of course, a few party poopers at the Fed warned that this could backfire in the next crisis—assuming we ever leave the current one. But hey, what's a few hundred billion in risk when Wall Street needs a boost?

https://www.federalreserve.gov/aboutthefed/boardmeetings/20250625open.htm

The May personal income and outlays report reads like a stagflation sitcom: prices are rising, incomes are falling, and consumers are finally realizing they can't outspend tariffs forever. Core PCE came in hotter than expected—because apparently, even legal advice and haircuts are feeling the heat. Spending shrank, especially on fun stuff, while incomes took a hit thanks to Uncle Sam tightening the transfer-payment tap. Meanwhile, the Fed’s favorite inflation metric, core PCE, keeps creeping up like that uninvited guest who won’t take the hint. Long story short: Americans are earning less, paying more, and spending with the enthusiasm of someone reading a tax audit letter.

Despite empty wallets and shrinking pay checks, consumers somehow found their happy place in late June—maybe denial really is a superpower. Sentiment jumped 16% from May, the first cheer in six months, even as real spending shrank and future expectations dimmed. Fewer folks are fretting over tariffs, Iran, or Trump’s tax plan, and inflation fears are down—because nothing says “economic confidence” like ignoring reality and hoping the bill never arrives.

In the never-ending soap opera of rate-cut wish casting, Wall Street’s eternal optimists—also known as traders—have once again dialed up their hopes to a modestly delusional 110% chance of a September cut after Jackson Hole. In this context, they’re now pricing in more than two cuts by year-end, clutching the soft-landing fantasy like it’s a security blanket stitched by Jerome Powell himself.

Those who see beyond the illusions of policy and rhetoric understand a deeper truth: cycles—not politicians—rule the tides of history. And among these, one force has loomed above all, both literally and metaphorically: the Sun.

For centuries, the solar cycle has acted as an unseen puppeteer, pulling the strings of the global economy. GDP booms and busts, interest rate pivots, inflation surges, and even the violent tremors of commodity markets—they all seem to dance to the rhythms of solar activity. But the influence doesn’t stop at markets. The Sun has ignited revolutions and unravelled empires. Every major spike in solar intensity has coincided with moments that reshaped the world. From the Paris Commune in 1871 (Cycle 11), through the Russian revolutions (Cycles 14 and 15), to the collapse of the Soviet empire during the peak of Cycle 22, history’s great ruptures seem to arrive on schedule—with the solar maximum as their herald. Even the Arab Spring, the most recent storm of rebellion, flared into life in lockstep with the fiery climax of Solar Cycle 24.

In short: the Sun has been moonlighting as history’s most consistent economic hitman. And its next job may already be booked.

As the Sun is heading into another minimum probably starting as soon as July 2025—the world once again began to tremble. Revolutions ignited, social unrest erupted, and acts of terror pierced the illusion of order. These weren’t isolated incidents or random bursts of chaos. They were part of a familiar rhythm—a historical echo of what has played out time and again around past solar maximums. The patterns are undeniable. Just as in centuries past, when solar peaks coincided with upheaval and collapse, today’s turbulence follows the same celestial script. History, it seems, is not just repeating—it’s solar-powered.

On October 7, 2023, as Solar Cycle 25 surged toward its peak, Hamas unleashed the deadliest terror attack in Israel’s history—killing nearly 1,200 civilians and taking 251 hostages. Dubbed “Israel’s 9/11,” the assault mirrored the trauma of the 2001 al-Qaeda attack on the U.S.—not just in scale and shock, but in timing. Both attacks occurred near solar maximums: 9/11 just two months before the peak of Cycle 23, and 10/7 roughly a year before Cycle 25’s apex in October 2024.

In response, war erupted. Israel’s retaliation escalated into a regional conflict involving Hezbollah, the Houthis, and Iran—eerily echoing the U.S.-led invasions of Afghanistan and Iraq after 9/11. Then, in March 2024, terror struck Moscow. An ISIS-linked attack at Crocus City Hall killed 145 and injured over 550—proving this wave of violence wasn’t confined to the Middle East. As with past solar peaks, the world didn’t just heat up—it burned. The Sun may give us light—but during its peaks, it seems to cast shadows far deeper.

In August 2024, as sunspot activity surged to its highest monthly level of Solar Cycle 25—just two months before the official solar maximum—revolution erupted in Bangladesh. The sudden toppling of Prime Minister Sheikh Hasina stunned the region, drawing immediate parallels to the 2022 uprising in neighboring Sri Lanka and evoking echoes of the Arab Spring, which had unfolded under the glare of Solar Cycle 24’s peak.

The timing was no coincidence. Just as Ukraine’s Maidan revolution in February 2014 peaked alongside the solar cycle—with sunspot counts at their highest—Bangladesh’s revolution followed the same solar rhythm. In both cases, the ousted leaders—Yanukovych and Hasina—fled to the very powers their people sought to resist. What followed was equally ominous. In 2014, Russia justified its annexation of Crimea by accusing the new Ukrainian government of violating minority rights. In 2024, India levels the same charge against the new authorities in Bangladesh, warning of alleged abuses against Hindus and other minorities. The solar clock ticks—and revolutions repeat.

In December 2024, the Assad regime—long thought unshakable—fell in a stunning collapse. A swift and coordinated offensive by the rebel coalition, led by Hay’at Tahrir al-Sham (HTS) and backed by the Turkish-aligned Free Syrian Army (FSA), brought an end to 13 years of brutal civil war and toppled a regime that had clung to power against all odds since 2011. The speed and scale of the fall shocked not only global observers, but the Syrian people themselves. What follows now is uncertain—and ominous.

Will this new coalition usher in a modern Syrian renaissance—or resurrect darker ghosts of the past? The memory of ISIL still looms large. At the peak of Solar Cycle 24 in 2014, ISIL rose from the ashes of regional chaos, seizing vast swathes of Iraq and Syria and ruling over 12 million people with a $1 billion war chest and 30,000 fighters. It took a global coalition to crush its caliphate by 2019—but its affiliates remain entrenched, particularly in Africa. Now, at the height of Solar Cycle 25, history may once again be poised to repeat—or escalate. As the heat of Cycle 25 reaches its apex, the question lingers: who’s next?

What came next was the inevitable escalation of war in the Middle East. Israel’s strikes against Iran unfolded with a chilling precision—seeming to follow the relentless 11-year rhythm of the sunspot cycle. As solar activity surged, so too did the flames of conflict, as if the cosmos itself were fanning the region’s most dangerous fires.

Decades ago, Russian scientist A. Chizhevsky uncovered a startling truth: solar maximums often ignite waves of mass migration—fueling revolutions, social upheaval, and the great human tides that reshape nations. Today, this phenomenon is painfully clear. The flood of migrants into the U.S. and Europe has surged alongside Solar Cycle 25’s climb toward its October 2024 peak—throwing governments into turmoil and making migration a decisive issue in elections worldwide. In the U.S., Donald Trump’s November 2024 victory came amid this chaos, nearly coinciding with the solar maximum itself. Across Europe, countries from the UK to France and Germany grapple with the mounting pressure, where managing migration has become a political fault line threatening governments and societies alike.

History repeats: the same surges in migration marked past solar peaks, proving once again that the Sun’s cycles ripple far beyond the skies—into the hearts and borders of nations.

The war cycle is right on schedule—because nothing says “progress” like replaying history’s greatest hits every solar maximum. On June 13, 2025, Israel lit the fuse with a drone-heavy fireworks show in Iran, supposedly to stop a bomb, but maybe just to ruin Trump’s potential peace deal. A week later, the U.S. joined in—because what better way to promote global stability than bombing a sovereign nation during peak solar flare season? Meanwhile, the “Peacemaker-in-Chief” proves he’s really the “Warmonger-in-Chief,” or maybe just the “Egocentric-in-Chief”—treating geopolitics like a World Cup match where the Global South is the away team and everyone else is a benchwarmer. Facts don’t matter, perception fuels missiles, and diplomacy now comes with hashtags and bunker busters.

In short: welcome to the next episode of “World War: Solar Edition”—where the stakes are nuclear, the cast is delusional, and the ending? Probably not a happy one.

But don’t be fooled—the real puppet master may be sitting quietly in the East, watching the West burn itself out while making all the right moves in silence. After all, why start a war when your enemies are kind enough to do it for you? Every missile fired at Israel in recent months bears the unmistakable mark of Chinese manufacture. Iran, once feared for its own ambitions, has become a proxy for Beijing’s silent war. But here’s the twist: China is imploding. Xi Jinping, once the all-powerful emperor of the Communist Party, is now beginning to look like a ceremonial ghost. His loyalists have been purged. His slogans scrubbed from state media. Even his father’s memorial has been renamed—a brutal, public humiliation. The Party is speaking loud and clear: the emperor has no clothes. Inside the People’s Liberation Army, the purge is in full swing. Generals are falling. Power is shifting. And when Vice Chairman Zhang Youxia refused to salute Xi at the Two Sessions? That wasn’t defiance—it was a funeral bell.

Behind the stagecraft, a darker truth is emerging China’s neocons are seizing power, and the West, mesmerized by the Middle East, is missing the real storm brewing in Asia. What we’re witnessing isn’t just a regional war—it’s a global unravelling. And all of it, once again, is unfolding beneath a raging Sun. History doesn’t repeat—it escalates. And the war cycle, fed by solar fire and human folly, has only just begun.

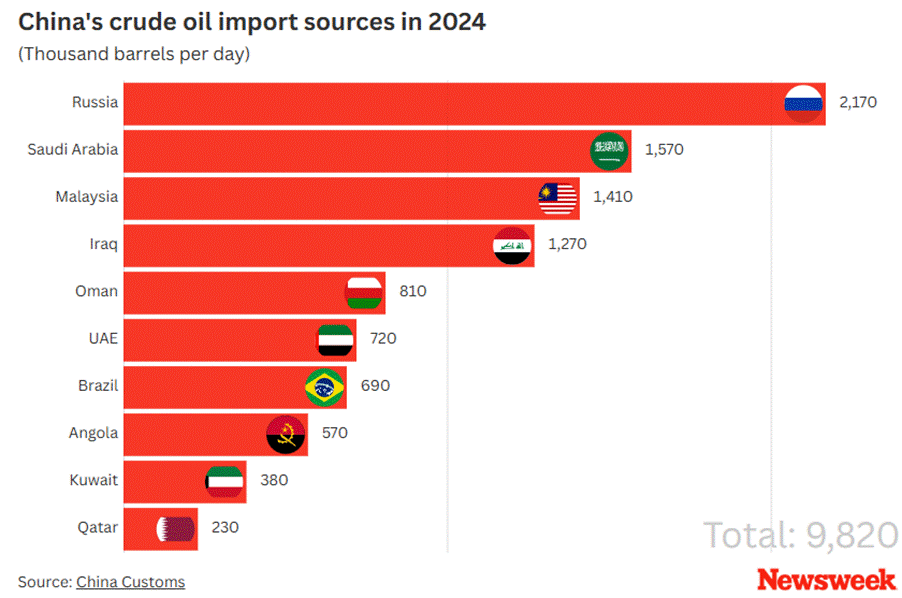

Officially, China imported zero oil from Iran last year—because, of course, when it comes to international trade, we all take authoritarian regimes at their word. But energy researchers tell a different story. Iranian oil is still flowing—just not through the front door. Instead, it sneaks in through the back via shadowy transshipment routes, ultimately winding up in China’s smaller, conveniently less-regulated refineries. The U.S., ever the global hall monitor, has slapped sanctions on Chinese firms allegedly helping Iran skirt Western restrictions. And yet, over 90% of Iran’s sanctioned, bargain-bin crude still finds its way to China, often rerouted through middlemen in places like Malaysia—because nothing says “rules-based order” like a thriving black market. But the real irony? China's heavy energy dependence is still anchored in or around the Persian Gulf, where six of its top ten oil suppliers reside—right in the middle of a region now teetering on the edge of war. So while Beijing keeps a straight face and claims innocence, its energy lifeline runs straight through the chaos.

https://www.worldstopexports.com/top-15-crude-oil-suppliers-to-china/

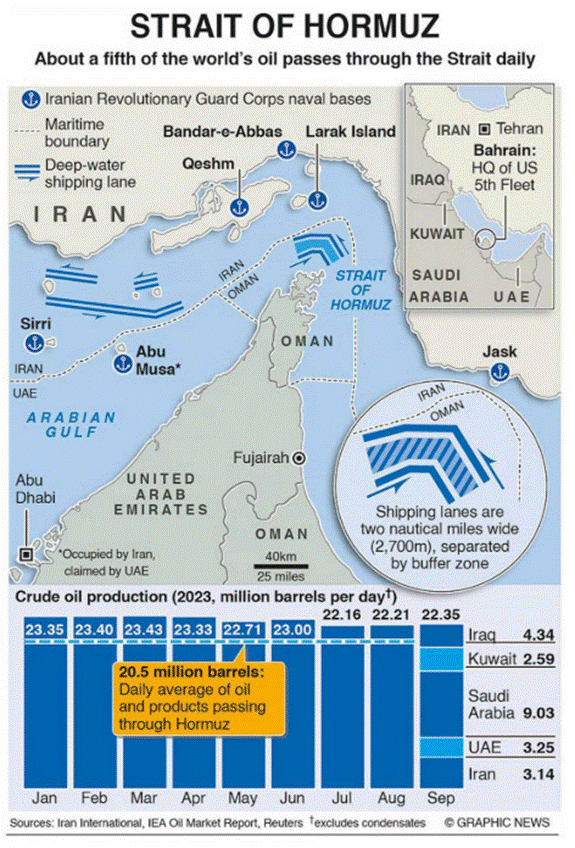

Since Israel’s June 13th strike, whispers have grown louder: Iran might close the Strait of Hormuz—a move that would send global oil markets into panic mode and, theoretically, choke off China’s energy supply. But here’s the twist no one’s reporting it wouldn’t.

Why? Because while Western analysts were busy obsessing over missiles and tankers, China and Iran quietly built a workaround. The long-forgotten ancient Silk Road has been resurrected—not by caravans, but by steel and freight. Enter the China-Iran railway link—a critical artery of Beijing’s Belt and Road Initiative, reviving imperial trade routes under the guise of modern infrastructure. This overland corridor, part of the China–Central Asia–West Asia Economic Corridor, relies on the Kazakhstan-Turkmenistan-Iran (KTI) railway, finalized in 2013, with freight rolling into Tehran as early as 2016. Today, it’s fully operational.

https://www.eurasiantimes.com/first-freight-train-from-china-wheels-into-iran/

So let Iran shut the Strait. Let the Houthis keep stirring the Red Sea. With the Hormuz chokepoint neutralized and the Suez Canal under pressure, Beijing’s energy strategy keeps humming along—thanks to railroads, not tankers.

It’s a brilliant piece of asymmetrical logistics. And it's nothing new. In antiquity, the city of Antioch grew fabulously wealthy by serving as the Silk Road’s gateway to the Roman world. From there came the famed purple dye—so prized it became exclusive to emperors. History, it seems, is color-coded and circular.

Now, with the West stuck in maritime thinking, China has quietly reasserted land power. Oil still flows. Ships can be stopped. But trains? Trains don’t sail through bottlenecks.

Yes, the Sunni-led monarchies—Saudi Arabia, Kuwait, the UAE, and Qatar—sit on a mountain of oil. Together, they control a massive share of the region’s proven reserves. But don’t underestimate the Shia crescent. Iran and southern Iraq may not have the volume edge, but their reserves are deep, strategic, and dangerously concentrated in a region that lights up in every war cycle. Iran, after all, was a founding member of OPEC—and its influence extends far beyond its borders when things get hot.

But the real game-changer isn't under the ground. It’s what’s been laid above it: steel rails stretching from China to Iran. In recent years, the China–Iran railway corridor quietly came online. Trains now glide from cities like Yiwu and Xi’an, cut across Kazakhstan and Turkmenistan, and roll straight into Tehran. The last piece—Turkmenistan into Iran—is done. Operational. And transformative.

This is Beijing’s backdoor into the Middle East. No Strait of Hormuz. No Malacca chokepoint. Just a land bridge linking Chinese factories to Iranian petrochemicals, pistachios, saffron—and maybe soon, sanctioned oil rebranded and rerouted.

For China, it’s more than commerce. It’s national security. The railway reduces reliance on vulnerable sea lanes and embeds Iran into China's Eurasian grand strategy. For Iran, it’s lifeline meets leverage—a path to markets that bypasses Western sanctions and naval blockades.

This isn’t just infrastructure—it’s alignment. China and Iran are now linked by more than interests. They’re bound by steel. And in a region increasingly hostile to U.S. influence, this rail line may become the fault line of the next geopolitical rupture.

Closing the Strait of Hormuz won’t cripple China or Iran—it’ll cripple their rivals. Thanks to the overland China–Iran rail corridor, Beijing and Tehran have already built their escape hatch. But the real losers? Saudi Arabia and the UAE. These two central pillars of global oil supply are still heavily reliant on this narrow maritime chokepoint to export their crude. Shut it down, and it’s not Beijing or Tehran that panics—it’s Riyadh and Abu Dhabi. In other words, Iran holds the keys to a strait that can strangle its enemies while barely touching its friends. That’s not just leverage. That’s strategy.

This war was always heading one way. Israel said Iran was weeks from a bomb—truth optional, panic mandatory. The U.S. played coy until June 21st, then dropped bunker busters with a wink and a “Who, me?” straight out of Trump’s first-term arsenal. And just hours after bombing Iranian soil, the self-anointed ‘Egocentric-in-Chief’ took the mic to declare he hopes this ends the war—before wrapping it all up with a “God Bless Israel,” just in case his allegiance wasn’t already obvious. Peace? Please. This isn’t diplomacy—it’s cheerleading for the same neocon cabal that’s been turning the world into a war subscription service for decades, complete with lobbyist perks and banker bonuses.

The reality is that in 1963, Benzion Netanyahu moved his family to Cheltenham, Philadelphia, where Bibi attended high school before leaving early to fight in the Six-Day War. Bibi later studied at MIT and Harvard, often visiting his brother Yoni at the University of Pennsylvania. There, Bibi met William Kristol— son of Irving Kristol, the Neocon founder—through their fathers’ intellectual circles. This early Philadelphia connection helped cement Bibi’s alignment with Neocon ideology, including the goal to remove Saddam, Assad, and Gaddafi, which Kristol openly defended as a path to peace for Israel.

Throughout history, politicians facing domestic crises have always resorted to a time-tested distraction strategy: inventing or inflating a foreign enemy to unite the populace and divert attention from economic mismanagement at home. When bread runs short, war drums conveniently drown out the protests. In the early 1980s, Argentina’s military junta, plagued by hyperinflation and civil unrest, invaded the Falkland Islands to stir nationalist fervor—only to face humiliating defeat. In 1999, facing impeachment, Russian President Boris Yeltsin escalated the Chechen conflict, a move echoed years later when Vladimir Putin used foreign conflicts like the annexation of Crimea in 2014 to boost approval amid economic stagnation. Even the U.S. is no stranger: George W. Bush’s 2003 invasion of Iraq came as recession loomed and his popularity waned. Creating an external threat—real or exaggerated—remains a political sleight of hand, shifting focus from food prices to false flags, from joblessness to jets. On June 12, 2025, ONE DAY before launching his attack against Iran, Netanyahu narrowly survived a no-confidence vote in the Knesset (61–53), avoiding a snap election as his coalition rallied over a divisive military draft bill. The political crisis exposed deep fractures about the warmongering agenda of the Israeli prime minister and the dire state of the Israeli economy since October 7 2023.

Understanding history means seeing events through their eyes. The Neocons, obsessed with Russia and the Middle East, pushed the Iraq war based on fabricated Weapons of Mass Destruction claims. They covertly backed efforts to topple Assad and Gaddafi, and their agenda still drives US policy against Iran, often undermining Trump’s approach. This network shapes endless conflicts under the guise of protecting Israel’s interests, with little regard for the chaos left behind.

https://www.npr.org/2023/02/03/1151160567/colin-powell-iraq-un-weapons-mass-destruction

The divide over Israel between Shia actors like Iran and Sunni-led states is driven more by geopolitics and ideology than theology. Since 1979, Iran’s revolutionary identity centres on opposing Israel as a Western proxy, backing groups like Hezbollah and Hamas to project power and lead the “Axis of Resistance.” Supporting Palestine boosts Iran’s legitimacy and regional influence. Many Sunni-led states have pragmatically normalized ties with Israel to counter Iran, gain economic benefits, and secure U.S. support, despite popular opposition in their populations. Sunni positions vary widely. Both Sunni and Shia revere Jerusalem and support Palestine, but Iran weaponizes the cause to challenge Sunni normalization. The real conflict is a holy struggle—maximalist Iran versus pragmatic Sunni states.

Israel and the U.S. err in thinking strikes on Iran will shift Shia actors toward Sunni pragmatism. This won’t happen. The clash is about power and strategy.

The Sunni-Shia split dates back nearly 1,400 years to a dispute over Muhammad’s succession—Sunnis support community-chosen leaders, while Shias insist leadership stay within Muhammad’s family, especially Ali. Historically, Sunni dominance was cemented by the Ottoman Empire across much of the Arab world, while Iran remains a Shia stronghold. Still, sizable Shia communities exist in Sunni-ruled areas like Iraq, Lebanon, and Yemen. Modern geopolitics—especially the Iran-Saudi rivalry—has deepened sectarian divides, fueling conflicts in Iraq, Syria, and Yemen. Yet, many Muslims prioritize their broader Muslim identity over sectarian labels.

As for war contagion—history teaches us it spreads like a bad virus. Archduke Ferdinand’s assassination spiralled into World War I thanks to alliance entanglements (hello, NATO). Revolutions spread ideologically across continents. Yet, some wars stay local (looking at you, Iran-Iraq ’80s conflict). Economics can prevent war, sanctions? They do the opposite—fuelling animosity and hardening adversaries. Europe’s supposed peace through economic integration works until bureaucrats ignore law and order concerns, dividing societies internally.

Meanwhile, nationalism and ethnic ties spread conflicts like wildfire—think Yugoslavia’s brutal breakup. NATO’s selective interventions reveal its partiality, ignoring agreements when convenient. The UN’s moral authority? As effective as the League of Nations, i.e., pretty much useless. The Cold War avoided superpower direct clashes only for the U.S. and Neocons to wage endless proxy wars focused on Russia, always blaming it for “the problem.” Now, with Israel vs. Iran escalating amid a backdrop of a simmering global confrontation with Russia, China, and North Korea, the risk of contagion is real and alarming.

Alliance systems like NATO, designed to deter war, most of the time do the opposite: turning local conflicts into global infernos. The 1914 spiral is their textbook example. Today, the EU’s eagerness to drag North America into a “dream war” with Russia benefits no one but globalist elites and, maybe, Bill Gates’ population control fantasies. Bottom line: War spreads like a contagion—but it’s not inevitable. Yet with current fault lines, the world better pay attention before this virus goes pandemic. Ah yes, the ever-enlightened Brussels brigade from the North Atlantic Terror Organization—famous for their noble slogan “We Only Bomb for Peace”—just gathered in The Hague to dig deeper into taxpayer pockets and funnel more billions into the world’s favourite proxy soap opera: funding the totally corrupt regime in Kiev. Peace, apparently, now comes with a price tag and a side of cluster munitions.

Ideology and revolution are the ultimate contagions—whether it’s overthrowing monarchies, communism versus capitalism, Protestant versus Catholic, Sunni versus Shia, or Islam versus Judaism. Successful uprisings inevitably inspire copycats nearby or among ideological soulmates. Fear of this “viral” spread often prompts preemptive crackdowns and foreign interventions. History’s full of this drama: The American and French Revolutions ignited sparks far beyond their borders; the Revolutions of 1848 spread like wildfire across Europe; religious wars flipped pagan against Christian, Protestant against Catholic—even sparking England’s Civil War, where Cromwell cheekily minted coins sporting a laurel wreath proclaiming, “The king is dead, long live the king.” Marxism’s 1917 Russian Revolution didn’t stop at Russia’s borders either—it inspired Germany’s 1918 revolution, toppled governments, and ultimately led to the Weimar Republic’s famous hyperinflation disaster.

Revolutions, it seems, are the world’s most persistent trend—and they never quite stay put.

The biggest risk today? This Iran-Israel conflict being seen purely as a religious war. With Europe’s growing Muslim populations, the tinderbox for civil unrest across major cities is already stacked—religion often becomes the convenient scapegoat when economies sour. History warns us well: look at the Protestant Reformation, which exploded right as the economic cycle turned down in the early 1500s. That upheaval wasn’t just theology—it was a perfect storm of tech (hello, Gutenberg’s printing press), political opportunism, social frustration, and fiery ideas spreading like wildfire. Cheap pamphlets, translations of the Bible into German, English, and French bypassed the clergy’s gatekeeping, putting power in the hands of the people—and threatening the status quo. Rulers saw it as a chance to grab Church lands while the economy was tanking.

The lesson? When money dries up, religion conveniently fills the void—and unrest follows.

Kings like Henry VIII were broke and debasing coins, but the Reformation’s break with Rome saved their crowns. Sweden’s Gustav Vasa seized Church lands and power, while merchant cities saw reform as a cash grab—cutting ties to Rome and boosting capitalism. Luther’s message fueled grievances, rulers backed it, and economic unrest made it unstoppable.

Wars tend to stay local without cross-border ethnic or religious ties—think Iran-Iraq or the Falklands. Even the English Civil War shook Britain but didn’t ignite Europe. Yet all were wrapped in economic interests dressed as religion.

War spreads like a contagion through alliances, ideology, and religion. The real risk now is Iran-Israel turning into a religious clash that ignites unrest across Europe’s Muslim, Jewish, and Christian communities. This conflict is part of a bigger Neocon plan to weaken Russia’s allies under the guise of peace for Israel. I argued with Bill Kristol in the ’90s—their tactic: topple Saddam, Assad, Gaddafi, promise peace, but deliver endless chaos.

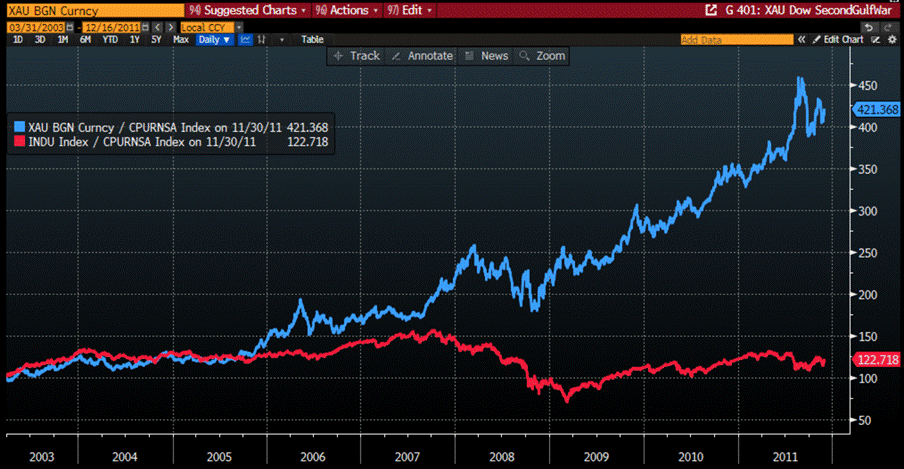

Anyone with a functioning brainstem, a basic Econ 101, and a habit of reading history—not scrolling through nonsense on ‘FaKebook’ or ‘Lies Social’—knows that the last century’s conflicts have repeatedly pushed us to the edge of catastrophe. Look at the Vietnam War (1955-75) and the Second Gulf War (2003-11): during both, gold outperformed the Dow by over three times when adjusted for inflation—and with far less downside risk.

Evolution of $100 invested in physical gold adjusted to inflation (blue line); the Dow Jones adjusted to inflation between 1955 and 1975. (Vietnam War).

Evolution of $100 invested in gold adjusted to inflation (blue line); the Dow Jones adjusted to inflation between 2003 and 2011 (Second Gulf War).

Fast forward to the 2020s: to understand how the four pillars of the Browne Portfolio have fared since Russia’s special operation in Ukraine began, it’s useful to compare gold (XAU), equities (S&P 500), government bonds (Bloomberg US Agg), and cash (Bloomberg 1–3 Month T-Bills). Despite Wall Street denials, anyone with common sense sees this is effectively a US-Russia war. Over the past 3 and half years, gold and equities have clearly outperformed cash and bonds.

Performance of $100 invested in Gold (blue line); S&P 500 index (red line); Bloomberg US Agg Total Return Index (green line); Bloomberg S T-bills 1-3 months Index (purple line) since 24th February 2022 adjusted to US CPI.

Savvy investors know rates rise during wartime, not fall. While the Fed tries to lower borrowing costs to boost growth, history—like during the Vietnam War—shows it controls only short-term rates, not long-term yields. That’s why QE was introduced. Without another round of QE or Yield Curve Control, Fed policy can’t truly stimulate the economy. Long-term bondholders will lose wealth, and mortgage and auto loan rates will climb, squeezing consumers and businesses alike.

Former General Wesley Clark was told the same back in the ’90s: this won’t end well for the US, Europe, the Middle East, or the world. Obama’s failed Syria invasion was blocked by Congress, yet CIA covert ops kept going. This NEOCON war to eliminate Israel’s enemies is a disaster waiting to explode. Pakistan has warned it will retaliate with nuclear weapons if Israel nukes Iran, per IRGC’s General Mohsen Rezaee. These NEOCONS think only short term. They used 9/11 to topple Saddam, never anticipating ISIS. They focus on immediate goals, ignoring the fallout. Turn this into a religious war, and Europe will burn. If the conflict is seen as Islam vs. Israel rather than government vs. government, it will blow up in everyone’s face.

Major General Smedley Butler, one of America’s most decorated Marines, exposed this decades ago in War Is a Racket (1935). After 33 years of service, he saw war as profit for Big Business, Wall Street, and bankers, not national defense. He laid out the “racket” in three brutal phases: Lobbying for War: Business interests push governments into conflicts to protect or expand their overseas markets.

· Profiteering During War: They rake in obscene profits selling weapons and supplies, while soldiers and civilians pay with blood and taxes.

· Profiteering After War: They seize post-war concessions and loans, enriching themselves while populations shoulder crushing debt.

Butler’s words still sting: the few profits massively while the many bear the costs—lives lost, families shattered, economies wrecked. War enriches a tiny elite and devastates societies.

https://kether.com/words/butler-smedley--war-is-a-racket-1.pdf

The critique of the Military-Industrial Complex—Eisenhower’s later famous term—is central here. Butler’s warnings about corporate influence on foreign policy, war profiteering, manipulated patriotism, and the human cost versus private gain remain painfully relevant. These forces fuel today’s proxy war against Russia, as Boris Johnson bluntly acknowledged Britain is at war with Russia. Of course, Butler’s critics argue he oversimplifies war by focusing mainly on economic motives, ignoring ideology, nationalism, security concerns, and diplomatic failures. While those factors matter, economics is always a core driver: when societies are prosperous and content, wars decline.

Butler’s solution was straightforward—make war unprofitable. If young men are conscripted to die, then wealth should be conscripted to pay. Wartime profits should be capped, and military deployments restricted to defending national soil—no more overseas expeditions to protect corporate interests. Simply: “Take the profit out of war.” And only those registered for frontline service should have the vote on going to war—not those who stand to profit from it.

As the solar minimum sets the stage for another volcanic winter—bringing war, disease, and regime change—smart investors should note that the S&P 500-to-gold ratio remains stuck below its 7-year moving average, flashing a clear warning. With the war and commodity cycles both accelerating, it’s time to shift focus from return on capital to return of capital.

The solution? Real assets. Physical gold and silver—no counterparty, no surveillance—are the ultimate antifragile assets. Broader commodities offer protection as the global supply chain fractures. Manage cash actively: favor short-dated USD IG bonds and T-bills for income and agility. In equities, seek lean, low-debt, high-cash-flow businesses poised to gain from reshoring, trade wars, and rising defense budgets—because the real enemy isn’t across the border, it’s the warmongers in charge.

Goldilocks is gone. Gold-in-lots is the new survival playbook.

What’s On The Agenda Next Week?

The first week of Q3 in this Jubilee Year kicks off with more fireworks than earnings, as markets from Hong Kong to Canada and the US hit snooze for their national holidays. While half the world hits the beach, the rest of us get treated to the thrilling combo of ISM data and a fresh batch of U.S. jobs numbers. As for earnings? Let’s just say Wall Street’s taking a summer nap—only two S&P 500 companies report, and unless you're deeply passionate about Constellation Brands, it’s probably safe to stay poolside with a margarita.

KEY TAKEWAYS.

As solar minimums ripple through everything from crop yields to geopolitical tensions, the key takeaways are:

The US economy’s cooling off but still beating expectations—while service prices keep sprinting thanks to tariffs, wages, and rising costs.

Fed Chair Powell sips tea while the economy sweats, insisting there’s “no rush” to cut rates—just as Trump brews a full-blown Twitter tantrum over it.

Americans are earning less, spending less, and paying more—stagflation is already here, and it's charging service fees.

Consumers are feeling better, spending less, and choosing optimism over reality—because why worry when you can just vibe through the tariffs?

History’s true ruler isn’t politicians—it’s the Sun, whose solar cycles have repeatedly driven economic upheavals, revolutions, and empire collapses throughout centuries.

As the Sun enters its next minimum in 2025, the world’s unrest and upheaval echo a timeless pattern—history’s chaos fuelled by solar rhythms, not random chance.

In June 2025, the war cycle has returned on schedule—fuelled by solar fury and geopolitical sparks—as Israel and the U.S. ignite a global powder keg edging the world toward a multi-front conflagration.

As the West lights the match, China watches from the shadows—quietly fuelling the chaos, importing sanctioned oil, and purging its leadership—while the real storm brews from the Middle East into Asia.

While the West fixates on tankers and chokepoints, China and Iran have quietly laid steel through the desert—turning a thousand-year-old trade route into a modern geopolitical escape hatch.

Israel lit the fuse, Iran took the hit, China armed the response, and Trump’s bombs made it official—welcome to the next forever holy war, solar cycle included.

History doesn’t lie: in every major war, gold wins, bonds bleed, and central banks lose control—welcome to Act III.

As the US economy shifts into an inflationary bust, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

Gold and silver are eternal hedge against "collective stupidity" and government hegemony, both of which are abundant worldwide.

With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

Long dated US Treasuries and Bonds are an ‘un-investable return-less' asset class which have also lost their rationale for being part of a diversified portfolio.

Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

The last week of the second quarter of the Jubilee Year will be remembered as the week when the S&P 500 and Nasdaq 100 reached new all-time highs, as a truce in the Middle East and on the tariff front led investors to extrapolate a Goldilocks environment into infinity and beyond. After two consecutive weeks of decline, both indices rebounded strongly, driven by renewed hopes of an honki dori future All major U.S. equity indices recorded their best weekly returns since mid-May, when the U.S.-China tariff truce began.

In this context, U.S. equity indices resumed the uptrend that began after the April “Tariff Tantrum.” While daily stochastics remain bullish—suggesting higher highs are possible in the days ahead—RSI levels indicate that all indices are once again overbought. This means investors should prepare for another pullback should the Middle East truce break down abruptly or if the July 9 tariff deadline reignites stress among investors. FOMO should be avoided; instead, investors should focus on fundamentals rather than hot tips from journalists who’ve never managed a dollar, even for themselves.

A potential correction in the coming weeks could bring the Nasdaq 100 and S&P 500 down to their respective 76.4% Fibonacci retracement levels (21,172 and 5,868), while the Dow Jones and Magnificent 7 may pull back to their 61.8% levels (41,841 and 24,199), signaling continued market headwinds.

With greed prevailing over fear and short-term indicators remaining overbought, another wave of volatility could trigger a retest of the 50% Fibonacci retracement levels: Nasdaq 100 at 19,572; S&P 500 at 5,670; Magnificent 7 at 23,089; and the Dow at 40,842. If these supports hold, it may present the last tactical buying opportunity of the year.

Since the April 21 “tariff tantrum” faded, all major U.S. indices have been forming higher lows, suggesting the 2025 bottom may already be in place. While geopolitical events—not economic data—are likely to drive volatility, long-term investors should stay focused and avoid getting caught in the doom-and-gloom or honki dori narratives.

As of June 27th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for exactly 5 months, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

As war once again becomes everyone’s favorite national pastime, those aiming for victory—whether in markets or military maneuvers—might want to dust off the basics. Step one: actually know your enemy. Step two: try knowing yourself. Because if you skip both and think you can wing it with blind optimism and Twitter-level strategy, don’t be surprised when every “win” costs you twice as much and ends in spectacular failure—economically, militarily, or both.

General George S. Patton’s victory over Field Marshal Erwin Rommel in North Africa wasn’t just a triumph of tanks and tactics—it was a triumph of understanding the enemy. Patton famously read Rommel’s own book, Infantry Attacks, studying the German commander’s strategies in detail. This deep dive into his adversary’s mindset allowed Patton to anticipate Rommel’s moves and exploit his weaknesses, culminating in success during the Battle of El Guettar in 1943. The lesson? Real strategic advantage comes not from projecting own personal assumptions onto a situation, but from seeing the world through your enemy’s eyes. By stepping outside his own bias and ego, Patton didn’t just outgun Rommel—he outthought him. In politics, markets, or war, understanding your opponent on their terms, not yours, is often the difference between victory and costly delusion.

When World War III finally kicks off—and let’s be honest, the fuse is already lit in the Middle East and Eastern Europe—your cozy urban life and Amazon Prime deliveries won’t mean much. The real winners? Those chilling on farmland in peaceful, law-abiding corners of nowhere, far from mushroom clouds and screaming headlines.

In the current mess of war and stagflation, here’s your tongue-in-cheek survival guide of financial DON'Ts:

Don’t park your wealth in the banking system. When the music stops, banks might “temporarily” freeze your funds… which in government-speak means forever. Think bail-ins and forced “patriotic” loans at negative real rates for the next decade.

Don’t cling to sovereign bonds. When the government defaults, they won’t even send you a thank-you card.

Don’t assume inflation will magically erase your debt. Sky-high interest or sneaky loan indexation will make repayment feel like climbing Everest in flip-flops.

In short: forget yachts and tech stocks—think tractors and potatoes.

Let’s face it—when the world’s run by central planners, warmongers, and spreadsheet sorcerers with a God complex, playing defense is the new offense. Here’s what smart money should actually be doing:

Do stack real gold and silver—the shiny kind you can touch, not the digital IOUs from a bank that’ll freeze faster than your FaceTime in Pyongyang. Store it offshore, in private vaults, far from any regime taking marching orders from the World Economic Forum’s Malthusian cosplay committee.

Do assume the government will eventually come for your stuff. Just ask history: FDR, Greece, Iceland—they’ve all played “surprise asset grab” before. And with CBDCs looming, it’s only getting easier for them to do it with a click and a smile.

Do spread your wealth across borders. Having all your assets (and passports) in one basket is like being the only sober guy at a Keynesian frat party—you won’t last long. A second residence or passport is your ticket to saying “No thanks” when things get unhinged at home.

Do shift from Return ON Capital to Return OF Capital. Survival beats bragging about basis points at a barbecue no one can afford to host anymore.

Do get cozy with defense stocks. As governments ramp up their war machines, companies in the Aerospace & Defense sector are quietly cashing in. Peace may be dead, but margins are alive and well.

Do rethink your “permanent portfolio.” Ditch the long-dated bonds and hike your gold allocation north of 25%. Toss in silver, platinum, copper, oil, and even agri-commodities. When wars spark shortages, these are your lifeboats.

Do limit cash to 10–20%, tucked in short-dated, investment-grade USD corporate bonds. Think of it as your emergency chocolate stash: small, liquid, and never in the hands of someone who thinks inflation is “transitory.”

Bottom line? Forget Goldilocks. She’s been evicted. It’s time to think in terms of Gold-in-lots—just make sure you hold the key.

No one wants war—Americans don’t, Iranians don’t, nor do Russians, Chinese, Ukrainians, or Israelis. But it doesn’t matter. As long as the neocons profit, regimes fall, and the military-industrial complex gets its payday, the blood keeps flowing.

History repeats the same brutal script: kings and politicians stoking conflict for glory and gain, while ordinary people die for causes they never chose. Even Louis XIV, the so-called Sun King, admitted on his deathbed: “I loved war too much.”

Every war is waged by governments but sold as a clash between peoples—turning neighbors into enemies for political theater. And now, as another war looms, even those who once hoped for peace see their leaders steering straight into the fire.

The real enemy? Not the people of Iran, Russia, Ukraine, or anywhere else. It’s the warmongers in power, drunk on ambition and deaf to the cost. As Plato warned: “Only the dead have seen the end of war.”

“Only the dead have seen the end of war.”

With the global chaos machine running at full speed, preserving your wealth—whether it’s $100 or $100 million—is no longer optional, it’s survival 101. Step one? Get your gold and silver out of reach of governments with spending addictions and seizure habits. Vault it privately, far from bureaucrats with sticky fingers.

As volcanic winters and war-fueled shortages loom, don’t hold your breath for inflation to “cool off.” Tariffs, supply shocks, and currency debasement are the new normal. Bonds? Please. Smart money’s piling into physical gold—because it doesn’t default, expire, or tweet about “transitory inflation.” In times like these, canned food and bullion beat Bitcoin and blind faith. Stack 12–24 months of essentials, grab some old-school silver coins (not for nostalgia, but for barter), and remember: real assets don’t need an internet connection—or government permission.

When it all unravels, gold won’t just sit there looking pretty—it’ll do what it’s done since 480 BC: survive emperors, outlast empires, and quietly mock every fiat fantasy that came before.

So yeah, gold matters—yesterday, today, and especially tomorrow.

Those who recognize the challenges ahead—war, shortages, and disease—won’t just endure them; they’ll be well-positioned to thrive when the world emerges stronger and more resilient on the other side, stepping into a new era of opportunity by the next decade when the light appears at the end of the tunnel.

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.

Share this post